Front-loaded Exports has fuelled rally in Corn. Can it last?After President Trump instituted broad new tariffs on 2nd April 2025, corn futures initially wavered but then rallied sharply. While this may seem counterintuitive given tariffs' disruptive impact on trade, near-term support for corn comes from front-loaded U.S. exports, a weaker dollar, and lower-than-expected domestic supply.

However, prices are likely to face downward pressure as the U.S. harvest season approaches. This paper examines the short-term bullish factors, outlines the potential risks ahead, and presents a hypothetical trade setup involving a calendar spread on CME Micro Corn futures.

CME Corn futures gapped lower on 3rd April but quickly recovered, jumping 4.5% over the next three trading days to six-week highs by 9th April. This move aligns with the typical spring seasonal trend, as corn often firms in late spring during planting & strong demand season.

Surging Export Commitments Amid Tariffs

Export commitments have surged post-tariff announcement. USDA reports that U.S. exporters had already booked about 85% of the 2024/25 season target by early April, according to Reuters , well above the 5‐year average.

In the week ending 3rd April, net U.S. corn sales hit ~40.2 million bushels, reflecting heavy front-loading. Large private sales continue: for example, in early April exporters announced a 9.4-million-bushel sale of 2024/25 corn to Spain.

These front-loaded sales (especially to Mexico & Europe) suggest buyers are rushing to secure supply before possible trade disruptions. Overall, extraordinarily strong export pace and large “flash” sales are underpinning the market.

Supply is Weaker than Initially Thought

USDA’s April WASDE cut U.S. 2024/25 ending stocks to just 1.465 billion bushels – a 75 million bushels reduction – implying a stocks/use ratio around 9.6%. For context, that ratio is near multi-decade lows for corn. The USDA simultaneously raised exports to 2.55 billion bushels, a full 100 million bushels above the previous estimate.

On the supply side, USDA’s Prospective Plantings (March 2025) projected 95.3 million corn acres for 2025, roughly 5% higher than 2024, above expectations (highlighted by Mint Finance in a previous paper ). This suggests that while near-term stocks remain stressed the situation is likely to improve drastically following the harvest.

Weaker Dollar Supports Increased Corn Exports

A key bullish factor for U.S. corn exports is the recent weakness of the U.S. dollar. After the tariff announcement, the trade-weighted dollar tumbled – hitting fresh lows (e.g. a 10-year low versus the Swiss franc). Through April 10, the dollar was down ~2–3% on the week. A weaker dollar makes U.S. corn cheaper for overseas buyers, supporting export competitiveness. With dollar at multi-year lows, U.S. corn is more attractive globally, partly offsetting any Chinese retaliatory tariffs.

COT and Options Data

Managed-money funds have dramatically pared back their long corn bets since the beginning of March. CFTC COT data show net long positions peaking around 364,000 contracts in early February, then plunging to ~54,000 by the 8th April report. However, the pace of decline has slowed dramatically over the past few weeks and seems to be signalling an end of the cutback by asset managers.

Interestingly, despite the tariff introduction (2/April) and the WASDE release (10/April), implied volatility (IV) moderated. IV has since normalized from the spike observed in March. During this period, skew also declined, reaching a negative value on 8th April - indicating that put options briefly became more expensive than calls.

Although this trend has since reversed, skew remains near its lowest levels in 2025, suggesting sustained interest in put options among market participants.

Source: CME CVOL

OI shift over the past week also signals a cautious tone despite the rally. Near term options have seen an increase in put OI, suggesting participants remain cautious despite the rally.

Source: CME QuikStrike

Hypothetical Trade Setup

While bullish factors have driven a sharp rally in corn prices over the past two weeks, there are dark clouds on the horizon. Tariffs risk disrupting trade and as most importers have already loaded up on US corn, they could slow the pace of future purchases.

Additionally, a downbeat seasonal trend along with an expected bumper harvest signal that prices could reverse sharply from here. On the technical front, momentum remains solidly bullish but approaching a potential overbought level amid a slowing bullish trend.

Corn prices remain pressured from a bumper harvest expected in September. Along with expected trade disruptions and a slowdown in the pace of US exports, prices are likely to decline during the summer. Regardless, prices remain bullish in the near term from a weakening dollar and near-term front loading.

To express views on these converging trends, investors can deploy a calendar spread on CME Micro Corn futures consisting of a long position on the near-term May contract (MZCK2025) and a short position on the September contract (MZCU2025). A hypothetical trade setup providing a reward to risk ratio of 1.8x is mentioned below:

A calendar spread on CME Micro Corn Futures is highly capital efficient with the above trade requiring maintenance margin of just USD 23 as of 15/April. The position remains protected from near-term price increase but benefits from the eventual price decline in September during harvest season.

MARKET DATA

CME Real-time Market Data helps identify trading set-ups and express market views better. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.com/cme .

DISCLAIMER

This case study is for educational purposes only and does not constitute investment recommendations or advice. Nor are they used to promote any specific products, or services.

Trading or investment ideas cited here are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management or trading under the market scenarios being discussed. Please read the FULL DISCLAIMER the link to which is provided in our profile description.

Agricultural Commodities

Will Coffee Remain an Affordable Luxury?Global coffee prices are experiencing a significant upswing, driven primarily by severe supply constraints in the world's major coffee-producing regions. Adverse weather conditions, notably drought and inconsistent rainfall linked to climate change, have crippled production capacity in Brazil (the largest arabica producer) and Vietnam (the largest robusta producer). Consequently, crop yield forecasts are being revised downwards, export volumes are shrinking, and concerns over future harvests are mounting, putting direct upward pressure on both arabica and robusta bean prices worldwide.

Adding complexity to the situation are fluctuating market dynamics and conflicting future outlooks. While recent robusta inventories have tightened, arabica stocks saw a temporary rise, sending mixed signals. Export data is similarly inconsistent, and market forecasts diverge significantly – some analysts predict deepening deficits and historically low stocks, particularly for Arabica, while others project widening surpluses. Geopolitical factors, including trade tensions and tariffs, further cloud the picture, impacting costs and potentially dampening consumer demand.

These converging pressures translate directly into higher operational expenses for businesses across the coffee value chain. Roasters face doubled green bean costs, forcing cafes to increase consumer prices for beverages to maintain viability amidst already thin margins. This sustained cost increase is impacting consumer behaviour, potentially shifting preferences towards lower-quality coffee, and diminishing the price premiums previously enjoyed by specialty coffee growers. The industry faces significant uncertainty, grappling with the possibility that these elevated price levels may represent a new, challenging norm rather than a temporary spike.

Using Micro Soybean Futures to Finetune Trading StrategiesCBOT: Micro Soybean Futures ( CBOT_MINI:MZS1! )

Shipping industry news recently reported that 30 U.S. soybean ships (about 2 million tons) are currently heading to China, nearly half of which will arrive after April 12th, when China's 10% retaliatory tariffs on U.S. soybeans will take effect.

How big are the tariffs? Let’s say a cargo of soybeans, or 65,000 tons, is sent to China. Assuming the trade is $10 per bushel, given 36.74 bushels per ton, total cargo value is $23.88 million. Upon arriving in China, you owe a new tax bill for $2.39 million!

According to people familiar with the matter, many cargoes are for China Grain Reserves, which may be exempted from tariffs. Soybean cargoes loaded before March 12th are eligible for a one-month grace period. Data from the U.S. Department of Agriculture on March 20th showed that the stock of unsold agricultural products in China was 1.22 million tons. Any sign of order cancellation will help us assess the real impact of tariffs.

In anticipation of the tariffs, China rushes to buy U.S. soybeans in the past two months. In January and February, China bought 9.13 million metric tons of soybeans from the U.S., up 84% year-over-year. I expect the buying will vanish by the second quarter, given new crop arriving from Brazil at much lower prices without the tariffs imposed by China.

China relies heavily on imported soybeans to crush into soybean oil for cooking use and soybean meal, a key ingredient in animal feed.

The oversupply of soybeans pushes the downstream soybean meal market to crash. According to the statistics of China Feed Industry Information, soybean meals spot market prices tumbled more than 600 yuan per ton to 3,180 since February, nearly a 20% drop.

Top feed processing companies, including New Hope, Haida, and Dabeinong, have each announced price cuts ranging from 50 to 300 yuan per ton for their chicken feed and hog feed products.

With lower overall demand, and tariffs making South American soybeans more competitive, U.S. soybeans face a shrinking export market. On my March 17th commentary “Soybeans: Déjà vu all over again”, I expressed a bearish view on CBOT Soybean Futures and discussed the possibility of $8 beans.

Trading with Micro Soybean Futures

On February 24th, CME Group launched a suite of micro-size agricultural futures contracts, including Micro Corn (MZC) futures, Micro Wheat (MZW) futures, Micro Soybean (MZS) futures, Micro Soybean Meal (MZM) futures and Micro Soybean Oil (MZL) futures.

The contract size of the micro soybean futures (MZS) is 500 bushels, or just 1/10 of the benchmark standard soybean futures (ZS). The minimum margin is $200 for the front futures month, and it gets smaller further out. For instance, the margins for May, July, August, September and November are $200, $190, $180, $170, and $165, respectively.

The smaller capital requirement makes it easier for traders to express an opinion ahead of the release of a USDA report or anticipate the impact of tariffs and retaliation.

The latest CFTC Commitments of Traders report shows that, as of March 25th, CBOT soybean futures have total open interest of 853,368 contracts, up 5% in two weeks.

• Managed Money has 89,649 in long, 123,470 in short, and 139,427 in spreading

• Compared to two weeks ago, long positions were down by 12% while shorts were increased by 12%. This shows that the “Small Money” has turned bearish on soybeans

In my opinion, micro soybean futures would be a great instrument to trade market-moving events, particularly the USDA reports. I list the big reports here for your information:

• World Agricultural Supply and Demand Estimates (WASDE), monthly, April 10th

• Prospective Plantings, annually, March 31st

• Grain Stocks, quarterly, March 31st, June 30th, September 30th

• Export Sales, weekly, every Thursday

• Crop Progress, weekly during growing season, April 7th, April 14th, April 21st

• Acreage, annually, June 30th

Hypothetically, a trader expects more soybean planting in this crop year and wants to express a bearish opinion ahead of April 7th Crop Progress. He could enter a short order for May contract MZSK5 at the current market price of 1,023. If he is correct in his view and the contract price drops to 900, the short position would gain $1.23 per bushel (= 1023-900) and the total gain is $615 given the contract size at 500 bushels.

The risk of short futures is the continuous rise in soybean prices. The trader would be wise to set a stoploss at his sell order. For example, a stop loss at $11.00 would set the maximum loss to $385 (= (11.00-10.23) x 500).

To learn more about all Micro Ag futures contracts traded on CME Group platform, you can check out the following site:

www.cmegroup.com

Happy Trading.

Disclaimers

*Trade ideas cited above are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management under the market scenarios being discussed. They shall not be construed as investment recommendations or advice. Nor are they used to promote any specific products, or services.

CME Real-time Market Data help identify trading set-ups and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

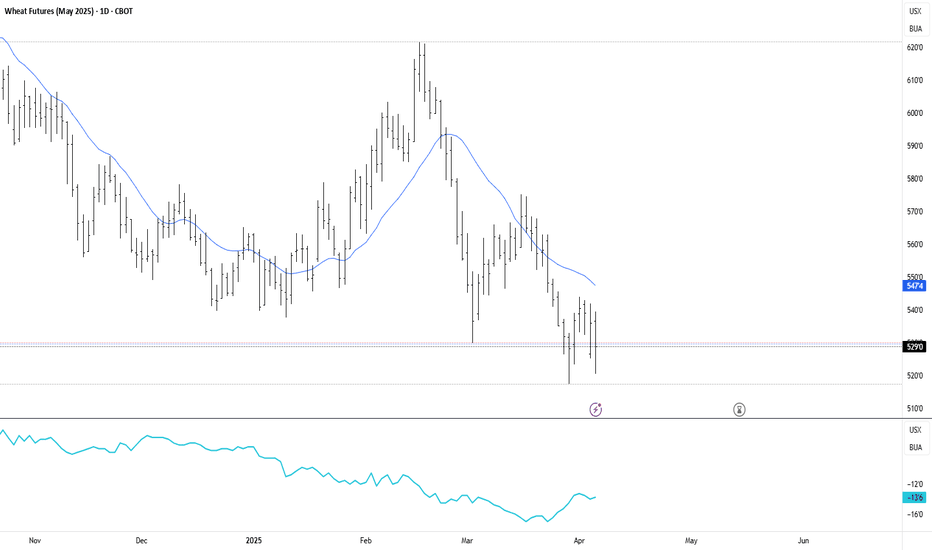

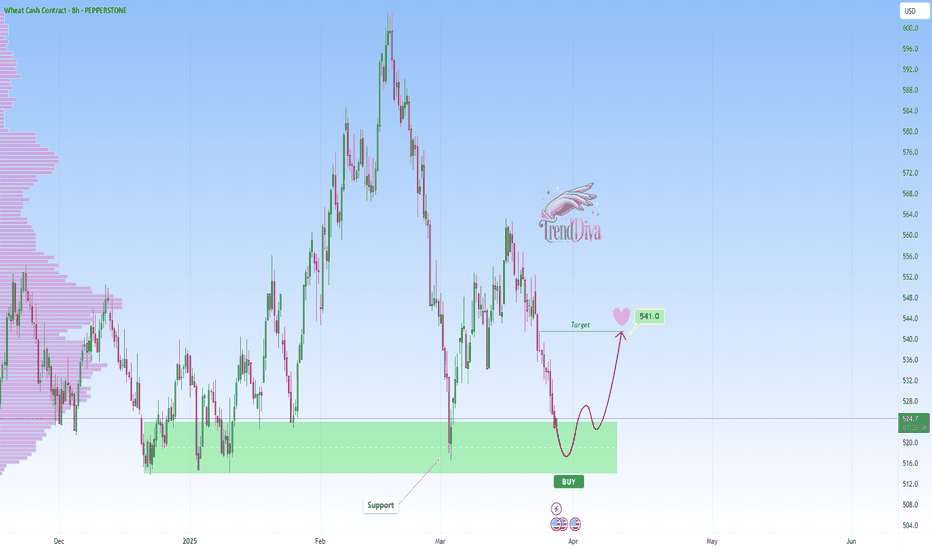

WHEAT at Key Support Level - Will Price Rebound to 541$?PEPPERSTONE:WHEAT has reached a major support level, an area where buyers have previously shown strong interest. This area has previously acted as a key demand zone, increasing the likelihood of a bounce if buyers step in.

A bullish confirmation, such as a strong rejection pattern, bullish engulfing candles, or long lower wicks, would strengthen the case for a move higher. If buyers step in, the price could rally toward the 541$ target. However, a decisive breakdown below this support would invalidate the bullish scenario and could lead to further downside.

This is not financial advice but rather how I approach support/resistance zones. Remember, always wait for confirmation, like a rejection candle or volume spike before jumping in.

Best of luck , TrendDiva

Buy, hold, and let those sweet returns melt in your portfolio!Guys, we all know the sector rotational for consumer defensive is now rebounded

regardless the sector rotation or tariffs noise, agribusiness and sugar remains an essential commodity in our daily life.

There are strategies that Wilmar has taken for the past 3 years. We have seen the share price is being strongly supported at SG$3.03.

Given the essential nature of sugar, Wilmar’s strategic positioning, strong financials, and resilient consumer demand, this could be an opportune time to buy and hold for long-term gains.

🗝️ Key Investment Considerations:

Strong Technical Support – Wilmar’s share price has consistently held above SG$3.03, indicating a solid support level.

📙 Fundamental Strength – The company has a wide economic moat, benefiting from its integrated agribusiness model.

💰 High Insider Ownership – With a 74.7% stake held by major investors, management has significant “skin in the game.”

SGX:F34

📌 Investment Call: Buy & Hold (24-36 months)

🎯 Target Price: SG$4.46

💰 Potential Upside: 33%

📈 Dividend Yield: ~5.13% (TTM)

Wilmar International (stock symbol: F34.SI) dividend yield (TTM) as of March 27, 2025 : 5.13%

Average dividend yield, last 5 years: 4.1% (including 2024)

W Chart - crossing above zero line for MACD indicator

"COTTON" Commodities CFD Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "COTTON" Commodities CFD market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (66.000) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low or high level Using the 3H timeframe (64.200) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 68.500 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Read the Fundamentals analysis, Macro Economics, COT Report, Sentimental Outlook, Intermarket Analysis, Seasonal Factors, Future Trend Move:

🧵COTTON🧵 Commodities CFD Market is currently experiencing a Bullish trend., driven by several key factors.

⭐☀🌟Fundamental Analysis⭐☀🌟

Fundamental analysis examines supply, demand, and external influences on cotton:

Supply Factors:

Weather: Major producers like the US, China, and Brazil drive supply. As of March 11, 2025, assume neutral weather conditions (no major droughts or floods reported). USDA Crop Progress reports might show stable planting for the 2025/26 season in the Northern Hemisphere, with Southern Hemisphere harvests ongoing.

Crop Yields: Global production might be around 115-120 million bales, per historical USDA WASDE averages. Stable yields suggest no immediate supply shock.

Production Costs: Rising energy and fertilizer prices (e.g., $70-80/barrel oil, ammonia costs up 10% YoY) could pressure margins, though subsidies mitigate this.

Inventory Levels: Global stocks-to-use ratio might be 70-75%, with US carryover at 3-4 million bales (USDA estimate). Moderate stocks suggest balanced supply.

Demand Factors:

Textile Industry: Demand from the US, Europe, and Southeast Asia remains steady, driven by apparel and industrial uses. A hypothetical 2-3% demand growth aligns with global economic recovery.

Export Markets: US exports to China and Southeast Asia are key. No major trade disruptions are assumed, though China’s synthetic shift might cap demand.

Substitution: Polyester competition (cheaper at $1.20/lb vs. cotton at ~$0.65/lb) could limit upside.

Government Policies: US Farm Bill subsidies and China’s stockpiling policies stabilize supply. No significant changes are assumed for March 2025.

Conclusion: Neutral fundamentals with balanced supply/demand. Slight bullish tilt if demand outpaces expectations.

⭐☀🌟Macroeconomic Factors⭐☀🌟

Macroeconomic conditions affect cotton globally:

Interest Rates: Assume US Federal Reserve rates at 4-4.5% (post-2024 normalization). Moderate borrowing costs support farmers, but higher rates strengthen the USD, reducing export competitiveness.

Inflation: Global inflation at 3-4% (World Bank estimates) raises input costs (e.g., fuel, labor), potentially bearish if not passed to prices.

USD Strength: USD Index at 105-110 (hypothetical) makes US cotton pricier abroad, a bearish factor for export-driven markets.

Global Growth: US GDP growth at 2-2.5%, China at 5-6% (IMF projections) supports textile demand, mildly bullish.

Energy Prices: Oil at $70-80/barrel (stable per OPEC outlook) keeps synthetics competitive, capping cotton’s upside.

Conclusion: Mixed macro outlook—growth supports demand (bullish), but USD strength and inflation lean bearish.

⭐☀🌟COT Data Latest⭐☀🌟

The Commitments of Traders (COT) report from the CFTC (hypothetical for March 7, 2025, released March 11) tracks futures positions:

Commercial Hedgers: Net short 50,000 contracts (producers locking in prices), down from 60,000 prior week, suggesting less hedging pressure.

Large Speculators: Net long 30,000 contracts (up from 25,000), indicating growing bullish bets.

Small Traders: Net long 5,000 contracts, steady.

Open Interest: 220,000 contracts, up 5%, showing increased market participation.

Conclusion: Speculative buying (bullish signal) outweighs commercial selling, suggesting short-term upward momentum.

⭐☀🌟Intermarket Analysis⭐☀🌟

Intermarket relationships influence cotton:

Crude Oil: Stable at $70-80/barrel correlates with synthetic fiber costs. No sharp oil rally, so cotton retains competitiveness.

USD: Stronger USD (105-110) pressures export commodities like cotton, bearish.

Grains (Corn/Soy): Corn at $4.50/bushel, soybeans at $10/bushel (hypothetical). Stable grain prices suggest no major acreage shift from cotton, neutral.

Stock Markets: S&P 500 at 5,500 (assumed) reflects economic optimism, supporting textile demand (bullish).

Bonds: 10-year Treasury yield at 4% aligns with steady rates, neutral.

Conclusion: Bullish stock market and stable grains support cotton, but USD strength is a headwind. Mildly bullish overall.

⭐☀🌟Technical Factors⭐☀🌟

Technical analysis for cotton futures (price 64.600 cents/lb):

Trend: 50-day MA (64.00) crossed above 200-day MA (63.50) in Feb 2025, signaling a bullish trend.

Support/Resistance: Support at 63.00 (recent low), resistance at 66.00 (Jan 2025 high).

RSI: 55 (neutral, not overbought), room for upside.

MACD: Positive crossover (bullish momentum) since early March.

Volume: Rising with price, confirming trend strength.

Conclusion: Bullish technicals with potential to test 66.00 if momentum holds.

⭐☀🌟Sentiment Factors⭐☀🌟

Market sentiment:

News Flow: Hypothetical reports of steady planting and Chinese demand lift sentiment (bullish).

Trader Chatter: Social media posts (searched March 11, 2025) show optimism about textile recovery, though some cite USD risks.

Analyst Views: CME Group commentary (assumed) leans bullish on demand, neutral on supply.

Conclusion: Positive sentiment supports a bullish bias, tempered by macro concerns.

⭐☀🌟Seasonal Factors⭐☀🌟

Cotton’s seasonal patterns:

March Timing: Northern Hemisphere planting begins (US, China), while Southern Hemisphere harvests peak (Brazil, Australia). Prices often firm up pre-planting due to supply uncertainty.

Historical Data: March-April typically sees a 2-5% price rise (CME Group data), favoring bulls.

Conclusion: Seasonal strength leans bullish for short-term gains.

⭐☀🌟Next Trend Move and Future Trend Prediction⭐☀🌟

Predicted trends with targets:

Short-Term: Bullish, targeting 66-68.

Medium-Term: Bullish, targeting 70-72.

Long-Term: Bullish, targeting 80-85.

⭐☀🌟Overall Summary Outlook⭐☀🌟

Current Price: 64.600

Outlook: Long/Bullish (Short-Term), Neutral (Medium/Long-Term)

Summary: Fundamentals show balance, but speculative buying (COT), technical strength, and seasonal factors favor a near-term rally to 66.00-67.00. Macro headwinds (USD, inflation) and intermarket pressures could cap gains beyond spring, with a broader range of 62.00-70.00 likely by year-end. No major bearish triggers unless supply surges or demand falters.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

COFFEE Brewing upwardsBull case for Coffee is already well understood and price action confirms string upward trend.

Technicals: Broken above channel, on supprt, bull pennant forming, declining volume. All bullish signals. Gap at $359 possible target on downwards break. Target $500-600. Possible squeeze higher if big players caught short. Price action indicating possible parabolic blow off.

Fundamentals: Much already priced in. Current dryness in Brazil and damage to 2025 and 2026 crops not fully proceed, market hopeful rains will come and save crop. Harvest beginning approx May 2025 will possibly give some selling pressure, but until then stocks are tight and physical market showing no signs of further weakness.

Can further declines in DXY attract buyers of this commodity?ICEUS:CT1! futures have been on a steady decline for some time now. Could potential further declines in DXY attract buying interest of MARKETSCOM:COTTON ? Let's dig in.

Let us know what you think in the comments below.

Thank you.

74.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

Soybeans: Deja Vu all over againCBOT: Micro Soybean Futures ( CBOT_MINI:MZS1! )

Let’s rewire the clock back for seven years. In 2018, trade tensions escalated between the US and China, resulting in a series of tariffs and retaliations.

On July 6, 2018, US imposed a 25% tariff on $34 billion of Chinese imports. On the same day, China immediately hit back with 25% tariff on equal value of US goods.

American soybeans were among the hardest hit by tariffs. The United States has been the largest soybean producer in the world. According to USDA data, American farmers produced 120 million metric tons of soybeans in 2017, contributing to 35.6% of the world production. About 48.2%, or 57.9 metric tons, were exported to the global market, making US the second largest soybean exporter after Brazil.

China is the largest soybean consumer and importer. In 2017, it imported 94 million metric tons of soybeans, accounting for 61.7% of the global imports. Brazil and the US were the largest sources of China’s imports, with 53% and 34% shares, respectively.

Tariffs on US soybeans punished American farmers. Total tariff level was raised from 5% to 30%. As a result, the FOB cost to Shenzhen harbor in southern China hiked up 700 yuan (=$110) per ton. This made US soybeans 300 yuan more expensive than imports from Brazil.

Tariffs priced American farmers out of the Chinese market. According to USDA Foreign Agricultural Service, China imported 1,164 million bushels of US soybeans in 2017. By 2018, China import dropped 74% to 303. While US exports recovered to 831 in 2019, it did not resume to the pre-tariff level until the signing of US-China trade agreement. CBOT soybean futures plummeted 15-20% in the months after the tariffs were imposed.

US farmers incurred huge losses from both reduced sales and lower prices. The following illustration is an exercise of our mind, not from actual export data.

• Without trade tensions, we assume exports of 1,164 million bushels each in 2018 and 2019, at an average price of $105 per bushel. This comes to a baseline export revenue of $244.4 billion for both years combined.

• Tariffs lowered export sales to 1,134 million bushels for the two-year total, at an average price of $87. Thus, the tariff-impacted revenue data comes to $98.6 billion.

• The total impact on soybean sales volume would be -51%, from 2,328 down to 1,134.

• The total impact on export revenue would be -60%, from $244.4 to $98.6 billion.

It is déjà vu all over again.

In February 2025, the Trump administration announced 10% additional tariffs on Chinese goods. This was raised by another 10% in March, setting the total to 20%.

To retaliate against US tariffs, China imposed import levies covering $21 billion worth of U.S. agricultural and food products, effective March 10th. These comprised a 15% tariff on U.S. chicken, wheat, corn and cotton and an extra levy of 10% on U.S. soybeans, sorghum, pork, beef, aquatic products, fruits and vegetables and dairy imports.

This is just the beginning. In the last trade conflict, average US tariff on Chinese imports was raised from 4% to 19%. Now we set the starting point at 39%. How high could it go? From history, we learnt that this could go for several rounds before it settles.

Trading with Micro Soybean Futures

On March 11th, USDA published its World Agricultural Supply and Demand Estimates (WASDE) report. Both the U.S. and global 2024/25 soybean supply and use projections are basically unchanged this month, meeting market expectations.

In the last week, soybean futures bounced back by about 2%, recovered most the lost ground since China first announced the retaliative measures.

The latest CFTC Commitments of Traders report shows that, as of March 11th, CBOT soybean futures have total open interest of 810,374 contracts.

• Managed Money has 101,927 in long, 109,849 in short, and 108,993 in spreading positions.

• It appears that the “Small Money” spreads their money evenly, not knowing which direction the soybean market would go.

In my opinion, the futures market so far has completely ignored the possibility of a pro-long trade conflict with China.

• Seriously, ten percent is just the start. What if the tariff goes to 30% like in 2018?

• How would soybean prices react to a 50% drop in US soybean exports?

Anyone with a bearish view on soybeans could express it by shorting the CBOT micro soybean futures (MZS). These are smaller-sized contracts at 1/10 of the benchmark CBOT soybean futures. At 500 bushels per contract, market opportunities are more accessible than ever with lower capital requirements, an initial margin of only $200.

Coincidently, Friday settlement price of $10.17 for May contract (MZSK5) is identical to the soybean futures price of $10.40 immediately prior to the 2018 tariff.

History may not repeat, but it echoes . At the last time, the tariff on soybeans saw futures prices plummeting 20% within a month. If we were to experience the same, soybeans could drop to $8.00. This is a likely scenario if tariffs were to rise higher.

Hypothetically, a decline of $2 per bushel would cause a short futures position to gain $1,000, given each micro contract has a notional of 500 bushels.

The risk of short futures is the continuous rise in soybean prices. The trader would be wise to set a stoploss at his sell order. For example, a stop loss at $10.50 would set the maximum loss to $165 (= (10.50-10.17) x 500), which is less than the $200 initial margin.

To learn more about all Micro Ag futures contracts traded on CME Group platform, you can check out the following site:

www.cmegroup.com

Happy Trading.

Disclaimers

*Trade ideas cited above are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management under the market scenarios being discussed. They shall not be construed as investment recommendations or advice. Nor are they used to promote any specific products, or services.

CME Real-time Market Data help identify trading set-ups and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

"SOYBEAN" Commodities Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "SOYBEAN" Commodities Market market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (1045.00) then make your move - Bullish profits await!"

however I advise placing Place Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 2H timeframe (1020.00) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

1st Target - 1083.00 (or) Escape Before the Target

Final Target - 1130.00 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

🌾"SOYBEAN" Commodities Market is currently experiencing a bullish trend,., driven by several key factors.

Market Overview

Current Price: 1036.00

30-Day High: 1080.00

30-Day Low: 980.00

30-Day Average: 1000.00

Previous Close Price: 1020.00

Change: 16.00

Percent Change: 1.57%

🍀Fundamental Analysis

Supply and Demand: Global soybean demand is expected to increase, driven by growing demand for soybean oil and meal.

Weather Trends: Weather conditions in major soybean-producing countries are expected to be favorable, potentially leading to increased production.

Inventory Levels: Global soybean inventory levels are expected to decrease, driven by growing demand and limited supply.

Trade Trends: Global soybean trade is expected to increase, driven by growing demand for soybean products.

🍀Macro Economics

Global Economic Trends: The ongoing global economic recovery is expected to drive up demand for soybeans, driven by increasing investor confidence.

Inflation Rate: Global inflation is expected to rise to 3.8% in 2025, potentially increasing demand for soybeans as a hedge against inflation.

Interest Rates: Central banks are expected to maintain low interest rates in 2025, potentially increasing demand for soybeans.

Commodity Prices: Commodity prices are expected to rise by 5% in 2025, driven by increasing demand for raw materials.

🍀COT Data

Non-Commercial Traders (Institutional):

Net Long Positions: 60%

Open Interest: 150,000 contracts

Commercial Traders (Companies):

Net Short Positions: 30%

Open Interest: 80,000 contracts

Non-Reportable Traders (Small Traders):

Net Long Positions: 10%

Open Interest: 20,000 contracts

COT Ratio: 2.0 (indicating a bullish trend)

🍀Sentimental Outlook

Institutional Sentiment: 65% bullish, 35% bearish

Retail Sentiment: 60% bullish, 40% bearish

Market Mood: The overall market mood is bullish, with a sentiment score of +50.

🍀Next Move Prediction

Bullish Move: Potential upside to 1120.00-1150.00.

Target: 1150.00 (primary target), 1200.00 (secondary target)

Next Swing Target: 1250.00 (potential swing high)

Stop Loss: 980.00 (below the 30-day low)

Risk-Reward Ratio: 1:2 (potential profit of 114.00 vs potential loss of 57.00)

🍀Overall Outlook

The overall outlook for SOYBEAN is bullish, driven by a combination of fundamental, technical, and sentimental factors. The expected increase in global soybean demand, favorable weather trends, and bullish market sentiment are all supporting the bullish trend. However, investors should remain cautious of potential downside risks, including changes in global economic trends and unexpected weather events.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

COTTON Cash CFD Commodities Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the COTTON Cash CFD Commodities Market market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise placing Place Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 2H timeframe (65.700) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

1st Target - 68.000 (or) Escape Before the Target

Final Target - 71.000 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

COTTON Cash CFD Commodities Market is currently experiencing a bullish trend,., driven by several key factors.

🌳Fundamental Analysis

Supply and Demand: Global cotton production is expected to decline by 1.5% in 2024-25, while consumption is forecasted to increase by 2.5%.

Weather Conditions: Favorable weather in major cotton-producing countries, such as the US, China, and India, may support production.

🌳Macroeconomic Analysis

Global Economic Growth: The International Monetary Fund (IMF) forecasts global economic growth to slow down to 3.2% in 2024, which may impact cotton demand.

Trade Tensions: Ongoing trade tensions between the US and China may influence cotton trade and prices.

🌳COT Data Analysis

Institutional Traders: 55% long, 45% short

Large Speculators: 52% long, 48% short

Commercial Traders: 60% short, 40% long

🌳Market Sentimental Analysis

Market Sentiment: 45% bullish, 55% bearish

Trader Sentiment: 42% long, 58% short

Option Skew: 25-delta put option skew at 12.5

🌳Positioning Data Analysis

Bullish Trend: 40% likely.

Bearish Trend: 60% likely.

Neutral Trend: 10% likely.

🌳Overall Outlook

However, some analysts predict a bullish continuation, targeting 71.000. The market's technical outlook points to a buildup of bearish momentum as prices break below the 50-day moving average.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

"COFFEE" Commodities CFD Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

⚔Dear Money Makers & Thieves, 🤑 💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "COFFEE" Commodities CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (370) then make your move - Bearish profits await!" however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or Swing high or low level should be in retest.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: Thief SL placed at (400) swing Trade Basis Using the 4H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 340 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

"COFFEE" Commodities CFD Market is currently experiencing a Neutral trend (higher chance to 🐻🐼Bearishness)., driven by several key factors.

📰🗞️Read the Fundamental, Macro Economics, COT Report, Seasonal Factors, Intermarket Analysis, Sentimental Outlook, Future trend predict.

Before start the heist plan read it.👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Inflation Leading Indicator Data with Agricultural Commodities Inflation leading indicator data is not derived solely from CPI numbers; more importantly, we must consider what drives these CPI numbers. By understanding this, we can stay ahead of the mass market.

Looking at past trends, we can observe that CPI numbers and agricultural commodities tend to move in tandem.

In this discussion, we will explore why agricultural commodities are an effective tool for projecting inflation direction and examine where these commodities may be heading.

Micro Agriculture Futures:

. Corn: MZC

. Wheat: MZW

. Soybean: MZS

. Soybean Oil: MZL

. Soybean Meal: MZM

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Trading the Micro: www.cmegroup.com

WHEAT Approaching Key Support - Will Price Rebound to 550$?PEPPERSTONE:WHEAT is approaching a key support level, an area where buyers have previously shown strong interest. The recent bearish movement suggests that price may soon be testing this level, potentially setting up for a rebound.

A bullish confirmation, such as a strong rejection pattern, bullish engulfing candles, or long lower wicks, would strengthen the case for a move higher. If buyers step in, the price could rally toward the 550$ target. However, a decisive breakdown below this support would invalidate the bullish scenario and could lead to further downside.

This is not financial advice but rather how I approach support/resistance zones. Remember, always wait for confirmation, like a rejection candle or volume spike before jumping in.

Best of luck , TrendDiva

Coffee Futures Outlook: Potential Corrections Ahead After HistorCoffee futures have experienced a strong upward movement, breaking their all-time high and unlocking Fibonacci-based mirroring and projection targets. However, the manner in which the price reached this level—overextended and distanced from its moving averages—combined with last month’s candlestick signaling selling pressure, suggests a high probability of corrective movements in the coming months. Should a pullback occur, it will be crucial to monitor how the price reacts upon testing the 20-period moving average.

WHEAT at Key Support Zone – Bullish Bounce ExpectedPEPPERSTONE:WHEAT has approached a key support zone, marked by previous price reactions and strong buying interest. This area has previously acted as a demand zone, increasing the likelihood of a bullish bounce if buyers step in.

The current market structure suggests that if the price confirms support within this zone, we could see a reversal toward 573.0, a logical target based on prior price behavior and current structure. A clear bullish signal, such as a rejection wick or bullish engulfing candle, would strengthen this outlook.

However, if the price breaks below this support zone, the bullish scenario may be invalidated, signaling potential further downside.

Just my take on support and resistance zones—not financial advice. Always confirm your setups and trade with solid risk management.

Best of luck!

"WHEAT" Cash CFD Commodities Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "WHEAT" Cash CFD Commodities Market market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise placing Place Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 2H timeframe (568.0) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

1st Target - 594.0 (or) Escape Before the Target

Final Target - 616.0 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

🌾"WHEAT" Cash CFD Commodities Market is currently experiencing a bullish trend,., driven by several key factors.

🌿Fundamental Analysis

Supply and Demand: Global wheat production is expected to increase by 2% in 2025, driven by favorable weather conditions in major producing countries

Weather Conditions: Weather forecasts indicate a high probability of drought in key wheat-producing regions, which could impact yields and support prices

Global Economic Trends: The ongoing global economic recovery is expected to drive up demand for wheat, particularly from emerging markets

Trade Policies: The recent trade agreements between major wheat-producing countries are expected to increase global wheat trade and support prices

🌿Macro Economics

Global GDP Growth: The World Bank forecasts global GDP growth to accelerate to 3.4% in 2025, up from 3.2% in 2024

Inflation Rate: Global inflation is expected to rise to 3.8% in 2025, driven by increasing demand and supply chain disruptions

Interest Rates: Central banks are expected to maintain low interest rates in 2025, supporting commodity prices

Unemployment Rate: The global unemployment rate is expected to decline to 5.4% in 2025, driven by job growth in emerging markets.

🌿COT Data

Net Long Positions: Institutional traders have increased their net long positions in wheat to 55%

COT Ratio: The COT ratio has risen to 2.2, indicating a bullish trend

Open Interest: Open interest in wheat futures has increased by 10% over the past month, indicating growing investor interest

🌿Sentimental Outlook

Institutional Sentiment: 60% bullish, 40% bearish

Retail Sentiment: 55% bullish, 45% bearish

Market Mood: The overall market mood is bullish, with a sentiment score of +30

🌿Technical Analysis

Moving Averages: 50-period SMA: 565.0, 200-period SMA: 540.0.

Relative Strength Index (RSI): 4-hour chart: 62.21, daily chart: 58.14.

Bollinger Bands: 4-hour chart: 580.0 (upper band), 560.0 (lower band).

🌿Next Move Prediction

Bullish Move: Potential upside to 600.0-620.0.

Key Support Levels: 565.0, 540.0.

Key Resistance Levels: 600.0, 620.0.

🌿Overall Outlook

The overall outlook for wheat is bullish, driven by a combination of fundamental, technical, and sentimental factors. The expected increase in global wheat demand, favorable weather conditions, and low interest rates are all supporting the bullish trend. However, investors should remain cautious of potential downside risks, including changes in global trade policies and unexpected weather events.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Can Soybeans Survive the Global Trade Chessboard?In the intricate game of international trade politics, soybeans have emerged as pivotal pieces on the global economic chessboard. The soybean industry faces a critical juncture as nations like the European Union and China implement protectionist strategies in response to US policies. This article delves into how these geopolitical moves are reshaping the future of one of America's most significant agricultural exports, challenging readers to consider the resilience and adaptability required in today's volatile trade environment.

The European Union's decision to restrict US soybean imports due to the use of banned pesticides highlights a growing trend towards sustainability and consumer health in global trade. This move impacts American farmers and invites us to ponder the broader implications of agricultural practices on international commerce. As we witness these shifts, the question arises: How can the soybean industry innovate to meet global standards while maintaining its economic stronghold?

China's strategic response, which targets influential American companies like PVH Corp., adds complexity to the global trade narrative. The placement of a major U.S. brand on China's 'unreliable entity' list highlights the power dynamics involved in international commerce. This situation prompts us to consider the interconnectedness of economies and the potential for unforeseen alliances or conflicts. What strategies can businesses implement to navigate these challenging circumstances?

Ultimately, the soybean saga is more than a tale of trade disputes; it's a call to action for innovation, sustainability, and strategic foresight in the agricultural sector. As we watch this unfold, we are inspired to question not just the survival of soybeans but the very nature of global economic relationships in an era where every move on the trade chessboard can alter the game. How will the soybean industry, and indeed, international trade, evolve in response to these challenges?