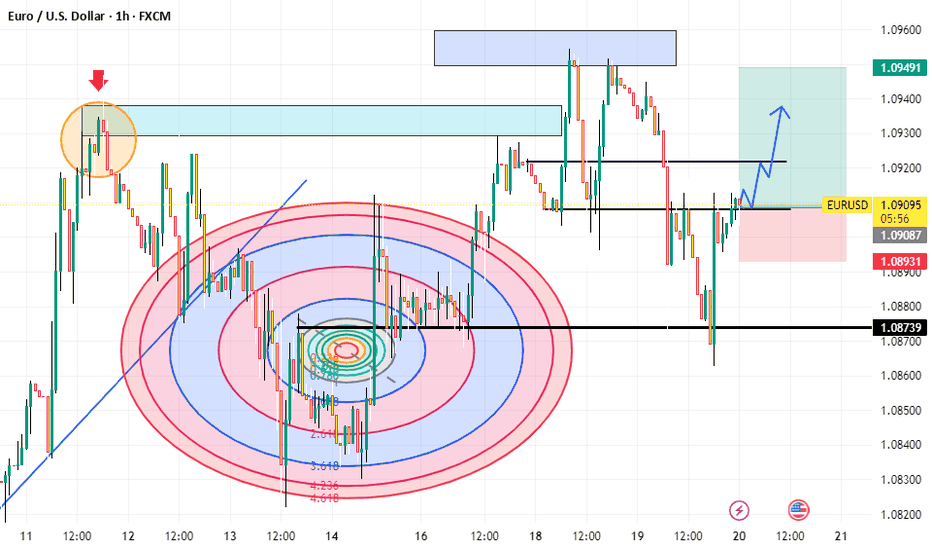

EURUSD TECHNICAL ANALYSIS FOCOUS ON KEY POINTS , EUR POSSIBLEhis chart is a technical analysis of the EUR/USD currency pair on a 1-hour timeframe, featuring several indicators and annotations. Here's a breakdown of what it means:

Key Features of the Chart:

Support & Resistance Levels:

The black horizontal lines indicate important support and resistance levels.

Support: Around 1.08739 (marked with a black line).

Resistance: Around 1.09491 (upper blue zone).

Fibonacci Circles:

The red and blue circular patterns in the middle of the chart suggest Fibonacci time and price levels.

These are used to predict potential reversal points or price movements.

Supply & Demand Zones:

Blue shaded areas indicate resistance (supply zones) where price previously reversed.

The price may react again when reaching these levels.

Candlestick Patterns & Trend Lines:

A previous rejection at the upper blue zone (left side) led to a strong downtrend.

The blue diagonal trendline suggests previous bullish momentum.

Forecasted Price Movement:

The blue arrow suggests an expected bullish move toward the 1.09491 resistance level.

The setup suggests a buy trade with a stop loss around 1.08931 and a target near 1.09491.

Conclusion:

This chart suggests a potential bullish move in EUR/USD, with an expected rise toward 1.09491 if it breaks the resistance near 1.09104. However, if it fails, it could drop back to the 1.08739 support level.

Would you like further analysis or clarification on any aspect? 🚀

Accountmannager

DON'T MISS EURAUD SHORT TRADE📌 Trade Setup Details:

Pair: EUR/AUD

Timeframe: 4H (4-Hour)

Entry: 1.66347 (Sell Entry after Liquidity Grab)

Stop-Loss (SL): 1.66587 (Above Sell-Side Liquidity Level)

Take Profit (TP):

TP1: 1.65000 (Fair Value Gap - FVG)

TP2: 1.64808 (Order Block - OB)

TP3: 1.64309 (Major Sell-Side Liquidity Target)

Risk-to-Reward (RR): Around 1:4

📊 Market Analysis & Justification:

Liquidity Grab: Price swept previous highs, indicating a potential reversal.

Order Block Confirmation: Rejection near the 4H OB confirms a possible sell setup.

FVG (Fair Value Gap): An imbalance below suggests price is likely to fill this zone.

Market Structure: After liquidity grab and rejection, we expect lower lows in the market.

This trade setup follows Smart Money Concept (SMC) and ICT principles, aligning with bearish price action. 📉🔥

EURUSD SELL TRADE EXECUTED.As we see in EURUSD Bearish BIAS and price is in downtrend. Weekly chart is in a bear breakout on the weekly chart, the bears will likely get a second leg down. This means that the upside is probably limited on the daily chart.

EURUSD NEXT:

In smaller timeframe eurusd creates equal high in M15 1.5152 so i am waiting for the price to enter in the ICT order block for the sell limit order trigger. for the target of next low ICT DEMAND Zone/.

XAUUSD GOLD DROP MORE ?`In the daily time frame gold was in sell off trend and in friday break its support of 1660 level and now respect its support trend line in 1h smallar time frame and we expect on monday open that price retrace to its previous support now test as a resistance and than after closing bearish on 1h we have a good short sell trade in gold xauusd for the target of next support level coming according to price action which is 1623 and the low of sep 1615 strong level of support according to daily time frame and expected that price bounce to upside from this 1615 level. if on monday price break coming market structure resistance than wait for the range of 1660 level and after sell closing on 1h good setup to short on gold for the target of 1645 1640 and this week target is 1623-1615 level.

The technically gold is in down trend and bearish market also fundamentally dxy dollar index is strong due to strong cpi numbers and hike in interest rate desicioun from the federal reserve fed/.

AUDCADIn AUDCAD after market test its strong resistance trendline at 0.91059 price drop to 0.90930 after the market open if price break market structure 0.90830 than you go for short position and exit on the coming support which i draw in the charts. if price come back and push to upside than wait for the trendline resistance again test if you see again some strong bearish candles than you go short with very good R:R.

ENTRY SHORT 0.90808 AND 2ND 0.91049

TAKE PROFIT 0.90561

TAKE PROFIT 0.9030

STOP LOSS 0.91171

XAUUSD(GOLD)Gold OANDA:XAUUSD break its previous strong swing high resistance and also #200EMA on 1H timeframe than retest to its resistance and #MOVINGAVERAGE as a support now price is consolidate between 1838-1849 zone. Now we see bullish move after break of this zone in the open of monday market we see break in #asiansession. so Buy after break of this zone and targets are 1858,65 and above levels are mentioned in charts.

GBPAUD - H1 - BuyGBPAUD - H1 - Buy

TP = 1.88400

SL = 1.86400

The RSI is below 50.

The MACD is below its signal line and positive.

The MACD must penetrate its zero line to expect further downside.

Moreover, the pair is trading under its 20 period moving average (1.8891) but above its 50 period moving average (1.8701).

How to be a Successful Forex trader Segment 1FIRST HAVE A PLAN .

Better yet, have 2 Plans!

Most traders have a trade plan, that will tell them when to get in and when to get out (or at least it should and I will cover that in the next segment)

What a lot of Trader's don't have and really need, is an account management plan.

An Account Management Plan is necessary to keep you from causing too much damage on bad days, to having a positive outcome on so-so days and a Great out come on the good days. In short, it will protect your account and allow it to flourish :)

1. How to do you handle the bad days? Unfortunately, we all have them but limiting their impact is crucial to your long term trading success. Personally, I risk 2% of my capital per trade and usually only take 1 sometimes 2 trades per day. so the most I will ever lose in a day is 4%. which is okay because the majority of my trades have a 3-1 RRR or better, so I can make that up in 1 trade. Might i suggest, limiting your daily losses to a percentage that you can make up in a single day/session. You don't want to spend days trying to recoup losses from a single day.

2. How do you turn the so-so days into a positive: On day's where the market does not do what you expect, you need to recognize that and hopefully bank some profit or at the very least, cause no damage to your account. Sitting on the sidelines patiently waiting for a good trade is a lot better than being in a bad trade. Today was a So-So day for me. As illustrated in the above chart, I took a pullback trade with an entry at 1.8318. it took a lot of heat and almost got stopped out, but I stuck with my stop loss and the trade came back and dropped down to the bottom of my Asian box, where I banked 1/2 my position and moved my stop to flat. And the remaining 1/2 of my position did indeed get stopped out. So yes the market did not breakout and run down as expected but I still made a profit. :)

3. Make the good days.... Great!!!

Before you enter into a trade, you should know where you are getting out, both good and bad. On the days where the market breaks your way. Stay with your anylasis and don't close the trade early. I talk to a lot of traders who do this and I get it!. The trade is Green, the Money is there...let's grab it!! You need t check yourself and stick with your original anylasis on how far the trade could run. That said you also must be prepared to protect your account. Personally, Once I am up 2% on the day. I will NOT let it become a losing day. Period. If the market reverses, I am out and I am done. Once I am up 4% I will lock in at least 2% of profit and so till the market reaches my Profit target and then I will close my full position. Although the market may run further, I stick with my original analysis of the proper Profit target.

I hope this post is helpful and If you have questions, either put them in the comments below or message me

Allen

Elements of a Successful Trading Plan 102SELF DEVELOPMENT/METHODOLOGY/PSYCHOLOGY

Elements of a Successful Trading Plan 102

2. Risk Level

Managing a risk in trading is essential if a person wishes to make profitable investments. As a

trader, one cannot control the market but he/ she do have the capacity to change what can be

done as circumstances require. They need to adapt the changes as the market conditions evolve.

A person does not take a position and hopes the market acts in your favour. Managing trading

risk will be a key factor in an individual’s long term success as a trader. As the market, structure

changes, the risk profile of trade will also change.

Risk will vary at different points of a trade and needs to be managed in a manner, which is

consistent with the individual style of each trader. This will be dependent on each trader’s

personality and time frame. Assessing market conditions can be categorised into core areas

where one need to consider the risk profile in his/ her trade. This risk needs to be assessed also in

line with your trading objectives. Active traders will tend to add and take off risk for each new

swing in the market, whilst passive investors will ride minor retracements looking to achieve

larger reward targets. Following are some areas where risk can be managed throughout a trade as

well as what to look out for at these points that indicate that the risk is increasing;

• At Entry: Stop loss risk.

• Distance from Moving Average: Price exhaustion risk.

• “M” Pattern: Price retest failure risk.

• Candlestick Tails and Shadows: Price rejection risk.

• Period Close: Price rejection risk.

• Reducing Range: Trend momentum risk.

• Support or Resistance: Price level failure risk.

It is necessary that how an individual plan to address the risk management needs to be included

as a critical part of the trading plan in order to protect the invested capital and preserve the

profits. One need to have strategies in place for how he will deal with the different areas

throughout a trade and how he will know when risk is increasing to a point where action needs to

be taken either to protect profits or capital.

Follow your trading plan, Remain disciplined and keep learning :)

More elements will follow... Like, share, Comment and follow us to keep updated on our professional trading ideas and education :)

GER30 in a Triangle area. Weekly analyseHola guys,

Our DAX30 is in a indecision moment, this is the reason this week i staied neutral. It is between R1 resistence and S1, S2 supports. The triangle pattern is made by connecting T1 upper trendline and T2 lower trendline. Also in the chart you can see T3 daily trendline.

Now... my plan for the next week is to wait Monday to see where it's gonna break and after i'll wait a confirmation for the trend that is gonna come ( i'll look for a test ceilling ).

We could have:

1) breaking of T2 and a test ceilling on T1 or S1. Than i'll sell paying attention at 5min candle stick patterns and at the price action. I'll also look for the possible pullback on S2 and T3 ( this are bullish areas ); here i could swip the trade, but anyway i'm gonna advice you if a change is near. S1 and T1 will protect my SL while the first TP could be when the price touches T3

2) breaking of T1 trendline and a test ceiling on the same trendline. This would be a bullish signal ( of course first we have to look at the price action of the market and candle stick patterns ). In this case i'm gonna take a long position, paying attention at when the market touches R1 resistence ( this is the strongest bearish area ). If a swip of the trade will happen i'll write you. S1 will protect my trade while the TP will be near to 11800 ( or i'll close it at a strong pullback that could be a change of direction ).

This is my weekly technical analyse for GER30. When the broke of the triangle will happen i'll publish the idea of the direction that i'm taking.

I hope that this idea will help you. Personally i'll use it to open BO options and couwntdowns... and of course for normal trading too. For any question about the analyse or others request like: the reason of the support and resiste areas, money management or personal market advicer service or account manager ( if you're account is in a bad moment ) contact me in p.m. without any problem, i'll be happy to help you.

Kind Regards,

Delta B.