Aggressive

Aggressive or ( X + X0 ) Entry Model 15m : must be we are in Kill zone of any session

X = LQ Swept against previous HL

X0 = LQ Swept against previous candle

after X + X0 happened, wait for last recent candle close then mark it as 15m Demand zone

LTF( 1m ) :

1. 15m Demand zone must be mitigated in LTF

2. LTF unmitigated Order Flow must be mitigated

After points 1 and 2 are met, we should be ready to place a market order as soon as a bullish confirmation candle appears on the 1-minute chart.

Since X and X0 happened at the same time, this entry should be considered an Aggressive Entry.

GDXJ (+ Gold) "Bear Trap" LongGiven USD strength and the sustained pressure of ever-increasing US interest rates, gold has been taking it on the chin. However, we’re getting into buy levels/demand where it may be poised for a near-term recovery. Keep tabs on gold (spot, futures, GLD), but if you see signs of accumulation/trend reversal (use small timeframe charts), consider climbing aboard. FYI, gold futures (GC) have a yet-to-be-filled gap @ 1872.70, so we may drift lower in the immediate-term as the precious metal seeks that level. In the Jr. Miners space, we’re eyeing the 30.57-31.85 demand zone, which formed in November of '22. Protective stops should be placed below the lower bound of the buy zone. Targeting is a bit challenging, but GC futures should be able to rally to ~1910, if not higher. As everything is uncertain in trading, use your judgement. We always take mechanical profits en route to opposing zones, which are used for our target setting, and would highly recommend doing the same given the stress currently being reflected across markets.

Just a thought/idea – take it . This is a very aggressive trade given recent price action - be careful!

JHart @ LionHart Trading

Combo Trade with RiskThis trading setup provides 1 of the Best Profit Factor. But because of how the candlesticks interact on the PRZ(rectangle box) it is also the most dangerous trading setup.

On the 8-range bar chart, there's a Deep Gartley Pattern setup, and on the 4-hourly chart, a Bat Pattern setup.

Both setups is now resting at X.

If you are new to trading, avoid this trade. If you have not traded Oil before, reduce your position sizing by at least 5x.

It is better to missed a trade than to enter a trade you shouldn't have.

Some Aggressive Long IdeaI have a crazy idea to long GBPAUD just like that. Well, at least it is seated within the consolidation zone, the weaker bear zone with a series of indecision candles and RSI Divergence.

I think I'm good to go, I see how this candle reacts.

Final Decision to be made at 4pm(SGT)

EVH - new 52 week high. Breaking out and holdingBreaking out of one month consolidation. Constructive price and volume action and a market leader.

You don't need to know what's going to happen next to make money ~Mark Douglas

Lose like a pro and keep trading, or lose like a novice and quit ~Mark Ritchie

NASDAQ SELL BEARISH RALLY

Currently Nasdaq is consolidating. A break to the upside our next target will be 13916. If the price does come down then we will see price come down to 13600- 13472. Nasdaq has been very bullish for days and there is high chance it will continue.

The market is currently consolidating. A break to the upside we can see price move to 13738- 13916. A break to the downside price will come to 13472, a break of this we may see price come further down to 13328.

NAS100 - Price is trending up. We have higher lows, higher highs formation. There is resistance zone at 13850, so I suggest you to wait for the breakout and then look to buy.

Uber bullish channelA new, super aggressive bullish channel has been formed and I will closely observe its top and bottom levels. In the short run I think we are all set to go parabolic, however this - as all parabolic moves (apart from TSLA) - is bound to be broken eventually, the question is only when. I might reap my LEAP rewards once the channel is broken and re-enter later, but I'm not sure yet.

However, RIOT is proving to be a beast.

SPX To 3500 by Friday, Weekend Update - 3800+ ComingThe aggressive pullback we saw after President Trumps tweet was the perfect set up for a bear flag to form and push down further. That didn't happen, instead all the market did was push and grind higher.

This tells us, all time highs are coming. This tells us now is the time to be aggressive. The market still needs a consolidation, a 4 hour higher lower. But it wants to go higher.

Look for a pullback Monday/Tuesday with a push up to 350+ for Friday.

It's important to understand when the market is consolidating, trading in a range or chopping around. It's even more important to identify when it is in an aggressive uptrend. Now is that uptrend. Now is the time to be aggressive.

If you missed out on July/August runs or suffered from FOMO off the March lows. This is your opportunity. This is the time you need to take advantage of the uptrend.

First position open! Good day fellow traders and enthusiasts! This is third analysis and first position open. Please keep in mind that first position i've opened is HALF RISK of usual positions because there is not enough confirmation that pullback is phased out yet, which makes it aggressive entry .

So let's recall from previous posts what exactly we were looking for in price action to open first position.

Nr.1: For price to fail making higher high . ✅

Nr.2: Break of previous low.✅

Nr.3: Formed new lover high .✅

This provides us with enough confirmation to open first Position with half risk. If price continues to drop down and forms lower high, i will start looking to open second SHORT position.

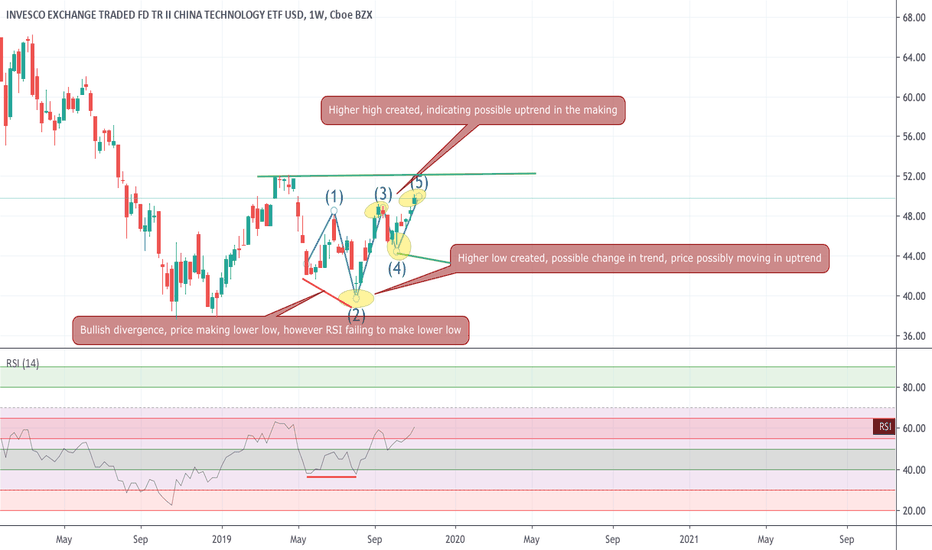

CQQQ, on weekly charts gaining strength - buy set upAs seen on the weekly charts, CQQQ seems to be changing directions. Bullish divergence seen recently as indicated in the chart and price getting into an uptrend, recent week high also broken and price now eying the 52.31 level breakout.

Important to see a retest and look out for price retracing and confirmation of uptrend if price makes a higher low than the most recent previous levels

2 ways to play

1. wait for higher low to be created and if next candle after that formation is positive, go long

2. Incase you want to wait for further confirmation, then wait for 52.31 levels to be breached and then go long

IF you like what you see, please share a thumbs up

Cheers

The price of eur/usd is moving now!The price of eur/usd is moving now! It stopped below the dynamic resistance identified by the EMA20 daily. So it did not complete the movement that we expected this week. The analysts had expected a slight decline in the US dollar against the other majors because of the FED conference, the announcement of the pay slips of the non-agricultural sector and the level of unemployment.

The price is going to look for the static resistance set around 1.13 on this pair. For after the announcement of Trump on the new duties that will be imposed on China, the USD has strengthened again. We close at Break Even the bullish position that we had opened on EURUSD.

Technical point of view

The main trend remained unchanged. The final target is reachable within a few months among the static supports set at 1.10-1.08. There wasn't the rebound we expected, is now very likely that it will continue in this downtrend.From here (1.12) the price should start to go down and re-test the non-key static support at 1.112 within a few sessions. Once tested and broken to the downside there will be confirmation of a channeling on the part of this change projected to the downside. Here the price will bounce between the upper and lower side until it reaches the minimum of the period which will presumably be the area around 1.08.

Fundamental point of view

Even the fundamental scenario supports this view. The European Central Bank will continue to adopt an expansive policy, devaluing the Euro. The FED does not intend to take steps back by cutting rates and reviewing its monetary policy.

Trading ideas

The price of eur/usd is moving now and the possible TPs that we will set for this pair are: -the first one on the support of the 1.112.-the second on that of the 1,104.-the third on the final target at 1.08 and coinciding with 78.6% of the Fibonacci retracement. The analysis will be invalidated at the break of the resistance zone in the 1.146 area.

GO/BTC Targeting previous highs for a 15% move!- Break in market structure

- .705 retracement

- Pivot level retest

3 factors for a nice 3.5 R/R setup right here, with a stop below previous low, worth playing with decent risk management.

NEBL/BTC Warming up for the skyWe're currently into a daily resistance block, and since we still haven't bounced hard off it and are proceeding to make higher lows, on lower timeframe, we can assume that the buyers are trying to push it through that resistance eventually.

Target is based on the weekly + daily resistance blocks.

Two possible strategies for the target of around 5627 to 6400 area.

- Aggressive:

Buy now, stop below previous low (3821)

- Tactical:

Buy on the retrace once it breaks above the daily green block with a stop below it, or based on the lower timeframe that develops in the meantime.

If it starts repeating the same scenario like now when it gets there, there might be even larger targets in play . But we'll get there in time.

NEO/BTC small reversal coming?This current retracement lines up well with the fibs (just under .705), successfully tested 4H(red) and 1H(gray) bullish orderblocks for support, and seems like it wants to make some higher lows.

All somewhat good indications of a possible move upwards.

Next step would be breaking the yellow pivot line and establishing support on top of it beofre attempting to break further resistances.

Upon successful bullish momentum I'd expect the final target for this short term(few days/1-2 weeks) movement to reach that tiny gap that it has left unfilled around my TARGET area.

Of course I may be completely wrong which should be obvious if it breaks that previous low and keeps attacking the bullish orderblocks.

If you're looking to enter right now just keep proper risk management in mind and all will be well. A more conservative entry would be when it tests yellow level as support AFTER breaking it.

XMR/BTC 24h - Aggressive EntryXMR appears to be in a downward channel, but we could find a bit of support here at the .786, please remember to set your stop loss and good luck!