#AGLD/USDT Alert! Imminent Rise #AGLD

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We have a bounce from the lower boundary of the descending channel. This support is at 0.740.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 0.737, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.761

First target: 0.775

Second target: 0.800

Third target: 0.821

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

AGLDUSD

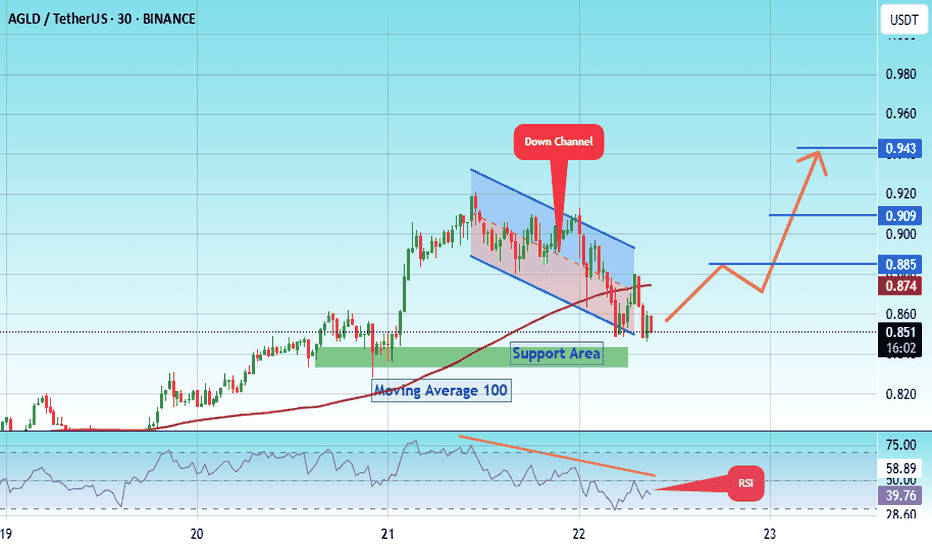

#AGLD/USDT Alert! Imminent Rise#AGLD

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have support from the lower boundary of the descending channel, at 0.850.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area (in green) at 0.835, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.850

First target: 0.885

Second target: 0.909

Third target: 0.943

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#AGLD/USDT Alert! Imminent Rise#AGLD

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bounce from the lower boundary of the descending channel. This support is at 0.685.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 0.680, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.0695

First target: 0.700

Second target: 0.718

Third target: 0.734

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#AGLD/USDT#AGLD

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 0.900.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.970

First target: 1.00

Second target: 1.065

Third target: 1.12

#AGLD/USDT#AGLD

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.848.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.900

First target: 0.939

Second target: 0.986

Third target: 1.06

#AGLD/USDT#AGLD

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator, which supports the upward move by breaking it upward.

We have a support area at the lower limit of the channel at 0.853, acting as strong support from which the price can rebound.

Entry price: 0.890

First target: 0.900

Second target: 0.921

Third target: 0.943

#AGLD/USDT#AGLD

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.808.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.825

First target: 0.844

Second target: 0.862

Third target: 0.884

#AGLD/USDT

#AGLD

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 0.960.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 1.00

First target: 1.02

Second target: 1.05

Third target: 1.087

AGLDUSDT – First Resistance at the Blue Box! AGLDUSDT – First Resistance at the Blue Box!

“Testing a key level—will buyers break through or get rejected?”

🔥 Key Insights:

✅ Blue Box = Strong Resistance Zone – Expect high volatility here.

✅ Breakout = Bullish Confirmation – Retest entries only, no chasing.

✅ Rejection = Short Opportunity – But only with LTF breakdown confirmation.

💡 The Smart Plan:

Monitor LTF (15M & 1H) for Clues – The breakout or rejection will be clear there.

Use CDV & Volume Profile – Smart money leaves tracks, follow them.

Trade the Reaction, Not the Prediction – We respond, not guess.

“Discipline wins, watch the blue box and let the market speak!” 📉

A tiny part of my runners:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

#AGLD/USDT#AGLD

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it upwards strongly and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 1.12

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 1.14

First target 1.19

Second target 1.24

Third target 1.29

#AGLD/USDT#AGLD

The price is moving in a descending channel on the 1-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 1.27

Entry price 1.30

First target 1.34

Second target 1.834

Third target 1.43

#AGLD/USDT#AGLD

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 1.08

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 1.22

First target 1.20

Second target 1.28

Third target 1.37

#AGLD/USDT#AGLD

The price is moving in a descending channel on the 1-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 1.40

Entry price 1.51

First target 1.60

Second target 1.68

Third target 1.76

AGLD should close 50% of this wickGATEIO:AGLDUSDT

We should come back and close at least 50% of this huge wick on D1

✅Before we start to discuss, I would be glad if you share your opinion on this post's comment section and hit the like button if you enjoyed it.

Thank you.

Possible Targets and explanation idea

➡️Local picture since June we got signals to buy on Trade ON indicator. Strong signal to buy

➡️Usually when we got some huge wick candle it means in that level we got a liquidity. So we should come back and close at least 50% of this wick

➡️Possible retest local downtrend line after FOMC increasing rate in November

➡️50% of June wick is exactly "Exit" line on Take Profit indicator

➡️Trades possible retest 0.28 cents and exit point 0.56 cents

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

* Look at my ideas about interesting altcoins in the related section down below ↓

* For more ideas please hit "Like" and "Follow"!

#AGLD/USDT Ready to go higher#AGLD

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 1.64

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 1.71

First target 1.85

Second target 2.00

Third target 2.20

AGLDUSDT Long Setup - Spot BINANCE:AGLDUSDT

📈Which side you pick?

Bull or Bear

Low-risk status: 3x-4x Leverage

Mid-risk status: 5x-8x Leverage

(For beginners, I suggest low risk status)

👾Note: The setup is active but expect the uncertain phase as well. also movement lines drawn to predict future price reactions are relative and approximate.

➡️Entry Area: 1 step now

Yellow zone: 2nd step = 2.61-2.32

⚡️TP:

3.13

3.55

4.13

🔴SL:

1.99

🧐The Alternate scenario:

If the price stabilizes against the direction of the position, below or above the trigger zone, the setup will be canceled.

AGLD looks bullish (1D)It appears that AGLD is forming a triangle, with wave E of this triangle not yet complete.

If it reaches the green zone, we will look for buy/long positions.

The targets are marked on the chart.

A daily candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

Adventure Gold AGLD price medium-term tradeWe don't know who “breathed life” into #AGLD and why)

⁉️(If you know, write in the comments), but the “strength” in the asset is visible, so you can trade.

But given the fact that we expect a possible price drop 💰 CRYPTOCAP:BTC ⬇️

📊and it is not fully known how altcoins will react to such a maneuver.

Therefore, for now, we are ready to try the OKX:AGLDUSDT trade like on the chart with a very low pending limit order.

And then we will adjust and maneuver according to the situation)

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

#AGLD/USDT#AGLD

The price is moving in a descending channel on the 1-hour frame upwards and is expected to continue.

We have a trend to stabilize above the moving average 100 again.

We have a downtrend on the RSI indicator that supports the rise by breaking it upwards.

We have a support area at the lower limit of the channel at a price of

1.30

Entry price 1.43

First target 1.67

Second target 2.00

Third target 2.53

#AGLD/USDT#AGLD

The price is moving in a bearish channel pattern on the 4-hour frame and sticking to it well

The price rebounded well from the lower border of the channel at the green support level 0.9500

We have a tendency to stabilize above the Moving Average 100

We have oversold resistance on the RSI indicator to support the rise, with a downtrend about to break higher

Entry price is 1.00

The first goal is 1.09

Second goal 1.18

Third goal 1.29

AGLD ANALYSIS (1D)AGLD appears to be inside a bullish diametric which is now in wave C of this diametric.

Wave C also appears to be a diametric.

In wave D, in the green range, you can look for buy/long positions.

Closing a daily candle below the invalidation level will violate the analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

Cage Cycle Values for AgldusdtCage Cycle Values: If the price is above 1.6542 (Buy Point), the price target is 1.8342, and if it is below 1.6470 (Sell Point), the price target is 1.4670. You can find the details of the Cage Cycle strategy attached. (MAKE SURE TO FOLLOW THE NEW TAKE PROFIT POINTS PUBLISHED AS TAKE PROFIT POINTS ARE INCREASED ACCORDING TO THE TRADING CYCLE)

Long Position:

Entry: 1.6542

Profit: 1.8342 (Will be updated if necessary in the positive direction)

Stop: 1.6470

Short Position:

Entry: 1.6470

Profit: 1.4670 (Will be updated if necessary in the positive direction)

Stop: 1.6542

The Cage Cycle Strategy is a model that emerges from analyzing approximately 2 over 20 data points (1,000,000 and above tick data). The price definitely reaches one of the specified Take Profit Points as a price target. It is not possible to determine the direction with a hundred percent certainty in financial markets. Therefore, success rates are attempted to be increased by using certain models. The Cage Cycles end when the price reaches the price target in any direction in the Cage Cycle Strategy. Although it is not an investment advice, an example of use is as follows: A Long position is opened at the price level of 1.6542, the Stop Loss is 1.4670, and the Take Profit is 1.8342. When the price reaches 1.4670, instead of the Long position that was stopped, a Short Position is opened, with the Stop Loss of the Short Position being 1.6542 and the Take Profit being 1.4670. Transactions are monitored by stopping until the market direction is determined. Considering the number of stopped transactions and the expected time, Take Profit points are updated to increase profits (Updated Take Profit Points will never be lower than the initially specified Take Profit points). By recalculating the Take Profit points to increase profits, the aim is to compensate for the losses of the stopped transactions when the Cage Cycle ends. In the data analysis of the last 10 years, the average number of stops is 12, and the highest number of stops is calculated as 83 (These figures may vary in the future). Although it is not an investment advice, in the Cage Cycle, if the amount to be stopped is set at $1, by increasing the position by half of the initial lot amount for every 10 stops (0.5 $ for every 10 stops), a higher profit can be targeted along with the increased Take Profit point. Using the Cage Cycle data provided above as an example for Peopleusdt, after 15 stops, when the cycle ends, the profit-loss calculation (Initial Stop Amount to be stopped is $1): For the first 10 stops, the loss will be 10$*1=10$, and between 10 and 15 stops, the loss will be 5*1.5$= 7.5$, resulting in a total loss of 17.5$. The profit to be obtained with the updated Take Profit points will be 1.5*27= 40.5$. The net profit, excluding commission, will be 40.5-17.5= 23$. The Cage Cycle helps you determine the Take Profit point in your own trades as well, as it is known that the price will definitely reach one of the Take Profit points. Enjoy and Good luck with your trades.

THIS IS NOT AN INVESTMENT ADVICE. Made by Yourcages