Aeva Technologies (AEVA) – Pioneering Next-Gen LiDAR Company Snapshot:

Aeva NASDAQ:AEVA is revolutionizing perception systems with 4D FMCW LiDAR—offering instant velocity detection, high precision, and long-range sensing, setting a new standard for autonomous systems.

Key Catalysts:

Breakthrough Technology

AEVA’s proprietary 4D Frequency Modulated Continuous Wave (FMCW) LiDAR provides real-time velocity and depth data, outperforming traditional Time-of-Flight systems in accuracy and safety.

Automotive OEM Traction 🚗

Strategic collaborations are translating into production-stage contracts, marking a key inflection from R&D to scalable revenue generation.

Multi-Sector Expansion 🌐

AEVA’s sensing tech is penetrating robotics, aerospace, and industrial automation, significantly broadening its TAM and diversifying revenue streams.

Government & Aerospace Validation

Recent contract wins with defense and aerospace clients underscore AEVA’s technological credibility and commercial viability.

Investment Outlook:

Bullish Entry Zone: Above $22.50–$23.00

Upside Target: $39.00–$40.00, supported by production scaling, cross-sector adoption, and deep-tech differentiation.

⚙️ AEVA stands at the forefront of smart sensing innovation with strong momentum into high-growth verticals.

#AEVA #LiDAR #AutonomousVehicles #Robotics #Aerospace #IndustrialTech #SensorRevolution #4DPerception #FMCW #TechStocks #Innovation #SmartMobility

Aerospace

Red Cat Holdings (RCAT) – Soaring with Defense & Global DemandCompany Snapshot:

Red Cat NASDAQ:RCAT is an emerging UAV (drone) technology leader, rapidly scaling through defense-grade contracts, global expansion, and vertical integration.

Key Catalysts:

Defense Sector Traction 🎯

Recent U.S. DoD contract wins underscore RCAT’s credibility as a mission-critical UAV supplier.

Sequential revenue growth in earnings signals accelerating adoption in defense and commercial markets.

Global Expansion Strategy 🌐

RCAT is diversifying via allied procurement programs, reducing dependence on U.S. defense budgets and broadening international exposure.

Tech Stack Integration ⚙️

Strategic acquisitions are bolstering RCAT’s in-house capabilities—driving vertical integration, improving margins, and fueling innovation velocity.

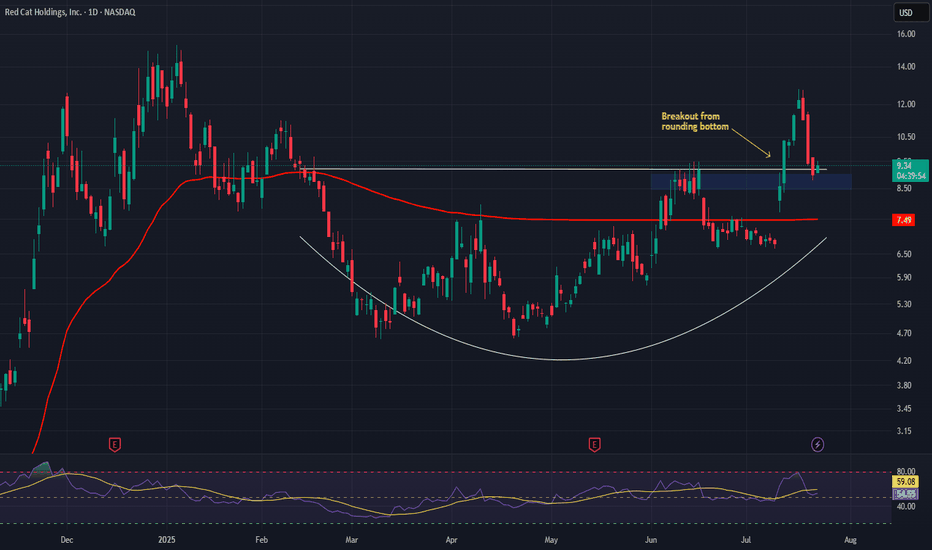

Investment Outlook:

Bullish Entry Zone: Above $8.50–$9.00

Upside Target: $15.00–$16.00, supported by defense contract momentum, global reach, and a strengthened tech edge.

🛡️ RCAT is becoming a high-leverage play on modern defense tech with scalable, global upside.

#RCAT #DefenseStocks #UAV #DroneTechnology #MilitaryContracts #Innovation #DoD #Aerospace #Geopolitics #GrowthStocks #VerticalIntegration

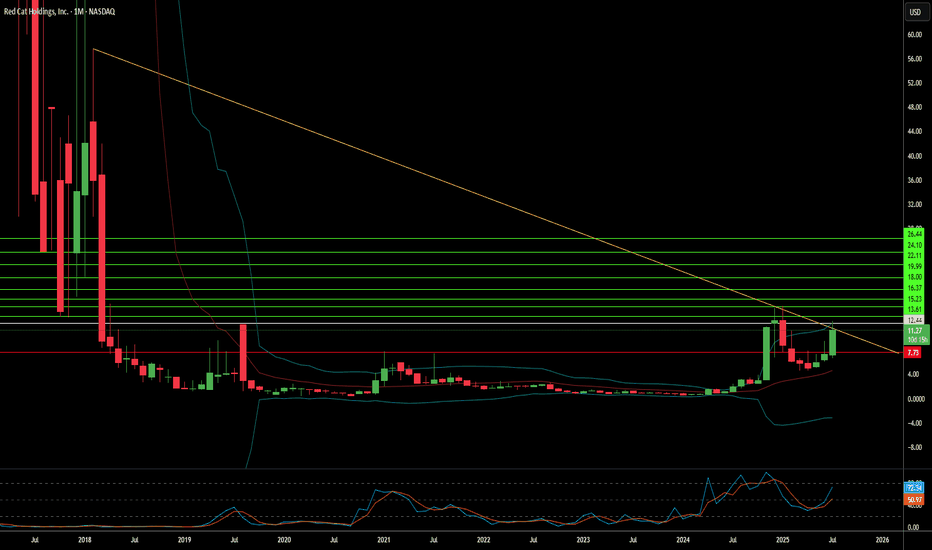

Is Red Cat Holdings a Drone Industry Maverick?Red Cat Holdings (NASDAQ: RCAT) navigates a high-stakes segment of the burgeoning drone market. Its subsidiary, Teal Drones, specializes in rugged, military-grade uncrewed aerial systems (UAS). This niche positioning has attracted significant attention, evidenced by contracts with the U.S. Army and U.S. Customs and Border Protection. Geopolitical tensions, particularly the escalating demand for advanced military drone capabilities, create a favorable backdrop for companies like Red Cat, which offer NDAA-compliant and Blue UAS-certified solutions. These certifications are critical, ensuring drones meet stringent U.S. defense and security standards, differentiating Red Cat from foreign competitors.

Despite its strategic positioning and significant contract wins, Red Cat faces considerable financial and operational challenges. The company currently operates at a loss, with a net loss of $23.1 million in Q1 2025 against modest revenues of $1.6 million. Its revenue projections of $80-$120 million for 2025 underscore the lumpy nature of government contracts. To bolster its capital, Red Cat completed a $30 million equity offering in April 2025. This financial volatility is compounded by an ongoing class action lawsuit. This lawsuit alleges misleading statements regarding the production capacity of its Salt Lake City facility and the value of its U.S. Army Short Range Reconnaissance (SRR) program contract.

The SRR contract, which could involve up to 5,880 Teal 2 systems over five years, represents a substantial opportunity. However, the lawsuit highlights a significant discrepancy, with allegations from short-seller Kerrisdale Capital suggesting a much lower annual budget allocation for the program compared to Red Cat's initially intimated "hundreds of millions to over a billion dollars." This legal challenge and the inherent risks of government funding cycles contribute to the stock's high volatility and elevated short interest, which recently exceeded 18%. For risk-tolerant investors, Red Cat presents a "moonshot" opportunity, contingent on its ability to convert contract wins into sustainable, scalable revenue and successfully navigate its legal and financial hurdles.

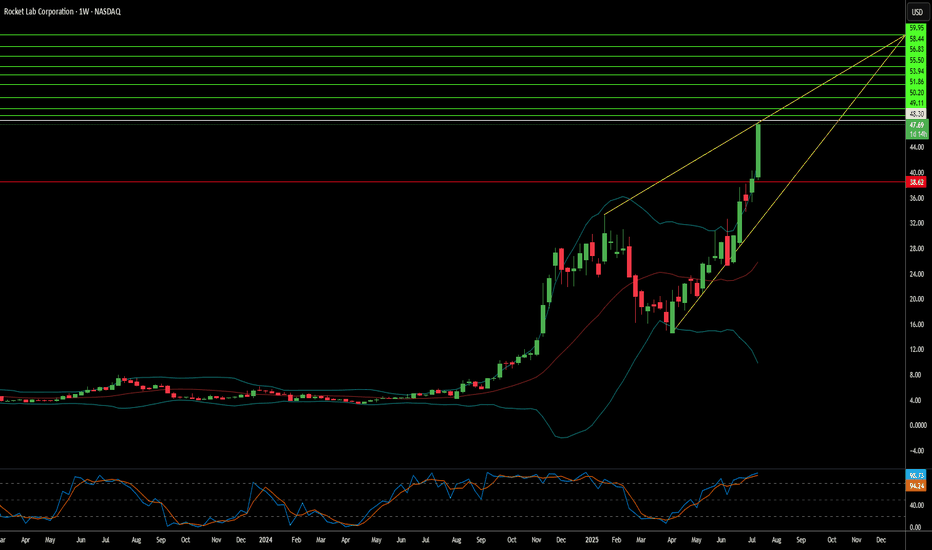

Is Rocket Lab the Future of Space Commerce?Rocket Lab (RKLB) is rapidly ascending as a pivotal force in the burgeoning commercial space industry. The company's vertically integrated model, spanning launch services, spacecraft manufacturing, and component production, distinguishes it as a comprehensive solutions provider. With key operations and launch sites in both the U.S. and New Zealand, Rocket Lab leverages a strategic geographic presence, particularly its strong U.S. footprint. This dual-nation capability is crucial for securing sensitive U.S. government and national security contracts, aligning perfectly with the U.S. imperative for resilient, domestic space supply chains in an era of heightened geopolitical competition. This positions Rocket Lab as a trusted partner for Western allies, mitigating supply chain risks for critical missions and bolstering its competitive edge.

The company's growth is inextricably linked to significant global shifts. The space economy is projected to surge from $630 billion in 2023 to $1.8 trillion by 2035, driven by decreasing launch costs and increasing demand for satellite data. Space is now a critical domain for national security, compelling governments to rely on commercial entities for responsive and reliable access to orbit. Rocket Lab's Electron rocket, with over 40 launches and a 91% success rate, is ideally suited for the burgeoning small satellite market, vital for Earth observation and global communications. Its ongoing development of Neutron, a reusable medium-lift rocket, promises to further reduce costs and increase launch cadence, targeting the expansive market for mega-constellations and human spaceflight.

Rocket Lab's strategic acquisitions, such as SolAero and Sinclair Interplanetary, enhance its in-house manufacturing capabilities, allowing greater control over the entire space value chain. This vertical integration not only streamlines operations and reduces lead times but also establishes a significant barrier to entry for competitors. While facing stiff competition from industry giants like SpaceX and emerging players, Rocket Lab's diversified approach into higher-margin space systems and its proven reliability position it strongly. Its strategic partnerships further validate its technological prowess and operational excellence, ensuring a robust position in an increasingly competitive landscape. As the company explores new frontiers like on-orbit servicing and in-space manufacturing, Rocket Lab continues to demonstrate the strategic foresight necessary to thrive in the dynamic new space race.

Soaring High: What Fuels GE Aerospace's Ascent?GE Aerospace's remarkable rise reflects a confluence of strategic maneuvers and favorable market dynamics. The company maintains a dominant position in the commercial and military aircraft engine markets, powering over 60% of the global narrowbody fleet through its CFM International joint venture and proprietary platforms. This market leadership, coupled with formidable barriers to entry and significant switching costs in the aircraft engine industry, secures a robust competitive advantage. Furthermore, a highly profitable aftermarket business, driven by long-term maintenance contracts and an expanding installed engine base, provides a resilient, recurring revenue stream. This lucrative segment buffers the company against cyclicality and ensures consistent earnings visibility.

Macroeconomic tailwinds also play a crucial role in GE Aerospace's sustained growth. Global air travel is steadily increasing, driving higher aircraft utilization rates. This directly translates to greater demand for new engines and, more importantly, consistent aftermarket servicing, which is a core profit driver for GE Aerospace. Management, under CEO Larry Culp, has also strategically navigated external challenges. They localized supply chains, secured alternate component sources, and optimized logistics costs. These actions proved critical in mitigating the impact of new tariff regimes and broader trade war tensions.

Geopolitical developments have significantly shaped GE Aerospace's trajectory. Notably, the U.S. government's decision to lift restrictions on exporting aircraft engines, including LEAP-1C and GE CF34 engines, to China's Commercial Aircraft Corporation of China (COMAC) reopened a vital market channel. This move, occurring amidst a complex U.S.-China trade environment, underscores the strategic importance of GE Aerospace's technology on the global stage. The company's robust financial performance further solidifies its position, with strong earnings beats, a healthy return on equity, and positive outlooks from a majority of Wall Street analysts. Institutional investors are actively increasing their stakes, signaling strong market confidence in GE Aerospace's continued growth potential.

Howmet Aerospace: Navigating Geopolitics to New Heights?Howmet Aerospace (HWM) has emerged as a formidable player in the aerospace sector, demonstrating exceptional resilience and growth amidst global uncertainties. The company's robust performance, marked by record revenues and significant earnings per share increases, stems from dual tailwinds: surging demand in commercial aerospace and heightened global defense spending. Howmet's diversified portfolio, which includes advanced engine components, fasteners, and forged wheels, positions it uniquely to capitalize on these trends. Its strategic focus on lightweight, high-performance parts for fuel-efficient aircraft like the Boeing 787 and Airbus A320neo, alongside critical components for defense programs such as the F-35 fighter jet, underpins its premium market valuation and investor confidence.

The company's trajectory is deeply intertwined with the prevailing geopolitical landscape. Escalating international rivalries, particularly between the U.S. and China, coupled with regional conflicts, are driving an unprecedented surge in global military expenditures. European defense budgets are expanding significantly, fueled by the conflict in Ukraine and broader security concerns, leading to increased demand for advanced military hardware incorporating Howmet’s specialized components. Simultaneously, while commercial aviation navigates challenges like airspace restrictions and volatile fuel costs, the imperative for fuel-efficient aircraft, driven by both environmental regulations and economic realities, solidifies Howmet’s role in the industry’s strategic evolution.

Howmet's success also reflects its adept navigation of complex geostrategic challenges, including trade protectionism. The company has proactively addressed potential tariff impacts, demonstrating a capacity to mitigate risks through strategic clauses and renegotiation, thereby protecting its supply chain and operational efficiency. Despite its premium valuation, Howmet’s strong fundamentals, disciplined capital allocation, and commitment to shareholder returns highlight its financial health. The company's innovative solutions, crucial for enhancing the performance and cost-effectiveness of next-generation aircraft, solidify its integral position within the global aerospace and defense ecosystem, making it a compelling consideration for discerning investors.

War is a Racket | DFEN | Long at $28.00The war machine keeps turning. Profits will reign. Direxion Aerospace and Defense 3x AMEX:DFEN never fully recovered from pandemic lows, but world peace is (unfortunately) far from reach. The uptrend in the chart has commenced. Personal entry point at $28.00.

Target #1 = $37.00

Target #2 = $50.00

Target #3 = $64.00

Embraer–Soaring on Regional Jet Demand &Global Defense ExpansionCompany Overview:

Embraer NYSE:ERJ is a top-tier aerospace manufacturer, delivering commercial jets, executive aircraft, and cutting-edge defense platforms. With a dominant position in the sub-150-seat market, it's primed to benefit from structural aviation tailwinds.

Key Catalysts:

$680B Market Opportunity 📈

Global demand forecast for 10,500 regional jets/turboprops over the next 20 years.

Embraer, with its E-Jet family, is positioned to capture meaningful share amid rising demand for regional connectivity and fleet efficiency.

Defense Momentum 🛡️

C-390 Millennium sales to Portugal and the Netherlands enhance NATO exposure.

Recent A-29N Super Tucano contracts expand Embraer’s tactical footprint, with follow-on order potential from NATO allies.

Resilience to Tariffs + Margin Protection ⚙️

Q1 results unaffected by new U.S. tariffs, thanks to global supply chain integration and high U.S.-sourced content.

Ongoing cost-cutting and trade advocacy expected to preserve margins.

Investment Outlook:

Bullish Case: We remain bullish on ERJ above $44.00–$45.00.

Upside Target: $72.00–$74.00, supported by commercial demand tailwinds, defense diversification, and cost discipline.

✈️ Embraer is flying high—with commercial orders climbing and global defense contracts in formation.

#Embraer #ERJ #Aerospace #RegionalJets #DefenseContracts #NATO #AviationMarket #IndustrialStocks #TariffResilience #C390 #SuperTucano #Bullish

GE AERO WHERE WILL THE PRICE GOTRENDS and Price targets marked.

Price appears to be in "danger zone" or high side with not many price targets left.

There are both support and rejection trends trading down in the short term.

These both lead to a support trend.

Good luck.

Follow for more charts like this.

These 2 Signals Made Members 80% Profit!NYSE:GE has had a massive rejection off of Monthly chart rejection.

We issued an alert to members om June 6th 2025. We entered a 245 Put (July 3) $5 con

We closed out our contracts today at $9 and roughly 80% gain.

This chart demonstrates the power of multiyear monthly chart resistance. Trades like these don't come around often but when they do you have to execute and forget about the noise!

This chart proves that technical trendlines do have power!

GE Aerospace: How to go to the moon!GE's stock is soaring due to strong earnings and optimistic future guidance from its aerospace division.

1. Blowout Earnings: GE Aerospace reported earnings per share of $1.75, far exceeding analysts' expectations of $1.10.

2. Surging Orders: The company saw a 46% increase in orders last quarter, signaling strong demand for its products.

3. Revenue Growth: GE generated $10.8 billion in revenue, beating forecasts of $10 billion.

4. Wall Street Optimism: Analysts are raising price targets, with some predicting the stock could climb even higher.

5. Industry Momentum: The aerospace sector is experiencing a boom, with GE positioned as a key player.

I'm betting we are close to a pullback and then catapult to New ATH!

Honeywell: Quantum Leap or Geopolitical Gambit?Honeywell is strategically positioning itself for significant future growth by aligning its portfolio with critical megatrends, notably aviation's future and quantum computing's burgeoning field. The company demonstrates remarkable resilience and foresight, actively pursuing partnerships and investments designed to capture emerging market opportunities and solidify its leadership in diversified industrial technologies. This forward-looking approach is evident across its core business segments, driving innovation and market expansion.

Key initiatives underscore Honeywell's trajectory. In aerospace, the selection of the JetWave™ X system for the U.S. Army's ARES aircraft highlights its role in enhancing defense capabilities through advanced, resilient satellite communication. Furthermore, the expanded partnership with Vertical Aerospace for the VX4 eVTOL aircraft's critical systems positions Honeywell at the forefront of urban air mobility. In the realm of quantum computing, Honeywell's majority-owned Quantinuum subsidiary recently secured a potentially $1 billion joint venture with Qatar's Al Rabban Capital, aiming to develop tailored applications for the Gulf region. This significant investment provides Quantinuum with a first-mover advantage in a rapidly expanding global market.

Geopolitical events significantly influence Honeywell's operational landscape. Increased global defense spending presents opportunities for its aerospace segment, while trade policies and regional dynamics necessitate strategic adaptation. Honeywell addresses these challenges through proactive measures like managing tariff impacts via pricing and supply chain adjustments, and by realigning its structure, such as the planned three-way breakup, to enhance focus and agility. The company's strategic planning emphasizes leading indicators and high-confidence deliverables, bolstering its ability to navigate global complexities and capitalize on opportunities arising from shifting geopolitical currents.

Analysts project strong financial performance for Honeywell, forecasting substantial increases in revenue and earnings per share over the coming years, which supports expected dividend growth. While the stock trades at a slight premium to historical averages, analyst ratings and institutional investor confidence reflect positive sentiment regarding the company's strategic direction and growth prospects. Honeywell's commitment to innovation, strategic partnerships, and adaptable operations positions it robustly to achieve sustained financial outperformance and maintain market leadership amidst a dynamic global environment.

Joby Aviation, Inc.Key arguments in support of the idea:

Over the past quarter, Joby Aviation has made meaningful progress toward certification of its electric air taxi. The company has now completed 62% of Stage 4, advancing 12 ppts in just one quarter. Engineers successfully conducted piloted transition flights, and a series of fault-tolerance tests—where batteries, tilt mechanisms, and even half of the engines were deliberately shut off—ended in safe landings, showcasing the robustness of Joby’s safety systems.

Progress on the certification front is complemented by tangible manufacturing achievements. Five fully functional flight prototypes have already been assembled, with each new unit being produced faster, more efficiently, and at lower cost. Scaling efforts are supported by a strong strategic partnership with Toyota, which plans to invest up to $500 million this year to help Joby refine its production processes. The company’s order backlog stands at approximately 1,500 units.

Joby is looking beyond California for operations. A pilot service is scheduled to launch in Dubai in spring 2026, with the first vertiports already under development. Test flights are expected to begin by mid2025. Simultaneously, a MoU has been signed with Virgin Atlantic, paving the way for future service networks in London and Manchester.

Joby’s monetization strategy is highly flexible—ranging from direct aircraft sales and defense contracts to joint ventures and proprietary passenger routes in partnership with Delta, Uber, and Virgin. The company currently holds $813 million in cash and has a disciplined 2025 spending plan of $500–540 million.

While Archer Aviation (ACHR) didn’t surprise with its latest report, its stock still saw impressive gains. We believe Joby could follow suit—especially given the overlap in their operational zones, as Joby’s stock typically reacts to competitor moves with a slight delay. Investors are beginning to price in the upcoming launch of eVTOL commercial operations, which could periodically trigger strong upward momentum in the stock. Technically, the chart also shows signs of an "inverse head and shoulders" formation.

2-month target price for JOBY is $8.50. We recommend setting a stop loss at $6.10.

Hexcel CorporationKey arguments in support of the idea:

Hexcel Corp. (HXL) engages in the development, manufacture, and marketing of lightweight structural materials. It operates through the Composite Materials and Engineered Products segments. The Composite Materials segment includes carbon fiber, specialty reinforcements, resins, prepregs and other fiber-reinforced matrix materials, and honeycomb core product lines and pultruded profiles. The Engineered Products segment refers to the lightweight high strength composite structures, engineered core and honeycomb products with added functionality, and additive manufacturing.

As of the end of 2024, approximately 40% of Hexcel’s revenue comes from Airbus and 15% from Boeing (BA). The latest quarterly outlook signals flat revenue expectations, although we believe there are still identifiable growth drivers.

While Airbus delivered fewer aircraft in Q1 2025 compared to the same period last year, the company reaffirmed its commitment to expanding production capacity for the A320neo—one of Hexcel’s the most exposed programs. A resolution between the U.S. and EU on tariffs would represent a highly favorable scenario for the company.

Hexcel’s second- and third-largest programs are the Boeing 737 MAX and 787. Recent delivery data from April shows Boeing is gradually increasing production for both aircraft, suggesting that Hexcel’s revenue share from Boeing could rise in 2025 and beyond. For context, Boeing accounted for 25% of Hexcel’s revenue in 2019, 10 ppts higher than the current level.

Hexcel’s stock performance has closely tracked that of Boeing over the past year. However, HXL has yet to fully catch up to Boeing’s recovery. HXL is currently trading above its 50-day moving average and is gradually gaining momentum.

We expect HXL shares to reach $61 within the next 2 months. We recommend setting a stop loss at $49.70.

DEFENSE EU vs USEU defense massively outperforming the US up 50% from the lows.

Lockheed Martin is forced to console American allies, convincing them not to abandon the US Defense industry as Trump completely destroys it with his pro-Russia behavior.

I don't see any way back to NATO normal. Trump has weaponized the US defense industry against our (former allies?) allies and that is unacceptable. The US defense industry mostly sells $107 billion annually to NATO, EU nations.

This win-win EU-US relationship between our allies has made it possible for the US to develope and sustain military technology we would otherwise not have been able to afford alone.

So America first? Not really. More like America last!

At any rate, should a downturn occur and need to be long. #EUAD is a good place to be.

What Drives Elbit Systems' Expansion?Elbit Systems is demonstrating significant forward momentum, underpinned by strategic international collaborations and advanced technological offerings that address specific defense needs. A cornerstone of this expansion is the deepening partnership with Germany's Diehl Defence. Together, they are bringing the Euro-GATR precision-guided rocket system to the German Army's helicopter fleet, showcasing Elbit's ability to integrate sophisticated, cost-effective solutions into established European defense frameworks and build upon existing industrial cooperation.

Simultaneously, Elbit is a potential key supplier for Greece's substantial multi-billion Euro defense modernization initiative. With Greece actively seeking rapid procurement from strategic partners such as Israel, discussions are reportedly underway regarding Elbit's Puls multiple rocket launcher systems. Securing participation in this large-scale program would represent a significant market penetration for Elbit, highlighting its growing role in equipping NATO allies that are undertaking significant capability upgrades.

This combination of strategic positioning and sought-after technology is attracting notable attention from the financial community. A marked increase in share purchases by institutional investors, prominently featuring Vanguard Group Inc., signals strong market confidence in Elbit's growth strategy and prospects. This investor validation, coupled with concrete collaborations and significant market opportunities, paints a picture of a company effectively leveraging innovation and partnerships to fuel its international expansion.

What Rules the Skies Now?In a landmark decision reshaping the future of aerial warfare, Boeing has secured the U.S. Air Force's Next Generation Air Dominance (NGAD) contract, giving rise to the F-47, a sixth-generation fighter poised to redefine air superiority. This advanced aircraft, succeeding the F-22 Raptor, promises unprecedented capabilities in stealth, speed, maneuverability, and payload, signaling a significant leap in aviation technology. The F-47 is not conceived as a solitary platform but as the core of an integrated "family of systems," working in concert with autonomous drone wingmen known as Collaborative Combat Aircraft (CCAs) to project power and enhance mission effectiveness in contested environments.

The development of the F-47 directly responds to the evolving global threat landscape, particularly the advancements made by near-peer adversaries like China and Russia. Designed with a focus on extended range and superior stealth, the F-47 is specifically tailored to operate effectively in high-threat regions, such as the Indo-Pacific. Years of clandestine experimental flight testing have validated key technologies, positioning the F-47 for a potentially accelerated deployment timeline. This next-generation fighter is expected to surpass its predecessors in critical areas, offering enhanced sustainability, supportability, and a reduced operational footprint, all while potentially costing less than the F-22.

The designation "F-47" itself carries historical and symbolic weight, honoring the legacy of the World War II-era P-47 Thunderbolt and commemorating the founding year of the U.S. Air Force. Furthermore, it acknowledges the pivotal role of the 47th President in supporting its development. Design elements observed in early visualizations hint at a lineage with Boeing's experimental aircraft, suggesting a blend of proven concepts and cutting-edge innovation. As the F-47 program moves forward, it represents not only a strategic investment in national security but also a testament to American ingenuity in maintaining its dominance of the skies.

Can L3Harris Redefine Defense and Space Frontiers?L3Harris Technologies stands at the crossroads of innovation and resilience, captivating investors and strategists with its bold vision. JPMorgan’s recent price target hike to $240 reflects confidence in its focus on margin expansion and cash flow, spotlighted during its investor day. Yet, this financial optimism intertwines with ambitious proposals—like doubling the EA-37B Compass Call fleet—challenging fiscal realities while addressing Indo-Pacific threats. What if a company could turn budgetary constraints into catalysts for growth? L3Harris dares to answer, blending pragmatism with a forward-leaning stance that intrigues and inspires.

On the technological front, L3Harris pushes boundaries with AI-driven autonomy and precision firepower. Its partnership with Shield AI fuses the DiSCO™ system with Hivemind software, promising real-time adaptability in electromagnetic warfare—a leap that could redefine battlefield dominance. Simultaneously, breakthroughs like long-range precision fires from VTOL platforms and rugged EO/IR systems for land missions showcase a relentless drive to equip warfighters for multi-domain challenges. Imagine a future where machines anticipate threats faster than humans can blink—L3Harris is crafting that reality, urging us to question the limits of human-machine synergy.

Beyond Earth, L3Harris powers NASA’s Artemis V with the newly assembled RS-25 engine, merging cost efficiency with cosmic ambition. This duality—mastering defense while reaching for the stars—positions the company as a paradox worth pondering. Can one entity excel in the gritty pragmatism of war and the boundless dreams of exploration? As L3Harris navigates tight budgets, evolving threats, and technological frontiers, it challenges readers to envision a world where resilience and imagination coexist, daring us to rethink what’s possible in a single corporate footprint.

Can Innovation Sink Stealthily Beneath the Waves?General Dynamics, a titan in aerospace and defense, is charting bold new waters, as revealed in its latest endeavors reported on March 4, 2025. Beyond its renowned submarine prowess, the company has secured a $31 million contract from the Department of Health and Human Services, venturing into healthcare IT with potential AI-driven solutions. Simultaneously, a $52.2 million DARPA contract fuels the APEX project, pushing the boundaries of submarine propulsion with stealth and efficiency at its core. These moves signal a future where technology transcends traditional battlegrounds, challenging us to rethink the intersections of defense, health, and innovation.

Financially, the company stands resilient, with a stock price hovering at $243 and a market cap of $65.49 billion, bolstered by a 14.2% earnings surge to $1.1 billion in Q4 2024. Analysts peg it as a "Hold" with a $296.71 target, reflecting cautious optimism, while institutional giants like Jones Financial bolster their stakes. Yet, a director’s recent stock sale stirs intrigue—confidence or caution? The Virginia Class submarine program, enhanced by a $35 million contract modification, further cements General Dynamics’ naval dominance, urging us to ponder: how does such multifaceted growth reshape global power dynamics?

Looking forward, General Dynamics is poised to ride a 7.6% CAGR wave in the submarine market through 2030, driven by its Electric Boat division. Its commitment to a 40% greenhouse gas reduction by 2034 adds a layer of responsibility to its ambition, blending technological leaps with sustainability. This duality invites a deeper question: can a company rooted in defense also pioneer a greener, smarter world? As General Dynamics navigates uncharted territories—from silent seas to healthcare’s digital frontier—it challenges us to imagine where innovation might lead when stealth meets purpose.

Explore submarine technology

Healthcare IT advancements

Make title more intriguing

Can Innovation Soar Higher Than the F-22 Itself?Pratt & Whitney, a titan in aerospace propulsion, has clinched a $1.5 billion, three-year contract from the U.S. Air Force to sustain the F119 engines powering the F-22 Raptor, announced on February 20, 2025. This deal is more than a financial milestone; it’s a bold step toward redefining military aviation through innovation and efficiency. With over 400 engines, boasting 900,000 flight hours, under its wing, Pratt & Whitney is tasked with enhancing readiness and slashing costs—ensuring the Raptor remains a predatory force in the skies. Imagine a future where every ounce of thrust is optimized, every maintenance call timed to perfection: this contract dares to make that vision real.

The F119 engine isn’t just machinery; it’s the heartbeat of the F-22, delivering over 35,000 pounds of thrust to pierce altitudes above 65,000 feet and sustain supersonic speeds without afterburners. This supercruise capability stretches fuel efficiency and range, giving pilots an edge in air superiority missions. Coupled with upgrades like next-generation infrared sensors, the F-22 is evolving into a smarter, sharper weapon. But here’s the challenge: can technological leaps like the Usage-Based Lifing (UBL) program, which uses real-time data to predict maintenance needs, truly transform how we sustain such power? With projected savings topping $800 million, Pratt & Whitney suggests yes—pushing readers to ponder the limits of predictive ingenuity.

Financially, this contract is a jetstream of opportunity for Pratt & Whitney, whose 2023 revenue hit $16.2 billion. Against rivals like General Electric and Rolls Royce, this deal fortifies their stronghold in military aviation, promising a steady climb in market influence. Yet beyond dollars, it’s a narrative of ambition: sustaining a fleet that defends nations while pioneering methods that could ripple across industries. What if this blend of power and precision isn’t just about maintaining jets but elevating how we innovate under pressure? The skies are watching—and so should you.

Can Quantum Leap Us into the Cosmos?Boeing's venture into the quantum realm is not just an exploration; it's a bold leap forward into a universe where technology transcends traditional boundaries. Through its involvement in the Quantum in Space Collaboration and the pioneering Q4S satellite project, Boeing is at the forefront of harnessing quantum mechanics for space applications. This initiative promises to revolutionize how we communicate, navigate, and secure data across the vast expanse of space, potentially unlocking new realms of scientific discovery and commercial opportunity.

Imagine a world where quantum sensors offer unprecedented precision, where quantum computers process data at speeds and volumes previously unimagined, and where communications are secured beyond the reach of conventional decryption. Boeing's efforts are not merely about technological advancement; they are about redefining the very fabric of space exploration and security. By demonstrating quantum entanglement swapping in orbit with the Q4S satellite, Boeing is laying the groundwork for a global quantum internet. This network could connect Earth to the stars with unbreakable security and accuracy.

This journey into quantum space technology challenges our understanding of physics and our expectations for the future. With its history of aerospace innovation, Boeing is now poised to lead in an area where the stakes are as high as the potential rewards. The implications of this work extend far beyond secure communications; they touch on every aspect of space utilization, from manufacturing in microgravity to precise environmental monitoring of our planet and beyond. As we stand on the brink of this new frontier, the question isn't just about what quantum technology can do for space, but how it will transform our very approach to living, exploring, and understanding the cosmos.

AXON & KTOS: Completely Overvalued at This Stage**📉 AXON & KTOS: Completely Overvalued at This Stage**

Both AXON and KTOS have run too far, too fast. Valuations are stretched, and the risk-reward is no longer attractive. At these levels, the upside looks limited while the downside potential is growing. I'm taking a short position against both. 🚨