Accumulate

#EOS - Accumulate small chunkDon't put in BIG capital hoping for quick returns, it is one of High market cap coin so will take that long to move!

i don't see it moving anytime sooner, possible accumulation going on, might happen till 2021, as long as weekly doesn't close below 2428 this chart is valid.

Immediate résistance - 3345

The support that was there for 1.5years has now turned in to a HUGE RESISTANCE!

S/R Flip -

Possible triangle forming on weekly

possible IH&S -

Weekly RSI Divergence -

Advice will be to accumulate small chunk till 2021, but don't allocate BIG capital as your capital will be locked, rather than go with small-cap coins they have a better chance of giving you good returns in smaller times!

#notfinancialadvisor

#DoYourOwnResearch

Long term. Long and accumulate some LTC/BTCBiggest TD9 I ever saw. 3 month LTC / BTC. I will not that both charts are on Camarillo range support levels or near.

Long term play. It has been to the topside of this range like a dozen times. And remember it was 140 or something last year. It has been nearly a year since its halving. and hasn't made a peep. I do not suppose... it is NOT being accumulated? and that nobody is buying it except for bots ever again? hmmm /shrug

#BTC swing - Update on H&SOriginal Idea -

i never say to go all in, I am happy that I was able to accumulate 6k-4k levels, I still had bids pending at 2k & 1k but IMHO if we hold 6.6k then people calling for BULL RUN won't be that far!!!

Trade safe boys & girls make sure to checkout telegram channel for scalping & leverage trading

#DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR #DYOR

LTCBTC Initiates Launch Sequence Some digital coins might be already be initiating launch sequence and:

* Begin final vehicle and facility close-outs for launch

* Check out backup flight systems

* Review flight software stored in mass memory units and display systems

* Load backup flight system software into the orbiter's general purpose computers

* Remove middeck and flight deck platforms

* Activate and test navigational systems

* Complete preparation to load power reactant storage and distribution system

* Complete flight deck preliminary inspections

Meanwhile, hundreds of humans are secretly planning to escape earth's fate preparing mission "Artemis"

Artemis, goddess of the hunt, the wilderness, wild animals, the Moon, and chastity, twin sister of appolo,

daughter of Zeus, son of Rheia & Kronos, youngest of the first generation Titans, the divine descendants of Uranus,

the sky, and Gaia, the earth a generation of gods preceding the Olympians.

In a few days Northrop Grumman's thirteenth contracted commercial resupply services mission is launching its Cygnus spacecraft

aboard an Antares rocket from Wallops Flight Facility in Virginia, delivering several tons of cargo to the International Space Station.

In March a SpaceX Dragon cargo spacecraft is scheduled to launch on a Falcon 9 rocket from Space Launch Complex 40 at

Cape Canaveral Air Force Station (CCAFS) in Florida, delivering NASA science investigations, supplies, and equipment to the International Space Station.

As far as we know these facts are not directly related to Litecoin nor it's imminemt launch to the moon what so ever.

Accumulation on XRP:BTC?Hello All,

Today, I wanted to talk about the possible accumulation on XRP:BTC. The reason why I am claiming that there is accumulation happening is that once price peaked (approximately 3780 satoshis) from the first bottom (approximately 2360 satoshis), the decline in price action formed a bullish falling channel. In addition, there is a weekly inverted hammer on the second bottom. The only problem with accumulation that occurs in a falling channel is that it can be difficult the gauge the bottom and that it is highly possible that there is a fakeout downward (known as a spring) before price increases.

The weekly hammer has a support of 2530 and if there is any weekly candle that breaks this support and has a weekly candle whose close is lower than this support is sufficient to inform that the inverted hammer is not respected and that there is a high possibility of strong movement downwards. However, if this candle holds as support, then there is a strong opportunity for price action to make significant upward movements.

Price action:

If this is a double bottom, we are most probably going to see that the price will possibily break the two converging trendline which form a falling wedge. If price action cannot break through this trendline, then I do believe that it will have a movement to the trendline and then drop. If price action can break the resistance of the falling wedge, then there is likely to be a retest of the previous resistance and a movement to the peak of the double bottom. In the ideal situation, the strongest form of bottom would be a saucer, or rounded bottom for the second as it breaks the resistance. The reason that this is ideal is that the falling wedge is not near its apex, and needs to show strong support in this region. One of the best patterns to show a lot of accumulation and support is a rounded bottom.

Best of Luck and Stay technical!

Previous Analysis:

LTCUSD - Still long on weeklyFrom my last idea about COINBASE:LTCUSD on the weekly:

"Personally, I feel this a valid time to accumulate given the very bullish news around crypto and blockchain technology in general in the last few days. I plan to hold for a while as the ratio is very low vs. BTC , see: COINBASE:LTCBTC . I'm a very firm bull on COINBASE:BTCUSD but also believe that LTC is at a low ratio, and with great signals for a potential trend change vs.USD."

This was while price was at around $58.

Key takeaways now:

Stochastic appears to be turning upwards while on a red candle. Means it is hard to push that indicator down at this time.

Bounce from bottom BBand.

MACD histogram getting really low, potential crossover still.

Green 50 Week MA forecasted potential cross above Yellow 100 Week MA in about 6 weeks with current prices.

I still feel like this is an excellent time to accumulate.

Only thing I don't care for is the Stochastic RSI still heading downward, however this indicator is quick to move, so solid bullish movements will correct it quickly.

DISCLAIMER: For educational and entertainment purposes only. Nothing in this content should be interpreted as financial advice or a recommendation to buy or sell any sort of security or investment including all types of crypto. DYOR, TYOB.

XRP - Strong Buy - Ripple - updateBITFINEX:XRPUSD Accumulate. Cycle Wave 3 is beginning.

Learn here: www.ripple.com

Stats:

XRP Price $0.281420 USD

XRP ROI 4,691.07%

Market Rank #3

Market Cap $12,147,991,414 USD

24 Hour Volume $1,567,699,568 USD

Circulating Supply 43,166,787,298 XRP

Total Supply 99,991,330,383 XRP

Max Supply 100,000,000,000 XRP

All Time High $3.84 USD

(Jan 04, 2018)

All Time Low $0.002802 USD

(Jul 07, 2014)

52 Week High / Low $0.560547 USD /

$0.227052 USD

90 Day High / Low $0.349789 USD /

$0.227052 USD

30 Day High / Low $0.322034 USD /

$0.227052 USD

7 Day High / Low $0.283725 USD /

$0.244366 USD

24 Hour High / Low $0.283725 USD /

$0.274915 USD

Yesterday's High / Low $0.283569 USD /

$0.271744 USD

Yesterday's Open / Close $0.275829 USD /

$0.278459 USD

Yesterday's Change $0.002630 USD (0.95%)

Yesterday's Volume $1,518,125,769 USD

coinmarketcap.com

Today's global payments infrastructure has more in common with the outdated postal system than this generation’s internet. Recognizing this friction in payments, our founders established Ripple with the idea of using blockchain technology and digital assets to enable financial institutions to send money across borders, instantly, reliably and for fractions of a penny.

This unification of the underlying infrastructure that ties institutions and providers together not only helps our customers grow their business but also it helps enable the world to move money like information moves today—a concept we refer to as the Internet of Value.

Utility:

The best digital asset built for payments

While all the financial institutions on our network enjoy faster, lower-cost global payments, those who use the digital asset XRP to source liquidity can do so in seconds. XRP is quicker, less costly and more scalable than any other digital asset.

Weekly Chart: Cycle Wave 1 & 2

Wave Count:

See related idea for further analysis.

Will update

-AB

Between a rock and a hard placeSince the dump two weeks ago, BTC has found support on the Weekly 100 Moving Average, but is also held by resistance from the Daily 200 Moving Average. To a lesser degree, the Daily 13 Moving Average may be starting to have some influence, although that remains to be seen.

Following these levels and their strength will give you the first indication of if BTC is going to break back up to $10,000, or down below $7700 to lower support levels.

Here is the link for the free 50,100,200 Daily AND Weekly Moving Average indicator , offering key areas of potential strong support & resistance - make sure to switch on and off to your preference.

Also save crucial space on your Trading View chart by utilising the free RSI and StochRSI indicator which overlays both in a clear and helpful fashion.

Please give me a thumbs up and follow me if you found my analysis interesting. This is for educational purposes only and not a recommendation to buy or sell.

Patient trade here. Wait for the accum zone...TREE Dont jump the gun on this one, but rather over the next 6 weeks begin accumulating some Lending Tree shares or options in anticipation of a continuation pattern upwards. See below for more close up look. The cup and handle pattern is one of the most misused patterns I see on here, as everyone just wants to call any round bottom a "cup and handle". They are not. A true cup and handle is a continuation patters coming off an uptrend. The "cup" forms, and then the handle needs to retrace approximately 2/3 of the cup depth, or usually right around the .618 fib zone. That is the buy area. In this case, puts your accumulation zone around 285-270 for the ride back up. In addition, this stock has respected the weekly 125 MA at each pullback in its uptrend thus far, and I expect no major deviance here. However, if the stock falls below 250 the pattern is negated and the loss needs to be cut at 7%ish. Happy hunting, and GLTA!!

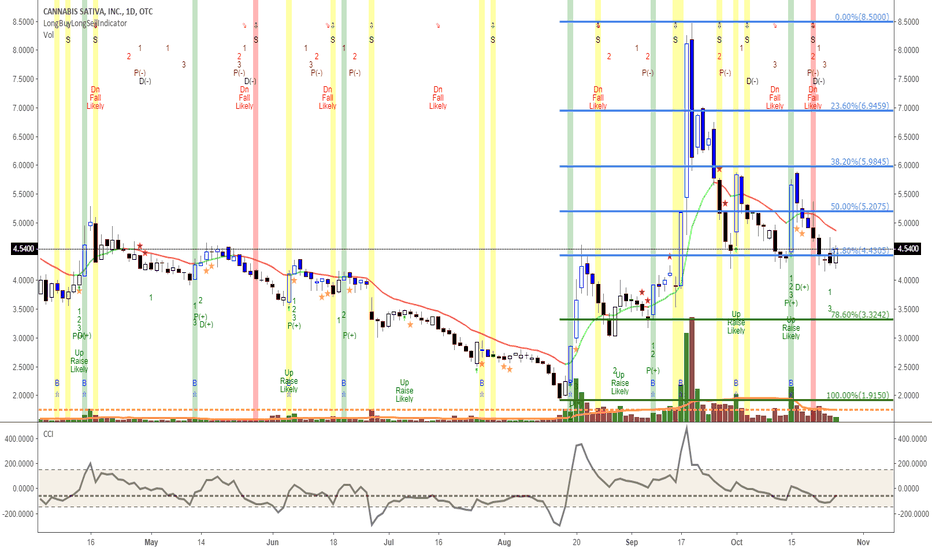

Last chance to buy TLRY sub $50!Update on TLRY. Please like/comment if you see value in this post. Thanks.

My previous post/analysis/thought is still in tact ( )

I found that the current price action found the blue channel very well. Also, the bottom blue line in that channel is very compatible with the other part of the price chart.

I still think any purchase within that green box would be a winner buy and this could be the last chance to buy TLRY below $50.

The Fib Circles in green still plays very well. I expect to see another drop as we approach/pass the next green circle and in general I expect to see the price chart follow the channel in blue.

ADX and DI looks very healthy and supportive too, the green line is above the red and DI looks like growing (getting more momentum).

TLRY finds a good support on 50-day MA as well.

Good luck.

REQ in an accumulation zone. REQ is chopping around in what appears to be an accumulation zone between the .618 fib and the .886 fib. Could be a lagging trade opportunity if it follows the path of its peers.

Moving average guide (All daily for this post):

50 day moving average in Green.

100 day moving average in Yellow.

200 day moving average in Red.

-This is not financial advice. Always do your own research and own due-diligence before investing and trading, as for investing and trading comes with high amounts of risk. I am not liable for any incurred losses or financial distress.

CBD Oil - pain relieving gainsCBDS CVSI GWPH INSY OTC:EMHTF

CBD oil as extracted from PCR HEMP has many pharmacological/nutraceutical benefits.

* Sleeping better

* Relieves stress / reducing anxiety

* Pain Relief & joint pain - and is non-psychotropic (PCR HEMP contains < 0.3% THC and often less in CBD Oils)

* Epilepsy and epileptic seizures

* IBS/Crohn's disease studies in process

* Helps immunity and found to reduce cancer

* Reduce risk of diabetes

* Reduces nausea and vomiting

* Alleviates skin irritations & itching (psoriasis)

All of these stocks offer various growth options in CBD Oil.

BTC: Price under SMMA + RSI over sold (under 40) = accumulate?Something I noticed on the Bitcoin 0.56% 0.69% weekly chart is that before the second and third bull run, while the price was under the SMMA ( Smoothed Moving Average ) and the RSI was oversold (under 40 in this case), it would have been a good idea to accumulate Bitcoin 0.56% 0.69% .

Is this a reliable indicator for future buying opportunities? What are arguments against this theory?

If you see any mistakes or anything interesting you wish to discuss, fire away.

Thanks for viewing.

What the freak is a smoothed average?

www.danielstrading.com

ADA wants to grow upCardano is still relatively dependent on bitcoins next major move. Regardless behind the scenes Emurgo hires a Chief Marketing Officer Florian Bohnert Forbes 30 Under 30. Also a recent Indonesian supply chain venture has been created with around 700 stores that will use ada in the future. Lots of room to grow with upgrades before the next giant wave of people enter, that will inevitably see cardano on coinbase 'hopefully with many others'' Targets are not long term, only for fun and not financial advice.

ARDR another chance to accumulateFollow this project intimately. Working release, growing team. innovative, nxt 2.0 platform with unique child chain technology. very active dev, great community. One of the best long term platform coins in the market. Fill your bags if it drops below 3k, could see all the way down to 2650, but its risky. A new ICO on the platform begins early June (triffic) and more childchains will come on board in the future. short term bearish, LONG term extremely bullish.

satoshi wise, new ATH will be reached without a doubt.

$$ value will suffer through btc bear market.

although, there is a childchain EURO gateway

and murmers of other fiat pairings in the future

BTFD on this one. should be in every well diversified altcoin portfolio

LTC/USD Head & Shoulders Weekend - Which Way?It looks like we're going to have a Head & Shoulders weekend in Litecoin. As usual, we've seen some solid dips and bounces over the past week, and if traded right, some nice profits have been made. Today I'm using the 1 hr chart to show the pattern formation. This one's kind of crazy, because it could go one way or the other.

Last weekend, we saw a solid dip below the bottom of the downchannel (pink lines) to 138, then a healthy bounce to 165 on Monday. Next, a bull flag formed, and an increase to 175 followed on Wednesday. There were 3 attempts to break the wall at 175, then the retracement started. Today we're sitting around 158, and it appears we have 2 possible H&S patterns forming. Haven't seen this is awhile, but it could go either way. the bottom of the right shoulder of H&S would be in the 155.5 range, and a bounce to 163 would be major decision time.

On the flip side, there's a good chance an inverse Head & Shoulders is in play,, and if this occurs, we may finally see a significant rise out of the downchannel. The inverse H&S is shown in green, and it began way back on March 12th when we dropped from 192 to 149, bounced to 172, dipped to 138, bounced to 175, and dipped back to where we are today. If we retrace to 150 and bounce...once again...163-164 will be major decision time. If we blow past 164, we cut be off to the races to complete the right shoulder at 178, and hopefully break the downchannel at 182. If we see a big dip at 164, the "bad" head and shoulders would complete near 156. IF that happens, don't be surprised if we dip back to the bottom of the downchannel around 130.

Either way, it appears something major is about to happen. We've got low volume, and a LOT came happen quickly when the "manipulators" decide to make a move. I'll be watching for the bounce on Friday morning. This is not a bad place to pick up some coins, and keep a close watch if it climbs to 164 range. Hoping for the inverse H&S to happen, and hoping to clear more than 5% gains. It's time for the bear market to end. Last year, the first major rise was on March 31st, and it looks like we could be in the same position this weekend.

Of course, this is crypto...so anything could happen. Don't FOMO, trade wisely, and always save some FIAT to cover your tail.

This is only an idea, and it's not by any means investment advice. Trade at your own risk. As a part trader, part HODL'er...LET"S BUY THIS BABY TO THE MOON...or at least the sky.

NEO potential breakout - IF it passes this test...In these bearish times, NEO has weathered the FUD storm with exceptional grace, stability and even prosperity.

2-month old articles being re-posted by traditional financial institutions and journalists who want nothing more than to see Cryptocurrency collapse - Fear mongering and overreactions to misinterpreted information has seen BTC sharply decline over the past few weeks, taking with it the alt-coins (even the best of them, such as BNTY, DBC and XBY) who simply couldn't sustain the decrease of market capital.

And now NEO enters a crossroad - Pass this test, and I predict NEO to go well beyond 200USD by Mid-March. NEO DevCon is currently underway, with some of the most innovative ICO's on the NEO network showcasing their stuff. Perhaps it is this optimism and it's advanced tech that is keeping NEO up there and putting it on the crypto map as the potential saviour to BTC's slow network and high fees.

Analysis: If NEO can test the lower 0.382 Fibonacci bound and return to the 0.5 point and beyond, I predict the decline will be no more - oscillation between 0.5 and 0.618 Fib level towards the BUY ZONE point shown in the graph indicates a PASS for NEO. IF the lower 0.382 Fib level is not returned to after NEO hits the top 0.618, I would recommend a large buy.

Breakout beyond 0.786 and even a return to 1 is very possible if the above conditions are met. I recommend watching for the next few days to see NEO's movements. DO not buy above the buy point, you'll regret it