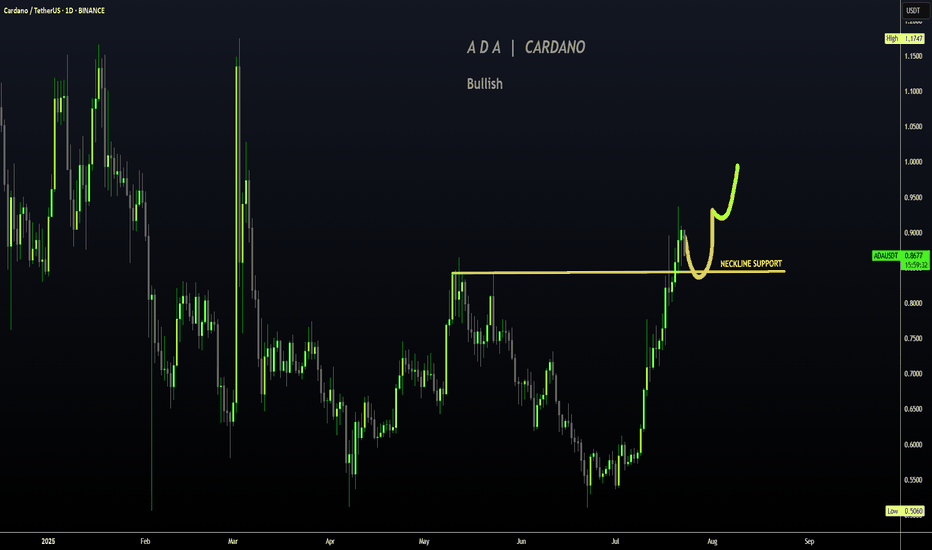

CARDANO | ADA Creeping UP to $1Cardano has made a big move in recent weeks, boasting a 77% increase.

If you were lucky enough to buy in around 30 or 40c, this may be a great TP zone:

Looking at the Technical Indicator (moving averages), we can see the price makes its parabolic increases ABOVE - which is exactly where we are currently beginning to trade. This could mean more upside is likely, and the 1$ zone is a big psychological resistance zone:

A continuation of the current correction may look something like this for the next few weeks:

_____________________

BINANCE:ADAUSDT

Adausdtlong

ADAUSDT: $1.50 Year End Target, Is It Possible? The price has remained steadily bullish, but we haven’t seen a strong bullish impulse in the daily timeframe yet. This suggests that we’ll likely reach the $1.50 price range. Please wait for the price to break out and then enter a trade when it shows confirmation. You can use smaller timeframes while taking any entry. Good luck and trade safely!

Like and comment for more!

Team Setupsfx_

ADA/USD Thief Trading Plan – Bullish Snatch & Run!🚨 ADA/USD HEIST ALERT! 🚨 – Bullish Loot Grab Before the Escape! (Thief Trading Strategy)

🌟 Greetings, Market Pirates & Profit Raiders! 🌟

🔥 THIEF TRADING STRIKES AGAIN! 🔥

💎 The Setup:

Based on our stealthy technical & fundamental heist tactics, ADA/USD is primed for a bullish loot grab! The plan? Long entry with an escape near key resistance. High-risk? Yes. Overbought? Maybe. But the heist must go on!

🎯 Key Levels:

📈 Entry (Vault Cracked!) → Swipe bullish positions on pullbacks (15m-30m precision).

🛑 Stop Loss (Escape Route) → Recent swing low (4H basis) at 0.5290 (adjust per risk!).

🏴☠️ Target (Profit Snatch!) → 0.6500 (or bail early if bears ambush!).

⚡ Scalpers’ Quick Heist:

Only scalp LONG!

Big wallets? Charge in! Small stacks? Ride the swing!

🔐 Lock profits with Trailing SL!

📢 Breaking News (Heist Intel!):

Fundamentals, COT, On-Chain, Sentiment— All hint at bullish momentum!.

🚨 ALERT! News volatility ahead—Avoid new trades during releases! Secure running positions with Trailing SL!

💥 BOOST THIS HEIST! 💥

👉 Hit LIKE & FOLLOW to fuel our next market robbery! 🚀💰

🎯 Profit taken? Treat yourself—you earned it!

🔜 Next heist incoming… Stay tuned, pirates! 🏴☠️💎

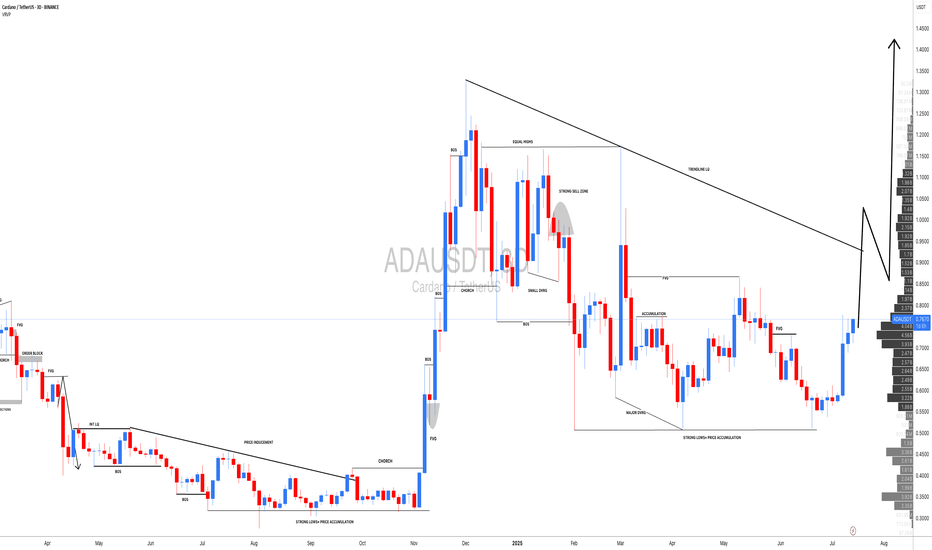

Cardano Forming Potential Reversal Structure Inside TriangleHello guys!

Cardano’s been stuck inside this big descending triangle for months. We had a fake breakout a while back that totally failed.

Now, price is back at support and showing bullish divergence. That’s usually a sign sellers are getting tired.

If buyers step in here, I’m expecting a move back up toward 0.67–0.70 (top of the triangle). But if it loses the 0.53 support, that setup’s off the table.

Bias: Leaning bullish

🎯 Target: 0.67–0.70

Invalidation: Clean break below 0.53

Let’s see how this plays out.

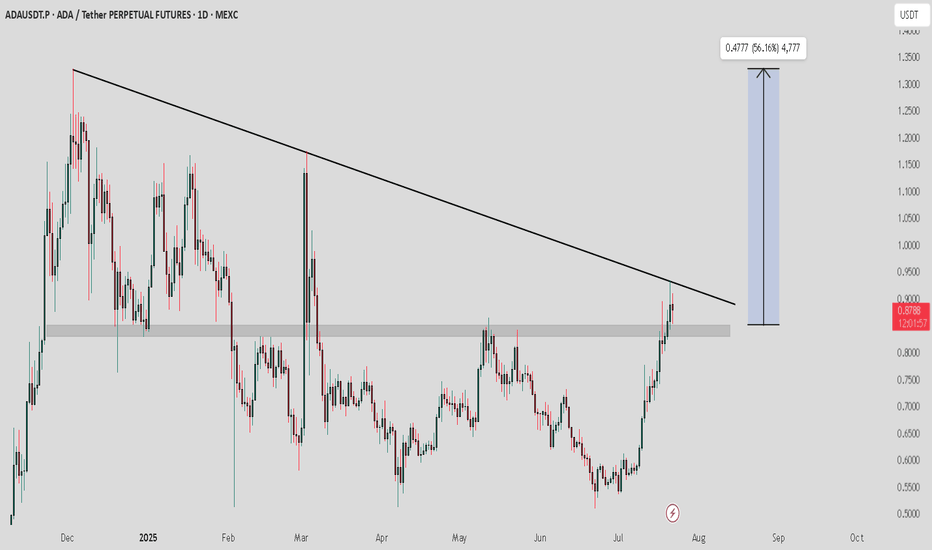

ADA/USDT Ready to Explode? Watch This Symmetrical Triangle

🧠 Detailed Technical Analysis:

Cardano (ADA) is currently consolidating within a well-defined Symmetrical Triangle pattern on the 3-day chart. This pattern is formed by a series of lower highs and higher lows, indicating compression and indecision in the market — a classic setup for a strong breakout in either direction.

Price has recently bounced off the lower boundary of the triangle and is now heading toward the resistance trendline. A breakout from this structure could trigger a powerful bullish move if confirmed with volume.

🔼 Bullish Scenario (Upside Breakout):

A confirmed breakout above the descending trendline (~$0.65) with strong volume would indicate buyers regaining control.

Key upside targets based on historical resistance zones and the triangle's height:

🟡 $0.8144 – First major horizontal resistance

🟡 $0.9386 – Mid-range resistance from March 2025

🟡 $1.0920 – Former distribution zone

🟡 $1.2118 – Medium-term bullish target

🔵 $1.3264 – Key structural high from previous cycle

🔔 A breakout from a symmetrical triangle often leads to significant price action due to the long period of coiled pressure release.

🔽 Bearish Scenario (Breakdown):

If ADA fails to break above $0.62–$0.65 and gets rejected from the upper boundary of the triangle, the price could:

Revisit the lower trendline support around $0.55

A breakdown below this zone could lead to:

🔻 $0.48

🔻 $0.39

🔻 $0.2756 – A major psychological and historical support level

⚠️ This scenario would invalidate the bullish structure and potentially resume the mid-term downtrend.

📐 Pattern Breakdown – Symmetrical Triangle:

Pattern Duration: ~6 months of consolidation (Feb – July 2025)

Support Zone: $0.55 – $0.60

Resistance Zone: $0.65 – $0.75

Breakout Confirmation: Requires strong bullish candle close with increased volume

Volume Profile: Decreasing, typical of symmetrical triangle before explosive move

💡 Final Thoughts:

Cardano is at a make-or-break point. It has bounced from support and is attempting a breakout from this symmetrical triangle. If successful, this could mark the beginning of a major trend reversal with over +100% upside potential from current levels.

On the flip side, failure to break resistance could lead to a deeper retracement. That’s why confirmation is critical before entering a position!

#ADAUSDT #CardanoAnalysis #CryptoBreakout #SymmetricalTriangle #AltcoinSeason #BullishBreakout #BearishScenario #TechnicalAnalysis #CryptoChart #CryptoTrading #Altcoins

ADAUSDT Intraday SetupAda Showing some good movement. Trade Rules

must gave 30m candle closing above marked area, if wick above marked area then trade will become risky. Must use the sl. Target is given.

If retraces back before the marked area then it also good, in this case 30m marked area will first tp book 30% here, rest hold till final tp or SL.

#ADAUSDT: Is the crypto hype finally over? ADAUSDT is likely to drop first then it can reverse and continue the bullish move upwards of previous all time high. Before we can confirm any entry on this pair we need strong confirmation which will allow us to predict a correct and accurate swing move.

If you like the work then do consider liking and commenting on the idea.

Team Setupsfx_❤️

#ADA/USDT#ADA

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower limit of the channel at 0.6300, acting as strong support from which the price can rebound.

Entry price: 0.6360

First target: 0.6460

Second target: 0.6580

Third target: 0.6700

Is it time to buy Cardano?Hello friends

According to the analysis and review we conducted on ADA, we reached almost definitive results:

This currency has fallen, which has caused the price to reach important and fundamental supports, and here we can buy in steps at the supports, depending on the level of risk and our capital management, and move with it to the specified goals.

*Trade safely with us*

ADAUSDT: Targeting $1.5 Long Term Swing View| Comment Your View|Hello everyone,

The cryptocurrency price is approaching a major bullish zone where it is anticipated to reverse. Price momentum has been slightly bullish in recent times, possibly due to the release of economic data that is against the US Dollar. A weak US dollar has recently influenced the cryptocurrency market volume, resulting in all-time highs. We anticipate similar or increased volume in the future.

We would appreciate your support by liking and commenting on your views about the cryptocurrency pair. Please let us know in the comments if you would like us to analyse any other cryptocurrency or trading pair.

Best regards,

Team Setupsfx_

#ADA/USDT#ADA

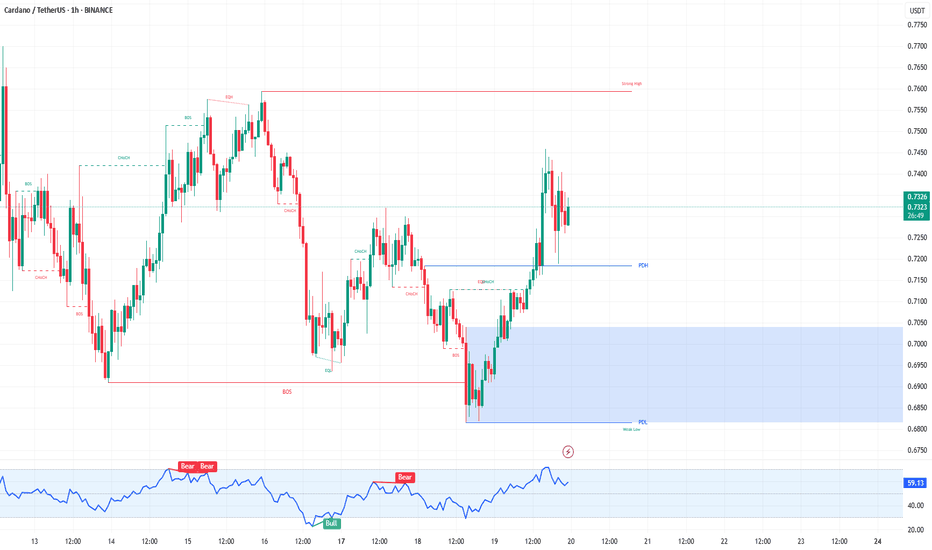

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 0.7200.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 0.7358

First target: 0.7510

Second target: 0.7700

Third target: 0.7946

#ADA/USDT#ADA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.7025.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.7045

First target: 0.7364

Second target: 0.7584

Third target: 0.7884

ADA bulling :)📈 ADA/USDT 4H Analysis

ADA has broken above the 0.7408 resistance, now at 0.78150, showing strong bullish momentum within an ascending channel, targeting higher levels if the trend holds.

🟢 Support Levels:

🔹 0.7220 – recent breakout zone (20/50 EMA)

🔹 0.6630 – key support

🔹 0.6230 – deeper support

[ *]🔴 Resistance Levels:

🔹 0.8430 – next target

🔹 0.9670 – major resistance zone

ADA/USDT 1H: Accumulation Phase Holding – Can $0.760 Be ReachedADA/USDT 1H: Accumulation Phase Holding – Can $0.760 Be Reached?

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

Current Market Conditions (Confidence: 7/10):

Price at $0.7331, currently consolidating after a breakout.

RSI momentum is building from mid-levels, indicating increasing strength.

Hidden bullish divergence forming on the 1H timeframe, signaling potential continuation.

LONG Trade Setup:

Entry: $0.730 - $0.732 zone.

Targets:

T1: $0.745 (initial resistance).

T2: $0.760 (extended target).

Stop Loss: $0.715 (below recent support).

Risk Score:

7/10 – Decent risk-to-reward, but requires confirmation of continued momentum.

Market Maker Activity:

Accumulation phase visible after a recent liquidity sweep at $0.69.

Strong support has formed at $0.72, reinforcing bullish potential.

Order blocks suggest further upside potential, as Smart Money positions for the next move.

Recommendation:

Long positions remain favorable in the $0.730 - $0.732 entry zone.

Monitor reaction at $0.745, as resistance could trigger a short-term pause.

Use tight stops, as consolidation could extend before continuation.

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

ADAUSDTADAUSDT Signal 📉

📌 Current Price: 0.7161 USDT

📊 Trend: Bearish ⬇️, but testing a descending trendline 📏

🔑 Key Levels:

🔼 Resistance: 0.9209 🛑

🔽 Support: 0.7782–0.8457 🟢

📉 Next Support: 0.6750 ⚠️

📢 Signal:

🔴 Short (Sell): Enter at 0.7161 if price rejects the trendline.

🎯 TP: 0.6750 | 🛑 SL: 0.7500

🟢 Long (Buy): If price breaks above 0.7284, target 0.7782–0.8457.

🎯 TP: 0.7782–0.8457 | 🛑 SL: 0.7000

⚖️ Risk Management: Use 1:2 risk-to-reward ratio. Control risk as highlighted.

🔍 Monitor for a trendline break! 🚨