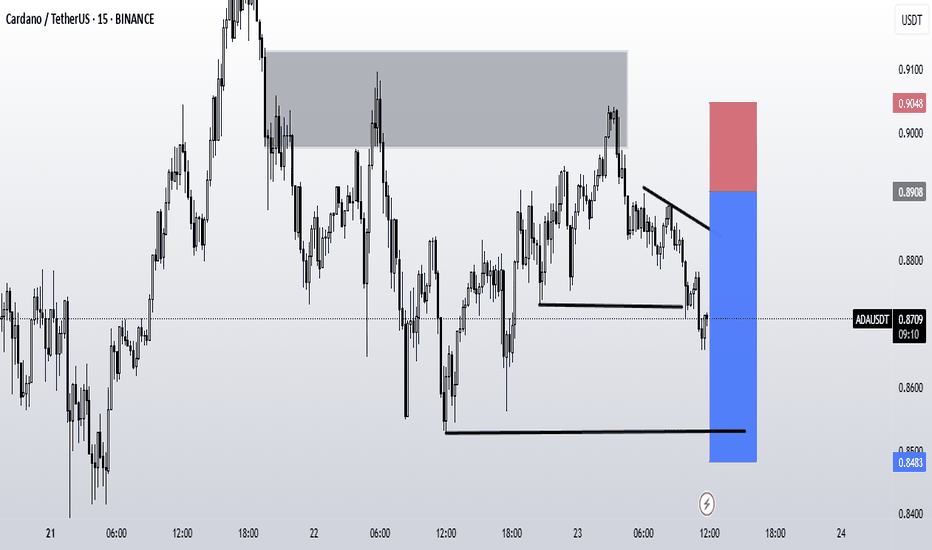

ADAUSDT.P m15 : a Short Position fot TP3The price, on its weekly upward path, reacted bearishly to the daily zone and seems likely to take out key lows to collect liquidity (whether for a future decline or rise).

Our trade will be activated after the liquidity Grab, based on trend and horizontal levels

ADAUSDTPERP

#ADA/USDT#ADA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.7025.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.7045

First target: 0.7364

Second target: 0.7584

Third target: 0.7884

ADA/USDT – Key Demand Zone Around $1The blue box on BINANCE:ADAUSDT.P represents a strong demand zone that could attract buyers, making it a pivotal area to watch. Its proximity to the psychological level of $1 enhances its significance, as this level could act as both a technical and psychological support.

Key Observations:

Demand Zone: The blue box aligns with a high-probability buying area where buyers are likely to step in.

Psychological Level: The $1 mark serves as a key round number, potentially reinforcing support in this zone.

Buyer Activity: Increased interest from buyers at this level could signal a trend reversal or continuation.

Strategy:

Monitor price action within the blue box for confirmation signals such as bullish candlestick patterns, strong wicks, or increased volume.

A break and hold above $1 could confirm the zone as a new support level.

Place stops below the demand zone to manage risk effectively.

If the zone holds, CRYPTOCAP:ADA has the potential to stage a significant bounce from this key level.

I keep my charts clean and simple because I believe clarity leads to better decisions.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups.

My Previous Analysis

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

ADAUSDT | The Blueprint for a Potential ReboundIn the current market structure, the blue boxes on the chart may serve as potential demand zones.

These areas are key levels where buying interest could emerge, providing support for ADA's price.

If the price revisits these zones, they could act as strong entry points for a potential bounce. However, it’s essential to monitor how price reacts upon reaching these levels and wait for confirmation signals to ensure the zones hold as valid support.

I keep my charts clean and simple because I believe clarity leads to better decisions. Trading doesn’t have to be overly complicated, and I enjoy sharing setups that have worked well for me.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups. It’s all about learning and growing together as traders, and I’m here to share what I see.

The markets can confirm what the charts whisper if we’re paying attention. I hope these levels help you as much as they’ve helped me in the past. Let’s see how this plays out!

My Previous Hits

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

Cardano ADA price has risen from the "dead"While CRYPTOCAP:BTC is updating ATH, the price of CRYPTOCAP:ADA is finally breaking away from the bottom)

Unfortunately or fortunately, these are the realities.

Very few projects from 20-21 and even more so from 16-17 feel good and confident now, only young, hype and “light” projects are shooting up.

God bless the price of OKX:ADAUSDT to rise to $0.49-0.50, then slightly adjust and then shoot up to $0.80, and if you're lucky, to $1.

And for the #Cardano holders and altruists, patience to wait for that time.

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

Important volume profile section: 0.5941

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost".

Have a nice day today.

-------------------------------------

(ADAUSDT.P 1M chart)

Important volume profile section is formed in the 0.4346-0.5941 section.

Accordingly, the key is whether it can receive support and rise near 0.5941.

-

(1W chart)

Currently, the BW(100) point is formed at the 0.6818 point, so the point to watch is whether it can rise above 0.6818.

To do this, we need to see if it can be supported near 0.5941

1st: 0.6206

2nd: 0.6818

and rise to the 1st and 2nd ranges above.

Since the HA-HIgh indicator and the BW(100) indicator indicate the high point range, if it breaks through this indicator upward and receives support, it is highly likely to renew the high point.

If it fails to rise, it may fall until it meets the HA-Low indicator or the BW(0) indicator, so we need to think about a countermeasure for this.

-

(1D chart)

If it is supported near 0.6818 and rises, you should set the target point at around 0.9242 and think about a countermeasure for it.

If it falls below 0.5941, you need to check if the BW(100) line is created.

If the BW(100) line is created, it is likely to lead to an additional decline, so you need to think about a countermeasure for it.

For now, if it falls below 0.5693, I think there could be a sharp decline, so you need to prepare a countermeasure for it.

-

Have a good time.

Thank you.

--------------------------------------------------

- Big picture

It is expected that a full-scale uptrend will begin when it rises above 29K.

The next expected range to touch is 81K-95K.

#BTCUSD 12M

1st: 44234.54

2nd: 61383.23

3rd: 89126.41

101875.70-106275.10 (overshooting)

4th: 134018.28

151166.97-157451.83 (overshooting)

5th: 178910.15

These are points that are likely to receive resistance in the future.

We need to check if these points can be broken upward.

We need to check the movement when this range is touched because it is thought that a new trend can be created in the overshooting range.

#BTCUSD 1M

If the major uptrend continues until 2025, it is expected to start forming a pull back pattern after rising to around 57014.33.

1st: 43833.05

2nd: 32992.55

-----------------

#ADAUSD 1DAYADAUSD (Cardano vs US Dollar)

Timeframe: 1 Day (Daily Chart)

Pattern: Uptrend Channel

Description:

The ADAUSD pair is currently exhibiting a well-established **uptrend channel** on the daily chart. This pattern is defined by a series of higher highs and higher lows, with the price consistently moving within two parallel ascending trendlines. The lower trendline serves as dynamic support, while the upper trendline acts as resistance. The price action within this channel indicates that buyers are in control, with bullish momentum driving prices higher over time.

Forecast:

The recommendation is to take a **buy** position, as the price is expected to continue moving upward within the channel. The trend shows strong bullish signals, and unless there is a break below the lower support line, the uptrend should persist. If the price approaches the upper resistance line, it may face some temporary consolidation or correction before continuing higher.

Entry Point: A buy entry is suggested near the lower support of the channel for optimal risk-reward.

Stop-Loss: Place a stop-loss slightly below the lower support line of the channel to mitigate risks in case of a downward breakout.

Take-Profit: The take-profit target should be set near the upper resistance line of the channel, or you may trail your stop-loss to lock in profits as the price advances. A breakout above the resistance line could signal further upside potential.

Cardano ADA price slowly turning aroundProbably shouldn't have high hopes for #Cardano CRYPTOCAP:ADA , as it is an old, heavy, and clumsy coin.

However, recently, the information field around the project has been stirring up, to the point where there will be memes on #ADA)

It would be nice to see OKX:ADAUSDT at $0.80 by the end of 2024, following the blue route, w hat do you think?

#ADA/USDT#ADA

The price is moving within a descending channel pattern on the 4-hour frame, which is a retracement pattern

We have a bounce from a major support area in the color EUR at 0.3600

We have a tendency to stabilize above the Moving Average 100

We have a downtrend on the RSI indicator that supports the rise and gives greater momentum and the price is based on it

Entry price is 0.3800

The first target is 0.4138

The second target is 0.4407

The third goal is 0.4736

Cardano ADA price at a crossroads before further movementLooking at the global #ADAUSDT chart

One question arises :

- Did the ABC correction already end in April at $0.40 in 🟥the red scenario?

- Or is there another dive down to the $0.30-0.34 area according to🟦the blue scenario?

The critical level from below is $0.40

The critical level from above is $0.50

Fixing the CRYPTOCAP:ADA price below or above the critical levels will decide the further price movement.

Globally, in the medium or long term, we would like to see the price of #Cardano at least $1.5

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

#ADA/USDT#ADA

The price is moving in a bearish channel pattern on the 12-hour frame, and it adheres to it well, and it is expected to break to the upside

The price rebounded well from the lower border of the channel at the green support level of 0.400

We have a tendency to stabilize above the Moving Average 100

We have oversold resistance on the RSI indicator to support the rise, with a downtrend about to break higher

Entry price 0.4500

The first target is 0.5080

The second target is 0.6000

The third target is 0.6870

ADA will create a chance to turn your life aroundHello friends, did you have a good day?

I'm going to show you a shocking and amazing chart today

It's a log-chart.

There's a way to read the ideas of the forces by applying a little bit of technology in the Fibonacci extension.

It's the SECRET of 0.1 and 0.236

0.1 and 0.236 are places where there is a fight between selling and buying, and have consolidation.

When it breaks out 0.236 upward, it can reach 0.618 (5.3135) and If it succeed in retesting beyond that, it can reach the 1 value of 38.3173.

If you take a long position at a 10x from the current point and chart goes to 1 value,

ADA - Time to Do or Die!Clarification:

1. I am hoping ADA will recover and perform well. However, hope is not a trading strategy; this chart is mega-bearish.

2. The chart is on the weekly TF, but the EMAs are the Daily EMAs.

Analysis:

1. ADA lost the upward-sloping trendline on April 2nd.

2. ADA was unable to reclaim the uptrend on April 8th.

3. As a result, ADA dropped to its initial support level of 45 cents.

4. Should ADA fail to reclaim the trendline, it is in danger of completing a Head and Shoulder Pattern on the weekly TF.

5. The Pattern’s target is 8-cents.

Initial Invalidation:

• Reclaim the trendline and the daily EMAs, whichever comes first.

Final Invalidation:

Make an HH above 82 cents.

Best wishes

Bearish outlook for ADAADA’s outlook is bearish for the following reasons:

1. Double Bottom formation. The first top is on March 4th at 80 cents. The second top on March 14th at 81.17 cents.

2. Cardano also formed a Head and Shoulders pattern between February 17th and April 2nd.

3. ADA is. Below the short EMAs, the 21 and the 50.

Should ADA lose the 58-cent support, It could drop as low as 36 cents.

Cardano(ADA) is Ready to Fall at least 🚨➖10%🚨🏃♂️ Cardano(ADA) is moving near 🔴 Heavy Resistance zone($1.053-$0.746) 🔴 and Resistance line .

🌊According to Elliott wave theory , Cardano(ADA) seems to have completed Zigzag correction(ABC/5-3-5) .

🔔I expect Cardano(ADA) to start falling again from the 🟡 Potential Reversal Zone(PRZ) 🟡 and at least fall to the 🟢 Support zone($0.661_$0.633) 🟢.

❗️⚠️Note⚠️❗️: An important point you should always remember is capital management and lack of greed.

Cardano Analyze (ADAUSDT), 15-minute time frame ⏰.

Do not forget to put Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

#ADA/USDT#ADA

The price is moving in a descending channel on a 4-hour frame

We now have a successful penetration of that channel upward

We have oversold conditions on the MACD indicator

We also have a higher stability moving average of 100

Entry price is 0.5230

First target 0.5443

Second target 0.5852

Third goal 0.6391