Bitcoin Dives once again!!SELF DEVELOPMENT/METHODOLOGY/PSYCHOLOGY

Bitcoin Dives once again !!

BITFINEX:BTCUSD continues on a further south direction. If it breaks the @4500 level and will see a further push towards the @3000 level. From my experience stay on the sidelines or short sell.

Follow your Trading plan, remained disciplined and keep learning !!

Please Follow, Like,Comment & Follow

Thank you for your support :)

This information is not a recommendation to buy or sell. It is to be used for educational purposes only!

Update idea

Algorithm

Beating Bitcoin buy and hold: 2600%* Active strategy vs. passive buy-and-hold (light blue line in backtest plot below).

* Includes Bitfinex fees (0.1%).

* Backtest plot is from 2017-01-03 until today.

* It is possible to reduce the drawdown by adjusting position size strategy and/or other parameters -- to get a smoother equity curve.

* No indicator or entry "repainting" is being done here; this is a common problem with some strategies here on TV.

* Send me a message if you're interested in development of automated trading of this and/or other strategies!

Works on other assets too!

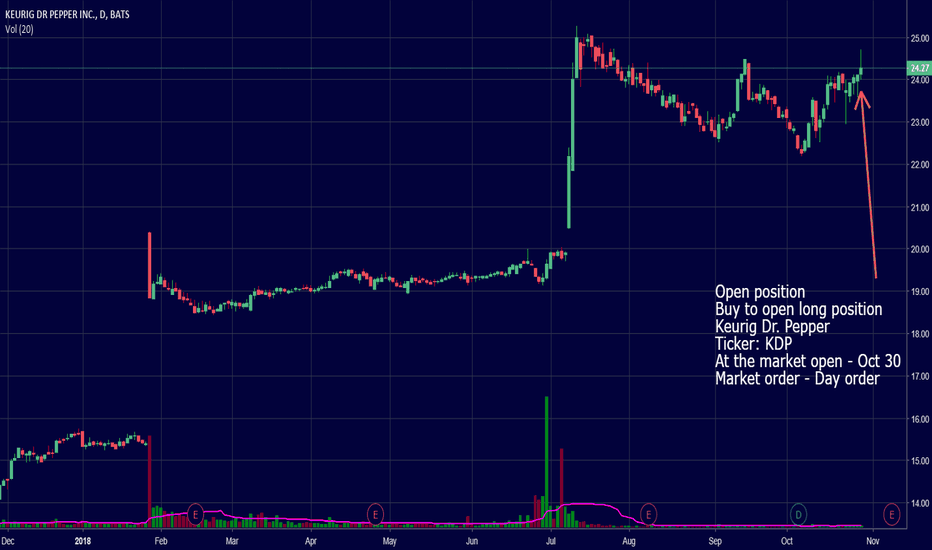

Signal from the equity algorithm for the market open Oct 30The equity trading algorithm opens a long position in KDP - Keurig Dr. Pepper stock.

BTC algo confluence, Elliot wave clarity to comeHere are the confluent algo zones, pattern targets and fib support. We can see 3 major clusters of likely support from the profits that algos take from their shorts, combined with the targets of the thrust from the potential elliot wave triangle(Needs to break the low to confirm) and the .786 fib retrace from the major wave structure and the next high volume node. If the triangle is confirmed here we would expect to complete this correction in one of two probable ways, 1) An impulse, looking for 5 waves, we would likely be working on the 1 wave of that sequence now, or 2) an ABC zig zag correction and we would be working on either the 1 of the A or the A itself. Elliot will have to be updated as we go, and will ultimately decide how we can get to some of those lower targets.

How could you have avoided the drop in the stock market?For many conspiracy theorists familiar with the cover of an edition of The Economist from 1988, the 10/10/2018 is significant for being the date when a new world currency will be ushered in. It seems instead the date that traditional stock markets come tumbling down, with DJI down 1,300 points over the past two days and many other stocks following suit.

China's 100-basis-point cut to their reserve requirement ratio is likely to inject about 109B$ into their economy and could devaluate their currency, thereby allowing China to make goods and services cheaper compared to the US. This could be a sign of China struggling against the US's aggressive trade policies. Any rattling of their economic growth is likely to effect markets globally, as it's the largest developing economy at the moment.

Not only this, but the Fed's decision to raise interest rates means that the rate of borrowing goes up which dips into the bottom line of companies that need to borrow to finance growth.

Higher rates restrict economic growth. This has made investors wary of markets at the moment and could be seen as reasons for the decline in the market. Saying that, it's too early to know whether or not we're officially in a downturn.

Anticipating, and acting, on this news is difficult and risky. It's hard to beat markets with this tactic. The big moves always happen after the fact, but the smaller movements in the markets beforehand create ripples and divergences that can be spotted quite easily with algorithms. -=Simplicity=- God Complex is one of those algorithms that anticipates big movements as opposed to reacting to them.

The chart above details the last 10 months of price-action against the DJI and if we assume an initial 10k trading position and compound the returns, then these are the results. These trades are without leverage too.

1st trade: +9.3% / 10930$

2nd trade: +5.73% / 11556$

3rd trade: -0.46% / 11503$

4th trade: +0.46% / 11555$

5th trade: breakeven / 11555$

6th trade: -1.22% / 11416$

7th trade: -1.01% / 11302$

8th trade: -0.88% / 11203$

9th trade: +1.23% / 11341$

10th trade: +0.65% / 11415$

11th trade: -0.24% / 11388$

12th trade: -0.9% / 11286$

13th trade: +1.54% / 11460$

14th trade: -0.94% / 11353$

15th trade: +1.18% / 11487$

16th trade: -0.44% / 11437$

17th trade: +1.83% / 11646$

18th trade: +4% / 12112$

That's a return of 21.12% with the biggest loss being recorded at -1.22%. If you had of bought and held, you would have made about 5%.

Don't react to news. Act before it.

---------------------------------------------------------------------------------

docs.google.com

Megalodon Trading - BTC - Long Term Bull - Short Term BearMegalodon Pro+ Short Term Isolators look like short term pull down.

--------------------------------------

Swing and day traders —> Look for 1D confirmation(green rectangle close) on Megalodon Pro+ Long Term Isolator. —> Look for 240 min & 60 min confirmation(green rectangle close) on Megalodon Pro+ Short Term Isolator.

1) Take the next red confirmation on the hourly if you believe the market state is bear.

2) Wait for daily confirmations(red rectangles) if you think market is more uppy.

Learn more about it on our website. Go to our TradingView profile for how to gain access.

--------------------------------------

MEGALODON PRO+ Long Term Isolator

Megalodon Pro+ is designed for longer term and shorter term investors.

Megalodon Pro+ is really simple to use.

Megalodon Pro+ combines 16 different back-tested indicators, that each have more than 66% win rate.

Megalodon Pro+ lets you turn on or off any setups that has been used for a better analysis.

Megalodon Pro+ works with any kind of market state, and any kind of asset.

Megalodon Pro+ can be used to set alarms as soon as a candle closes with a green or red bar.

Megalodon Pro+ has more features than any other indicator in the market, these features can also be turned off in the settings:

Looks for 12 different investing setups automatically and prints them out.

Shows 2 different viewing options: Setups View that shows how many bear or bull setups are currently formed, Isolator View that shows Megalodon Price, Volume and Momentum isolators.

Prints green or red bars for longer term signals.

--------------------------------------

MEGALODON PRO+ Long Term Isolator is designed for longer term and shorter term investors!

All you have to do is:

1- Apply it on any asset with 1Day time frame and combine it with 240minutes and 60 minutes Megalodon Pro+ Short Term Isolator.

2- Look for green bar confirmation on all isolators.

3- Define your stop losses.

4- Define your target before you enter.

5-Repeat

--------------------------------------

~Megalodon Trading~

Enlighten others

Megalodon Trading - Litecoin Short Term Pull Down Waiting to pull the long term trigger for litecoin. Waiting on the green rectangles on Megalodon Pro+ Short Term Isolator.

--------------------------------------

Swing and day traders —> Look for 1D confirmation(green rectangle close) on Megalodon Pro+ Long Term Isolator. —> Look for 240 min & 60 min confirmation(green rectangle close) on Megalodon Pro+ Short Term Isolator.

1) Take the next red confirmation on the hourly if you believe the market state is bear.

2) Wait for daily confirmations(red rectangles) if you think market is more uppy.

Learn more about it on our website. Go to our TradingView profile for how to gain access.

--------------------------------------

MEGALODON PRO+ Long Term Isolator

Megalodon Pro+ is designed for longer term and shorter term investors.

Megalodon Pro+ is really simple to use.

Megalodon Pro+ combines 16 different back-tested indicators, that each have more than 66% win rate.

Megalodon Pro+ lets you turn on or off any setups that has been used for a better analysis.

Megalodon Pro+ works with any kind of market state, and any kind of asset.

Megalodon Pro+ can be used to set alarms as soon as a candle closes with a green or red bar.

Megalodon Pro+ has more features than any other indicator in the market, these features can also be turned off in the settings:

Looks for 12 different investing setups automatically and prints them out.

Shows 2 different viewing options: Setups View that shows how many bear or bull setups are currently formed, Isolator View that shows Megalodon Price, Volume and Momentum isolators.

Prints green or red bars for longer term signals.

--------------------------------------

MEGALODON PRO+ Long Term Isolator is designed for longer term and shorter term investors!

All you have to do is:

1- Apply it on any asset with 1Day time frame and combine it with 240minutes and 60 minutes Megalodon Pro+ Short Term Isolator.

2- Look for green bar confirmation on all isolators.

3- Define your stop losses.

4- Define your target before you enter.

5-Repeat

--------------------------------------

UncleBoMadeIt

Enlighten others

>>100% Algorithm Based Trading<< - LONGCall: LONG BTC 0.66% @ $6,723

Hello from Crypto Bots Hub! Bringing you another call from out automated trading strategy, this one looks juicy. There are tons of benefits to using automated algorithms to trade Bitcoin 0.66% , removing emotion and sticking to a pre-determined strategy that has been backtested through both BULL and BEAR markets create straight profits. Algorithms are perfect for the traders who want to take a hands-off approach to their trading and not have to worry about sitting in front of the charts all day.

This bear market since January has been tough on us all...to give back to the community we're starting to post signals from our algorithm here for use for the next 60 days. We hope these ideas can help you earn some of that BTC 0.66% back into your accounts!

This algorithm is what we use to choose our own Long/Shorts on our individual accounts, where we've seen an approximate 60% return over the last 3 months (see spreadsheet below for previous calls.)

You can check out the previous bot trades here: docs.google.com

We will be posting the Long and Short signals generated by this bot for the next 60 days. Be sure to follow to be updated with future signals. A new Idea will be posted when this trade is closed.

Cheers!