AEX

Basic-Fit ascending triangle, bullish at openEURONEXT:BFIT is making a beautiful ascending triangle on a good volume. This is my top pick to watch and go long because it has enough fuel left. Lost over 70% of its value because of the Coronavirus but it's a great growth company (successful gym business in Europe). You can trade Basic-Fit on the Dutch Euronext stock Exchange (Amsterdam).

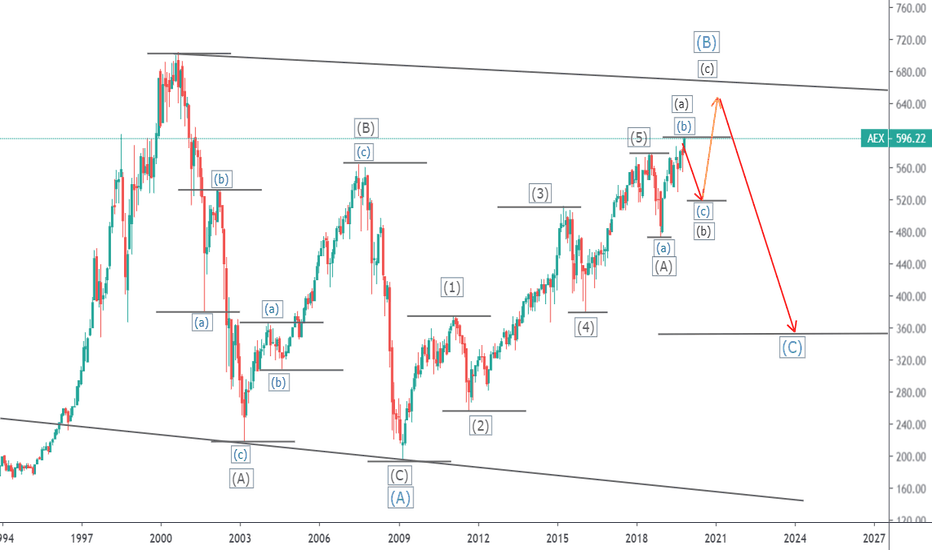

AEX 485-500 Short Opportunity2001:

AEX broke the 4 year positive trendline and from that moment dropped 57% in the following 105 weeks.

After breaking that trendline the price recovered until slightly above the initial break point. From there the real downward rally continued. In hindsight this point of recovery would have been an excellent short opportunity.

2008:

AEX broke the 5 year positive trendline and from that moment dropped 57% in the following 61 weeks.

After breaking that trendline the price recovered until slightly above the initial break point again (just like in 2001). From there the real downward rally continued again (just like in 2001). In hindsight this point of recovery would have been an excellent short opportunity again (just like in 2001).

2020:

AEX broke the 11 year positive trendline, a similar thing that happened in 2001 and 2008.

The price dropped sharply but is now recovering slightly. If the price recovers the next few weeks to 485-500 this would give a similar short opportunity as we have seen in 2001 and 2008.

Let me know your thoughts :)

PS: a more or less similar opportunity can be spotted when looking at S&P500 and DJ30.

UPDATE: #AEX - "Financial recession is a fact!"UPDATE: #AEX - "Financial recession is a fact! Depression is coming!"

Feb 19

UPDATE: #AEX - "Financial markets will goes into years of recession!"

Financial market is going to prepare itself for a long-term downward movement.

Some financial experts will call this an economic depression the coming period!

Mar 02

Trade active: #IEX #AEX #coronavirus is being misused by the financial market to justify correction that has long been established! It will take approximately 10 years for the financial market reach the bottom.

2020 End of AEX BullrunNo '100% proof' analysis, my personal idea of the future of the chart. ATH has been hit and is still funnelling. Personally not thinking of a much higher hit in the future of 2020.

Complete random analysis with personal view of interpretation.

Comment with your own view on the market or this chart, no harm in a disagreement.

Warning! AEX shows topping formation Hi everyone,

Today I want to warn you that the AEX-index shows double top formation.

At first, AEX looked quite strong: breaking out of the rising wedge, but now it broke back into the wedge and formed a bearish formation.

Trade safe and take some profits I would say.

Galapagos - Monthly outlookWe are currently in the middle of the month and Christmas is coming. This is a quiet period and normally there will be little movement here. We can therefore conclude that the biggest moves of the month have now come to an end within a week. Assuming that the price closes around this value at the end of the month, we see a pretty good respectation around 200. This may mean that the price will first fall back to the 175 area and then, potentially, break through all time highs.

On the weekly timeframe we see that the 200 level is enormously respected. This is a strong signal that the price could fall back to the indicated 175. This does not necessarily mean that this must necessarily go there, but a correction towards that area would be very common. The moment the price lingers around 175 and creates a solid bottom, there is again a great chance of a price move up and certainly also the possibility of making a new all time high. The next publication is in February, which means that the biggest fundamental influences stay out until that time.

If you have GLPG in your portfolio you should not be surprised when the stock drops a little in the next months. That would be a healthy cycle of the market. In the short term it would therefore not be a very bad idea to sell GLPG relatively close to 200. On the medium / long-term price timeframe the 200 was your ideal target.

If you want to buy GLPG; I would wait a bit. It is not the most favorable price to get in. There are plenty of other stocks that are more attractive to buy.