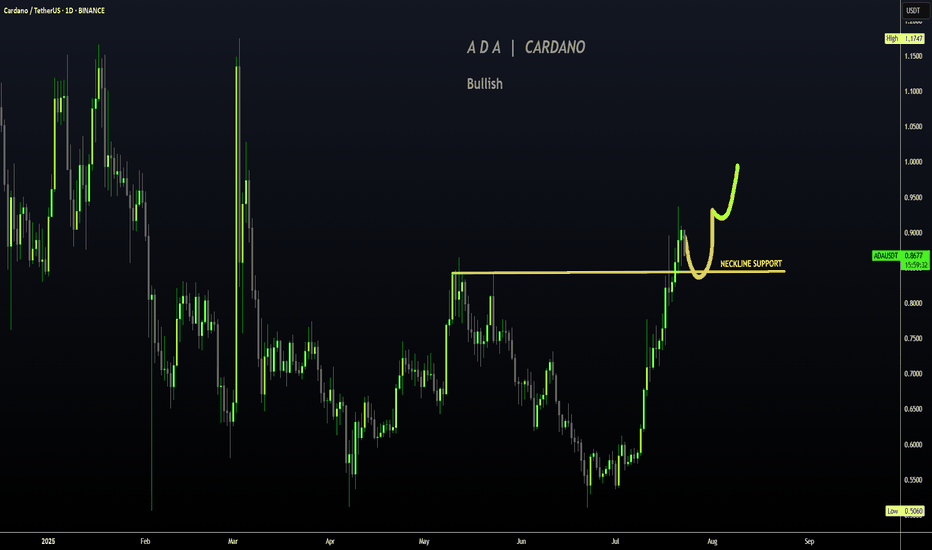

CARDANO | ADA Creeping UP to $1Cardano has made a big move in recent weeks, boasting a 77% increase.

If you were lucky enough to buy in around 30 or 40c, this may be a great TP zone:

Looking at the Technical Indicator (moving averages), we can see the price makes its parabolic increases ABOVE - which is exactly where we are currently beginning to trade. This could mean more upside is likely, and the 1$ zone is a big psychological resistance zone:

A continuation of the current correction may look something like this for the next few weeks:

_____________________

BINANCE:ADAUSDT

Adalong

ADA bounce!...?????Ada is bouncing well after the dumpster fire that happened over the weekend....

currently ADA is forming an ascending wedge...(bearish) i am expecting a rejection and a retest of the recent low of sunday night... Keep an eye on the $.857 area... with a support level at the $.7665 level...Lets GO!!!! ill be buying at $.58-$.53

ADA/USDT CHART UPDATE !!ADA/USDT 4-hour chart shows a bullish continuation pattern as Cardano prepares for a potential breakout after a period of consolidation.

The price is making higher lows, indicated by the rising trendline.

Resistance lies at $1.20, which aligns with the upper boundary of the triangle.

Support: $0.80–$0.90 (green area and trendline).

Resistance: $1.20 (key breakout level).

The 21-day MA and 100-day MA are sloping upwards, indicating bullish momentum.

The price is currently above both MAs, which provide additional support.

If ADA breaks above $1.20, it could head towards $1.50 or higher.

However, a breakdown below the rising trendline could lead to a retest of $0.80.

This setup suggests that ADA is gaining strength, with bullish continuation likely on the breakout.

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

ADA underrated now and here is whyBINANCE:ADAUSDT

Cardano now underrated. ✅Before we start to discuss, I would be glad if you share your opinion on this post's comment section and hit the like button if you enjoyed it.

Thank you.

Possible Targets and explanation idea

➡️ We got global covid dump uptrend line

➡️ On weekly timeframe we formed huge divergency you can see confirmation on ADZ

➡️ Fundamental price line now around Monthly FVG which we should test really soon.

➡️ Impulse to FVG we will see after liquidation local stop losses

➡️ Take Profit line on weekly timeframe around Middle term stop losses

➡️ ADA launched own stable coin, (not sure if its a good idea for ADA for long term) but now its drive the price also

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

---

• Look at my ideas about interesting altcoins in the related section down below ↓

• For more ideas please hit "Like" and "Follow"!

ADA → Cardano Heading for $0.65!? In a Key Support Zone.ADA completed its 2-legged pullback per my previous analysis and even overshot the key support zone to Push #1 support at $0.41. Is this an opportune time to long?

Previous Analysis:

How do we trade this? 🤔

Cardano found support at Push #1 support from the previous bull trend around $0.40 and has rebounded to the Daily 200EMA. It's reasonable to expect a pullback from the 200EMA to the $0.45-$0.47 area in the Support Zone. We need a strong bull candle closing on or near its high followed by a confirmation candle to support the idea of longing ADA. Even with such price action, we should be cautious given Bitcoins likely pullback from its recent all-time high and halving period.

That being said, it's reasonable to think Cardano will have more upside before it comes down and with the signal and confirmation bar off of the Support Zone, it's reasonable to enter a long position toward the $0.65 range. Take half profits at 1:1 Risk/Reward at $0.5635, move the stop loss up to the entry price, then swing the latter half of the position to Take Profit #2 target of $0.65. The likelihood of hitting $0.65 is less than ideal, but it's worth holding that second take profit target until the price action gives us a reason to exit the trade.

This analysis is in alignment with my recent ADA Lifetime Analysis as seen here:

💡 Trade Idea 💡

Long Entry: $0.4767

🟥 Stop Loss: $0.3900

✅ Take Profit #1: $0.5635

✅ Take Profit #2: $0.6500

⚖️ Risk/Reward Ratio: 1:2

🔑 Key Takeaways 🔑

1. 2-Legged pullback completed at Support Zone.

2. Double Bottom pattern at Support Zone

3. Strong bull candle to Daily 200EMA, expect a pullback to the Support Zone.

4. Look for a strong signal candle closing on or near its high with a confirmation candle following.

5. RSI is at 41.00 and above the Moving Average, supporting the idea of a long position.

💰 Trading Tip 💰

It's reasonable to take half profits at the first resistance target in a long trade or the first support target in a short trade. Using a 1:1 Risk/Reward Ratio for your first target, you can move your stop loss up to your entry price, locking in profits. This allows you to watch the rest of the trade execute without worrying about losing money, which helps improve trading psychology and the equity in your account.

⚠️ Risk Warning! ⚠️

Past performance is not necessarily indicative of future results. You are solely responsible for your trades. Trade at your own risk!

Like 👍 and Follow to learn more about:

1. Reading Price Action

2. Chart Analysis

3. Trade Management

4. Trading Psychology

ADA/USDT WEEKLY CHART UPDATE !!Hello friends, welcome to this ADA/USDT update from Crypto Sanders.

Chart Analysis Everyone, what are your thoughts on the charts? Please share your comments regarding the ADA Weekly Update.

Earlier this month, ADA found robust support at 46 cents, culminating in a 2.6% weekly price rise. With the key support intact, buyers may strive to reassert dominance over price movements.

Presently, ADA faces resistance at 61 cents, a level yet untested. A potential relief rally could ensue if support remains unbroken, potentially leading to a challenge of key resistance.

Looking forward, if buyers successfully halt the downtrend, they could endeavor to steer ADA back onto an upward trajectory in the forthcoming month.

I have tried to bring the best possible results in this chart.

If you like it, hit the like button and share your charts in the comments section.

Thank you.

ADA → Cardano to $0.40? or $1.40? Get your Longs Ready!ADA completed its 230% price increase since October 2023 and now appears to be finding some resistance. Should we short here?

How do we trade this? 🤔

Shorting is not ideal on the Daily timeframe. Since October 2023, ADA has put in three legs in a bull trend, a double-top reversal pattern that has come off of an ascending wedge (bearish pattern). We're now finding resistance below the Daily 30EMA with a gap down to the Daily 200EMA. This analysis screams a two-legged pullback to the 200EMA, likely in alignment with the Bitcoin halving that's about to happen in April 2024.

Short on the 1HR timeframe, but get your equity ready for a long position when ADA comes into contact with the $0.53-$0.57 price area. Look for a strong bull candle closing on or near its high off of the Daily 200EMA, this is our signal bar and a reasonable one to enter on with a 1:2 Risk/Reward Ratio, aiming for a conservative target of $0.775.

A confirmation bar should take us somewhere in the $0.60-$0.65 range. If we see this, given the crypto market's similar sentiment after the halving, it's reasonable to enter at a 1:2 risk reward aiming for the $1.20 area. It's reasonable to take half profits at 1:1 Risk/Reward and swing the latter half of your position to 1:2, 1:3, or even 1:4 Risk/Reward on this timeframe, depending on how the price action plays out.

This analysis is in alignment with my recent ADA Lifetime Analysis as seen here:

💡 Trade Idea 💡

Long Entry: $0.55

🟥 Stop Loss: $0.4375

✅ Take Profit #1: $0.663

✅ Take Profit #2: $0.775

⚖️ Risk/Reward Ratio: 1:2

🔑 Key Takeaways 🔑

1. Three legs in a bull trend

2. Double top reversal pattern which has come off of an ascending wedge (bearish pattern)

3. Finding resistance below the Daily 30EMA with a gap down to the Daily 200EMA.

4. Look for a 2-legged pullback to the 200EMA, likely in alignment with the Bitcoin halving that's about to happen in April 2024.

5. RSI is at 48.00 and Above the Moving Average, supporting the idea of a pullback to the 30.00 area below the Moving Average.

💰 Trading Tip 💰

It's reasonable to take half profits at the first resistance target in a long trade or the first support target in a short trade. Using a 1:1 Risk/Reward Ratio for your first target, you can move your stop loss up to your entry price, locking in profits. This allows you to watch the rest of the trade execute without worrying about losing money, which helps improve trading psychology and the equity in your account.

⚠️ Risk Warning! ⚠️

Past performance is not necessarily indicative of future results. You are solely responsible for your trades. Trade at your own risk!

Like 👍 and Follow to learn more about:

1. Reading Price Action

2. Chart Analysis

3. Trade Management

4. Trading Psychology

ADA → Cardano Lifetime Analysis Shows $7.50 High!? Let's Answer.ADA has established lifetime trend lines following the conclusion of the 2022/2023 bear run. The bear run low at $0.22, provides us a connecting dot to the 2020 bear run low of $0.018, allowing us to establish a Lifetime Support line. Likewise, the conclusion of the 2021 bull run provided us with a connecting dot for a Lifetime Resistance line.

Now that we established a trend, how heavily can we rely on those lines? What about other areas of support and resistance? Will the altcoin market respond to market forces and reach new highs?

How do we trade this? 🤔

Let's answer these questions in order and expand upon them:

1. How heavily can we rely on these trend lines?

As heavily as any other established trend line. While it's important to remember that altcoin markets are more volatile than higher volume markets such as Bitcoin or especially Forex, these support and resistance areas *are* the data. Our analysis frames the playing field such that we can apply trade management strategies to gain a profit, which means any trade we should consider these price areas to be the boundaries of our trades.

2. What about other areas of support and resistance?

Lifetime Support and Resistance frame our macro trend, but we need to zoom into the EMA ribbons and previous areas of support and resistance. After the conclusion of the 2022/2023 bear run, ADA broke through the 30EMA and 200EMA ribbons and established support on both. In my analysis rubric, the 30EMA and 200EMA ribbons are immensely important in determining what price areas are respected by a security.

Currently, ADA is following the movements of Bitcoin and the crypto market as a whole. My Bitcoin Lifetime Analysis explains why I believe Bitcoin needs a strong pullback before reaching new all-time highs:

If Bitcoin fails to find a new all-time high here, ADA will likely stall and fall with it. The degree to which it falls is up for debate, but I would argue we will see the price fall to $0.50 (Weekly 200EMA) at a minimum, with a worst-case being $0.40 at Lifetime Support, maybe a wick into the $0.35 range. This will likely come in the form of a two-legged pullback on the Weekly chart.

Once that pullback concludes alongside Bitcoin, we should see another attempt to find new highs with Bitcoin. If ADA and the altcoin market are going to find strong upward momentum, it will be after Bitcoin and Ethereum find new all-time highs, generating excitement and volume. I'll be honest, what happens with the price from here is difficult to estimate. I believe what is closer to a worst-case scenario is ADA stalls around the 2021 Resistance Zone at the $1.50 range. A best-case scenario is it reaches near the Lifetime Resistance at $7.50. Somewhere in the middle, reaches the previous all-time high of $3.10.

We need to see the market reaction to the pullback and Bitcoin reaching new all-time highs to remotely begin estimating where ADA will land.

3. Will the altcoin market respond to market forces and reach new highs

There are a variety of arguments for and against the notion that we'll get another "alt season" where the alt market securities find new highs. My position on this is that we don't have nearly enough evidence to conclude that the alt market will be strong during this next bull run.

Here are some key points regarding what we do have:

1. Price Action is truth and we have price action data. Bitcoin has had a 300% increase in price since the 2023 $15,500 low, ADA has had a 200% increase in that same timeframe.

2. Volume into BTC and ETH proportionally is greater than the volume into the alt coin market.

3. ADA is respecting support and resistance areas and responding to macro crypto market sentiment.

4. The altcoin market is bloated, but the top 20 coins are more insulated from that bloat.

5. The RSI, a weak indicator on its own, shows us that the market is burning hot and needs a cooling-off period. This supports my other data points.

So where does that leave ADA? As previously stated, we have some key events that need to play out before we can have any confidence in where ADA ends up by 2025. Those include the pullback I believe is coming, followed by Bitcoin and Ethereum finding new highs. Once we hit those marks, we can start talking about $1.50, $3.00, and $7.50 price targets.

The Trade

That being said, we can still construct a reasonable trade based on the data we have. There are two ways to play this chart, wait for the pullback and start buying around $0.50, or start buying now and fade your position in either direction. Personally, I'm going to put weight on my overall crypto analysis and wait for the market to pullback.

My ideal buy for ADA would be at $0.57 after we see an established bounce off of the EMA ribbons. I would place a stop loss below the previous bear trend low at $0.18. My take profit targets would be as follows:

Take Profit #1 : $0.96. For two reasons, this is a 1:1 Risk/Reward ratio, so if I sell half of my position and move my stop loss to my entry price, profits are locked in, and I can swing the second half of my position. The second reason is there is a minor resistance zone at $1.00 on top of $1.00 being a psychological resistance price. $0.96 allows us to sell before that resistance is met.

Take Profit #2 : $1.50. I would sell 25% of my remaining half because this is a major resistance area where a lot of trading happened. This is also about 1:2.5 Risk/Reward, which is reasonable to take more profit.

Take Profit #3 : $2.95. Take another 25% of the second half of the position off the table just before the previous all-time high is met. This will be a major resistance area and the likelihood of it breaking is far less than the $1.50 resistance area. This is also a 1:6 Risk/Reward area, absolutely reasonable to take profits this late in the game.

Take Profit #4 : $6.85. The final 50% of the second half of my position (25% of my original position), will be taken off the table before we get close to the Lifetime Resistance price of $7.50. $7.00 will be a psychological barrier and close enough to $7.50, where if we hit that price, it will be a very low probability compared to just under $7.00. $6.85 is 1:16 Risk/Reward, a massively successful trade at this stage and completely reasonable to close the entire trade and be very satisfied with the results.

💡 Trade Idea 💡

Long Entry: $0.57

🟥 Stop Loss: $0.18

✅ Take Profit #1: $0.96

✅ Take Profit #2: $1.50

✅ Take Profit #3: $2.95

✅ Take Profit #4: $6.85

⚖️ Risk/Reward Ratio: 1:16

🔑 Key Takeaways 🔑

1. Price Action is truth and we have price action data. Bitcoin has had a 300% increase in price since the 2023 $15,500 low, ADA has had a 200% increase in that same timeframe.

2. Volume into BTC and ETH proportionally is greater than the volume into the alt coin market.

3. ADA is respecting support and resistance areas and responding to macro crypto market sentiment.

4. The altcoin market is bloated, but the top 20 coins are more insulated from that bloat.

5. The RSI, a weak indicator on its own, shows us that the market is burning hot and needs a cooling-off period. This supports my other data points.

💰 Trading Tip 💰

It's reasonable to take half profits at the first resistance target in a long trade, or the first support target in a short trade. Using a 1:1 Risk/Reward Ratio for your first target, you can move your stop loss up to your entry price, locking in profits. This allows you to watch the rest of the trade execute without worry of losing money. This helps improve trading psychology and the equity in your account.

⚠️ Risk Warning! ⚠️

Past performance is not necessarily indicative of future results. You are solely responsible for your trades. Trade at your own risk!

Like 👍 and Follow to learn more about:

1. Reading Price Action

2. Chart Analysis

3. Trade Management

4. Trading Psychology

ADA → Cardano Pullback Followed by New Highs? Let's Answer.ADA completed its measured move to $0.68 and has now completed two legs down in a pullback to Support Zone #1. Should we long here?

How do we trade this? 🤔

Support Zone #1 has held through two failed attempts to break down. We have a strong bull bar leading into the Daily 30EMA where we are now seeing some resistance. The RSI is around 50 and above the Moving Average, another sign for a long position. The only thing we're missing is a solid Risk/Reward Ratio, which requires the price pullback a bit more before we can enter the market.

We ought to target at least a 1:2 Risk/Reward, but I believe we have the runway for a 1:3 Risk/Reward given the distance to the previous high of $0.68. Target the $0.487 area for an entry and place a stop loss below Support Zone #1 around $0.44, the first Take Profit at $0.535, and the final Take Profit around $0.63 or until you see a sell signal. Move the stop loss up to the entry price when Take Profit #1 is hit to lock in profits.

💡 Trade Idea 💡

Long Entry: $0.4875

🟥 Stop Loss: $0.440

✅ Take Profit #1: $0.535

✅ Take Profit #2: $0.630

⚖️ Risk/Reward Ratio: 1:3

🔑 Key Takeaways 🔑

1. Two-legged pullback after a bull run

2. Two failed attempts to break Support Zone #1

3. Strong bull bar after pullback into the Daily 30EMA

4. Wait for the price to pullback to the $0.487 area for an entry

5. RSI at 50.00 and above the moving average, supports long bias.

💰 Trading Tip 💰

Trends typically have 3 pushes in either direction before a trend change begins. Along with other market indicators, creates a situation to look for counter-trend trades because the probability of profit is high enough.

⚠️ Risk Warning! ⚠️

Past performance is not necessarily indicative of future results. You are solely responsible for your trades. Trade at your own risk!

Like 👍 and Follow to learn more about:

1. Reading Price Action

2. Chart Analysis

3. Trade Management

4. Trading Psychology

ADA → Cardano Threatening to Fall to Support. Should We Short?ADA closed the large bull gap from our previous analysis and found support at the large bull candle open. We did not get a higher high and Bitcoin is showing signs of a pullback. Should we short here?

How do we trade this? 🤔

We should not short ADA on the Daily timeframe. The time to short was after the double top reversal near the $0.60 price range, we're too far away from the proper stop loss placement relative to Support Zone #1. You can find short trades on the 1HR timeframe or lower but for the Daily/4HR timeframe, we need to look for long entries.

We can wait for a bounce on Support Zone #1 to enter a long, but the crypto market may be looking at a more significant pullback. It's difficult to tell how the alt coin market will react to say, a 30% Bitcoin pullback. The point is, don't think that Support Zone #2 isn't a probable target. Either zone is reasonably to long, but we need to wait for the buy signal and confirmation bars before entering. A good buy signal is one with a long wick on the bottom at least 1/3 the size of the body closing on or near its high. A confirmation candle will be a strong bull candle closing on or near its low following the buy signal buy 1 to a few bars.

Until then, it's best to trade a different currency pair and wait for a good long opportunity here on ADA.

💡 Trade Idea 💡

Long Entry: $0.4210

🟥 Stop Loss: $0.3734

✅ Take Profit #1: $0.4690

✅ Take Profit #2: $0.5640

⚖️ Risk/Reward Ratio: 1:3

🔑 Key Takeaways 🔑

1. Large Bull Bar Gap Closed.

2. Strong Support on the Daily 30EMA.

3. Lower High after the 30EMA bounce.

4. Bad Risk/Reward Ratio for a short, wait for a long setup at Support Zone #1 or Support Zone #2

5. Bitcoin Showing Strong Reversal Signals, Impacts Market Sentiment.

💰 Trading Tip 💰

It's reasonable to take half profits at the first resistance target in a long trade, or the first support target in a short trade. Using a 1:1 Risk/Reward Ratio for your first target, you can move your stop loss up to your entry price, locking in profits. This allows you to watch the rest of the trade execute without worry of losing money. This helps improve trading psychology and the equity in your account.

⚠️ Risk Warning! ⚠️

Past performance is not necessarily indicative of future results. You are solely responsible for your trades. Trade at your own risk!

Like 👍 and Follow to learn more about:

1. Reading Price Action

2. Chart Analysis

3. Trade Management

4. Trading Psychology

ADA → Cardano Ready to Rip? Or Dip? Maybe $0.72 before Reversal.Cardano has been on a ride along with the entire crypto market for months and with a bull flag playing out, looks like we're going to get a little more upward price action. Should we long here?

How do we trade this? 🤔

We need to wait for a pullback to at least the 30EMA, maybe the 200EMA, whenever we see some bullish price action in response. A strong bull signal bar closing near its high and a confirmation candle are preferable. This gives us the necessary probability to enter a long and place a protective stop below the 200EMA around $0.59. Plan to take half profits at 1:1 Risk/Reward around $0.63, move your stop loss up to the entry price to secure profits, then take profits at the next reversal signal or at 1:3 Risk/Reward around $0.727.

We need to be aware that on the higher timeframes, Bitcoin and the crypto market is running hot and we should be on the lookout for a trend change. Either to a trading range and/or a reversal to the downside. We need to close a few more weekly candles to get an indication of the next market moves on the higher timeframes.

💡 Trade Ideas 💡

Long Entry: $0.630

🟥 Stop Loss: $0.599

✅ Take Profit #1: $0.630

✅ Take Profit #2: $0.727

⚖️ Risk/Reward Ratio: 1:3

🔑 Key Takeaways 🔑

1. Bull Flag after a Bull Run, Bias to Long.

2. Near Flag Resistance, Wait for a Pullback.

3. Gap to 1HR 30EMA and 200EMA, Wait for Pullback.

4. RSI at 64.00, Above Moving Average. Bias to Long.

5. Take half profits at 1:1, Remainder at 1:3.

💰 Trading Tip 💰

Bull flags in the proper context, provide over a 60% probability that a trend will continue. This provides justification to enter a long trade.

⚠️ Risk Warning! ⚠️

Past performance is not necessarily indicative of future results. You are solely responsible for your trades. Trade at your own risk!

Like 👍 and comment if you found this analysis useful!

ADA/USDT 1DAY UPDATE BY CRYPTOSANDERS !!Hello friends, welcome to this ADA/USDT update from Crypto Sanders.

Chart Analysis:- ADA bulls woke up this week with an impressive 28% price increase. This spectacular performance obliterated the resistance at 46 cents, and now buyers are looking at much higher levels.

The most important resistance on the chart right now is found at 60 cents. Sellers may attempt to stop this rally around 50 cents, but that is unlikely to last, considering market sentiment.

ADA manages to maintain this momentum, and then going to 60 cents becomes likely.

I have tried to bring the best possible results in this chart.

If you like it, hit the like button and share your charts in the comments section.

Thank you.

ADA → Cardano Coming Down! Where Will We Land? Let's Answer.Cardano had a fantastic measured move event from the breakout point on October 23rd, a move that I overlooked in my last couple of analysis! The price shot up from $0.27 to $0.41, pulling back into a bull flag, then ripping up from $0.41 to $0.62! Now that the move is complete, where do we go from here?

How do we trade this? 🤔

The measured move is usually followed by a trading range, which can turn into a continuation pattern over time *OR* a reversal to the downside. We need more price action to determine the next moves. Right now we have a market that is burning hot on the upside, and RSI that is over 70.00, and the massive bear candle from last night that showed the bulls taking profits at this key level.

Right now, we need more price action to justify an entry. Given the current datapoints, we should expect some sideways price action until the 30EMA catches up, but its likely we'll fall down toward the previous Resistance Zone that may not act as support. The test of that zone will give us strong evidence as to the next moves for Cardano. We need to see a strong bull signal and confirmation bar to justify a long. An RSI level of 50.00 or below would be ideal as well.

Until then, it's reasonable to stay on the sidelines until more price action plays out.

💡 Trade Idea 💡

Long Entry: 0.482

🟥 Stop Loss: $0.437

✅ Take Profit: $0.572

⚖️ Risk/Reward Ratio: 1:2

🔑 Key Takeaways 🔑

1. Measured Move Complete! Trading Range or Reversal Likely.

2. Previous Resistance Needs to be tested as Support.

3. If Support Holds, Could go up for another test of the Previous High.

4. If Support Fails, Expected Lower Lows around 200EMA.

5. RSI at 70.00, Above Moving Average. Bias for Short-Term Short.

⚠️ Risk Warning! ⚠️

Past performance is not necessarily indicative of future results. You are solely responsible for your trades. Trade at your own risk!

Like 👍 and comment if you found this analysis useful!

ADA/USDT 1DAY UPDATE BY CRYPTOSANDERS !!Hello friends, welcome to this ADA/USDT update from Crypto Sanders.

Chart Analysis:- Cardano landed on its key support at 38 cents this week and, in the process, also registered a 3% loss in valuation. If bulls hold here, then ADA could end its correction.

The current resistance is found at 41 cents, and it may take some time before this cryptocurrency tests it again.

ADA has a good opportunity to reverse and end its correction at this level. If it fails and the current support falls, then the price is likely to go to 35 cents next.

I have tried to bring the best possible results in this chart.

If you like it, hit the like button and share your charts in the comments section.

Thank you.

ADA is underrated nowBINANCE:ADAUSDT

✅Before we start to discuss, I would be glad if you share your opinion on this post's comment section and hit the like button if you enjoyed it.

Thank you.

Possible Targets and explanation idea

➡️Now we are in 0.27 Zone by Fib since April

➡️Target for this correction is 0.618 level on fib

➡️Perfect signal to buy on TradeON indicator

➡️Signal on Direction indicator. (big investors came in to Cardano)

➡️After 0.618 we will test above downtrend global line since May 2021

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

* Look at my ideas about interesting altcoins in the related section down below ↓

* For more ideas please hit "Like" and "Follow"!

ADA/USDT 1DAY UPDATE BY CRYPTOSANDERS !!hello, welcome to this ADA/USDT update by CRYPTO SANDERS.

CHART ANALYSIS:- Cardano (ADA) was a notable gainer, with the cryptocurrency climbing away from a floor of its own.

ADA/USD rose to a high of 0.2628 earlier in the day, which comes after a low of 0.255 the day prior.

Today’s move saw Cardano move away from its recent support point at 0.250, just as the RSI bounced from a floor of its own.

After colliding with a floor at the 55.00 mark, price strength has gone on to reach a high peak at 58.82.

The next visible ceiling looks to be at the 65.00 zone, and in the event bulls manage to reach this point, ADA will likely rise above 0.270.

I have tried to bring the best possible outcome to this chart.

Hit the like button if you like it and share your charts in the comments section.

Thank you