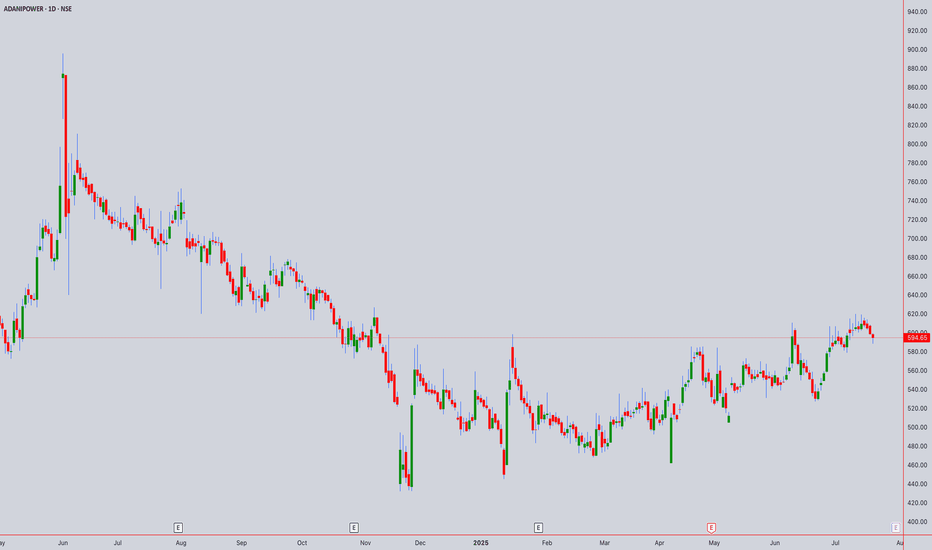

Adani Power (NSE:ADANIPOWER) Technical Analysis July 18th, 2025Current Price : ₹594.65 (as of July 18th, 2025, 02:00PM UTC+4)

Target Price: ₹633.67 (+6.56% upside potential)

Executive Summary

Adani Power is currently showing mixed signals across different timeframes. The stock has broken through key resistance levels but is facing overhead resistance. Multiple technical theories suggest a consolidation phase with potential for upward movement.

1. CANDLESTICK PATTERN ANALYSIS

Intraday Patterns (5M-1H)

Current Formation: Doji/Spinning top patterns indicating indecision

Key Pattern: Inside bar formations suggest consolidation

Volume Profile: Moderate volume with no significant breakout confirmation

Swing Patterns (4H-Weekly)

Primary Pattern: Rectangle/Channel formation identified

Support Zone: ₹513-520 (Strong support)

Resistance Zone: ₹588-600 (Current testing area)

2. HARMONIC PATTERN ANALYSIS

Potential Patterns

ABCD Pattern: Incomplete - monitoring for completion around ₹630-650 zone

Gartley Pattern: Potential bearish setup if rejection occurs at current levels

Fibonacci Levels:

Support: ₹450 (S1), ₹300 (S2), ₹200 (S3)

Resistance: ₹700 (R1), ₹850 (R2), ₹1,000 (R3)

3. ELLIOTT WAVE THEORY

Wave Count Analysis

Primary Wave: Currently in Wave 3 of a larger impulse structure

Sub-wave: Wave 4 correction potentially completing around ₹580-590

Target: Wave 5 projection towards ₹700-750 zone

Invalidation Level: Below ₹513 would negate current count

Time Cycles

Short-term: 5-8 day correction cycle

Medium-term: 21-34 day impulse cycle active

4. WYCKOFF THEORY ANALYSIS

Current Phase Assessment

Phase: Potential Mark-up Phase (Phase D-E transition)

Volume Analysis: Accumulation patterns visible on weekly charts

Smart Money: Institutional interest evident from volume profiles

Composite Operator: Testing supply around ₹600 levels

Key Levels

Spring Test: ₹513 level held as key support

Supply Line: ₹588-600 acting as resistance

Upthrust Potential: Break above ₹605 could trigger mark-up

5. W.D. GANN THEORY ANALYSIS

Square of Nine Analysis

Current Position: 594° on the wheel

Next Resistance: 625° (₹625) - significant Gann angle

Support Level: 576° (₹576) - 45-degree angle support

Cardinal Points: 600° represents a critical decision point

Time Theory

Natural Time Cycles: 90-day cycle completion expected by August 2025

Anniversary Dates: Historical significant dates align with current timeframe

Time Windows: July 25-30, 2025 represents important time cluster

Angle Theory

1x1 Angle: Currently trading above the 1x1 rising angle from ₹513 low

2x1 Angle: Resistance at ₹630 level (steep angle)

Price/Time Squares: Next square at ₹625 (25²)

Forecasting

Price Target: ₹625-650 based on geometric progressions

Time Target: 15-20 trading days for next significant move

Harmony Level: ₹594 is in harmony with previous swing levels

6. ICHIMOKU KINKO HYO ANALYSIS

Cloud (Kumo) Analysis

Current Position: Price trading above the cloud (bullish)

Cloud Thickness: Thin cloud ahead suggests easier breakout potential

Cloud Color: Green cloud in coming periods (bullish bias)

Line Analysis

Tenkan-sen (9): ₹587 - price above (bullish)

Kijun-sen (26): ₹571 - price above (strong bullish)

Chikou Span: Clear of price action (no interference)

Senkou Span A: ₹579 (support)

Senkou Span B: ₹562 (key support)

7. TECHNICAL INDICATORS

RSI Analysis

Current RSI: 58-62 range (neutral to slightly bullish)

Divergence: No major divergences detected

Overbought/Oversold: Not in extreme zones

Bollinger Bands

Position: Price in upper half of bands

Squeeze: Bands expanding, indicating increased volatility

Signal: Potential for continued upward movement

VWAP Analysis

Daily VWAP: ₹591 (price above - bullish)

Weekly VWAP: ₹584 (strong support)

Volume Profile: Heavy volume around ₹570-580 zone

Moving Averages

SMA 20: ₹583 (bullish crossover)

EMA 20: ₹586 (price above)

SMA 50: ₹567 (strong support)

EMA 50: ₹569 (upward sloping)

SMA 200: ₹524 (long-term bull market)

8. MULTI-TIMEFRAME ANALYSIS

Intraday Timeframes

5-Minute Chart

Trend: Sideways with bullish bias

Key Level: ₹592-596 range bound

Signal: Wait for breakout above ₹600

15-Minute Chart

Trend: Consolidating triangle pattern

Volume: Decreasing (typical in consolidation)

Target: ₹605-610 on upside breakout

30-Minute Chart

Trend: Higher highs and higher lows intact

Support: ₹590-592

Resistance: ₹598-602

1-Hour Chart

Trend: Bullish flag pattern forming

Breakout Level: Above ₹602

Target: ₹625-630

4-Hour Chart

Trend: Strong uptrend since ₹513 low

Pattern: Bull flag consolidation

Key Level: ₹588 as crucial support

Swing Timeframes

Daily Chart

Trend: Primary uptrend intact

Pattern: Rectangle between ₹513-588 broken upside

Target: Next resistance at ₹700 zone

Weekly Chart

Trend: Long-term bullish structure

Support: ₹450-500 major support zone

Resistance: ₹700-750 target area

Monthly Chart

Trend: Recovery from major lows

Long-term View: Potential for ₹850+ targets

Time Horizon: 6-12 months for major targets

9. FORECAST & OUTLOOK

Intraday Forecast (Next 1-5 Days)

Bias: Neutral to Bullish

Range: ₹585-610

Breakout Level: Above ₹605 for ₹625 target

Stop Loss: Below ₹582

Swing Forecast (Next 2-8 Weeks)

Primary Target: ₹633-650

Secondary Target: ₹700-720

Support Zone: ₹570-580

Risk Level: Medium (volatility expected)

Key Risk Factors

Overall market sentiment and Adani group developments

Earnings disappointment (recent -23.91% surprise noted)

Broader power sector dynamics

Regulatory changes in power sector

Trading Strategy Recommendations

For Intraday Traders

Buy: Above ₹602 with ₹610-615 target

Sell: Below ₹590 with ₹582-585 target

Risk Management: 1-2% position sizing

For Swing Traders

Accumulate: ₹580-590 zone

Target: ₹633-650 (first target)

Stop Loss: Below ₹570 (daily close basis)

Time Horizon: 4-8 weeks

Confluence Factors Supporting Bullish View

Multiple theories align for ₹625-650 targets

Strong volume accumulation patterns

Technical breakout from rectangle formation

Ichimoku cloud support

Gann squares and angles alignment

Warning Signals to Watch

Daily close below ₹580

RSI divergence formation

Volume decrease on any upward moves

Broader market weakness

Disclaimer: This analysis is for educational purposes only. Always consult with financial advisors and conduct your own research before making investment decisions. Past performance does not guarantee future results.

Adani

Adani Enterprises Weekly Chart Analysis: Bullish ScenarioAdani Enterprises Weekly Chart Analysis: Bullish Scenario

-June 23 Weekly candle close above 200EMA(Bullish)

-EMA 9/21 Bullish cross on May 26

-MACD signal line crossing above zero line -Bullish

-If next couple weeks candles close above Support level i am expecting 3070 as next Buyside target(Long)

Beginning of a DUOPOLY - Great OpportunityUltratech cement has approved an acquisition of 8.69% stake in Star cement for Rs 851 crore. As mentioned earlier in my post of August 26 that their is a possible chance of creation of duopoly in the cement sector after Adani's entrance in the sector it has been adamant after looking to the aggressive acquisitions made by Ultratech and Adani group. Till now Ultratech cement has taken stakes in Kesoram industries, India cements and Star cement while Adani Group has taken stakes in Ambuja, ACC, Sanghi Industries, Penna Cement and Orient Cement. As we know that Greenfield projects are limited due to limited natural resources, production capacity can only be increased and dominance can be maintained by acquiring small companies. Because of this tug of war share prices of small companies have surged significantly. Star cement has given a return of 40% in 2024. It's present capacity is 7.7 MTPA and plans to increase the capacity to 25 MTPA by 2030. Cement sector is going to be exciting in the coming years. Do keep a track and be updated about the sector.

Adani Green Energy What's Next....?Adani Green Energy has reached a significant support level of around 1180, coinciding with the 0.5 Fibonacci retracement level. This indicates a strong potential for a rebound at this price point. Given these technical indicators, considering entering a long position could be an opportune moment. The projected target range for this trade would be between 1450 and 1500, allowing for a potentially lucrative upside as the stock moves towards these levels. Monitoring market conditions and additional technical signals is advisable to ensure a well-informed decision.

ADANI GREEN, 45% SHORT TRADE CAUGHTADANI GREEN Trade Overview:

Adani Green saw a sharp 45% drop on the 4-hour timeframe, perfectly captured by the Risological Swing Trading System . This short trade setup successfully achieved all profit targets, providing traders with a significant opportunity to capitalize on the bearish momentum.

ADANI GREEN Key Levels:

TP1: 1789.10 ✅

TP2: 1602.55 ✅

TP3: 1415.95 ✅

TP4: 1300.65 ✅

ADANI GREEN Technical Analysis:

The entry was confirmed at 1904.45 as the Risological Red Lines indicated strong downward pressure. Adani Green continued to follow this bearish trend with no signs of reversal, allowing for precise execution of all targets. Traders who maintained their positions benefited immensely from this clear and systematic setup.

The final breakdown past TP4 marked the culmination of the trade, further affirming the system's accuracy in identifying reliable entry and exit levels.

The strategic placement of the stop-loss at 1997.70 ensured risk management was intact throughout the move.

ACC Ltd (NSE: ACC) Weekly Chart Analysis🔹 Channel Support and Resistance

The stock has been moving within an ascending channel since early 2022, creating a structured uptrend. Currently, it’s trading near the channel’s lower boundary, around ₹2,357. This zone has historically acted as a key support level, making it an area to watch closely for potential buying interest.

🔹 Descending Wedge Breakout

Recently, ACC broke out of a descending wedge pattern, a generally bullish formation, which suggests the potential for an upward move. The breakout is still in its early stages, so continued momentum will be critical in confirming the trend reversal.

🔹 Price Targets

First Resistance: ₹2,592.75 – If momentum sustains, this level aligns with a prior high and could act as a short-term target.

Channel Resistance: If the stock gains further strength, the upper boundary of the channel could offer the next significant resistance level.

🔹 Cement Industry Tailwinds

According to brokerages, Indian cement firms, including ACC, have seen successful price hikes in September, and there are plans for further hikes in October. This is generally positive for margins, adding fundamental support to the current technical picture.

🔹 RSI

The Relative Strength Index (RSI) shows an oversold condition that’s starting to turn upwards, suggesting possible accumulation at these levels.

📈 Conclusion: Watch for sustained support around ₹2,357 and an upward move towards ₹2,592. A close above ₹2,592 could indicate renewed bullish strength, especially with ongoing industry tailwinds from price hikes.

Adani Power at SupportThe strongest Adani Group company with sound financials and comfortably manageable debt along with sound current ratio.

Stock P/E - 14.8

ROCE 5Yr - 16.6 %

ROE 5Yr - 39.2 %

Debt to equity - 0.80

Current ratio - 1.60

The technical chart pattern suggest an entry.

Note: The idea is intended to spread awareness regarding the ratios that you should consider before investing and the chart reading done.

Any financial commitment will solely be your risk and should be done after thorough research.

Cement sector- A duopoly?After Adani group bought ACC and Ambuja cements and became an impact player in cement sector of the country there is a chance of duopoly creation in the cement sector as was seen in the case of telecom sector when Jio entered the segment. Although such extreme duopoly will not be created in cement sector as the other regional cement will continue to operate. There is a chance that the plants of regional companies can also be bought as Ambuja and ACC were bought. So both Ultratech and Adani group cement companies should be looked upon and should be added to our personal portfolio keeping in mind the long term vision of the country. Please do your analysis and share your views in the comment section below.

Hope you like my idea.

ADANI NOW or LATER For InvestmentIf you haven't checked my ADANIENSOL analysis kindly check it 1st.

If you look at ADANI stocks clearly we can see a massive view as investment.

Now question is for how long ?

From this position you can plan a hold for 2-3 years and it may give you more than something.

Don't let you influenced by short term market scenarios.

Investment for long term MAY give you GOOD return. BUT

Investment for long term from a good location MAY give you MASSIVE return.

ADANIPOWER LONGBeautiful Setup. Keep an eye on it.

Flag Pattern visible.

Breakout expected.

Good for Short Term.

Disclaimer : This is not a Buy or Sell recommendation. I am not SEBI Registered. Please consult your financial advisor before making any investments . This is for Educational purpose only.

18 % UP POTENTIAL LARGE CAP SHARE BUY OPPORTUNITYADANI PORT BUY NOW ON PRICE OF 713 WILL GET APROX PROFIT OF 18 PERCENT AND THAT TOO FROM A LARGECAP

FOR MORE WSUP ME 8459 22 0202

Adani Ports and Special Economic Zone Limited (APSEZ) is India's largest private port and logistics company. It operates a network of ports and terminals in India, including the Mundra Port in Gujarat, which is one of the largest ports in the country. The company also provides logistics and supply chain management services. Adani Ports is listed on the National Stock Exchange of India and the Bombay Stock Exchange. Adani Ports and Special Economic Zone Limited (APSEZ) is a part of the Adani Group, an Indian conglomerate with interests in agribusiness, energy, resources, logistics, and real estate

BOMBAY SENSEX #BSE #SENSEX Pullback completed after #Adani fraudInvesting in #INDIA has been a trade of a lifetime

Based on a burgeoning middle class and best low population demographics in the world

Indians want to FLEX and move up the income brackets

Highly motivated and educated

I believe the pullback after the Adani scandal is over

And the #Nifty can resume its long term bull and finally meet its inverse and head and shoulder from the Covid debacle.

ATGL Very Good setup seen in chart.

Consolidation done .

Good for Short term and Long term.

Target 1500, 2900.

Do Follow , Like ,Comment for regular updates...

Disclaimer : This is not a Buy or Sell recommendation. I am not SEBI Registered. Please consult your financial advisor before making any investments . This is for Educational purpose only.

Adani enterprises in Neutral modeThis stock in neutral mode - means neither good for selller or buyer

Advice --

For quity trader --

please trader according to my red Trendline price and sell above Trendline

-- stopp loss is mandatory if Trendline broken

For option trader -- seems market can go up 200-300 points to touch upper red Trendline

For more chart analysis comments me in this post.

#ATGL Attempting a breakout on Daily timeframe#ATGL

Attempting a breakout on Daily timeframe. If it does breakout, we can see another good rally in stock!

Also, if we use Fib tool, we can clearly see that the stock has been consolidating above 0.382% level and has been forming a nice base there since many days now.

Breakout looks imminent imo.