IAG Airlines Group what next? $261 Reached & Breached! $172?🤔 IAG Airlines Group what next?

ℹ️ $261 Reached & Breached!

Will the $261 be regained and start to offer some support or is $172 NEXT?❓️❔️❓️

🌍 To be completely transparent I have no horse in this race at the moment BUT I really would like a serious flush to try and accumulate a long-term POSITION.

🟢SeekingPips🟢 is not interested at current price at all unless we start to see some SERIOUS VOLUME START TO COME IN TO PLAY

Airlinesstock

IAG Stock Took some heat! Is there anything to take here?🟢SeekingPips🟢 has this on the radar.

⭐️ Have your levels ready and wait for your A+⭐️ Setup.

ℹ️ Our levels are here marked out.

I have ZERO interest in taking a position here however a deeper sell-off and I will start paying attention.❗️

⚠️ ALERTS set and LEVELS marked.

🟢Now go away and ENJOY your WEEKEND and lets HURRY UP AND WAIT and lets see what NEXT WEEK has for us👍

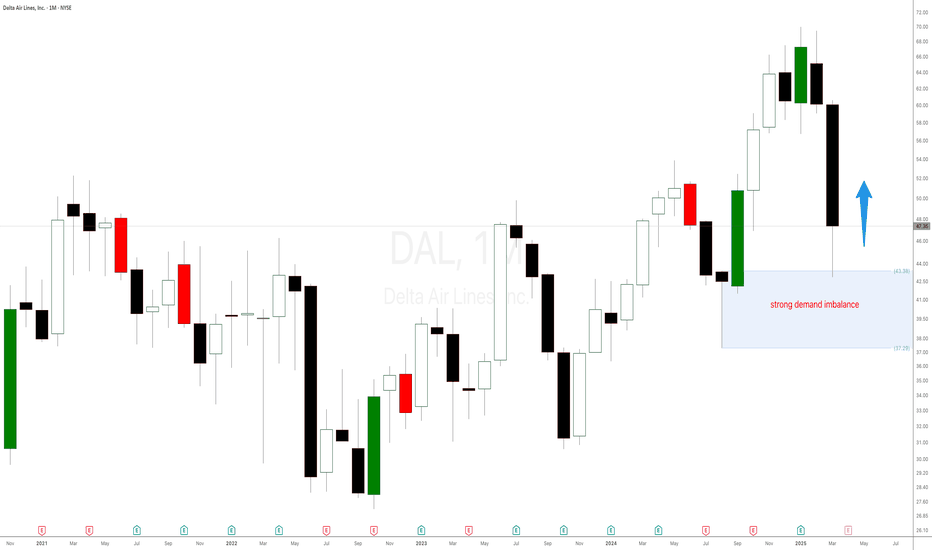

Watch This Before Trading Delta Airlines Stock in 2025!The Art of Trading: Price Action, Supply and Demand, and Patience in Delta Airlines. Trading in the stock market is a skill that requires a deep understanding of market dynamics, disciplined decision-making, and the ability to remain patient in the face of volatility. Among the most effective strategies for achieving consistent success are price action analysis, supply and demand principles, and meticulous money management. This supply and demand stock analysis will explore how these strategies can be applied to Delta Airlines (DAL), focusing on key price levels, candlestick patterns, and the importance of patience in making informed investment decisions.

A strong demand level for Delta Airlines (DAL) has been identified at $43. This level represents a price zone where buyers have historically shown significant interest, leading to price reversals. By waiting for the stock to retrace to this level, traders can enter positions with a higher probability of success as the likelihood of renewed buying pressure increases.

American Airlines | AAL | Long at $13.34As the Great American Wealth Transfer happens, people are using that money to travel more (after all, few can afford to transfer that wealth into real estate). Airline data show passenger counts are increasing rapidly and with airfares expected to rise, this sector is likely to go through a long-awaited boom cycle.

Those following me know I am heavily long in airlines, cruise lines, and travel companies. With today's dip, and the long-term historical moving average starting to show upward momentum, American Airlines NASDAQ:AAL is in a personal buy zone at $13.34. A further dip to $11.00 to close the daily price gaps is also where I will be adding more.

Targets:

$15.00

$18.00

Sabre Corporation | SABR | Long at $3.00Sabre Corporation's NASDAQ:SABR earnings have slowly been improving since the pandemic and may be heading into profitability by 2025/2026. Disinterest in the stock may also be waning as the price creeps closer to my selected historical simple moving average (SMA, white and teal lines). Often, but not always, as the price nears this line, it jumps to make contact over a few weeks or months. Not to say that more volatility won't be ahead, but NASDAQ:SABR currently sits in a personal buy zone at $3.00.

Target #1 = $4.00

Target #2 = $5.00

Target #3 = $6.70

JetBlue Airways | JBLU | Long at $5.92JetBlue NASDAQ:JBLU - Earnings and revenue beat today, stock drops -26% by noon.

2025 Outlook:

"For the first quarter of 2025, JetBlue expects its available seat miles (ASM) to decline 2% to 5% year-over-year, with revenue per ASM projected to range from a 0.5% decline to a 3.5% gain, while analysts had expected the metric to rise 5% year-over-year. JetBlue said it also expects cost per ASM to rise 8% to 10% in the first quarter. The airline also expects cost per ASM to rise 5% to 7% for the full fiscal year, with revenue per ASM projected to rise 3% to 6% compared to the metric staying flat in 2024."

Travel is increasing rapidly from the pandemic lows and if oil continues to drop, airlines will continue to experience a boom. This outlook may be overly negative as "protection" while the company further moves toward profitability.

My only concern is there is a price gap on the daily chart near $4.00 that is still open (and could be filled in the near future. But, from a technical analysis perspective, the bottom of my historical simple moving average line today is $5.90. It may bounce there, or shakeout shareholders for a while to test the $4 range. Regardless, JetBlue is a mid-level ranked airline that is, indeed, moving toward profitability - it may just take it getting through 2025 to gain investor confidence.

Initial entry position started at $5.92.

Target:

$7.95

American Airlines | AAL | Long at $14.00Similar to my cruise line picks, I anticipate airlines to quite literally "take off" in the coming years as interest rates are lowered and people travel more. These two industries never quite recovered from the pandemic, but their time to do so is "likely" fast approaching.

American Airlines NASDAQ:AAL has been consolidating near my selected long-term simple moving average (SMA) for several years. Many retail investors have been beaten up by the sudden up and (especially) down price movements, but this is where larger investors gather their shares. The fact NASDAQ:AAL did not make a new low in August 2024 is a hopeful sign from a technical analysis perspective. While the price may dip to close out the new lower price gaps, I think we are nearing the "take off" zone which will be a massive break through the long-term SMA. A confirmation that something bigger is brewing would be a price move into the $15s, dip down to the $12s, and the larger move up. Regardless of trying to predict bottoms, NASDAQ:AAL is in a personal buy zone at $14.00.

Target #1 = $15.25

Target #2 = $16.55

Target #3 = $18.40

Target #4 = $27.00 (very long-term outlook...)

DAL... We have take offGood morning traders,

If you have been following my predictions on DAL and UAL, well... WE HAVE TAKE OFF! OB has been tested, we could see a pullback testing the previous red candle but should be a decent flight from there on out. Some turbulence along the way, but shouldn't be big enough to knock this plane down.

All previous areas have been tested and structurally it looks great. Hang on tight a bit more we are almost there. Keep UAL on your sights, this has much more traveling to do which means bigger profits as well.

Hope you enjoy the rest of your day, and don't forget to follow for all my other predictions. Have a great rest of your week, happy trading & God Bless!

Boeing | BA | Long at $180Boeing NYSE:BA is getting bad press (and rightfully so) due to quality/safety assurance issues, but I view this dip as a buying opportunity for future returns. The company expects profitability beyond 2024 and once that happens, I expect this ticker to soar. There may be some pains in the near-term, but long-term, it is in my buy zone at $180.00.

Target #1 = $260

Target #2 = $335

Target #3 = $414

Wake up the Spirit

1)Enhance Customer Experience with AI

Implement AI-driven chatbots and virtual assistants to provide 24/7 customer support, handle common inquiries, and manage bookings. Use AI to personalize travel recommendations and offer tailored promotions based on customer preferences and behavior. AI can also be used to streamline the check-in process and provide real-time updates on flight status and delays.

2)Optimize Operations with Predictive Analytics

Leverage predictive analytics to optimize flight schedules, maintenance, and staffing. This can help reduce delays, improve aircraft utilization, and ensure timely maintenance, thus enhancing overall efficiency and reducing costs. AI can also help in demand forecasting to better match supply with demand, reducing overbooking and underbooking issues.

3)Implement Dynamic Pricing Algorithms

Adopt dynamic pricing strategies powered by AI to adjust ticket prices in real-time based on demand, competition, and other market conditions. This can help maximize revenue while remaining competitive in the market. AI-driven pricing models can also identify the optimal time to offer discounts or promotions to fill seats without undercutting profitability.

4)Focus on Sustainability

Invest in fuel-efficient aircraft and explore sustainable aviation fuels to reduce the airline's carbon footprint. Implement AI to optimize flight routes for fuel efficiency. Engage customers by offering them options to offset their carbon emissions. Demonstrating a commitment to sustainability can enhance the airline's reputation and attract environmentally conscious travelers.

5)Create a Positive Work Culture

Invest in training and development programs to empower employees and improve service quality. Foster a positive work environment where employees feel valued and motivated. Use AI to streamline internal processes, making it easier for employees to focus on delivering excellent customer service. Recognize and reward employees who go above and beyond, creating a culture of appreciation and support.

Embracing Love in Business

Love can be a transformative force in business. Encourage empathy and kindness in customer interactions. Show appreciation to loyal customers through personalized gestures and rewards. Build strong relationships with customers by listening to their feedback and continually improving based on their needs. By putting people first and cultivating a culture of love and respect, Spirit Airlines can foster loyalty and stand out in the competitive airline industry.

American Airlines Downgrades Forecast and Loses CCOAmerican Airlines recently revised its financial forecast downward and announced that Chief Commercial Officer Vasu Raja will leave his position next month. This comes amid a challenging period for the airline, which has been underperforming compared to rivals Delta and United Airlines. The company now expects a sharper decline in unit revenues for Q2 and has lowered its earnings per share estimate to $1-$1.15. Raja’s departure follows recent strategic changes aimed at increasing direct bookings. Vice Chair Stephen Johnson will temporarily assume Raja’s duties. Following the news, American Airlines' stock fell over 8% in after-hours trading.

Key Points:

* Unit revenue expected to decline up to 6% in Q2 2024 (previously forecast at max 3% decline).

* Adjusted earnings per share for Q2 2024 lowered to $1.00-$1.15 (previously $1.15-$1.45).

* CCO Vasu Raja is to depart next month, following recent commercial strategy changes.

* Challenges include weaker international connectivity and pushback from corporate customers on new ticket distribution strategies.

* American Airlines stock dropped over 8% after the announcement.

Trading Idea:

* Short American Airlines (AAL) with a stop-loss at $16.41.

* Target prices (T.P.) for downside move: $10.89, $7.61, $4.06 (and further down to $2.89).

JETS, a travel ETF rising summer travel season approaches LONGJETS on the reliable daily chart is in trend up since last fall which followed a trend down

during the spring and summer. Travel stocks are booming here and there including TCOM

(Trips.com) in China. The airlines have high volumes and are competing on price and perks.

So are the cruise lines. This ETF is a way to capture some profit from the trends. If has lower

risk but also lower reward than an individual stock JETS is upside range bound by the

second upper VWAP line above it. The predictive algorithm of Luxalgo forecasts a rise

to about 22 before that VWAP line rejects price into a reversal. I am shorts JETS while also

shorting NCLH and going long on AAL. I expect to profit and use funds for some more

frequent travel. The karma in the whole thing is that it is a closed circle. Watch travel

companies including booking agents, spent money traveling get insights and then deploy

capital to work those markets for profit returns to recycle the funds into more travel.

Is BA accumulating for an another leg higher ? LONGOn this 120 minute chart of BA where price is a blue line I have superimposed a RSI from the 4H

time frame. Each is on its own scale RSI is 0-100 while BA is the actual price level. This set

up detects divergences to forecast near-future price action. One the chart text box comments

serve to explain this a bit more. Basically if price is flat and RSI is rising divergence is there.

Likewise if RSI is falling and price is sideways there is bearish divergence. It follows that when

the RSI line is above price and price is rising, if the slope of RSI exceeds the slope of price,

that is a bullish bias. If price is falling and is above the RSI which is falling faster that is

a bearish bias. At this time, I believe that institutions are making small ( for them )

incremental buys trying not to move price until they get their quota. Price is currently

below the mean VWAP anchored into the distant past. Most buying and volatity will occur

at that price. I want to get in early. I will buy call options above current price near to

the VWAP so striking $210. So far BA has been very good to me actually a cash cow because

of the strategy used. I have two contracts at $220 for July. If things go well with this

trade, I will use the profits to buy a contract for expiration in September and spread the

risk over more time as a risk-off strategy. A stock share long trade is good from here for an

investor but the price ranging is not enough for your average trader. Fundamentally BA has

had plenty of good news and bad news. I focus on the good news. The new contracts to buy

coming out of India and Thailand point to future earnings stability something that suggests

the time to trade is now.

JBLU Bullish after JetBlue - Spirit merger was BlockedJetBlue's $3.8 billion buyout of Spirit Airlines was blocked by a judge, citing a threat to competition!

After the news, SAVE went down, while JBLU surged from $4.54 to $5.45! However, today it continued the 6 month downtrend and closed at $4.68.

This might seem like business as usual on Wall Street, except for the presence of some aggressive blocks of calls with strike prices of $6 and $7 on JetBlue's options chain, across multiple expiration dates!

The most commonly chosen expiration date was February 16, following the earnings release. This leads me to believe that we might witness excellent results from the upcoming earnings report.

JBLU was trading at $9.45 just 6 months ago. Its decline was not due to fundamentals but rather on the potential buyout of SAVE. Now that the deal is off the table, I expect JBLU to rise back up.

I'm extremely bullish on JBLU ahead of earnings!

BA VWAP bounce LONGBA on the 1H chart put in a double top. Given the heavy volumes on the volume

profile, BA was shorted heavily at the top. Those shorts have rode the profit train

down to the mean VWAP. At this point they are buying to cover and taking profit

and are joined by new buyers. BA has reversed and pivoted up. the MACD is

confirmatory. Volume is adaquate and steady albeit without any spikes.

BA is a low mover. Price has about 5% upside to the double top and POC line of

the volume profile. This is most suitable for a call option trade to follow this

megacap up. Please leave a comment if you would like to query my ideas as to

a good option for this trade.

Hawaiian Airlines HA Reversal LongHA is on a 30 minute- chart. A Head and Shoulder pattern is drawn. It is assymetrical with

an ascending neckline extension. An anchored VWAP is added. Price is currently in the

deeply oversold zone near to the -2 standard aWVAP line. I see buyers and money flow

coming in at this level. The stop loss is 9. The first target is at 10.7 and so about 15% upside

in the area of the mean VWAP. The second target is the confluence of the July 10 pivot ,

the ascending neckline of the pattern and 2 deviations above aVWAP ( the thinnest red

line) at the area 12.5. This is about 35% upside. I will take this swing long trade and

investigate a suitable call option as well.

Is America Airlines about to take off?

With a 20% higher than expected earnings today and also raising future expectations...is American Airlines NASDAQ:AAL about to "take off" ? ✈️✈️✈️

EARNINGS RELEASED: Exp 1.59 / Rep 1.92 (20.6% higher than expected)

- Breaking diagonal resistance line

- Price peaking above the 200 week SMA

- Nice to see 200 week SMA slope up now (TBC)

- Ideally OBV to make a new higher high (TBC)

Pre-market coming in lower. Pull back to $17 before continuation would not surprise me. I would enter having established support on the 200 week SMA. I would be waiting here. An eventual rise to over head resistance possible.

LUV is loving the summer vacation travel LONGLUV has been in a persistent trend up for a couple of months after lackluster earnings were

reported in early May with another due on July 27th. The airports have been quite busy

with vacation travel and Southwest has been part of that action. On the 1H chart, price has

been supported by the line two standard deviations above the mean anchored VWAP which

shows persistent relative strength in a rise of over 25% over two months. Price above the

POC line of the volume profile is another sign of buyer dominance. The MACD indicator show

the lines in parallel and above a positive histogram. The relative volatility indicator shows

sufficient volatility to support momentum trading.

I will take a long trade going into earnings. I will do this with ten call options contracts

with a strike at $40 expiring on July 28th. On the last trading day, this contract had

a low of $ 0.36 and a high of $0.48 for a range of 33% in a single day. I expect similar

price action as the earnings date approaches. I expect to pay about $480 for ten contracts

and the profit expectation is 100% over the next 15 trading days.

Delta Airlines DAL Pre-Earnings PlayDAL has been ascending for two months now and has upcoming earnings. As can be seen

on the 2H chart, price has been consistently above the anchored mean VWAP since June 1st.

Price crossed over the POC line of the volume profile on June 26th. This is the level where

the most trading volume in the time range occurred. Above that line, buyers and their buying

pressure are dominant. The Zero Lag MACD shows the lines crossing and the histogram

going from negative to zero. I will take a long trade considering the earnings report anticipated

for July 13rd. For this, I will take a call option trade of ten contracts for the strike of $47.50

expirating 7/14th. On the last trading day, the contract had a low of $0.96 to a high

of $1.54 meaning a one-day increase of 60%. I anticipate a three-day return of

100% and expect the trade to cost about $1.54 x 10 X 100 or $1540 which is also the

profit expectation.

Hitting LowsATSG is sitting right now at the $15 price point which we have not seen it trade around since back in March of 2020. With price back at this low range, analyst are still holding their price valuations of around $22-$27 making this a favorable target for long term portfolio growth. The last two earning reports were more on the negative side although the company has shown before its ability to be able to generate revenue historically. Having hit highs of just under $35 at the start of the year we can start to see where the peaks and valleys of this range will be.

American Airlines Group: The Best Stock to Buy Right Now?The pandemic hit the airline industry hard, with many companies filing for bankruptcy or struggling to stay afloat. However, one company that has managed to weather the storm is American Airlines. Despite facing unprecedented challenges, American Airlines (NASDAQ: AAL) has survived and emerged stronger than ever before. So if you’re looking for a smart investment opportunity in these uncertain times, read on to discover why investing in American Airlines could pay off big time!

A new and strong weekly demand imbalance trading at $12.85 per share took control last week, in April 2023. The strength of the impulse is important. This is a long-term investment opportunity for American Airlines (NASDAQ: AAL) stock.

UAL - BULLISH SCENARIOUnited Airlines is one of the few airline stocks that registered growth in the last 3 years, and also the airline that recovered faster than the competition at the beginning of the pandemic. Breaking the 55 resistance can pursue the 63 high during the pandemic. UAL has vast expansion plans. In December, UAL made a historic purchase of 200 new 787 Dreamliners from Boeing (BA). BNP Paribas put a price target of 70 dollars after upgraded the stock to outperform from underperform.

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.