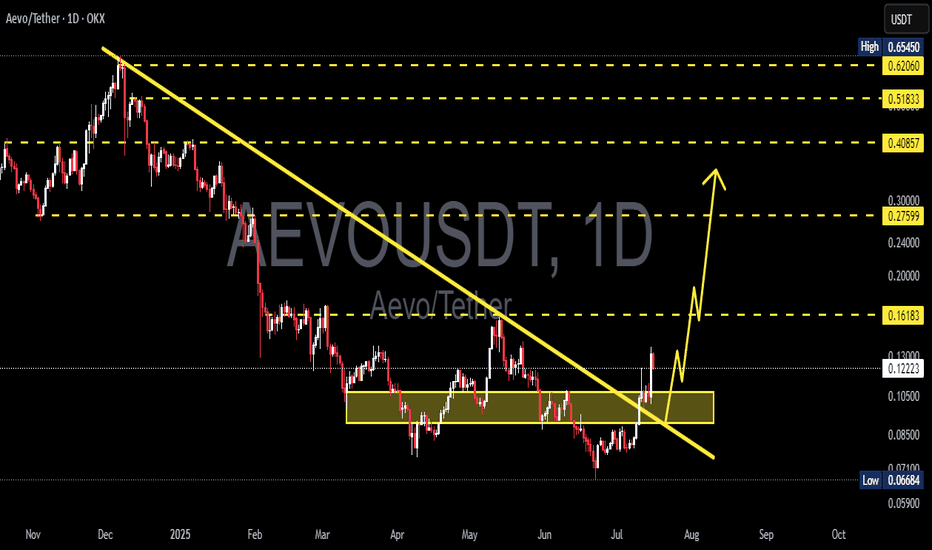

AEVO/USDT – Major Trendline Breakout! Is This the Beginning?🔍 Chart Overview & Pattern Analysis

The AEVO/USDT daily chart reveals a significant breakout from a long-term descending trendline that has been intact since November 2024. This trendline acted as a strong dynamic resistance, suppressing every bullish attempt—until now.

A clear multi-month accumulation zone is visible between $0.080 – $0.105 (highlighted in yellow). Price tested this support zone multiple times, forming a strong base of demand. The combination of horizontal support and descending resistance creates a classic descending triangle breakout, often signaling a trend reversal when broken to the upside.

What's more, price action recently:

Broke above the trendline with strong bullish candles

Retested the breakout zone successfully

Is now forming a potential bullish continuation structure (mini bull flag or pennant)

This structure suggests that the bulls are not done yet—and momentum could be accelerating.

🟢 Bullish Scenario – The Path to Higher Highs

If AEVO continues to hold above the breakout zone, the following upside targets become very realistic:

✅ Target 1: $0.16183 – Previous resistance zone, short-term TP.

✅ Target 2: $0.27599 – Key horizontal resistance from late Q1 2025.

✅ Target 3: $0.40857 – Weekly structure resistance.

✅ Target 4: $0.51833 – Bullish extension zone.

🎯 Ultimate Bull Target: $0.62660 – Full recovery to pre-downtrend levels.

Confluence factors supporting this bullish outlook:

Breakout above dynamic and static resistances

Accumulation breakout after long consolidation

Higher low and bullish retest pattern

Bullish momentum building with volume confirmation (volume not shown but implied)

🔴 Bearish Scenario – Key Levels to Watch

In case of a false breakout or macro weakness:

Breakdown below $0.105 could invalidate the bullish structure

Price could revisit $0.080 or even $0.06684 (last line of defense)

A daily close below this zone would shift the bias back to bearish or neutral

However, as long as price stays above the yellow support box, the bullish thesis remains valid.

---

🧠 Key Technical Highlights

Pattern: Descending Triangle Breakout + Accumulation Base

Trend Shift: From Bearish to Bullish (confirmed with breakout + retest)

Momentum: Building up toward higher time frame resistances

Market Psychology: Smart money likely accumulated during sideways chop

📣 Final Thoughts

AEVO/USDT is showing one of the cleanest breakout structures in the altcoin space right now. With clear upside targets, a retested breakout zone, and strengthening market structure, this could be the early phase of a major bullish leg.

Traders and investors should watch for confirmation of higher highs and pullbacks to the $0.105 zone for potential entries.

#AEVOUSDT #CryptoBreakout #TrendReversal #AltseasonReady #DescendingTriangle #CryptoTA #BullishCrypto #AltcoinAnalysis #TechnicalBreakout #AEVOAnalysis

AEVOUSD

AEVO Main Trend DEX L2 Listing 212 X !) Decrease -98% 06 25Logarithm. Term 3 days.

Asset super hype in the past, listing with overly positive and aggressive marketing at 212X!

1️⃣Q1 2023 Private Seed $0.0185 / $1.85 million

2️⃣10 05 2023 Private Series A $0.13 / $6.01 million

3️⃣Q4 2023 Private Series A+ $0.25 / $8.75 million

4️⃣13 03 2024 Listing on the Binance exchange on the day of the secondary market trend reversal (I missed it, and it happens).

26 06 2025 now -98% decline after listing, which is 4.2X from the last prices of scammers, who gradually distributed, maintaining liquidity and the news background all this time their huge profit. Most of the coins are redistributed. You can think about collecting in this sideways, on a breakout of a local wedge (local trend), or on a breakout of a descending channel (reversal of the main trend).

Those who are far from trading can buy in equal parts (3 parts). From the position of the main trend and potential, the prices are now acceptable (you can buy the first part), so to speak (former "hype investors" are in wild horror).

Exit zones will be zones of previous consolidation, that is, those who previously bought on the hype will not be able to make a profit. In fact, it is always like this ... There are no “passengers”, then they will pump up well. As a rule, +800-1000% such assets of the previous excitement and such liquidity.

Local reversal zone.

#AEVO/USDT#AEVO

The price is moving in a descending channel on the 1-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 0.3595

Entry price 0.3624

First target 0.3856

Second target 0.3856

Third target 0.3976

#AEVO/USDT#AEVO

The price is moving within a descending channel on the 1-hour frame and is expected to continue lower.

We have a trend to stabilize below the 100 moving average once again.

We have a downtrend on the RSI indicator, supporting the upward move with a break above it.

We have a resistance area at the upper limit of the channel at 0.1100.

Entry price: 0.1093

First target: 0.1079

Second target: 0.1069

Third target: 0.1057

AEVO ANALYSIS (1D)It seems to be completing a triangle. If it reaches the green limit, we will look for buy/long positions.

The targets are marked on the chart.

Closing a daily candle below the invalidation level will violate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

AEVO's Ascendant Path: Riding the Breakout WaveAEVO shows good accumulation and several bullish signals. It reminds me of the Goldfinch chart. Overall I would expect a return to the $2 area minimum. I like the project in terms of the funds and the market maker that is here. Wintermute have started to spread coins around the exchanges, this is a signal to fly, the pumping software will be activated soon! Buckle up!

Horban Brothers.

Explosive Long-Term Potential - Aptos Evolved ($AEVOUSDT)I spend time researching and finding the best entries and setups, so make sure to boost and follow for more.

Aptos Evolved ( BINANCE:AEVOUSDT ): Daily Timeframe Analysis for Explosive Long-Term Potential

Trade Setup:

- Entry Price: $0.4505

- Stop-Loss: $0.3109

- Take-Profit Targets:

- TP1: $1.0672

- TP2: $2.5329

Fundamental Analysis:

Aptos Evolved ( BINANCE:AEVOUSDT ) is making waves in the blockchain space with its innovative approach to scalability and decentralized applications. Designed to meet the demands of next-generation DeFi protocols, BINANCE:AEVOUSDT has steadily built a strong ecosystem. Recent partnerships and a focus on interoperability have positioned this project for significant long-term growth.

BINANCE:AEVOUSDT has been consolidating for months, and this moment feels like the calm before the storm. With strong fundamentals and increasing attention from both institutional and retail investors, BINANCE:AEVOUSDT is ready for a breakout. If you’ve been waiting for the right time, this is it—make sure you’re in!

Technical Analysis (Daily Timeframe):

- Current Price: $0.4520

- Moving Averages:

- 50-Day SMA: $0.4250

- 200-Day SMA: $0.3800

- Relative Strength Index (RSI): Currently at 61, indicating increasing bullish momentum.

- Support and Resistance Levels:

- Support: $0.4000

- Resistance: $0.6000

The daily chart shows a classic breakout pattern, with BINANCE:AEVOUSDT breaking out of its consolidation phase. With strong volume support and bullish divergence on the RSI, the setup looks primed for a significant move toward the first target at $1.0672. TP2 at $2.5329 represents the long-term explosion many have been anticipating.

Market Sentiment:

Market sentiment around BINANCE:AEVOUSDT is overwhelmingly positive. Recent developments, such as new partnerships and integrations with major DeFi protocols, have sparked renewed interest. Long-term holders are showing confidence, and trading volume has picked up significantly, reflecting increasing demand.

Risk Management:

A stop-loss at $0.3109 protects against downside risks, while the targets offer exceptional reward potential. TP1 provides a 137% return, while TP2 offers a massive 462% gain, aligning with long-term growth expectations.

Key Takeaways:

- ASX:AEVO is positioned for a significant rally after months of consolidation.

- A strong technical setup combined with growing ecosystem fundamentals makes this a must-watch opportunity.

- Long-term holders should find confidence in BINANCE:AEVOUSDT potential to deliver explosive returns.

When the Market’s Call, We Stand Tall. Bull or Bear, We’ll Brave It All!

*Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Traders should conduct their own due diligence before making investment decisions.*

AEVOUSDTAEVO ~ 2D

#AEVO We were late in finding the lowest price on this coin.

For now,,. If you are an aggressive trader, you can buy gradually after this red resistance line is successfully broken through with strong volume. or if you are a trader who plays it safe,. you can place buy on this support block, However, if the bullish momentum on AEVO is still strong, then you will miss your opportunity.

#AEVO (SPOT) entry ( 0.285- 0.340) T. (0.934) SL (0.269)entry range ( 0.285- 0.340)

Target (0.934)

SL .4H close below (0.269)

************************************

BINANCE:AEVOUSDT

#AEVO

#AEVOUSDT

#AEVOUSD

#swingtrade

#shortterminvestment

#ALTCOIN

#Cryptotading

#cryptoinvesting

#investment

##trading

#cryptocurrencytrading

#bitcoininvestments

#Investing_Coins

#Investingcoins

#Crypto_investing

#Cryptoinvesting

**** #Manta ,#OMNI, #DYM, #AI, #IO, #XAI , #ACE #NFP #RAD #WLD #ORDI #BLUR #SUI #Voxel #AEVO ****

#bitcoin

#BTC

#BTCUSDT

AEVO the most hated coin atmAEVO / USDT

One of most hated coins at moment

Weeks of dumping and blood Since listed in binance

Its not about good coin or bad coin

Its about your timing .. if your action at right time you can always make profits

For people who asking me about it :

its finally broke 4 months decending channel pattern so price can start pumping around here

Probably AEVO price has reached its “bottom”It seems that the OKX:AEVOUSDT price has reached its “bottom”

After the airdrop and listing in March 2024, the #AEVO price dropped 10 times.

Now it looks like the #AEVOUSD price is breaking out of the downtrend.

Confirmation of strength and a buy signal will be if the price stays above $0.45-0.49

The target for medium-term growth is at least $0.95-1

85% of the coins are in circulation, which is also good.

#AEVO/USDT#AEVO

We have a bullish channel pattern on a 4-hour frame, the price moves within it and adheres to its limits well

We have a green support area at 0.700

We have a tendency to stabilize above moving average 100

We have an uptrend on the RSI indicator that supports the price higher

Entry price is 0.820

The first goal is 1.08

The second goal is 1.25

the third goal is 1.47

Trade Idea for Aevo (AEVO) - Accumulation StrategyAevo (AEVO) is currently trading around $0.82, experiencing significant volatility due to upcoming token unlock events and its recent market performance. With a circulating supply of 110 million AEVO and a maximum supply of 1 billion, the market cap stands at approximately $90 million.

Consider initiating a position at the current price level of approximately $0.82. This price provides a strategic entry point, considering the recent price corrections and the potential for future rebounds.

Plan to accumulate additional AEVO tokens at lower price points of $0.80 and $0.60. This approach allows for averaging down the entry price and capitalizing on market dips.

Set multiple take-profit targets to capture potential gains during upward price movements. The initial targets can be set at $1.80 and $2.25, followed by $3.00 and $3.50. These targets are chosen based on psychological price levels and potential resistance points.

On May 15, 2024, a significant token unlock event will increase the circulating supply by 827.6 million tokens. This could lead to short-term price volatility but also presents opportunities for strategic accumulation during potential dips.

AEVO’s role as a decentralized derivatives exchange with a custom Layer 2 solution enhances its value proposition. Despite recent declines, the long-term potential remains promising due to its robust trading infrastructure and backing by significant investors.

Accumulating AEVO at strategic price points leverages market volatility and the potential for future growth. The phased profit-taking strategy aims to optimize returns as the market potentially appreciates following the token unlock event and increased adoption.

This trade idea is based on the current market data and AEVO’s strategic positioning as of May 2024. Cryptocurrency investments carry inherent risks, including the loss of principal. Investors should conduct their own research and consider their financial circumstances and risk appetite before engaging in cryptocurrency trading. This analysis is not financial advice.

Aevo completed a setup for upto 60% pumpHi dear friends, hope you are well and welcome to the new trade setup of Aevo with US Dollar pair.

Recently we caught a nice trade of AEVO as below:

Now on a daily time frame, AEVO has formed a bullish Gartley move for the next price reversal.

Note: Above idea is for educational purpose only. It is advised to diversify and strictly follow the stop loss, and don't get stuck with trade.

Aevo completed a setup for upto 26% pumpHi dear friends, hope you are well and welcome to the new trade setup of Aevo with US Dollar pair.

Recently we caught almost a nice trade of AEVO as below:

Now on a 2-hr time frame, AEVO has formed a bullish Gartley move for the next price reversal.

Note: Above idea is for educational purpose only. It is advised to diversify and strictly follow the stop loss, and don't get stuck with trade.

AEVO MID TERMAevo operates on Aevo L2, a custom Ethereum rollup created using the Optimism stack. This enables Aevo to support over 5,000 transactions per second and process over $30 billion in trading volume.

With a market cap of $300 million, we expect this token to show significant growth in the medium term.