ADAUSDT

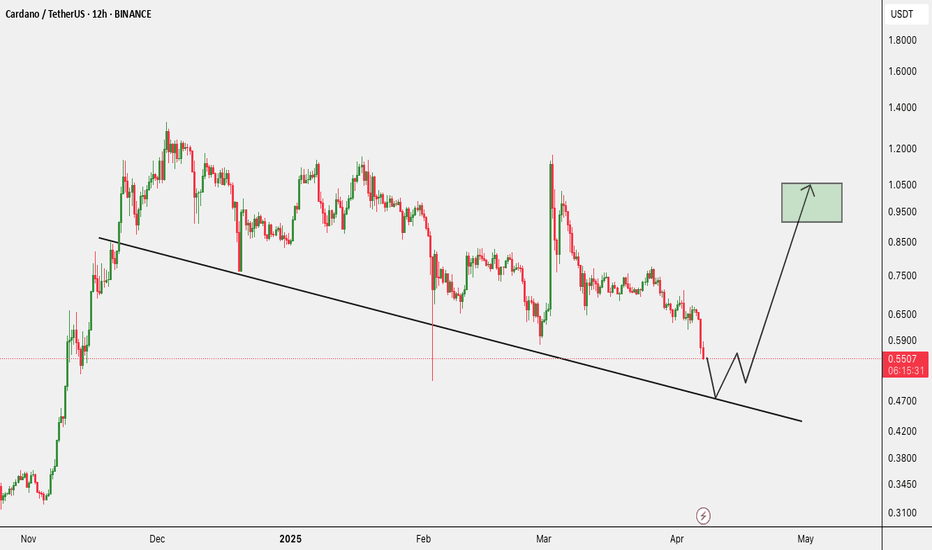

ADA/USDT: Is ADA Preparing for Its Next Rally?(READ THE CAPTION)By analyzing the #Cardano (ADA) chart on the 3-day timeframe, we can see that over the past few months, the price surged from $0.33 to $1.32, delivering a gain of over 300%. After reaching its highest level in 3 years, it faced selling pressure and corrected down to $0.50.

Currently, Cardano is trading around $0.70, and if the price can hold and close above the $0.65 level, we may expect further upside in the medium term.

The next potential targets are $0.75, $0.81, $0.93, and $1.05, respectively.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

BTC.D : READY FOR ALT-SEASONHi Guys, Hope You well

As you can see, the trend is finally breaking and the downtrend is starting again for the growth of the altcoins in the market. I hope you get the best profits from this alt season, which may be the last alt season and the best in this market cycle.

SecondChanceCrypto

⏰ 9/May/26

⛔️DYOR

ADA Breakdown Ahead? Don’t Let This Bull Trap Fool YouYello Paradisers—are you ready for what could be a classic trap before a deeper drop? ADAUSDT is flashing multiple bearish signals that are difficult to ignore, and if you're not paying attention, this setup could catch you off guard.

💎ADAUSDT recently took a firm rejection from a key resistance zone, failing to push higher. Following that, price action broke down from a well-formed descending channel, and we’ve now seen a clear bearish Change of Character (CHoCH). These three factors together significantly increase the probability of a bearish continuation.

💎If ADAUSDT pulls back and grabs liquidity, that could offer a highly favorable opportunity to enter on the short side. The ideal scenario would be a return to the resistance zone, followed by the formation of bearish price patterns—such as rejections or bearish engulfing candles. This would confirm the intent to move lower and offer a strong risk-to-reward short setup.

💎However, if the price manages to break and close decisively above the resistance zone, this would invalidate the current bearish outlook. In that case, it's critical to remain patient and wait for cleaner, higher-probability price action to form. Forcing trades in an uncertain setup can lead to unnecessary losses, so discipline is essential here.

Strive for consistency, not fast profits. The most successful traders are the ones who wait for the market to show its hand clearly. Stay focused, stay sharp, and trade smart.

MyCryptoParadise

iFeel the success🌴

ADA (Cardano) – Long Spot Trade Setup at SupportCardano has pulled back to a key support zone around $0.66, providing a potential entry opportunity for a long spot position as the broader structure attempts to hold.

🔹 Entry Zone:

$0.66

🎯 Take Profit Targets:

🥇 $0.80 – $0.84

🥈 $0.98 – $1.02

🛑 Stop Loss:

Just below $0.59 (to protect against deeper breakdowns)

Cardano, 2nd Entry —Friendly ReminderI am doing a second entry on Cardano for my people with leverage. I know it is more risky as we no longer have bottom prices but the show must go on.

When the action is already ongoing, when it is no longer 100% certain that we are looking at a bottom, we still jump-in but with lower leverage compared to the initial and main entry.

These leveraged trade-setup that I share are long-term based, these are not your conventional type of trades. Traditional traders get in and get out and normally are looking to catch a 1-3% bullish wave. Here we are looking for hundreds of percentages of points of growth and this removes all the complexity of brokers commissions, fees, interest on the margin and so on. We spot the reversal. Of course, every method has its advantages and disadvantages but remember that my group is a more spiritually oriented one; we look for market conditions that produce great results, easy but with peace of mind, time to trade and earn but also to relax.

There is always risk involved. Many trades can fail in a cycle or during a transition period. But as soon as the next wave is in we have great entry and can easily win big, many times more than any of the losses incurred during the transition period.

It is a fallacy to think that trading is about getting them all right or many right, it is about making money, period. What works for you works.

There are many different methods and ways to approach the market. No one owns the golden rules. You can buy and hold, you can use leverage, you can do what works for you and all is good.

Long-term, we end up winning with the Cryptocurrency market. It is hard to lose to be honest because everything grows. When prices are down, we wait and we hold. When prices are up, we collect profits and move up.

When the market is at a new bottom (7-April) and highly depressed, we jump in with full force and make up with huge wins for any natural and unavoidable mistakes.

It is a process of growth. If you can gain control of your mind, the market becomes as easy as waiting for the right time, buying and just watching your money grow. The hardest part is being patient; the easiest part is to trust.

Trust this process. Trust the market. Trust me, and you will be happy with the results.

Namaste.

LONG ADA/USDT | Bullish Reversal SetupADA/USDT | Bullish Reversal Setup

📊 Market Structure

Context: After a retest of April highs, ADA pulled back into a shallow down-sloping support line (blue).

Implication: A series of higher-low tests into that line suggests buyers are defending this area.

🔹 Demand Order Block

Zone: 0.6350 – 0.6500 USDT (shaded blue)

Key Entry Levels:

0.6500 USDT

0.6436 USDT

0.6350 USDT

⚔️ Long Entry Strategies

Aggressive: Scale into longs on a bounce off 0.6500 USDT with a strong bullish candle.

🛑 Stop Loss

Close below Level: 0.6157 USDT

Placed just below the demand block to absorb noise yet protect capital.

🎯 Profit Targets

TP1 0.6853

TP2 0.7192

TP3 0.7568

🔧 Trade Management

Scale-Out: Take partial profit at each TP to lock in gains.

Trail Stop: Move to breakeven once TP1 is reached.

Invalidation: A daily close below 0.6157 USDT negates the setup—exit and reassess.

Cardano: Buy Opportunity In The Making (Buy When Red)Retraces, even if these are very small, can be used as an opportunity to buy. Whenever the market turns red that is an opportunity in the making, because we are set to experience growth long-term.

When the market is green, we either wait patiently or secure portions of profits. When the market turns red, that's the time to buy because as soon as the low is in (higher low always) what happens is the continuation of the initial and main move, the bullish wave.

Cardano is red today but it was also red on the 30th of April, the 29 and so on. If you consider the chart closely, the action always fluctuates between green and red. Now, this red action won't last long so the opportunity within hours or days can be gone.

» Any drops, corrections and retraces are an opportunity to buy-in, rebuy and reload. This is true for Cardano as it is true for Bitcoin and the rest of the Altcoins.

Namaste.

ADA - Ready for Launch? Helllooo and welcome!! - Look at this

This is a 4H SVP chart for Cardano,

The price is currently around $0.7078, and the recent structure shows a consolidation phase. The POCs (Point of Control) are clustering between $0.70 and $0.71, which means this is where the most trading volume is happening – a fair value area. Price is being accepted here.

We also see that in the past few sessions, VAH (Value Area High) and VAL (Value Area Low) are narrowing, suggesting reduced volatility and possibly a squeeze building up. The session from April 30th had a deep sell-off, but buyers responded well, and the price recovered quickly above VAL. This is a sign of demand stepping in at lower prices.

However, unless the price breaks above $0.715 (recent VAH zone) with strong volume, we might stay range-bound. If price falls below $0.695, it could slide to lower value zones near $0.685–$0.675

However my doodle is suggesting a move like this as mentioned. Invalid if touches the pink, first touches the cyan box, Purple shows the last place for all buys if it wrecks, what you want is breaking the orange!

Parallel Channel Ending? Cardano Targets 0.85 With 20% SurgeHello and greetings to all the crypto enthusiasts, ✌

All previous targets were nailed ✅! Now, let’s dive into a full analysis of the upcoming price potential for Cardano 🔍📈.

Cardano is consolidating within a parallel channel, nearing a major daily support level after a sharp decline. This technical setup suggests a potential bullish reversal in the short term. I anticipate at least a 20% move upward, with a primary target of 0.85.📚🙌

🧨 Our team's main opinion is: 🧨

Cardano’s holding strong at key support, and I’m expecting a 20% bounce soon with 0.85 as the main target.📚🎇

Give me some energy !!

✨We invest hours crafting valuable ideas, and your support means everything—feel free to ask questions in the comments! 😊💬

Cheers, Mad Whale. 🐋

Be careful with ADA !!!So if you pay attention to the ADA chart you can see that the price has formed a Ascending FLAG or WEDGE which means it is expected to price move as equal as the measured price movement.( AB=CD )

NOTE: wait for break of the FLAG .

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

ADA/USDT 1H: Markup Phase – Long Setup Above $0.7080ADA/USDT 1H: Markup Phase – Long Setup Above $0.7080

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

Current Market Conditions (Confidence Level: 8/10):

Price at $0.7086, showing neutral-bullish structure after breaking above previous high.

Hidden bullish divergence spotted on RSI, supporting bullish continuation bias.

Smart Money completed accumulation between $0.68 – $0.69, signaling strength.

Trade Setup (Long Bias):

Entry: $0.7080 – $0.7090 zone.

Targets:

T1: $0.7300

T2: $0.7500

Stop Loss: $0.6950 (below recent swing low).

Risk Score:

7/10 – Strong breakout supports the setup, minor pullback into equilibrium zone remains possible.

Key Observations:

Break of market structure aligns with start of markup phase.

Volume profile confirms solid support near equilibrium around $0.69.

Momentum increasing after breakout above PCH, suggesting bullish continuation.

Smart Money positioning favors further upside moves.

Recommendation:

Long positions favored within entry zone with tight risk below $0.6950.

Consider scaling out at $0.7300 and trailing stop for potential extension towards $0.7500.

Monitor price action closely for bullish continuation or signs of early exhaustion.

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

Cardano Is Ready To Move Now! Final Call —Friendly ReminderThere is a very thin line drawn around 0.6950 which is a Fib. support level. Cardano is trading above this level, remains above this level and continues to be green. These candles are composed of two days each... This is it.

Good afternoon my fellow Cryptocurrency trader, I hope you are having a wonderful day.

Cardano is ready now, we are ready now, the market is ready now...

Prepare to profit. Huge profits can be made.

A life changing situation is developing within the Cryptocurrency market right now and prices are still low. We had months and months of a long correction, weeks of sideways, and the market is ready now, we are ready now to go up, see up and grow. This is the opportunity you've been waiting for. Time to take action.

These are the same drawings on the chart as before I haven't changed them because they are good and valid and get the message across. It shows a nice chart structure with a consolidation corrective phase, sort of big bullish flag, or a channel but the upper resistance has been broken and the downtrend is no more.

Remember, the low was hit 3-February and the 7-April wick on the Doji reversal candle was a higher low. This means that Cardano is very strong, buyers were ready and waiting for bears to sell and they bought. Once the action resumes it will be so strong that there will be no time to think, no time to adapt. The market starts moving now or within days.

After a low is hit if there is no continuation on the bearish side this becomes a bullish signal. With the higher low and consolidation this is as bullish as it gets. Cardano is trading back above support.

The conditions are perfect and the action is pointing toward additional growth. This is what I see coming from the chart and the fact that Bitcoin remains strong, really strong not dropping even $2,000 but trading above $90,000 supports the Altcoins market.

Cardano being at the top and moving strongly last year, it is sure to move strong again and out-perform many of the other Altcoins. With a pair like this you can't go wrong.

Get the big one, get the small ones, get anything you want but, diversify and use some stable reputable projects to secure your profits on the way up.

The 2025 bull market is confirmed.

This is the start of the next advance.

Buy and hold. Go LONG!

Enjoy the profits as they come.

Namaste.

Trading Plan For Cardano ADA Revealed!Hello, Skyrexians!

I tried multiple times to understand what is happening on BINANCE:ADAUSDT chart. The Elliott waves analysis was too complicated and I didn't share anything, but today I found the scenario which fits with the trading system rules.

Let's take a loot at the weekly time frame. The bull market wave 2 has been finished with the green dot on the Bullish/Bearish Reversal Bar Indicator then the wave 3 has been started. Technically it could be finished at 1.61 Fibonacci and Awesome oscillator tells us that it's not the trend finish, but anticipated wave 4 has significantly overlapped the wave 1. It can't be wave 4 and it can't be trend finish. It means that now price is entering into the wave 3 inside 3 and the higher degree wave 3 has the target mush higher approximately at $3.

Best regards,

Ivan Skyrexio

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

Cardano: Is It Too Late To Join The Action?It is not too late. Actually, it is still pretty early.

Notice this chart and the 0.236 fib. extension level. While Cardano is breaking out of a consolidation pattern with a local downtrend, it is still trading below this most primitive fib. resistance. Simply meaning that it is very early when we consider the biggest picture and long-term growth potential.

You see, some smaller Altcoins have grown by 100%+ in a single day. Even some of the big projects moved 20%, 30% and even 50% in a single day. It is the start, now, of a major bullish cycle and phase. It is the start of the 2025 bull market, so there is no such thing as being late.

Imagine daily growth, day by day, week by week, going and going, over and over, for months. This growth can go until November 2025 or even beyond, into early 2026. Knowing this, we know that it is very early.

Now, what about retraces, pull-backs, corrections and shakeouts?

What to do if the market shakes?

Every time there is a drop, this is positive, it is an opportunity to buy at lower prices. Every drop or correction should be considered an opportunity to buy-up, rebuy and reload. And, if you missed the early entry, the first entry, you can buy whenever your favorite pair, in this case Cardano, hits support.

Cardano it still very early in its bullish breakout and bullish cycle, it will grow for months. Knowing this, you can go ahead easily and buy and hold.

You will be happy with the results.

Just focus on the long-term, think of a waiting period of at least 3-6 months. With this mentality, you can't go wrong.

If you think of making money in a matter of days, this can result in anxiety and mistakes. No, that's not the way you should trade.

You should focus on resistance and support. As long as prices remain above support, we are bullish, when resistance hit, we take profits home. That's all there is. After you buy, you hold. The market will take care of the rest.

It is still early for Cardano but once you buy, you have to wait.

Many pairs are still trading at bottom prices. New pairs will be breaking out strongly every single day. Daily. Every day a new pair will produce massive growth. When all is set and done, the entire market will be 20-30X up. It will be awesome.

Thanks a lot for your continued support.

Namaste.

ADA on high time frame

"Hello traders, focusing on ADA on high time frames, the price is at a critical level, known as the VECTOR level. If the price manages to close above this zone and forms a (FVG) in the 1-hour chart, it could indicate a potential move to the upside.

However, if the price fails to surpass this level and simply sweeps the liquidity, I anticipate lower prices ahead."

If you have any further questions or need additional assistance, feel free to ask!

Cardano Prepares For A 300% Rise Mid-TermCardano is preparing to grow and I see a 300%+ potential profits rise within 3 months, which is our mid-term time horizon. This would put ADAUSDT at around $2.65 but this will not be the end of the bull market, this is only a portion of it because we are expecting more growth in this year 2025 or maybe even beyond.

How are you feeling in this wonderful day?

It is wonderful because the market is green.

It is wonderful because we are alive, healthy and happy; are you with me?

Look at the chart, what do you see?

The low was in early February with a long lower wick. That's it, this signal gives it all away. The fact that there is a higher low just two weeks ago, 7-April, signals that the bottom of the correction is in, once the correction is over we get a new bullish impulse and that's the bullish wave that I am talking about. It is happening now but it will last a long time.

Now, the action will not all happen in a single day but the first move tends to leave great entry prices behind. So after the start there can be some swings, some shaking, some down, some up, but always long-term growth based on a chart structure of higher highs and higher lows. As long as you can protect against the present low, any and all positions will hold because Cardano is set to grow.

This is a friendly reminder, we are going up very strong.

Get in now!

The 2025 bull market is here.

Thanks a lot for your continued support.

Namaste.

Cardano Breakout and Potential RetraceBINANCE:ADAUSDT Hey Traders, in today's trading session we are monitoring Cardano for a selling opportunity around 0.6250 zone, ADAUSDT was trading in an uptrend and successfully managed to break it out. Currently is in a correction phase in which it is approaching the retrace area at 0.6250 support and resistance zone.

Trade safe, Joe.

SHORT ADA/USDT🔥 #ADA/USDT

🔴 SHORT

🎲 Entry Zone 1: 0.6310

🎲 Entry Zone 2: 0.6340

✅ Take Profit 1: 0.6205

✅ Take Profit 2: 0.6063

✅ Take Profit 3: 0.5926

✅ Take Profit 4: 0.5784

✅ Take Profit 5: 0.5587

❌ Stop Loss: Above 0.6511

💱 Recommended Margin: 2.5% - 5%

🧳 Recommended Leverage: 5X - 15X

🧠 Narrative: ADA/USDT is experiencing resistance in the 0.6310–0.6340 zone. Failure to break above this level could trigger a bearish move toward lower support zones.

📈 Market Context: Monitor overall crypto sentiment and Bitcoin’s trend; a strong BTC rally may invalidate this short, while a broader pullback could accelerate the downside.

⚠️ Risk Management: Place stops above 0.6511, size positions carefully, and remain flexible if price action shows unexpected strength.

⚠️ Take Care of Risk Management for Your Account