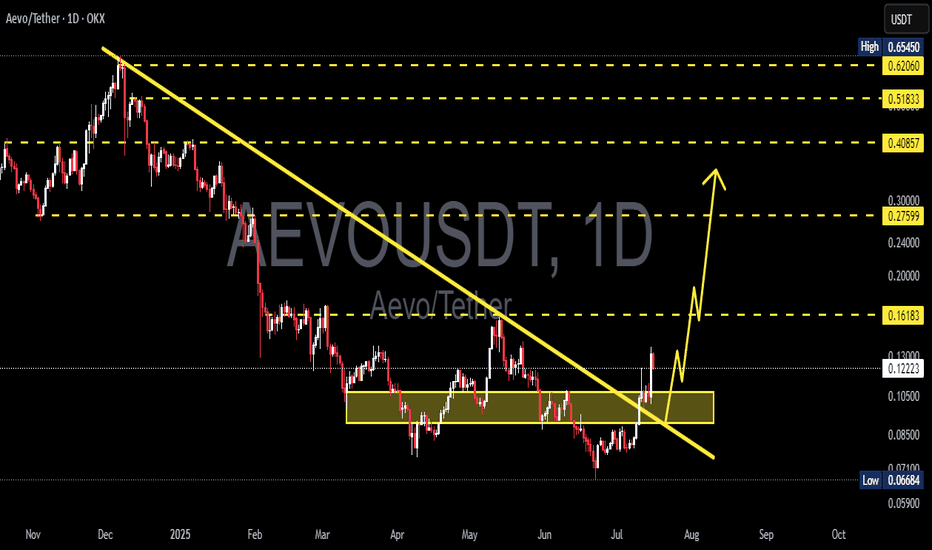

AEVO/USDT – Major Trendline Breakout! Is This the Beginning?🔍 Chart Overview & Pattern Analysis

The AEVO/USDT daily chart reveals a significant breakout from a long-term descending trendline that has been intact since November 2024. This trendline acted as a strong dynamic resistance, suppressing every bullish attempt—until now.

A clear multi-month accumulation zone is visible between $0.080 – $0.105 (highlighted in yellow). Price tested this support zone multiple times, forming a strong base of demand. The combination of horizontal support and descending resistance creates a classic descending triangle breakout, often signaling a trend reversal when broken to the upside.

What's more, price action recently:

Broke above the trendline with strong bullish candles

Retested the breakout zone successfully

Is now forming a potential bullish continuation structure (mini bull flag or pennant)

This structure suggests that the bulls are not done yet—and momentum could be accelerating.

🟢 Bullish Scenario – The Path to Higher Highs

If AEVO continues to hold above the breakout zone, the following upside targets become very realistic:

✅ Target 1: $0.16183 – Previous resistance zone, short-term TP.

✅ Target 2: $0.27599 – Key horizontal resistance from late Q1 2025.

✅ Target 3: $0.40857 – Weekly structure resistance.

✅ Target 4: $0.51833 – Bullish extension zone.

🎯 Ultimate Bull Target: $0.62660 – Full recovery to pre-downtrend levels.

Confluence factors supporting this bullish outlook:

Breakout above dynamic and static resistances

Accumulation breakout after long consolidation

Higher low and bullish retest pattern

Bullish momentum building with volume confirmation (volume not shown but implied)

🔴 Bearish Scenario – Key Levels to Watch

In case of a false breakout or macro weakness:

Breakdown below $0.105 could invalidate the bullish structure

Price could revisit $0.080 or even $0.06684 (last line of defense)

A daily close below this zone would shift the bias back to bearish or neutral

However, as long as price stays above the yellow support box, the bullish thesis remains valid.

---

🧠 Key Technical Highlights

Pattern: Descending Triangle Breakout + Accumulation Base

Trend Shift: From Bearish to Bullish (confirmed with breakout + retest)

Momentum: Building up toward higher time frame resistances

Market Psychology: Smart money likely accumulated during sideways chop

📣 Final Thoughts

AEVO/USDT is showing one of the cleanest breakout structures in the altcoin space right now. With clear upside targets, a retested breakout zone, and strengthening market structure, this could be the early phase of a major bullish leg.

Traders and investors should watch for confirmation of higher highs and pullbacks to the $0.105 zone for potential entries.

#AEVOUSDT #CryptoBreakout #TrendReversal #AltseasonReady #DescendingTriangle #CryptoTA #BullishCrypto #AltcoinAnalysis #TechnicalBreakout #AEVOAnalysis

Aevousdtp

#AEVO/USDT#AEVO

The price is moving in a descending channel on the 1-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 0.3595

Entry price 0.3624

First target 0.3856

Second target 0.3856

Third target 0.3976

#AEVO/USDT#AEVO

The price is moving within a descending channel on the 1-hour frame and is expected to continue lower.

We have a trend to stabilize below the 100 moving average once again.

We have a downtrend on the RSI indicator, supporting the upward move with a break above it.

We have a resistance area at the upper limit of the channel at 0.1100.

Entry price: 0.1093

First target: 0.1079

Second target: 0.1069

Third target: 0.1057

AEVOUSDTAEVO ~ 2D

#AEVO We were late in finding the lowest price on this coin.

For now,,. If you are an aggressive trader, you can buy gradually after this red resistance line is successfully broken through with strong volume. or if you are a trader who plays it safe,. you can place buy on this support block, However, if the bullish momentum on AEVO is still strong, then you will miss your opportunity.

AEVO/USDT Breakout ConfirmAEVO/USDT Breakout Confirm 🚀

AEVO/USDT has successfully broken above a key resistance level, and now it's time to wait for the retest 📈. If the price comes back to test the breakout level and holds it as new support, a strong bullish move could follow 💥.

🔍 Key factors to monitor:

1. Retest: Wait for the price to come back and test the breakout level, confirming it as support.

2. Hold: A solid hold at the breakout level would strengthen the bullish outlook.

3. Volume surge: Keep an eye on a significant increase in volume to confirm momentum.

⚠️ Stay sharp with this pair, but always DYOR (Do Your Own Research) before making any decisions. 📊

#AEVO/USDT#AEVO

We have a bullish channel pattern on a 4-hour frame, the price moves within it and adheres to its limits well

We have a green support area at 0.700

We have a tendency to stabilize above moving average 100

We have an uptrend on the RSI indicator that supports the price higher

Entry price is 0.820

The first goal is 1.08

The second goal is 1.25

the third goal is 1.47

Trade Idea for Aevo (AEVO) - Accumulation StrategyAevo (AEVO) is currently trading around $0.82, experiencing significant volatility due to upcoming token unlock events and its recent market performance. With a circulating supply of 110 million AEVO and a maximum supply of 1 billion, the market cap stands at approximately $90 million.

Consider initiating a position at the current price level of approximately $0.82. This price provides a strategic entry point, considering the recent price corrections and the potential for future rebounds.

Plan to accumulate additional AEVO tokens at lower price points of $0.80 and $0.60. This approach allows for averaging down the entry price and capitalizing on market dips.

Set multiple take-profit targets to capture potential gains during upward price movements. The initial targets can be set at $1.80 and $2.25, followed by $3.00 and $3.50. These targets are chosen based on psychological price levels and potential resistance points.

On May 15, 2024, a significant token unlock event will increase the circulating supply by 827.6 million tokens. This could lead to short-term price volatility but also presents opportunities for strategic accumulation during potential dips.

AEVO’s role as a decentralized derivatives exchange with a custom Layer 2 solution enhances its value proposition. Despite recent declines, the long-term potential remains promising due to its robust trading infrastructure and backing by significant investors.

Accumulating AEVO at strategic price points leverages market volatility and the potential for future growth. The phased profit-taking strategy aims to optimize returns as the market potentially appreciates following the token unlock event and increased adoption.

This trade idea is based on the current market data and AEVO’s strategic positioning as of May 2024. Cryptocurrency investments carry inherent risks, including the loss of principal. Investors should conduct their own research and consider their financial circumstances and risk appetite before engaging in cryptocurrency trading. This analysis is not financial advice.

#AEV/USDT#AEV

We have a bearish channel pattern on a 4-hour frame, the price moves within it and adheres to its limits well

We have a green support area at 1.20

We have a tendency to stabilize above moving average 100

We have an uptrend on the RSI indicator that supports the price higher

Entry price is 1.54

The first goal is 1.77

The second goal is 2.00

The third goal is 2.23

Aevo completed a setup for upto 60% pumpHi dear friends, hope you are well and welcome to the new trade setup of Aevo with US Dollar pair.

Recently we caught a nice trade of AEVO as below:

Now on a daily time frame, AEVO has formed a bullish Gartley move for the next price reversal.

Note: Above idea is for educational purpose only. It is advised to diversify and strictly follow the stop loss, and don't get stuck with trade.

Aevo/Usdt Buying Opportunity Currently, the AEVO/USDT pair is displaying signs of a breakout on the 4-hour time frame. Buyers are demonstrating increased interest in the asset, indicating a potential upward movement. If the breakout is successful, it is anticipated that there could be a bullish move of approximately 30-60% in the short term. It is important to note that this information is not to be construed as financial advice. Please conduct your own research (DYOR) before making any investment decisions.

AVEOUSDT READY 125% PUMP READ DESCRIPTIONCertainly! Let's delve deeper into the potential trade setup for AEVOUSDT:

1. **Market Analysis**: AEVOUSDT is currently positioned within a demand zone, typically an area where significant buying interest exists, particularly from big players and whales. This zone, ranging between 3.04 and 3.19, indicates a level where buyers are likely to enter the market in large volumes, anticipating a potential price increase.

2. **Technical Indicators**: Various technical indicators strongly support a bullish outlook for AEVOUSDT. These indicators include moving averages, oscillators, and momentum indicators, all signaling a buy sentiment. This alignment strengthens the bullish bias and suggests a potential upward movement in price.

3. **Trading Conditions**: To initiate a trade, specific conditions must be met. Firstly, a bullish candle breaking above a trendline acts as a signal for a potential bullish breakout. Secondly, confirmation of the breakout occurs when the accompanying volume surpasses the moving average, indicating substantial buying pressure supporting the upward move.

4. **Price Action Analysis**: Beyond technical indicators, analyzing price action provides valuable insights. AEVOUSDT is currently situated within a demand zone, indicating a favorable environment for buyers. Additionally, it's positioned near the top of an ascending triangle pattern, suggesting the potential for an upward breakout, further supporting the bullish sentiment.

5. **Profit Target**: The profit target for this trade is set at an ambitious 125%. This indicates the potential for significant returns if the trade reaches its full potential, reflecting the trader's confidence in the bullish scenario.

6. **Risk Management**: Alongside profit targets, effective risk management is crucial. Traders should implement stop-loss orders to mitigate potential losses if the trade moves against expectations. Additionally, monitoring the trade closely and adjusting positions as necessary is essential to navigate market fluctuations.

7. **Market Psychology**: Understanding market psychology is key. The presence of a demand zone suggests that buyers are eager to enter the market, which could further amplify the bullish momentum if prices start to rise.

8. **Market Sentiment**: Consideration of market sentiment, including trader sentiment and institutional positioning, provides valuable insights into market dynamics and potential future price movements. In this case, the imbalance in long and short orders further supports the bullish bias.

9. **Continued Monitoring**: Successful trading requires continuous monitoring of market conditions. Traders should remain vigilant for any developments that could impact the trade setup, adjusting strategies accordingly to maximize opportunities and minimize risks.

10. **Flexibility and Adaptability**: Lastly, traders should maintain flexibility and adaptability in their approach. Markets are dynamic, and unexpected events can occur. Being prepared to adjust strategies in response to changing market conditions is essential for long-term success.

In conclusion, the trade setup for AEVOUSDT presents a compelling opportunity based on a combination of technical indicators, price action analysis, and market sentiment. However, prudent risk management and ongoing monitoring are essential to navigate the complexities of the financial markets successfully.

Aevo completed a setup for upto 26% pumpHi dear friends, hope you are well and welcome to the new trade setup of Aevo with US Dollar pair.

Recently we caught almost a nice trade of AEVO as below:

Now on a 2-hr time frame, AEVO has formed a bullish Gartley move for the next price reversal.

Note: Above idea is for educational purpose only. It is advised to diversify and strictly follow the stop loss, and don't get stuck with trade.

AEVO MID TERMAevo operates on Aevo L2, a custom Ethereum rollup created using the Optimism stack. This enables Aevo to support over 5,000 transactions per second and process over $30 billion in trading volume.

With a market cap of $300 million, we expect this token to show significant growth in the medium term.

AEVO/USDT LAST CHANCE Aevo/USDT appears to be on the verge of a breakout, making it a potentially opportune moment to purchase the dip. Based on my analysis, I anticipate a substantial breakout in the near future, possibly leading to a new all-time high (ATH) for the asset. I foresee a bullish move ranging between 80% to 160%. However, please note that this information is not financial advice; it is advisable to conduct your research (DYOR) before making any investment decisions.

AEVO/USDT PLAN The Aevo/USDT market structure currently exhibits a shift towards a bullish sentiment, indicating that the price is likely to approach a retest of the trendline resistance. Analysts estimate a 90% probability of an upcoming breakout, which could potentially lead to a 40-80% bullish movement in the short term. However, it is important to note that this information is for educational purposes only and should not be considered as financial advice.