Major Move Ahead for ADA – Breakout or Breakdown?

🔍 ADA/USDT Analysis – Dual Scenario Setup (BUY & SELL)

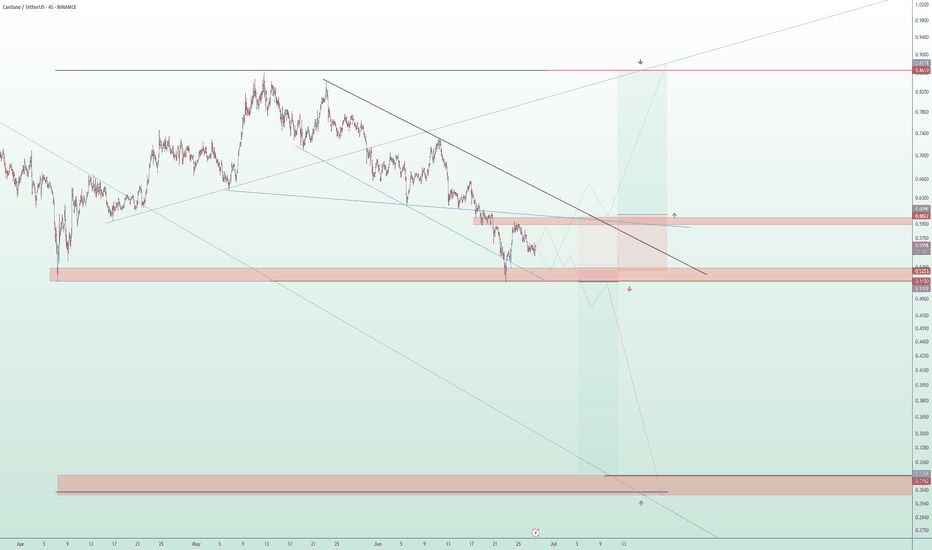

Currently, ADA is ranging between major supply and demand zones. Two clear scenarios are in play depending on how price reacts to key levels:

📈 Bullish Scenario (Long):

Entry: On breakout and confirmation above $0.6027

Target: $0.869 (major resistance zone)

Stop Loss: Below $0.523

Trigger: Break of descending trendline and solid structure above $0.6027

📉 Bearish Scenario (Short):

Entry: Around $0.5120 (rejection from supply zone)

Target: $0.315 (strong demand zone)

Stop Loss: Above $0.6027

Trigger: Failed breakout and rejection from $0.5120 level, with confirmation below it

📌 Based on the descending channel structure, this might have been the final leg of the downtrend, and a reversal to the upside could be underway. However, for confirmation, we prefer to wait for stronger price action signals before fully committing.

🛑 Always use risk management. Market remains bearish until proven otherwise.

Adashortsetup

ADA → Cardano Failed to Break Resistance Zone. About to Fall!?Cardano had a failed breakout above the Resistance Zone at $0.62, followed by several failed attempts to break it again. Does this mean we enter a long?

How do we trade this? 🤔

Entering a short right now is reasonable if you accept the low probability nature of reversal trading. The number of failures to break the resistance zone are great signals to enter a trade, but additional confirmation to the downside with a strong bear candle is preferable. Due to the current distance to the proper stop loss placement above the Resistance Zone, it's reasonable to take a 1:1 Risk/Reward Ratio trade down to the support zone. Use a smaller position size given the additional risk.

💡 Trade Ideas 💡

Short Entry: $0.575

🟥 Stop Loss: $0.665

✅ Take Profit: $0.485

⚖️ Risk/Reward Ratio: 1:1

🔑 Key Takeaways 🔑

1. Failed Breakout at Resistance Zone, Sell Signal.

2. Failed three times to break Resistance Zone after Signal, Confirmation.

3. Gap to Daily 30EMA and Support Zone.

4. RSI at 60.00, Below Moving Average. Bias to Short.

5. Watch for Bitcoin Trend Change at $46,000.

💰 Trading Tip 💰

Price seeks balance and will naturally move toward moving averages. Trade with the trend for maximum probability, but also expect gaps between the price and moving averages to close before they widen.

⚠️ Risk Warning! ⚠️

Past performance is not necessarily indicative of future results. You are solely responsible for your trades. Trade at your own risk!

Like 👍 and comment if you found this analysis useful!

ADA Failed to Break Down! Will The Price Rocket to the Upside?ADA failed to break down after the triple top failed! The minute that bull bar on November 21st at 19:00 closed near its high, a short position should have been closed for a break even. We're still below the resistance zone. It would have been reasonable to long that bar given the multiple failed attempts to break to the downside.

How do we trade this?

The price is currently sitting at resistance in a bull trend. We should be waiting for either a strong bear signal bar to short or a breakout above the resistance zone to long. Bitcoin is in a similar situation, and we should wait for the signal before entering.

If we get a bull breakout bar closing on or near its high above the resistance zone, it's reasonable to long. Place a protective stop below the resistance zone and a 1:2 Risk/Reward ratio to the upside.

Don't trade a bull breakout bar until it closes and shows support above the resistance zone. That bar could quickly become a bear signal bar in which case, we're looking for a bar closing below the resistance zone on or near its low. A break below the channel support with a bar closing on or near its low would give us enough probability of profit to short with a tight stop, playing the reversal. We are in a bull trend, make sure the signal and confirmation are clear with tight stops.

Key Points

1. Fanning Bull Channel, Bias to Long

2. Resistance Zone Still in Play

3. Failed Triple-Top Reversal

4. RSI at 56.00 above Moving Average, Indecisive.

5. Bitcoin at a critical moment. Breakout or Breakdown?

You are solely responsible for your trades, trade at your own risk!

If you found this analysis helpful, click the Boost button and let us know what you think in the comment section below!