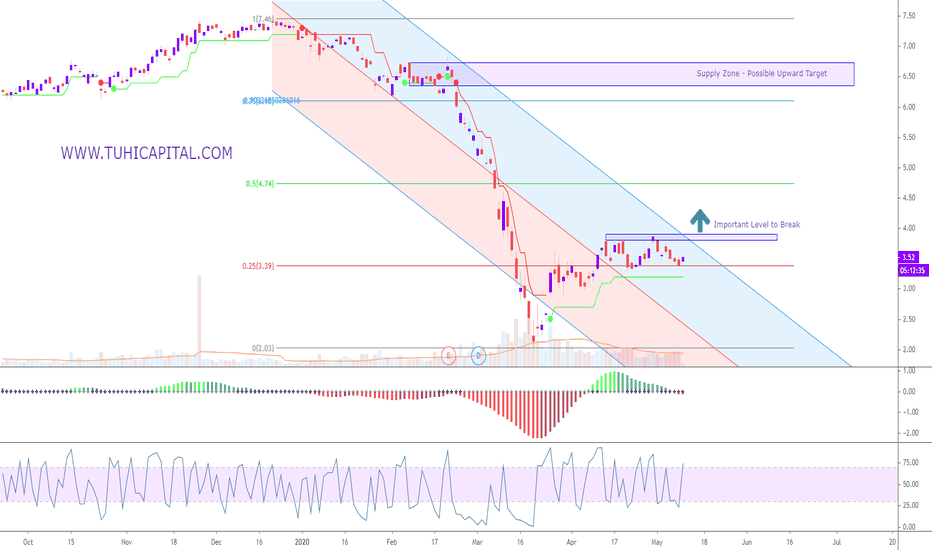

Can Spirit Airlines start a recovery cycle?First off, please don't take anything I say seriously or as financial advice. As always, this is on an opinion based basis. While, I don't personally like airline investments at this time period (for obvious reasons), I feel like as restrictions slow down, the supply and demand curve dramatically changes. Spirit Airlines already been dramatically beaten up a bit, and I see a positive retracement already happening for what will be a slow recovery cycle.

Airlines

Air Canada looking for 20% run?Hello traders,

AC stocks looking bullish mid-short term:

1) Morning star reverse bullish pattern

2) Daily MA50 is starting to curve upwards

3) MACD is gaining bullish momentum

As long as AC closes above $16 next few days, my target will be:

1) $16.80

2) $18.00

3) $19.30

4) $22~$22.2

Stop loss: $15.5

Air Lease profitable in Q1As airlines continue to struggle to find their footing in today's current market Air lease is in a great position to provide aid to the airlines while also generating revenue. Their business model of owning over 300 aircraft that are being leased out to commercial and private airlines ensure that they are able to generate consistent cash flow while holding many of the assets on their on books.

Taking Advantage of Cargo movementCargo Airlines are taking over the skies. As commercial routes are no longer able to meet the demands of the logistics and transportations supply chain, cargo airlines are filling the gap.

In the end of last year Atlas air looked at ground 3 of its aircraft due to lack of demand with trade war tension and covid-19. As demand for cargo freighter remain high the reintroduce one of their B747 to take advantage of the opportunity.

As the price of the stock has rallied quickly looking for a retest towards previous supply zone would be a key target to secure an ideal entry price

American Airlines Supportprice has respected the levels near the bottom range of the current price. As we are continuing to test the support levels and create a more prominant bias and the market condition begin to strength one can look for a potential in holding AAL towards previous highs. Although the time range for this correction to occur could take weeks over time as the consumer confidence raises.

Tight Channel on UALUnited Airline has dropped down from its all time highs and is currently being pushed into this channel range that price is creating.

As volatility drops dramatically the potential of massive spikes reduces and we can start to look for opportunities to trade most consistent and less volatile markets

long AALWith the idea that we are seeing the light at the end of the tunnel. Many states are opening up even in phases. AAL will rise with the markets.

looks like it might even be able to reach $13 if not the end of this week then by the end of next week.

The only thing I can see slow down progress for airline stocks is another outbreak of the virus. They will also not be back in full capacity I understand that 100% In fact I have Airline workers that have said they will cut the capacity by %30 which may increase rates by 30%+

Nearing Speculative Buy PointAirlines have been dumbstruck by this health crisis and many have lost all the stock gains since the financial crisis. That being said... we are still going to use airplanes right? Maybe they'll need to update health and safety procedures and spend a little more money on cleaning the planes, but we don't really have another feasible option for long distance travel, SOO... Future Demand exists.

The descending wedge pattern we've been in since mid-March may be a reversal pattern. I would not recommend entering a long trade until we get confirmation of a reversal on the shorter time frame and a daily break out of this wedge pattern.

AC.TO for the Long RunI am 21 and besides trading , I have set aside a designated portfolio for long term holdings. Stocks to hold up to 30 years. This is why I believe Air Canada is a suitable stock for any retirement portfolio.

1) Current market price is lower than IPO price from 14 years ago.

2) Given the current market price, there’s a return opportunity of 158% or $30 gain per share assuming the ceiling price is the all time high of $50.

3) Canada has a population of less than 40 million people. Given that’s the second biggest country in the world with one of the highest qualifies of life, one can expect lots of immigration, travel, and tourism growth. All good news for the airline industry.

4) Oil prices have never been lower, and that’s another great news for a company who’s biggest operating expense is fuel.

5) Just like the United States government has bailed out United Airlines, the Canadian Government will do the same thing to save the biggest and most prestigious air line in the country. So even if the company goes bankrupt, government bailout is a reality.

Note - I believe the stock price will drop momentarily, and that’s when I’m preparing myself to double my current position.

Spirit Airlines $SAVE$SAVE is still in bearish side and after it formed an unconfirmed cup, now it is looking for its direction. Breaking below $7.25 will confirm the cup w handle,inverted. There is a positive divergence which is a signal for upward. However, there are 20SMA (red one) and 50SMA ahed will work as the resistances.

I would wait to get above $18.68 to be long.

If you find my charts useful, please leave me "like"

thx

Descending Triangle Setup on UALAirline fundamentals are horrible for the rest of 2020, with earnings expected to go DEEP negative (we're talking potential bankruptcy level negative).

50MA and 100MA well below 200MA.

Descending triangle pattern offers well defined stop level.

Few ways I'm considering to play this position:

|Chicken Short|

Short 100 shares, buy 25 CALL expiring Sep. 18, 2020

- BP reduced by ~ $1740

- Defined risk, negative theta

- initial delta between -35 to -50 (more initial directional risk)

- can leg out of call or buyback shares to adjust position

|Partially Covered Call|

Buy 40 shares @ 24.00, short 26 CALL expiring Sep. 18, 2020

- BP reduced by ~ $1200

- Undefined risk, delta capped at -60, positive theta

- initial delta between -12 to -20 (less initial directional risk)

- can buy/sell shares and roll call out in time to adjust position

With a stop at 26.50 price level, the total risk should be somewhere between $40 - $300 depending on which strategy is used and when the stop triggers.

TP aimed around 17.10 price level.

DAL - The Airlines Are Not Looking to HotChecking Back in with Delta Airlines. Check out our previous analysis on these as you can see how we've been playing them and get an overall feel of the direction we're going. Our previous posts provide some detail towards our positions.

Short and Sweet Fundamentals:

1. Delta just suspended flights to 10 major airports through at least September: Chicago Midway, Oakland International Airport, Hollywood Burbank, Long Beach, T. F. Green International Airport, Westchester County Airport, Stewart International, Akron-Canton, Manchester-Boston Regional Airport and Newport News/Williamsburg International Airport.

2. DAL is trying to cut losses anywhere possible as they're burning through $50-$60 million per day.

3. At current pace, they're scheduled to run out of the Stimulus $ by the end of June.

Technical:

1. We have a bearish pennant. There was a clear break and a retest.

2. If you entered the short position on the break where we have the purple circle on the chart, we're looking to play this down to the following targets:

Target 1: $17.09

Target 2: $12.67

Target 3: $6.41

I would keep a trailing 4-5% stop loss on this one as we feel price could get volatile. The trailing stop will keep you position going if DAL tanks.

Not to leave the bulls hanging out to dry, they would like to see a Double Bottom at $19.00 area and a reversal (unlikely, but anything is possible when the FED is printing). As we've mentioned before, we're personally not long on airlines until we start seeing people fly again.

Hit us with a like and a follow for more updates. Cheers!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor. I am an amateur investor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, or stock picks, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies. I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on here, expressed or implied herein, are committed at your own risk, financial or otherwise.

Do Planes Fly? (DAL)Symbol: DAL

Sector: Airlines

Delta airlines is currently testing rock bottom.

Horizontal support at low of 21.26 needs to hold or we could see sell off.

Adding to this position at current price I like.

We are closing with lower highs down over 190%

We have so far attacked support area 4 times almost directly and held.

What we would like to see next is price to hold support and start to curve into the gray triangle as our pennant compresses. Then look for breakout above the black dashed line.

First target 24%

Second target 56%

Third target full recovery 190%

Great opportunity, this is the patterns we want to focus on.

It is ideal to wait for the Crossover and than the breakout for a strong confirmation.

Limit at 21.26 see if we can get filled and set a tight stoploss and play that level closely in case of break down.

I will stay updated on Delta Air Lines on this post below.

AAL DAL LUV BA Time to fly is approachingAs everyone knows, the airlines have taken probably the worst of the hit from the pandemic.

If you take a look at the weekly for all the top airlines and BA, they all look very similar.

I present American because I like feel like this chart has one has more defined risk areas due to recent price action and currently sits at one of its strongest supports in the history of the stock

From highest time frames to lowest, here is my bullish case:

Monthly: RSI has never been this oversold in its history, even at the near collapse in 2008

Weekly:You cannot miss the bullish divergences on weekly RSI. It is rare to see on a weekly chart.

MACD bottoming nicely.

Daily chart shows lots of incoming accumulation volume starting the end of April. After the Buffet news, it seems lots of retail investors dumped their stock into stronger hands.

Bullish divergences on RSI began Middle of March. Almost 2 months of divergences will make this thing pop strong and fast when it is ready.

Admittedly, the market structure is still bearish. Lower highs since the start of the fall with the last high at 13 dollars.

What intrigues me now though is this second bounce off 9.08 lows. It may not ultimately be the double bottom we hope for, but that 9 dollar mark created a defined stop loss.

I am playing AAL here. If it is to break below 9 dollars and close the week at that point, it is a clear sell with reassessment at 7.80-7.95. Break that and ill be a buyer at 5.25

First target here is 15.50.

This trade needs 1-2 months, and possibly to August. It is a buy and hold. When fall comes around, it is IMPORTANT to assess due to the potential of the second wave of Covid-19. If it hits again, run for the hills because the second time around we will have a full 6-8 months of Corona season, debilitating all airlines and probably bringing them all back to all time lows, in this case $1.50.

If you do not get greedy on this trade, you will get a 50% return within 3 months. It is a gamble after that until a vaccine is out there.

Qantas in Talks with the Government- Qantas is in talks with the government to secure an exemption for 1.5m social distancing rules on its its flights.

- If given the green light and the ability to kick off at full capacity for domestic flights / (possibly incl. New Zealand) we expect the stock to move higher - possible to the 50% retracement.

- Technically we are in a downward Channel and we need to break out of the immediate resistance and out of this channel. Our Momentum Squeeze is ON and we are waiting for a breakout.

Allegiant Travel Company With the airlines starting to implement face coverings as mandatory many airlines are even creating new seat plans to respect social distancing. This although brings and invites certain guest will certainly raise the price of tickets as load factors go up. Allegiant operates on an ultra low cost carrier model and will most likely continue to work towards selling as much space in their aircraft as possible. with a lot of cash reserves leaving them to have positive outlooks for holding operations during slower months.

HoneywellAs a defense contractor and service provider to various industries they providing a wide range of products to their clients. They are having a slow recovery from the lows of 2020. Looking to reach back in previous trading ranges.