AK Steel - breakout from the "handle"Week ago discussed that NYSE:AKS looks promising for low risk entry as it touched various support lines. Today, it appears that stock is breaking out of its bullish flag or "handle" in what appears to be cup&handle formation.

Do not expect strong rally immediately, but should continue working higher in the upcoming weeks

Aksteel

Low risk opportunity in AK SteelAfter breaking through inverse H&S and long term resistance in December and making nice rally afterwards, NYSE:AKS continues to correct in what appears to be bullish flag.

However, now stock finally is approaching various support lines including IHS neckline and current market sell-off may be used as a nice opportunity to attempt low risk buy entry for another major leg higher, if it comes.

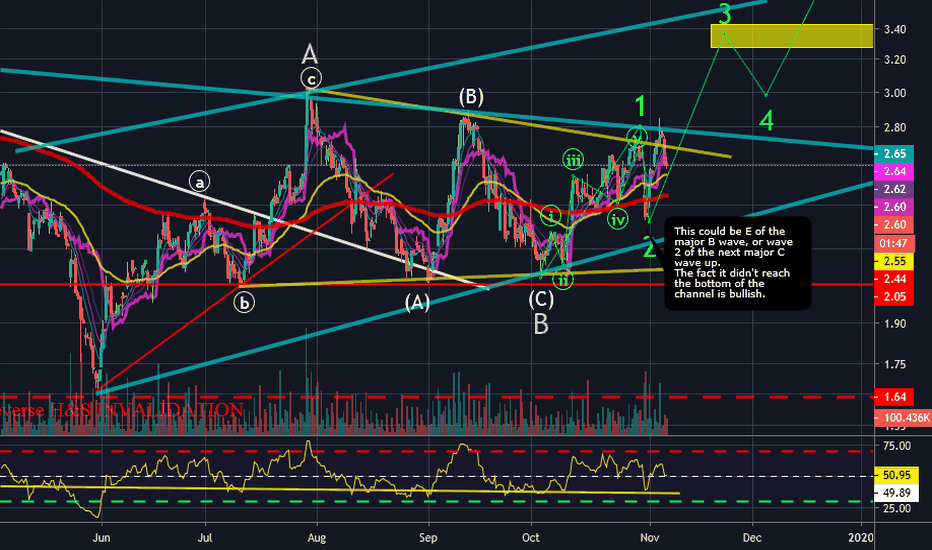

Correction Maybe FinishedWe were waiting for an abcde sideways move inside the larger B wave.

It looks like either the e wave ended short, or we could have just had an abc inside the B wave, which would mean this could be the next impulsive move up.

We could go long and set our stop loss to $2.30. If price can hold above 2.33, technically this is looking bullish now.

Reverse Head&Shoulders finishing?!I've been watching this for the last few months and I feel very optimistic about AKS. Once the new year comes around, their contract prices are set to update, and I think this could drive us through the shoulder line. I've only been trading for a couple years though, and would love some 2nd opinions. I realize that once you think you see something, sometimes it's difficult to dissuade yourself, so thank you.