Adidas_buy

Adidas Soars 8% on Surging Profit & Upgraded GuidanceAdidas ( OTC:ADDYY ), the German sportswear giant, has sent shockwaves through the market with an unexpected surge in first-quarter profits and a bold revision of its full-year guidance. Buoyed by robust sales performance and strategic initiatives, Adidas ( OTC:ADDYY ) has captured investor attention by raising expectations for revenue and operating profit in 2024.

1. Profit Surge and Upgraded Guidance: Adidas' first-quarter profit has witnessed a remarkable year-on-year increase, propelling the company to revise its full-year guidance upwards. With an 8% jump in shares reflecting investor confidence, Adidas ( OTC:ADDYY ) now forecasts a mid-to-high-single-digit growth in currency-neutral revenues for 2024, signaling optimism and resilience in the face of market challenges.

2. Strategic Inventory Management: Adidas' decision to divest its Yeezy inventory following the split with rapper Kanye West has proven to be a strategic masterstroke. Anticipating additional sales of around 200 million euros from the remaining Yeezy inventory, Adidas ( OTC:ADDYY ) has demonstrated agility and foresight in optimizing its product portfolio to drive profitability and shareholder value.

3. Operational Resilience and Growth Momentum: Despite facing headwinds from unfavorable currency effects, Adidas' first-quarter operating profit soared to 336 million euros, showcasing operational resilience and efficient cost management. Analysts anticipate a steadily improving sales trajectory throughout the year, fueled by the momentum of Adidas' core brand and strategic partnerships with marquee sporting events.

4. Brand Momentum and Market Perception: UBS analysts highlight Adidas ( OTC:ADDYY ) as one of the "best earnings momentum stories in the space," underscoring the brand's rapidly accelerating momentum and market appeal. With a packed summer sporting calendar and investments in performance shoes, Adidas ( OTC:ADDYY ) is poised to capitalize on consumer demand and solidify its position as a global sportswear leader.

5. Strategic Partnerships and Product Innovation: Adidas' partnerships with high-profile events like the Olympics, Paralympics, EURO 24, and Copa events further bolster its brand visibility and market penetration. The focus on performance shoes and the resurgence of the Terrace footwear brand signal Adidas' commitment to innovation and meeting evolving consumer preferences.

Technical Outlook

Adidas ( OTC:ADDYY ) stock is riding hard on the bullish train with a positive Relative Strength Index (RSI) of 67.12 indicating bullish momentum. The stock is trading above the 200, 100 & 50- Day Moving Averages respectively.

ADS BUYHi, According to my analysis of Adidas stock, there is a good chance that you will buy or invest in this stock for the long term. The stock is in a very positive condition, going in an upward channel. It also broke the strong resistance at the level of 170. It is expected that the price will return to the same area to retest the rise once again. Good luck everyone

ADDYY ABC correction, long setupAdidas just broke an uptrend and finished 1-5 Elliot wave. We are waiting for an ABC correction, we should enter for a long position on the C, which should be ~80$ mark, since market created gap there which needs to be filled, also there is a 61.8% fib zone which indicates that market should reverse in that zone.

Entry: 80

Target 140

Invalidation: 70

Ratio: 6

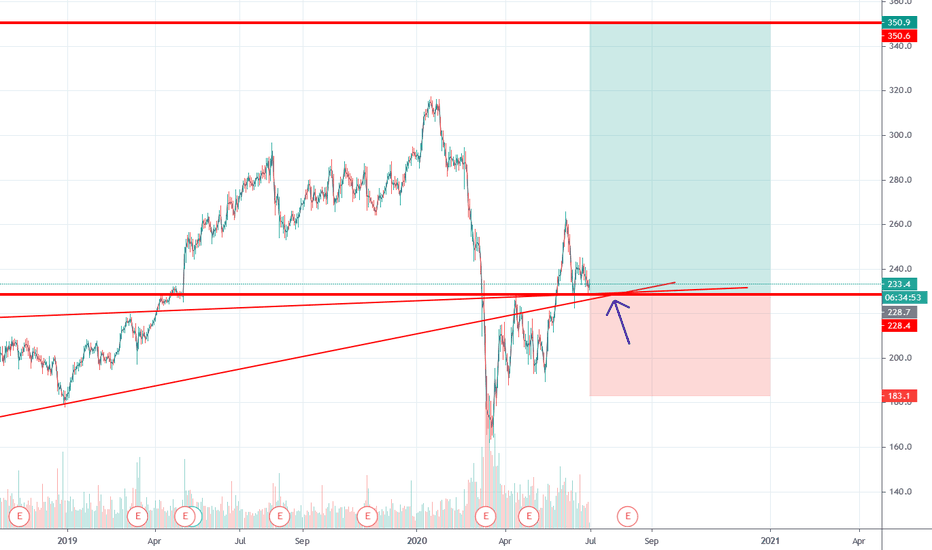

Adidas , Long view The curve for Adidas shares has been upwards since mid-May. At first, it seemed as if buyers were running out of Amo in the area of the € 220 mark, but in the past few days the share has regained momentum. In the meantime, investors have caused the price to rise to EUR 241.10. Until the pre-crisis level of 282.45 euros was reached, however, more than 17 percent is still missing.

At the moment, however, during the past one or two days, investors are primarily interested in positive topics. Because of this sentiment, the stock receives a “hold” rating today. In-depth and automatic analyzes of the communication have shown that lately "buy" signals have been the main focus. This gives Adidas a Buy Signal based on the investor sentiment barometer.

Good Luck .

Long-term Investment #ADIDASSportswear manufacturer #ADIDAS dropped overall -47% after they had to close their local shops cause of Covid and got terrible expectations for Sales.

If we comparing the blue indicator (TEXTILES & APPARELS Index - TSE/TXA) in the chart we can see that we already reached the bottom of the crash (maybe). And the white indicator (Nike) give us a picture what stock growth we could expect.

I´m calculating with a fulfilling channel run, good risk/award ratio as a long-term investment.

Your Sincerely Christian S.

ADSD @ daily @ closed higher while last 4 trading daysThis is only a trading capability - no recommendation !!!

Buying/Selling or even only watching is always your own responsibility ...

.zip (with PDF`s) @ my Google Drive

Break Ups (Dax Index incl. all shares)

drive.google.com

Best regards :)

Aaron

ADSD @ Daily @ with +69% in 2016 best DAX Performer & in a trendTake care

& analyzed it again

- it`s always your decision ...

(for a bigger picture zoom the chart)

This is only a trading capability - no recommendation !!!

Buying/Selling or even only watching is always your own responsibility ...

DAX 30 Index & all Shares (2016 yearly Performance) @ drive.google.com

Best regards

Aaron