Royal Gold (RGLD) Poised for Growth with $3.5B Sandstorm Acq.🚀 **Royal Gold (RGLD) Poised for Growth with $3.5B Sandstorm Acquisition!** 🥇

Royal Gold ( NASDAQ:RGLD ) is making waves with its $3.5B all-stock acquisition of Sandstorm Gold ( NYSE:SAND ) and a $196M cash buyout of Horizon Copper, announced July 7, 2025. Here’s why this could be a game-changer for investors! 📈

**🔥 Financial Highlights:**

- **Q2 2025 Performance**: Sold 40,600 GEOs at $3,248/oz gold, $32.91/oz silver, with an impressive 87% gross margin. $11.1B market cap reflects strength. 💰

- **Acquisition Impact**: Sandstorm deal adds 40 producing assets, boosting 2025 GEO production by 26%. Expect revenue & earnings growth post-Q4 2025 close. 🚀

- **Dividend Confidence**: Declared $0.45/share Q3 dividend, signaling robust cash flows. 💸

**📊 Sector Edge & Valuation**:

- **Undervalued?** Compared to Wheaton ($56B) & Franco-Nevada ($44B), Royal Gold’s lower valuation (per RBC Capital) could signal a bargain. Post-deal scale (75% gold revenue) may close the gap. 📉

- **Performance**: Sandstorm’s record Q1 2025 results + Royal Gold’s aggressive expansion outpace peers in growth potential. 🚀

**⚠️ Risks to Watch**:

- 6%–8.5% stock dip post-announcement reflects dilution fears (~19M new shares). 📉

- Commodity price volatility & regulatory approvals (due Q4 2025) pose risks. ⚖️

**🎯 SWOT Snapshot**:

- **Strengths**: Enhanced portfolio, 87% margins, leading North American royalty player.

- **Opportunities**: Analyst optimism (BMO $197 target) & copper exposure via Horizon.

- **Weaknesses**: Short-term dilution concerns.

- **Threats**: Commodity price swings, peer competition.

**💡 Why Buy Now?**

Royal Gold’s stock dip could be a buying opportunity, with analysts like BMO ($197 target) and unusual options activity signaling confidence. If precious metals stay hot ($3,342.80/oz gold futures), RGLD’s diversified portfolio could shine! 🌟

📅 **Deal Close**: Q4 2025, pending approvals.

🔎 **Dive Deeper**: Check Royal Gold’s IR page or Yahoo Finance for details.

What’s your take on NASDAQ:RGLD ’s big move? Bullish or cautious? 🐂🐻 #StockMarket #Gold #Investing

Acquisition

Defining SWDY's TrendSWDY stock in the short run is still defining its trend. The most recommended case is rising, it's expected to reach the 1st resistance line 80.081, then the 2nd resistance line 80.183, and the 3rd resistance line 80.448 points. In case of falling, it's expected to reach the 1st support line 79.89, the 2nd support line 79.51, and the 3rd support line at 79.001, which is fundamentally not highly expected due to its latest acquisition.

SWDY Chart AnalysisEl Sewedy Electric stock trend rose last period from the support line 76.249 to the resistance line 83.77, then rebounded to reach the support line 79.001, so the general trend was down by 1.04%. The stock rose and broke the first support line at 78.287, to get the second support line at 78.389, then the third support line at 78.650. On the other hand, when the stock rebounded, it broke the first resistance line at 83.505 to reach the second resistance line at 83.097, then the third resistance line at 82.914. This upward trend is due to the acquisition of the majority of the stake in Thomassen Service, which is 60%. This step unlocks expansion into Europe, the Middle East, and Africa.

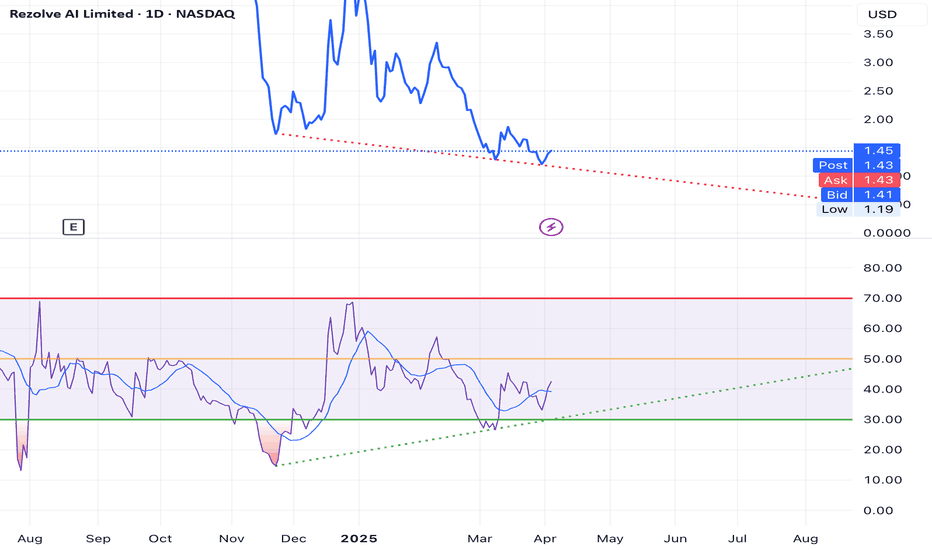

BULLISH RSI DIVERGENCE ON REZOLVE AI (RZLV) 1D CHARTA bullish RSI divergence appeared to gather more strength on the 1 hour chart today. This could possibly signal a bullish up trend. The London based company provides AI solutions for commerce. Rezolve recently closed an acquisition of GroupBy, an ECommerce company, and has recently been featured favorably in articles by Nasdaq and others.

Rothschild & Co.'s Five Arrows Acquires Rimes: A Strategic MoveRothschild & Co.'s alternative assets unit, Five Arrows, recently made a strategic acquisition by purchasing Rimes from Swedish investment firm EQT. Rimes, a leading provider of enterprise data management and investment intelligence solutions, has been a significant player in the investment industry, empowering asset managers to efficiently handle market data.

The deal marks a significant milestone in Rimes' journey, which has been bolstered by EQT's support since 2020. Under EQT's ownership, Rimes experienced notable growth, expanding its technology offerings and acquiring Matrix IDM, an Australian investment data management platform. Additionally, Rimes ventured into AI with the establishment of a dedicated product division last year.

Five Arrows' decision to acquire Rimes underscores its commitment to the alternative assets space. With global assets under management exceeding €26 billion, Five Arrows is well-positioned to leverage its long-term fund FALT and principal investments division FAPI to facilitate the acquisition. The transaction, expected to close in the coming months pending regulatory approval, holds promise for both parties.

Brad Hunt, CEO of Rimes, expressed optimism about the acquisition, emphasizing its potential to propel Rimes' growth trajectory. Meanwhile, FAPI partners Vivek Kumar and Sacha Oshry highlighted Five Arrows' intention to unlock new avenues of growth for Rimes.

As the transaction unfolds, industry observers eagerly anticipate how Five Arrows' strategic vision will shape Rimes' future. The move underscores the evolving landscape of data management and investment intelligence, signaling potential shifts in the competitive dynamics within the sector.

In conclusion, Five Arrows' acquisition of Rimes marks a pivotal moment for both companies, poised to catalyze growth and innovation in the ever-evolving realm of enterprise data management and investment solutions.

Merck to Acquire Harpoon Therapeutics in $680M DealNavigating the Oncology Frontier with Harpoon Therapeutics Acquisition

In a significant strategic move, pharmaceutical giant Merck & Co. ( NYSE:MRK ) has announced its plans to acquire cancer drugmaker Harpoon Therapeutics Inc. ( NASDAQ:HARP ) in a transformative deal valued at $680 million. The move aims to solidify Merck's leadership position in the highly lucrative oncology space, diversifying its portfolio and positioning itself for sustained growth in the face of potential challenges for its flagship cancer immunotherapy, Keytruda.

The Deal Overview:

Merck's acquisition of Harpoon Therapeutics involves a payment of $23 per share, more than double Harpoon's last closing share price, signaling Merck's strong commitment to the strategic partnership. The deal is currently pending, awaiting approval from Harpoon shareholders, with the expected closure in the first half of 2024.

Keytruda and Beyond:

Merck's pursuit of Harpoon Therapeutics aligns with its broader strategy of seeking new sources of growth. With Keytruda generating a substantial $20.9 billion in 2022, Merck recognizes the importance of expanding its pipeline to maintain a competitive edge. Harpoon's promising early-stage trials and T-cell engager assets present Merck with an opportunity to diversify its oncology offerings and explore new avenues of therapeutic innovation.

Analyst Insights:

Merck's acquisition of Harpoon is a strategic and value-driven move. The early but promising data from Harpoon's T-cell engager assets, coupled with investor interest in similar technologies, positions Merck for potential growth in the oncology market.

Building a Robust Portfolio:

Merck's proactive approach to portfolio expansion is evident in its recent deals, including the acquisition of Daiichi Sankyo Co.'s experimental cancer drugs and the purchase of autoimmune drugmaker Prometheus. These moves showcase Merck's commitment to staying at the forefront of medical innovation and bolstering its position in key therapeutic areas.

Investor Sentiment and Momentum:

As evidenced by the stock's current trading position near the top of its 52-week range and above its 200-day simple moving average, investor sentiment towards Merck is positive.

Conclusion:

Merck's acquisition of Harpoon Therapeutics marks a pivotal moment in the pharmaceutical landscape, where innovation and strategic partnerships are crucial for sustained growth. By expanding its oncology portfolio with cutting-edge technologies, Merck positions itself as a leader in the fight against cancer, ensuring a robust pipeline and securing its role as a key player in the evolving healthcare landscape. As the deal progresses towards closure, investors and industry observers will keenly watch Merck's journey into a new era of therapeutic possibilities.

Grindrod $GRIN - Acquisition Target at a very very cheap price. NASDAQ:GRIN

Taylor Maritime Investments (TMI) closed its offer to acquire all of the issued ordinary shares in Grindrod Shipping for HKEX:26 back in October 22. NASDAQ:GRIN has since sold off sharply following concerns of imminent de-listing by TMI.

However,

TMI does not meet the compulsory acquisition threshold of at least 90% for delisting of GRIN from the JSE.

I wouldn't be surprised if NASDAQ:GRIN is the target of future buyouts from larger dry bulk shipping companies which recognise it's strong fundamentals and growth prospects.

My DCF model of NASDAQ:GRIN supports my opinion that current stock price April 2023 is very very cheap.

An opportunity to make some serious gains for the patient investor.

How do you feel?If you check at least 3/5 on the below we might be in the right place.

1. Depressed

2. Tired

3. Stressed

4. Scared

5. Out of money to buy more

I do not know about you but I have been through all of the above over the last 12 months! I made tons of mistakes no doubt about that! BUT i wIll not make the biggest one, panic sell at the bottom or in the first rally!

Some things to consider when you try to draw the picture of the next 6-12months

1. Advertising Costs or User Acquisition Costs ⬇ + NPS ⬆ ( What's doing Meow Meow on the roof???)

2. Shipping Costs + Shipping time ⬇

3. West Disposable Income ⬇

Why is Peter Selling? well, for a buyout to take place at least >50% of shareholders must agree! Now retail holds 39% + the previous 10% of Peter before starting selling makes 49%! you understand how dangerous that was for the Funds that they wanted to take over right? Probably the price is already set! nobody else besides peter is selling here! Now have a look here:

Vijay's Contract

"Restricted Stock Units. Subject to the approval of the Company’s Board of Directors or its Compensation Committee, you will be granted

an award of Restricted Stock Units (“RSUs”) for that number of shares of the Company’s Common Stock equal to $12,000,000 divided by

the average closing price of a share of the Company’s Common Stock as reported on Nasdaq during the full calendar month prior to your

Start Date, rounded down to the nearest whole share

+

"Stock Options. Subject to the approval of the Company’s Board of Directors or its Compensation Committee, you will be granted an

option to purchase that number of shares of the Company’s Class A Common Stock equal to $16,800,000 divided by the average closing

price of a share of the Company’s Common Stock as reported on Nasdaq during the full calendar month prior to your Start Date, rounded

down to the nearest whole share (the “Option”)"

The average closing price prior to the Start Date meaning Dec 21 was around $3.2 giving to Vijay the option in case he would stay with the company to hold around 9m shares or 1.3%.

So Peter's 10% + Vijay 1.3% + Retail 39% or more at the time since many got liquidated gives us >50%, if one of the funds holding 3-4% could be on their side the acquisition would be even harder to take place. Imo this is an ordered acquisition and Retail will pay for it! What a beautiful game!

Based on 670m shares float here are the % based on (simplywallst.com data and fintle.io)

Holders >1%

1. Vanguard together with its passive funds holds 84,819,961 or 12.65%

2. Blackrock together with its passive funds holds 37,909,425 or 5.65% + iShares (owned by Blackrock) 20,564,283 or 3.069%

3. Formation8 Partners 42,192,476 or 6.29%

4. DST Global 38,301,392 or 5.71%

5. GGV Capital, LLC 25,707,499 or 3,83%

6. General Atlantic Llc 16,888,478 or 2.52%

7. Maple Rock Capital Partners Inc. 13,519,000 or 2.01% +5m call option + potential 0.74%

8. State Street Corp 13,349,046 or 1.99%

9. Geode Capital Management, Llc 8,442,463 or 1.26%

10. Comprehensive Financial Management LLC 8,406,736 or 1.25%

11. Renaissance Technologies Llc 8,264,800 or 1.23%

All of the above players hold together 47.45%! Peter already sold 3.63% and probably going for >5%, when we learn who bought in i think the price would not be where it is now!

From the 2021 Annual Report

"In addition, in July 2017, FTSE Russell and Standard & Poor’s announced that they would cease to allow most

newly public companies utilizing dual or multi-class capital structures to be included in their indices. Affected indices

include the Russell 2000 and the S&P 500, S&P MidCap 400, and S&P SmallCap 600, which together make up the S&P

Composite 1500. Under the announced policies, our multi-class capital structure would make us ineligible for inclusion in

any of these indices, and as a result, mutual funds, exchange-traded funds, and other investment vehicles that attempt to

passively track these indices will not be investing in our stock."

IMO Peter's conversion from B to A opened the door for the acquisition ! Since they will scoop everything from their passive funds!

What's the price????

If the deal is done and you are the SMART MONEY wouldn't you like to purchase all the stock available??? I mean look at that depressed 39% that sits there! IMO 2 paths are possible depending on how the markets will do over the next 6-12months

1. If markets do well there will be an explosive rally to $3-5 towards the EoY, I bet most of you will take your money and leave at that point, the volatility (shaking) is going to be insane! RSI constantly overbought on divergence the opposite of what's happening now!

2. If markets do bad then 0.90-0.70 will do. I think a big % of retail will give up on new lows or on the first 100-300% rally.

Now IF and i say IF there is a buyout what would be the price? I would like to think of a price higher than the institution's average. Wish right now has no major shareholder (Peter is gone) I think VC's will likely dictate the price.

My guess would be something around 4-6x FY23 sales if markets go well! That should be in the range of 4-6b maybe a little higher depending on how sales would look in 23. That translates to a price of more or less $7-9 or Inside the GAP!!!

*Peter's Thiel Fund sold all of it's shares on the WSB frenzy for an average of $12 i think in the best best best case scenario that's the ceiling!

Do your own research and do not listen and trust nobody! In the end, we are all alone in this game!

Keep calm WGMI!

CFVI Long, It could rumblePossible WSB play if network effects of Andrew Tate could influence Zoomer capital to buy the stock as a FU to the monopoly to social media content platforms. However, it does bring into question how much of an influence they really have given how personal savings have fallen back to 2016 levels . This idea is only valid as long as we don't close under $12.05 on a daily candle.

Max price point I could see it going would be ~$52-$65 given how BBBY had a max mcap of $2.5B after WSB made its move on it (But lets not forget that it was short squeezed). Realistically, I can see it going to $17-$27. Good entries for a long at this point are ~$12, $11.35, and $10.30.

Max low price: 10.00

Max high price: 65.00

Trade:

Entry:12.19

SL:11.22

TP:17, 25, 50, 65

$AMZN (Amazon) Stock - AnalysisIn my opinion, Amazon has completed (or is about to complete) a full market Supercycle: Impulse Wave (I) and Corrective Wave (II).

What I would anticipate would be for Amazon to accumulate during the recession and then emerge out of it with Supercycle Impulse Wave (III).

$GMPR Huge Restaurant Acquis/Military Contracts/Retail ExpanCorporate Update Highlights:

1.Finalize the pre audits, audited financials with M&K CPAS, PLLC to finish the necessary financial statements for uplisting to NASDAQ.

2. Hire fulltime CFO

3. Acquisition of Black Rock Bar & Grill which was voted the #1 Steakhouse in Michigan 3 years in a row!

4. Pizza Fusion deal with US Military. Thier Gourmet Gluten-Free Frozen Pizzas in 150+ grocery stores, in 5 different states, through two food distributors Gia Russa & McAneny Brothers.

In March GMPR was 1 of 22 companies invited to the DeCA Arm Forces Food Service Military Show in Petersburg, VA. The US Military Food Service decision makers attended the show, sampled, loved and approved our Pizza Fusion’s Founders Pie for the US troops in Kuwait.

We have been told we have been approved to feed 36,000 US Troops based in Kuwait for two lunches and one dinner per week and all events and parties.

5. Cousin T’s expansion into retail and introduction of new products; Jose Madrid Salsa into food distributor McAneny Foods; PopsyCakes partnered with $16 million Chocolate company in Pittsburgh.

Gourmet Provisions International signed a distribution partnership with comedian Terrence K. Williams and launched his Gourmet line of Pancake mix under Williams’ custom brand Cousin T’s. in October 2021.

In early 2021 GMPR partnered with Williams to help create and launch a Gourmet line of food products starting with his own personal line of Gourmet Pancake Mix & Syrup all under his custom brand, ‘Cousin T’s’

www.CousinTs.com

www.globenewswire.com

There's no reason for it to be down here this low imo, huge moves should be coming here.

Twitter: Deal is still on, says Musk!!Twitter

Short Term - We look to Buy at 39.16 (stop at 37.32)

They recently gave Elon Musk more information as he requested and deal seems to be still forging ahead. The sequence for trading is higher highs and lows. This is positive for sentiment and the uptrend has potential to return. There is scope for mild selling at the open but losses should be limited. Dip buying offers good risk/reward.

Our profit targets will be 43.86 and 46.00

Resistance: 44.00 / 46.00 / 52.00

Support: 39.00 / 34.00 / 28.50

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Signal Centre’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Signal Centre.

USDC hitsThe circulation of USDC has more than doubled since the original deal was announced, reaching $52.7 billion as of the above date.

Jeremy Allaire, Circle’s co-founder and CEO expressed optimism about the new partnership. He was targeting a public listing through the above merger with an SPAC (special purpose acquisition company), which would augment trust and confidence in Circle. He commented:

Circle has made massive strides toward transforming the global economic system through the power of digital currencies and the open internet. This is a critical milestone as we continue our mission to build a more inclusive financial ecosystem. Making this journey with Concord under our new agreement is a strategic accelerator.

Initially, the plan was to conclude the new agreement on December 8, 2022 with the potential to extend to January 31, 2023. Then, the company would be listed on the New York Stock Exchange under the stock ticker symbol ‘CRCL’.

The agreement was approved by the boards of directors of Circle and Concord Acquisition Corp. The latter’s executives also expressed a positive attitude toward the deal. Concord Chairman Bob Diamond said:

We believe our new deal is attractive because it preserves the ability of Concord’s public stakeholders to participate in a transaction with this great company.

Is it the time to buy some Nvidia?As of the last 2 months, there have been some very interesting progressions in NASDAQ:NVDA 's stock. In the beginning of November, they had a drastic price climb (15 percentage points) in the stock due to their announcement of their strong third quarter earnings. Although, a couple of weeks later (the present) their stock has tumbled a considerable 7% and there are many debates on whether the stock shall continue to fall or will have a kickback. Nonetheless, this may present an ideal opportunity to purchase some semi-conductor stocks if it suits your fancy.

For those who have not been following the recent news, Nvidia recently proposed and was acting on an acquisition of ARM a British based semi-conductor company at the hefty price of $40B. The Federal Trade Commission sued Nvidia to have this exchange blocked. Shareholder's were in high hopes for this acquisition as it would benefit Nvidia immensely but the argument that, this would allow them to have an unfair market monopoly has most probably put the "nail in the coffin" for the 'little' business maneuver.

Now the question is, does this price drop make NASDAQ:NVDA quite the attractive purchase for the trader? Personally, I reckon it could be justified based on the trader's frequency of actions. If you plan on holding Nvidia for less than 3 months, you could turn a nifty profit, but if you're looking toward the longer term; you may want to wait for a more considerable price drop as by many investors' standards, it is overpriced.

As usual, other opinions, facts and news are very welcome. Comment away!

TL;DR: Nvidia's price drop as of recent could justify buying for short term trade profits but other wise, 'longer-term' investors may want to wait for a more considerable drop.

Something is cooking here2 key points with huge volume

Do you guys believe Wish is on about to be acquired?

Anything below previous lows is an EXIT from the position for me.

$APYP R/M Into SleepX Could Make it a MASSIVE Runner PT: $1+On Nov 11th the company was successfully redomiciled to Nevada leaving just the last administrative steps towards the completion of the merger in December.

twitter.com

FRANCE Patent No. EP11819507.2 renewed in September

twitter.com

UK Patent No. EP2608717 renewed in September

twitter.com

Israeli Patent No. 224854 renewed in August

twitter.com

SleepX also has a portfolio of FIVE patents some of which are used in Fitbit:

www.sleepxclear.com

Intellectual property

The company’s technology is protected by patents in order to provide a strong IP protection, one of the Company's most important assets. Its technology, applications and products, both in the medical and nonmedical fields, are protected by the laws of the United States and other jurisdictions worldwide. The Company's measurement technology utilizes a technique that measures a range of physical parameters as a function of time to a level of accuracy previously unattainable.

The company's patent portfolio includes:

***SYSTEMS AND METHODS FOR SNORING DETECTION AND PREVENTION***

1. HIGH-SENSITIVITY SENSORS FOR SENSING VARIOUS PHYSIOLOGICAL PHENOMENA, PARTICULARLY USEFUL IN ANTI-SNORING APPARATUS AND METHODS.

2. APPARATUS FOR USE IN CONTROLLING SNORING AND SENSOR UNIT PARTICULARLY USEFUL THEREN.

3. APPARATUS AND METHOD FOR DIAGNOSING SLEEP QUALITY

4. ESTIMATION OF SLEEP QUALITY PARAMETERS FROM WHOLE NIGHT AUDIO ANALYSIS

5. APPARATUS AND METHOD FOR DIGNOSING OBSTRUCTIVE SLEEP APNEA

With distinctive innovative sensor technologies and algorithms, the Company is well-positioned to become a market leader in the snoring and obstructive sleep apnea treatment markets.

twitter.com

twitter.com

The company also signed an agreement with NewsDirect's PR Firm for upcoming press release and marketing capabilities once everything has been finalized and completed.

twitter.com

www.sleepxclear.com

$IFXY 62% Owned by Krisa/Cooley Biggest R/M or Holding CmpyKrisa Management and Carey Cooley own 62% of all Common Shares

twitter.com

www.otcmarkets.com

They have continually said that this will be their biggest merger out of all their shells

twitter.com

twitter.com

In their most recent update they announced that the launch is getting closer and is almost ready. They are also working on two acquisitions already turning $IFXY into possibly a holding company for multiple acquisitions.

twitter.com

"The $IFXY launch is getting closer. @CareyCooley is working hard on a deal to get his preferred COO on board. We are also trying to negotiate deals for our first two acquisitions."

$IGEX Massive DD Huge Potential for a Major Run Personal PT $1+Caren Currier in the wheel house driving this merger

www.otcmarkets.com

Pink Current = unaffected by new SEC/Broker rules everyone is freaking out about. Current before OTCMarkets suggested June30th deadline to ensure survival. This may sound trivial, but it huge!

www.otcmarkets.com

ZERO Liabilities/Debt = see current filings

www.otcmarkets.com

No Dilution for over a year = OTC regularly updated, TA not gagged

www.otcmarkets.com

Small float recently updated on OTCMarkets

Most outstanding shares held by insiders in the company.

Float fairly locked and moves on small volume.

Change of control:

backend.otcmarkets.com

Pending merger and acquisitions acknowledged by company directly in their OTCMarkets profile

"Focus on a merger and some acquisitions" quite possibly lithium related.

Previous to that company hinted:

"Focus on the acquisition and exploration of mineral properties in Nevada"

www.otcmarkets.com

$PUGE New CEO/Attorney/Board Members/Multiple Catalysts PT $1+Multiple Catalysts on the Horizon this one is a true gem of the OTC and could very well end up being one of the farthest moving plays this upcoming season. PT $1+

New CEO Came from a $1.4B Rev hospital

New Attorney CLO who happens to own Glades

3 Brand New Board Members with immense Backgrounds (Humana, Ex Florida Senator, Professor and Ex CEO)

Multiple Acquisitions & Projects in Health, Nano & AI Etc.

In process of closing a $20 Mill Offering

Def Agreement 8K out this week:

www.sec.gov

$TONR New Domain Reg / Upcoming Merger and Twitter Updated PT $1$TONR Management has a Roadmap that will likely take this stock to around a $1 sometime next year given the numerous catalysts to name a few:

1. Debt Cancellation

2. Share Cancellation

3. Reverse Merger

4. OTCQB

Their old twitter and Facebook were removed today and OTCM was updated with the new twitter

twitter.com

twitter.com

A New Domain was also registered today as well:

www.whois.com

Roadmap:

twitter.com

$CYBL Multiple Rev Streams + Possible 525% Rev Increase PT: $1$CYBL has MULTIPLE revenue streams we have yet to even scratch the surface on.

FCS = FUTURE COMBAT SYSTEMS

1. FCS Battle Command

2. FCS SOSCOE (System-of-Systems Common Operating Environment)

3. Telecommunications

www.youtube.com

www.youtube.com

$CYBL from the latest info on the Infrastructure Bill, every state will receive at least $100M for #RuralBroadband and underserved areas even more. With #CyberluxITS

@CyberluxCFBD Group, we're primed and ready to deliver in this area. $45M opportunity they've identified here.

twitter.com