AG

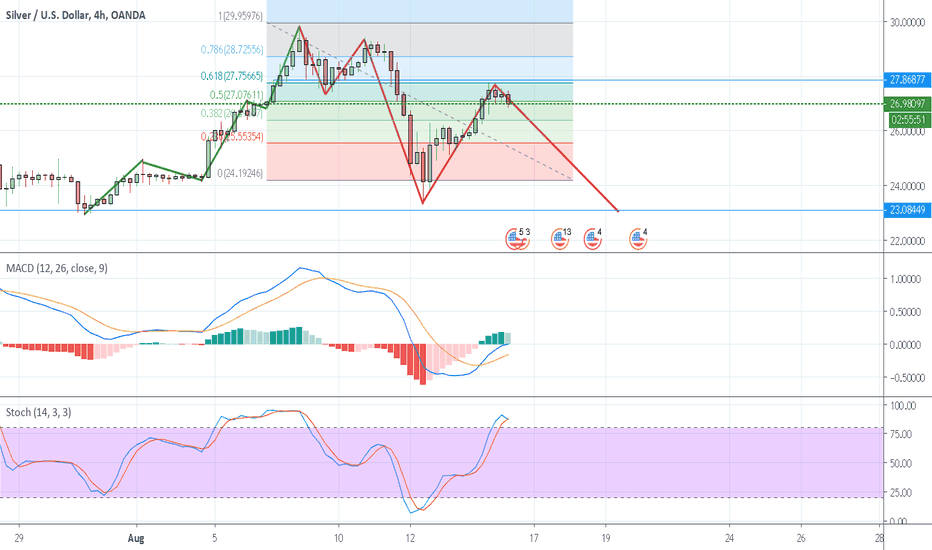

Silver Price Target $30 in 2021Based on Wyckoffian analysis, #silver is in Phase D. We had the bullish confirmation in Phase C.

A price move through $20 will show us the sign of strength (sos).

If silver can pass above $20, then the next target will be $30, which is the golden zone of the previous higher level downtrend.

#silver #ag

@leopisbig

GPL Long ideaGPL is a silver miner. It looks to be moving higher out of a downtrend. I think its fairly obvious being above the 200sma. Good buy here.

SIlver (USD)- Monthly chart. Must break out of downslopping chanSIlver (USD)- Monthly chart. Must break out of down-slopping channel (pink).

Sadly, hasn't even retraced past the 23.6% Fib Retracement from the 2011 highs.

Silver (USD)- clearly has a lot of work to do to recover from the blow off top of 2011.

Silver (AUD)- Monthly chart. Forming Double bottom.Silver (AUD)- Monthly chart. Potentially forming a Double bottom.

Note over head resistance (yellow line)- 4 failed previous attempts.

Yellow line also coincides with 38.2% Fib retracement from the 2011 highs. So a very important line to break to complete Double bottom.

DXY - Bull Flag/Ascending TriangleShort - Term: SHORT GOLD watch at key levels.

Currently using GLL, DZZ, and one other as a medium to short the market.

Considering INVERSE gold miner ETFs for TUES buys. Also watching out for FOMC meeting as well as ECB. WED will be when the rubber meets the road.

* Took profits on all gold mining stocks and looking for buy in opportunities according to gold price movement.

LONG BTC price movement looks steady and solid as we head towards the 100 day moving average!

Long - Term: BULLISH on Facebook and Appian as well as

Silver Miners and Royalty Companies: AG, EXK, etc. (Will post more if any interest is shown.)

- as well as ETFs- AGQ, USLV

Gold Miners: SBSW and several others.

RIOT entry at 1.10, 1.00, .90 if BTC CONSOLIDATES, 1.15, 1.20, 1.25 if it continues UPWARD

I use this stock as a BTC derivative with an eye on what's going on with mining.

n For instance the new Antminer S17 and T17 have a failure rate between 20% and 30%. How will this effect RIOT's bottom line as well as the BTC halving?

Silver At 11-year LowThis precious metal is getting decimated after Chinese factory production(electronics) collapses in the month of February, down -12% in this trading session. This is going to be the deal of the century once a bottom is found as gold and silver are the only money to stand the test of time with over 5,000 years of recorded use as money, especially in a world where every central banks is currently hell-bent on devaluing their currencies. Silver took a dive at the beginning of the 2008 financial crisis, and then eventually exploded to new highs afterward. Once you understand the difference between money vs currency, you'll understand why gold and silver are important in the financial world.

We're likely looking at sub-$10 silver/oz before the bleeding stops. Gonna be a bogo deal compared to prices last week.

SLV - Shaken . . . Not StirredWhere did this all come from? Dramatic market moves this past week even crashed silver and gold. Bonds were the only investment instrument that went unscathed. So much for the diversification theory that gold and silver would remain uncorrelated and offer protection in a weak market environment. Past debacles have shown that when margin call liquidations enter the market, everything goes down, but yesterday was a bit over the top, as were moves in many key companies across the board.

As the dust settles, it's clear to see that SPX retraced 50% of it's recent move, DJI retraced .618% and Silver retraced a bit beyond 50% but thus far has not exceed .618 that could indicate a trend change. It's also important to note that yesterday's big move down still did not violate the top of Wave 1. In Elliott Wave rules, Wave 4 cannot violate Wave 1. Holding support here gives clues that SLV will rebound to the -.23 Fib level or 19.60.

I held my nose and bought more physicals yesterday, as many of you also did. Also added to the equity positions of First Majestic Silver and Wheaton Precious Metals. Would like to pick up more RGLD if weakness continues.

What are your favorite silver stocks?