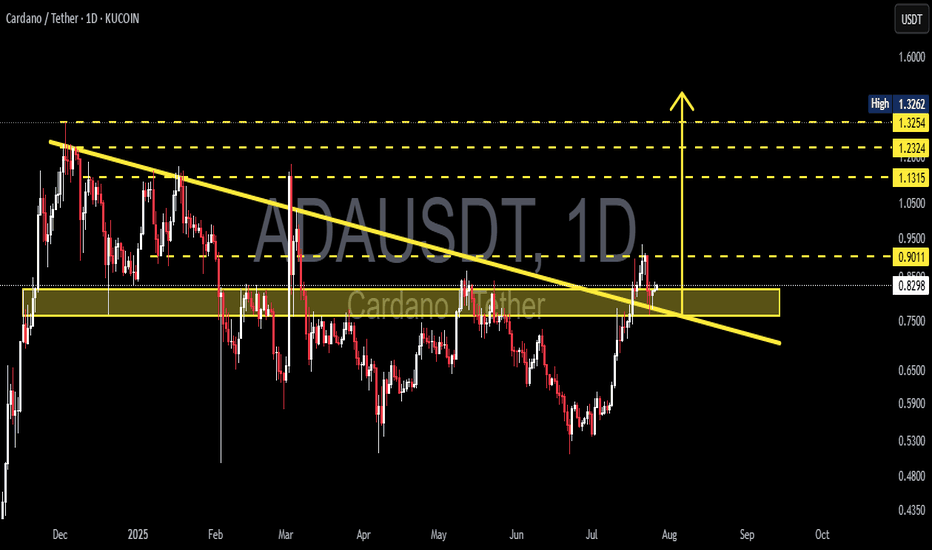

ADAUSDT Breaks Long-Term Downtrend – Critical Support Retest!The ADAUSDT pair is showing a compelling technical setup. The price has successfully broken out of a long-term descending trendline (yellow line) that had been acting as dynamic resistance since late 2024. This breakout came with strong momentum, signaling a potential shift from a bearish trend to a bullish reversal.

After the breakout, price managed to rally up to minor resistance around $0.90, but is now pulling back and retesting the key support zone (highlighted yellow box) — a previous strong resistance area now potentially flipping into support.

---

🟢 Bullish Scenario:

If the price holds above the $0.80 - $0.83 support zone, the break-and-retest structure will be validated.

A successful bounce from this area could push ADA back toward:

$0.90 (current minor resistance)

$1.13 (psychological and horizontal resistance)

$1.23 (previous supply zone)

$1.32 (recent local high)

A confirmed bullish continuation will be more convincing if the price forms a higher low and breaks above $0.90 with strong volume.

---

🔴 Bearish Scenario:

If ADA fails to hold the $0.8281 support and falls back below the descending trendline, then:

It may re-enter the previous range and test lower support around $0.75 or even $0.65.

This would suggest a potential false breakout and return to bearish territory.

Watch for bearish candlestick confirmations below $0.80 as an early warning.

---

📌 Pattern Insights:

Descending Trendline Breakout: Suggests a possible long-term trend reversal.

Break & Retest Structure: Price is currently testing the previous resistance zone as new support.

Layered Resistance Zones: Several clear resistance levels above provide logical targets for a bullish rally.

---

📊 Conclusion:

ADAUSDT has printed an early signal of a bullish reversal by breaking out of a long-standing downtrend. However, the sustainability of this trend depends heavily on the ability of price to hold the $0.80 - $0.83 support zone. Look for bullish confirmation candles in this area for a safer long entry.

#ADAUSDT #Cardano #CryptoBreakout #TechnicalAnalysis #Altcoins #BreakoutSetup #BullishRetest #CryptoChart #SupportAndResistance #PriceAction #TrendReversal

Adausdtrade

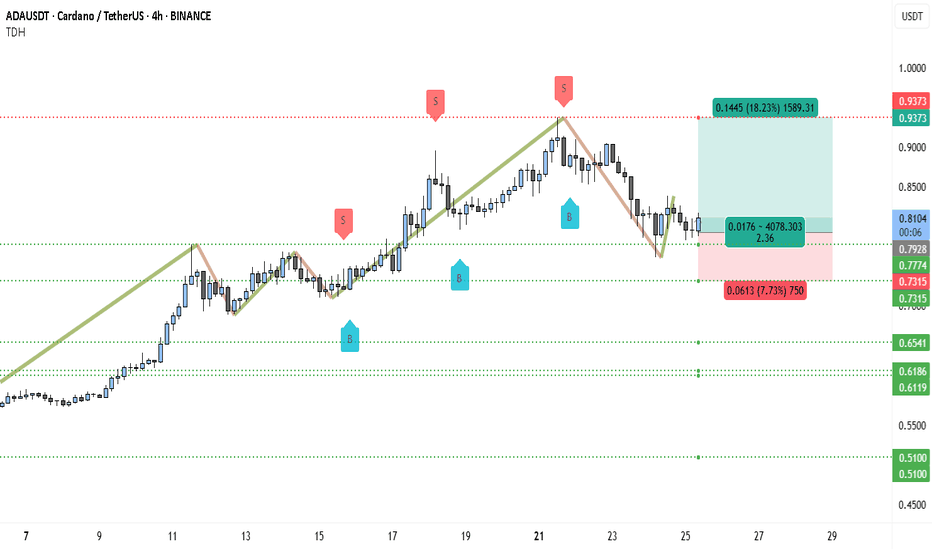

Cardano (ADA) Just Flipped Bullish — Next Stop: $0.9373?ADAUSDT is currently displaying a strong bullish structure on the 4-hour chart, bouncing from a critical support zone near $0.7774–$0.7315. After a healthy retracement, the pair appears to be regaining momentum, forming a potential higher low, which aligns with the continuation of the broader uptrend that started earlier this month.

Recent price action confirms that buyers are stepping in at key zones previously marked by blue “B” labels, and sell-side pressure seems to be weakening after the last swing top around $0.9373. The support zones, marked with dotted green lines, have held well, and the current structure suggests a rebound toward the previous high.

The most recent small leg up shows the formation of a bullish engulfing setup near $0.78, which could serve as a launch point toward the higher resistance. The candlesticks are also showing longer lower wicks — a sign that buyers are defending lower levels aggressively. With price currently floating near $0.81, there’s a good upside window available.

Here’s the trading setup based on the chart:

• Entry: Around $0.8106 (current price zone)

• Take Profit (TP): $0.9373 (previous swing high — +18.23%)

• Stop Loss (SL): $0.7315 (invalidates higher low structure — -7.73%)

• Risk-Reward Ratio: 2.36R (favorable for swing positioning)

If ADA can reclaim the $0.85 zone with strong candle closures, it would signal bullish continuation. Momentum indicators like RSI or MACD (not shown) would likely confirm the shift, especially if divergence was forming on recent dips.

Until ADA breaks below $0.7315, the bullish bias remains intact. The formation of higher lows and increasing buying interest at dynamic supports adds weight to the long setup. Price reclaiming the $0.85 zone may trigger a fast rally to $0.93, and possibly beyond if market-wide sentiment remains risk-on.

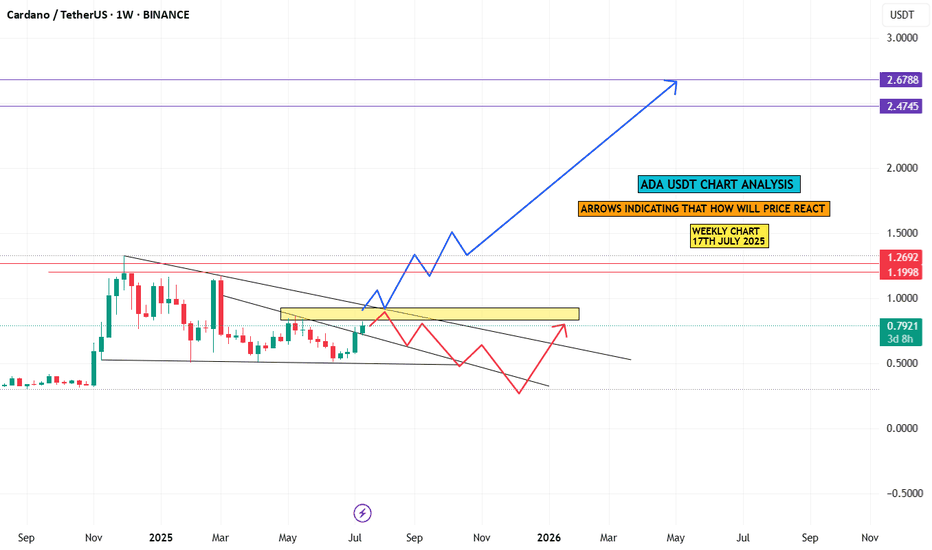

Cardano (ADA) a solid play in crypto, a Macro lookHi guys, so with Bitcoin in price discovery mode. It hints at the final phase of Crypto bull in action. With that comes altseason and in my opinion explosive growth in altcoins.

1 particular coin i've been looking at is Cardano (ADA).

This is a macro technical analysis of ADA on the 1 month timeframe. So each candle is 1 month of price action. This is very powerful on its own. And can give signs into where an asset will trend.

If you compare this to majority of other alts, its looking alot more bullish and is ahead of the game.

SO jumping right in.

Lets look at price action. Notice we are in a macro rectangle or sideways pattern.

Upper limit at $1.24

Lower limit at around $0.25.

This indicates a consolidation phase.

Real action is seen above that upper limit. Where we see explosive price action to the upside. Previously in Sept 2021 seeing highs of up to $3.07.

I believe we are making our way up to this $1.24 level.

Which in the short term will be a solid area to take profit due to it being a major supply zone in my opinion or sell zone. With a potential pull back. This is because if you look previously in price history, cardano price movement heavily involves this level with most of price history being either above or below $1.24.

A key sign but not yet confirmation is a breakout above this slanted resistance line we were being pushed down from that was created in 11-2024.

We have an engulfing candle break out currently. But still awaiting confirmation which will require august monthly candle to stay above this line and present a bullish candle print.

We will be on the look out for this.

There are other signs and signals appearing in Cardano (ADA) that support my theory and Price action developments. To take trades i always look for multiple signs that overlap.

Stay tune for more of that where ill go over many different indicators and other aspects that point to ADA being above other alts as a solid trade or investment for the next altseason.

ADAUSDT: $1.50 Year End Target, Is It Possible? The price has remained steadily bullish, but we haven’t seen a strong bullish impulse in the daily timeframe yet. This suggests that we’ll likely reach the $1.50 price range. Please wait for the price to break out and then enter a trade when it shows confirmation. You can use smaller timeframes while taking any entry. Good luck and trade safely!

Like and comment for more!

Team Setupsfx_

ADA/USD Thief Trading Plan – Bullish Snatch & Run!🚨 ADA/USD HEIST ALERT! 🚨 – Bullish Loot Grab Before the Escape! (Thief Trading Strategy)

🌟 Greetings, Market Pirates & Profit Raiders! 🌟

🔥 THIEF TRADING STRIKES AGAIN! 🔥

💎 The Setup:

Based on our stealthy technical & fundamental heist tactics, ADA/USD is primed for a bullish loot grab! The plan? Long entry with an escape near key resistance. High-risk? Yes. Overbought? Maybe. But the heist must go on!

🎯 Key Levels:

📈 Entry (Vault Cracked!) → Swipe bullish positions on pullbacks (15m-30m precision).

🛑 Stop Loss (Escape Route) → Recent swing low (4H basis) at 0.5290 (adjust per risk!).

🏴☠️ Target (Profit Snatch!) → 0.6500 (or bail early if bears ambush!).

⚡ Scalpers’ Quick Heist:

Only scalp LONG!

Big wallets? Charge in! Small stacks? Ride the swing!

🔐 Lock profits with Trailing SL!

📢 Breaking News (Heist Intel!):

Fundamentals, COT, On-Chain, Sentiment— All hint at bullish momentum!.

🚨 ALERT! News volatility ahead—Avoid new trades during releases! Secure running positions with Trailing SL!

💥 BOOST THIS HEIST! 💥

👉 Hit LIKE & FOLLOW to fuel our next market robbery! 🚀💰

🎯 Profit taken? Treat yourself—you earned it!

🔜 Next heist incoming… Stay tuned, pirates! 🏴☠️💎

Cardano Forming Potential Reversal Structure Inside TriangleHello guys!

Cardano’s been stuck inside this big descending triangle for months. We had a fake breakout a while back that totally failed.

Now, price is back at support and showing bullish divergence. That’s usually a sign sellers are getting tired.

If buyers step in here, I’m expecting a move back up toward 0.67–0.70 (top of the triangle). But if it loses the 0.53 support, that setup’s off the table.

Bias: Leaning bullish

🎯 Target: 0.67–0.70

Invalidation: Clean break below 0.53

Let’s see how this plays out.

ADA/USDT Ready to Explode? Watch This Symmetrical Triangle

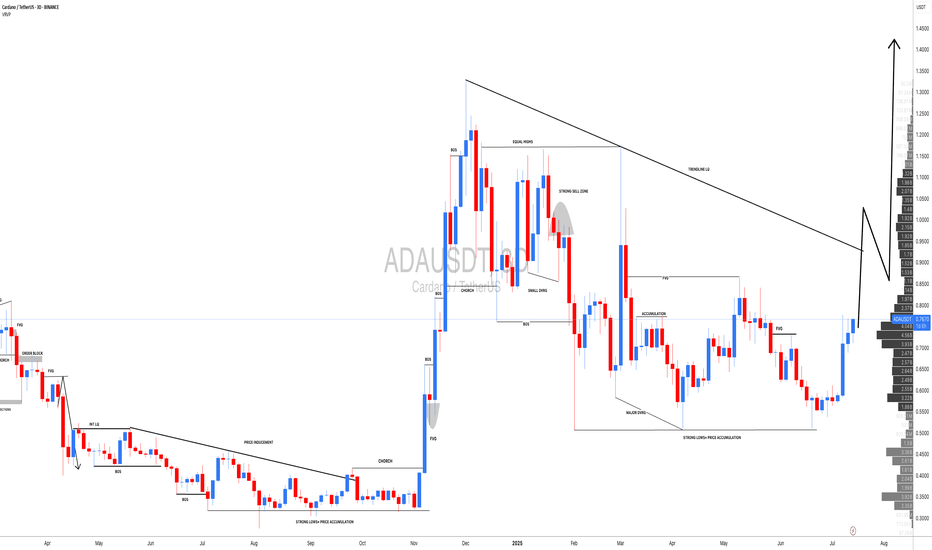

🧠 Detailed Technical Analysis:

Cardano (ADA) is currently consolidating within a well-defined Symmetrical Triangle pattern on the 3-day chart. This pattern is formed by a series of lower highs and higher lows, indicating compression and indecision in the market — a classic setup for a strong breakout in either direction.

Price has recently bounced off the lower boundary of the triangle and is now heading toward the resistance trendline. A breakout from this structure could trigger a powerful bullish move if confirmed with volume.

🔼 Bullish Scenario (Upside Breakout):

A confirmed breakout above the descending trendline (~$0.65) with strong volume would indicate buyers regaining control.

Key upside targets based on historical resistance zones and the triangle's height:

🟡 $0.8144 – First major horizontal resistance

🟡 $0.9386 – Mid-range resistance from March 2025

🟡 $1.0920 – Former distribution zone

🟡 $1.2118 – Medium-term bullish target

🔵 $1.3264 – Key structural high from previous cycle

🔔 A breakout from a symmetrical triangle often leads to significant price action due to the long period of coiled pressure release.

🔽 Bearish Scenario (Breakdown):

If ADA fails to break above $0.62–$0.65 and gets rejected from the upper boundary of the triangle, the price could:

Revisit the lower trendline support around $0.55

A breakdown below this zone could lead to:

🔻 $0.48

🔻 $0.39

🔻 $0.2756 – A major psychological and historical support level

⚠️ This scenario would invalidate the bullish structure and potentially resume the mid-term downtrend.

📐 Pattern Breakdown – Symmetrical Triangle:

Pattern Duration: ~6 months of consolidation (Feb – July 2025)

Support Zone: $0.55 – $0.60

Resistance Zone: $0.65 – $0.75

Breakout Confirmation: Requires strong bullish candle close with increased volume

Volume Profile: Decreasing, typical of symmetrical triangle before explosive move

💡 Final Thoughts:

Cardano is at a make-or-break point. It has bounced from support and is attempting a breakout from this symmetrical triangle. If successful, this could mark the beginning of a major trend reversal with over +100% upside potential from current levels.

On the flip side, failure to break resistance could lead to a deeper retracement. That’s why confirmation is critical before entering a position!

#ADAUSDT #CardanoAnalysis #CryptoBreakout #SymmetricalTriangle #AltcoinSeason #BullishBreakout #BearishScenario #TechnicalAnalysis #CryptoChart #CryptoTrading #Altcoins

ADAUSDT Intraday SetupAda Showing some good movement. Trade Rules

must gave 30m candle closing above marked area, if wick above marked area then trade will become risky. Must use the sl. Target is given.

If retraces back before the marked area then it also good, in this case 30m marked area will first tp book 30% here, rest hold till final tp or SL.

$ADA Bulls Wake Up—Potential 9% Rally If This Level HoldsCardano (ADA) appears to be attempting a short-term recovery after a prolonged decline, as shown in the 4H chart from Binance. The price recently bounced from a well-defined support level around $0.5391, which has held multiple times in recent sessions, confirming buyer interest in this zone. This support also aligns with a previous consolidation range and has proven reliable in the past.

The price is now approaching a zone of dynamic resistance marked by the BEST Cloud ALL MA indicator. This red-shaded cloud represents the bearish control zone, and ADA has repeatedly failed to break through this area in recent weeks. However, ADA is now showing early signs of upward momentum as it consolidates just beneath the first resistance at $0.5734 (also marked as TP1). This resistance corresponds with the bottom of the cloud and recent swing highs.

The broader trend is still bearish, but the structure suggests a possible reversal if bulls can reclaim levels above the cloud. A further push above $0.5734 could attract fresh buying interest and target the next resistance level near $0.6155, which also represents TP2 on the chart. This upper zone served as a breakdown point in mid-June and may now act as a key level to watch.

Meanwhile, the green moving average line (part of the cloud setup) is starting to flatten. This often signals a transition from downtrend to range or even an early reversal—especially when combined with a support bounce and higher low formation.

There’s no clear bullish breakout yet, but the setup looks favorable for a cautious long position.

Trading Idea

• Entry Zone: 0.5550 – 0.5600 (near current consolidation)

• Target 1 (TP1): 0.5734

• Target 2 (TP2): 0.6155

• Stop Loss: Below 0.5391 (e.g., 0.5320 – adjust based on your risk appetite)

• Risk/Reward to TP2: Around 2:1

If price breaks below $0.5391, the bearish structure would be confirmed, possibly leading ADA back toward the $0.50–$0.48 region. But as long as this support holds, the market favors a recovery scenario toward the resistance levels mentioned.

Overall, this is a textbook support-to-resistance play, with potential for an 8–9% upside if bullish momentum sustains. Confirmation through volume breakout above the cloud will further strengthen the case for short-term gains.

#ADAUSDT: Is the crypto hype finally over? ADAUSDT is likely to drop first then it can reverse and continue the bullish move upwards of previous all time high. Before we can confirm any entry on this pair we need strong confirmation which will allow us to predict a correct and accurate swing move.

If you like the work then do consider liking and commenting on the idea.

Team Setupsfx_❤️

#ADA/USDT#ADA

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower limit of the channel at 0.6300, acting as strong support from which the price can rebound.

Entry price: 0.6360

First target: 0.6460

Second target: 0.6580

Third target: 0.6700

Is it time to buy Cardano?Hello friends

According to the analysis and review we conducted on ADA, we reached almost definitive results:

This currency has fallen, which has caused the price to reach important and fundamental supports, and here we can buy in steps at the supports, depending on the level of risk and our capital management, and move with it to the specified goals.

*Trade safely with us*

Bearish Divergence Warning: Will ADA Break the Channel?Hello guys!

Cardano has been trading within a rising parallel channel after forming a clear Inverse Head and Shoulders pattern, triggering a bullish breakout. However, recent price action has shown signs of weakness, especially with a noticeable bearish divergence between the price and RSI.

What I see:

The price is approaching the lower boundary of the ascending channel.

A channel breakout to the downside could lead to a deeper correction toward the $0.58–$0.62 support zone (highlighted area), which aligns with previous consolidation and the neckline of the inverse H&S.

If bulls defend the channel and push price higher, a potential rally toward the $0.93 resistance level remains in play.

⚠️ Keep an eye on the channel support and RSI behavior to anticipate the next move.

ADAUSDT: Targeting $1.5 Long Term Swing View| Comment Your View|Hello everyone,

The cryptocurrency price is approaching a major bullish zone where it is anticipated to reverse. Price momentum has been slightly bullish in recent times, possibly due to the release of economic data that is against the US Dollar. A weak US dollar has recently influenced the cryptocurrency market volume, resulting in all-time highs. We anticipate similar or increased volume in the future.

We would appreciate your support by liking and commenting on your views about the cryptocurrency pair. Please let us know in the comments if you would like us to analyse any other cryptocurrency or trading pair.

Best regards,

Team Setupsfx_

ADA Is Approaching a Trap Zone ? Yello Paradisers, are you watching how ADA is slowly coiling up near a crucial level while pretending nothing’s happening? Don’t be fooled — this is the calm before the storm, and the next move could wipe out the unprepared.

💎#ADAUSDT is currently respecting a well-established ascending channel. We’ve already seen three meaningful reactions at the ascending support, each triggering fresh bullish momentum. At the same time, the price is pressing just above a key demand zone around the $0.73–$0.74 region. This level remains absolutely critical for the bulls to defend if the structure is to remain intact.

💎What adds strength to this setup is #ADA’s current trading position above both the 50 EMA and 200 EMA on the daily timeframe. This reinforces the short-to-mid-term bullish bias. The 50 EMA is starting to slope upward, signaling that momentum could be gradually building, while the 200 EMA sits well below as solid structural support.

💎As long as the price continues to respect the ascending support line and stays above the demand zone, we expect a continuation move toward the $0.8728 moderate resistance. A successful break and close above that could open up the next leg toward $1.0011, where a strong supply zone sits waiting.

💎The real danger lies below $0.6495. A daily close under this level would not just invalidate the current setup it would completely shift market structure and expose ADA to deeper downside, likely towards the $0.60 area or lower.

Discipline, patience, robust strategies, and trading tactics are the only ways you can make it long-term in this market.

MyCryptoParadise

iFeel the success🌴

#ADA/USDT#ADA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 0.7200.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 0.7358

First target: 0.7510

Second target: 0.7700

Third target: 0.7946

Be prepared for everything...Hello dears

Given the recent growth, the price is stuck in a range and now that it has reached the bottom of the range, there are two options:

1_The price grows from here and hits our target.

2_The price continues to fall and falls to the support area below and our second buying step is activated and grows from there.

Buy a step and be ready for anything.

*Trade safely with us*

#ADA/USDT#ADA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.7025.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.7045

First target: 0.7364

Second target: 0.7584

Third target: 0.7884

ADAUSDT | Two-Tier Long StrategyAfter a period of quiet accumulation, ADAUSDT maybe a good choice after the manipulation of orange box. This presents a near-term opportunity for those seeking quick entries:

Short-Term Longs

Wait for a liquidity cleaning of the orange box first. Below that level you can look for 4h upward breakout and enter with retest. This signals that buyers are stepping in decisively and can fuel a retracement or trend resumption.

For investors with a multi-year horizon, the deep blue box at the chart’s base represents a true margin-of-safety zone:

Long-Term Accumulation

Placing staggered buy orders within the blue box, and scaling in as price holds, aligns with a value-based approach. If ADAUSDT respects this area over time, disciplined accumulation here could yield life-changing returns years down the road.

In both cases, rely solely on real volume footprint confirmations, never on guesswork. By trading these zones with patience and strict risk control, you tap into where genuine demand resides and strict risk control, you tap into where genuine demand resides and let market behavior guide your entries.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

📊 Simple Red Box, Extraordinary Results

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

ADA bulling :)📈 ADA/USDT 4H Analysis

ADA has broken above the 0.7408 resistance, now at 0.78150, showing strong bullish momentum within an ascending channel, targeting higher levels if the trend holds.

🟢 Support Levels:

🔹 0.7220 – recent breakout zone (20/50 EMA)

🔹 0.6630 – key support

🔹 0.6230 – deeper support

[ *]🔴 Resistance Levels:

🔹 0.8430 – next target

🔹 0.9670 – major resistance zone