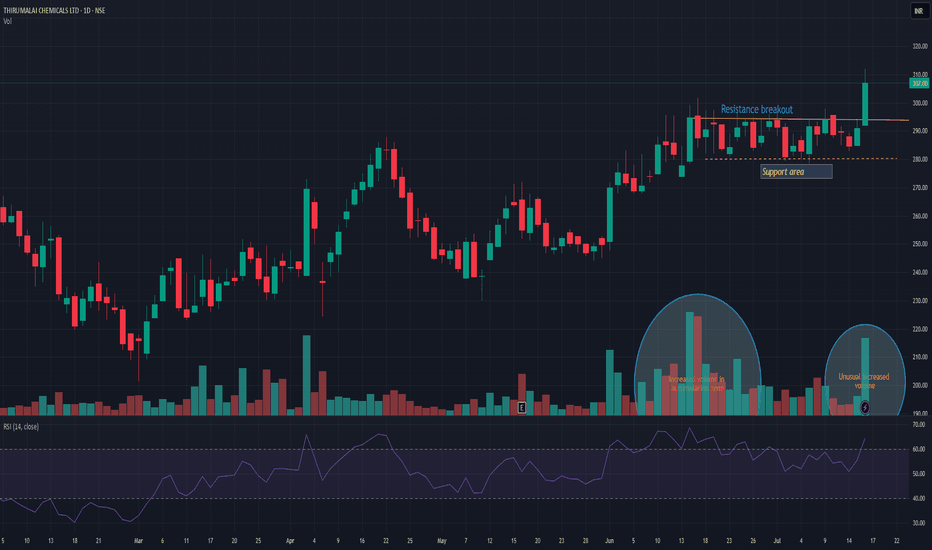

TIRUMALCHMTIRUMALCHM has given resistance breakout with decent volume. Another good thing is unusual volume increased in accumulation zone. Support can be seen near 280 levels. There is high probability that this time it may push the stock in to trend change and may take momentum to the next level. Keep it on radar.

Accumulationzone

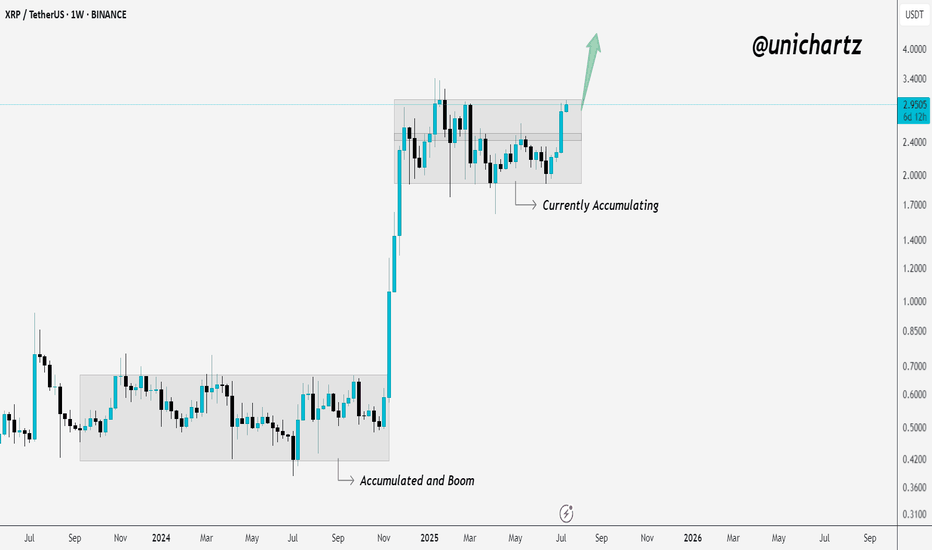

Accumulation Ending? XRP Showing Signs of BreakoutXRP is in the process of breaking out of its weekly accumulation range.

The last time we saw this kind of structure — it led to a massive move.

Now, price is pushing toward the top of the zone again… and momentum is picking up.

If it closes strong above this level, it could trigger the next big leg higher.

Stay alert — this could be the start of something big!

DUCKCHAIN LONGDUCKCHAIN is currently primed to move out of its accumulation zone. In fact, it is lagging behind alt coins who has already made there way out of their accumulation channel. Duckchain is in a prime location to see massive moves from this zone. First major target area is .00448 region. We are currently lookinng at using 4x leverage in the futures market. This will also give us a 1:4 risk reward from these levels.

Gold Xau (tf1M) Last Phase AccumulationGold Xau Last Phase Accumulation incoming 👇

"Way from 1500 to 4100" (+175%)

OANDA:XAUUSD

⏰ TimeFrame 1 Month

👉 Go to last phase accumulation

👉 White Trace

👉 Green Trace

👉 EMA 200 1M (White)

👉 Fib Measure as pattern "ExPanding Triangle" ( blue stick )

👉 Potential +175%

✔️Logarithmic (Log) Chart & Fib

$TTD to go below $60- Investors were paying too much for growth in NASDAQ:TTD

- It operates in a very competitive space.

- Leadership is solid however eps growth and gaap eps tells a different story. EPS growth is impressive but gaap eps is terrible. Stock based comp remain consistent but somehow gaap eps isn't growing as fast as non-gaap eps.

- Nonetheless, here's fair value for NASDAQ:TTD

Year | 2025 | 2026 | 2027 | 2028

EPS | 1.79 | 2.21 | 2.85 | 3.89

EPS growth | 9.54% | 23.13% | 28.92% | 36.66%

For eps growth of 20%+ and company with a moat. Fair forward EPS is 30

Year | 2025 | 2026 | 2027 | 2028

Bear Case ( p/e 20 ) | $35 | $44 | $57 | $77

Base Case (p/e 30 ) | $53.7 | $66.3 | 85.5 | $116

Bull Case (p/e 35 ) | $62 | $77 | $99 | $136

Idea is to buy close to fair value and hold it for period when there is optimism in the market or euphoria and/or valuation expansion where stock is assigned higher forward p/e multiple.

For me, NASDAQ:TTD is a buy under $65. However, I have started with a starter position at 80s because you many times good stocks bottom above its fair value.

I plan to build a position in increments because you never know how much stock will undercut on pessimism. However, the above intrinsic value based on EPS should help to identify the ranges

BILI | China's Gaming Industry will RiseBilibili, Inc. is a holding company, which engages in the provision of online entertainment content. The firm enables broad video-based content consumption scenarios centered around professional user generated videos supplemented with live broadcasting, occupationally generated videos, or occupationally generated videos. The company was founded by Xu Yi in June 2009 and is headquartered Shanghai, China.

Google is Taking a Break and accumulating for the 2nd run !Google returns to the inflection zone we had previously studied. This is good news because, after pulling back, we got a bounce in the same inflection zone.

What does this mean?

It means that the price is more than ready to continue its upward trend; however, it is just forming an accumulation pattern, where it could resume its upward movement at any moment.

Key points to follow:

Markets, in general, are bullish, and we are in a week of high market euphoria, which could support the price to continue rising.

Google continues to report positive news within the company.

Google’s prices have increased, indicating that higher figures may be reported in their next earnings report.

In my opinion, Google will remain in an accumulation range this week—it's a pattern where the price will hold steady this week before its next bullish run.

Thank you for supporting my analysis. TRADE SAFE! Best regards."

Nvidia So close to earnings report ! here is my analysis... In this chart, I haven't moved anything at all since my previous analysis of Nvidia. The price is making its natural movement just as we’ve been predicting.

As you can see, the last candle closed by bouncing off my order block and following the pattern of my forecast arrow.(yellow dotted arrow) Based on the price behavior, we can predict that as it gets closer to November 20 — the earnings report date — it will simply be accumulating.

Nvidia's last earnings reports have been phenomenal, and I don’t doubt that this report will be a trigger for the price to make a decision.

But for now, we’ll only see the price in a range until a few days before the report, when we’ll see those high-volume candles that will drive the price in a single direction.

Which direction? The one the report indicates.

Best regards!

Hooking the BigTime: Reeling in Profits Before the Tide Turns!💡 Overview :

This trade setup focuses on accumulation and distribution zones of BITGET:BIGTIMEUSDT.P identified through technical analysis, inflow/outflow metrics, open interest, and funding rates. Based on the data provided, we're targeting a strategic entry point during accumulation, a clear stop-loss level, and a take-profit level based on historical resistance. Let’s dive into the why , what , when , how , and where of this trade.

🐝 Why This Trade?

Accumulation Phase 🟢:

The accumulation zone between $0.10 and $0.12 is based on increased inflows (green bars) combined with strong support levels where buying pressure was historically dominant.

Long/Short Sentiment 📊:

A favorable long-short ratio around these levels signals traders expecting upward momentum, supporting the accumulation narrative.

Price Bounce Potential 🚀:

The charts indicate significant price rebounds after reaching this zone, supported by previous spikes in Open Interest and inflows, signaling that buyers are active here.

🐝 What’s the Plan?

We aim to enter the market within the accumulation zone between $0.10 and $0.12 and exit at a key distribution level of $0.15 for a calculated risk/reward trade.

🐝 When?

Entry Point 📈:

Enter the trade when the price touches or consolidates between $0.10 and $0.12 , confirming that accumulation is happening (evident by inflows outweighing outflows).

Exit Point 💰:

Exit when the price hits $0.15 , which aligns with a previous resistance level where heavy distribution and outflows were seen, suggesting a potential reversal.

🐝 How?

Risk Management Strategy 🔒:

Stop-Loss :

Place your stop-loss just below $0.10 to protect against downside risk in case the market fails to hold the accumulation zone.

Take Profit :

Set your take-profit level at $0.15 , which is the projected distribution zone , as prices have historically struggled to break past this level without major outflows.

🐝 Where are the Key Levels?

Accumulation Zone 🟢:

$0.10 - $0.12

Look for inflows > outflows and rising open interest to confirm accumulation.

Take Profit Level 🏆:

$0.15

Previous resistance and outflow spikes suggest this is a key distribution zone.

Stop-Loss 🛑:

Below $0.10

To protect against losses, use a tight stop-loss just below this level where strong support is expected.

🐝 Trade Summary 📝:

Entry : $0.10 - $0.12 (Accumulation Zone)

Take Profit : $0.15 (Distribution Level)

Stop-Loss : Below $0.10

📊 Indicators to Watch :

Long/Short Ratio : Favorable for longs near accumulation.

Net Inflows/Outflows : Inflows must exceed outflows in the accumulation phase.

Open Interest : Look for peaks to signal strong market activity before a potential breakout.

🚨 Final Thoughts :

This trade idea relies on well-established support at $0.10 - $0.12 and anticipates a rebound towards $0.15 , where distribution pressure might cause a reversal. Risk is managed with a stop-loss just below the accumulation zone, and profits are locked in at the $0.15 level.

Good luck! 🍀📈

Ethereum just entered an accumulation phase after the breakoutEthereum just broke out of the months-long channel, and in this case, we didn’t see a breakout with strength and volume. However, ETH is entering an accumulation phase and will consequently need to make a decision to break out and rise back to last month's levels.

Just remember that the backbone of all cryptocurrencies is Bitcoin, and if Bitcoin decides to go up, the entire crypto market will rise as a result. So, I invite you to check out my Bitcoin analysis.

Thanks for supporting my analysis.

Good luck!

Ethereum still in accumulation zone, what's next?After Ethereum has been in a downward channel, it breaks the sequence at point #4, which remains in the accumulation range from previous days. This zone is extremely important because, as you can see, it has been moving within this area for several days, which means that the price could gain strength at any moment and start a bullish run. But NOTE: as long as the price remains within the channel, there will be no bullish run. We need to wait for the price to break out of the downward channel to confirm that it is heading back to the supply zone.

Thank you for supporting the analysis. ETH is at a point where adding a position might be considered; let’s hope the price makes a decision soon.

Thankyou for supporting my analysis i invite you to visit my analysis on Bitcoin

Use bitcoin price movement as a base of all the crypto market trend.

Best Regards

ETH Accumulating possible breakout (Very Bullish) Ethereum is still in the liquidity zone, but there is good news, first of all is that it has stayed in that zone for several days accumulating. Second, ETH has shown a lot of strength over the last 3 days, reaching up to $3,700. And the best part, as you may have seen in my Bitcoin analysis, is that the price is close to making a strong bullish move. This suggests that ETH and other coins will also gain strength and move in a bullish direction.

The key for Ethereum is to wait for it to break out of this downward channel. I believe it has been following a bearish sequence for a long time, but these last few days have been very positive as Bitcoin starts to gain momentum, and we are also seeing ETH begin to gather volume and buying pressure.

We will be keeping a close eye on the market in the coming days.

Thank you for following and supporting my analysis; we have been predicting every price movement according to a positive forecast.

Best regards.

UMA - Three D(r)ives Down PATTERNUMA is approaching an ideal buy-back zone whilst forming an important chart pattern - the Three Dives Down Pattern.

This pattern goes by many names including Three Drivers, Three Drives Down and Three Dives Down (which is the one I prefer to use). This pattern is bearish for the SHORT term, but bullish for the NEAR and LONGER term.

It's important to note that this analysis is from a macro timeframe, with the aim on identifying the key buy-back or re-accumulation zone. From the daily and lower timeframes, the price could easily increase by large amounts however, keep in mind we're looking for an accumulation zone not for swing trades in this post.

________________________________

BINANCE:UMAUSDT

Rapid Accumulation Pattern: COHRNYSE:COHR rebounded upward from a strong support level due to Rapid Accumulation by Derivative Developers. The company had a good earnings report on August 15th. This is NOT an all-time high. A shift to a platform or sideways trend would be ideal to reset for the next swing-style run. Chaikin Osc is overextended and floating as oscillators tend to do. Sideways trends pattern that out rather quickly most of the time.

$IBM Support Levels HoldingNYSE:IBM did not have a great earnings report for the 1st Quarter 2024, but 2nd quarter improved. The stock has one of the better charts in the Dow 30 components. It has held up better than most of the Dow components, except for those stocks that are in buyback mode. It has been tapering off its buybacks for 2 quarters. So the gains holding above the support lows are not from buybacks. There are accumulation patterns and pro trader activity in the mix. One to watch for swing trading potential.

ETF Developers Buying Ahead of Q2 Earnings Reports: HDThis Dow component was the highest gainer for the average with a modest 2.10% gain yesterday. NYSE:HD price action was very controlled. Volume was slightly below average indicating it was likely ETF developers buying ahead of the earnings report.

Accumulation/Distribution indicator confirms this price range is a buy zone.

This is a technical setup to watch for pre-earnings runs for swing trading.

Solama in accumulation-zoneIt seems Solama is in an accumulation-zone between the blue lines. Volume is increasing.. I don't know how long this wil gonna take, but I think the Solama's are preparing their self to move (significantly) higher

GE Aerospace Needs to CorrectAfter many years of struggle due to the Banking Debacle of 2008, this venerable old company is finally showing strength again. Spinning off divisions to focus on and drive growth in the key businesses was exactly what was needed.

NYSE:GE Aerospace is over-speculated now. The run up from the heavy accumulation during the last half of 2023 is too steep to sustain. Smaller funds have been driving it upward since March, causing the more volatile action recently.

It had a small gap up on earnings this week but it still needs to correct, either down or sideways . It has the look of a stock with short-term topping risk at the moment, but extended sideways action could adjust out the overextended uptrend instead.

Paychex (PAYX) Revenue miss... Is this the end?Hi guys! As always, im looking for macro trends/ signals and critical movements/ developments in the markets.

What caught my eye is PAYX.

Today it gets the focus as it had Q3 revenue miss and its down 6% pre-market.

With panic coming in, ill go over technical developments and the big picture.

Lets jump in. We are in the 1 week timeframe (note this weeks candle has not yet printed and can current develops can change throughout the week).

Currently, we are range bound between $100.00 and $133.00.

After the large bull run it had looking left. It is now in a period of accumulation/ consolidation in my opinion.

This pattern started December 2021. So its a long-term pattern. Which will take alot to break out of.

Breaking to upside would continue the bull run to new all-time highs.

Getting there though, will take time. And we must break other obstacles first.

First thing to break is the Short-term resistance trendline.

2nd thing to break is the upsloping channel highlighted, which is a intermediate trend.

If we get rejected from any of these obstacles, we can also continue down to test the lower border of the range.

Our first test of support would be the lower border of the sloping channel.

We must also watch VOLUME -> increase in volume would help us with breaking this obstacles and eventually getting us to the top of the range and an eventual breakout.

Watch also the 2 indicators i put up.

MACD -> We need a bullish cross with the lines moving ABOVE black horizontal trendline to form a higher high. This would help the case of breaking trends, moving above the consolidation range and to new highs.

If we get a bearish cross we can retest the support line of the ascending channel and lower range of the consolidation zone.

RSI - A HIgher high print is needed to continue upward and eventually out of the consolidation range. Notice however the resistance ABOVE us, depicted by the trendlines.

A bearish case is printing a Lower low, doing so may bring us down to the black support trendline. Depending on how low the RSI goes, will determine how far down we go as well.

__________________________________________________________________________________

Thank you for taking the time to read my analysis. Hope it helped keep you informed. Please do support my ideas by boosting, following me and commenting. Thanks again.

Stay tuned for more updates on PAYX in the near future.

If you have any questions, do reach out. Thank you again.

DISCLAIMER: This is not financial advice, i am not a financial advisor. The thoughts expressed in the posts are my opinion and for educational purposes. Do not use my ideas for the basis of your trading strategy, make sure to work out your own strategy and when trading always spend majority of your time on risk management strategy.

RPL back to Demand ZoneRocket Pool is one of the largest Eth liquid staking platform. Billion in total value locked, but market cap still below 1 billion.

Currently back to the weekly support and the demand zone. If we see the volume we can see huge accumulation of RPL at this zone.

We can get a good risk to reward entry at this levels. It will be very interesting to see when it breaks the current accumulation zone towards upside.