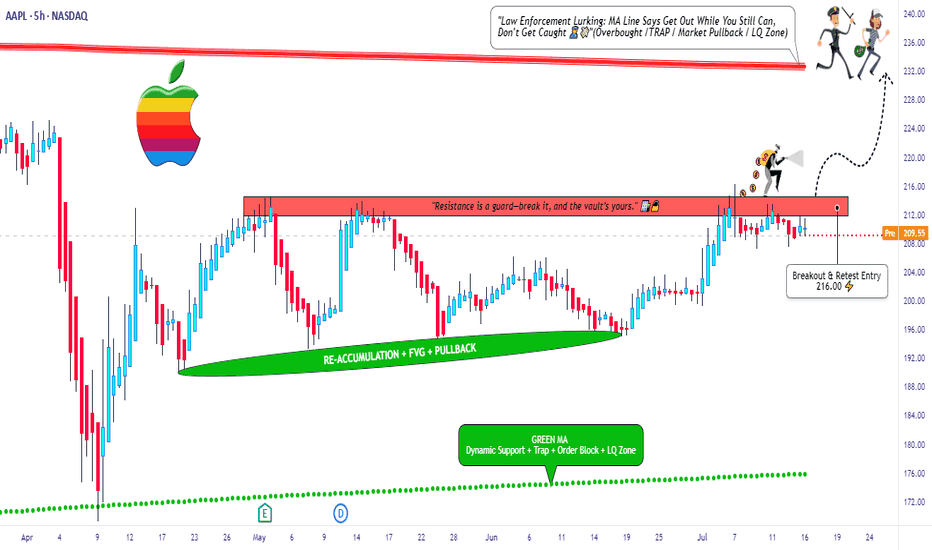

Apple Inc Long Setup – Break, Ride, Exit Like a Pro🕵️♂️💼 “The Apple Heist: Thief Trader's Masterplan for a Clean Escape” 💸🚀

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Welcome, Money Makers & Market Thieves! 🤑💰💸✈️

This ain’t your average stock analysis — this is a high-level blueprint for the Apple Inc. (AAPL) market heist, built using the Thief Trading Style 🔥📊.

We've scouted the field using a mix of technical patterns, market sentiment, and fundamental fuel, and we’re ready to make our move. The plan is set: go long once the resistance wall cracks, and aim for a clean getaway just before the danger zone hits.

🎯 THE PLAN: INFILTRATE, ESCAPE, PROFIT

Entry Point:

💥 “The vault’s cracking – the breakout begins at 216.00!”

Place Buy Stop orders just above the resistance wall or wait for a pullback to recent swing zones (15M–30M charts work best).

📌 Set your alerts early – you don’t want to miss the opening.

🛑 STOP LOSS - YOUR BACKUP PLAN

🔊 “Listen up, crew: No stop loss until the breakout confirms! Once you’re in, place SL wisely – use the 4H swing low (200.00). Your risk, your rules. Don't get caught slippin’.”

📍 Adjust SL based on lot size, entry volume, and trade size. Protect your stash.

🏁 TARGET ZONE:

🎯 Heist Target = 232.00

(Or bail early if the heat's on – you know the drill.)

⚠️ SCALPERS & SWINGERS

💸 Long side only – don’t fight the wave.

🧲 Scalpers: Get in, grab the cash, trail the stop.

📈 Swing Traders: Hold firm. This setup has legs.

🔎 WHY WE’RE ROBBING THIS CHART:

Apple’s bullish momentum is fueled by:

📌 Strong institutional sentiment

📌 Earnings strength

📌 Index rotation and positioning

📌 COT data & macro tailwinds

Get the full scope: fundamentals, macro outlook, positioning data, sentiment, and intermarket dynamics 🔗📊.

Stay sharp – stay informed.

📰 NEWS ALERTS & POSITION MANAGEMENT

🚨 Avoid new entries during high-impact news releases.

🏃 Use trailing SLs to lock profits and exit clean.

💖 BOOST THE CREW — STRENGTH IN NUMBERS

🚀 Hit that BOOST button if this helped you steal a profitable trade. Your support powers our heist team.

Let’s keep making money the Thief Way – with style, planning, and confidence. 🎉💪🏆

📌 NOTE FROM HQ:

This analysis is for educational purposes. It’s not personalized financial advice. Manage your trades responsibly. Conditions can shift quickly — stay updated and flexible. Stay in the shadows and move smart. 🐱👤

💬 Drop a comment, hit like, share with your gang – the market's a vault, and we’re the codebreakers.

See you on the next heist, Thief Fam. 🤑🔥🕶️💼

Aaple_tradingsetup

Apple - The next major push higher!🍎Apple ( NASDAQ:AAPL ) will head for new highs:

🔎Analysis summary :

Apple has been underperforming markets for a couple of months lately. However technicals still remain very bullish, indicating an inherent and substantial move higher soon. All we need now is bullish confirmation and proper risk management and this setup looks very decent.

📝Levels to watch:

$200, $300

🙏🏻#LONGTERMVISION

Philip - Swing Trader

Apple Stock Drops: Is Slow AI Development to Blame?The tech world was abuzz on Monday as Apple, a titan of industry and a beacon of innovation, experienced a sudden and significant dip in its stock value, shedding approximately $75 billion in market capitalization. This abrupt decline sent ripples through the investment community, prompting a closer examination of the underlying factors contributing to what many perceive as a rare moment of vulnerability for the Cupertino giant. While market fluctuations are a normal part of the financial landscape, this particular downturn has been widely attributed to growing investor apprehension regarding Apple's perceived slow progress in the burgeoning field of generative artificial intelligence (AI). In an era where competitors are aggressively pushing the boundaries of AI capabilities, Apple's more measured approach appears to be raising questions about its future competitive edge and its ability to maintain its unparalleled ecosystem.

The $75 Billion Question: Unpacking Apple's Stock Drop

Apple's stock drop on Monday was not an isolated incident but rather a culmination of mounting concerns among investors. While the immediate trigger for such a sharp decline can often be a specific news event or analyst downgrade, the broader context points to a deeper anxiety: the pace and direction of Apple's generative AI development. For a company that has historically set the pace in consumer technology, a perception of lagging in a critical emerging technology like generative AI is a significant red flag for the market.

The $75 billion loss in market value represents a substantial sum, even for a company of Apple's immense size. It signifies that a considerable portion of investor confidence, particularly concerning future growth prospects, has been eroded. This erosion stems from the understanding that generative AI is not just another feature; it is poised to revolutionize how users interact with technology, from personal assistants to content creation and productivity tools. Companies that fail to innovate rapidly and effectively in this space risk being left behind, potentially losing market share and, more importantly, mindshare among consumers.

Investors are keenly aware that the tech landscape is unforgiving. Past leaders, even those with seemingly unassailable positions, have faltered when they failed to adapt to paradigm shifts. The market's reaction to Apple's AI progress, or lack thereof, is a testament to the perceived urgency and transformative potential of generative AI. It suggests that the market is valuing future AI capabilities heavily, and any perceived deficit in this area translates directly into a discounted valuation. The stock drop, therefore, serves as a stark reminder that even for Apple, continued dominance is not guaranteed without aggressive innovation in key technological frontiers.

Apple's Generative AI Journey: A Work in Progress

Apple's approach to AI has historically been characterized by a focus on integration, privacy, and user experience. Features like Siri, Face ID, and computational photography are all powered by sophisticated AI algorithms, seamlessly woven into the Apple ecosystem. However, these applications typically fall under the umbrella of discriminative AI, which is designed to make predictions or classifications based on input data. Generative AI, on the other hand, is about creating new content—text, images, audio, video—that is often indistinguishable from human-created output. This is where Apple's "work in progress" status becomes a point of contention.

For years, Apple has been quietly investing in AI research, acquiring smaller AI companies, and hiring top talent. Its chips, particularly the A-series and M-series, are designed with powerful Neural Engines specifically optimized for on-device AI processing. This emphasis on on-device AI aligns with Apple's core philosophy of privacy, allowing many AI computations to occur directly on the device without sending user data to the cloud. While this approach offers significant privacy benefits and can lead to faster, more responsive experiences, it may also present challenges in scaling the massive computational power required for large language models (LLMs) and other complex generative AI applications that often rely on vast cloud infrastructures.

The challenge for Apple lies in translating its existing AI prowess and privacy-centric philosophy into compelling generative AI experiences that can compete with the rapid advancements seen elsewhere. While there have been reports and rumors of Apple developing its own LLMs and generative AI tools, concrete product announcements or widespread public demonstrations have been notably absent. This silence, coupled with the aggressive public releases from competitors, has fueled the narrative that Apple is behind the curve. The market is looking for tangible evidence of Apple's generative AI capabilities, not just promises of future integration. The "work in progress" status, while a natural part of any complex technological development, is being scrutinized under a microscope, especially given the high stakes of the generative AI race.

The AI Race: Contrasting Apple with OpenAI, Google, and Microsoft

The generative AI landscape is currently dominated by a few key players who have made significant strides, setting a high bar for innovation and public perception. The contrast between these leaders and Apple's perceived pace is stark and forms the crux of investor concerns.

OpenAI, with its groundbreaking ChatGPT, DALL-E, and Sora models, has arguably ignited the current generative AI boom. Its strategy has been one of rapid iteration, public release, and collaborative development, often prioritizing innovation and accessibility over immediate commercialization. This approach has allowed OpenAI to capture significant public attention and demonstrate the immense potential of generative AI, effectively becoming the face of the movement.

Google, a long-standing leader in AI research, has been quick to integrate generative AI into its vast ecosystem. Its Gemini models are designed to be multimodal and highly capable, powering features across Google Search, Workspace, and Android. Google's advantage lies in its immense data reserves, vast computational infrastructure, and decades of AI expertise. While it initially faced criticism for being slow to respond to ChatGPT, Google has since demonstrated its commitment to integrating generative AI deeply into its core products and services, showcasing a comprehensive and aggressive strategy.

Microsoft, through its strategic partnership and substantial investment in OpenAI, has positioned itself as a formidable force in the generative AI space. By integrating OpenAI's models into its Azure cloud services, Microsoft 365 suite (Copilot), and Bing search engine, Microsoft has rapidly brought generative AI capabilities to millions of enterprise and consumer users. This partnership has allowed Microsoft to leverage cutting-edge AI research without having to build every component from scratch, accelerating its time to market and providing a significant competitive advantage.

In contrast, Apple has historically preferred to develop its core technologies in-house, maintaining tight control over its hardware and software integration. While this approach has resulted in highly optimized and secure products, it may be a slower path when it comes to rapidly evolving, data-intensive fields like generative AI. The lack of a public-facing, widely accessible generative AI product from Apple, akin to ChatGPT or Gemini, creates a perception that it is not participating in the same league as its rivals. This perception, whether entirely accurate or not, is what is currently impacting investor confidence and contributing to the stock's recent performance. The market is looking for Apple to demonstrate its unique value proposition in generative AI, beyond its traditional strengths.

Challenges and Implications for Apple

Apple's perceived lag in generative AI development presents several significant challenges and implications for its future.

Firstly, there's the risk of falling behind in core product experiences. As generative AI becomes increasingly integrated into operating systems, productivity suites, and creative tools, devices and platforms that lack these capabilities may appear less competitive. Imagine a future where intelligent agents seamlessly manage tasks, generate content, and provide hyper-personalized experiences. If Apple's ecosystem doesn't offer comparable features, it could erode its premium appeal and lead users to platforms that do.

Secondly, developer mindshare is crucial. The most innovative applications and services often gravitate towards platforms that offer the best tools and capabilities. If generative AI developers perceive Apple's platform as less capable or slower to adopt cutting-edge AI models, they might prioritize other ecosystems, potentially leading to a stagnation in the breadth and quality of third-party applications within the Apple App Store.

Thirdly, ecosystem lock-in, a traditional Apple strength, could be challenged. While Apple's integrated hardware and software create a powerful ecosystem, the allure of superior AI capabilities on other platforms could tempt users to switch. For instance, if Google's AI-powered features on Android become significantly more advanced and useful than what Apple offers on iOS, even loyal Apple users might consider alternatives.

Finally, there's the impact on brand perception and innovation narrative. Apple has built its brand on innovation and pushing technological boundaries. A perception of being a follower rather than a leader in a transformative technology like generative AI could tarnish this image, potentially affecting consumer loyalty and its ability to attract top talent in the long run. The $75 billion stock drop is a clear signal that the market is taking these implications seriously.

The Path Forward: Apple's Strategy to Reclaim AI Leadership

Despite the current concerns, it would be premature to count Apple out of the generative AI race. The company possesses immense resources, a vast user base, unparalleled brand loyalty, and a proven track record of entering established markets and redefining them. Apple's path forward in generative AI will likely involve several strategic moves.

One approach could be to leverage its existing hardware advantage. Apple's custom silicon, particularly the Neural Engine in its A-series and M-series chips, provides a powerful foundation for on-device AI. The company could double down on developing highly efficient, privacy-preserving generative AI models that run directly on its devices, offering unique capabilities that cloud-based solutions cannot match. This would align with its privacy-first philosophy and differentiate its offerings.

Secondly, strategic acquisitions and partnerships could accelerate its progress. While Apple prefers in-house development, the rapid pace of generative AI might necessitate acquiring specialized AI startups or forming partnerships with leading AI research labs to quickly integrate cutting-edge models and talent. This would allow Apple to bridge any perceived gaps more rapidly.

Thirdly, Apple might focus on integrating generative AI subtly and seamlessly into its existing products and services, rather than launching standalone, attention-grabbing AI models. This "Apple way" of introducing technology often involves refining and perfecting features before a public rollout, ensuring they are intuitive and enhance the user experience without being overtly complex. This could involve AI-powered enhancements to Siri, improved content creation tools in its creative suite, or more intelligent automation within iOS and macOS.

Finally, developer engagement will be crucial. Apple needs to provide robust tools and frameworks that empower developers to integrate generative AI capabilities into their apps, leveraging Apple's on-device AI power. This would foster a vibrant ecosystem of AI-powered applications that further enhance the value proposition of Apple devices.

In conclusion, Apple's recent stock drop serves as a potent reminder of the market's high expectations and the transformative power of generative AI. While the company's deliberate and privacy-focused approach to AI has its merits, the rapid advancements by competitors like OpenAI, Google, and Microsoft have created a perception of lag. The challenge for Apple is to demonstrate how its unique strengths—integrated hardware and software, a focus on user experience, and a commitment to privacy—can translate into a compelling and competitive generative AI strategy. The coming months will be critical as Apple navigates this pivotal technological shift, aiming to reassure investors and consumers that it remains at the forefront of innovation, ready to define the next era of personal computing with its own distinct AI vision.

AAPL Stock Trading Plan 2025-05-25AAPL Stock Trading Plan (2025-05-25)

Final Trading Decision

Models’ Key Points

DS Report

Technical: Strong bearish—price ($195.27) below all EMAs (10/50/200) on M30/daily/weekly; RSI oversold but in downtrend; bearish MACD; hugging lower Bollinger band. Sentiment: Rising VIX (22.29), negative tariff news, heavy institutional distribution. Trade: Short at $195.27; target $189.56; stop $197.50; 3–4 week hold; confidence 70%.

LM Report

Technical: Bearish price vs EMAs; RSI near oversold; Bollinger lower‐band touch hints at bounce; bearish MACD. Sentiment: Elevated VIX; negative headlines. Trade: No trade—mixed oversold/bearish signals; confidence 55% (below 60% threshold).

GK Report

Technical: Bearish across daily/weekly; RSI approaching oversold; MACD bearish but weakening; Bollinger lower‐band proximity. Sentiment: Rising VIX; tariff news headwind. Trade: Short at $195.00; target $189.56; stop $200.35; 4 week hold; confidence 65%.

GM Report

Technical: Multi‐timeframe bearish—price below EMAs M30/daily/weekly; RSI oversold short‐term; strong bearish MACD. Sentiment: VIX up; negative tariff/profit‐risk headlines; 5-day −7.6% drop. Trade: Short at $195.00; target $187.50; stop $198.90; 3–4 week hold; position sizing example 25 shares on $10k equity; confidence 85%.

CD Report

Technical: Bearish across timeframes; RSI oversold; lower Bollinger band; MACD bearish but showing early convergence. Sentiment: Elevated VIX; tariff threat. Trade: Short at $195.27; target $189.56 (secondary $185.00); stop $202.41; 3–4 week hold; confidence 72%. Agreement and Disagreement

Agreement

Broadly bearish technical setup: price below key EMAs; bearish MACD; lower‐band Bollinger action. Negative fundamental catalyst: potential tariffs and geopolitical risk. Rising VIX supports risk‐off bias. Recommendation skewed toward shorting AAPL shares.

Disagreement

LM sees too much mixed signal (oversold + bearish) to trade; all others recommend a short. Entry divergences: $195.00 vs. $195.27. Stop‐loss levels range from $197.50 up to $202.41. Take-profit levels range from $189.56 down to $185.00 (secondary) or $187.50. Confidence varies 65%–85%. Conclusion

Overall Market Direction Consensus: Strongly Bearish

Recommended Trade

Strategy: Short AAPL shares Holding Period: 3–4 weeks Entry Timing: At market open (~$195.00) Position Sizing: Risk 1% of trading capital (e.g., 25 shares on a $10 000 account; scale accordingly) Entry Price: 195.00 Stop‐Loss: 198.90 (≈2% above entry; sits above recent resistance) Take‐Profit: 187.50 (below key support for a ~3.8% move) Confidence Level: 85%

Key Risks and Considerations

Severe oversold conditions could trigger a technical bounce. AAPL’s strong balance sheet may limit downside if market stress eases. Tariff news or policy reversal could abruptly shift sentiment. Monitor VIX and major support at $189.56 for early signs of exhaustion.

TRADE_DETAILS (JSON Format) { "instrument": "AAPL", "direction": "short", "entry_price": 195.00, "stop_loss": 198.90, "take_profit": 187.50, "size": 25, "confidence": 0.85, "entry_timing": "open" }

📊 TRADE DETAILS 📊 🎯 Instrument: AAPL 📉 Direction: SHORT 💰 Entry Price: 195.0 🛑 Stop Loss: 198.9 🎯 Take Profit: 187.5 📊 Size: 25 💪 Confidence: 85% ⏰ Entry Timing: open

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions based on proprietary research which I am sharing publicly as my personal blog. Futures, stocks, and options trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of TradingView. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors' IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.

Apple Surges 3% in Premarket Amid AI Optimism & Strong ForecastApple Inc. (NASDAQ: NASDAQ:AAPL ) has seen a notable 3.46% surge in premarket trading, defying concerns over declining China sales. The upward momentum follows an optimistic sales forecast, hinting at a resurgence in iPhone demand fueled by Apple's strategic adoption of artificial intelligence (AI) features.

Earnings Outlook

Apple’s latest earnings report revealed a nuanced performance, with robust overall revenue counterbalanced by a slight dip in iPhone sales. Despite a shortfall in China, where revenue declined 11% to $18.5 billion—falling short of the projected $21.57 billion—Apple’s services unit exhibited strong growth, climbing 14% year-over-year to $26.34 billion. This exceeded Wall Street expectations of $26.09 billion, reinforcing Apple’s ability to diversify revenue streams beyond hardware sales.

CEO Tim Cook emphasized that Apple Intelligence, the company’s AI-powered suite of features, is playing a crucial role in boosting iPhone sales where available. However, Apple’s cautious approach to AI investments, unlike its peers such as Microsoft (MSFT) and Meta (META), has insulated its stock from recent market turbulence. The restrained AI strategy aligns with Apple's focus on integrating AI within its hardware ecosystem, enhancing device functionality without excessive capital expenditure on data centers.

The company posted earnings of $2.42 per share on revenue of $124.3 billion, surpassing analyst expectations of $2.36 EPS on $124.12 billion revenue. While iPhone sales, accounting for nearly half of Apple's revenue, declined to $69.14 billion from $69.70 billion year-over-year, the broader growth trajectory suggests a potential iPhone rebound in FY26.

Technical Outlook

From a technical standpoint, NASDAQ:AAPL is demonstrating strong bullish patterns. The stock is currently up 3.41%, benefiting from the renewed confidence in its growth trajectory. Prior to this recent rally, Apple shares had experienced a 15% decline since late December 2024. However, the current price action suggests a recovery, with NASDAQ:AAPL reclaiming 10% of its lost value, forming a falling wedge pattern—a historically bullish signal.

The premarket surge sets up the possibility of a gap-up pattern at market open, a strong bullish indicator that could further accelerate buying pressure. In the event of a pullback, immediate support lies at the 61.8% Fibonacci retracement level, a key level that often dictates price reversals in technical analysis.

The China Factor and AI’s Role in Future Growth

While Apple’s sales slump in China remains a wildcard, analysts expect a recovery once Apple Intelligence is introduced in the region. The lack of AI features has been cited as a major reason for weaker-than-expected sales in the Chinese market. TD Cowen analysts predict that demand could rebound once Apple secures a local partner to facilitate AI integration, boosting sales in a highly competitive market.

Moreover, Apple's performance relative to its tech peers remains strong. In 2024, Apple stock surged 30.07%, outperforming Microsoft’s 12.09% increase but trailing Meta’s impressive 65.42% rise. Apple’s 12-month forward price-to-earnings (P/E) ratio stands at 31.12, compared to Microsoft’s 29.2 and Meta’s 26, indicating sustained investor confidence in Apple’s long-term growth potential.

AAPL Positioned for Further Gains

Apple’s ability to weather market challenges, coupled with its strategic AI rollout, positions it favorably for continued growth. The bullish technical setup, strong fundamentals, and AI-driven sales optimism indicate that AAPL could maintain its upward trajectory. Investors should monitor key support and resistance levels, as well as further developments regarding Apple Intelligence’s expansion into new markets.

With analysts raising price targets and market sentiment improving, Apple’s stock could be on track for a sustained rally in 2024 and beyond.

🍏💼 AAPL: Will the Price Stand Firm at $165.67?Traders, brace yourselves for a rollercoaster ride with Apple! 🍏💼

🔍 Critical Crossroads:

As Apple navigates the treacherous waters of the market, all eyes are on the crucial level at $165.67. With the downtrend in full swing, will this support hold firm? The stage is set for a showdown!

💡 Bargains Ahead:

While the trend may be pointing downwards, don't rush into buying those discounted Apple shares just yet. With the potential for even more iPhones flooding the market, patience may be the key to unlocking greater rewards!

📉 Navigating the Downtrend:

In a market filled with uncertainty, how will you chart your course with Apple? Share your strategies for weathering the storm and seizing opportunities amidst the turbulence!

🚀 Riding the Waves:

Whether you're a seasoned trader or a newcomer to the game, join the discussion and share your insights on Apple's journey through the market's ups and downs!

🎁 Unlock the Rewards:

Remember, the most insightful comment could lead to lucrative rewards! So dive into the discussion, share your thoughts, and position yourself for success in the world of Apple trading! 🏆🍎

AAPL Technical Analysis and Trade IdeaOn the monthly time frame, #AAPL exhibits a bullish trend with a recent retracement into an equilibrium zone. As we delve into lower timeframes, a base formation becomes evident. Specifically, we observe a double bottom setup followed by a break below the previous lows, a robust rally, and subsequently, a higher low formation.

As we continue analyzing the shorter timeframes, we notice a potential shift in the current downtrend. This change in character suggests the possibility of a structural break. My focus lies on identifying a buy opportunity if we witness a breakout and subsequent retest of the previous high on the 15-minute timeframe.

However, it’s paramount to acknowledge the inherent risks associated with trading. Always conduct thorough research, considering both fundamental market drivers and the broader macroeconomic landscape, in addition to your technical analysis. Implement sound risk management strategies to safeguard your capital.

Disclaimer: This analysis provides a technical perspective on AAPL and should not be construed as investment advice. Tailor your trading decisions to your specific risk tolerance, informed by comprehensive market research and a holistic assessment of all relevant factors.

AAPL Technical Analysis and Trade IdeaRecent rallies in AAPL have stalled, with the 1D chart indicating a possible bearish shift.

Key observations:

- Market Structure Break: A clear break of market structure to the downside, including a lower low followed by a lower high, signals a potential downward trend.

- Fibonacci Retracement: Price action has retraced to the crucial 61.8% - 78.6% Fibonacci zone. This area often acts as a strong support or resistance level.

- Trading Strategy: Consider short entry points within the Fibonacci optimal entry zone throughout February and March. This offers a short-term opportunity with a stop-loss placed above the previous high. Target the previous downswing low as a potential profit-taking point.

Additional Considerations:

Macroeconomic Factors: Stay informed about broader market conditions and news that could impact AAPL's price.

Disclaimer: This analysis is for informational purposes and not financial advice. Always conduct your own research and risk assessment before trading.

#AAPL: Possible continued uptrend!Dear Traders,

Apple's stock prices are undervalued while we still think company is in well positioned to continue the bullish trend in upcoming months. While also looking at the current news event the new line up for the new iPhone also suggest that demand of apple products has increased.

Celebrating Apple's Historic Milestone: Market Cap Hits $3 Trill

Apple Inc. has achieved an extraordinary milestone - our market capitalization has soared to an unprecedented $3 trillion! 🎉🍏

As you may know, Apple's journey to success has been nothing short of remarkable. From the launch of the iconic iPhone that revolutionized the smartphone industry to the introduction of groundbreaking services like Apple Music, Apple Pay, and Apple Fitness+, they have consistently pushed the boundaries of what technology can do, enriching the lives of millions worldwide.

This significant milestone highlights Apple's strength and presents a remarkable opportunity to consider further investing in Apple stock.

Here's why we believe Apple continues to be an excellent investment opportunity:

1. Continued Innovation: Apple's commitment to innovation remains at the core of its DNA. With upcoming products and services in the pipeline, they are poised to redefine numerous industries and create new growth opportunities.

2. Strong Financial Performance: Apple has a consistent track record of delivering strong financial results and a robust balance sheet provides a solid foundation for long-term growth and stability.

3. Expanding Ecosystem: Apple's ecosystem, encompassing hardware, software, and services, creates a seamless user experience that fosters customer loyalty and drives revenue across various verticals.

Consulting with your financial advisor to evaluate your investment strategy and make informed decisions is recommended as always.

Apple Vision Pro Product Will Add Value To AAPL Stock

I wanted to share some exciting news about Apple’s latest Apple Vision Pro product.

This new device boasts some seriously impressive specs, including a high-resolution display and a powerful processor. But what sets it apart is its unique way of interacting with virtual reality. Instead of relying on clunky controllers, the Apple Vision Pro uses advanced eye-tracking technology to allow for a more natural and intuitive experience.

This could be a game-changer for the VR industry, which has struggled to gain widespread adoption due to its high cost and complex setup. With the Apple Vision Pro, we could see a new wave of interest and excitement in VR, which could translate into big profits for investors.

So, I encourage you to consider investing in Apple long-term. With their track record of innovation and success, I believe they have the potential to revolutionize the VR industry and bring it into the mainstream.

Thank you for your time and consideration. Have a wonderful day! Please let me your thoughts via a comment.

AAPL Apple Options Ahead Of EarningsIf you haven`t bought AAPL here:

Then analyzing the options chain of AAPL Apple prior to the earnings report this week,

I would consider purchasing the $167.5 strike price Puts with

an expiration date of 2023-5-19,

for a premium of approximately $3.37.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

$AAPL bearish inside bar?$AAPL continue to pull back along with other tech companies. after massive rally.

inflation is still high and consumer is start to spend their more strictly. despite the

high labor cost. most tech companies are started to reduce their labor force as they start

to feel the consumer spending their money carefully.

No big catalyst so far for AAPL about up coming product except the new upcoming iphone.

which is nothing new anymore for most consumer.

below is the price level I'm looking for $AAPL:

AAPL average price move per day is $2-6 per day depending on market volatility and catalyst.

Below is the price level I'm looking for entry and exit for AAPL:

Buy call above 146.64 and sell at 147.38+ or above

Buy puts below 145.02 and sell at 143.74 or below

sometimes, the fist 30 minute of the opening bell is always volatile.

you can catch the move there. or wait for an 1 hour for better cheaper price

after it pulls back.

make sure that you set up alerts on those key level so you wont miss the move.

and always to take your profits as you see one.

AAPL pulls back, back to bearish move?$AAPL pulls back along with the market, just before President Biden speaks. on top of the power hour few minutes before the market close. aapl release

a news about laying off their contractors as part of mass tech layoffs. if you notice lately, most of the tech layoffs sometimes make positive effects on

company stocks. making it to bounce up from the bad news. In 1hr chart AAPL is entering the squeeze momentum. and it looks like it will continues to

pulls back tomorrow depending on the market conditions volatility.

AAPL average price move per day is $3 TO $4 per day depending on market volatility and catalyst.

Below is the price level I'm looking for entries and exit for AAPL

Buy call above 153.97 and sell at 155.49 or above

Buy puts below 152.59 and sell at 151.49 or below

make sure that you set up alerts on those key level so you wont miss the move.

and always to take your profits as you see one.

Another honorable mentions for bearish setups are semis:

$AMD , $QCOM, $TSM and $META

Apple Analysis 24.01.2023Hello Traders,

welcome to this free and educational analysis.

I am going to explain where I think this asset is going to go over the next few days and weeks and where I would look for trading opportunities.

If you have any questions or suggestions which asset I should analyse tomorrow, please leave a comment below.

I will personally reply to every single comment!

If you enjoyed this analysis, I would definitely appreciate it, if you smash that like button and maybe consider following my channel.

Thank you for watching and I will see you tomorrow!

You can also check out my previous analysis of this asset:

Apple Analysis 11.01.2023Hello Traders,

welcome to this free and educational analysis.

I am going to explain where I think this asset is going to go over the next few days and weeks and where I would look for trading opportunities.

If you have any questions or suggestions which asset I should analyse tomorrow, please leave a comment below.

I will personally reply to every single comment!

If you enjoyed this analysis, I would definitely appreciate it, if you smash that like button and maybe consider following my channel.

Thank you for watching and I will see you tomorrow!

You can also check out my previous analysis of this asset:

Apple Analysis 03.01.2023Hello Traders,

welcome to this free and educational analysis.

I am going to explain where I think this asset is going to go over the next few days and weeks and where I would look for trading opportunities.

If you have any questions or suggestions which asset I should analyse tomorrow, please leave a comment below.

I will personally reply to every single comment!

If you enjoyed this analysis, I would definitely appreciate it, if you smash that like button and maybe consider following my channel.

Thank you for watching and I will see you tomorrow!

You can also check out my previous analysis:

AAPL BULLISH AND BEARISH SCENARIO (DOUBLE TOP) $$$As you can see, a double top formed weeks ago, and since the second peak in price, AAPL has been consistently declining, indicating that the market has properly priced this double top. We are on our way to the neckline, which tells us that if we bounce off it, we may retest the resistance, but if we break it, we will see serious bearish price action.