AIXBTUSDT

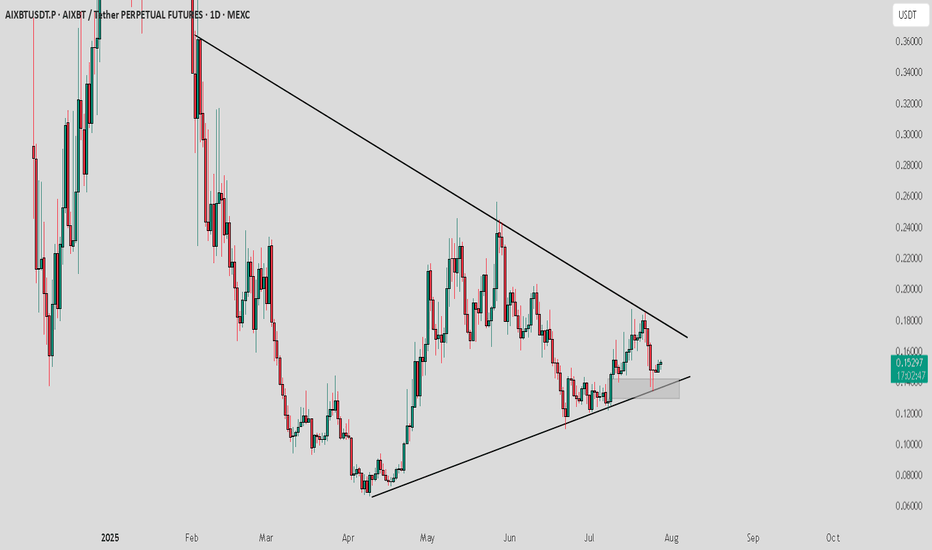

AIXBT / USDT : Getting support and moving towards resistance AIXBT/USDT is currently forming a symmetrical triangle pattern and testing a key support zone. A short-term rally of around 10% towards the upper resistance is expected, leading to a potential breakout.

Bullish Scenario:

A solid breakout above the upper trendline could initiate a major rally, targeting levels around $0.18 and higher.

Watch for confirmation of the breakout for a sustained move.

Targets for the short-term rally:

Expect a move towards $0.18 before the breakout happens. A major rally will commence once the breakout occurs. 🚀

Stay patient and keep an eye on the price action for potential entry points! 📈

AIXBT/USDT – Symmetrical Triangle Squeeze! A Major Move is Brewi🔍 Market Structure Overview

AIXBT/USDT is currently forming a well-defined Symmetrical Triangle pattern on the 1D timeframe, signaling a tightening consolidation between lower highs and higher lows.

Price is consolidating just above a strong demand zone between $0.1200–$0.1350, suggesting accumulation by smart money. This triangle formation represents a classic volatility squeeze, where price coils before a significant breakout or breakdown.

These setups are often the calm before the storm—and they typically lead to explosive moves once price escapes the pattern.

✅ Bullish Scenario (Breakout Upwards)

If price breaks above the descending trendline and clears the $0.1664 horizontal resistance level, it could ignite a powerful bullish run toward the following targets:

1. 🎯 Target 1: $0.2255 – Previous swing high & structural resistance.

2. 🎯 Target 2: $0.3942 – Strong horizontal resistance from historical price action.

3. 🎯 Target 3: $0.5982 – Mid-term Fibonacci/volume confluence level.

4. 🚀 Ultimate Target: $0.8763 – Psychological level and former macro resistance.

> Breakout Confirmation: Look for a daily candle close above the triangle with a surge in volume for confirmation.

❌ Bearish Scenario (Breakdown)

If bulls fail to break out and the price breaks down below the triangle and loses the $0.1200–$0.1349 support zone, the following downside targets come into play:

1. ⚠️ Support 1: $0.0950 – Previous local low.

2. ⚠️ Support 2: $0.0750 – A historical accumulation zone.

3. ⚠️ Support 3: $0.0590 – Major demand floor and last line of defense.

This would invalidate the current bullish structure and signal a potential mid-term trend reversal.

📐 Pattern Highlight: Symmetrical Triangle

Nature: Neutral continuation/reversal pattern, depending on breakout direction.

Volume Behavior: Typically contracts as price nears the apex, then expands post-breakout.

Strategy: Smart entries usually occur on breakout + retest with volume confirmation.

🧠 Final Thoughts

AIXBT/USDT is reaching a critical inflection point. The symmetrical triangle formation is nearing its apex, suggesting that a large move is imminent. Whether the breakout will be bullish or bearish depends on how price behaves at the key boundaries outlined.

📢 Pro Tip: Watch for breakout direction, volume spikes, and possible retests to position accordingly. Don’t forget to set stop-losses in either scenario to manage risk effectively.

#AIXBT #CryptoBreakout #SymmetricalTriangle #TechnicalAnalysis #AltcoinSetup #ChartPatterns #VolumeAnalysis #SupportAndResistance #CryptoTrading #CryptoTA

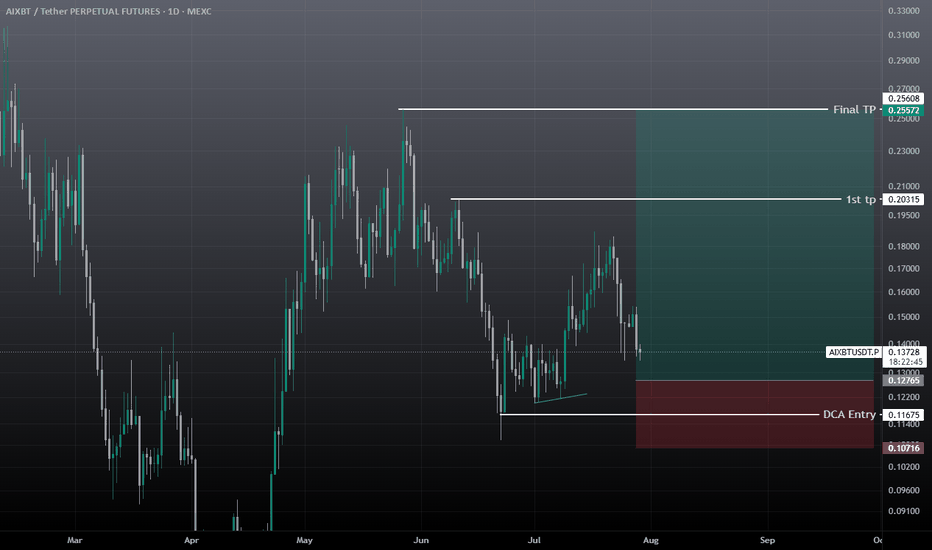

$AXIBT Breakout Confirmed – 2x Potential Ahead?$AXIBT just broke above a key accumulation zone after days of consolidation.🚀

Strong volume, bullish Ichimoku support, and a clean breakout above resistance suggest this could be the start of a major move.

If this rally continues, we could see a sharp push toward the $0.50+ zone, nearly 2x from here.

Reclaiming and holding above the $0.22–$0.24 zone is crucial for confirmation.

Eyes on this one.

$AIXBT macro analysis [ ai coin having huge potential ] Hi it's me ur Raj_crypt0

Here is my view on BINANCE:AIXBTUSDT an #ai sector coin .DYOR / NFA

This is low cap high risky coin u may lose 100% before investment check ur self

Entry - $0.25 below

targets ....

¹$0.55

²$1.5

³$3.5

Note - $0.1 below stop buying ( I will update where to avg or wt to do )

If , u are risky taker $1.5 ( get ur liquid there + 1x profit )

AIXBT should take a coffee break...AIXBT has done super well with the move up. An exchange of hands should be expected, and perhaps a test of lower levels to pick up bullish bits. The divergence in the momentum suggests fresh longs could be risky without a proper structure.

Full TA: Links in the BIO

Alikze »» AIXBT | Formation of the valley pattern - 4H🔍 Technical analysis: Formation of the valley pattern - 4H

📣 BINANCE:AIXBTUSDT currency is moving in an ascending channel on the 4-hour time frame, which is currently in the supply zone and the middle of the ascending channel.

🟢From a classical perspective, a valley has formed that can break the current supply zone in the green box area by removing liquidity under the previous leg and grow to the next supply zone.

💎 Second scenario: The current supply zone break, depending on the number and frequency of hits to the supply level, can break it and continue its growth to the next supply zone, which is also the ceiling of the ascending channel, and then encounter a correction that, after a pullback to the previous supply zone, continues its path to the next target.

»»»«««»»»«««»»»«««

Please support this idea 💡 with a LIKE 👍 and COMMENT 💬 if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email 📧 in the future.

Thanks for your continued support.🙏

Best Regards,❤️

Alikze.

»»»«««»»»«««»»»«««

AIXBT/USDT 1H: Markup Phase – Long Setup Above $0.1540AIXBT/USDT 1H: Markup Phase – Long Setup Above $0.1540

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

Current Market Conditions (Confidence Level: 8/10):

Price at $0.1553, showing strong bullish structure after breaking above Fair Value Gap (FVG).

Hidden bullish divergence spotted on RSI, reinforcing bullish continuation potential.

Market Makers completed accumulation phase between $0.0750 – $0.0800, entering markup

phase.

Trade Setup (Long Bias):

Entry: $0.1540 – $0.1555 zone.

Targets:

T1: $0.1650

T2: $0.1700

Stop Loss: $0.1480 (below recent swing low).

Risk Score:

7/10 – Strong breakout supports the setup, though minor pullbacks into FVG retest remain possible.

Key Observations:

Strong support around $0.1300 (equilibrium zone).

Volume profile confirms breakout strength and new bullish order flow.

Break of structure aligns with Smart Money Concepts for continued upward movement.

Price action suggests potential for rapid expansion during markup phase.

Recommendation:

Long positions favored within entry range with tight risk management.

Consider securing partial profits at $0.1650 and trailing stop for potential extension towards $0.1700.

Monitor price action on any pullback into the FVG zone for additional entries.

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

AIXBT/USDT 1H: Accumulation Complete – Bullish Breakout !AIXBT/USDT 1H: Accumulation Complete – Bullish Breakout Targeting $0.1200?

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

Current Market Conditions (Confidence: 8/10):

Price at $0.1023, confirming a clear breakout from the accumulation zone.

RSI at 61.27, indicating bullish momentum with room to push higher.

Hidden bullish divergence on RSI vs price, reinforcing underlying strength.

Market Makers have completed accumulation in the $0.0950 - $0.1000 zone.

LONG Trade Setup:

Entry: $0.1020 - $0.1025 zone.

Targets:

T1: $0.1150 (short-term resistance).

T2: $0.1200 (extended target).

Stop Loss: $0.0950 (below recent support).

Risk Score:

7/10 – Favorable risk-to-reward, but requires confirmation above $0.1050.

Market Maker Activity:

Transitioning from accumulation to markup phase, confirming Smart Money positioning.

Strong support built at $0.0950, reinforcing stability for longs.

Recent higher low formation with increased volume, signaling potential continuation.

Clean break above resistance, indicating a setup for further upside.

Recommendation:

Long positions remain favorable within the $0.1020 - $0.1025 entry range.

Monitor price action at $0.1150, as this level may trigger temporary selling pressure.

If momentum sustains, expect a move toward $0.1200+.

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

AIXBT COIN UPDATE AND NEXT POSSIBLE MOVES!!$AIXBT Coin Update!!

• Keep Your eyes on it... Any Time 15%-30% bounce back expected in its price if market stay little bit stable🫡

Reason : on chain data & technical analysis with market current conditions totally fit with this coin ( according to my analysis)

But without SL Trade is Not recommended... Still if you want to buy it in spot ( without SL)🚨then i will recommend don't use up 10% of your portfolio... No one Knows what will happen next🙈

Warning : That's my idea DYOR Before taking any action🚨

AIXBT/USDT 1H: Bearish Distribution with Reversal Potential !AIXBT/USDT 1H: Bearish Distribution with Reversal Potential – Wait for Confirmation?

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

Current Market Analysis:

Price at $0.1813 showing strong bearish momentum.

Clear distribution pattern with lower highs and lower lows.

RSI at 30 indicating oversold conditions.

Risk Score: 8/10 – High risk environment.

Market Maker Activity:

Distribution phase evident with heavy selling pressure.

Declining volume suggests a potential reversal may be imminent.

Key support at $0.1750 must hold for any bullish case.

Trade Setup (Confidence 7/10):

Recommendation: Wait for reversal confirmation before entering.

Entry Zone: $0.1750 - $0.1800 after a bullish reversal candle.

Targets:

T1: $0.1950

T2: $0.2100

Stop Loss: Set at $0.1650 (below major support).

Recommendation:

Wait for confirmation of a reversal before entering. Market makers appear to be shaking out weak hands, potentially setting the stage for an accumulation phase.

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

aixbt 666% Blind TargetThe concept looks good (sounds good) and people are crazy about everything—or anything— that has the word 'AI' in it. People are also crazy, in a good way, about the Cryptocurrency market and trading, so this can be a good concept, it can work to attract the attention of the public and that is all that is needed for a rising chart.

(And the logo is beyond funny of course. 😂)

AIXBTUSDT (aixbt) is moving now out of a falling wedge pattern, breaking a local down-trendline and going green after a strong decline. The same hammer candlestick pattern just mentioned on the EOSUSDT publication is also present here. This is the last session (18-Feb.).

I am calling this a "blind target" because there isn't much information on the chart. The chart is pretty young. We have the pattern, the break of the downtrend and the candles, but also marketwide action and market cycle; we know Crypto is going up.

There is another target beyond the one reading 562%. There is another strong target and I belief this can be achieved easily, the one at $2.25 has a potential of 920% from current price.

The 9-Feb. session holds high bullish volume preceding the down-waves low. This can be taken as a signal that the market is getting ready to change course.

aixbt is going up.

Crypto is going up.

The Altcoins are going up.

Thanks a lot for your continued support.

Namaste.

AIXBT/USDT 1H: Hidden Bullish Divergence – Potential Reversal??!AIXBT/USDT 1H: Hidden Bullish Divergence – Potential Reversal at $0.1850?

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

Current Market Structure:

Price at $0.1776 is exhibiting a bearish distribution pattern with lower highs.

Clear resistance is observed at $0.1850.

Market Maker Activity:

Accumulation is evident in the $0.1700-0.1750 zone, suggesting that institutional players are positioning for a reversal.

Smart Money appears to be building positions at these levels.

Technical Indicators:

Hidden bullish divergence is present on RSI at 46.36 relative to price action, signaling potential for a reversal despite the bearish setup.

Trade Setup (Confidence 8/10):

Long Entry: At $0.1776.

Targets:

T1: $0.1850

T2: $0.1950

Stop Loss: Place at $0.1700 (below key support).

Risk Score:

7/10 – Favorable risk-to-reward, with clear entry, target, and stop levels.

Key Levels:

Support: $0.1700, $0.1650

Resistance: $0.1850, $0.2000

Recommendation:

Recommend a cautious long position given the accumulation signals and hidden bullish divergence.

Maintain tight stops below $0.1700 to manage risk effectively.

Monitor price action near $0.1850 for further confirmation of upward momentum.

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

AIXBT/USDT 1H: Bullish Breakout – Next Stop $0.30?AIXBT/USDT 1H: Bullish Breakout – Next Stop $0.30?

Market Structure & Momentum:

Bullish Breakout: Price has broken above $0.26 resistance with strong momentum and increasing volume.

Pattern: Completed Inverse Head & Shoulders with the neckline at $0.24.

RSI: At 70.48, showing strong momentum but nearing overbought territory.

Trade Setup (Confidence 8/10):

Entry:

Primary: $0.2647 (current level)

Alternate: Pullback to $0.26 for a better risk-to-reward ratio

Targets:

T1: $0.28 (first major resistance)

T2: $0.30 (previous high)

Stop Loss: Below $0.245 (below recent support)

Risk Score: 7/10 – Favorable risk-to-reward, though caution is advised given near-overbought RSI.

Market Maker Analysis:

A

ccumulation Phase Complete: Market Makers accumulated in the $0.23 - $0.24 zone.

Institutional Buying: Confirmed by strong volume profile.

Hidden Bullish Divergence: Visible on RSI relative to price lows, adding to the bullish case.

Outlook: Smart Money is likely targeting the previous high at $0.30.

Recommendation:

Long positions are favorable at $0.2647 or on a pullback to $0.26.

Keep tight stops below $0.245 to manage risk.

Watch for resistance at $0.28 as the first major hurdle on the path to $0.30.

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

#AIXBTUSDT: Get Ready for a Breakout! Short Still the Priority?BYBIT:AIXBTUSDT.P is showing significant weakness after a prolonged downtrend, and now the market is at a critical level. Buyers failed to initiate even a minor rebound, indicating strong selling pressure.

🔎 Key Factors Right Now:

✔ Current Price: $0.23480

✔ Daily Change: -10.76%

✔ Key Levels:

🔹 Resistance: $0.38080, $0.31670

🔹 Support: $0.22063

━━━━━━━━━━━━━━━━━━━━━━

💡 Main Signals Influencing the Market:

📌 No rebound after the drop – the lack of buying pressure increases the chances of further decline.

📌 Empty space ahead – below $0.2206, there are no strong support zones, meaning a sharp drop could follow.

📌 Closing near a critical level – price remains at risk, increasing the likelihood of a breakdown.

📌 Breakout from consolidation – the asset has left its range, signaling the potential formation of a new trend.

━━━━━━━━━━━━━━━━━━━━━━

📉 Main Scenario: Continued Decline

🔻 If BYBIT:AIXBTUSDT.P breaks below $0.2206, the market may accelerate downward:

✅ Target 1: $0.2100 – the nearest technical support.

✅ Target 2: $0.1955 – a zone where a short-term bounce could occur.

✅ Target 3: $0.1780 – a major support level where stronger buyer resistance is expected.

📢 Short remains the priority as long as price stays below $0.2300.

A breakdown of $0.2206 could trigger liquidations and accelerate the drop.

Be cautious with long positions – there are no strong reversal signals yet.

━━━━━━━━━━━━━━━━━━━━━━

🟢 Alternative Scenario: Bullish Reversal

If BYBIT:AIXBTUSDT.P holds above $0.2300 and starts to recover, potential targets include:

✅ Target 1: $0.2700 – a local resistance zone.

✅ Target 2: $0.3167 – a level where a pullback is likely.

✅ Target 3: $0.3800 – a key resistance, breaking which could change the overall trend.

📢 A long entry is only valid if price holds above $0.2400.

Reversal confirmation requires an increase in volume and stability above $0.2500.

📢 As long as the price is below $0.2300 – long positions remain risky.

Conclusion : Critical Moment! Be Ready for a Sharp Move!

📌 BYBIT:AIXBTUSDT.P is at a make-or-break level – any move could lead to an explosive price shift.

📌 Sellers remain in control, but if $0.2300 holds, an unexpected rebound could happen.

📌 Short remains the main scenario, unless price successfully stabilizes above $0.2400.

🚀 Get ready for a major move! Watch $0.2206 closely – this level will determine BYBIT:AIXBTUSDT.P is next direction! 🔥

#AIXBTUSDT continuation of the downtrend📉 SHORT BYBIT:AIXBTUSDT.P from $0.2255

🛡 Stop Loss: $0.2366

⏱ 1H Timeframe

✅ Overview:

➡️ BYBIT:AIXBTUSDT.P continues its downtrend, forming lower highs and lower lows.

➡️ The price has broken the $0.2290 liquidity zone and is holding below it, signaling weak buying pressure.

➡️ If sellers maintain control at $0.2255, a drop towards $0.2040 is likely.

➡️ POC at $0.2566 suggests the main volume accumulation is above the current price, reinforcing the bearish outlook.

➡️ High volume on recent candles indicates selling pressure, which could accelerate the downtrend.

⚡ Plan:

📉 Bearish Scenario:

➡️ Enter SHORT from $0.2255 if price confirms a breakdown.

➡️ Risk management with Stop-Loss at $0.2366, above key resistance.

🎯 TP Target:

💎 TP1: $0.2040 — strong support and profit-taking zone.

📢 BYBIT:AIXBTUSDT.P is in a bearish phase. If the price holds below $0.2255, further downside movement towards $0.2040 is expected.

📢 However, if the price reclaims $0.2366, the bearish scenario could be invalidated, leading to a potential bullish correction.

🚀 BYBIT:AIXBTUSDT.P Expecting a continuation of the downtrend!

AIXBT/USDT 1H: Distribution in Play – Short Setup Targeting $0.2AIXBT/USDT 1H:Analysis

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

Current Market Structure:

Bearish trend intact, with price trading at $0.24483 in the discount zone.

Hidden bearish divergence detected – RSI forming higher highs, while price forms lower highs, signaling Smart Money distribution.

Smart Money Analysis:

Market Makers appear to be distributing at premium zones between $0.32 - $0.34.

Equilibrium zone at $0.30 acting as a strong resistance level.

Bearish Order Block (OB) at $0.34 reinforces the overall downtrend continuation.

Trade Setup:

Confidence Level: 8/10 – Strong bearish setup with clear invalidation points.

Entry Zone: $0.26 - $0.27 (retest of premium zone).

Targets:

T1: $0.22 (support zone).

T2: $0.20 (major liquidity level).

Stop Loss: Above $0.285 (key invalidation level).

Risk Score:

7/10 – Favorable R:R setup but requires patience for optimal entry.

Market Maker Intent:

D

istribution phase confirmed, with Market Makers engineering liquidity at higher levels.

Expect price to retest the premium zone before continuing lower.

Bearish OB at $0.34 confirms downward pressure, making this a high-probability short setup.

Recommendation:

Wait for a retest of $0.26 - $0.27 for an ideal short entry.

Avoid chasing current price – patience will provide the best risk-to-reward setup.

Monitor price reaction at $0.22 - $0.20 for potential accumulation signs.

Confidence Level:

8/10 – Clear downtrend continuation with Smart Money positioning.

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!