ADR

Flat ADR: Basic Attention Token Continued RiseRight now a crypto that is on the alternative coins list that interests me is the twenty seven cent Basic Attention Token. ADR is kind of flat, and even given the bull run retracement it had, I still think it has some ways to go in terms of a positive correlation continuation pattern. Right now I would say this is mid risk. Please keep in mind, this is on an opinion based basis. Please do your own due diligence and don't consider this actionable financial advice.

Two FX Pairs in the Red Making Me Excited: NZDUSD and CADCHFLooking at charting patterns right now, two pairs I would get excited to retrade for a decent reentry are NZDUSD and CADCHF, I think the current resistance bubble is about to be broken up and than you will see another positive retracement pattern just as prior. Overall, I feel like it is a strong entry. As always, proceed on your own risk. Everything I say is on an opinion based basis and do your own due diligence.

The Force is Strong in This One. The Fed vs the Rebel Alliance The Empire is strong, Darth Powell’s lightsabre is carving into every company, fund, and bond, but instead of cutting off limbs, his magical weapon is adding them.

What we end up with is a grotesque monster that does not resemble anything in the known universe.

Every right-minded investor knows in the back of their mind that this cannot last.

But while it does last, why not make a profit?

I know many of you are strong bears, even perma bears. However, you need to go big as a bear at the right time or it begins to hurt quickly.

I reserve the right to change from a bull to a bear is the drop of a hat, so don’t be surprised if I change. And you should too, being flexible is key to profits.

What I share here are my thought processes, I do not want or expect anyone to take my advice, make your own mind up what to do with your money.

Technical Analysis & Thoughts

The ISLAND TOP – in technical analysis, this is a serious concern for a major direction change because it depicts the battle between extreme bulls and bears. In this case, the bears won. I guess the feds massive purchasing of Index ETFs, stabilized everything again.

Shock Day

The mauling of the markets on June 11th was huge, although the market has recovered, but this is an important sign. In a normal pullback, 5% loss in a week indicates a serious reversal. I have backtested this back to 1920. This was greater that 5% in a day, a serious shock. Another 1 or 2 of these shocks will be the end of this Goldilocks recovery.

Confidence is everything and we are all feeling very itchy.

ADR is still very positive , the up days are excellent, freakish really, but they are weakening.

RSI and KST are not telling us too much.

@Mystrybox pointed out that pyjama investors / Ma and Pa investors are pouring into the market, and even the Economist magazine mentioned it this week. A sure sign of a bubble if I ever saw one.

Summary

You expect it, I expect it, the right-thinking rebel alliance of bears see an unsustainable market.

But in the short-term, I am long and making money until Mr. Market tells me to move to cash and short.

Watch out for drops of more than 5% in a week as a tell-tale early signal of a significant move down.

Stay safe traders/investors.

Barry

Like and Follow for future updates via tradingview

The Trump Pump Effect is Starting to Wear OffThe market is currently in a short term 22-day consolidation.

We currently have a double top and considering the futures, we will probably hit a triple top.

What is interesting to note is the recent $3 trillion aid package did not have an extremely positive effect on the market, unlike those previously.

Looking at the advance-decline ratio we see that the Bullish appetite is diminishing, meaning the extremely bullish days are losing their power.

RSI is neutral suggesting a potential turn-around.

Finally, the KST indication is crossing over at the suggesting the market is running out of steam.

At some point, the market participants will realize that there is a serious economic decline ahead.

My guess is a triple top, decline, panic selling, and another bottom.

“You will get business failures on a grand scale.” So declared James Bullard, president of the Federal Reserve Bank of St Louis, on May 12th. Peter Orszag, a former official in Barack Obama’s White House and now with Lazard, an investment bank, warned that the American economy could face “a significant risk of cascading bankruptcies”.

If you like this analysis. Please like and follow to get more.

Thanks

Barry

AD Ratio Suggests Birth of a New Bull Market!AD Ratio Suggests Birth of a New Bull Market!

Or the madness of crowds.

The Advance-Decline Ratio (ADR) is a simple measure of how many stocks increase versus how many decline. A ratio of 1 means 1 company’s stock increases to every 1 that declines. A ratio of 4 means 4 increase to every 1 that declines.

It is a good measure of the bullishness of the market participants. The magic number I am using for this analysis is an ADR of 4, as anything above 4 increases to 1 typically indicates a turning point in the market.

Chart Setup:

Price – Log Weekly

AD Ratio – 10 Bar Moving Average + 200 Bar Moving Average

AD Ratio Red Line = 4 Indicating Extreme Bullishness

There are two stories here. You need to decide which one you believe.

Pre 2008 Crash – The Madness of Crowds.

During the Financial Crisis crash from 2007 to 2009 the crowds were simply wrong. Extreme ADR indicated only temporary market bottoms, which were followed by brief rallies then market collapse.

Post 2009 – The Birth of Bull Markets.

Since 2009 the market participants signaled extreme positive sentiment with an AD ratio above 4 on 9 separate occasions which all indicated the end of the bear market and birth of a new bull market.

This suggests one of two things:

1. During a major market crash the crowds are overly optimistic, underestimating the full impact of the economic devastation.

2. During a long-term bull market, the crowds are correct, in fact, it is the crowds of course, who power the bull market.

The Key Point.

The Corona Crash has shown us 2 extreme bursts of ADR buying above 7 for the week’s March 9 and April 6.

This means either the birth of a new bull market or the radical underestimation of the impact of Corona on the economy.

Final Summary.

I am not convinced either way.

Part of me thinks that this is the start of the new bull market, because in fact governments have done everything possible to stimulate the economy and save jobs and industry, there is no other choice apart from instant economic devastation. Interest rates will remain close to zero for the next 10 years and in governments stimulate inflation that the debt will eventually reduce by itself (according to the Economist April 24th Edition)

The other part of me thinks that we simply cannot move to a new market high without further market correction to account for the large losses in future earnings.

Do not forget.

This market is driven now by central banks, Trump and Macro-economics. This market will turn on its head with a few massive headlines.

Let’s have a discussion, let me know your thoughts below, I will try to reply to all.

If you Like, then Like and Follow to get more updates.

Stay healthy.

Barry

Alibaba - don't miss this train!Technicals

There has been no divergence with RSI and the OBV and trade price. They are steadily growing. ----> BULL

DI+>DI- (positive directional index just crossed above the negative) ---> BULL

MACD>MACsignal (MACD just crossed above the signal) -----> BULL

Fundamentals

Alibaba reported earnings yesterday (Aug15th) continued positive non-GAAP earnings of $1.84 per share, 45.98% above the same quarter a year ago, beating the mean consensus estimate of $1.51.

All analyst price target values are above $200 (17% above current price @$170)

Risks

JD.com who is a competitor, is doing great.

Trade war between China & USA.

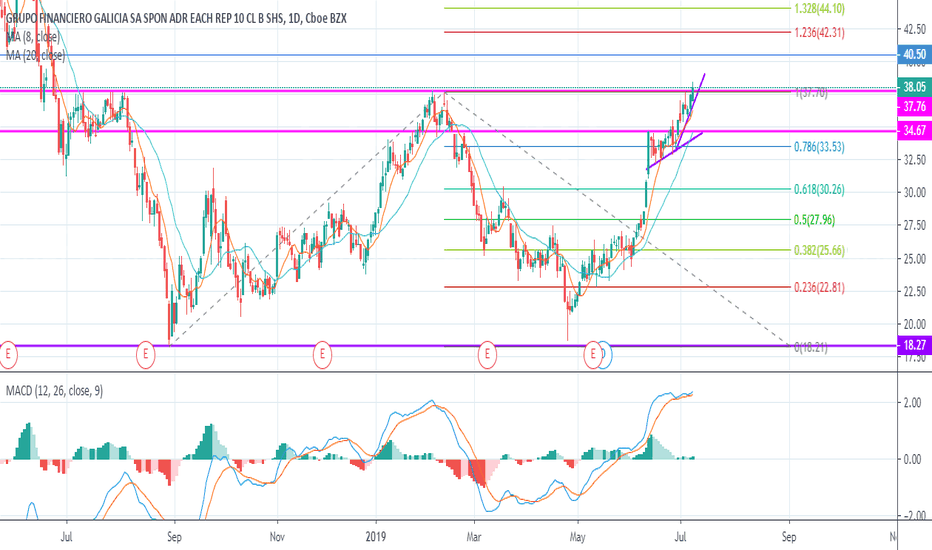

$GGALNASDAQ:GGAL Supera la resistencia en 37,7 y ya opera arriba de 38. Con esto sale de la lateralización a la que ingresó el 27/06/2018, un año entre los valores 37 y 18. De cerrar por encima de la resistencia, podemos esperar que el próximo valor a superar sea 40,5, una resistencia de 2017. Además podríamos esperar que se acentúe la suba y que mañana la apertura sea por encima del valor marcado. MACD muestra valores por encima de la línea de señal y comienza a despegarse de la misma. Continúa la tendencia pronunciada que se aceleró el 28/06/2019, veremos si es capaz de mantenerla o en qué valor será la ruptura

$MELINASDAQ:MELI una bestia, enorme. Hoy subió 3% mientras el resto de los ADR argentinos cerraron en baja (algunos se hicieron pedazos). Está en máximos históricos por lo que se hace un poco dificil definir hacia donde irá. En lo que podemos definir con extensión de Fibonacci, ya estaríamos llegando al 2 que se encuentra en 654. Esta puede ser una posible resistencia. Hacia abajo vemos varias cosas, apertura en límite superior del canal de Keltner, canal alcista formado a partir del 26/12/2018, rebote del MACD que indicaría una continuación de suba. Por otro lado, RSI se acerca a la zona de sobrecompra, si pasa los 70 deberíamos empezar a tener un poco de cautela teniendo en cuenta la resistencia de la extensión de Fibonacci que en combinación con el RSI podría generar un retroceso hacia la zona de los 610, soporte que veo clave por ser una línea de Fibonacci de 1,786

GGAL: Perfect short setup in the makingGGAL is offering a great short setup here. This is an ADR (American depositary receipt), that is, basically, a foreign stock that is traded in an american exchange. It's of special interest since I'm from Argentina. Fellow argentinians can take note of this setup and trade it in the local market as well. Upside risk is the same, despite the ADR being priced in dollars, so the stop loss is easy to calculate: use the recent highest high.

Target is the bare minimum this stock should fall, and can possibly evolve into a larger move, since the Rgmov indicator is firmly planted in negative territory, without showing any new 44 bar high yet, after plotting a 44 bar low before.

Check out my updated track record here: pastebin.com

If interested in my trading signals, or in personal tuition, contact me privately. I'm offering a considerable discount on a packaged course which includes access to my private trading signals list for a year.

Cheers!

Ivan Labrie

Link to Tim West's chatroom: www.tradingview.com

We discuss setups like this often there. Feel free to stop by and subscribe to his indicator pack. If you have any questions ask.

Risk disclaimer: My analysis is provided as general market commentary and does not constitute investment advice. I will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance0.57% on such information.