SN - Potential ALL TIME HIGH ?SN - CURRENT PRICE : 115.50 - 116.10

SN is bullish as the price is making HIGHER HIGH and HIGHER LOW. On 01 August 2025 the stock made a down gap due to weak market sentiment. However, today 04 August 2025 the share price rises and move above the down gap zone. This scenario hints that the bulls are strong enough to overcome the selling pressure. As the major trend is up, trend follower traders may anticipate to buy the stock right now. Nearest target will be 122 (one dollar below the ALL TIME HIGH resistance). Then if it continues to break 123, next target will be 1.35.

ENTRY PRICE : 115.50 - 116.10

TARGET : 122 and 135

SUPPORT : 110

Alltimehigh

Crypto consolidating ahead of rally towards All Time HighsWith US equity markets closed for Juneteenth, I'm checking in on an equal weight basket of cryptos. Recently I said crypto looked to be heating up for a run at new highs.

As I look today, prices appear range bound on the daily chart. There's a bearish double-top formation, beside declining momentum. The bottom of the range resting at the 200 Day Moving Average, and a test of it seems likely.

Should there be a bounce off the 200 Day SMA, and a break through the top end of the range we might get a shot at those new All Time Highs.

This is why I firmly believe we'll witness BTC reach 150K soon.No caption needed and every reasons are kept in the chart. Zoom In and analyze every single lines in the chart and hope you will see what I tend to see as far as my capabilities allows me. Let me know your comments on the idea. I am looking forward to witness $150K in the next 3 to 4 months time. I will be updating my confluences to say this on higher timeframes too.

With Regards. And stay Tuned.

SWING IDEA - JUBILANT PHARMOVAJubilant Pharmova , a diversified pharmaceutical company focused on CRAMS and specialty pharma, is presenting a strong swing opportunity backed by a major pattern breakout and volume confirmation.

Reasons are listed below :

Breakout from an Inverted Head & Shoulders pattern after over a year of consolidation

Attempting breakout above 1250, a key resistance zone with multiple rejections in the past

Strong marubozu candle on the daily chart with a notable volume spike, signaling conviction

Trading near all-time highs, and comfortably above key EMAs, reinforcing trend strength

Target : 1480 // 1600

Stoploss : weekly close below 1090

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights

BTC - Bulls vs Bears: who will win?Market Context

Bitcoin is trading in a tight consolidation just below its all-time high after a strong impulsive rally. This phase represents a balance of power between buyers and sellers, with neither side able to take control yet. Such a pause in momentum at this key level often builds pressure for a breakout move as liquidity pools accumulate above and below the range.

Consolidation Phase

The current range is clearly defined by a resistance area at the top and a support area at the bottom. Price has been oscillating within these boundaries without any sustained breakout attempts. This range-bound behavior is an essential part of the market cycle, as it allows larger players to build or distribute positions. The longer price stays in this box, the more significant the breakout that follows tends to be.

Bullish Breakout Scenario

If price breaks out decisively above resistance, it would indicate buyers have absorbed all the supply at these levels. Such a breakout opens the path to a new all-time high and could potentially extend far beyond as trapped shorts are forced to cover. For traders, a retest of the breakout level on lower timeframes could provide a low-risk entry point for continuation to the upside.

Bearish Breakout Scenario

On the flip side, if support fails, the market will likely gravitate toward the unfilled Fair Value Gap left behind during the previous rally. This inefficiency becomes a natural draw for price, offering a logical downside target for a corrective move. A clean break below the range followed by a retest from underneath could present shorting opportunities for those aiming to capture that move into the FVG.

Final Words

Patience and precision are key when dealing with setups like this. Let the market come to your level — and react with intent.

If you found this breakdown helpful, a like is much appreciated! Let me know in the comments what you think or if you’re watching the same zones.

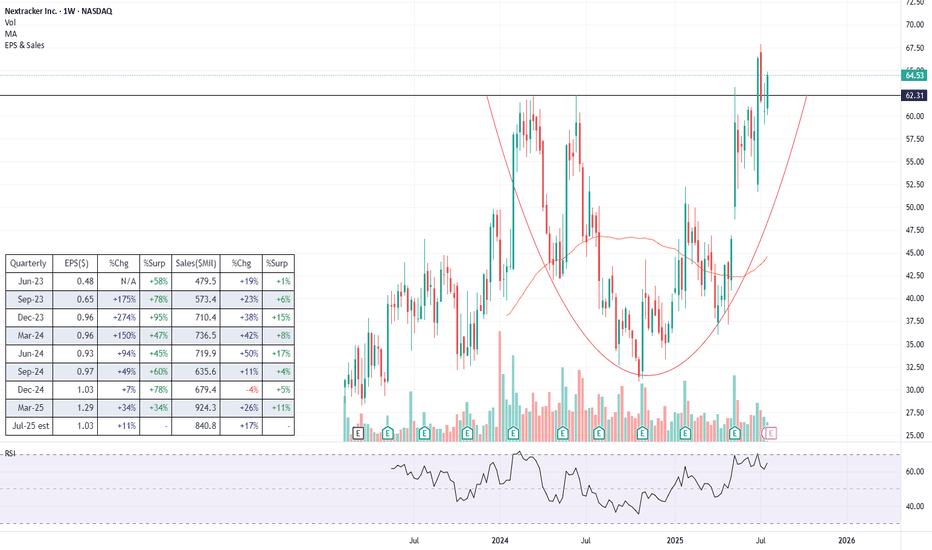

NXT (Long) - Clean energy player with even cleaner financialsLet's preamble with what the company actually does (as I imagine a lot of traders trade without even bothering... understandably). In short, Nextracker operates in the solar energy space where it is a leader in providing energy output optimization solutions, i.e. mechanical systems that rotate solar panels to follow the sun, along with software (TrueCapture) that uses sensors and machine learning to fine-tune positioning in real time.

Fundamentals

NASDAQ:NXT has been growing very strongly in recent years (see the table) despite the numerous hiccups this space has seen since 2022. There is also a backlog of $4.5bn , giving us clear visibility into the next year. Profitability is strong with earnings growth even outpacing revenue growth, showing strong operating leverage .

This all comes on the back of a relatively cheap valuation , with P/E of just below 18, which is significantly lower than some of its competitors like NYSE:NVT at 52, and NYSE:RRX at 43. No clear reason for why the markets are discounting the stock.

The balance sheet is rock solid , with no debt and $766m in cash. Moreover, free cash flow is plentiful with the firm most recently generating $622m in FCF.

Overall, the company is growing, has strong financials and is cheaply valued compared to its competitors - the kind of smoothie I usually look for. One obvious risk is policy , given that the current administration doesn't really see eye to eye with renewables and two thirds of NXT's revenue still comes from the US.

Technicals

Just breaking into an all-time high is a nice-to-have advantage when entering a new trade. The stock is breaking out from a decent, almost year-and-half long base , though I would prefer the base to be a tad more prolongated.

The stock broke the ATH on higher volume, pulled back to around the breakout point and is currently establishing the next leg higher

The price is some distance away from its moving averages, so there is a chance that there still might be some more consolidation around this level before we proceed higher

Trade

Main caveat is that the stock is about to release its earnings on Tuesday , so naturally it is a slight gamble to buy ahead of it. I decided to jump in beforehand just because I have strong conviction (and I love to punch the wall when I always get it wrong), but I would advise others to first wait on the results as a potential catalyst.

For gamblers like myself, the ATH breakout point likely serves as the best possible stoploss (black line).

One more reason why these earnings in particular could be even more of a gamble is that the BBB bill was passed since the last earnings, so if the executives decide to sprinkle the release with some not-so-positive comments regarding that, it could spook investors.

Follow me for more analysis & Feel free to ask any questions you have, I am happy to help

If you like my content, please leave a like, comment or a donation , it motivates me to keep producing ideas, thank you :)

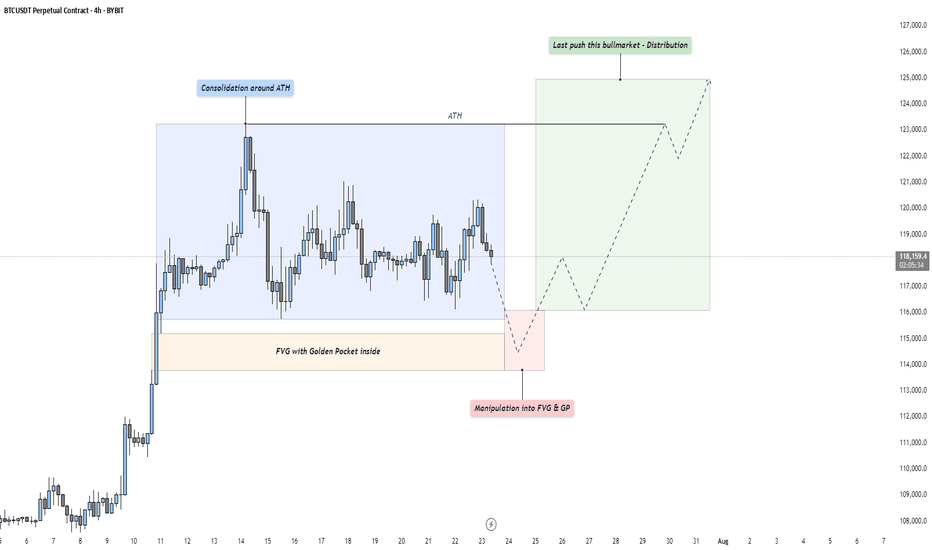

BTC - Last Push: Consolidation, Manipulation & DistributionMarket Context

After a strong upward impulse, Bitcoin has entered a mid-term consolidation phase just below its all-time high. This kind of price action is typical as the market digests recent gains and larger participants prepare for the next move. These pauses in momentum often precede either trend continuation or a reversal — and the structure here suggests we might be witnessing the former, but not without a final shakeout.

Phase 1: Consolidation Around the All-Time High

The first phase is defined by a tight range just beneath the all-time high, where price moves sideways in a balanced struggle between buyers and sellers. This is often where retail participants become overly bullish, anticipating a breakout. However, the lack of a sustained move higher indicates that smart money may be waiting for better entries — or preparing to engineer liquidity to fuel the next move.

Phase 2: Manipulation Into the Fair Value Gap and Golden Pocket

Directly below the range lies a clean Fair Value Gap, with a Golden Pocket retracement nestled inside it. This zone represents a strong area of interest. A sharp move into this area would likely sweep late long positions and trigger stop-losses from range traders — a classic manipulation pattern. This phase serves two purposes: collect liquidity and offer favorable pricing for larger players looking to position themselves before expansion. Watch for signs of absorption or reversal as price enters this zone.

Phase 3: Expansion – The Last Push of the Bull Market?

Following the liquidity sweep and reaction from the Fair Value Gap and Golden Pocket zone, we could see a renewed expansion toward higher highs. This is the phase where volume returns, sentiment shifts, and price accelerates. If this plays out, it could mark the final leg of this bull cycle — potentially driving Bitcoin to new all-time highs with strength.

Execution Thoughts

If you're looking to participate, it's wise to wait for a confirmation signal on a lower timeframe — like the 5-minute or 15-minute chart — once price enters the Fair Value Gap and Golden Pocket zone. Watch for a strong bullish reaction, break of structure, or shift in order flow to signal that buyers are stepping back in.

Final Thoughts

Let the market come to your level and don’t chase moves without context. These three phases — consolidation, manipulation, and expansion — are timeless patterns seen across all markets. Stay patient, stay objective, and react with clarity.

If this breakdown helped you see the setup more clearly, a like would mean a lot — and I’d love to hear your thoughts in the comments! Are you watching the same zone, or do you see something different?

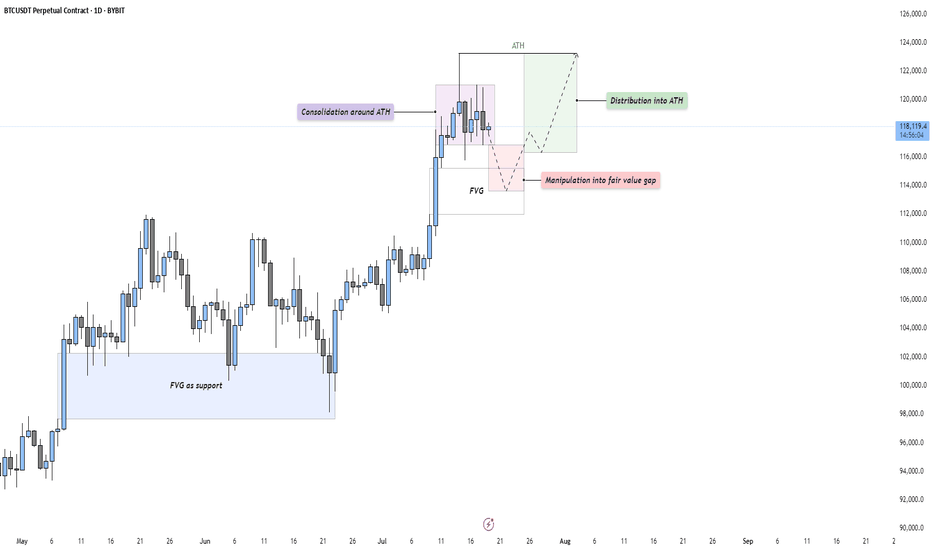

BTC - Consolidation, Manipulation & DistributionMarket Context

After a strong impulsive rally, Bitcoin is currently consolidating just beneath its All-Time High (ATH). This type of consolidation following an extended move higher often indicates indecision in the market — a pause that either leads to continuation or reversal. The current structure suggests that price is building energy for the next leg.

Consolidation and Liquidity Above ATH

The price action is tight and sideways around the ATH, which likely means liquidity is building above. Many stop-losses and breakout orders are sitting just overhead — classic conditions for a Buy Side Liquidity Sweep. This range may serve as a trap for early breakout traders, providing an opportunity for smart money to manipulate price lower before taking it higher.

Fair Value Gap Retest Scenario

Below the current range, we see a Daily Fair Value Gap that aligns with prior bullish imbalances. A move down into this Gap would represent a manipulation phase — shaking out weak longs before rebounding. The Gap also acts as a potential support level where buyers might be waiting. If price reaches into this zone and reacts strongly, it may offer a high-probability long setup.

Distribution or Reaccumulation?

While this could be interpreted as distribution beneath resistance, it’s equally valid to consider it a reaccumulation phase — a temporary markdown into demand before a fresh expansion. If the market dips into the Gap and quickly reclaims the range, it opens the door for a clean breakout above the ATH and continuation toward the 124,000–126,000 region.

Final Thoughts

Price rarely moves in a straight line. It pauses, retraces, and often tricks participants before making the real move. This type of consolidation presents opportunity — but also demands patience and clarity.

If you found this breakdown insightful, a like would be much appreciated! And I’d love to hear your thoughts in the comments — are we about to sweep down into demand, or is the rocket already on the launchpad?

ETH - Confirmed target is 4100- After successfully breakout from the major resistance price is heading towards the next resistance line.

- From the previous all time high, we have a clear resistance around 4100 range.

- We can expect this bullish trend to continue easily and reach the next resistance around 4100.

Stay tuned for more updates

Cheers

GreenCrypto

BTC - Falling Correction = Continuation?BTC has been playing by the rules lately!

Every time Bitcoin forms a falling correction, it turns out to be a bullish continuation pattern — and history might be repeating itself 👀

As shown on the chart:

Previous falling channels (flag/wedge structures) have consistently led to strong bullish impulses.

The current correction also appears to be a falling channel, hinting at another potential bullish leg soon.

As long as the structure holds and no major support is broken, the next target could be a new all-time high.

Let’s see if BTC continues to respect this textbook behavior.

📌 Remember: Falling corrections in an uptrend = healthy continuation!

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Bitcoin Sets New All-Time High – The Bull Run Is OnBitcoin has just printed a new all-time high, breaking decisively above its previous record and entering price discovery. After months of consolidation below resistance, the breakout above ~$118K confirms a major shift in market structure — from sideways to breakout phase.

This level isn’t just a number — it’s a psychological turning point. ATH breakouts often fuel aggressive momentum, FOMO, and trend acceleration, especially with no historical resistance above. All eyes now shift to round levels like $125K and $135K.

📈 New ATH: $118,923

📊 Previous Resistance: $109K → Now Support

🧠 This is what breakout structure looks like on a macro scale.

#BTC #BitcoinATH #AllTimeHigh #PriceDiscovery #CryptoMomentum #BTCUSD #TradingView

QUICK TRADE - GOING LONG IN BTCUSDCOINBASE:BTCUSD QUICK TRADE - GOING LONG IN BTCUSD📈

Yesterday bitcoin unexpectedly hit the all-time high 112,000.00 level. Since after that the asset has been shaping the pennant chart pattern, which may be just a consolidation before next bullish impulse. In this case I consider openning

🔼 a buy stop order at 111458.95 with

💰a take profit at 113984.10 and

❌a stop loss at 110591.05

If this happens and we break the resistance level of 112,000.00, we may expect the bullish impulse climb towards 114,000.00 level (my take profit in this case is just below it). Let's see.

Bitcoin Breaks Out — Major Momentum ShiftBTC/USDT has officially broken out of the descending channel it was consolidating in for over a month. The breakout was strong, clearing the horizontal resistance at $111,862, flipping it into support.

Chart Structure:

Descending channel broken to the upside

Horizontal resistance is flipped to support

Volume confirmed breakout momentum

Key Levels:

Support: $111,862 → Newly flipped support

Resistance Zones Ahead:

$116,818

$122,342

Upside Targets:

Immediate: $116,818

Extended: $122,342

Caution: Avoid FOMO. Wait for a retest near $111,800–$112,200 to confirm breakout strength.

Bias: Bullish

Timeframe: 4H

Wait for confirmation before fresh entries.

DYOR | Not financial advice

#BTC #Bitcoin

Crypto at All Time Highs! But...Last month I shared a chart of an equal-weight crypto basket suggesting crypto may be on the cusp of fresh All Time Highs -- those highs have arrived! While that is certainly exciting for crypto holders one should take note of other aspects of the rally.

The US Dollar has depreciated substantially against foreign currencies this year (2025)

Bitcoin has yet to reach a fresh high against Gold

Bitcoin is strongly correlated to US equities, which are also at all time highs

USD Decline

The US Dollar is down a whopping 10% against a basket of foreign currencies this year, lead ostensibly by President Trump's raucous political policies, most notably aggressive tariffs across the globe and industries. The crypto rally therefore could be characterized as more of a Dollar softening than a crypto strengthening.

Bitcoin v Gold

Bitcoin - still the epicenter of all things crypto has not topped Gold.

Gold in fact has been on a heater of late against the Dollar.

Many folks still regard Gold as "real money". As such crypto could be said to be in a "stealth bear market", especially considering the declining momentum against Gold while failing to match its highs.

Bitcoin v Stocks

Bitcoin is also strongly correlated to US equity performance, despite claims that it's a hedge. The correlation has only grown stronger as Bitcoin's price against the Dollar has soared.

That said, it does consistently outperform equities, as long as the music is still playing!

Closing Thoughts

Most people likely don't care about how Bitcoin is faring against Gold. Bitcoin, the highest quality form of crypto is itself still highly speculative. While an equal-weight basket of cryptos is impressively reaching an all time high against the Dollar, coins with smaller market caps will surely be the first to go when this speculative impulse subsides.

There's probably still some gas in the tank at this point, but now is a good time to consider trimming positions before you miss the chance 🤑

Let your winners run🧠 Fear | Hope | Growth – When Trading Meets Emotion

The message on the chart isn't just poetic — it's real psychology.

🔹 Fear wants to cut your winners short.

It sneaks in after a small move in your favor.

"What if it reverses? I better lock this in."

And just like that, a great trade turns into a missed opportunity.

🔹 Hope drags you into holding too long.

It dreams: "Maybe it doubles... maybe this time it'll be massive."

But it's not guided by data — it's driven by fantasy.

🔹 Discipline is what sits in the middle.

Quiet. Neutral.

It doesn’t scream or seduce — it just follows the plan.

And that’s where Growth lives — not just on the PnL, but in your psychology.

When Bitcoin pushes toward new ATHs, these emotions get amplified.

The real question becomes: Can you manage yourself, not just your trade?

📌 A Real Example from My Desk

In my earlier BTCUSD idea — “Another Edge – Decision Time” (shared above) —

I sent that setup to one of my managed clients.

He entered long exactly at the edge of the channel — a clean, strategic buy.

Price moved beautifully in our favor…

But he manually closed the trade at 106,600 — long before the move matured.

Why?

Because fear of giving back profit overwhelmed the original plan.

The chart was right. The timing was right.

But the exit was emotional, not tactical.

✅ The trade made money.

❌ But the lesson is clear: a profitable trade doesn’t always mean a disciplined one.

🎯 Final Takeaway:

“Fear kills your winners. Hope kills your timing. Discipline grows your equity and your character.”

🗣 What would you have done in that position?

Held longer? Closed at resistance? Let it run toward ATH?

Let’s talk psychology — drop your thoughts 👇

#MJTrading

#TradingPsychology #BTCUSD #FearHopeDiscipline #LetYourWinnersRun #PriceAction #BTCATH #ForexMindset #CryptoStrategy

₿itcoin: ATHBitcoin recently marked a new all time high. Our primary expectation is for an even bigger breakout to the upside, allowing green wave B to reach its peak within the upper blue Target Zone between $117,553 and $130,891. After this corrective high, we anticipate a sharp sell-off during green wave C, which should drive Bitcoin down into the lower blue Target Zone between $62,395 and $51,323—where we also expect the low of the larger orange wave a. This move should, for now, signal the start of another corrective rally along orange wave b, with a retest of the freshly marked all-time high well within reach. Once this countertrend move concludes, another significant decline should follow as orange wave c develops, targeting the low of the higher-level blue wave (ii). Alternatively, there remains a 30% chance that the preceding wave alt.(i) is still in progress, which could result in a direct breakout above resistance at $130,891.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

Bitcoin vs Gold: Driving the Point Home📉 Bitcoin vs Gold: Driving the Point Home The long-term comparison we can't afford to ignore.

Gold, after achieving mainstream status, weathered a 20-year consolidation phase, low volatility, muted investor excitement, but enduring presence. This historical precedent forces us to reconsider expectations for Bitcoin, now in its 15th year.

⚡ While Bitcoin’s adoption curve has been sharper, its market dominance has steadily declined since 2017. Despite intermittent, and often deceptive relief rallies, the trend remains downward. Altcoins, forks, and shifting narratives (DeFi, NFTs, meme tokens) continue to fragment attention and capital.

⚡ Could Bitcoin follow gold’s path and enter a prolonged era of post-hype consolidation? If so, the next bull run might be a decade away or more … if it happens at all. In an age of digital abundance, durability; not innovation, may define Bitcoin’s legacy.

📊 Chart Highlights: The latest image visualizes Bitcoin’s current phase against gold’s historical arc. The final label "Monetary Maturity" suggests a shift from speculative highs to a more sober test of endurance.

🔍 Will Bitcoin evolve into a true store of value or fade as just another chapter in financial innovation? Let the markets answer, but history offers clues. Only Time will tell.

#Bitcoin #Gold #CryptoAnalysis #BTCdominance #CryptoHistory #DigitalAssets #TradingView

CRYPTO:BTCUSD INDEX:BTCUSD TVC:SILVER NASDAQ:MSTR NASDAQ:MARA NASDAQ:COIN NASDAQ:TSLA TVC:DXY NYSE:CRCL

BTC - Bullflag Pattern points to new ATHMarket Context

Bitcoin has been trading within a well-defined descending channel for several weeks now, respecting both upper and lower boundaries with precision (3 touches on the top, 2 on the bottom). This structure suggests an orderly pullback after a strong impulsive leg to the upside in Q2. As price compresses within this flag-like pattern, market participants are watching closely for signs of breakout or breakdown.

Bullish Fair Value Gap Reaction

Recently, price dipped into a Daily Fair Value Gap (FVG) and bounced strongly — a key bullish signal indicating that demand stepped in at the inefficiency. The FVG also aligns with a retest of the channel’s resistance-turned-support, further validating the bounce. This confluence zone acts as a springboard for potential continuation.

Channel Breakout & Liquidity Above ATH

Price has now broken above the channel structure, shifting the market narrative from consolidation to potential expansion. The breakout zone is located just beneath the All-Time High (ATH) — an area that’s likely loaded with stop orders and breakout buys. A sweep or clean break above the ATH would not only invalidate the prior bearish structure but also trigger a fresh wave of bullish momentum.

Bull Flag Continuation Potential

Structurally, this chart presents a classic bull flag breakout. After a strong impulsive leg up and a controlled consolidation phase, we now see bullish continuation potential toward the 112,000–114,000 region. If the ATH gets breached and reclaimed, it could become strong support in the next leg higher.

Final Thoughts

This is the type of setup that blends both technical precision and market psychology — structure, liquidity, and momentum all coming together. Whether you're already long or watching for confirmation, this move could set the tone for Bitcoin’s next major rally.

If you found this analysis helpful or thought-provoking, please give it a like! And let me know in the comments — do you see this as a true breakout or a trap in disguise?

GOLD TRADE IDEA BULLISH MOMENTPrice is approaching a high-interest demand zone, marked by previous accumulation and clean inefficiency. My plan?

I’m not rushing in — I’m waiting for a 15-minute structure shift. Once that happens, I’ll look for a minor FVG to enter with precision.

📌 Key Criteria:

Price must react in the zone

Clear shift in structure (bullish intent)

Minor FVG forms = potential sniper entry

Targeting a high RR setup (6.5+)

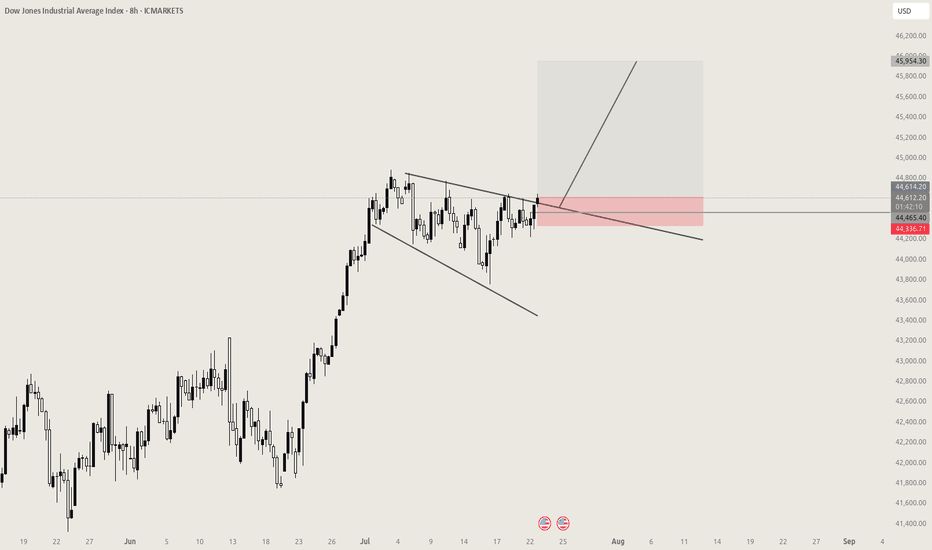

All-Time Highs (3% Up) or US/China Trade Gap (4-5% Down)?It's summer time (1st week of June)

Brutally slow price action thus far, Non-Farm Payroll hits this Friday

Next week will be more US Inflation Date (CPI, PPI)

S&P and Nasdaq are only 3% (or slightly less) away from all-time highs

Melt-up momentum says it's the path of least resistance

US/China Trade Agreement Gap (that silly little Monday announcement) is 4-5% lower

Whatever we hit, there will be disappointed traders and investors - the ultimate pain trade :)

I'm not bearish, I'm ridiculously cautious as a bull and wanting to see a pullback. I can tell

because it's actually annoying watching the market grind so slow to the upside shrugging

off every bad news bite and sense of reality

The big beautiful tax bill is losing support (see Elon Musk's latest comments)

The Trump Administration has pivoted so hard the other way the market is virtually

ignoring tariff news now

Let price be your guide. I'm connecting the April 7 lows forward and if the bears cross it and price sweeps some lows, there might be some pullback potential in the cards

Plenty to watch - be patient - opportunities await. Not forcing anything for now and I'm

doing the "boring" stuff for income trading.

Thanks for watching!!!