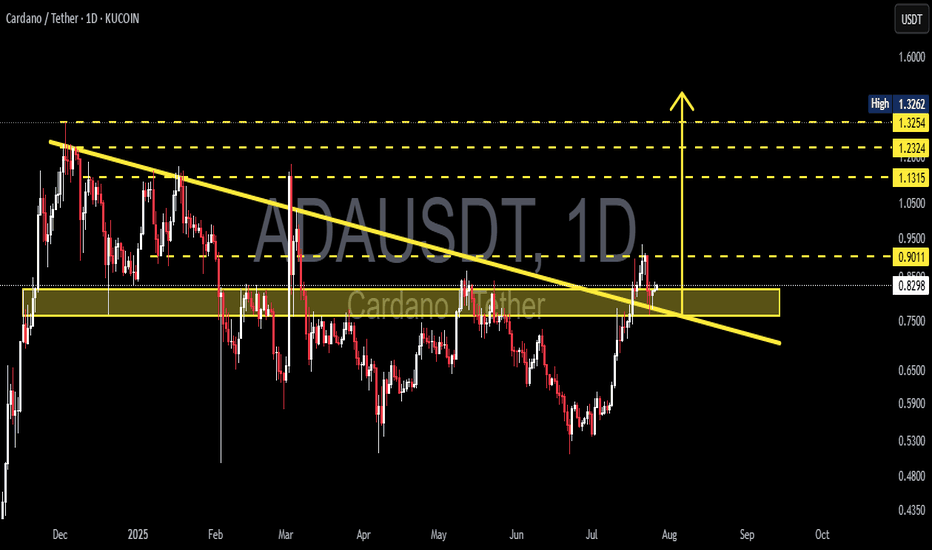

ADAUSDT Breaks Long-Term Downtrend – Critical Support Retest!The ADAUSDT pair is showing a compelling technical setup. The price has successfully broken out of a long-term descending trendline (yellow line) that had been acting as dynamic resistance since late 2024. This breakout came with strong momentum, signaling a potential shift from a bearish trend to a bullish reversal.

After the breakout, price managed to rally up to minor resistance around $0.90, but is now pulling back and retesting the key support zone (highlighted yellow box) — a previous strong resistance area now potentially flipping into support.

---

🟢 Bullish Scenario:

If the price holds above the $0.80 - $0.83 support zone, the break-and-retest structure will be validated.

A successful bounce from this area could push ADA back toward:

$0.90 (current minor resistance)

$1.13 (psychological and horizontal resistance)

$1.23 (previous supply zone)

$1.32 (recent local high)

A confirmed bullish continuation will be more convincing if the price forms a higher low and breaks above $0.90 with strong volume.

---

🔴 Bearish Scenario:

If ADA fails to hold the $0.8281 support and falls back below the descending trendline, then:

It may re-enter the previous range and test lower support around $0.75 or even $0.65.

This would suggest a potential false breakout and return to bearish territory.

Watch for bearish candlestick confirmations below $0.80 as an early warning.

---

📌 Pattern Insights:

Descending Trendline Breakout: Suggests a possible long-term trend reversal.

Break & Retest Structure: Price is currently testing the previous resistance zone as new support.

Layered Resistance Zones: Several clear resistance levels above provide logical targets for a bullish rally.

---

📊 Conclusion:

ADAUSDT has printed an early signal of a bullish reversal by breaking out of a long-standing downtrend. However, the sustainability of this trend depends heavily on the ability of price to hold the $0.80 - $0.83 support zone. Look for bullish confirmation candles in this area for a safer long entry.

#ADAUSDT #Cardano #CryptoBreakout #TechnicalAnalysis #Altcoins #BreakoutSetup #BullishRetest #CryptoChart #SupportAndResistance #PriceAction #TrendReversal

Adausdtradeidea

ADAUSDT: $1.50 Year End Target, Is It Possible? The price has remained steadily bullish, but we haven’t seen a strong bullish impulse in the daily timeframe yet. This suggests that we’ll likely reach the $1.50 price range. Please wait for the price to break out and then enter a trade when it shows confirmation. You can use smaller timeframes while taking any entry. Good luck and trade safely!

Like and comment for more!

Team Setupsfx_

ADA/USD Thief Trading Plan – Bullish Snatch & Run!🚨 ADA/USD HEIST ALERT! 🚨 – Bullish Loot Grab Before the Escape! (Thief Trading Strategy)

🌟 Greetings, Market Pirates & Profit Raiders! 🌟

🔥 THIEF TRADING STRIKES AGAIN! 🔥

💎 The Setup:

Based on our stealthy technical & fundamental heist tactics, ADA/USD is primed for a bullish loot grab! The plan? Long entry with an escape near key resistance. High-risk? Yes. Overbought? Maybe. But the heist must go on!

🎯 Key Levels:

📈 Entry (Vault Cracked!) → Swipe bullish positions on pullbacks (15m-30m precision).

🛑 Stop Loss (Escape Route) → Recent swing low (4H basis) at 0.5290 (adjust per risk!).

🏴☠️ Target (Profit Snatch!) → 0.6500 (or bail early if bears ambush!).

⚡ Scalpers’ Quick Heist:

Only scalp LONG!

Big wallets? Charge in! Small stacks? Ride the swing!

🔐 Lock profits with Trailing SL!

📢 Breaking News (Heist Intel!):

Fundamentals, COT, On-Chain, Sentiment— All hint at bullish momentum!.

🚨 ALERT! News volatility ahead—Avoid new trades during releases! Secure running positions with Trailing SL!

💥 BOOST THIS HEIST! 💥

👉 Hit LIKE & FOLLOW to fuel our next market robbery! 🚀💰

🎯 Profit taken? Treat yourself—you earned it!

🔜 Next heist incoming… Stay tuned, pirates! 🏴☠️💎

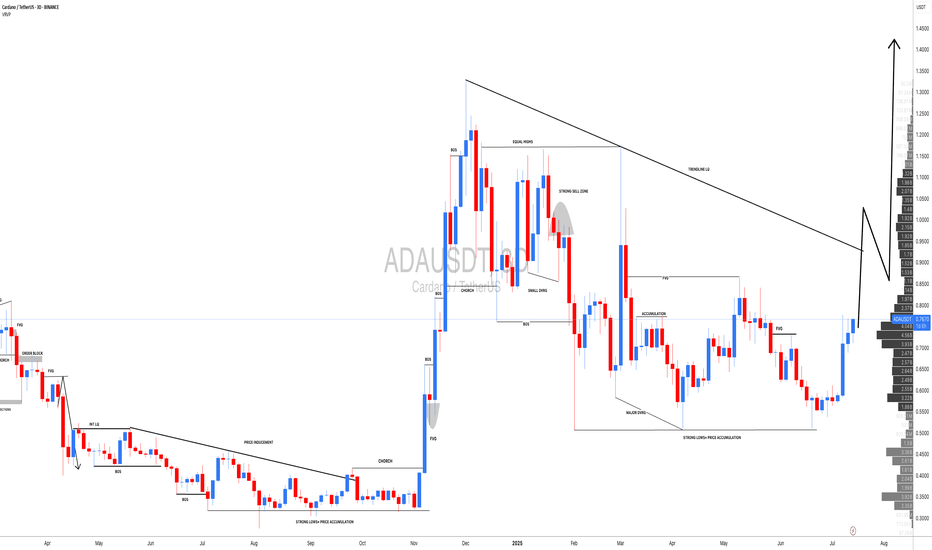

ADA/USDT Ready to Explode? Watch This Symmetrical Triangle

🧠 Detailed Technical Analysis:

Cardano (ADA) is currently consolidating within a well-defined Symmetrical Triangle pattern on the 3-day chart. This pattern is formed by a series of lower highs and higher lows, indicating compression and indecision in the market — a classic setup for a strong breakout in either direction.

Price has recently bounced off the lower boundary of the triangle and is now heading toward the resistance trendline. A breakout from this structure could trigger a powerful bullish move if confirmed with volume.

🔼 Bullish Scenario (Upside Breakout):

A confirmed breakout above the descending trendline (~$0.65) with strong volume would indicate buyers regaining control.

Key upside targets based on historical resistance zones and the triangle's height:

🟡 $0.8144 – First major horizontal resistance

🟡 $0.9386 – Mid-range resistance from March 2025

🟡 $1.0920 – Former distribution zone

🟡 $1.2118 – Medium-term bullish target

🔵 $1.3264 – Key structural high from previous cycle

🔔 A breakout from a symmetrical triangle often leads to significant price action due to the long period of coiled pressure release.

🔽 Bearish Scenario (Breakdown):

If ADA fails to break above $0.62–$0.65 and gets rejected from the upper boundary of the triangle, the price could:

Revisit the lower trendline support around $0.55

A breakdown below this zone could lead to:

🔻 $0.48

🔻 $0.39

🔻 $0.2756 – A major psychological and historical support level

⚠️ This scenario would invalidate the bullish structure and potentially resume the mid-term downtrend.

📐 Pattern Breakdown – Symmetrical Triangle:

Pattern Duration: ~6 months of consolidation (Feb – July 2025)

Support Zone: $0.55 – $0.60

Resistance Zone: $0.65 – $0.75

Breakout Confirmation: Requires strong bullish candle close with increased volume

Volume Profile: Decreasing, typical of symmetrical triangle before explosive move

💡 Final Thoughts:

Cardano is at a make-or-break point. It has bounced from support and is attempting a breakout from this symmetrical triangle. If successful, this could mark the beginning of a major trend reversal with over +100% upside potential from current levels.

On the flip side, failure to break resistance could lead to a deeper retracement. That’s why confirmation is critical before entering a position!

#ADAUSDT #CardanoAnalysis #CryptoBreakout #SymmetricalTriangle #AltcoinSeason #BullishBreakout #BearishScenario #TechnicalAnalysis #CryptoChart #CryptoTrading #Altcoins

ADAUSDT Intraday SetupAda Showing some good movement. Trade Rules

must gave 30m candle closing above marked area, if wick above marked area then trade will become risky. Must use the sl. Target is given.

If retraces back before the marked area then it also good, in this case 30m marked area will first tp book 30% here, rest hold till final tp or SL.

$ADA Bulls Wake Up—Potential 9% Rally If This Level HoldsCardano (ADA) appears to be attempting a short-term recovery after a prolonged decline, as shown in the 4H chart from Binance. The price recently bounced from a well-defined support level around $0.5391, which has held multiple times in recent sessions, confirming buyer interest in this zone. This support also aligns with a previous consolidation range and has proven reliable in the past.

The price is now approaching a zone of dynamic resistance marked by the BEST Cloud ALL MA indicator. This red-shaded cloud represents the bearish control zone, and ADA has repeatedly failed to break through this area in recent weeks. However, ADA is now showing early signs of upward momentum as it consolidates just beneath the first resistance at $0.5734 (also marked as TP1). This resistance corresponds with the bottom of the cloud and recent swing highs.

The broader trend is still bearish, but the structure suggests a possible reversal if bulls can reclaim levels above the cloud. A further push above $0.5734 could attract fresh buying interest and target the next resistance level near $0.6155, which also represents TP2 on the chart. This upper zone served as a breakdown point in mid-June and may now act as a key level to watch.

Meanwhile, the green moving average line (part of the cloud setup) is starting to flatten. This often signals a transition from downtrend to range or even an early reversal—especially when combined with a support bounce and higher low formation.

There’s no clear bullish breakout yet, but the setup looks favorable for a cautious long position.

Trading Idea

• Entry Zone: 0.5550 – 0.5600 (near current consolidation)

• Target 1 (TP1): 0.5734

• Target 2 (TP2): 0.6155

• Stop Loss: Below 0.5391 (e.g., 0.5320 – adjust based on your risk appetite)

• Risk/Reward to TP2: Around 2:1

If price breaks below $0.5391, the bearish structure would be confirmed, possibly leading ADA back toward the $0.50–$0.48 region. But as long as this support holds, the market favors a recovery scenario toward the resistance levels mentioned.

Overall, this is a textbook support-to-resistance play, with potential for an 8–9% upside if bullish momentum sustains. Confirmation through volume breakout above the cloud will further strengthen the case for short-term gains.

ADAUSDT: Targeting $1.5 Long Term Swing View| Comment Your View|Hello everyone,

The cryptocurrency price is approaching a major bullish zone where it is anticipated to reverse. Price momentum has been slightly bullish in recent times, possibly due to the release of economic data that is against the US Dollar. A weak US dollar has recently influenced the cryptocurrency market volume, resulting in all-time highs. We anticipate similar or increased volume in the future.

We would appreciate your support by liking and commenting on your views about the cryptocurrency pair. Please let us know in the comments if you would like us to analyse any other cryptocurrency or trading pair.

Best regards,

Team Setupsfx_

ADA bulling :)📈 ADA/USDT 4H Analysis

ADA has broken above the 0.7408 resistance, now at 0.78150, showing strong bullish momentum within an ascending channel, targeting higher levels if the trend holds.

🟢 Support Levels:

🔹 0.7220 – recent breakout zone (20/50 EMA)

🔹 0.6630 – key support

🔹 0.6230 – deeper support

[ *]🔴 Resistance Levels:

🔹 0.8430 – next target

🔹 0.9670 – major resistance zone

Cardano Rangebound – Is a Breakout or Breakdown Imminent?📉 ADA is Rangebound! I’m watching closely—if price breaks out of this consolidation, it could set up a strong trading opportunity.

🎯 In this video, we analyze the market structure and price action, breaking down a possible trade setup—if the right conditions align.

🚨 Stay sharp, manage risk—this is not financial advice! 🚀🔥

ADAUSDTADAUSDT Signal 📉

📌 Current Price: 0.7161 USDT

📊 Trend: Bearish ⬇️, but testing a descending trendline 📏

🔑 Key Levels:

🔼 Resistance: 0.9209 🛑

🔽 Support: 0.7782–0.8457 🟢

📉 Next Support: 0.6750 ⚠️

📢 Signal:

🔴 Short (Sell): Enter at 0.7161 if price rejects the trendline.

🎯 TP: 0.6750 | 🛑 SL: 0.7500

🟢 Long (Buy): If price breaks above 0.7284, target 0.7782–0.8457.

🎯 TP: 0.7782–0.8457 | 🛑 SL: 0.7000

⚖️ Risk Management: Use 1:2 risk-to-reward ratio. Control risk as highlighted.

🔍 Monitor for a trendline break! 🚨

ADA/USD "Cardano vs U.S Dollar" Crypto Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the ADA/USD "Cardano vs U.S Dollar" Crypto Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise placing Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at (0.7000) swing Trade Basis Using the 3H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 0.5200 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT Report, Sentimental Outlook:

ADA/USD "Cardano vs U.S Dollar" Crypto Market is currently experiencing a Bearish trend in short term, driven by several key factors.

⚡⭐Fundamental Analysis

Market Capitalization : Cardano's market capitalization stands at $23.12 billion USD, with a circulating supply of 35.21 billion ADA.

Tokenomics : The total supply of ADA is capped at 45 billion, with a significant portion already in circulation.

Blockchain Technology : Cardano's blockchain technology is based on the Ouroboros consensus algorithm, which provides a secure and energy-efficient way to validate transactions.

Development Activity : The Cardano development team is actively working on improving the blockchain's scalability, interoperability, and usability.

Partnerships and Collaborations : Cardano has partnered with various organizations, including universities, research institutions, and businesses, to promote the adoption of its blockchain technology.

⚡⭐Macro Economics

Inflation : The current inflation rate is not explicitly stated, but it's essential to consider its impact on the cryptocurrency market. Rising inflation can lead to increased adoption of cryptocurrencies as a store of value.

Interest Rates : Interest rates can influence the attractiveness of cryptocurrencies like ADA. Higher interest rates can make traditional investments more attractive, potentially reducing demand for cryptocurrencies.

Global Economic Growth : The global economy is experiencing a slowdown, which can impact the demand for cryptocurrencies. However, some investors may view cryptocurrencies as a safe-haven asset during times of economic uncertainty.

Regulatory Environment : The regulatory environment for cryptocurrencies is constantly evolving. Changes in regulations can impact the adoption and price of cryptocurrencies like ADA.

⚡⭐Global Market Analysis

Trend: The ADA/USD pair is experiencing a mixed trend, with a 4.27% increase in the last 24 hours, but a 12.92% decrease in the last week.

Support and Resistance: Key support levels are at $0.63 and $0.61, while resistance levels are at $0.68 and $0.70.

⚡⭐COT Data

Speculators (Non-Commercials): The current COT report shows that speculators are holding 26,729 long positions and 9,961 short positions.

Hedgers (Commercials): Hedgers are holding 7,275 long positions and 24,341 short positions.

⚡⭐On-Chain Analysis

Transaction Volume: The 24-hour transaction volume for ADA is approximately $868.36 million USD.

Active Addresses: The number of active addresses on the Cardano network is not provided.

⚡⭐Market Sentiment Analysis

Sentiment: The overall sentiment for ADA/USD is neutral, with a mix of bullish and bearish predictions.

Fear and Greed Index: The current fear and greed index reading is not available.

⚡⭐Positioning

Long/Short Ratio: The long/short ratio for ADA/USD is not provided.

Open Interest: The open interest for ADA/USD is approximately $776.6 million USD.

⚡⭐Next Trend Move

Bullish Prediction: Some analysts suggest a potential bullish move, targeting $0.70 and $0.80.

Bearish Prediction: Others predict a potential bearish move, targeting $0.52 and $0.50, due to the recent downward trend and potential selling pressure.

⚡⭐Overall Summary Outlook

Bullish or Bearish: The overall outlook for ADA/USD is neutral, with a mix of bullish and bearish predictions.

Real-Time Market Feed: As of the current time, the ADA/USD price is $0.66, with a 0.42% increase in the last 24 hours.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

#ADA/USDT#ADA

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it upwards strongly and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.5923

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.6615

First target 0.7111

Second target at 0.7585

Third target at 0.8205

Cardano AnalysisCardano ADA/USD Analysis

Cardano (ADA/USD) is currently trading at 0.788, having recently breached a critical support level. This breakdown has shifted the asset's technical structure, with the price now retesting the previously broken support zone, which has since turned into resistance. In technical analysis, such a retest of a breached support level often acts as a key confirmation point for the potential continuation of the prevailing trend. If the current candle closes decisively below this newly established resistance level, it could signal a resumption of bearish momentum, potentially opening the door for further downward movement.

The validity of this bearish outlook hinges on several factors, including the volume accompanying the price action and the broader market sentiment surrounding Cardano. Traders should remain vigilant for any signs of rejection or reversal patterns at this critical level, as these could negate the bearish thesis and indicate a shift in market dynamics.

In summary, while the current price action suggests a potential continuation of the downtrend, it is essential to approach the market with caution. We welcome your perspective on this analysis and whether you agree with the potential bearish outlook for Cardano. As always, prioritize responsible trading practices and robust risk management strategies.

Time to Buy Cardano..? Analyzing the Current BreakoutCardano (ADA) has recently surpassed a significant resistance level on the daily timeframe, but it is currently facing challenges in maintaining its position above this level. A potential long trade could be considered if the daily candle closes at or above the 0.8200 mark. Conversely, if the price fails to hold above this level and begins to decline, a short position may be warranted once the price falls to or below the 0.7400 level on the daily candle, with a recommended stop loss set at 0.8100.

ADA Buy📊 ADAUSDT Signal Analysis

📆 Timeframe: 4H

🏛️ Exchange: Binance

🔍 Market Overview:

🔸 The current price of ADA is around 0.6988 USDT.

🔸 A recent downtrend has pushed the price lower, bringing it close to a key support level.

🔸 If the price reacts positively, a potential uptrend could begin.

📉 Technical Analysis:

🔹 Key Support Level: 🟢 0.6482 USDT

🔹 Key Resistance Levels: 🔵 0.7729 USDT, 🔵 0.9082 USDT, 🔵 1.0486 USDT

🔹 Stop Loss: 🔴 0.5472 USDT

🔹 Capital Management: 📌 Enter the trade only after a confirmed bullish candle.

📌 Entry Strategy:

✅ If the price reacts positively around 0.6482 USDT, a long position can be considered after a confirmed bullish candle.

🎯 Target Levels:

1️⃣ 0.7729 USDT

2️⃣ 0.9082 USDT

3️⃣ 1.0486 USDT

❌ Stop Loss: If the price breaks below 0.6482 USDT and reaches 0.5472 USDT, the trade should be closed.

🔔 Important Note: A confirmed bullish candle is essential before entering to ensure a strong reversal.

⚠️ Conclusion:

📌 This analysis is based on technical data and should be used alongside other strategies and proper risk management.

ADA/USD "Cardano vs US Dollar" Crypto Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑💰🐱👤

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the ADA/USD "Cardano vs US Dollar" Crypto market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry and short entry. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 :

"The loot's within reach! Wait for the breakout, then grab your share - whether you're a Bullish thief or a Bearish bandit!"

Buy entry above 0.8100

Sell Entry below 0.6700

Stop Loss 🛑:

Thief SL placed at 0.7300 (swing Trade Basis) for Bullish Trade

Thief SL placed at 0.7700 (swing Trade Basis) for Bearish Trade

Using the 4H period, the recent / nearest low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

-Bullish Robbers TP 1.0200 (or) Escape Before the Target

-Bearish Robbers TP 0.5500 (or) Escape Before the Target

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

ADA/USD "Cardano vs US Dollar" Crypto market is currently experiencing a Neutral trend (Bearish trend in short term but there is a higher chance for Bullish in long term)., driven by several key factors.

🟠Fundamental Analysis

- Cardano's current price is around $0.28, with a 24-hour volume of $150M.

- The market sentiment is neutral, indicating a potential shift in trend.

- Cardano's blockchain has seen significant development, with the recent launch of the Alonzo hard fork, which enables smart contract functionality.

🟤Macro Economics

- The global economic outlook is uncertain, which may impact Cardano's price.

- The growing adoption of cryptocurrencies and increasing institutional investment could support Cardano's value.

- The US Federal Reserve's interest rate decisions and inflation rates will also influence the cryptocurrency market.

⚪COT Report

- Unfortunately, the latest COT report data is not available.

- However, I can suggest checking reliable sources like the Commodity Futures Trading Commission (CFTC) or FXStreet for the latest updates.

🔴Sentimental Market

- The sentimental market is currently neutral, with some traders expecting a bullish trend while others predict a bearish trend.

- Retail traders are holding long positions in ADA/USD, while institutional traders are cautious.

🟡Overall Sentimental Analysis

- Institutional Traders: The sentiment is bearish, with a focus on short-term gains. They are expecting a drop in price due to the current market conditions

- Retail Traders: The sentiment is bullish, with many traders holding long positions in ADA/USD. They are expecting a rebound in price due to the growing adoption of Cardano's blockchain technology

- Technical Analysts: The sentiment is neutral, with some analysts predicting a short-term drop in price due to bearish indicators, while others are expecting a long-term increase in price due to bullish divergences

- Cryptocurrency Enthusiasts: The sentiment is bullish, with many enthusiasts expecting Cardano's price to increase due to its growing ecosystem and adoption

⚫Positioning

- Institutional traders are holding short positions in ADA/USD, while retail traders are holding long positions.

- This positioning suggests a potential short-term correction in the pair.

🟣Overall Outlook

- ADA/USD is expected to trend bearish in the short term, driven by the mixed market sentiment and cautious institutional traders.

- However, the growing adoption of cryptocurrencies and increasing institutional investment could support Cardano's value in the long term.

- The overall outlook for ADA/USD Cardano is bearish in the short term, with a potential drop to $0.505, but bullish in the long term, with expected growth to $1.13

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩