American Airlines AAL long. This is similar to Delta airlines. Very possible to swing up. High probability. Needs patience. They got funding. They have crappy debt. No cash on hand. And financials aren’t so great. But they are America’s airline. And they are the worlds largest airline. America won’t let this airline fail. At 10$ it’s a steal. Check out YouTube for the CEO talking about the funding they received from the government.

Airline

DAL Projection *UPDATE*NYSE:DAL With rising fuel prices, its not helping the airline industry (jet fuel is one of their major expenses) combined with shuydowns. I am still bullish as this investment is getting cheaper for me to get back in at a lower price (averaging down). Still waiting for the 29th when I anticipated a bottom of $20.49 for further adjustments. An addition to this holding, an energy investment that benefits from rising energy prices may be a hedge (i.e. MR NYSE:MR ).

The 4 Major Airlines - OpinionsAll,

Most of my opinions are in the text. Just think Delta is actually the most capable to take off without running into trouble right off the bat. Not saying they are the best company by any means. I am just waiting until I actually hear one of the airlines come up with a plan or have a decent earnings. I would pay attention to the airline with the best operational cash flow. Meaning their earnings might be bad, but they still had net operational cash flow to keep them alive.

DAL 1w to 6w trading outlookNYSE:DAL

This chart represents my 1w to 6w trading outlook on DAL.

Background: The unprecedented turmoil in which global airline industry found itself is yet to clear up and show signs of resolution, despite the fact that the covid-19 curve is somewhat flattening, this does not means that we are close to be back on track with the global economy's recovery. We are yet to truly and fully comprehend and measure the long term effects of covid-19 pandemic and its collateral damage to the global economy. As a result - entire industries will be reshaped and restructured and global recovery will potentially take years to get to the pre-pandemic levels of Dec 2019. Until there will be developed vaccine/herd vaccine - there will quite a lot sensitivity and edginess in the markets. CL1 (oil) broke the recent support despite the cut in production from last week which is not a bullish sign for the global economy. The market is on drugs and is not acting rationally (fed aggressively pumping money into the economy via intra-venous injections) and there likely will be bad withdrawal symptoms for the markets.

Potential catalyst this week - Q1 earnings call (expected on Apr 22nd).

This upcoming week we approaching Q1/20 earnings call (which apparently has been delayed for a couple of weeks and for good reasons).

It is obvious that Q1/20 earnings will be in red for the first time in over a decade. Since the beginning of the pandemic he company burnt through the vast majority of its cash and took on more debt and govt "relief". About 90% of its scheduled flights (=revenue) are cancelled and it is unclear when the company will return to fly at its full capacity if ever. What I will be paying close attention to is company's guidance and outlook for the rest of the year. Anything has to do with uncertainty and less-than-expected recovery outlook will potentially cause a sell-off and brake the current short-term support line (blue on the chart). As of today @24$ DAL is trading way over it's current market capitalization (under pandemic conditions and taking into account that recovery might take years) there's a lot of room towards the bottom.

Technicals - on the above chart you see near-term green support line and near-term red resistance line which outline the range in which the stock was trading in recent weeks since the outbreak of the pandemic in the US. In the last few weeks there was formed a support tine (blue line on the chart).

At the bottom of the chart you will see the white all time low line above which there are 4 yellow-ish strong historical support and resistance lines which will be relevant in case DAL breaks the short-term blue support line (potentially on the earnings call news next week). If this break happens - I expect the price to fall to 14.95$ area (top yellow historical resistance line) and in coming weeks after - followed by tumbling lower and settling to trade anywhere in the range of the yellow historical lines on the chart. If DAL breaks through and closes above 27.5$ - 28$ red resistance - sentiment is bullish and we will be looking into resistance line becoming a new support.

There are quite a few good trades that can be constructed with the described above scenario.

Share your thoughts with me.

Thank you for reading and good trading!

Delta in a Bearish Pennant? Thoughts?However, I am overall bullish on Delta. I actually think this stock may drop even further especially looking back to 2012. Let me know your thoughts. It looks bullish on lower time frames.Untested levels from 2012 remain and it appears to be making a bearish pennant on 2D-Weekly. Let me know why you think this is bullish, because apparently everyone does.

Don't let the drastic price drop make you think we have hit a bottom. We would need a massive bull candle and if you see the higher levels that hasn't happened or any signal of a reversal.

Long-term Investors Should Build PositionLong term investors should consider building a position in Boeing between the $185-$130 levels. Traders should be hesitant as it is possible to retest 130 support. The Coronavirus will continue to inflict volatility on the market; however, Boeing is primed for a run into the mid 200's. A reiterated May estimate for the 737 MAX approval looks promising and the Coronavirus will reach apex before Summer. Boeing still faces challenges ahead, but with these two colossal problems out of the way, there is a lot of runway for this stock to run. BUY IT AND HOLD IT

Boeing Bottom?To no surprise, the travel industry has been beaten down more than the rest of the market. Between plane malfunctions, travel restrictions and more, Boeing is way oversold-- sitting down ~40% this month. Entering at the $160-170 range, where previous resistance turned support, should be a 'safe' place to buy for a quick flip.

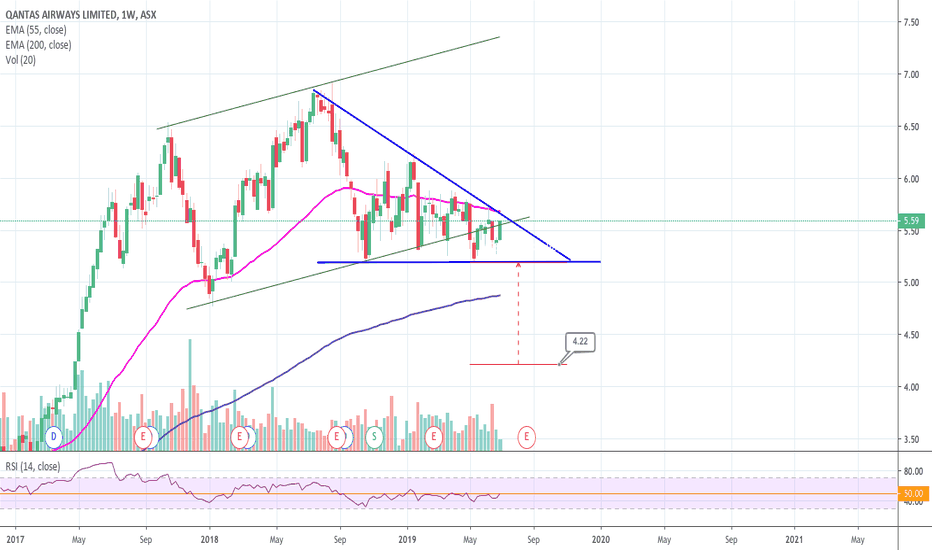

ASX:QANTAS - Running out of room on the weekly - Long termQantas ASX:QAN is running out of room in what seems like a descending triangle. If there's no break to the upside, expect more downward pressure to $4.22 in the coming months - long term outlook.

Due to the uncertainty of the market - trade wars and oil prices - a breakout in the coming weeks should also be taken with a pinch of salt as it might be a bull trap and may revisit $5.20. However, a break with conviction to the upside and doesn't look back will bring us to the top of the channel above $7.

A break below $5.20 invalidates this outlook.

$SAVE down 22% after earnings, long entry $43-46+Very short term trade, time 1-2 weeks. Closed my $50 Puts at $44, had a great earnings play betting to the downside. I'm going to use those profits to take a bit of a gamble and attempt to play the reversal.

Objective:

We're near multiple areas of support at $43, $42, $41, and the 1.168 Fib extension. I'm going long calls that have an August 16th expiration $45 strike. If this gets to $41 I'll buy the $42.5 strikes. 22% is overextended to the downside, and this company isn't going out of business anytime soon. I'm confident one of those will make a profit. Targeting $46-47.

Subjective:

I actually recently was looking at plane tickets (unrelated to this play) and Spirit Airlines has a new membership subscription program where you get perks with a $50 a year membership. Anything subscription based has been profitable across industries, airlines have all been screwing customers across the board (things that used to be free, you have to pay for/more now, because "F you what are you going to do about it"), and this company really loves to cut corners after dealing with their ticket buying system.

Fly High With These Boeing SignalsBoeing recently crashed in more ways than one... Now the buy opportunities are coming in. Be sure to join Megalodon trading today and take full advantage of Boeing Stock.

The Megalodon Indicator uses an artificial intelligence, combined with over 500 different buy setups, as well as over 2000 different indicators to produce stunningly accurate buy and sell signals. Join Megalodon Trading today and get your hands on our automated trade bot for cryptocurrency! You will also receive real time buy and sell signals for the stock market, cryptocurrency, as well as forex markets! Link in Bio!

Look for gains in Delta (DAL)When you look at Delta (NYSE: DAL), you see a clear resistance but a triangle pattern. When adding a pitch fan you clearly see obvious tests of both the resistance zones. With the gains and natural consolidation you see clear bull flags everywhere. Gains are expected to rise at the beginning of trading at 6:30 AM PST. If I were to guess they will occur around 7:15 AM PST. Major changes (in relation to breaking resistance zones/trends) will end FOR SURE at 8:30 AM PST.

Airline - Upside in perspective of historical seasonality?Upside in perspective of historical seasonality in airline company SAS?

- Please, share your thoughts!