Solana Price Analysis: Breaks to All-Time High Solana (SOL/USD) the 10th-largest cryptocurrency by market capitalization, with a total market cap of over $21 billion reached a new all-time high of $81.97. The rally is showing signs of a slow down after it rallied more than 120% since the beginning of the month.

Equal Waves Pattern

From a technical perspective, SOL/USD has rallied in a three wave pattern from the low of $1.27. According to the Elliott Wave theory, the magnitude of wave A should be equal to the magnitude of wave C.

To find the possible end of wave C, the Fibonacci extension tool can be used to project wave C which can be 100% Fib extension of wave A and B. In our case, the 100% Fibonacci extension comes in at $76.64, which is exactly near the levels were the rally has started to lose steam.

To the downside, possible support areas come in at the end of wave A of $58.92 followed by $41.0. On the flips side if the current rally wants to extend more, we have the 1.272 Fibonacci extensions at $92.33 and 1.618 Fibonacci extensions that come at $112.27.

ALL-TIME

PYPL looking to break all-time-highs?PYPL made a new all-time-high in February of 2021 and now it's looking to make new all-time-highs.

Fundamentally:

* Sales growth quarter over quarter is more than 30%

* Earnings-per-share expected to grow +5% over the next year

Technically:

* Beta score of over 1

* General up-trend

* In rage from year-to-date

* Found new support at $289.46

* Steady volume as it makes new support

Trade Idea:

* Look for buying opportunities near its new support of $289.46

* A break below that, $277.87 should hold as support since it's acting a pivot

OR

* Wait for a weekly close above $309.14 to confirm the break

FAST trying to make new all-time-highsFAST is trying to break through and close above its recent all-time-high of $54.31.

Good news is that it's holding its previous all-time-high of $51.89 as support.

With buying pressure slowing down it may come back down to retest the $52.50 to $53.10 area as support before making another attempt at breaking and closing above $54.31

Final thoughts

* Strong up trending stock

* Expected to have earnings-per-share growth over the coming year

* Great long term hold as it pays dividends

Trade Idea

* Look for buying opportunities around the $52.50 to $53.10 area

OR

* Wait for a confirm break and close above $54.30

Next bullrunPullback weekly after making all time high currently uptrending and weekly price rebound EMA30

BITCOIN MASSIVE BREAKOUT POTENTIAL OUT IF TRIANGLE for new atmBitcoin trying to break out if the triangle(counter trendline from all time high to bottom of channel. If it confirms and closes an hourly above look for an upside towards the top of the channel and a second target of the all time high. After that a target of 65k (triangle breakout target) and to complete the cup and handle breakout target at 73k which will be the cycles high most proburbly

APPLE - Falling From The Tree!Hello everyone, if you like the idea, do not forget to support with a like and follow.

APPLE rejected its all-time-high and now falling down, so we are currently in a down-trend.

on H1: APPLE is forming a symmetrical triangle (pennant) in red but the lower trendline is not valid yet (as it only connects two swing lows) so we will be waiting for a third swing low to form around it to consider it valid.

Trigger: Waiting for a momentum candle close below the gray area (the entire structure) to sell.

When the sell is activated, a downward movement would be expected equal to the previous impulse.

and until the sell is activated, this one would be overall bullish and can still break the upper red trendline and test the all-time-high again before falling.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Ripple Bomb Setup - Explosive Movement In The Making!As per my last video analysis (attached below) on Ripple, we were waiting for a third swing to form around our upper red trendline to consider it valid and then buy on its break upward.

Which is exactly what happened. Ripple formed a third swing around the red trendline so it is now valid, but it is not ready to buy yet.

we want to buyers to prove to us that they are taking over, by breaking above the upper gray area (around 0.25)

so trigger would be after a momentum candle close above the gray area.

but what is really interesting now, is that a RichBomb (orange dots) setup is formed now which adds more confluence to our buy setup in this case.

so if price breaks above the gray area, we can expect an explosive movement upward.

good luck!

NASDAQ Long-Term Possible ScenarioHello everyone, if you like the idea, do not forget to support with a like and follow.

on DAILY: NASDAQ is sitting around its all-time-high and 140.0 round number in blue so a reversal may be expected from here.

As you can see, this one formed an objective trendline in red and a valid RichBomb setup (orange dots)

The bearish movement would be confirmed after a momentum candle close below the gray area (the entire structure)

and until the sell is activated, this one would be overall bullish and can still break above the 140.0 round number to reach 150.0 before going down.

As price approaches our lower green support and round number 100.0, we will be looking for buy setups.

Good luck!

$BTC / USD 4H - Breakout & Retest to a Full send to new ATH$BTC / USD 4H - Breakout & Retest to a Full send to new ATH

Bitcoin ranging up in the $19Ks is bullish. Price (USD) has never held these levels for this long, showing strength in the region. I think we breakout of this triangle, retest the zone (chop) and then proceed to a new USD all time high. It may not be as easy as drawn on the chart in the green line - we may re-test lower in this range.

If you were trying to catch any dip before the ATH, levels around $18.2K and $17.2K are valid to bid. As long as the $15.5-16.5K level remains in tact on a macro scale, I tend to remain bullish.

For clarification:

- Dotted line is the previous daily close

- Support levels in green

- Resistance levels in red

- The pink line is a significant level - if price can close above the pink line, that is very bullish

Bitcoin is close to a decision point!Hello everyone,

Bitcoin has seen a fantastic rally over the last months. We've managed to reach all the way to the all-time highs.

There hasn't been any serious pullback yet.

I've found a bearish divergence on the daily timeframe in the RSi and a rising wedge pattern.

The target of the rising wedge is calculated by the height of the wedge, so around 16200.

If the rising wedge is to complete, we will see one more pump towards 20k and then a real pullback will start.

However, that being said, if bitcoin manages to clearly pump above 20200 and actually closes there, I think much higher prices are in play.

Thanks for reading my analysis,

Goodluck!

Spot Silver Weekly Chart: Very Long term BullishSpot Silver , current price $23.72. comparison with 2011 trend when at all time high and where we are heading in long terms , direction for long term is clear , we are in super bull market , wherein we should keep buying silver on any major retracment or I may say buy on dips to see we reaching first all time high of $49.81. and then probably seeing all time high of $55. the time horizon for this should be from here to next 3-5 years.The above study is for educational purposes and should not be considered as Financial Advice

GOLD PredictionOver the past days the price of gold has been consolidating in a triangle pattern. As well as between 1738.22 resistance zone and 1673.70 support zone. We are like to seen a break of the upper resistance and the triangle pattern, and gold is like to restest the 1738 zone before making all time highs until $1800.00. Let's see how it plays out.

Thanks for viewing.

Comment with your thoughts I'd like to hear them.

Disclaimer

the content on this analysis is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions.

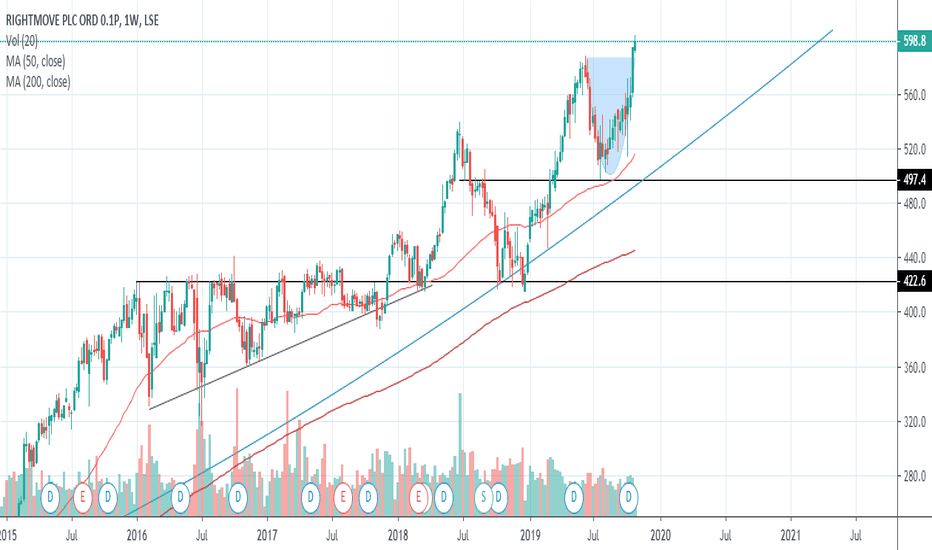

S&P 500 Finally Making New Highs!Last post: July 3rd 2019. See chart .

Review: Price had created new highs but could have moved back below support.

Update: Price has since continued to move even higher.

Conclusion: Price is making new all-time highs and we may see the start of the next bull trend. We will now look for long opportunities in stocks.

Any comments or questions, do not hesitate to leave them below. Give us the thumbs up if you share our sentiments!

Sublime Trading

Bitcoin: Correlation between NVT and the All-Time Mean Today I want to look at the bigger picture to put in context the recent Bitcoin move.

In the weekly chart, we see that the bias is bearish. The lows at 3100 fail to qualify as a THE BOTTOM by any sort of crypto standard:

a) Lack of volume

b) Lack of strong bounce

c) Lack of institutional blueprint

d) NVT still optimistic

Now, I want to look it from the perspective of the All-Time historical Mean for Bitcoin.

The bottom would be more credible if it coincides with a test of this line, as happened in 2015.

I'm plotting Bitstamp and BNC series, and we can see there a huge void between the current price location and the place where the All-Time Mean sits.

At Bitstamp, Bitcoin consolidated above the All-Time mean during 8 months before confirming the bull trend.

At the BraveNewCoin series (which is the longest one available in Tradingview), we see that the $150 spike bounced from the All-Time Mean.

Therefore, this is a legit line to be taken into consideration to prove the bottoming. Most of the assets have a natural tendency to revisit this line along high time frame cycles (unless they are heavily manipulated).

Additionally, the NVT is sitting at a similar range level (80-100) than did at 2015 before crashing below 50 and signal the low.

Will bitcoin test the All-Time Mean during this cycle? Well, we don't know that for sure but certainly the chances are there.

Bitcoin has been unable to fulfill any solid bottoming criteria and this one looks like could be the missing one that could trigger heavy volume and flash crash action.