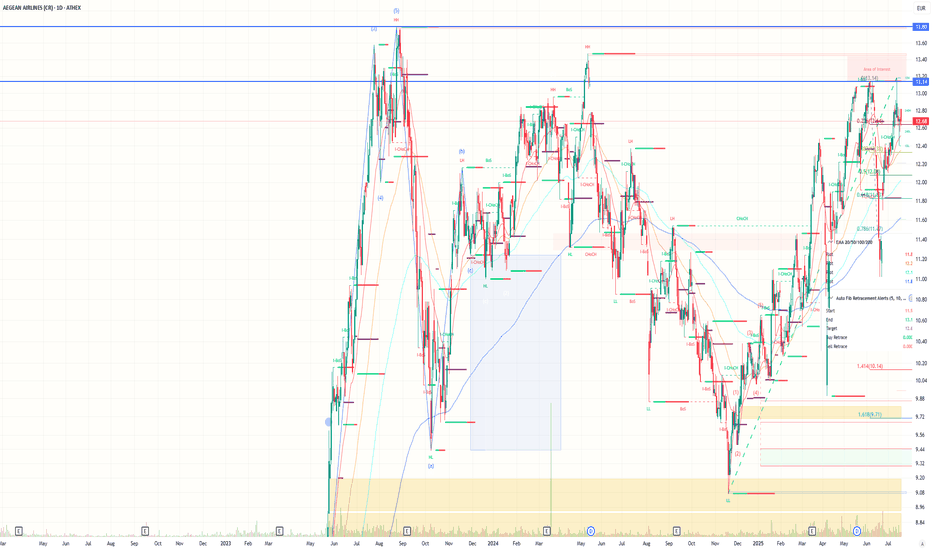

Aegean: The cheapest airline in Europe?Aegean is flying high, but the stock remains grounded at -71.5% – The market values it at just 28.5% of its real worth: The cheapest airline in Europe?

Aegean: Time for the Market to Wake Up

We’ve said a lot about Aegean. About its stock going nowhere, about how it's been ignored by the market, about how it just refuses to move. Sure, some of that skepticism is understandable—geopolitical risk, a volatile global landscape, travel disruptions. But at some point, we need to look at the numbers.

Because this isn’t just another airline stock. Aegean is sitting on assets worth over €4 billion. And its current market cap? Just €1.14 billion.

Do the math: that's a 71.5% discount — the stock is trading at only 28.5% of what the company is worth on paper.

If that’s not undervalued, what is?

60 Aircraft, €4 Billion in Investment

This isn’t hype — it's hard investment. Aegean has committed to 60 Airbus A320/321neo aircraft by 2031, with a total fleet investment reaching $4 billion. The two newest additions, the A321neo XLRs, have a flight range of over 10 hours. That opens the door to long-haul destinations far beyond Europe — like India, the Maldives, Nairobi, and more.

In fact, direct flights to India are already scheduled to start in March 2026, ahead of the original plan. This isn’t about just growing the fleet — it’s a shift in scale, reach, and ambition.

Meanwhile, Aegean has already received 36 of the 60 aircraft. The buildout is real. And it’s happening now.

An Airline Investing in Itself

Aegean isn't just growing in the air — it’s building on the ground. It has launched maintenance and training facilities, is servicing third-party aircraft, and is investing heavily in talent and education.

From 1,878 employees in 2013 to nearly 4,000 today. Dozens of scholarships. A full ecosystem of aviation infrastructure is taking shape — one that positions Aegean not just as an airline, but as a regional aviation hub.

How is all of that still being missed on the board?

The Market Is Rallying – Aegean Is Not

While the Athens Stock Exchange hits 15-year highs, and large caps are breaking records, Aegean’s stock is standing still.

It’s one of the few big names that hasn’t made a move — and that makes it a prime candidate for a snap revaluation.

All it needs is a spark — a catalyst. A major deal. A re-rating. A surprise quarter. Something to jolt the market awake. And when that happens, it won’t be slow or gradual. It’ll be violent and vertical.

Geopolitics? Sure. But Everyone’s Facing It

Yes, global tensions are high. Wars, inflation, airspace closures, unpredictability. But every airline is in the same storm. What matters is how you build resilience. And Aegean has done that.

It emerged from the COVID crisis leaner, stronger, more focused. While others pulled back, Aegean doubled down. That’s not weakness — that’s conviction.

Why the Discount Still Exists

The short answer: the market hasn't connected the dots.

The new fleet hasn’t been fully priced in.

The strategic expansion hasn’t registered.

The infrastructure buildout hasn’t translated into market value.

Investors are still judging it on short-term P&Ls — not on what it’s quietly turning into.

Time for That to Change

It’s time for the market to take another look. To see the €4 billion in assets not as a future maybe — but as a real foundation for growth. To recognize the international pivot. To price in the hidden strength.

Aegean has the fundamentals. It has the vision. It has the operational edge.

What it doesn’t have — yet — is the recognition on the board.

But that’s coming. And when it comes, the move won’t be subtle.

Aegean is undervalued. Not just theoretically, but blatantly — with a 71.5% discount staring everyone in the face. The business is solid. The growth is real. The investments are in motion.

The market will catch up. The only question is: will you be in before it does?

Airlines

SUI SIGNAL...Hello friends

As you can see, buyers entered the price correction and a reversal pattern is being built...

Due to the buying pressure and the entry of buyers, we can buy within the specified ranges and move towards the set targets, of course with capital and risk management.

*Trade safely with us*

Yesterday was bad for BOEING CompanyYesterday was bad for BOEING Company.

This stock has been fighting to recover from the many challenges it has faced lately, and here comes the India news.

The stock (BA) experienced about 5% drop before its recovered a bit.

It is trading at about $203, but if it breaks the trendline on the chart and the $200 support zone, we might see it go downhill a little more.

I will be happy to buy using DCA strategy from $193 - $186 zone.

Trade with care.

Please, if it is helpful, follow me, like, comment and share

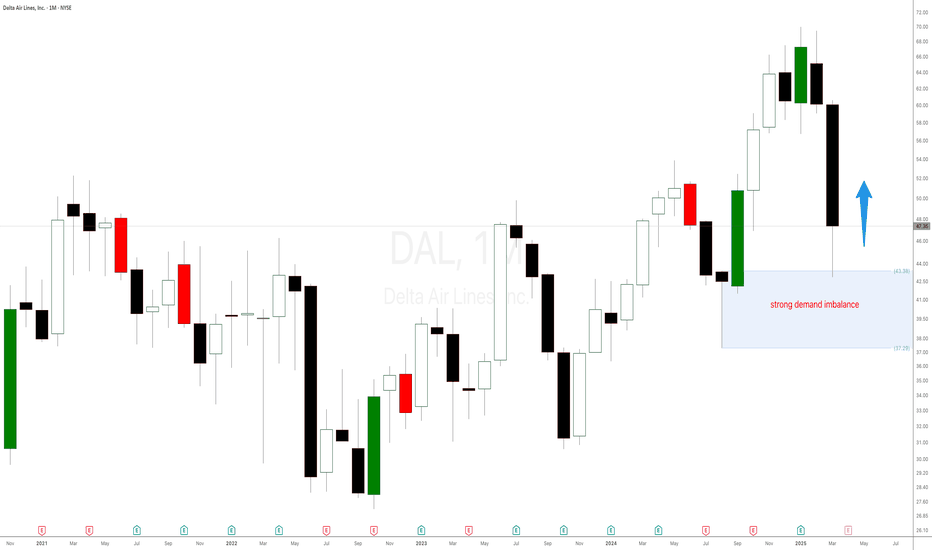

Delta Airlines - Long Term FlyerHey, all. Pretty intense idea here, but I am a buyer of NYSE:DAL at these levels. Obviously, the chart looks awful from a recent performance perspective. However, if you take a long term view, we could actually be rebalancing after an initial range expansion to the upside. Just like NASDAQ:RIVN , airlines are/have been a pretty brutal investment. I guess I have a thing for pain. Ha.

I am certainly a believer that airlines are undervalued here and can reverse back to the upside. Of course, it goes against the current narrative that the economy is showing signs of weakness. But I am just willing to take the risk on this one. I believe the consumer and culture shift in the US to have more experiences in life will continue to hold.

Are we going to come in for a hard landing, or take off to cruising altitude? We'll see what kind of lift the market will give us. Right now the turbulence is pretty intense.

Fasten your seatbelts - China Southern Airlines to fly higherChina’s recent decision to grant visa-free entry to citizens of four Gulf Cooperation Council (GCC) countries—Saudi Arabia, Oman, Kuwait, and Bahrain—from June 9, 2025, is expected to significantly boost travel demand between China and the Gulf region.

Key benefits for China Southern Airlines:

> Increased passenger traffic from GCC countries for tourism, business, and cultural exchange.

> Opportunity to expand direct flight routes to major Gulf cities, enhancing its international network.

> Stronger hub positioning for cities like Guangzhou and Urumqi as gateways for Middle East–Asia connectivity.

> Improved load factors and revenue from both inbound and outbound travel, especially during peak seasons.

This policy complements earlier agreements with the UAE and Qatar, which already enjoy 30-day visa-free access, effectively making all GCC nations visa-exempt for short-term visits to China

Basis review of monthly chart, price has potential to retest level of 5.70 which is 46% upside from current level of 3.90. Price needs to breach the overhead resistance of 4 and sustain above it for multiple days for the upside momentum to kick in. However, this view is negated if price breaks below 3.20 level.

American Airlines Group Inc.Key arguments in support of the idea.

International routes continue to show strong demand. While the U.S. domestic market is facing challenges—especially in the low-cost carrier (LCC) segment—the company is capitalizing on inbound foreign tourism. However, it's worth noting that the U.S. Travel Association (USTA) reports the opposite trend: domestic tourism demand from U.S. citizens remains strong. We expect conditions in domestic flights to improve by summer 2025. During the reporting period, American Airlines highlighted that its premium offerings continue to drive revenue growth, and demand from American travelers for international flights remains steady.

AAL continues to rebuild its indirect sales channels, which is helping to expand its flight schedule in the short term. Following an acknowledgment of operational missteps in summer 2024, this recovery is not only helping to sustain current sales levels but also enabling the airline to better monetize its loyalty program.

Progress in tariff negotiations has given the stock a strong boost. Currently, AAL shares are trading with an RSI near overbought territory. However, if political progress continues, this momentum could very well be sustained. The recent formation of a technical "double bottom" pattern supports this possibility.

The 2-month target price for AAL is $14.9. We recommend setting a stop loss at $10.4.

United Airlines Holdings, IncKey arguments in support of the idea.

International routes continue to experience high demand. While the U.S. domestic market is in a less favorable position, especially the low-cost carrier (LCC) segment, the company is benefiting from foreign tourists. However, it's worth noting that the U.S. Travel Association (USTA) reports the opposite: demand from U.S. citizens for domestic tourism remains strong. We expect the situation in domestic flights to improve by summer 2025. During the reporting period, United emphasized that its premium offerings continue to drive revenue growth, with demand from American tourists for international flights remaining stable.

Our 12-month forecast maintains the possibility of a positive surprise for the company. UAL’s pricing power is generally stronger than that of competitors, allowing the company to maintain a high level of revenue per passenger mile and profit margins.

Progress in tariff negotiations has given a strong boost to the stock. Currently, UAL shares are trading above their 200-day moving average with an RSI near overbought levels. However, if political progress continues, this momentum could persist. The 2-month target price for UAL is $97, and we recommend setting a stop loss at $72.8.

The 2-month target price for UAL is $97. We recommend setting a stop loss at $72.

JETS 7 Year ResistanceThis is a very simple chart to read. Airlines hitting a 7-year resistance trendline.

Airlines are very capital-intensive and would greatly benefit from rate cuts.

Despite inflation pricing power has not risen sufficiently even nominally.

Oil has not helped their situation.

We have seen many airlines go bankrupt, close shop, and reduce capacity. This indirectly helps the major airlines as the industry cleanses.

A lot of talk of mergers and buyouts. For example, Frontier wants to merge with Spirit, Jetblue & United, and Southwest Pilot union seeking merger attorneys. Streamlining is always a good thing which is why JETS has risen as much as it has.

However, this may be it according to the chart. The next move could be down from here. Airlines are very economically sensitive and a recession would hit them hard.

United Airlines Holdings, (NASDAQ: $UAL) Surge 6% on Strong Q1Shares of United Airlines Holdings, (NASDAQ: NASDAQ:UAL ) saw a noteworthy uptick of 6% on Wednesday's premarket session after the industry leaders reported it swung to a profit in the first quarter as revenue hit a record high, sending shares surging in extended trading Tuesday, further extending gains to premarket session.

The Chicago-based carrier posted first-quarter revenue of $13.2 billion, up 5% year-over-year and above the analyst consensus from Visible Alpha.1 Adjusted net income of $302 million, or 91 cents per share, compared to a loss of $50 million, or 15 cents per share, a year earlier, and also topped Wall Street’s estimates.

United Says It Expects 'Resilient' Earnings in Q2

The results come amid an uncertain economic environment for airlines. Last week, Visual Approach Analytics warned that air travel could face "demand destruction" as a result of the Trump administration's tariff policies, and rival carrier Delta (DAL) withdrew its full-year outlook, citing “current uncertainty."

Looking ahead, United said it expects "resilient earnings" in the second quarter and full fiscal year, despite macroeconomic challenges. The airline said it plans to reduce off-peak flying on lower-demand days.

Technical Outlook

United shares jumped nearly 7% in after-hours trading, extending gains to Wednesday premarket session. The stock has lost nearly a third of its value so far in 2025 through Tuesday’s close. The daily price chart depicts a bullish flag pattern with the asset gearing to break the ceiling of the flag - a move that will cement the bullish campaign for NASDAQ:UAL shares.

Further more, with the RSI at 44.97, NASDAQ:UAL shares are well ready for a bullish campaign capitalizing on the moderate momentum of the market.

IAG Additional Price Levels • LSE • Airlines Group Stock • FTSE⚠️ IAG Going to plan, looks like it's a TRUMP DUMP 🤣

Now is the TIME TO HUNT the stocks for your PORTFOLIO.

ℹ️ When TRUMP causes a DUMP I accumulate SIT BACK and just WAIT fornthe PUMP...🚀

These additional price levels will be used as an additional filter to TIME an ENTRY ONLY IF the BIDS come in 🟢SeekingPips🟢 NEEDS to see some VOLUME🚀🚀🚀

IAG Airlines Group what next? $261 Reached & Breached! $172?🤔 IAG Airlines Group what next?

ℹ️ $261 Reached & Breached!

Will the $261 be regained and start to offer some support or is $172 NEXT?❓️❔️❓️

🌍 To be completely transparent I have no horse in this race at the moment BUT I really would like a serious flush to try and accumulate a long-term POSITION.

🟢SeekingPips🟢 is not interested at current price at all unless we start to see some SERIOUS VOLUME START TO COME IN TO PLAY

IAG Stock Took some heat! Is there anything to take here?🟢SeekingPips🟢 has this on the radar.

⭐️ Have your levels ready and wait for your A+⭐️ Setup.

ℹ️ Our levels are here marked out.

I have ZERO interest in taking a position here however a deeper sell-off and I will start paying attention.❗️

⚠️ ALERTS set and LEVELS marked.

🟢Now go away and ENJOY your WEEKEND and lets HURRY UP AND WAIT and lets see what NEXT WEEK has for us👍

Watch This Before Trading Delta Airlines Stock in 2025!The Art of Trading: Price Action, Supply and Demand, and Patience in Delta Airlines. Trading in the stock market is a skill that requires a deep understanding of market dynamics, disciplined decision-making, and the ability to remain patient in the face of volatility. Among the most effective strategies for achieving consistent success are price action analysis, supply and demand principles, and meticulous money management. This supply and demand stock analysis will explore how these strategies can be applied to Delta Airlines (DAL), focusing on key price levels, candlestick patterns, and the importance of patience in making informed investment decisions.

A strong demand level for Delta Airlines (DAL) has been identified at $43. This level represents a price zone where buyers have historically shown significant interest, leading to price reversals. By waiting for the stock to retrace to this level, traders can enter positions with a higher probability of success as the likelihood of renewed buying pressure increases.

TRANSPORTATION! CRACK!!The transportation average breaking the first time warned us that things were not right back in July 2024. Today we are getting yet another CRACK WARNING!

The TRUMP economy will be a disaster area if he doesn't change his ways quickly. Even then it may be too late. Trust in the government has eroded.

Democracy and markets rely on TRUST! Trust can not be bought, or taken, it may only be lost!

DANGER for bulls!

last month I started to warn about Airlines (JETS) since then the results speak for themselves.

Click like, follow subscribe for more!

General Market Ramblings - $BTCUSD, $TSLA, $GDX, $DAL, $BBEUHi, all. Wanted to get something published for the first time in awhile. Unfortunately my mom passed away recently and that has been something I have been going through. It is therapeutic to record something and get it out to you all. I am approaching feature film length on this one, so kudos if you make it through the whole video.

I just wanted to discuss some general market thoughts here - especially as we are now in an interesting time. I hope you do find some value here! Believe me, this really is just scratching the surface of my market thoughts and the different stocks that I have thoughts on. But again, really just wanted to get something out to you guys. Even if you tune in for a minute or two, thanks for watching! It means a lot. Feel free to provide feedback as well of course.

As always, a lot of my thoughts are based on the "Time @ Mode" method that we discuss in the Key Hidden Levels TradingView chat.

Also, as always, these are strictly my thoughts and opinions. I am not a professional and I encourage you to do your own research before making investment/trading decisions. These opinions are not financial advice.

Assets in this video: COINBASE:BTCUSD , COMEX:GC1! , NASDAQ:TSLA , AMEX:GDX , CBOE:BBEU , NYSE:DAL , maybe others I forgot about.

American Airlines | AAL | Long at $13.34As the Great American Wealth Transfer happens, people are using that money to travel more (after all, few can afford to transfer that wealth into real estate). Airline data show passenger counts are increasing rapidly and with airfares expected to rise, this sector is likely to go through a long-awaited boom cycle.

Those following me know I am heavily long in airlines, cruise lines, and travel companies. With today's dip, and the long-term historical moving average starting to show upward momentum, American Airlines NASDAQ:AAL is in a personal buy zone at $13.34. A further dip to $11.00 to close the daily price gaps is also where I will be adding more.

Targets:

$15.00

$18.00

Bullish potential detected for AIZEntry conditions:

(i) higher share price for ASX:AIZ along with swing up of indicators such as DMI/RSI.

Stop loss for the trade would be:

(i) below the support level from the open of 29th November (i.e.: below $0.51), or

(ii) below the support level from the open of 7th November (i.e.: below $0.49), depending on risk tolerance.

Sabre Corporation | SABR | Long at $3.00Sabre Corporation's NASDAQ:SABR earnings have slowly been improving since the pandemic and may be heading into profitability by 2025/2026. Disinterest in the stock may also be waning as the price creeps closer to my selected historical simple moving average (SMA, white and teal lines). Often, but not always, as the price nears this line, it jumps to make contact over a few weeks or months. Not to say that more volatility won't be ahead, but NASDAQ:SABR currently sits in a personal buy zone at $3.00.

Target #1 = $4.00

Target #2 = $5.00

Target #3 = $6.70

JBLU Prediction: Q4 '24 Earnings Slide from Q1 '25 Guidance?It's my estimation that the market sentiment felt from AAL Q1 '25 guidance will ripple into JBLU's earnings report come JAN-28-25.

While AAL beat earnings estimates (revenue up 4.6% / $0.86/share vs. $0.66/share expected), Q1 guidance was set at a loss of $-0.40/share vs. $-0.04/share. Investors I believe are expecting a much stronger output in 2025 from domestic carriers, and this was a horrible start to the year.

AAL and JBLU's failed Northeast Alliance, a break up due to antitrust laws, has now caused both airlines to pay $2M in legal fees across several states.

Looking at LuxAlgo's Support Resistance Signals MTF among additional indicators, I believe the underlying will touch below $7.50 after earnings are released.

JetBlue Airways | JBLU | Long at $5.92JetBlue NASDAQ:JBLU - Earnings and revenue beat today, stock drops -26% by noon.

2025 Outlook:

"For the first quarter of 2025, JetBlue expects its available seat miles (ASM) to decline 2% to 5% year-over-year, with revenue per ASM projected to range from a 0.5% decline to a 3.5% gain, while analysts had expected the metric to rise 5% year-over-year. JetBlue said it also expects cost per ASM to rise 8% to 10% in the first quarter. The airline also expects cost per ASM to rise 5% to 7% for the full fiscal year, with revenue per ASM projected to rise 3% to 6% compared to the metric staying flat in 2024."

Travel is increasing rapidly from the pandemic lows and if oil continues to drop, airlines will continue to experience a boom. This outlook may be overly negative as "protection" while the company further moves toward profitability.

My only concern is there is a price gap on the daily chart near $4.00 that is still open (and could be filled in the near future. But, from a technical analysis perspective, the bottom of my historical simple moving average line today is $5.90. It may bounce there, or shakeout shareholders for a while to test the $4 range. Regardless, JetBlue is a mid-level ranked airline that is, indeed, moving toward profitability - it may just take it getting through 2025 to gain investor confidence.

Initial entry position started at $5.92.

Target:

$7.95

American Airlines | AAL | Long at $14.00Similar to my cruise line picks, I anticipate airlines to quite literally "take off" in the coming years as interest rates are lowered and people travel more. These two industries never quite recovered from the pandemic, but their time to do so is "likely" fast approaching.

American Airlines NASDAQ:AAL has been consolidating near my selected long-term simple moving average (SMA) for several years. Many retail investors have been beaten up by the sudden up and (especially) down price movements, but this is where larger investors gather their shares. The fact NASDAQ:AAL did not make a new low in August 2024 is a hopeful sign from a technical analysis perspective. While the price may dip to close out the new lower price gaps, I think we are nearing the "take off" zone which will be a massive break through the long-term SMA. A confirmation that something bigger is brewing would be a price move into the $15s, dip down to the $12s, and the larger move up. Regardless of trying to predict bottoms, NASDAQ:AAL is in a personal buy zone at $14.00.

Target #1 = $15.25

Target #2 = $16.55

Target #3 = $18.40

Target #4 = $27.00 (very long-term outlook...)

#AI/USDT #AI

The price is moving in a descending channel on a 30-minute frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 0.7000

Entry price 0.7130

First target 0.7355

Second target 0.7642

Third target 0.8000