THE DIAMOND MARKET: TRADITION MEETS INNOVATION💎 THE DIAMOND MARKET: TRADITION MEETS INNOVATION

Sector Analysis | February 8, 2025

By: @dcalphaofficial

Introduction

The diamond sector in 2025 stands at a crossroads between tradition and innovation. Natural diamond markets are under siege, with revenue declines and shifting consumer preferences, while lab-grown diamonds 🧪 continue to gain market share. In this analysis, we break down the financial performance, key players, market trends, and strategic investment opportunities shaping the sector's future.

1. Market Size and Performance 📊

Natural Diamonds:

Valued at $94.19 billion in 2023, projected to reach $128.18 billion by 2032 (CAGR: 4.5%).

Recent volatility 📉: Chinese demand has dropped by 50% since pre-pandemic levels, leading to oversupply.

Lab-Grown Diamonds:

Expected to hit $38.86 billion by 2029 (CAGR: 8.3%).

Market share is rising 📈 due to ethical sourcing 🌱 and affordability 💲, especially for engagement rings.

2. Key Players in the Sector 🏆

Natural Diamond Companies:

De Beers LSE:AAL : Revenue fell to $4.3 billion in 2024; strategic restructuring is underway.

Alrosa PJSC: Holding 30% of global supply despite Western sanctions; maintaining alternative sales channels.

Petra Diamonds ( LSE:PDL ) & Gem Diamonds ( CBOE:GEMD ): Focused on high-value rare stones to mitigate pressure.

Lab-Grown Diamond Companies:

Diamond Foundry: Producing high-quality diamonds for jewelry and industrial use.

Lightbox: De Beers’ venture; initially aimed at budget-conscious buyers but now faces fierce competition.

ABD Diamonds & Clean Origin: Direct-to-consumer leaders with a strong ethical appeal.

3. Financial Analysis 💰

Natural diamonds: Revenue down 21% 📉 due to inventory buildup and low demand.

Lab-grown firms: Experiencing production growth 📈, with volumes doubling in key markets.

Profitability:

Natural diamond companies are under pressure, while lab-grown firms enjoy higher margins 💲—but face pricing pressures.

Valuation Metrics:

P/E Ratios: Negative for many natural diamond firms, reflecting concerns.

P/S Ratios: Low for natural diamonds, possibly indicating undervaluation 🤔, while lab-grown firms' ratios remain high due to growth expectations.

4. Market Trends and Challenges 📈🔍

Consumer Trends:

Younger demographics favor lab-grown diamonds 🌱 due to ethical and financial reasons.

Supply & Demand:

Oversupply of natural diamonds is suppressing prices 📉, while lab-grown production continues to grow steadily.

Technological Innovation:

Advances in lab-grown diamond tech have democratized access, raising saturation concerns.

Regulatory Environment:

Sanctions on Russian diamonds 🇷🇺.

Evolving regulations around certification and marketing for lab-grown diamonds.

5. Investment Thesis 💡

Natural Diamonds:

Undervaluation Potential: Companies like Anglo American (De Beers' parent) may offer value if market recovery succeeds.

Risks: High volatility 📉, geopolitical risks 🌍, and competition from lab-grown diamonds 🧪.

Lab-Grown Diamonds:

Growth Opportunity: Strong case for firms scaling production while keeping quality high.

Challenges: Market saturation ⚠️, pricing pressures, and need for brand differentiation.

6. Strategic Recommendations 📊💼

Diversification:

Look for companies offering both natural and lab-grown diamonds, or those with strong commodity portfolios 🛢️.

Innovation Focus:

Target firms leveraging industrial applications for lab-grown diamonds, which could support long-term growth.

Market Timing:

Monitor for signs of market recovery in natural diamonds or major strategic shifts 🔄 (e.g., De Beers' restructuring).

Conclusion 🏁

The diamond market’s future depends on adaptation to consumer trends and embracing innovation. Natural diamond companies face the challenge of revitalizing demand, while lab-grown firms need to manage growth and pricing pressures. Both offer investment opportunities but require careful strategic navigation.

💬 What’s your take on the diamond market's future?

Will natural diamonds make a comeback, or will lab-grown diamonds dominate the market?

Alrosa

ALROSA PJSC $ALRS: CAN IT WEATHER THE STORM?💎 ALROSA PJSC (ALRS.ME): CAN IT WEATHER THE STORM?

Russia’s diamond giant, Alrosa, is under pressure from global sanctions and weak demand. Can this dominant player maintain its shine ✨ or will it get buried under geopolitical and market risks? Let's dig in! 👇

1/ Revenue Hits:

Alrosa's diamond sales halted in Sept-Oct 2024, reflecting a tough market.

This move was part of a strategic response to sluggish demand 📉 and efforts to stabilize earnings.

The diamond industry isn't sparkling like it used to. 💎

2/ Market Stabilization Efforts: 🛑

No recent earnings reports were mentioned, but the sales halt highlights how volatile the market has become.

Alrosa is bracing for financial pressure while keeping reserves intact for better conditions.

Is this a smart move, or just delaying the pain? 🤔

3/ Major Threat: G7 Sanctions ⚠️

The G7 plans to ban Russian diamond imports, a major blow to Alrosa's access to key markets.

Sanctions could severely disrupt revenue and global sales channels. 🌍

This geopolitical chess match might redefine the company's future moves. ♟️

4/ How's Alrosa Valued? 💲

The last known analysis suggested a 25% undervaluation (based on a DCF model in 2019).

However, without updated data, it's unclear if this still holds true under current conditions.

Alrosa's financial outlook hinges on lifting or navigating around sanctions.

5/ Comparing Alrosa to Peers:

Alrosa’s dominance in diamonds is clear, but sector-wide data remains limited.

Compared to precious metals miners, Alrosa’s reliance on one commodity increases its risk exposure.

Diversifying might be crucial for long-term resilience. 🏗️

6/ Key Risks to Watch: 🚨

Geopolitical Tensions:

Sanctions are the biggest risk threatening Alrosa's market access.

Market Demand Slump:

Global demand for natural diamonds is weakening as lab-grown diamonds gain popularity. 🧪

Regulatory Risks:

Changes to mining laws in Russia could further complicate operations.

Currency Volatility:

The ruble's instability 💱 may distort reported earnings and profitability.

7/ SWOT Analysis: 🔍

Strengths:

✅ Global leader with significant diamond reserves

✅ State-backed, offering some political protection

Weaknesses:

⚠️ Heavy reliance on a struggling market

⚠️ Susceptible to international sanctions

8/ SWOT Continued:

Opportunities:

🚀 Recovery potential in the diamond market post-sanctions

🚀 Diversification into other minerals or industries

Threats:

🌍 Sanction risks from Western nations

🌍 Rising competition from lab-grown diamonds

Alrosa will need bold strategies to capitalize on any opportunities ahead.

9/ Investment Thesis: 💡

Alrosa’s future remains uncertain due to sanctions and weak market conditions. However, significant reserves and state support could provide resilience if market demand recovers. Investors must weigh the high geopolitical risk against potential recovery gains.

10/ What do YOU think? 💬

📈 Bullish: Alrosa can weather this storm.

🔄 Hold: Let’s see how sanctions evolve.

🚫 Bearish: Too risky, no recovery in sight.

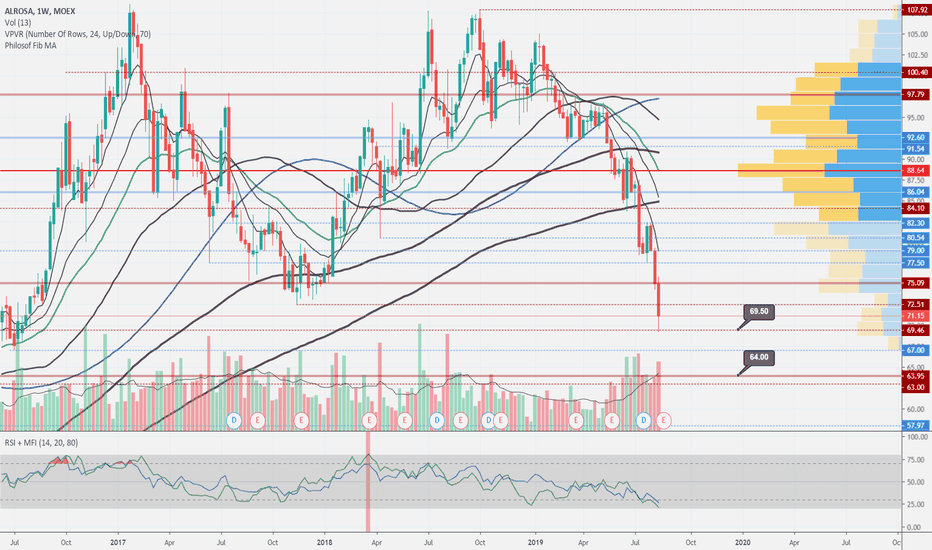

Alrosa near the bounceAlrosa been showing bad results for the whole 2019 year. Went below previous lows and now going deeper. Support at 69.5 bounced the price, and at day timeframe it looks nicely oversold and ready to bounce. But at week timeframe the situation is still dramatic. If current 70 SR won't stop the price, next support that has potential to stop the fall is at 64. In any case these stocks will have to recover for some time, before any kind of uptrend may appear.