Alphabet - The textbook break and retest!📧Alphabet ( NASDAQ:GOOGL ) will head much higher:

🔎Analysis summary:

If we look at the chart of Alphabet we can basically only see green lines. And despite the recent correction of about -30%, Alphabet remains in a very bullish market. Looking at the recent all time high break and retest, there is a chance that we will see new all time highs soon.

📝Levels to watch:

$200

🙏🏻#LONGTERMVISION

Philip - Swing Trader

Alphabetanalysis

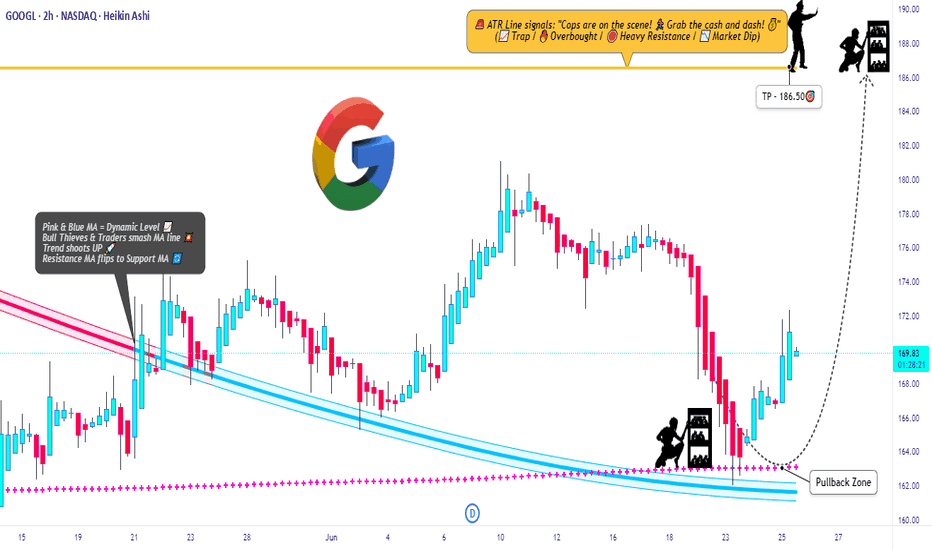

GOOGL Raid Plan: Bulls Set to Hijack the Chart!💎🚨**Operation GOOGL Grab: Robbery in Progress! Swing & Run!**🚨💎

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Silent Robbers, 🤑💰💸✈️

Get ready for another high-stakes market heist – this time, we’re raiding the vaults of GOOGL (Alphabet Inc.) using the Thief Trading Strategy™. Based on sharp technical intel and subtle fundamental whispers, the setup is clear: the bulls have cracked the code, and it’s time to grab our loot.

🟢 🎯 ENTRY POINT - THE LOOT ZONE

"The vault is wide open!"

Snatch your bullish entry anywhere on the chart, but the pros will place limit buys on recent pullbacks (15m/30m zones), either on swing lows or highs. The pullback is your door in — don’t miss it!

🛑 STOP LOSS - ESCAPE ROUTE

Set the Thief SL at the recent 2H swing low (162.00).

But remember, each robber’s risk appetite is unique — adjust your SL based on your size, cash, and courage.

🎯 TARGET - GETAWAY MONEY

💼 Main Target: 186.50

Or if heat rises early, vanish with your gains before the full score hits. Disappear like a ghost — profit first, questions later!

🧲 FOR SCALPERS – THE QUICK GRAB

Only ride the long wave — shorting is off-limits in this mission.

If your wallet is loaded, dive in. If not, join the swing crew.

Use trailing SL to protect your cash stack 💰.

📈 THE SETUP – WHY THIS RAID WORKS

The GOOGL Market is bursting with bullish energy — a classic Red Zone robbery moment.

Overbought tension, fakeouts, trend shifts — exactly where we love to strike! Consolidation and reversals = opportunity for the brave.

📣 TRADING ALERT - NEWS AHEAD!

🚨 Avoid entries during news releases – they trigger alarms!

Use trailing SL to lock in your stash, especially during high-volatility windows.

🔍 TIPS FROM THE THIEF’S DESK

Stay updated with the latest whispers — from fundamentals to geopolitical noise, COT positioning to sentiment swings. The market changes faster than a thief on the run — so adapt fast!

💖 Show some love: 💥Hit that Boost Button💥

Let’s fuel this robbery plan with more power and precision.

Every day in the market is a new heist — let’s win like thieves, not sheep. 🏆💪🤝❤️🚀

I'll be back soon with another masterplan...

📡 Stay sharp, stay hidden — and always aim for the vault. 🤑🐱👤🎯

$141 Stop, $207 Target — Bullish Setup on GOOGL with 1.4RMarket Context

Alphabet Inc. (GOOGL) is showing renewed bullish momentum on the 2-week chart. After a healthy correction earlier in the year, price action is now turning decisively upward, reclaiming its long-term trendline and bouncing off a major support level. This setup suggests a shift in market sentiment from consolidation to breakout mode, with significant upside potential.

Key Technical Levels

• Key Support – $151.90

This zone has acted as a major demand level and was tested multiple times. The recent bounce from here reaffirms its strength and underscores the market’s willingness to buy dips at this level.

• Stop Loss – $141.49

Positioned just below the Key Support, this stop loss accounts for volatility while protecting against a full breakdown. A close below this level would invalidate the bullish thesis.

• Resistance Level 1 (TP1) – $191.91

This price level marks a prior swing high and represents the first bullish target.

• Resistance Level 2 (TP2) – $207.32

A clear breakout beyond TP1 sets up the path toward this higher resistance, which also aligns with historical supply from mid-2021.

• Trendline Reclaim

The multi-year ascending trendline, breached temporarily, has now been reclaimed with conviction — a strong bullish signal on higher timeframes.

Trade Setup

• Entry Zone: $168.00 – $169.00

• Take Profit 1 (TP1): $191.91 (approx. 14% upside)

• Take Profit 2 (TP2): $207.32 (approx. 23% upside)

• Stop Loss: $141.49 (just below Key Support)

• Risk–Reward Ratio: Approximately 1.43

Price Action & Trend Confirmation

After establishing a series of higher lows, GOOGL has rebounded from the $151.90 zone with strength, forming a bullish engulfing candle on the 2W chart. This move brought the price back above the long-term trendline — a textbook bullish signal when viewed on a macro timescale. The structure now favors trend continuation, especially if the price holds above the $168–$170 zone in the short term.

Risk Management and Strategy

The stop loss below $151.90 is deliberately placed at $141.49 to avoid premature exit from minor volatility. This level is safely beneath the most recent swing low and gives the trade breathing room to develop. A partial exit at TP1 locks in gains while preserving capital for the extended move to TP2, where major resistance could trigger broader market attention.

Conclusion

GOOGL is setting up for a high-probability breakout from a clean technical base. With the price respecting long-term support, reclaiming the trendline, and establishing bullish momentum, the path of least resistance is upward. The trade offers a solid reward-to-risk profile and aligns with institutional-style setups often seen prior to extended rallies.

In short: GOOGL looks ready to move, and this is a setup bulls won’t want to ignore.

Alphabet (GOOGL) Shares Drop Over 7% in a Single DayAlphabet (GOOGL) Shares Drop Over 7% in a Single Day

According to the Alphabet (GOOGL) stock chart, yesterday’s main trading session opened around $163.70 but then saw a sharp decline, hitting an intraday low of approximately $148 per share. By the close, bulls managed to recover only a small portion of the losses. As a result, Alphabet (GOOGL) shares fell by more than 7% during the session – marking the worst performance among the S&P 500 constituents (US SPX 500 mini on FXOpen).

Why Did GOOGL Shares Fall?

The drop followed remarks by Eddy Cue, Apple’s Senior Vice President of Internet Software and Services, who:

→ noted a decline in search traffic on Safari;

→ revealed plans to expand Safari’s search capabilities using artificial intelligence.

These developments heightened concerns over Google’s dominance in search and its advertising revenue. According to media reports, analysts are warning of rising competition from AI-powered search platforms such as OpenAI, Grok, and Perplexity.

Technical Analysis of Alphabet (GOOGL) Shares

In our 23 April analysis, we identified a descending price channel and emphasised the psychological significance of the $150 level, which had served as a key support in 2024.

Since then, bulls showed confidence by pushing the price above the red channel. In addition, the chart has begun to outline a potential ascending trend channel (marked in blue).

However, yesterday’s statement from competitors shifts the outlook. The current GOOGL stock price is positioned at the lower boundary of the blue channel – which could act as support, reinforced by the psychological $150 level.

On the other hand, a bearish breakout below this area may revive the downtrend that began in February, potentially paving the way for a test of this year’s lows.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Alphabet (GOOGL) Shares Hover Near Psychological LevelAlphabet (GOOGL) Shares Hover Near Psychological Level Ahead of Earnings Report

On 31 March, we noted that bearish sentiment could push Alphabet’s (GOOGL) share price towards the psychological level of $150. As the current price chart suggests, GOOGL is now trading close to that very level.

Moreover, the price is approximately equidistant from the recent highs and lows (marked A and B), which may be interpreted as a sign of balanced supply and demand — and a wait-and-see stance from market participants ahead of Alphabet’s Q1 earnings release (scheduled for tomorrow, 24 April).

Awaiting the GOOGL Earnings Report

With the Nasdaq 100 index (US Tech 100 mini on FXOpen) having fallen by around 13.5% since the beginning of the year, investors are approaching tech earnings with caution. According to Barron’s, three key themes are expected to dominate the narrative:

→ management forecasts amid continued uncertainty around the White House’s tariff policy;

→ plans for major capital investment in AI-related infrastructure;

→ signs of softening consumer demand.

Given the current climate of uncertainty, Alphabet’s earnings report could prove particularly influential — serving as a benchmark for shaping market expectations ahead of other major tech company reports.

Technical Analysis of Alphabet (GOOGL)

The $150 level has served as key support throughout 2024, and over the coming days it may act as a springboard for a new price movement, potentially driven by the earnings results.

From a bearish perspective, the market remains in a downward trend (indicated in red) following a breakout below the lower boundary of a previously active rising channel (marked in purple) that had held since last autumn. However, if Alphabet’s management maintains an upbeat outlook for 2025, this could give the bulls the confidence to challenge the upper limit of the red channel.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Breaking: Alphabet ($GOOG) Shares Drop 7% in PremarketAlphabet Inc. (NASDAQ: NASDAQ:GOOG ) witnessed a significant 7% drop in premarket trading on Wednesday, driven by investor concerns over slowing cloud growth and the tech giant’s hefty $75 billion investment into artificial intelligence (AI) infrastructure. This figure far exceeded Wall Street’s projected $58 billion, raising doubts about the necessity and efficiency of such high spending.

AI Investment and Competitive Pressure

Alphabet has been aggressively investing in AI research and its integration across Google Search, Cloud services, and other platforms. However, the emergence of China’s low-cost DeepSeek AI model—which reportedly rivals leading U.S. AI models—has triggered discussions about whether Big Tech companies need to allocate billions toward AI advancements.

Cloud Growth Concerns

Alphabet's cloud division reported a 30% revenue increase to $11.96 billion in Q4, but this marked a slowdown compared to the 35% growth in Q3. In contrast, Microsoft Azure saw a 31% increase, while Amazon Web Services (AMZN) is projected to post only a 19% rise. Despite the slowdown, analysts believe the surging demand for AI-powered cloud computing will keep the long-term outlook positive for Alphabet’s cloud business.

Advertising Challenges

Beyond AI and cloud investments, Alphabet is grappling with fierce competition in the digital advertising space. With marketers increasingly shifting to social media-driven ad platforms like Meta’s Facebook and Instagram, and ByteDance’s TikTok, Google’s traditional ad model faces mounting pressure.

Technical Analysis

At the time of writing, NASDAQ:GOOG shares are down 6.75%, signaling a potential bearish continuation pattern. The stock appears poised to form a gap-down pattern, a bearish technical indicator that may lead to further downside pressure.

- Support Levels:* The first minor support lies at $197, aligning with the 78.6% Fibonacci retracement level. A breakdown below this level could result in gap-filling towards $185-$190.

- Major Structural Support: The BOS (Break of Structure) level is set at $155. A dip to this level could trigger further bearish sentiment and result in deeper losses.

- Moving Averages: Despite the premarket decline, NASDAQ:GOOG remains above key moving averages, suggesting that the broader trend remains bullish unless further downside momentum builds.

- RSI Positioning: Prior to this drop, the Relative Strength Index (RSI) was at 64, indicating that the stock was not overbought. This means the decline is not necessarily a reaction to overvaluation but rather a response to external market forces and investor sentiment.

Market Sentiment and Analyst Outlook

While some brokerage firms have cut their price targets on Alphabet, the median price target now stands at $220—still above its current premarket trading price of $191.20. Alphabet’s stock had gained 9% in 2024 before this drop, outperforming Amazon’s 10.3% gain and Microsoft’s -2.2% decline.

Conclusion

Despite the current dip, Alphabet’s long-term prospects in AI and cloud computing remain strong. The significant AI investment could prove to be a long-term advantage if it strengthens Alphabet’s competitive positioning. However, traders should closely monitor key support levels ($197 and $155) and whether the stock can hold above key moving averages.

For long-term investors, the recent drop could present a buying opportunity, but in the short term, further downside volatility is possible as market sentiment adjusts to Alphabet’s spending strategy. The coming days will be crucial in determining whether NASDAQ:GOOG can recover swiftly or continue its downward trajectory.

Google: Room to Head HigherFor the past two months, GOOGL has been stuck in a sluggish sideways phase, with even its latest breakout attempt quickly sold off. During the magenta wave , we still expect a new high, though a direct transition into the subsequent wave remains technically possible. In our 33% likely alternative scenario, we would have to reckon with a significantly delayed continuation of the overarching upward cycle. In this case, GOOGL would still be working through the (intermediate) correction of the green wave alt. , which would bottom below the support at $147.22.

Google: There We Go!Since late October, the Alphabet stock has been rejected twice at the $181.61 resistance. This Monday, though, it achieved an impulsive rally above this critical level. This advance aligns perfectly with our primary scenario by propelling the magenta wave further upward, and we expect additional gains as this movement progresses. However, the development of the ongoing upward impulse would be significantly delayed in our 33% likely alternative scenario. In this case, Alphabet’s stock would still be working on the corrective green wave alt. and sell off below the support at $147.22.

Google: At the Resistance!Driven by bullish momentum in the tech sector, Google’s stock has recently gained as expected. The resistance at $181.61 has presented a key hurdle in recent weeks. However, our primary wave count indicates that this level will be surpassed next during the ongoing magenta wave . This bullish impulse should conclude significantly higher in the chart, thereby setting a new all-time high. Conversely, there’s a 38% chance for our alternative scenario, which suggests an extended wave alt. correction.

Googling Gains: Long Trade Insights for AlphabetNASDAQ:GOOGL is a MUST HOLD for future gains.

Following up on last week's call, price did hit our ideal entry point and we are now long and strong. Stop loss has been re-adjusted at break even. Any bystanders, below is the ideal entry STRATEGY

Bullish time at mode trend has just been confirmed.

* Expiry is set for the end of November

* Targets of $189 and $201's at first.

* Ideal entry DCA low $170’s

* Stop at $169

GOOGLE Rockets! 15-Min Surge Hits All Targets – What's Fueling?ALPHABET (GOOGLE) Analysis:

Alphabet Inc. (GOOGL) experienced a powerful upward movement in the 15-minute timeframe, achieving all set profit targets with ease using the Risological Swing Trader.

The momentum from a strong earnings report has aligned with a positive risk sentiment across US equity indexes, sparking increased buying interest in tech giants like Alphabet.

Here’s a breakdown of the trade and supporting market context:

Entry : $164.75

Targets Achieved:

TP1: $167.07

TP2: $170.81

TP3: $174.56

TP4: $176.88

Stop Loss (SL): $162.87

Market Sentiment:

Recent quarterly earnings reports have fortified investor confidence, with broader equity indexes advancing. Alphabet's strong fundamentals and growth projections contributed to the bullish sentiment, encouraging traders to follow through on this aggressive buying trend.

With all targets hit in a single session, this upward momentum for Alphabet highlights robust institutional interest and solid fundamentals. Keep an eye on further tech earnings, which may continue to impact Alphabet's trajectory in the upcoming sessions.

Google - Textbook break and retest!NASDAQ:GOOGL might retest the previous breakout level before continuing the uptrend.

The entire chart of Alphabet (Google) is green, yet I do expect a (short term) move lower first. For almost a decade, Alphabet has been retesting and respecting a major support trendline before then breaking out of the ascending triangle formation just a couple of months ago. I just expect Alphabet to retrace back to the breakout level before then creating new all time highs.

Levels to watch: $150

Keep your long term vision,

Philip - BasicTrading

GOOGL may be ready to rally with the other Magnificent 7.NASDAQ:GOOGL has not performed as well as other Magnificent 7 names, which are currently trading much higher than their August 5th lows. If NASDAQ:QQQ continues to build above its daily 50 SMA, and other technology names in this space continue to move higher, GOOGL may start to move higher as well. GOOGL has held demand at the retest of the previous all-time high and may break out of a falling wedge on the weekly chart.

Alphabet - It is just a textbook company!NASDAQ:GOOGL has been one of the best performing stocks over the previous decade.

The most profitable stocks are the ones which trade under the radar. And Alphabet (Google) is definitely one of these stocks which is simply trending higher, providing textbook trading opportunities and not a "hype" stock. Slow and steady wins the race, but you have to be careful that you don't miss your chances. After a retest of the breakout level, you can enter a long trade.

Levels to watch: $150

Keep your long term vision,

Philip - BasicTrading

Alphabet (Google) - 330% Rally ahead!Hello Traders and Investors, today I will take a look at Alphabet.

--------

Explanation of my video analysis:

About 8 years ago Alphabet stock created the first retest and rejection of the long term ascending bullish trendline. Then we had a lot of retests of this trendline, the last one being in the beginning of 2023 and this retest was followed by another decent bullish rejection. Last month Alphabet stock broke out of an ascending triangle formation and is now just very very bullish.

--------

Keep your long term vision,

Philip (BasicTrading)

Alphabet - Wait For The RetestHello Traders, welcome to today's analysis of Alphabet.

--------

Explanation of my video analysis:

Back in 2012 Alphabet created a beautiful triangle formation and after we saw the breakout Alphabet pumped more than +750% towards the upside. At the moment Alphabet is creating a solid resistance area at the $150 level. If we get a retest of the bullish trendline which I mentioned in the analysis, I am looking for longs and eventually new all time highs.

--------

I will only take a trade if all the rules of my strategy are satisfied.

Let me know in the comment section below if you have any questions.

Keep your long term vision.

Alphabet (GOOGL) -> Following The NasdaqMy name is Philip, I am a German swing-trader with 4+ years of trading experience and I only trade stocks , crypto , options and indices 🖥️

I only focus on the higher timeframes because this allows me to massively capitalize on the major market swings and cycles without getting caught up in the short term noise.

This is how you build real long term wealth!

In today's anaylsis I want to take a look at the bigger picture on Alphabet.

Just 9 months ago Alphabet stock perfectly retested major previous resistance which was turned support and in confluence with a retest of the 0.618 fib level we saw a rally of 60%.

Considering that Alphabet is now retesting the channel resistance it is quite likely that we will see a short term drop before I do expect new all time highs on Google stock.

- - - - - - - - - - - - - - - - - - - -

I know that this is a quite simple trading approach but over the past 4 years I've realized that simplicity and consistency are much more important than any trading strategy.

Keep the long term vision🫡

Alphabet(Google) Long BullishTechnical Bullish

HHHL above 99

Trendomat BuySell pressure Bullish

Weekly average price above Monthly average price

145.32 is critical as Volume value is weak.

Incase volume would increase and abreak above 151

Alphabet will potentially walk to above 210

A break below 86 is bearish.

Return vs Industry: GOOGL underperformed the US Interactive Media and Services industry which returned 22.5% over the past year.

Return vs Market: GOOGL underperformed the US Market which returned 14.5% over the past year.

Stable Share Price: GOOGL is less volatile than 75% of US stocks over the past 3 months, typically moving +/- 4% a week.

Volatility Over Time: GOOGL's weekly volatility (4%) has been stable over the past year.

Price-To-Earnings vs Peers: GOOGL is good value based on its Price-To-Earnings Ratio (26.7x) compared to the peer average (51x).

Price-To-Earnings vs Industry: GOOGL is expensive based on its Price-To-Earnings Ratio (26.7x) compared to the US Interactive Media and Services industry average (19.9x)

What is the Fair Price of GOOGL when looking at its future cash flows? For this estimate we use a Discounted Cash Flow model.

Below Fair Value: GOOGL ($123.1) is trading below our estimate of fair value ($160.36)

Significantly Below Fair Value: GOOGL is trading below fair value by more than 20%.

Alphabet is forecasted to grow earnings and revenue by 13.1% and 9% per annum respectively. EPS is expected to grow by 14.6%. Return on equity is forecast to be 22.3% in 3 years.

Analyst Future Growth Forecasts

Earnings vs Savings Rate: GOOGL's forecast earnings growth (13.1% per year) is above the savings rate (2.1%).

Earnings vs Market: GOOGL's earnings (13.1% per year) are forecast to grow slower than the US market (15.7% per year).

High Growth Earnings: GOOGL's earnings are forecast to grow, but not significantly.

Revenue vs Market: GOOGL's revenue (9% per year) is forecast to grow faster than the US market (7.5% per year).

High Growth Revenue: GOOGL's revenue (9% per year) is forecast to grow slower than 20% per year.

Future ROE: GOOGL's Return on Equity is forecast to be high in 3 years time (22.3%)

Earnings and Revenue History

Quality Earnings: GOOGL has high quality earnings.

Growing Profit Margin: GOOGL's current net profit margins (20.6%) are lower than last year (27.6%).

Earnings Trend: GOOGL's earnings have grown significantly by 25.9% per year over the past 5 years.

Accelerating Growth: GOOGL's has had negative earnings growth over the past year, so it can't be compared to its 5-year average.

Earnings vs Industry: GOOGL had negative earnings growth (-21.4%) over the past year, making it difficult to compare to the Interactive Media and Services industry average (-16.9%).

High ROE: GOOGL's Return on Equity (22.5%) is considered high.

Financial Position Analysis

Short Term Liabilities: GOOGL's short term assets ($162.0B) exceed its short term liabilities ($68.9B).

Long Term Liabilities: GOOGL's short term assets ($162.0B) exceed its long term liabilities ($39.7B).

Debt to Equity History and Analysis

Debt Level: GOOGL has more cash than its total debt.

Reducing Debt: GOOGL's debt to equity ratio has increased from 3.3% to 4.5% over the past 5 years.

Debt Coverage: GOOGL's debt is well covered by operating cash flow (757.9%).

Interest Coverage: GOOGL earns more interest than it pays, so coverage of interest payments is not a concern.

CEO Compensation Analysis

Compensation vs Market: Sundar's total compensation ($USD225.99M) is above average for companies of similar size in the US market ($USD12.23M).

Compensation vs Earnings: Sundar's compensation has increased by more than 20% whilst company earnings have fallen more than 20% in the past year.

Insider Buying: Insufficient data to determine if insiders have bought more shares than they have sold in the past 3 months.

Google Analysis 22.01.2023Hello Traders,

welcome to this free and educational analysis.

I am going to explain where I think this asset is going to go over the next few days and weeks and where I would look for trading opportunities.

If you have any questions or suggestions which asset I should analyse tomorrow, please leave a comment below.

I will personally reply to every single comment!

If you enjoyed this analysis, I would definitely appreciate it, if you smash that like button and maybe consider following my channel.

Thank you for watching and I will see you tomorrow!

Wait before entering Alphabet GoogleThere will be absolute volatility as Fed's Hawkish stand. Best place to invest will be India more than US.

Regarding Alphabet. If I was you I would wait for it to cool down till 2646-2655 levels Or You can buy after it gives a break out above 3037 levels. Right now it will stay range bound and keep fluctuating with action of FED.

If important support level of 2646 is broken Alphabet can go to 2483 or below. So we should wait for it to form a bottom. Let it bounce from there then make your moves.

Other thing you can do is let it give a Break out above 3037. If it gives a closing above 3037 Alphabet (Google) can go to 3366 levels. That's the target for medium term.

Closing below 2190 should be the Stop loss.