Why Soybean Oil Outperforms Crude Oil?From their recent lows, soybean oil has quietly crept up by 50%, while crude oil has risen by 40%. The reason goes beyond the recent renewal of tensions in the Middle East — it runs deeper than that.

Mirco SoybeanOil Futures

Ticker: MZL

Minimum fluctuation:

0.02 per pound = $1.20

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Trading the Micro: www.cmegroup.com

www.cmegroup.com

Agriculture

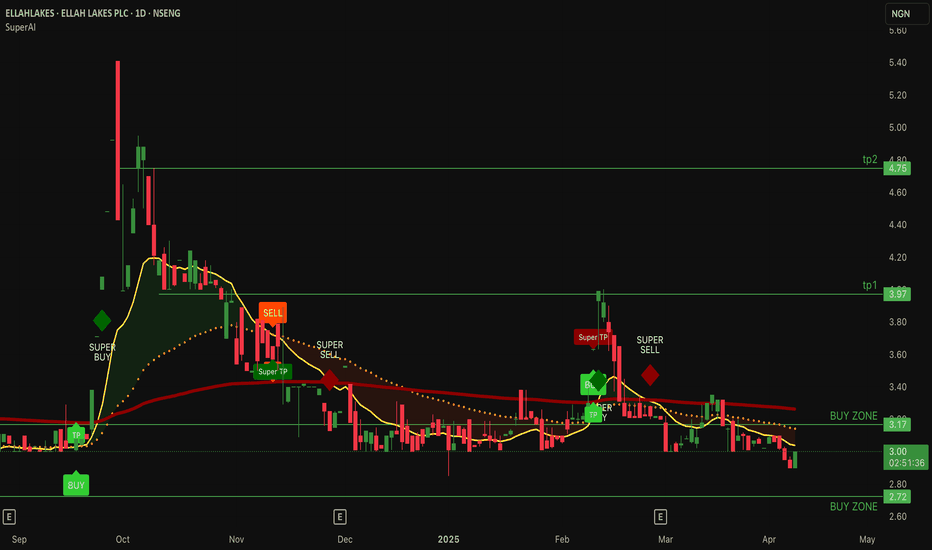

$ellahlakes Ellahlakes over 45% Retracement from 5.4naira/shareEllah Lakes Plc, established in 1980 and headquartered in Benin City, Nigeria, is an agribusiness company engaged in cultivating oil palm, cassava, soybean, maize, and rice. The company manages plantations across Edo, Ondo, and Enugu States.

NSENG:ELLAHLAKES all time high is 5.4naira/share in September 2024

Current price: 2.99naira/Share

#Ellahlakes is currently a low risk investment with possible heights of 3.9 and 4.7 per share.

Preferred buy zone is between: 2.7-3.1

Please Note: Idea Invalidation is Under 2.7

Indicator in use is the SuperAI: Check my Profile for more Information.

Will Dry Soil Lift Wheat's Price?Global wheat markets are currently experiencing significant attention as traders and analysts weigh various factors influencing their future price trajectory. Recent activity, particularly in key futures markets, suggests a growing consensus towards potential upward price movements. While numerous elements contribute to the complex dynamics of the grain trade, current indicators highlight specific supply-side concerns as the primary catalyst for this outlook.

A major force behind the anticipation of higher wheat prices stems from challenging agricultural conditions in significant production areas. The United States, a crucial global supplier, faces concerns regarding its winter wheat crop. Persistent dryness across key growing regions is directly impacting crop development and posing a material threat to achieving expected yields. This environmental pressure is viewed by market participants as a fundamental constraint on forthcoming supply.

Further reinforcing these concerns, official assessments of crop health have underscored the severity of the situation. Recent data from the U.S. Department of Agriculture revealed a winter wheat condition rating below both the previous year's level and average analyst expectations. This shortfall in anticipated crop health indicates a less robust supply picture than previously factored into market pricing, thereby increasing the likelihood of price appreciation as supply tightens relative to demand, even as other global factors like shifts in export prices from other regions introduce different market crosscurrents.

Cocoa's Future: Sweet Commodity or Bitter Harvest?The global cocoa market faces significant turbulence, driven by a complex interplay of environmental, political, and economic factors threatening price stability and future supply. Climate change presents a major challenge, with unpredictable weather patterns in West Africa increasing disease risk and directly impacting yields, as evidenced by farmer reports and scientific studies showing significant yield reductions due to higher temperatures. Farmers warn of potential crop destruction within the decade without substantial support and adaptation measures.

Geopolitical pressures add another layer of complexity, particularly regarding farmgate pricing in Ghana and Côte d'Ivoire. Political debate in Ghana centres on demands to double farmer payments to align with campaign promises and counter the incentive for cross-border smuggling created by higher prices in neighbouring Côte d'Ivoire. This disparity highlights the precarious economic situation for many farmers and the national security implications of unprofitable cocoa cultivation.

Supply chain vulnerabilities, including aging trees, disease prevalence like Swollen Shoot Virus, and historical underinvestment by farmers due to low prices, contribute to a significant gap between potential and actual yields. While recent projections suggest a potential surplus for 2024/25 after a record deficit, pollination limitations remain a key constraint, with studies confirming yields are often capped by insufficient natural pollination. Concurrently, high prices are dampening consumer demand and forcing manufacturers to consider reformulating products, reflected in declining cocoa grinding figures globally.

Addressing these challenges necessitates a multi-pronged approach focused on sustainability and resilience. Initiatives promoting fairer farmer compensation, longer-term contracts, agroforestry practices, and improved soil management are crucial. Enhanced collaboration across the value chain, alongside government support for sustainable practices and compliance with new environmental regulations, is essential to navigate the current volatility and secure a stable future for cocoa production and the millions who depend on it.

Will Coffee Remain an Affordable Luxury?Global coffee prices are experiencing a significant upswing, driven primarily by severe supply constraints in the world's major coffee-producing regions. Adverse weather conditions, notably drought and inconsistent rainfall linked to climate change, have crippled production capacity in Brazil (the largest arabica producer) and Vietnam (the largest robusta producer). Consequently, crop yield forecasts are being revised downwards, export volumes are shrinking, and concerns over future harvests are mounting, putting direct upward pressure on both arabica and robusta bean prices worldwide.

Adding complexity to the situation are fluctuating market dynamics and conflicting future outlooks. While recent robusta inventories have tightened, arabica stocks saw a temporary rise, sending mixed signals. Export data is similarly inconsistent, and market forecasts diverge significantly – some analysts predict deepening deficits and historically low stocks, particularly for Arabica, while others project widening surpluses. Geopolitical factors, including trade tensions and tariffs, further cloud the picture, impacting costs and potentially dampening consumer demand.

These converging pressures translate directly into higher operational expenses for businesses across the coffee value chain. Roasters face doubled green bean costs, forcing cafes to increase consumer prices for beverages to maintain viability amidst already thin margins. This sustained cost increase is impacting consumer behaviour, potentially shifting preferences towards lower-quality coffee, and diminishing the price premiums previously enjoyed by specialty coffee growers. The industry faces significant uncertainty, grappling with the possibility that these elevated price levels may represent a new, challenging norm rather than a temporary spike.

Soybeans: Deja Vu all over againCBOT: Micro Soybean Futures ( CBOT_MINI:MZS1! )

Let’s rewire the clock back for seven years. In 2018, trade tensions escalated between the US and China, resulting in a series of tariffs and retaliations.

On July 6, 2018, US imposed a 25% tariff on $34 billion of Chinese imports. On the same day, China immediately hit back with 25% tariff on equal value of US goods.

American soybeans were among the hardest hit by tariffs. The United States has been the largest soybean producer in the world. According to USDA data, American farmers produced 120 million metric tons of soybeans in 2017, contributing to 35.6% of the world production. About 48.2%, or 57.9 metric tons, were exported to the global market, making US the second largest soybean exporter after Brazil.

China is the largest soybean consumer and importer. In 2017, it imported 94 million metric tons of soybeans, accounting for 61.7% of the global imports. Brazil and the US were the largest sources of China’s imports, with 53% and 34% shares, respectively.

Tariffs on US soybeans punished American farmers. Total tariff level was raised from 5% to 30%. As a result, the FOB cost to Shenzhen harbor in southern China hiked up 700 yuan (=$110) per ton. This made US soybeans 300 yuan more expensive than imports from Brazil.

Tariffs priced American farmers out of the Chinese market. According to USDA Foreign Agricultural Service, China imported 1,164 million bushels of US soybeans in 2017. By 2018, China import dropped 74% to 303. While US exports recovered to 831 in 2019, it did not resume to the pre-tariff level until the signing of US-China trade agreement. CBOT soybean futures plummeted 15-20% in the months after the tariffs were imposed.

US farmers incurred huge losses from both reduced sales and lower prices. The following illustration is an exercise of our mind, not from actual export data.

• Without trade tensions, we assume exports of 1,164 million bushels each in 2018 and 2019, at an average price of $105 per bushel. This comes to a baseline export revenue of $244.4 billion for both years combined.

• Tariffs lowered export sales to 1,134 million bushels for the two-year total, at an average price of $87. Thus, the tariff-impacted revenue data comes to $98.6 billion.

• The total impact on soybean sales volume would be -51%, from 2,328 down to 1,134.

• The total impact on export revenue would be -60%, from $244.4 to $98.6 billion.

It is déjà vu all over again.

In February 2025, the Trump administration announced 10% additional tariffs on Chinese goods. This was raised by another 10% in March, setting the total to 20%.

To retaliate against US tariffs, China imposed import levies covering $21 billion worth of U.S. agricultural and food products, effective March 10th. These comprised a 15% tariff on U.S. chicken, wheat, corn and cotton and an extra levy of 10% on U.S. soybeans, sorghum, pork, beef, aquatic products, fruits and vegetables and dairy imports.

This is just the beginning. In the last trade conflict, average US tariff on Chinese imports was raised from 4% to 19%. Now we set the starting point at 39%. How high could it go? From history, we learnt that this could go for several rounds before it settles.

Trading with Micro Soybean Futures

On March 11th, USDA published its World Agricultural Supply and Demand Estimates (WASDE) report. Both the U.S. and global 2024/25 soybean supply and use projections are basically unchanged this month, meeting market expectations.

In the last week, soybean futures bounced back by about 2%, recovered most the lost ground since China first announced the retaliative measures.

The latest CFTC Commitments of Traders report shows that, as of March 11th, CBOT soybean futures have total open interest of 810,374 contracts.

• Managed Money has 101,927 in long, 109,849 in short, and 108,993 in spreading positions.

• It appears that the “Small Money” spreads their money evenly, not knowing which direction the soybean market would go.

In my opinion, the futures market so far has completely ignored the possibility of a pro-long trade conflict with China.

• Seriously, ten percent is just the start. What if the tariff goes to 30% like in 2018?

• How would soybean prices react to a 50% drop in US soybean exports?

Anyone with a bearish view on soybeans could express it by shorting the CBOT micro soybean futures (MZS). These are smaller-sized contracts at 1/10 of the benchmark CBOT soybean futures. At 500 bushels per contract, market opportunities are more accessible than ever with lower capital requirements, an initial margin of only $200.

Coincidently, Friday settlement price of $10.17 for May contract (MZSK5) is identical to the soybean futures price of $10.40 immediately prior to the 2018 tariff.

History may not repeat, but it echoes . At the last time, the tariff on soybeans saw futures prices plummeting 20% within a month. If we were to experience the same, soybeans could drop to $8.00. This is a likely scenario if tariffs were to rise higher.

Hypothetically, a decline of $2 per bushel would cause a short futures position to gain $1,000, given each micro contract has a notional of 500 bushels.

The risk of short futures is the continuous rise in soybean prices. The trader would be wise to set a stoploss at his sell order. For example, a stop loss at $10.50 would set the maximum loss to $165 (= (10.50-10.17) x 500), which is less than the $200 initial margin.

To learn more about all Micro Ag futures contracts traded on CME Group platform, you can check out the following site:

www.cmegroup.com

Happy Trading.

Disclaimers

*Trade ideas cited above are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management under the market scenarios being discussed. They shall not be construed as investment recommendations or advice. Nor are they used to promote any specific products, or services.

CME Real-time Market Data help identify trading set-ups and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Inflation Leading Indicator Data with Agricultural Commodities Inflation leading indicator data is not derived solely from CPI numbers; more importantly, we must consider what drives these CPI numbers. By understanding this, we can stay ahead of the mass market.

Looking at past trends, we can observe that CPI numbers and agricultural commodities tend to move in tandem.

In this discussion, we will explore why agricultural commodities are an effective tool for projecting inflation direction and examine where these commodities may be heading.

Micro Agriculture Futures:

. Corn: MZC

. Wheat: MZW

. Soybean: MZS

. Soybean Oil: MZL

. Soybean Meal: MZM

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Trading the Micro: www.cmegroup.com

Overdue for a strong correction before higher yet?Here is my current view of LC. Like many others, I never thought it would get this high in the first place. But following and adapting with this runaway longwinded bull, the funds are very long and as they unwind (it already looks to have started), it's gonna be a sharp downward move. There's good support and technical retracement down around the 190 region, but panic and momentum and long liquidation turning to even shorts could get thing uglier yet. I currently expect to eventually shoot back to new highs, perhaps targeting 220 region.

What Lies Beyond the Cornfield's Horizon?The narrative of corn in the global agricultural scene is not merely about sustenance but a complex ballet of economics, innovation, and policy. This staple crop stands at the intersection of international trade, with U.S. farmers gaining a foothold in Mexico's market through a significant legal victory against GMO corn restrictions, highlighting the nuanced dance between technology and trade agreements. Meanwhile, Brazil's agricultural strategies reveal a shift towards leveraging corn for ethanol, showcasing a potential future where corn could play an even more pivotal role in sustainable energy solutions.

In science and technology, the development of digital corn twins presents a frontier in crop breeding. This innovative approach could redefine how we think about plant resilience and efficiency, potentially leading to crops tailored to withstand the capricious whims of climate change. The challenge lies in translating theoretical models into practical, field-ready solutions that can benefit farmers and consumers alike.

However, the journey isn't without its threats. The unexpected rise of corn leaf aphids in 2024 serves as a stark reminder of the ongoing battle with nature's unpredictability. Farmers are now challenged to anticipate and manage these pests, pushing the boundaries of traditional farming practices into more predictive, data-driven methodologies. This situation beckons a broader inquiry into how agriculture can evolve not just to react but preemptively adapt to ecological shifts.

As we look beyond the cornfield's horizon, we see a landscape where policy, technology, and biology converge. The future of corn involves navigating this triad with foresight, ensuring that each step taken today not only secures current yields but also plants the seeds for a sustainable agricultural legacy. This exploration into corn's evolving role invites us to ponder how we can harness these developments for a future where food security and environmental stewardship walk hand in hand.

Can One Bean's Rally Reshape Global Markets?The extraordinary trajectory of cocoa in 2024 has rewritten the commodities playbook, outperforming traditional powerhouses like oil and metals with a staggering 175% price surge. This unprecedented rally, culminating in record prices of nearly $13,000 per metric ton, reveals more than just market volatility—it exposes the delicate balance between global supply chains and environmental factors.

West Africa's cocoa belt lies at the heart of this transformation, where Ivory Coast and Ghana face a complex web of challenges. The convergence of adverse weather conditions, particularly the harsh Harmattan winds from the Sahara and widespread bean disease, and the encroachment of illegal gold mining operations, has created a perfect storm that threatens global chocolate production. This situation presents a compelling case study of how localized agricultural challenges can cascade into global market disruptions.

The ripple effects extend beyond just chocolate manufacturers and commodities traders. This market upheaval coincides with similar pressures in other soft commodities, notably coffee, which saw prices reach forty-year highs. These parallel developments suggest a broader pattern of vulnerability in agricultural commodities that could reshape our understanding of market dynamics and risk assessment in commodity trading. As we look toward 2025, the cocoa market stands as a harbinger of how climate volatility and regional production challenges might increasingly influence global commodity markets, forcing investors and industry players to adapt to a new normal in agricultural commodity trading.

ICL Group (NYSE:ICL): This Stock Looking Like a Strong BuyIn a world where agricultural demands continue to rise and global food supply chains strive for resilience, few sectors hold as much long-term promise as fertilizers. For investors scanning the market for a standout play, ICL Group Ltd (NYSE:ICL) has steadily emerged as a compelling candidate. This Israel-based potash and fertilizer producer, once tucked quietly under the radar, has recently begun charting an impressive upward trajectory—one that’s been catching the attention of analysts and portfolio managers alike.

Analysis according to recent price movements:

A Fertile Foundation for Growth

The fertilizer industry stands at a pivotal moment. Growing populations, changing dietary patterns, and the constant quest for greater crop yields all support a robust future for nutrient-rich soils. In this landscape, ICL’s diversified suite of phosphate and potash-based solutions sets it apart. The company’s market valuation of approximately $6.46 billion, coupled with its influential presence in the sector, means it’s well-positioned to capitalize on long-term trends in global agriculture.

At a time when many commodity-driven companies grapple with short-term price swings, ICL has managed a steady hand at the helm. Leveraging decades of industry experience, its leadership team is navigating supply-demand dynamics and evolving consumer needs to secure healthy growth prospects. Just as crucially, the company’s operations are fortified by strong fundamentals—traits increasingly sought after by investors craving a balance of stability and upside potential.

Charting a Three-Month Breakout

While many stocks have wavered amid market uncertainties, ICL has carved out a sturdy, bullish pattern. Over the last three months, shares have embarked on a notable uptrend. The momentum speaks for itself: the stock has surged more than 28% in the past 12 weeks, outpacing broader market benchmarks and signaling heightened interest from the investing community. Over the last month alone, ICL added nearly 13% to its value, steadily approaching its 52-week high of $5.54.

This price action hasn’t come in isolation. Technical indicators corroborate the story: the stock is currently hovering around $4.90 to $5.05 intraday—comfortably above key moving averages. Short-term indicators lean bullish, painting a picture of a market participants warming to ICL’s narrative. With its 14-day Relative Strength Index (RSI) near 72, the shares are displaying robust near-term momentum, while the average true range (ATR) and beta of 1.27 highlight the stock’s responsiveness to market catalysts. In other words, ICL isn’t just drifting upward; it’s sprinting ahead with conviction.

Continual Earnings Surprises Spark Investor Optimism

Many companies talk the talk, but ICL keeps walking the walk—especially when it comes to earnings. The firm has consistently outperformed Wall Street’s expectations, posting positive surprises that reinforce investor confidence. Quarter after quarter, ICL hasn’t just met the Street’s targets—it has beaten them, setting a precedent of reliable growth and profitability.

This consistency has generated palpable excitement ahead of the company’s upcoming quarterly earnings report, slated for release in January. Analysts currently forecast quarterly revenue around $1.65 billion, and the market’s growing optimism is reflected in ICL’s valuation and dividend. With a forward dividend ratio of 0.20 and a yield of nearly 4%, the stock doesn’t just reward shareholders with capital gains potential; it also delivers a meaningful income stream.

Building Momentum at a Bargain

What truly sets ICL apart is its blend of surging momentum and attractive valuation metrics. While many market darlings end up trading at lofty multiples that make value-conscious investors wince, ICL remains reasonably priced. Its trailing 12-month P/E ratio sits at around 16, and a price-to-sales ratio near 0.95 suggests a bargain for those confident in the company’s trajectory. Simply put, ICL offers the rare combination of forward momentum, reliable earnings growth, and an appealing entry point.

Other Financials pointing to a strong Buy:

ICL revenue's has grown by 0.06% QoQ from Q2 2024 to Q3 2024-Aside from this company having financials in check and beating earning estimates quarter over quarter with an earnings surprise. According to MSN Money when scanning the stock's health, ICL's EPS has grown by 10% QoQ from Q2 2024 to Q3 2024, and its quality of earnings is better than its peer average, and ICL's net profit margin has grown by 5.83% which is 0.64% above its peer average. And more great news as far as Financial health-ICL's ability to cover its short-term obligations with short term assets is above that of its peers. In addition ICL is trading at a P/S multiple (0.89x) below the industry average (3.55x). No wonder Zacks just recently commented that this is one of their momentum buys.

Technicals Pointing to a Strong Buy :

Now, when is it time to get into a a trade of a great stock, what should be the entry level ? This is where technicals are very important to pay close attention to. This stock just went on my radar as a strong buy. Here's why: Firstly: This stock has a beautiful trend line over the last 3 months. And if you look at all the most important technicals I believe this stock is ready to go much higher. According to its key MAs (Moving Averages)its all pointing to a strong buy at this current price level, also according to many other key technical indicators all pointing to a strong buy such as: MacD, RSI , also a buy according to Ultimate Oscillator.

Key resistance levels to pay attention to now are: 4.956, 4.967,4.984, And key support levels: 4.9,4.911, 4.928

The Bottom Line

In a market environment that often forces investors to choose between growth, value, and reliability, ICL Group stands out as a name that potentially bridges all three. Surging investor interest and a chart-friendly breakout over the past three months underscore a new chapter in the company’s story—one defined by consistent earnings outperformance, a favorable industry backdrop, and compelling valuation.

As global agriculture faces increasing demands, ICL’s position in the fertilizer ecosystem, its track record of earnings surprises, and a rising stock price might just make it one of the more fertile grounds for investors’ portfolios. For those looking to harvest returns from a sector with solid long-term fundamentals, ICL deserves serious consideration as a growth story that’s still just beginning to blossom.

Agricultural commodities outperforming After a +20% gain in the first quarter of the year, AMEX:DBA formed a 30-week base respecting the 2022 highs

Price resolver higher confirming the continuation of the uptrend making 52-week highs

This week has been very bad for the equity indexes, but AMEX:DBA is making 3 month highs relative to the SP:SPX

The best thing to do in this kind of market environment is to look for what is outperforming

Can Coffee's Future Brew a Global Economic Storm?In the high-stakes world of global commodities, coffee has emerged as an unexpected harbinger of economic complexity, revealing how climate volatility can transform a morning ritual into a geopolitical and financial chess game. The current market is experiencing unprecedented turbulence, with Arabica coffee prices surging over 80% in 2024, shattering decades-old records and signaling a profound disruption in one of the world's most beloved agricultural products.

This dramatic price escalation is not merely a statistical anomaly, but a stark illustration of interconnected global systems under extreme stress. Brazil and Vietnam, the twin titans of coffee production, have been ravaged by climatic extremes—from the most severe drought in 70 years to unpredictable rainfall patterns—creating a perfect storm that threatens not just coffee supplies, but exposes the fragile underbelly of global agricultural supply chains. Leading traders like Volcafe are projecting an unprecedented fifth consecutive year of supply deficits, a scenario that challenges traditional market resilience and demands innovative strategic responses.

Beyond the immediate economic implications, this coffee crisis represents a microcosm of broader challenges facing our increasingly complex and climate-vulnerable global economic ecosystem. As major manufacturers like Nestlé begin to signal potential price increases and package reductions, consumers and businesses alike are forced to confront a fundamental question: How do we build sustainable, adaptable systems in an era of escalating environmental uncertainty? The coffee market's current volatility is not just about a potential price hike in your morning brew, but a compelling narrative about resilience, adaptation, and the intricate dance between human enterprise and natural systems.

For the astute observer and strategic thinker, this coffee market disruption offers a compelling lens through which to examine broader economic trends. It underscores the critical importance of diversification, technological innovation, and proactive risk management in an era where climate change is no longer a distant threat, but an immediate and transformative economic reality. The story of coffee in 2024 is more than a commodity report—it's a provocative invitation to reimagine our understanding of global economic interdependence.

Why Cost of Living is Still a Concern?Why is the cost of living still a concern, even though inflation has declined to 2.6%?

In many elections over the past two years, voters have ranked inflation as their top concern.

As we can see, the prices of many commodities remain above pre-COVID levels, with gold and meat prices currently much higher than they were at the inflation peak in 2022.

Consciously or unconsciously, both investors and consumers seem to feel that the cost of living will remain elevated for a prolonged period. Moreover, there is always a risk that inflation might creep back up again.

Feeder Cattle Futures & Options

Ticker: GF

Minimum fluctuation:

0.00025 per pound = $12.50

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

MULTIBAGGER Series - Stock 4Hello everyone!

I am back with 3rd company of the multibagger series.

The company is Nirman Agri Genetics Ltd. NAGL is an agricultural input company that produces, processes, and markets premium hybrid seeds, organic fertilizers, and bio-organic seeds for a variety of crops, including corn, sunflower, cotton, rice, sorghum, and grain. Majorly they are processing corn. It has recently started producing micronutrients and bioproducts. In addition, it grows non-hybrid seeds. Company is working towards creating seeds with greater yield potential, drought resistance, pest and disease tolerance, etc. As drought is a great issue in Maharashtra where the company operates, these seeds are playing an important role during droughts because of their resistance. It is also working on research and development projects about better breeding techniques and biotechnology instruments, which allows it to create hybrid seeds, micronutrients, and bioproducts.

In FY24, company generated revenue from Sale of Products which was ~121% higher than FY23. In has shown a triple digit growth this June quarter. Company has an advance Order Book for the Rabi season for Rs. 120 Crores. Currently the revenue stands at more than 100 crores and profit at 14 crores. The market cap of the company is 242 crore making it a small cap company.

Investing in such companies will make our portfolio diverse and as they are smallcap company, chance of giving multibagger returns are more from such companies.

Investing in such companies bring a high risk factor so please do your own analysis before investing.

Hope you learned something new from this post.

Do like, share and follow me. Thank you!

What Hidden Forces Are Reshaping the Soybean Market’s Future?The soybean market stands at a crossroads, where familiar patterns of supply and demand are being challenged by a web of global forces. U.S. crops, though abundant, face domestic difficulties as adverse weather threatens yield projections. South America, poised to increase production, is battling its climate concerns, leaving traders and analysts questioning what the true state of global supply will be. Despite the current pessimistic outlook, is there more to this story than meets the eye?

On the demand side, the rising global appetite for vegetable oils, fueled by population growth and the biofuel industry, adds another layer of complexity. Yet, regulatory changes like the EU’s deforestation rules and China’s ongoing economic struggles continue to shape the trade landscape. How will these evolving dynamics impact global soybean trade flows, and what are the risks and opportunities hidden within?

As technological advancements in biotechnology and precision agriculture push the boundaries of efficiency and productivity, the soybean market finds itself on the cusp of transformation. Investors and traders must decipher this intricate puzzle, where geopolitical shifts, weather risks, and innovation collide. Will those who grasp the nuances of these forces be the ones to seize the emerging opportunities?

Is Your Summer BBQ in Jeopardy?The seemingly innocuous drought in Brazil could have far-reaching consequences for global food supply chains. As the world's largest soybean exporter, Brazil's weather patterns significantly influence the availability and affordability of various food products.

The delayed planting of soybean crops due to dry conditions in Brazil is raising concerns about potential shortages and price hikes. This could have a ripple effect on the production of meat, poultry, and other food items that rely on soybeans as a key ingredient.

Beyond the immediate impact on soybean prices, the drought could also have broader implications:

Increased Food Costs: The shortage of soybeans could lead to higher prices for animal feed, ultimately affecting the cost of meat and poultry.

Disruptions in Food Processing: Industries that rely heavily on soybeans, such as food processing and biofuel production, may face disruptions due to limited supply.

Global Economic Impacts: The drought could have economic consequences beyond the food sector, affecting trade, transportation, and employment in related industries.

The question now is: How will the global food system adapt to this challenge?

As the world grapples with the implications of Brazil's drought, it is crucial to explore sustainable solutions and strategies to mitigate the potential impacts on food security and economic stability.

Can Corn Conquer Climate Change?The global food system is under siege from the escalating climate crisis, and corn, a pivotal commodity, is facing a particularly formidable challenge. Rising temperatures, erratic rainfall patterns, and the increased prevalence of pests and diseases are all conspiring to undermine corn production. This article delves into the intricate relationship between corn and climate change, examining the potential consequences for food security, economic stability, and social well-being.

Beyond the immediate threats posed by climate change, the impacts on corn production can have far-reaching consequences. Reduced yields can lead to price volatility, making it difficult for low-income households to afford basic food staples. This can contribute to food insecurity and malnutrition, particularly in vulnerable populations. Moreover, corn production is a major source of income for many farmers, especially in developing countries. Climate change-induced crop failures can have devastating consequences for rural livelihoods and economic stability.

However, the challenges are not insurmountable. By adopting sustainable agricultural practices, investing in climate-resilient crop varieties, and fostering global cooperation, we can safeguard the future of corn and ensure a more sustainable and equitable food system for generations to come. Climate-smart agriculture, which includes practices like crop rotation, cover cropping, and precision agriculture, can improve soil health, reduce water use, and enhance resilience to climate change. Additionally, breeding for resilience can develop corn varieties that are more tolerant to heat, drought, and pests.

Furthermore, promoting crop diversification can help reduce the risk of crop failures and ensure food security even in the face of climate-related challenges. Governments can also play a crucial role in supporting farmers by providing financial assistance, access to climate information, and investments in agricultural research and development.

In conclusion, the future of corn is inextricably linked to our ability to adapt to a changing climate. By embracing sustainable practices, investing in innovation, and fostering global cooperation, we can ensure that corn continues to play a vital role in feeding the world. It's a call to action, a challenge to rethink our approach to agriculture, and a reminder that the future of food is in our hands.

Is This the Beginning of a Global Food Crisis?Wheat, a cornerstone of global food security, is facing unprecedented challenges.

Rising temperatures, extreme weather events, and geopolitical tensions are converging to create a perfect storm for wheat production. The result? A significant wheat rally that could have far-reaching implications.

Climate Change's Impact:

As the planet warms, wheat-growing regions are becoming increasingly vulnerable. Extreme heat and unpredictable weather patterns are disrupting harvests and reducing yields. This is especially pronounced in Europe, where persistent rainfall and heatwaves have devastated crops.

Global Supply Chain Disruptions:

The war in Ukraine, coupled with export restrictions and transportation challenges, has further strained global wheat supplies. This has led to a surge in demand for wheat from other regions, exacerbating the price increase.

The Looming Food Security Threat:

The rising cost of wheat, a key ingredient in many staple foods, poses a significant threat to food security, particularly in developing countries. As prices continue to climb, access to affordable food becomes increasingly difficult for millions.

The Road Ahead:

The future of wheat production and global food security is uncertain. The world must adapt to the changing climate, invest in sustainable agricultural practices, and develop strategies to mitigate the risks posed by geopolitical tensions. The stakes are high, and the time for action is now.

Can We Unravel the Mysteries of Wheat Market Stability?In an era of interconnectedness and unprecedented challenges, the global wheat market stands as a critical linchpin of food security. Its intricate interplay of supply, demand, and geopolitical factors has profound implications for the world's ability to feed itself.

The wheat market, a cornerstone of global agriculture, is subject to numerous forces that can disrupt its equilibrium. Climate change, with its increasing frequency of extreme weather events, poses a significant threat to wheat production. Droughts, floods, and heatwaves can devastate crops, leading to shortages and price volatility. Additionally, the geopolitical landscape is fraught with tensions that can impact wheat trade. Conflicts, sanctions, and trade disputes can disrupt supply chains, limiting access to essential food commodities.

Moreover, the growing global population, coupled with changing dietary habits, is placing increasing pressure on wheat production. As incomes rise, consumers are demanding more diverse and protein-rich diets, which can drive up demand for wheat-based products. This increased demand, combined with the challenges posed by climate change and geopolitical instability, creates a perfect storm of uncertainty for the wheat market.

The future of wheat, and by extension, the global food system, hangs in the balance. Can we unravel the enigma of wheat market stability, or will the challenges posed by this vital commodity prove insurmountable? The answer to this question will determine the extent to which we can ensure food security for generations to come.

Sugar heading for multi-year lowsIs easy to see that the $20 zone is key for sugar, the price broke below it in April and it has not been able to come back above

The price has dropped more than 36% since it peaked in November of 2023 and this week just made a new 52-week low

The next key level is at $17.50, the daily chart already gave a sell or short signal

A follow through below this level could lead to a good gain in the short side

Also, could lower sugar prices lead to higher oil prices?

Remember that oil prices tends to be inversely correlated with the price of sugar, primarily due to its impact on ethanol production and the competing use of sugarcane for fuel versus food.