Alibaba - This chart is pretty bullish!🎁Alibaba ( NYSE:BABA ) will head much higher:

🔎Analysis summary:

After we saw the perfect creation of the rounding bottom on Alibaba, the trend finally shifted back to bullish. Especially with the recent bullish break and retest, Alibaba is now preparing for another major move higher. All we need now is simple bullish confirmation.

📝Levels to watch:

$140

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

Alibabalong

Alibaba - A remarkable reversal!🛒Alibaba ( NYSE:BABA ) reversed exactly here:

🔎Analysis summary:

Recently Alibaba has perfectly been respecting market structure. With the current bullish break and retest playing out, there is a very high chance that Alibaba will rally at least another +20%. But all of this chart behaviour just looks like we will witness a major bottom formation soon.

📝Levels to watch:

$110, $135

🙏🏻#LONGTERMVISION

Philip - Swing Trader

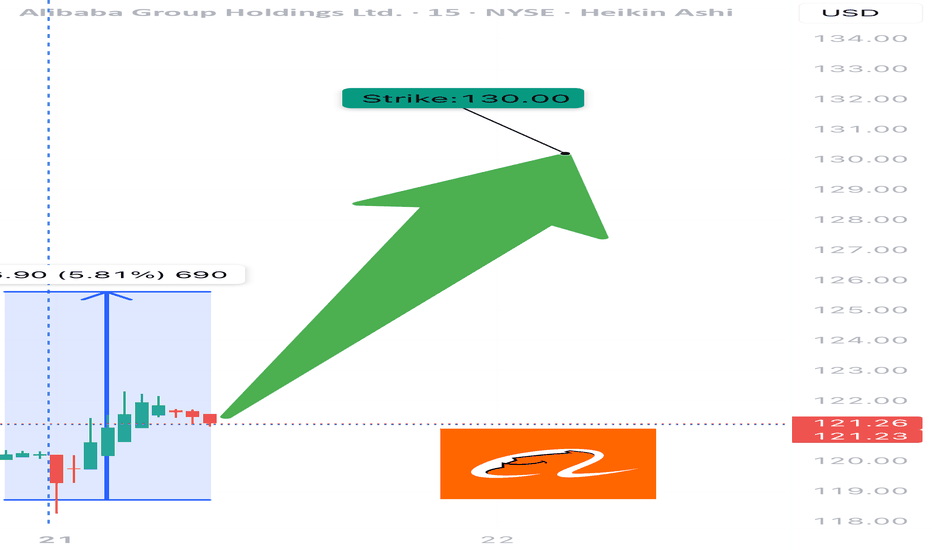

BABA WEEKLY TRADE IDEA – JULY 21, 2025

🐉 NYSE:BABA WEEKLY TRADE IDEA – JULY 21, 2025 🐉

📈 Strong RSI. Institutional Accumulation. Gamma-juiced upside.

Momentum is building — timing is key.

⸻

📊 Trade Setup

🔹 Type: Long Call

🎯 Strike: $130.00

📆 Expiry: July 25, 2025 (4 DTE)

💰 Entry Price: $0.52

🎯 Profit Target: $0.74 (📈 +42%)

🛑 Stop Loss: $0.30 (~40% Risk)

📈 Confidence: 70%

🕰️ Timing: Enter at Monday Open

📦 Size: 1 Contract (or scale accordingly)

⸻

🔍 Why This Trade?

✅ Daily RSI = 68.3 → Bullish momentum building

✅ Volume = 1.3x week-over-week → Institutional buying confirmed

📊 Neutral Call/Put Flow → Sentiment not overheated = better entry

🧠 Multiple models agree on MODERATE BULLISH bias

🌬️ VIX stable = ideal for controlled option premium entries

💎 Gamma risk manageable, but monitor price spikes at resistance near $130–132

⸻

⚠️ Risk Management Notes

🔸 RSI near breakout zone → monitor for fakeouts

⏳ Only 4 days to expiry → time decay risk accelerates

📉 Watch for rejection near key levels ($130.50–132.00)

🛑 Respect the stop: If momentum stalls early, exit fast

⸻

📌 Execution Strategy

🔹 Enter clean, single-leg naked call

🔹 Exit partial at 30% profit, full by Thursday unless breakout is strong

🔹 Avoid spreads: delta exposure preferred for upside spike capture

⸻

🏁 Verdict:

All models point to upside, but not full conviction.

This is a momentum + positioning trade, not a breakout gamble.

NYSE:BABA 130C – Risk $0.30 to Target $0.74 📈

Tight structure. Moderate aggression. Execute with precision.

⸻

#BABA #OptionsTrading #CallOption #WeeklyTrade #MomentumPlay #UnusualOptionsActivity #TradingViewIdeas #GammaFlow #FlowBasedSetup #Alibaba

Alibaba | BABA | Long at $108.84Like Amazon, I suspect AI and robotics will enhance Alibaba's NYSE:BABA e-commerce, logistics, and cloud computing operations. There is some risk here, like other Chinese stocks, that they could be delisted from the US market if trade/war tensions rise. But I just don't think that is likely (no matter the threats) due to the importance of worldwide trade and investment. I could be way wrong, though...

NYSE:BABA has a current P/E of 14.2x and a forward P/E of 2x, which indicates strong earnings growth ahead. The company is very healthy, with a debt-to-equity of 0.2x, Altmans Z Score of 3.3, and a Quick Ratio of 1.5. If this were a US stock, investors would have piled in long ago at the current price.

From a technical analysis perspective, the historical simple moving average (SMA) band has started to reverse trend (now upward), indicating a high potential for continued (overall) price movement up. It is possible, however, that the price may reenter the SMA band in the near-term - the $80s aren't out of the question - as tariff threats arise. But that area is another personal entry zone if fundamentals hold.

Thus, while it could be a bumpy ride and the risk is there for delisting, NYSE:BABA is in a personal buy zone at $108.84 (with known risk of drop to the $80s in the near-term).

Targets into 2028:

$125.00 (+14.8%)

$160.00 (+47.0%)

Alibaba (BABA) Technical Analysis:Retracement Within an Ascending Channel

Alibaba (BABA) has faced strong supply pressure at $149, a key price level that previously acted as support in 2019 and has now flipped into resistance. The inability to reclaim this level has triggered a retracement, with the stock currently trading around $132, showing signs of continued corrective movement.

Despite the short-term weakness, BABA remains within a developing ascending channel, suggesting a potential higher timeframe bullish structure. If the retracement extends, the next significant level to watch is $110, a historical 2016 resistance level that could now act as a demand zone. A strong reaction and rejection from this level would reinforce the validity of the ascending channel and increase the probability of a trend continuation toward previous all-time highs.

Key Levels to Watch:

Resistance: $149 (2019 support turned resistance)

Current Price: $132 (active retracement zone)

Support Levels:

$110 – Historical resistance from 2016, potential demand zone

$100 – Psychological level, further downside risk

Traders should monitor price action around these key levels, as a confirmed breakdown below $110 could invalidate the channel and shift market structure to a more bearish outlook, while a strong bounce could provide a high-probability long setup within the channel’s framework.

BABA in a falling wedge (NEW)BABA stock has been in a long-term downtrend.

We're expecting the price to continue droping as it looks like it got rejected from the downsloping resistance line on the weekly timeframe.

What we can see on the chart is a pattern called a falling wedge.

Most likely the price will revisit $60 or lower but eventually we expect the breakout in Q2 or Q3 2023.

How to trade:

Enter long position if/when we get a breakout with a volume increase.

Final target and the take profit level are shown on the chart.

Good luck

I'm GAGA for BABA!NYSE:BABA

🎯134🎯150🎯171

Five weeks of green candles for over 55%!

Road this one higher from the beginning and fully exited. Now that we are pretty extended and broke out of the Inverse H&S Pattern I'd like to see a pullback to retest the breakout at $115-118 for an entry back in.

- Green H5

- Volume GAP

- Wr% Up trending

- Inverse H&S breakout

- China has momentum (look for tariff news or earnings this week to provide a dip buying opp.)

Not financial advice

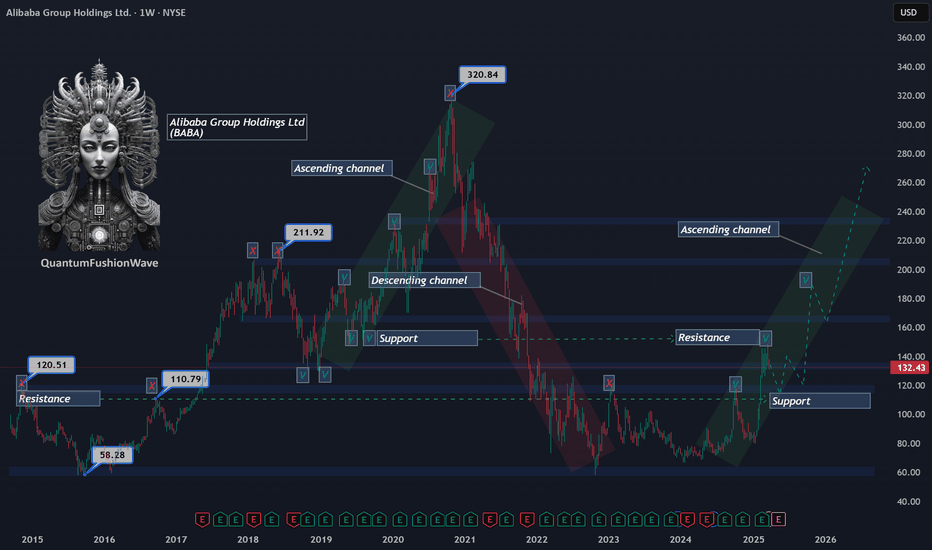

Alibaba - with Eyes on $200–$230 by end of 2025Alibaba (BABA): Entering a Bullish Phase

Alibaba (BABA) has officially entered a bullish phase after successfully holding the $80 support level at the beginning of 2024. This strong rejection set the stage for a rally to $127, confirming the start of an uptrend.

Key Resistance Battle: Breaking $130 with Ease?

The next critical price level to watch is $130, last seen in November 2018.

If Alibaba breaks through $130 without effort, this will confirm strong bullish momentum, allowing the stock to continue climbing.

However, if BABA initially fails to break $130, it could trigger a pullback to $108, offering a new entry opportunity before the next leg up.

Long-Term Target: $200–$230 by Late 2025

Phase 1: If Alibaba retests $108 and successfully holds, it will make another attempt to break $130.

Phase 2: Once $130 is broken, BABA will gradually climb to $200 by the end of 2025, following a steady growth pattern without rapid acceleration.

Bullish Catalyst Scenario: If news flow remains favorable, Alibaba could push even higher, targeting $230 by the end of 2025.

Key Price Levels to Watch:

Support: $108 (potential pullback zone if $130 is rejected).

Resistance 1: $130 (major breakout level).

Resistance 2: $200 (main target by year-end 2025).

Bullish Extension: $230 (if market sentiment remains strong).

Summary: Strong Bullish Structure with Potential Upside

Alibaba’s price action suggests a clear uptrend, with $130 being the next major battle zone. If it breaks with ease, expect a smooth climb toward $200 by 2025. If it faces rejection, a pullback to $108 will offer a new buying opportunity before resuming the uptrend.

Should favorable news emerge, Alibaba could even hit $230 by the end of 2025, reinforcing its long-term bullish outlook.

Alibaba - It Is So Predictable!Alibaba ( NYSE:BABA ) just rejected a major resistance:

Click chart above to see the detailed analysis👆🏻

A couple of days ago Alibaba stock perfectly retested a major previous resistance level after rallying +45% just within a couple of weeks. We can first see more bearish movement and maybe even a retest of the trendline breakout level before Alibaba will continue its overall uptrend.

Levels to watch: $80, $110

Keep your long term vision,

Philip (BasicTrading)

ALIBABA Ready to Explode! Big Gains on the Horizon!Alibaba (BABA) Technical Analysis - 15-Minute Timeframe - Long Position Setup

Entry Price: $99.13

Stop Loss (SL): $97.32

Target Levels:

TP1: $101.36

TP2: $104.96

TP3: $108.57

TP4: $110.80

Market Context and Sentiment: Recent developments indicate strong institutional interest in Alibaba, as evidenced by prominent fund manager Zhang Kun making Alibaba a substantial holding in his portfolio. This investment has bolstered positive sentiment around Alibaba, further supported by strategic economic measures favoring leading tech stocks in China.

Technical Indicators:

Trend Direction: Positive momentum is observed with price action above the Risological Dotted Trendline, signaling a bullish bias.

Volume: Current volume at 16.04M aligns with the recent positive market sentiment, with average 30-day volume standing at 26.70M. This moderate volume increase reinforces the long setup validity.

Analysis and Outlook: This setup presents a well-defined long entry with clear stop loss and target levels. The bullish institutional interest provides a strong fundamental tailwind, which could drive price action towards initial and extended targets. Should the price break through TP1 at $101.36 with sustained volume, a continuation towards TP2 at $104.96 becomes likely, with potential progression to TP3 and TP4.

Conclusion: Alibaba's current price action and market sentiment create a favorable environment for a long position. Close monitoring is advised, particularly as price approaches each target, with adjustments as necessary to secure gains.

Alibaba - Finally The Trendline Breakout!Alibaba ( NYSE:BABA ) finally broke above the bearish trendline:

Click chart above to see the detailed analysis👆🏻

Alibaba is breaking out and the breakout is not unexpected whatsoever. For a long time, Alibaba has been hugging the resistance trendline and finally managed to fulfil its destiny. This could very well be the bottom of the bear market and the start of something big: new all time highs.

Levels to watch: $115, $80

Keep your long term vision,

Philip (BasicTrading)

Alibaba Stock Spike After Stimulus and Nvidia PartnershipAlibaba (NYSE: NYSE:BABA ) saw its American depositary receipts surge by 5% in premarket trading on Tuesday following significant news of China’s central bank stimulus and a strategic partnership with Nvidia, pushing optimism for the e-commerce giant's growth prospects. The People's Bank of China (PBoC) slashed key interest rates and injected liquidity into the banking system, providing a broad boost to Chinese stocks, with Alibaba at the forefront.

The whole story

Alibaba (NYSE: NYSE:BABA ) has positioned itself as a global leader, especially with its recent strides in AI and cloud computing. The company’s partnership with Nvidia to enhance AI capabilities for Chinese EV makers like Li Auto, Great Wall Motor, and ZEEKR highlights its ambitions to dominate the rapidly evolving autonomous driving space. This partnership is seen as particularly strategic given U.S. sanctions that limit China’s access to advanced semiconductor chips. By integrating its large language models (LLMs) with Nvidia’s Drive AGX Orin platform, Alibaba seeks to power next-generation in-car AI technologies.

In addition, Alibaba’s continued AI expansion is bolstered by its release of over 100 open-source AI models. These tools democratize access to advanced AI technologies, benefiting small- to medium-sized businesses (SMBs) and helping them compete more effectively in the digital commerce space. Alibaba’s focus on AI not only positions it well in the global tech landscape but also diversifies its revenue streams beyond e-commerce.

Moreover, Alibaba’s strong shareholder yield is further evidenced by its aggressive stock buyback program. In a recent filing, Alibaba revealed that it had repurchased $275 million worth of stock in just one week, signaling management’s confidence in the company’s long-term value. A discounted cash flow (DCF) model indicates Alibaba is currently undervalued by nearly 40%, suggesting potential annual returns exceeding 15%, making it an attractive long-term investment.

Technical Analysis Outlook

From a technical standpoint, Alibaba’s stock is showcasing a classic bullish cup and handle pattern on the daily charts, indicating a possible continuation of the upward trend. The recent 5% surge in premarket trading further emphasizes this pattern, particularly as the handle formation has completed, setting the stage for a potential breakout.

The Relative Strength Index (RSI) currently sits at 69, approaching the overbought region. While this could suggest a short-term cooling-off period, it also reinforces the strength of the current upward momentum. With Alibaba trading above all its major moving averages, the bullish momentum looks well-supported.

Additionally, as China’s economy receives stimulus support ahead of its National Day Holiday, investor sentiment remains positive. The People's Bank of China’s rate cuts aim to revive domestic growth, and Alibaba stands to benefit as one of China’s leading tech giants.

Conclusion:

Alibaba’s solid fundamentals, strategic partnerships, and promising technical indicators make it an attractive stock to watch. The confluence of bullish signals—strong buybacks, AI expansion, and macroeconomic tailwinds—suggests the potential for significant upside. Investors should keep an eye on the cup and handle breakout, as a move above resistance could trigger further gains, especially with the stock trading above key moving averages. With growing confidence in China’s economic stimulus measures and Alibaba’s strategic moves in the AI and EV space, the stock is well-positioned for continued growth.

Key Levels to Watch:

- Resistance: $100

- RSI: 69 (approaching overbought territory)

- Cup & Handle breakout confirmation level: Above $100

Alibaba’s forward-looking strategies and market sentiment hint at a prosperous run, making it a must-watch stock in the coming days.

Alibaba - The Bleeding Is OverNYSE:BABA dropped roughly -75% after it broke the long term trendline towards the downside back in 2021 before it found some strong support at a previous horizontal support level.

Click chart above to see detailed analysis 👆🏻

Bulls are still not giving up on Alibaba and after the strong retest and reversal of the all time low back in 2022, Alibaba managed to consolidate and stop the agressive downtrend. If Alibaba actually manages to break back above the confluence of resistance, this stock is actually back to a bullish market and we could see the beginning of a new uptrend and maybe even new all time highs.

Levels to watch: $81

Keep your long term vision,

Philip - BasicTrading

$BABA | Allocation & Watchlist | Market Exec & Buy Stops |Technical Confluences:

- Price action has been consolidating between a Wedge pattern

- Price action is at a Demand Zone of all-time lows

- Price is starting to slowly break above the 200MA

- A break above the resistance trendline (been a good support/resistance TL) would be a significant move.

Fundamental Confluences:

- Considerably cheap valuations

- Still one of the largest e-commerce players, don't see it dropping it off anytime soon

- China's economy has been weakening and we are seeing efforts by the China government to help boost back the domestic economy. Potential for revenue boost.

________________________________

Putting in my first tranche of NYSE:BABA allocation for my Long-Term portfolio.

Gonna be holding this share for years and will continue adding position with Buy Stop orders.

Remember, DYOR.

________________________________

Boosts 🚀, Follows ✌️, Shares 🙌 & Comments ✍️ are much appreciated!

If you have any ideas or charts, do share them in the 'Comments' section below and we can discuss our perspectives to improve or strengthen our strategies.

If you want something analyzed, do drop me a DM. :D

________________________________

Disclaimer: The above suggestion is an personal opinion in general and does not constitute as investment advice. Any decisions taken based on the above suggestion is purely your own risks. DYOR.

Alibaba - Back to bearish (not)?Hello Traders and Investors, today I will take a look at Alibaba .

--------

Explanation of my video analysis:

After Alibaba broke below the major support trendline in 2021 we saw a massive correction of -75% towards the downside. Alibaba was then retesting another major level, this time a previous support area which is at $60. So far Alibaba stock is still respecting the bearish trendline, but it is just a matter of time until we will see a bullish trading opportunity on this stock.

--------

Keep your long term vision,

Philip (BasicTrading)

Alibaba Long Term Analysis. 1st Target 134, 2nd Target 308This is my Long Term Analysis _ "Alibaba".

Downtrend is Breakout in monthly time frame and retested. So, from now on, the market will move to a Bullish Trend. And 1st Target is 0.5 Fibonacci Retracement (134), 2nd Target is (308).

I want to help people to Make Profit all over the "World".

PDD Stock Jumps 6% Following Strong Q1 Earnings For Temu NASDAQ:PDD stock surged 6% on Thursday, following strong Q1 earnings for Temu parent company PDD Holdings ( NASDAQ:PDD ). Sales jumped 131% year-over-year for the March-ending quarter. On the stock market today, U.S.-listed NASDAQ:PDD stock is up 6% at 156.14 in higher than usual volume. NASDAQ:PDD Holdings includes China-focused e-commerce platform Pinduoduo and international discount retail platform Temu. Shares of NASDAQ:PDD surged nearly 80% in 2023, as Temu expanded rapidly in the U.S. and elsewhere.

Both Alibaba (BABA) and JD.com (JD) posted better-than-expected sales for their March quarters last week. The tech giants are PDD's main competitors in China. Analysts were mostly positive on PDD's Q1 results. Morningstar analyst Chelsey Tam upped the research firm's fair value estimate for PDD stock to by 8% to 230.

PDD Holdings beat first-quarter revenue estimates on Wednesday, powered by its international shopping site Temu and growing consumer interest in its Chinese discount e-commerce platform Pinduoduo. The company's revenue rose 131% to 86.81 billion yuan ($11.99 billion) in the first quarter, compared with analysts' average estimate of 75.66 billion yuan, based on LSEG data. PDD's shares were up 5.7% in pre-market trading.

Consumers in China have turned to less expensive shopping platforms such as Pinduoduo and Bytedance's Douyin at a time when a property sector downturn and rising local debt have weighed on the country's economic growth. NASDAQ:PDD 's co-CEO Chen Lei told analysts in a call following the company's earnings release that competition has been fierce in the first quarter, with consumers growing accustomed to making purchases from a variety of platforms, rather than defaulting to just one.

Technical Outlook

NASDAQ:PDD stock is up 6.14% as of the time of writing. NASDAQ:PDD stock appears to be overbought with a Relative Strength Index (RSI) of 76.78 which made it primed for a trend reversal. The stock's daily price chart depicts a double bottom that lasted for about 5 weeks before the uptrend.