Barrick Gold Corporation ($ABX): Golden Opportunity or Risky

Barrick Gold Corporation (ABX): Golden Opportunity or Risky Prospect? 🏆💰

1/10

Barrick Gold TSX:ABX has seen a solid financial performance recently. EPS for the last quarter hit C$0.42, with next quarter estimates at C$0.63. They beat estimates 75% of the time in the past year. 📈

2/10

Analysts are bullish! The average price target is C$33.57, implying a potential upside of 50.13% from the current C$22.36 price. Strong Buy ratings dominate: 10 Buy, 2 Hold. 🔍 What do analysts know that the market doesn’t?

3/10

However, ABX is facing operational challenges. A suspension in Mali due to government intervention highlights geopolitical risks in mining. 🛑 Regulatory challenges are part of the gold mining game.

4/10

Stock price check: ABX currently trades at C$23.15. That’s 20.94% below its 52-week high of C$29.28 but 21.59% above its low. What does this tell us? Room for recovery, but risks loom. 📊

5/10

Valuation time! Compared to sector peers, Barrick offers an attractive price level, especially given the 50% upside target. Analysts love undervalued plays like this, but what about the risks? 🤔

6/10

Strengths: Barrick operates across multiple countries, ensuring diversified production. That’s crucial in a volatile gold market. 🌍 Diversification is a key defensive strategy here.

7/10

Challenges: High operational costs are always a concern. Pair that with political instability, like the Mali suspension, and ABX faces a steep uphill climb. 🏔️ How much risk are you willing to take on?

8/10

Opportunities: Expansion is always on the table. With gold prices looking stable, Barrick could capitalize on new projects or mines. But timing matters in this market. ⛏️

9/10

Threats: Regulatory and political risks never sleep. Changes in mining laws or political unrest can hit Barrick hard—Mali’s situation is a prime example. Always know your risks. ⚠️

10/10

What’s your take on Barrick Gold TSX:ABX ? Will it strike gold again? Vote here! 🗳️

Buy for the long term 📈

Hold and watch growth 🔄

Too risky, avoid 🚫

ABX

Gold likely going lower until rate cuts in 2024#GOLD sell we posted (trading portion) was SPOT ON (tee hee)

Barring something out of ordinary AMEX:GLD is most likely not going bull, at least, until 2024. There's also possibility it could also consolidate for few years but that's a story for another day.

The precious metal is likely headed towards 1800 area.

The last chart shows all major support levels by the dashed green line.

We will wait for reversals @ support levels.

Short of ABX Barrick Gold #ABXA clear setup; with the long-term chart (M) month. in downtrend. The Current-chart (W) Week is also in downtrend. the (W) is in clear move up, lots of buying to support this momentary fake uptrend. How do I know it is fake. Well one never knows anything as a disclaimer for any trading position; we stack up odd Enhancers in our favour.

So, why did I take the SHRT at $26 while price was rallying (fake rally); the red line on the right hand (W) chart. the price met a Supply Zone, and this SZ happens to be Lower High of the (W) downtrend. a technical downtrend is marked by a series of Lower Lows and Lower High(LH), as long as the LH are not violated the downtrend continue.

Once a price rally into a Lower High Supply zone, am looking for a tight SHORT entry, with a low-er risk STP loss just above the SZ & plenty of room below for the price to fall into & thats exactly what happened here. remembering the long-term is in my favour. thats a great off enhancer.

I Shorted at 26.xx and price fell into my Profit-Target 1, where I closed 2/3 of the position at $5 profit per share. and I moved my STP loss down; today, with price opening well above my last STP Loss, after a weak end of speculation on fallout of banks, the Gold price goes up and so does ABX, no surprise here

Bearish market is changing the rulesIt seems like all trading rules are out of control in this bearish market. One of the Greatest investors of all time Warren Buffett said "be greedy when others are fearful; and be fearful when others are Greedy" this rings true in the mind. However Buffer was an investor & not a traders. the rules differ or both games.

THIS IS ONE OF MY BEST & MOST PROFITABLE trades.

short term (W) is in correction while longterm (M) still technically in uptrend. price comes into the DZ which is the HL (Higher Low) of the

longterm (M) chart. provide low risk entry & high profit.

It seems in this market nothing hold true. As the price broke through the DZ. I followed my rules and took the Loss.

If there is a lesson to carry. the DZ was tested (in the dark square) this basically weakens the

DZ. One of my first trading teacher compared a DZ to a door. the more you knock on the door the more likely it will break down. This DZ door has been knocked before. it broke & the door opened. A better trade enhancer would of been a fresh untested DZ

Gold is cheap versus Miner ETFsGold and Silver mining equities remain very cheap relative to gold.

Using historical prices and disregarding dilution, the upside of miners to current gold prices is

GDX: 96%

SILJ: 132%

GDXJ: 260%

Barrick Gold: Huge Buying OpportunityHello traders,

Looking at the daily chart for ABX, it is at the really critical level.

RSI is oversold for the first time in the daily chart this year, and there is confluent layer of trading volume in this trading range:

resistance (Feb 25th, 2020)

support (June 5th, 2020)

Also, XAUUSD is at 200MA in daily chart as well.

We can expect relief rally if and only if we see drop in Bitcoin and SPX. My first target will be the 200MA which is about $32-33

NEM Rising channel, heading to 2 week highNEM Rising channel, heading to 2 week high of $68.88. Newmont is the world largest gold producer and ready to hit 52 week highs. The gold miners have lagged GC futures and GLD etf. Barrick gold is the 2nd largest producer and has a perfect ascending triangle. With FOMC july 30th, I expect these to breakout before and I would take some profits before known event. Still working on my videos, haha. thanks for watching! GL!

$GOLD formerly #ABX fib and bullish DW$GOLD ending a descending wedge. Quite tight, but you can see a completed five waves, and we are right on a 61.8% fib, or a closer 50% fib. I suggest waiting for one more touch of the 61.8% with a stop under the other one for a 7.8:1 trade.

I wish they would remove that ticker GOLD it plays hell with the CFD market. I thought when Randgold was bought it would disappear.

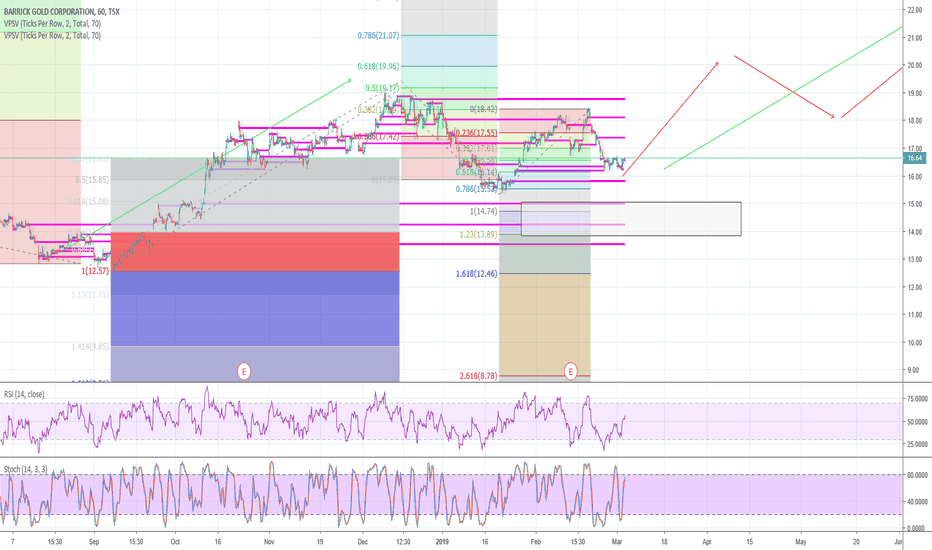

BULLISH GOING INTO 2019 - INCREASED DIVIDEND - WORLD'S LARGEST!ABX looks really good at current levels especially with the market corruption taking place.

Right now, Daily and Weekly Charts look good.

Although we are not happy with the stock price action of late, we still think 2019 will be a record year for ABX.

The Randgold merger was approved and announced today. After the positive news on the merger, ABX then released the news of a bigger dividend.

We think the stock "COULD" come back down to between the $12.00 - $13.00 range before the next run up.

POSITION: 250,000 SHARES

Average Price: $13.11

ABX Long ABX chatter has been increasing heavily among analysts during 2018.

Macquarie Downgrade the shares of Barrick Gold Corporation from Outperform to Neutral when they released a research note on October 22nd, 2018. (BEFORE merger with RandGold was approved)

Citigroup Upgraded the shares of Barrick Gold Corporation from Neutral to Buy in a research note they presented on September 25th, 2018, but they now have set a price target of $235. Which is ridiculous.

However back in August 29th 2018, Citigroup Upgrade the shares of Barrick Gold Corporation from Sell to Neutral when they released a research note on August 29th, 2018, with a more realistic price target of $31, (an increase from their early 2018 target of $23.

Technical - Weekly BB expanding as price moved and stayed above medium of bearish pitchfork. With Gold floating up amidst global turmoil, ABX profit margins are increasing and quickly.

Also the Moving Averages are about to cross positive on weekly which should help break up of the descending wedge.

Fundamentals - The M&A with RandGold is cleared for 1st Jan completion. Bullish. www.kitco.com - Also 95 Staff have been let go in preparation of this merger, including the resignation of the current head Honcho at ABX to make room for a new leader which is part of the Merger. This news has been received mostly positive as a lot of fat is being cut out to make room for streamlining operations and reducing costs as the M&A completes.

Trade setup: Long with stop at below $10 - we will find out in the month of Jan most likely. If it runs, target is $31 and will take a few months to play out.

ABX is worth gold... The exchange rate may continue to move upward. The rise is expected in a definite wave structure with a primary target price of 14.66 usd. At present, the exchange rate stood on a fractal accurate ATR mirror axis, which is a resistance axis function. After this step, the rise can begin.

ABX Surged to Topside of the Trend, Potential ReversalBarrick Gold Corporation surged in the last two week as gold rises amid a global stock market correction. Where the stock price high rocketed to see gains as high as 26%. Now price is trading at key resistance of the bearish channel. Look closely to the performance of gold for the direction of price.

Trade Step-ups:

Bearish Reversal: Price rejects a breakout from current trend. Profit levels to look for are 10.50 and 9.50.

Bullish Breakout: Price breaks from current trend channel, look for consolidation above 13.00.