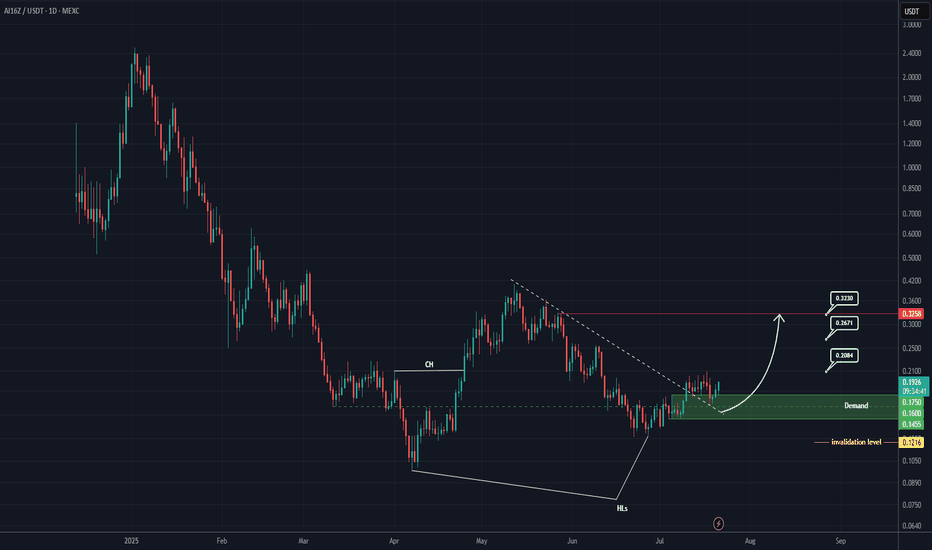

AI16Z Analysis (1D)Given the bullish CH, the breakout of the trendline, and the formation of a support zone, it appears that this token is aiming to move toward the targets marked on the chart.

Additionally, a double bottom pattern is visible at the lows, and higher lows have been recorded for this asset.

A daily candle closing below the invalidation level would invalidate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

AI16ZUSDT

AI16ZUSDT – Setting Up Like PEPE - 3x Potential!Given recent market behavior and the strength behind some reversals, I’m expecting COINEX:AI16ZUSDT to follow a similar path.

Picked up a small bag here—will look to add either above the orange line or on a retest of the Monthly Open.

Structurally, this setup reminds me a lot of $PEPE.

AI16Z Forming Cup and Handle Pattern🚨 $AI16Z Forming Cup and Handle Pattern 🚨

$AI16Z is forming a cup and handle pattern and is currently waiting for a breakout above the red resistance zone. If the breakout is confirmed, the target will be the green line level.

📈 Technical Overview:

Pattern: Cup and Handle

Resistance Zone: Red area currently being tested.

🎯 Breakout Target: Green line level upon confirmation.

AI16Z Breakout Confirmed – Eyes on $1.15 Target$AI16Z has successfully broken above a key descending resistance line, signaling a potential major trend reversal after a prolonged downtrend.

After the breakout, the price is now testing a minor resistance zone. Holding above this zone could open the door for a strong upside move toward the next higher targets (highlighted in blue).

The structure looks bullish as long as price stays above the minor resistance area.

DYOR, NFA

#AI16ZUSDT remains in a bearish momentum

📉 SHORT BYBIT:AI16ZUSDT.P from $0.1544

⚡️ Stop loss $0.1582

🕒 Timeframe: 1H

✅ Overview BYBIT:AI16ZUSDT.P

➡️ Price continues in a downtrend, breaking key support levels.

➡️ POC: $0.1615 marks a high-volume area where price was rejected, indicating strong selling pressure.

➡️ Resistance at $0.1582 — expect rejection on retest.

➡️ Entry zone: $0.1544, but wait for confirmation before entering!

➡️ Targeting TP1: $0.1510 and TP2: $0.1485 on further downside movement.

📍 Important Note: Watch for confirmation levels before entering! Do not enter too early.

🎯 Take Profit Targets:

💎 TP 1: $0.1510

💎 TP 2: $0.1485

⚡️ Plan:

➡️ Wait for confirmation before entering at $0.1544.

➡️ Stop loss $0.1582 — above resistance.

➡️ Take profits at $0.1510 and $0.1485.

🚀 BYBIT:AI16ZUSDT.P remains in a bearish momentum — follow the plan after confirmation!

$AI16ZUSDT long setup active – targeting a short-term 2x move.Starting to build a small position on $AI16ZUSDT.

Seems like a reasonable setup, considering how CRYPTOCAP:SOL has been performing and the fact that CRYPTOCAP:BTC remains in an active bullish trend.

📌 **Bidding as low as $0.18** in case we get a dip into the 12H block, but not counting on it.

✅ **Trade is now active.**

#AI16ZUSDT is setting up for a breakout📉 Long BYBIT:AI16ZUSDT.P from $0,2037

🛡 Stop loss $0,1985

1h Timeframe

⚡ Plan:

➡️ Waiting for consolidation near resistance and increased buying activity before the breakout.

➡️ Expecting an impulsive upward move as buy orders accumulate.

🎯 TP Targets:

💎 TP 1: $0,2072

💎 TP 2: $0,2100

💎 TP 3: $0,2125

🚀 BYBIT:AI16ZUSDT.P is setting up for a breakout — preparing for an upward move!

AI16Z/USDT 1H: Bearish Distribution – Wait for Reversal Bounce?!AI16Z/USDT 1H: Bearish Distribution – Wait for Reversal Bounce at Support?

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

Current Market Structure:

Price at $0.3103 (-1.55%) in a bearish trend, showing consistent lower highs and lower lows.

Overall market structure remains bearish.

Technical Indicators & Key Points:

RSI: 31.57, indicating oversold conditions.

Resistance: Strong at $0.42.

Support: Established at $0.28 (weekly low).

No clear divergences present.

Market Maker Activity:

Clear distribution phase evident from recent sells.

Heavy selling pressure from institutional players.

Accumulation likely occurring near the $0.28-$0.29 zone.

Trade Setup (Confidence 8/10):

Entry: Target the $0.31-$0.32 range.

Targets:

T1: $0.36 (previous support).

T2: $0.38 (liquidity pool).

Stop Loss: $0.295 (below current price).

Risk Score:

7/10 – High risk environment, but favorable risk-to-reward if key levels hold.

Recommendation:

Wait for confirmation of a bounce at $0.28-$0.29 before entering long positions.

Market structure remains bearish until price reclaims $0.36.

Exercise patience and maintain tight risk management.

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

AI16Z/USDT 1H: Consolidation Nearing Breakout – Next Leg Above 0AI16Z/USDT 1H: Consolidation Nearing Breakout – Next Leg Above 0.58?

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

Current Market Structure:

Price currently in consolidation after rejection from the 0.52 level, showing signs of an accumulation pattern.

Ascending triangle formation with higher lows, indicating potential bullish buildup.

Market Maker Activity:

Accumulation evident in the 0.44-0.46 zone with multiple CHoCH formations signaling institutional interest.

Current price action suggests the distribution phase is nearly complete, setting the stage for a breakout.

Technical Indicators:

Hidden bullish divergence on RSI (in the 40-50 range) supports the potential for a reversal and further upside.

Trade Setup (Confidence 7/10):

Entry: Consider entering at 0.48 upon breakout confirmation with supportive volume.

Targets:

T1: 0.52

T2: 0.58

Stop Loss: Place below recent support at 0.445.

Risk Score:

7/10 – Promising structure with favorable risk-to-reward, but wait for volume confirmation above 0.48.

Recommendation:

Long positions are recommended once the breakout above 0.48 is confirmed.

Monitor volume closely to ensure the move is supported, as the accumulation phase appears to be transitioning into a markup phase.

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

Phemex Analysis #58: How to Trade AI16Z Like a ProAI16Z ( PHEMEX:AI16ZUSDT.P ) has experienced extreme volatility, dropping from its $2.00 price level to a low of $0.2619. However, the price has since rebounded by 140%, reaching a recent peak of $0.6337, and is currently trading at $0.5012. This rapid recovery has sparked debate among traders—is it the right time to enter AI16Z, or is another drop on the horizon?

As one of the top 3 cryptocurrencies in the AI Agents category, AI16Z remains a key player in the AI-driven blockchain sector. In this analysis, we explore three possible scenarios for AI16Z’s price movement and provide strategic trading insights for each.

Possible Scenarios

1. Price Continues to Rise

If AI16Z maintains its bullish momentum, it could break through key resistance levels and push toward higher price targets. Traders should watch these resistance points:

$0.73 – First resistance level; a breakout here could lead to a stronger rally.

$0.89 – A key psychological level; breaking above this signals strong bullish sentiment.

$1.26 – A major resistance area; expect profit-taking around this zone.

$1.64 – If momentum remains strong, this could be a mid-term price target.

Pro Tips:

• Enter on a confirmed breakout above $0.73 with strong trading volume.

• Use trailing stop-losses to secure profits as price moves up.

• If AI16Z struggles to break above resistance, consider taking partial profits.

2. Price Drops Again

Despite the recent recovery, a renewed downtrend is still possible, especially if market conditions weaken. The strength of the decline will depend on volume and RSI behavior compared to February 6th.

High Volume & Lower RSI: If AI16Z drops below $0.26 with increasing volume and lower RSI (relative strength index), this could indicate further downside. In this case, it’s best to stay out of the market until a new support level is established.

Low Volume & Higher RSI: If AI16Z retraces to $0.26 but with decreasing volume and higher RSI, this could suggest price stabilization and the formation of a strong base. This would present an opportunity to buy AI16Z at a discount before the next upward move.

Pro Tips:

• Avoid catching a falling knife—wait for clear signs of stabilization before entering.

• If a base forms around $0.26, consider accumulating AI16Z with a dollar-cost averaging (DCA) approach.

• Watch the broader crypto market—if sentiment turns bearish, AI16Z may follow suit.

3. Consolidation Phase

If AI16Z neither surges nor crashes, it may trade sideways around the 50-day EMA (Exponential Moving Average). Consolidation often precedes a strong move in either direction.

Pro Tips:

• Monitor support and resistance within the consolidation range.

• Be patient and wait for a decisive breakout before committing to long or short positions.

• Use grid trading bots to take advantage of the price range until a clear trend emerges.

Final Thoughts

AI16Z remains a strong player in the AI Agents crypto sector, but its high volatility demands a strategic trading approach. Whether the price continues rising, drops again, or consolidates, staying disciplined and managing risk is crucial. Patience and proper analysis will help traders navigate AI16Z’s price movements like a pro.

Would you enter AI16Z now, or wait for further confirmation? Let us know your thoughts!

Pro Tips:

Elevate Your Trading Game with Phemex. Experience unparalleled flexibility with features like multiple watchlists, basket orders, and real-time adjustments to strategy orders. Our USDT-based scaled orders give you precise control over your risk, while iceberg orders provide stealthy execution.

Disclaimer: This is NOT financial or investment advice. Please conduct your own research (DYOR). Phemex is not responsible, directly or indirectly, for any damage or loss incurred or claimed to be caused by or in association with the use of or reliance on any content, goods, or services mentioned in this article.

Play on the Brain, Inverted ai16z, now ElizaOSHere is a play on the brain, the ai16z chart, now ElizaOS operating system, claiming to be able to grow to 100 Bil M/Cap

now this chart is almost a textbook rising wedge that is bearish, it usually breaks down earlier, but retraces to the base of the wedge. Then the Fib retraces to the previous spike high before the base measuring point, usually between the .618 and the .786... I will credit Sheldon the Sniper for that simple but powerful tool. Check your own charts for the retracements to that previous high, falling between the .618 & the .786 and most of th etime it will eventually retrace to that mark, even some of these most recent drops fell to that level in ,any tokens and just now turning around.

so, if ai16z ElizaOS does follow the text books or algorithmic bot traders, it should at least fall to the yellow dashed line at 1.80, at least the .618 or then a bounce, then fall to the bottom of the wedge.

Now save the chart and go to settings and INVERT SCALE and see how this is actually bullish

IF, ONLY IF, IT CAN BREAK OUT PAST THE OTHER FIBS BUT SHOULD HAPPEN IF ELIZAOS DELIVERS

IF is the biggest little wEnglish Dictionary.

Just wanted to show a different perspective on an inverted chart

AI16Z/USDT 1H: Reversal Signals Appearing – Can Bulls Take ?AI16Z/USDT 1H

🚀 Follow me on TradingView if you respect our charts! 📈

Market Structure:

Price: $0.447, showing rejection at $0.48 resistance

RSI: 60.33, indicating neutral momentum with hidden bullish divergence

Key levels:

Support: $0.42

Resistance: $0.48

Market makers appear to be accumulating at discount zone ($0.25-$0.30)

Trade Setup (Confidence 7/10):

Entry: $0.445-$0.447 zone

Targets:

T1: $0.48

T2: $0.52

Stop Loss: $0.42 (below recent swing low)

Risk Score: 6/10 (moderate risk due to market volatility)

Smart Money Analysis:

Accumulation visible in discount zone

Volume profile suggests institutional buying

Premium zone identified at $0.70-$0.75

Recommendation:

Long positions favorable within $0.445-$0.447 range. Monitor volume for breakout confirmation. Avoid chasing; best entries come on retests.

🚀 Follow me on TradingView if you respect our charts! 📈

$AI16Z: A Risky But Promising Long PlayTaking on Some Risk with This Meme Coin COINEX:AI16ZUSDT

I’ve decided to take a bit of risk on this meme coin, as it’s back at a key weekly block. I’ve been waiting for this level since the expansion.

Will it hold? Hard to say, but I’m playing the setup.

For this to play out, CRYPTOCAP:BTC needs to hold above the current mid-level at 97k. For now, it seems like a likely scenario.

AI16Z/USDT 1H: Bulls Targeting $1.20 After BreakoutAI16Z/USDT 1H Chart Analysis

🚀 Follow me on Tradingview if you respect our charts 📈

Current Price: ~$1.03

Market Structure:

Bullish breakout from the discount zone with strong upward momentum.

Key Levels:

Support: $0.95 (Fair Value Gap - FVG).

Resistance:

T1: $1.15 (Equilibrium).

T2: $1.20 (Premium zone).

Stop Loss: Below $0.92.

Momentum Indicators:

RSI: 69.48, showing strong bullish momentum but nearing overbought territory.

Trade Setup (Confidence Level: 8/10):

Entry Zone: ~$1.03 (current price) or pullback to $0.95.

Targets:

T1: $1.15

T2: $1.20

Market Maker Analysis:

Accumulation at the discount zone suggests preparation for a push higher.

Distribution expected near $1.15-$1.20.

Notes:

No hidden divergences currently, but monitor RSI for potential bearish divergence at resistance.

Risk score: 7/10 due to RSI nearing overbought levels.

Recommendation:

Long position favored with tight risk management.

Watch for volume confirmation and price reaction near $1.15.

Confidence Level: 8/10 for bullish continuation.

🚀 Follow me on Tradingview if you respect our charts 📈

Do not try to buy the dip!!! But the strength!!!Although the current chart set up is pretty ominous, I am still bullish on ai16z.

The new US president just came into the office and also his memes sucked all the liquidity out of the rest of the crypto market. The market is very volatile and it is hard to do technical analysis at the moment.

The one thing I can say is that it is not the time to be hopeful and keep buying every dip to add to your position. I haven’t sold any of my ai16z because I don’t trade with leverage. And my allocation for this asset is small. However,

once Trump meme mania settles and the liquidity starts to flow back to the rest of the crypto market, I will start to look for an opportunity to buy more, but buy at the strength!!

My main style of trading is buy at the strength using momentum indicators - mainly MACD/Stochastic. I will wait until Daily stochastic resets and start to roll back up towards 50 and 4H MACD lines properly crosses and enter the bull zone (above 0). If that happens, I might consider buying more.

ai16z - can the bull survive? ai16z went through a major correction from $2.40 to $0.91. It started to recover and reached $1.64 at Fib 0.5 level, however, the price is dropping again.

4H MACD is in the bull territory. 4H Stochastics is in the bear territory but is about to roll back up. I consider Fib 0.236 as the last line of defence for the bull, so ideally I don't want the price to drop below that level. So I need to keep a close eye of its price action in a lower time frame.

When you go to the 1H chart, the price is currently travelling inside the narrow descending parallel channel. All momentum indicators in 1H are in the bear territory.

i am not trading ai16z. I hold a large amount of ai16z and haven't sold any. My overall bias for this project is bullish, until the chart set in a higher time frame (daily and weekly) becomes strongly bearish.

AI16Z Breaks Out: Bulls Target $2.00 Resistance!AI16Z/USDT 4H Chart Analysis

Breakout confirmed: AI16Z has broken above the equilibrium zone with increasing volume, signaling bullish momentum and recovery from the recent dip.

Current price: $1.59.

Key levels:

Support: $1.50 (breakout level) and $1.10 (recent low, strong demand zone).

Resistance: $2.00 (key psychological and technical level).

Accumulation complete: Recent price action suggests the accumulation phase has concluded, paving the way for further upside.

Trade setup:

Entry: Current level ($1.59) or on a pullback near $1.50 (breakout retest).

Target: $2.00 (next major resistance).

Stop loss: Below $1.50 to limit downside risk.

Risk-to-reward: Favorable R:R setup with significant upside potential if $1.50 holds.

Confidence level: 8/10 for continued bullish movement.

Considerations:

Breakout retest: Watch for a potential retest of the $1.50 breakout level to confirm support.

Volume confirmation: Ensure buying volume remains strong to support further upward movement.

Resistance reaction: Monitor price action near $2.00 for potential profit-taking or rejection signs.

This setup aligns with a bullish outlook, but maintaining support at $1.50 is crucial for continued upside.

Buy opportunity coming up! ai16z had been going through a major price correction. The price retraced to $0.91 at Fib 0.786 level (the last line of defence for the bull) and finally presented a strong bounce towards the upside. All momentum indicators reached oversold territory and broke up the descending trendline. There are some signs of strength, however, it is still too premature to open a long position.

When the price goes down significantly and tries to recover to the upside, V shape recovery is quite rare. It usually goes through a very choppy consolidation phase and works its way through to the upside.

One way to identify the trend reversal for me is to use a Fibonacci retracement line. When I think the price has hit the bottom, I draw a Fib from the suspected top to the suspected bottom. In this case, from $2.30 to $0.91 (Orange colored fib line in the chart). Once I draw the line, I need to see if the price decisively break and closes above the Fib 0.236 level. When it does, there is a good probability the price continues to move up to at least 0.5. You can see in the chart that there is a sell block sitting just above Fib 0.5/previous week's level. But I need to look for more confluences as below:

1) I need to wait for the daily stochastics (9,3,3) to reset and start to move to the upside.

2) 4H MACD lines cross, point upwards and enter the bull zone (above 0).

3) 4H Stochastics is not overbought territory. If it is, the price is likely to retrace at least one more time.

If those three conditions are met and the price also breaks above 0.236 fib level, it is likely to give me a good entry for long.

The price has broken and closed above Fin 0236 level. 4H MACD has crossed but it is still not quite in the bull zone and also the 4H Stochastics has already reached the overbought territory and starting to roll over. I think there is a good chance the price will eventually move up, but the but it might have a minor pull back. Once the 4h Stochastics is reset and 4H MACD properly enters the bull zone, I will buy more.

Public trade #8 - #Ai16z price analysisAnother hype coin #ai16z whose price is being "rolled" into the asphalt...

Not enough trading time has passed for a thorough analysis, but from what we found:

1️⃣ It would be nice if OKX:AI16ZUSDT.P price did not fall below the 1st Buy zone, that is, the desired purchase range is $0.60-0.80

2️⃣ Because the next buy zone is very, very low from the current price.

We will buy in our copytrading.

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

AI16Z Faces Sharp Dip Amid Volatility: Is Recovery in Sight?The crypto market is no stranger to turbulence, and AI tokens have been among the hardest hit in recent days. $AI16Z, a prominent token supporting the DAO venture fund and the Eliza OS agent framework, has experienced a dramatic 50% drop in value, falling from $2.38 on January 7 to $1.04 by January 13. This decline underscores the challenges facing the AI token sector as broader market volatility persists.

A Closer Look at the Decline

The price drop of $AI16Z aligns with a broader trend impacting AI-focused cryptocurrencies. Alongside $AI16Z, SPARKS:VIRTUAL , a token powering decentralized AI assistants, saw its value plummet by 44%, and Swarms framework token experienced a staggering 55% decline. These tokens have demonstrated heightened sensitivity to Bitcoin's price movements, with BTC remaining stable yet exerting significant influence on altcoin markets.

Technical Analysis

From a technical perspective, $AI16Z’s recent decline highlights key support and resistance levels:

1. Support Levels: The token’s price is currently testing critical support zones within the 1–0.5 Fibonacci retracement range. Historically, these levels have served as accumulation points for long-term investors. However, if selling pressure persists, $AI16Z may breach its current support, with $0.74 identified as the nearest consolidation zone.

2. RSI Indications: With a Relative Strength Index (RSI) of 29, $AI16Z is firmly in oversold territory. This metric suggests that a reversal could be imminent, as oversold conditions often precede a bounce in price.

3. Resistance Levels: The former support at $1.04 has now flipped into a resistance level. A break above this threshold would be a critical indicator of recovery, signaling renewed buying strength.

Beyond technical indicators, several fundamental factors contribute to $AI16Z’s recent performance:

1. Market Sentiment: Smaller-cap tokens like $AI16Z and SPARKS:VIRTUAL are particularly vulnerable to shifts in market sentiment. Limited buyer-side liquidity exacerbates price volatility, with minor selling pressure often triggering significant declines.

2. Profit-Taking: Early investors appear to have locked in gains at recent highs, contributing to the current correction. This behavior is typical of overheated markets where growth temporarily outpaces underlying fundamentals.

3. Ecosystem Development: Despite the downturn, $AI16Z remains a vital component of the DAO venture fund and the Eliza OS agent framework. Continued technological progress and ecosystem expansion will be crucial for long-term recovery.

Community Sentiment and Market Outlook

The reaction to $AI16Z’s price swings has been surprisingly calm among the crypto community. On platforms like Twitter, many traders have framed the dip as an accumulation opportunity rather than a cause for panic. Sarcastic commentary—such as advising others to “sell during the dip only to repurchase at higher prices later”—reflects a broader confidence in the sector’s resilience.

Conclusion

While the recent decline of $AI16Z is concerning, it also presents a potential buying opportunity for those with a long-term outlook. The token’s oversold RSI and proximity to key Fibonacci levels suggest that a reversal may be on the horizon. However, continued market volatility and broader crypto trends will play a pivotal role in determining its trajectory.

For now, cautious optimism prevails. Investors are encouraged to keep a close eye on $AI16Z’s technical indicators and ecosystem developments, as these will be the key drivers of its recovery in the coming weeks.

AI16Z has come down to my buy zone$AI16Z currently has a good risk to reward long set up. If you are bullish in the AI Agent space, this may be good one to consider accumulating.

It has retraced significantly from its ATH and closed to its weekly golden pocket fib level. I am accumulating in drops below $1.06 level. It would be great if we can go down to the .95 cent level but I think there is enough liquidity at the $1 level.

You can see in the chart my views on the potential targets.

Not a financial advice so DYOR.

AI16Z ANALYSIS (4H)The AI16Z symbol appears to be within a large diametric pattern, currently at the end of wave E.

For a rebuy, it's crucial to execute this on a support zone, especially for assets that have experienced significant pumps.

Based on the structure, if the price reaches the entry zone, we can look for buy/long positions around the green area.

The target could be the top of wave E, but if you achieve reasonable profit, consider securing your gains.

A daily candle close below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You