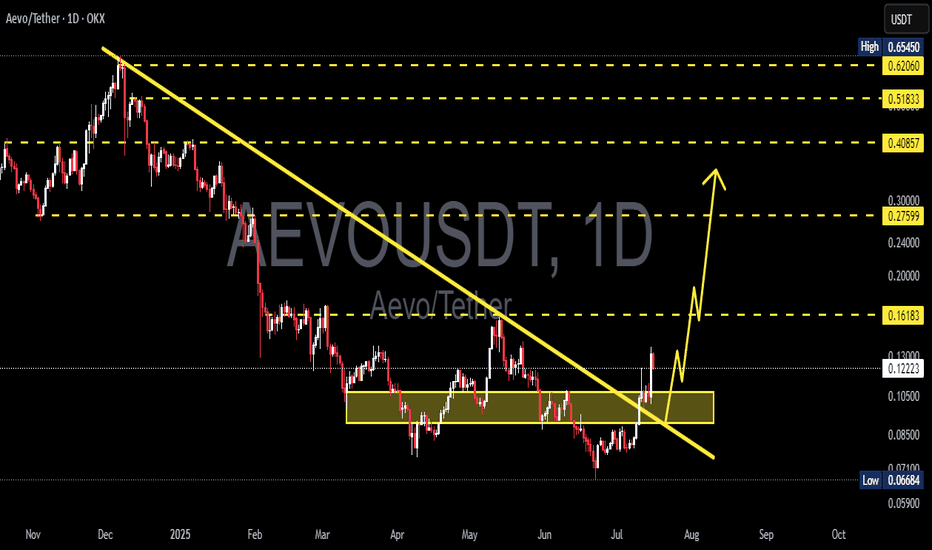

AEVO/USDT – Major Trendline Breakout! Is This the Beginning?🔍 Chart Overview & Pattern Analysis

The AEVO/USDT daily chart reveals a significant breakout from a long-term descending trendline that has been intact since November 2024. This trendline acted as a strong dynamic resistance, suppressing every bullish attempt—until now.

A clear multi-month accumulation zone is visible between $0.080 – $0.105 (highlighted in yellow). Price tested this support zone multiple times, forming a strong base of demand. The combination of horizontal support and descending resistance creates a classic descending triangle breakout, often signaling a trend reversal when broken to the upside.

What's more, price action recently:

Broke above the trendline with strong bullish candles

Retested the breakout zone successfully

Is now forming a potential bullish continuation structure (mini bull flag or pennant)

This structure suggests that the bulls are not done yet—and momentum could be accelerating.

🟢 Bullish Scenario – The Path to Higher Highs

If AEVO continues to hold above the breakout zone, the following upside targets become very realistic:

✅ Target 1: $0.16183 – Previous resistance zone, short-term TP.

✅ Target 2: $0.27599 – Key horizontal resistance from late Q1 2025.

✅ Target 3: $0.40857 – Weekly structure resistance.

✅ Target 4: $0.51833 – Bullish extension zone.

🎯 Ultimate Bull Target: $0.62660 – Full recovery to pre-downtrend levels.

Confluence factors supporting this bullish outlook:

Breakout above dynamic and static resistances

Accumulation breakout after long consolidation

Higher low and bullish retest pattern

Bullish momentum building with volume confirmation (volume not shown but implied)

🔴 Bearish Scenario – Key Levels to Watch

In case of a false breakout or macro weakness:

Breakdown below $0.105 could invalidate the bullish structure

Price could revisit $0.080 or even $0.06684 (last line of defense)

A daily close below this zone would shift the bias back to bearish or neutral

However, as long as price stays above the yellow support box, the bullish thesis remains valid.

---

🧠 Key Technical Highlights

Pattern: Descending Triangle Breakout + Accumulation Base

Trend Shift: From Bearish to Bullish (confirmed with breakout + retest)

Momentum: Building up toward higher time frame resistances

Market Psychology: Smart money likely accumulated during sideways chop

📣 Final Thoughts

AEVO/USDT is showing one of the cleanest breakout structures in the altcoin space right now. With clear upside targets, a retested breakout zone, and strengthening market structure, this could be the early phase of a major bullish leg.

Traders and investors should watch for confirmation of higher highs and pullbacks to the $0.105 zone for potential entries.

#AEVOUSDT #CryptoBreakout #TrendReversal #AltseasonReady #DescendingTriangle #CryptoTA #BullishCrypto #AltcoinAnalysis #TechnicalBreakout #AEVOAnalysis

Aevousdt

AEVO Main Trend DEX L2 Listing 212 X !) Decrease -98% 06 25Logarithm. Term 3 days.

Asset super hype in the past, listing with overly positive and aggressive marketing at 212X!

1️⃣Q1 2023 Private Seed $0.0185 / $1.85 million

2️⃣10 05 2023 Private Series A $0.13 / $6.01 million

3️⃣Q4 2023 Private Series A+ $0.25 / $8.75 million

4️⃣13 03 2024 Listing on the Binance exchange on the day of the secondary market trend reversal (I missed it, and it happens).

26 06 2025 now -98% decline after listing, which is 4.2X from the last prices of scammers, who gradually distributed, maintaining liquidity and the news background all this time their huge profit. Most of the coins are redistributed. You can think about collecting in this sideways, on a breakout of a local wedge (local trend), or on a breakout of a descending channel (reversal of the main trend).

Those who are far from trading can buy in equal parts (3 parts). From the position of the main trend and potential, the prices are now acceptable (you can buy the first part), so to speak (former "hype investors" are in wild horror).

Exit zones will be zones of previous consolidation, that is, those who previously bought on the hype will not be able to make a profit. In fact, it is always like this ... There are no “passengers”, then they will pump up well. As a rule, +800-1000% such assets of the previous excitement and such liquidity.

Local reversal zone.

#AEVO/USDT#AEVO

The price is moving in a descending channel on the 1-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 0.3595

Entry price 0.3624

First target 0.3856

Second target 0.3856

Third target 0.3976

#AEVO/USDT#AEVO

The price is moving within a descending channel on the 1-hour frame and is expected to continue lower.

We have a trend to stabilize below the 100 moving average once again.

We have a downtrend on the RSI indicator, supporting the upward move with a break above it.

We have a resistance area at the upper limit of the channel at 0.1100.

Entry price: 0.1093

First target: 0.1079

Second target: 0.1069

Third target: 0.1057

AEVO LONG DEVIATION For the past 7 months, AEVO has ranged between $0.60 and $0.25. It seems to have broken below this range, creating a new low. However, for those with patience, this presents an ideal setup for a long position in this coin.

At the moment, market psychology suggests the following:

Traders who bought at the support zone are now losing money and likely closing their positions or even opening shorts, adding liquidity.

Meanwhile, whales that shorted from $0.64 down to the current levels are likely accumulating below support.

These whales could push the price higher to liquidate short positions.

As the price rises, short sellers may be forced to close in losses or add to their losing positions, creating further fuel for an upward move.

If the price re-enters the range, this would confirm that the breakdown was just a stop hunt, signaling a good opportunity to open a long-term position.

$AEVO at the Lows – Can It Get Any Better?Decided to start buying ASX:AEVO at these levels. It reminds me a lot of CRYPTOCAP:ETHFI , and with CRYPTOCAP:ETH holding up well for now, I'm feeling optimistic.

It's been 5 days without a new low at a key level, so it looks promising. I might get another shot at the lows, so I have some bids placed lower just in case.

AEVO ANALYSIS (1D)It seems to be completing a triangle. If it reaches the green limit, we will look for buy/long positions.

The targets are marked on the chart.

Closing a daily candle below the invalidation level will violate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

AEVO's Ascendant Path: Riding the Breakout WaveAEVO shows good accumulation and several bullish signals. It reminds me of the Goldfinch chart. Overall I would expect a return to the $2 area minimum. I like the project in terms of the funds and the market maker that is here. Wintermute have started to spread coins around the exchanges, this is a signal to fly, the pumping software will be activated soon! Buckle up!

Horban Brothers.

Explosive Long-Term Potential - Aptos Evolved ($AEVOUSDT)I spend time researching and finding the best entries and setups, so make sure to boost and follow for more.

Aptos Evolved ( BINANCE:AEVOUSDT ): Daily Timeframe Analysis for Explosive Long-Term Potential

Trade Setup:

- Entry Price: $0.4505

- Stop-Loss: $0.3109

- Take-Profit Targets:

- TP1: $1.0672

- TP2: $2.5329

Fundamental Analysis:

Aptos Evolved ( BINANCE:AEVOUSDT ) is making waves in the blockchain space with its innovative approach to scalability and decentralized applications. Designed to meet the demands of next-generation DeFi protocols, BINANCE:AEVOUSDT has steadily built a strong ecosystem. Recent partnerships and a focus on interoperability have positioned this project for significant long-term growth.

BINANCE:AEVOUSDT has been consolidating for months, and this moment feels like the calm before the storm. With strong fundamentals and increasing attention from both institutional and retail investors, BINANCE:AEVOUSDT is ready for a breakout. If you’ve been waiting for the right time, this is it—make sure you’re in!

Technical Analysis (Daily Timeframe):

- Current Price: $0.4520

- Moving Averages:

- 50-Day SMA: $0.4250

- 200-Day SMA: $0.3800

- Relative Strength Index (RSI): Currently at 61, indicating increasing bullish momentum.

- Support and Resistance Levels:

- Support: $0.4000

- Resistance: $0.6000

The daily chart shows a classic breakout pattern, with BINANCE:AEVOUSDT breaking out of its consolidation phase. With strong volume support and bullish divergence on the RSI, the setup looks primed for a significant move toward the first target at $1.0672. TP2 at $2.5329 represents the long-term explosion many have been anticipating.

Market Sentiment:

Market sentiment around BINANCE:AEVOUSDT is overwhelmingly positive. Recent developments, such as new partnerships and integrations with major DeFi protocols, have sparked renewed interest. Long-term holders are showing confidence, and trading volume has picked up significantly, reflecting increasing demand.

Risk Management:

A stop-loss at $0.3109 protects against downside risks, while the targets offer exceptional reward potential. TP1 provides a 137% return, while TP2 offers a massive 462% gain, aligning with long-term growth expectations.

Key Takeaways:

- ASX:AEVO is positioned for a significant rally after months of consolidation.

- A strong technical setup combined with growing ecosystem fundamentals makes this a must-watch opportunity.

- Long-term holders should find confidence in BINANCE:AEVOUSDT potential to deliver explosive returns.

When the Market’s Call, We Stand Tall. Bull or Bear, We’ll Brave It All!

*Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Traders should conduct their own due diligence before making investment decisions.*

TradeCityPro | AEVO : Accumulation Box with Potential for Growth👋 Welcome to TradeCityPro!

In this analysis, I’m going to review the AEVO coin. This project operates in the Premarket space, providing users with charts of coins before they are listed, enabling them to trade within this market.

📅 Daily Timeframe: Accumulation Box

On the daily timeframe, we observe a ranging accumulation box that, unlike most altcoins, has not been broken yet and remains below the resistance level of 0.6160.

💪 There is a critical zone at 0.4472 that acted as a strong resistance prior to being broken. After the breakout, during a market correction, this zone prevented a deeper price drop and provided a strong recovery for the coin.

✨ The RSI indicator has shown a very strong positive divergence since the beginning of the chart, featuring five lows. Currently, this divergence is active and could reflect its influence on the chart.

🛒 The key area right now is 0.6160. If this level is broken, the accumulation box will also break, and we can expect the divergence to manifest its effect on the price action.

📈 Upon breaking this level, the next resistance levels are 0.7776 and 1.0775. The next major resistance is the ATH, located at 3.6599. Considering the project's low market cap, reaching this target is plausible if sufficient buying volume enters the market.

🤝 If you already hold AEVO and are in profit, I recommend continuing to hold, as the coin has not moved significantly yet. Given its high potential, it’s worth holding at least until 0.7776 or 1.0775.

🔽 Correction Scenario

If the price corrects, the first significant area is 0.4472, which has been tested once and has proven to be very robust. In the event of a deeper correction, 0.2823 is the most critical level on this chart and represents the coin’s final stronghold.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

AEVOUSDT --> Just One Step Away From a Price SurgeThe AEVOUSDT chart presents an interesting scenario where price action remains constrained within a key resistance zone, but recent developments suggest the possibility of a breakout. Currently, the price is facing significant resistance near the 0.53–0.60 USDT level, a region where sellers have previously maintained control. Despite this, the chart reflects encouraging signs: the formation of a higher low (a newly established bottom) supported by an ascending trendline.

This development is particularly noteworthy in the context of broader market dynamics. As Bitcoin’s dominance in the cryptocurrency market gradually diminishes, altcoins like AEVO are finding opportunities to gain momentum. This shift in capital flow creates a fertile environment for AEVO to realize its bullish potential.

Before the price can decisively break through the resistance, a retest of the trendline is reasonable. This retest, likely within the 0.40–0.45 USDT range, will serve as a litmus test for the strength of buyer support.

If the trendline holds, AEVO will be well-positioned to push higher, eventually targeting the 1.1 USDT mark as investor confidence builds and resistance levels are surpassed.

#AEVO (SPOT) entry range( 0.2700- 0.3600) T.(2.3600) SL(0.2694)BINANCE:AEVOUSDT

entry range ( 0.2700- 0.3600)

Target1 (0.4140) - Target2 (0.5360) - Target3 (0.9600) - Target4 (1.6500) - Target4 (2.3600)

1 Extra Targets(optional) in chart, if you like to continue in the trade with making stoploss very high.

SL .1D close below (0.2694)

*This coin is defi & still did not breakout so it may breakout so hard.

* This coin expected target is more than 5X from the highest point from the entry range.

*This trade is update for the below trade due to market situation.

______________________________________________________________

Golden Advices.

********************

* collect the coin slowly in the entry range.

* Please calculate your losses before the entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

Useful Tags.

****************

My total posts

www.tradingview.com

1Million Journey

www.tradingview.com

www.tradingview.com

**********************************************************************************************

#Manta #OMNI #DYM #AI #IO #XAI #ACE #NFP #RAD #WLD #ORDI #BLUR #SUI #VOXEL #AEVO #VITE #APE #RDNT #FLUX #NMR #VANRY #TRB #HBAR #DGB #XEC #ERN #ALT #IO #ACA #HIVE #ASTR #ARDR #PIXEL #LTO #AERGO #SCRT #ATA #HOOK #FLOW #KSM #HFT #MINA #DATA #SC #JOE #RDNT #IQ #CFX #BICO #CTSI #KMD #FXS #DEGO #FORTH #AST #PORTAL #CYBER #RIF #ENJ #ZIL #APT #GALA #STEEM #ONE #LINK #NTRN #COTI #RENDER #ICX #IMX #ALICE #PYR #PORTAL #GRT #GMT #IDEX #NEAR #ICP #ETH #QTUM #VET #QNT #API3 #BURGER #MOVR #SKL #BAND #ETHFI #SAND

AEVO one of most hated coinsAEVO / USDT

We saw many hated coins are pumping the most recently

AEVO is also considered one of most hated coins in crypto space why ? because it had a bad price actions since listing

Currently it is trading above potential accumulation zone of 3 months and trying to breakout

Could be finally the real breakout

NFA

Aevo

📊 Overview Analysis

The AEVO cryptocurrency, after a sharp downward movement, entered a consolidation range. Following a prolonged range-bound movement, the price managed to climb within an ascending channel on the 4-hour timeframe, reaching the top of its consolidation range.

🕰 4-Hour Timeframe Analysis

🔸 Current Status:

The price is challenging both the top of the ascending channel and the range ceiling.

Increased trading volume indicates growing liquidity in this area.

🔸 Bullish Scenario:

A breakout above the ascending channel's ceiling could trigger a parabolic move toward the green target zones.

🔸 Potential Risks:

An RSI divergence on the 4-hour timeframe suggests a possible pullback.

Corrections could extend toward the channel's midline or, in a more severe case, to the channel's lower boundary.

🎯 Price Targets & Key Considerations

🔹 Upside Targets:

Breakout to the green zones following an upward channel breach.

🔹 Downside Risks:

RSI divergence might limit upward momentum, leading to short-term corrections.

Maintaining support at the channel's midline or bottom is crucial for a sustained bullish outlook.

💡 Advice: Always employ risk management and rely on personal analysis when making trading decisions.

💡 Reminder: This analysis is for educational purposes only and should not be considered financial advice.

AEVOUSDTAEVO ~ 2D

#AEVO We were late in finding the lowest price on this coin.

For now,,. If you are an aggressive trader, you can buy gradually after this red resistance line is successfully broken through with strong volume. or if you are a trader who plays it safe,. you can place buy on this support block, However, if the bullish momentum on AEVO is still strong, then you will miss your opportunity.

#AEVO (SPOT) entry ( 0.285- 0.340) T. (0.934) SL (0.269)entry range ( 0.285- 0.340)

Target (0.934)

SL .4H close below (0.269)

************************************

BINANCE:AEVOUSDT

#AEVO

#AEVOUSDT

#AEVOUSD

#swingtrade

#shortterminvestment

#ALTCOIN

#Cryptotading

#cryptoinvesting

#investment

##trading

#cryptocurrencytrading

#bitcoininvestments

#Investing_Coins

#Investingcoins

#Crypto_investing

#Cryptoinvesting

**** #Manta ,#OMNI, #DYM, #AI, #IO, #XAI , #ACE #NFP #RAD #WLD #ORDI #BLUR #SUI #Voxel #AEVO ****

#bitcoin

#BTC

#BTCUSDT

AEVO/USDT Breakout ConfirmAEVO/USDT Breakout Confirm 🚀

AEVO/USDT has successfully broken above a key resistance level, and now it's time to wait for the retest 📈. If the price comes back to test the breakout level and holds it as new support, a strong bullish move could follow 💥.

🔍 Key factors to monitor:

1. Retest: Wait for the price to come back and test the breakout level, confirming it as support.

2. Hold: A solid hold at the breakout level would strengthen the bullish outlook.

3. Volume surge: Keep an eye on a significant increase in volume to confirm momentum.

⚠️ Stay sharp with this pair, but always DYOR (Do Your Own Research) before making any decisions. 📊