AKS

AK Steel - breakout from the "handle"Week ago discussed that NYSE:AKS looks promising for low risk entry as it touched various support lines. Today, it appears that stock is breaking out of its bullish flag or "handle" in what appears to be cup&handle formation.

Do not expect strong rally immediately, but should continue working higher in the upcoming weeks

Low risk opportunity in AK SteelAfter breaking through inverse H&S and long term resistance in December and making nice rally afterwards, NYSE:AKS continues to correct in what appears to be bullish flag.

However, now stock finally is approaching various support lines including IHS neckline and current market sell-off may be used as a nice opportunity to attempt low risk buy entry for another major leg higher, if it comes.

i43.AKSBeta-R:Journal. Risk Management: Compound .Level : PA . Time: Short-term - Intermediate . This is just my view follow if it aligns with yours. Ideas are not repeated rather updated.Worry about risk only.

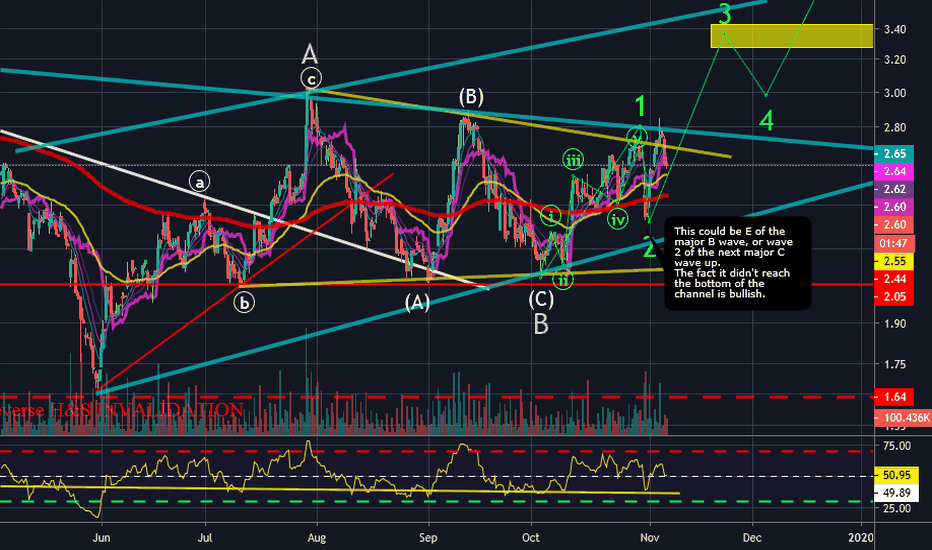

Correction Maybe FinishedWe were waiting for an abcde sideways move inside the larger B wave.

It looks like either the e wave ended short, or we could have just had an abc inside the B wave, which would mean this could be the next impulsive move up.

We could go long and set our stop loss to $2.30. If price can hold above 2.33, technically this is looking bullish now.

US STEEL coiling up$x $aks US steel looks good-Potential for lower prices before it breaks above this descending pattern. I was bearish on X above 46. I didn't think it would come this far down but some special could be in the works.. It could go RIPPING higher but I would not blink if it dropped to 5 or 6 per share again. Bear chart from 2018:

AKS support and resistance, can it break through?looking where AKS might head next, may need to cool down a bit before pushing higher, but good earnings and momentum are on its side. needs to hurdle current levels and create a base here for me to want to go long, If you missed the run, wait for some consolidation at support and go long with a tight stop. GL

Reverse Head&Shoulders finishing?!I've been watching this for the last few months and I feel very optimistic about AKS. Once the new year comes around, their contract prices are set to update, and I think this could drive us through the shoulder line. I've only been trading for a couple years though, and would love some 2nd opinions. I realize that once you think you see something, sometimes it's difficult to dissuade yourself, so thank you.

AKS long...AKS long. The exchange rate may fall momentarily. Technically, the bottom is 3.54 usd. We expect a rise from this level. This can be a steady upward wave structure with a target price above 6 usd.

Trump Trade LONG AKSPut your feelings of Trump aside for a second and listen to how much this man talks about the Steel Industry in the US and consider the effects of the Steel tariffs. AKS is a small cap US based steel stock that whose stock shows signs of accumulation while the big cheese goes on about US Steel coming back imposing tariffs (taxes) on the foreign competition. I don't know much about the industry but the stock seems okay, the company seems to have a bit of debt but favorable business conditions can change that. I'll post the daily chart in comments that shows a nice gap overhead that coupled with a falling ADX provides a positive tone for gap filling to about 5.35. While selling at 5.35 would be a good trade I want to hold and continue to accumulate AKS because I think we're way ahead of the curve on this US Small Cap Steel trade based on the little price movement and if anyone else has any US Small Cap Steel plays they would like to share I would love to hear about them. Thanks and good luck.

Many Possible Shorts Coming UpThe only thing holding up the price of this stock is a weekly demand zone in the 4.00 to 4.50 range. There are very strong weekly supply zones right above with very strong daily supply zones embedded within them.

Very high probability short trades can be taken when evidence of sellers showing up on a lower timeframe (1H or 4H). Any of these daily supply zones are a possible short trade.

THE WEEK AHEAD: DIS, AKS, P, TSLA, TWTR, X, MU, DISHWith most of the earnings heavy hitters in the rear view mirror, there isn't much to trade this week of quality from an earnings announcement volatility contraction standpoint, with DIS being the standout name.

DIS announces on Tuesday after market close with a 30-day implied volatility of 25%, which is in the upper half of its 52-week range. The May 18th 96/97 16 delta short strangle pays .97 with a 75% probably of profit, which isn't horrible, but I'd rather have a background implied above 50%.

One underlying that I don't usually trade earnings that caught my eye, however, was DISH, with an implied of >50%, which is at the top end of its 52-week range. It announces earnings on Tuesday before market open. You can naturally play it for earnings-related vol contraction (the May 18th 20-delta 30.5/37.5 short strangle's paying .88), but the chart may suggest taking a directional shot instead. I'll set out several bullish assumption plays in a separate post that would take advantage of its "being on its butt-dom."

On the slip side of the coin, there are several individual names that have that ~50% metric I'm looking for that have already announced and that may be worth nondirectional plays that are just as -- if not more productive -- than the Disney earnings play if set up in the June monthly. Here they are, ranked by their 30-day implied volatility percentages: AKS (65.5) (straddle), P (59.2) (straddle), TSLA (53.9) (strangle), TWTR (49.5) (strangle), X (48.6) (strangle), and MU (47) (strangle).*

On the exchange-traded fund front, not much is attractive, having all fallen below 35% 30-day implied: XOP (29.3), EWZ (28.5), SMH (26.9), EWW (24.9), FXI (22.8), so I'm unlikely to consider putting on a play in one of those unless something substantially changes as the week evolves. Moreover, my tendency is to set those up in the monthlies nearest 45 days until expiration and June (40 days 'til) is starting to "fall out of that window," with July (75 days 'til) being too far out in time.

* -- You can naturally consider going defined risk with some of these, using iron flies instead of naked short straddles; iron condors instead of short strangles.

$AKS Bearish Rising Wedge Pre-earnings$AKS Bearish Rising Wedge heading into earnings Monday before market opens.

Note: US Steel (X) sold off significantly post earnings earlier this week.

Currently long 05/04 PUTS

AKS (AK Steel Holding Corporation)AKS is filling out its pennant. I will be looking at this for a potential long position.

Profit targets will be 5.78 and 6.18.

Cheers!

Long AKS -- Short Term playAKS has pulled back to 61.8% Fibonacci level and building a strong support at this current price range.

Adjusting stop loss. No sell limit.

AKS -- AK Steel Holding Corp. Earning Play (July 25)My prediction is that AKS will have a strong earning and will resume its bullishness a week ago (July 19). Right now, we are in a pullback stage. RSI indicates that AKS is oversold.

This price at $6.19 is the price that I decide to go in.

The Risk/Reward Ratio of this trade is 2.93

AKS earnings don't move the stock AKS should bounce after the last 3 earnings being better then expected but didn't. It doesn't appear that people are buying into the earnings either. Since 7/14 the stock has double digit short percentage. While more the half the stock is owned by major players. That is what i think is keeping this stock down. It is not what i call a peoples stock-that is when us privet investors make little if ant impact. I do think this is where i will buy but not for a quick 8-10 percent, more like a longer hold. There is plenty of upside if your willing to chill a while. I have bought this stock twice and been stopped out both times in under a week. If you have any ideas plz share-link you chart or add to comments...this AKS is a learning curve for me. This was suppose to be a trump affect stock.