ACB

Cannabis Market Reversal.So far so good.

The gains are holding, and day trade opportunities are everywhere in the cannabis show.

The blue wave has a lot to do with it. Imagine that a market with 300m people opens up and its ready to be taken....US legalization.

Technically, its good.

Good Bullish Trades!

Cannabis Stocks- GRWGI LOVE this company LONG. Unfortunately this is the perfect place to buy and the sketchiest place to buy. With a possible Biden win, cannabis stocks like this one will soar. Two things in GRWG's favor in the mean time is the possible legalization in 5 states. Also, earnings coming up is expected to be a good one. So if we hit all three. Biden win. Earnings hit. Legaliztion. Then i could see a strong run up as this ticker as already see some good volume in the past.

#LEGALIZEIT $MJ ETF Daily ChartYou already know it... Holding the mj sector longterm & reinvesting dividends & diversifying in new canna tech businesses will = financial freedom ♾ might need another 10 years but well worth the wait later on!

JUST #LEGALIZEIT ~~~

BLAZE IT & reap in those extra tax revenues for schools, roads ect...

its just plain stupid for tax payers to continue to pay for incarcerated immates over a FKn plant that the good god put on this earth for a reason & has been used for thousands of years medicinally.

I'm Buying ACB @ $4.07 will Dollar Cost Average at lower pricesMy first buy was at $4.07, just a hunch we can see a reversal at this levels...

I see a RSI bullish divergence at this level, but sincerely this is not about technical analysis... the price can go to $2.00 in the next weeks

I will be buying what I consider next 3 support levels (DCA)*

HIGH risk investment for the long term...(at least 1 year) but also HIGH reward

Invest only what you are willing to lose...

Wish me luck !

(See you in HELL...or in HEAVEN)

* Dollar-cost averaging (DCA) is an investment strategy in which an investor divides up the total amount to be invested across periodic purchases of a target asset in an effort to reduce the impact of volatility on the overall purchase.

ACB possible bottomACB recent move up has some structure that looks decent enough to have an update on. Right now micro doesn't look great. Expecting further correction ~4.9 to 4.65. Bearish under 4.5

ACB nice bullish divergence -- counter trend though

Disclaimer, this is only for entertainment and education purposes and doesn't serve by any means as a buy or sell recommendation.

APHA Range BrokeClosed the gap, but support didn't hold. ACB created fear among retail investors, and this deeper retrace could be a buying opportunity. APHA has consistently shown us strong performance.

Confluence in the lower yellow zone.

Trading plan: start accumulating at $4.22 and add if she reaches downside targets $4, $3.80 and $3.50 into earnings.

Anticipating bear gaps to close, and potentially try at the recent higher high. A bounce would likely kick off Minor wave 1 of Intermediate wave 3. We need to assess further potential when we have October's earnings report.

ACB BUY (AURORA CANNABIS INC)Hi there. Price is forming a continuation pattern to the upside. Watch strong price action at the current levels for buy.

[ACB] Why ACB Will Erode Further... Puff the NIGHTMARE DRAGON!The EMA 377 says it all. That's what heavy gravity looks like.

Pretty terrifying huh? B)

ACB Aurora Cannabis slow deathWaiting for a some sings of life to turn bullish. Has a lot of potential and a good one to watch

ACB Strong Buy Signal w/ High Upside Potential next 6 monthsAurora Cannabis (ACB) closed at $6.98 on Sept 11, meeting 2 previous support Lows.

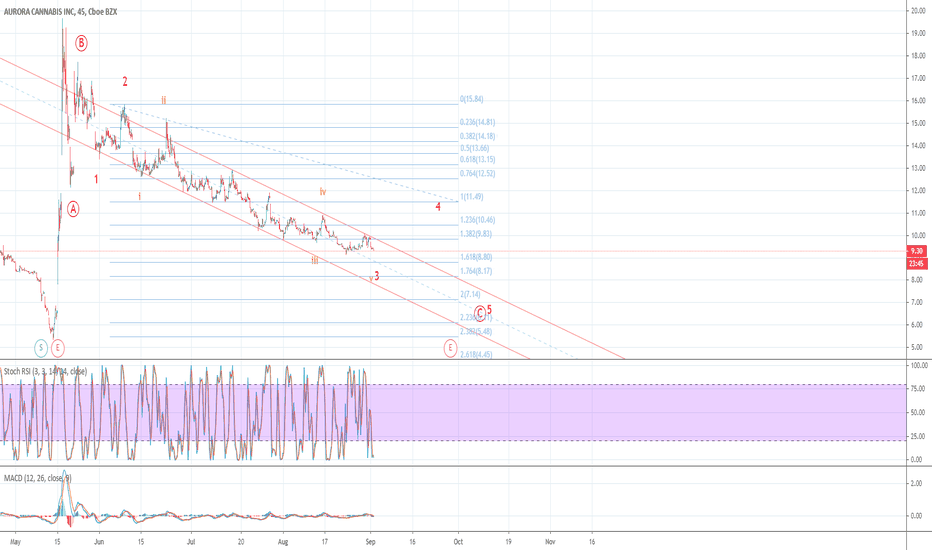

Fibonacci ratios and Elliot Waves on this chart fit quite nicely.

Key points for a BULLish trend over the next 6 months:

Key Support met again. History tells us a breakout may be on the horizon.

Declining volume on the downward trade indicates a possibility for a breakout with high volume.

RSI provides a strong oversold indicator.

Consider the larger Elliot Wave Trend and see that we may be at the low of a Wave 2 on the larger cycle, indicating the best buying opportunity of all time, with low downside risk.

Key Points for Risk-Reward Trades over the shorter-term:

Note the MACD cross-over, but also the unreliable nature of this indicator, especially considering prior history of "flip-flopping".

Lots of opportunity to trade the up and down moves to $150 over the short term if there is a bull breakout.

First target of $33.50 is based on the .786 retracement, and coincides with the impulse peak of wave 3. This will require a strong breakout with volume and likely be accompanied by high volatility.

Disclaimer: I am not a professional and I chart for my own education and learning. Please feel free to share your ideas and any resources you might recommend! Thank you! :)

THE WEEK AHEAD: PLAY, ACB, PTON, CHWY, WORK, AEO, GDXJ, QQQ, EWZEARNINGS:

Some decent earnings on tap in terms of options liquidity and implied volatility metrics this coming week. Here they are, ranked by how much the at-the-money short straddle is paying as a function of stock price:

PLAY (33/136/35.5%):* Thursday after market close.

ACB (30/205/32.5%): Wednesday (time not specified).

PTON (66/125/32.4%): Thursday after market close.

CHWY (19/112/25.7%): Thursday after market close.

WORK (51/104/25.1%): Tuesday after market close.

AEO (36/108/22.6%): Wednesday before market open.

ORCL (42/47/10.8): Wednesday (time not specified).

Pictured here is an expected move short put in PLAY with a break even at 13.70, 9.5% ROC as a function of notional risk, 88.9% ROC annualized; 4.8% ROC at 50% max/44.5% annualized at 50% max. Look to take profit at 50% max or cover if assigned. Basically, another COVID-19 recovery play (along with airlines, cruise lines, and restaurant chains).

With ACB and AEO being under $20/share, my basic approach would be either short straddle or iron fly, with the latter set up to generate risk one to make one metrics.

Examples:

ACB October 16th 8/9 "skinny short strangle," 2.70 at the mid price.

ACB October 16th 3/8/9/14 "skinny" iron fly, 2.42 credit, 2.58 max loss.

AEO October 16th 13 short straddle, 2.90 at the mid price.

AEO October 16th 8/13/13/18 iron fly, 2.48 credit, 2.52, max loss.

With the remainder, I would generally just sell the 20-25 deltas:

Examples:

PTON October 16th 65/135 short strangle, 8.43 credit at the mid price.

PTON October 16th 65/105/110 Jade Lizard, 6.01 at the mid price (no upside risk, downside break even at 58.99).**

PTON October 16th 2 x 55/2 x 60/125/135 "double double" iron condor, 3.43 at the mid.***

CHWY October 16th 49/90 short strangle, 5.08 at the mid.

CHWY October 16th 45/50/85/90 iron condor, markets showing wide in the off hours, but would look to get at least one-third the width of the wings in credit.

WORK October 16th 24/41 short strangle, 2.52 at the mid.

WORK October 16th 21/24/41/44 iron condor, 1.00 at the mid (but also showing wide in the off hours).

EXCHANGE-TRADED FUNDS RANKED BY PERCENTAGE OF STOCK PRICE THE OCTOBER AT-THE-MONEY SHORT STRADDLE IS PAYING:

TQQQ (49/117/29.0%)

GDXJ (22/59/14.7%)

XOP (16/56/14.3%)

SLV (44/55/14.0%)

GDX (23/47/12.4%)

EWZ (21/48/12.4%)

XLE (27/43/11.6%)

USO (7/44/11.4%)

SMH (26/41/10.3%)

I don't usually play TQQQ because it's leveraged, but thought I'd keep an eye on it if it does a mid-March lather, rinse, repeat.

BROAD MARKET:

QQQ (44/38/10.2%)

IWM (34/37/8.5%)

SPY (26/30/6.3%)

EFA (23/24/6.3%)

IRA DIVIDEND PAYERS:

EWZ (21/48/12.4%)

EWA (27/30/7.7%)

IYR (24/29/6.9%)

SPY (26/30/6.3%)

GLD (31/23/5.3%)

TLT (17/19/4.3%)

HYG (23/16/3.3%)

EMB (13/13/2.7%)

* -- The first number is the implied volatility rank; the second, 30-day implied volatility; and the third, the percentage the next monthly at-the-money short straddle is paying in credit as a function of stock price.

** -- Currently, PTON is showing some horrible skew on the call side, which can be accommodated via ratio, Jade Lizard, or a "double double" iron condor.

*** -- Double the number of contracts on the put side with the short put at half the delta of the short call and the short call vertical aspect at double the width of the put side. Hence the term "double double."

MJ- Cannabis stocks in the accumulation zoneACB, APHA, CGC, CRON, GTBIF, TLRY are in my Cannabis watchlist. I am bullish on APHA and GTBIF.

MJ is a more conservative approach to capture the gain with limited downside risk.

Ladder buy within the demand zone. Set the stop loss 10% to 15% below the demand zone for the swing to intermediate setup.

ACB updateStill bearish and looking for some kind of bottom around ~8.75. Show a potential alternate bearish count for a lower wave C

ACB Alternative CountIf you want to play for a bounce, levels of confluence are where you scale in. The next level of confluence appears to be $8.75 (thank you, Cryptowaveman).

The extremes of the falling wedge cross each other at around $8.50. The FIB 0.786 from the initial spike resides around $8.40, the 1.618 extension of waves 1-2 of the final C wave resides at $8.77. So the area between $8.40 and $8.80 has the potential for a bottom. In addition, one should not ignore the fact that falling wedges are bullish, so playing for a break out from these levels is a good idea.

Of course, the other count I have been following, isn't invalidated, and the set up is rather fragile, in my opinion. There is no momentum, and we should definitely be careful, not to get stuck in a bull trap. Any break out could confirm the wedge, then sell off. Fake out... That gap down there is lingering. Not all gaps get filled, so... will this one?

Trade safe!

ACB Aurora CannabisDon't like the look of the impulse/correction and still think ~ 8.76 is looking like a good potential entry if I see 5 waves down

ACB Still SpeculativeCould go either way, but the current setup strikes me as corrective in a downtrend. Since the trend seems to be down still, lets expect a flat correction here, with $9.80 as resistance and the previous low as the wave B target. Double top for a wave C to complete wave 2, before continuing down for wave 3.

So in summary, I'm still looking for a gap close at the larger wave 2 target, before starting on a more sustainable rally. That'll be intermediate wave 3, which should lead ACB back towards former highs now, finally.

The only thing that can mess up this game plan, is the broader market, which looks to be due for a more serious correction, or ACB itself, messing up earnings, or raising more cash at the expense of shareholders.

Levels on watch!