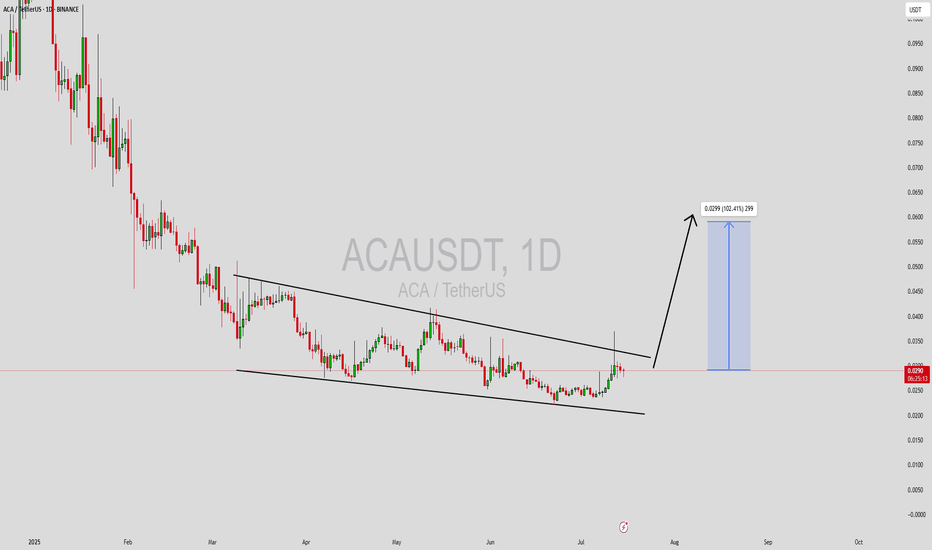

ACAUSDT Forming Descending ChannelACAUSDT is shaping up to be an exciting crypto pair to watch, as it is currently trading within a well-defined descending channel pattern. This technical setup is widely recognized by traders as a potential bullish reversal indicator once the price breaks out above the upper trendline. The consistent formation of lower highs and lower lows within the channel reflects a controlled pullback phase, setting the stage for a significant breakout that could deliver gains in the range of 90% to 100%+.

The good trading volume backing ACAUSDT’s current moves adds more conviction to this pattern. Increasing volume during a breakout from a descending channel often signals strong buying interest and growing momentum. This pattern has historically rewarded patient investors who can identify early signs of a reversal and position themselves accordingly. Many crypto traders actively search for descending channel breakouts to capitalize on explosive price moves that follow.

Investor sentiment around ACAUSDT is turning increasingly positive as more participants take notice of this project’s fundamentals and technical signals. This growing interest is helping to build a solid base of support, making a breakout even more likely. If the overall crypto market remains favorable, ACAUSDT could attract significant capital inflow once the breakout confirms, driving the price well beyond current levels and potentially outperforming many other altcoins.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you

ACAUSDT

Acala Hits Bottom, Which Means Bull Market Next (2800-3500% PP)Acala is now five weeks into the fire. If you read often you will understand clearly what I mean; if you are new, this might not make much sense.

The low happened 14-April here, ACAUSDT. Some weak action and then red. Five weeks red and the action remains relatively sideways, not much change in price.

Current price trades above the 14-April low. The 14-April low was 0.02698. Current price is higher. Five weeks red, high bearish volume and yet, no new major lows.

Notice the drop from early December 2024 until April 2025. Five weeks red can cover a huge distance, there can be a strong decline. When you see five weeks red but no change in price, this is a bullish signal. It means that the bears have no strength. It means we are not seeing a bearish trend nor a bearish impulse, instead, a retrace and stop-loss hunt. Since bearish pressure is non-existent and after weeks of selling prices aren't going any lower, we can predict change soon.

This change is bullish. The bullish signal comes from the fact that the bearish action is just too weak. It is like seeing prices trading near resistance (say a new all-time high) for weeks, months with no advance. This would reveal that the top is in and a crash comes next. In this case, the bottom is in and a bull market will follow.

Thank you for reading.

Namaste.

ACAUSDT forming a falling WedgeACAUSDT is currently displaying a strong falling wedge pattern—a historically bullish reversal structure that typically precedes sharp breakouts. After a prolonged downtrend, the price has formed lower highs and lower lows within a narrowing channel, suggesting decreasing selling momentum. The recent price action bouncing off the wedge's lower boundary, combined with a solid spike in volume, indicates a potential bottom formation and growing buyer interest.

Acala (ACA), known for its role in the Polkadot ecosystem as a decentralized finance hub, continues to show fundamental promise. With DeFi narratives heating up again and more liquidity flowing back into the Polkadot parachain ecosystem, ACA is regaining the attention of crypto investors and traders alike. Technical and fundamental convergence here is strong—making it a potential high-reward candidate for short- to mid-term bullish plays.

If this breakout confirms with strength above the wedge resistance, the projected price move could reach up to 90% to 100%+ based on measured move theory. Such breakouts often accelerate quickly due to short covering and renewed speculative interest. This is supported by rising trading volume and increased chatter among crypto communities, pointing toward renewed bullish momentum for ACAUSDT.

From a risk-reward perspective, the current zone near the wedge support offers an attractive entry for swing traders aiming to capitalize on the upcoming breakout. With multiple confluences lining up technically and fundamentally, this setup is one worth watching very closely.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

Acala Hits Bottom —Pre 2025 Bull Market Buy OpportunityLet's start with the long-term linear chart for perspective.

In this chart, we can see that the major decline ended in late 2022. All the action afterward is sideways.

Then we can notice the candles becoming ultra-small. This is the confirmation that the market is in a period of consolidation. At some point, the consolidation period ends and a new market cycle starts, the bull market.

Now, notice the far right, present day. Acala is trading at bottom prices and what happens? The highest volume ever, clearly visible; whales are buying.

So after years of sideways and strong new lows, buy activity goes off the chart. Those in the know are loading up and getting ready because Crypto is about to grow. The biggest growth cycle since 2021.

Thanks a lot for your continued support.

This is a friendly reminder. The best time to buy is now, when prices are low trading near support.

Namaste.

#ACA/USDT#ACA

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.0340

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.0377

First target 0.0404

Second target 0.0435

Third target 0.0474

ACAUSDT %1600 Daily Volume SpikeACAUSDT Analysis: Patience with Precision

With a %1600 daily volume increase , SCRTUSDT is showing heightened activity. The blue box marked on the chart is identified as a strong demand zone , offering a high-probability entry point.

Key Points:

Demand Zone: The blue box is strategically selected using advanced analysis techniques.

Volume Surge: A significant spike in volume suggests potential for strong moves.

Wait for Confirmation: Be patient and allow the price to confirm before entering.

Trading Strategy:

When trading the blue box, I rely on these indicators for confirmation:

Cumulative Delta Volume (CDV)

Liquidity Heatmap

Volume Profile

Volume Footprint

Upward Market Structure Breaks on Lower Time Frames

Learn the Process:

I can teach you how to effectively use CDV, liquidity heatmaps, volume profiles, and volume footprints. DM me to elevate your trading skills and make better-informed decisions.

Final Remarks:

Patience is key in markets like this. Manage your risk carefully and ensure proper confirmation before taking action. Wishing everyone successful trades!

#ACA (SPOT) entry range(0.0360- 0.0580) T. (0.3090) SL (0.0309)BINANCE:ACAUSDT

entry range (0.0360- 0.0580)

Target1 (0.1039)- Target2 (0.1450) - Target3 (0.1798) - Target4 (0.3090)

SL .1D close below (0.0309)

*** Collect slowly in the entry range ****

*** This trade is short time investment ****

**** #Manta ,#OMNI, #DYM, #AI, #IO, #XAI , #ACE #NFP #RAD #WLD #ORDI #BLUR #SUI #Voxel #AEVO #VITE #APE #RDNT #FLUX #NMR #VANRY #TRB #HBAR #DGB #XEC #ERN #ALT #IO #ACA ****

ACA underwater, but divergency is huge

Possible Targets and explanation idea

ACA brand new coin so we don't have a lot of data for indicators but here is what the main things what you should know

➡️Based on Accumulation Distribution indicator on Weekly you can see we formed huge divergency

➡️Trade long time period under -0.27 level by weekly fib (bullish accumulation zone)

➡️Leave 2 main Weekly IMB zones which most likely we will come back to trade

➡️0.28 / 0.46 / 0.81 main rejection zones. Visualisation by line.

➡️When ACA reach 0.81 everyone start posting "we are going to the moon" and after we will see correction

➡️2 main signals to Buy by "Trade on" indicator on weekly (bullish)

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

---

• Look at my ideas about interesting altcoins in the related section down below ↓

• For more ideas please hit "Like" and "Follow"!

#ACA/USDT#ACA

The price is moving in a descending channel on the 4-hour frame and we are about to break it

We have a bounce from a major support area in green at 0.475

We have a downtrend on the RSI indicator that has been broken upwards

We have a trend to stabilize above the moving average 100 which supports the rise

Entry price 0.0705

First target 0.1083

Second target 0.1345

Third target 0.1695

ACA Potential Limit Buy Setup🚀 ACA Limit Buy Signal 📈

ACA is showing strong potential for gains. Remember: "Buy low, sell high." Stick to your strategy and stay disciplined for successful trading.

📈 Entry: 0.0715

🛑 SL: 0.0441

🎯 Target 1: 0.1198

🎯 Target 2: 0.1676

🎯 Target 3: 0.3183

🎯 Target 4: 0.4853

Keep learning with ML Master trading insights.

ACA TargetsHi Guys

Best level to buy (Green Level)

or after breakout the White trend line.

Targets on Chart.

Plz DYOR.

Disclaimer: This article is for informational purposes only and not financial advice. Conduct thorough research and consult with professionals before making investment decisions.

Good luck.

ACA is very bullish (4H)A large triangle is completed. It is expected to pump for bullish wave C.

The targets are clear on the chart.

Closing a 4-hour candle below the invalidation level will violate the analysis

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

Acala Token (ACAUSDT) 75% Rally ForecastAcala Token (ACA) has swiftly risen to the top of our favorites list, and for good reason—its price action is nothing short of extremely bullish. The end of 2023 marked a significant turning point for ACAUSDT as it boldly broke free from a descending channel, setting the stage for an impressive journey.

Following the breakout, a substantial and extended pullback unfolded, only to be halted by the steadfast support of a simple uptrend trendline. This trendline also found solidarity with the top of the descending channel, which his a crucial intersection that showcased ACA's resilience.

Direct your attention to the supply/demand zone hovering near $0.09. Today, ACA is breaking above this zone, signaling a potential transformation into a demand area once more.

In the grand scheme of things, the stars are aligning for Acala, and we're anticipating a 75% price increase in the next month or two.