ARTY - The Undervalued Gaming Rocket?While most eyes are on memecoins and major Layer-1s, a sleeping giant may be gearing up in the GameFi sector — and this time, it’s powered by real innovation and user growth.

🎮 Fundamental Boost

Artyfact has just launched its long-awaited Play-and-Earn mode — the first of its kind. This new feature is expected to onboard hundreds of thousands of gamers into the ecosystem. And here’s the catch: players can only purchase gaming NFTs using KUCOIN:ARTYUSDT . This shift not only introduces a fresh wave of demand but also builds real token utility — the kind most GameFi tokens lack.

💼Additionally, recent sell pressure from early investors has now faded. Those who had been staking ARTY for three years have finally taken their profits. With that wave of selling behind us, the token now has room to breathe — and potentially fly.

And yes, I bought ARTY myself — not financial advice, but I’m personally betting on its next big move.

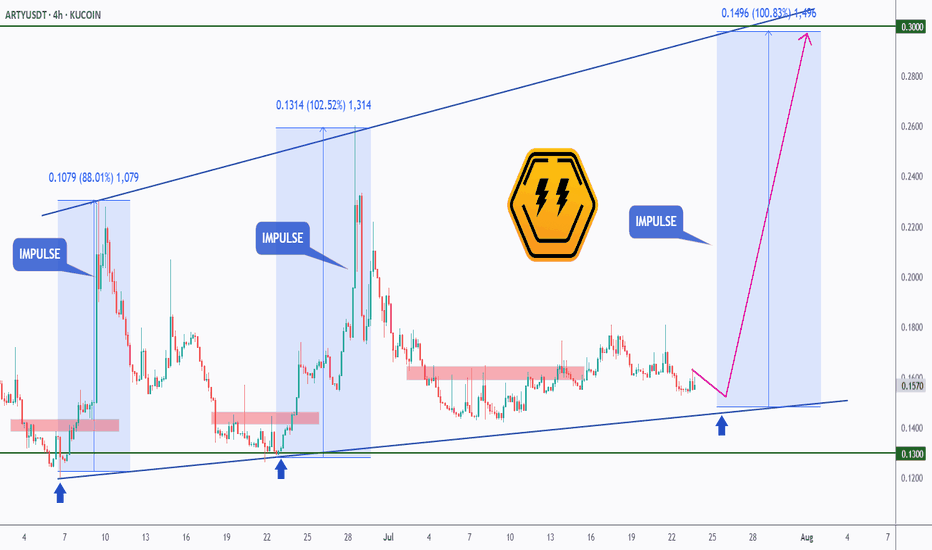

📊 Technical Analysis

AMEX:ARTY has been trading within a bullish ascending triangle, forming higher lows and maintaining strong support around the $0.13 level. Each time it tapped this zone, it triggered strong impulse moves — one up 88%, another over 100%.

Right now, ARTY is back at that exact support level, with a third impulse wave potentially brewing. A bounce from here could send it back toward the upper trendline near $0.30 — our first target.

If that breaks, the next resistance sits around the $0.70 zone, a previous structural high and psychological round number. And if the gaming adoption kicks in as expected, we could be heading toward a macro bull market target of $1+, which would represent a multi-X move from here.

📈 3 Bullish Targets for AMEX:ARTY

$0.30 — top of ascending triangle

$0.70 — structural resistance from prior impulse

$1.00+ — psychological milestone backed by new NFT demand and adoption

📍 Why ARTY?

Artyfact is not just another GameFi project — it’s building a functional gaming economy where NFTs have real use, and where the token is required for participation. In a sea of hype-driven tokens, ARTY stands out by actually shipping product and onboarding users.

With the new Play-and-Earn mode gaining traction, a solid technical base forming, and sell pressure behind us, ARTY could be setting up for its biggest run yet.

➡️ As always, make sure to do your own research and only invest in what you truly believe in.

🎯 Stick to your trading plan — entry, risk, and execution.

Good luck!

All strategies are good, if managed properly.

~ Richard Nasr

Altcoin

ETH - Altseason ??ETH has rallied sharply and is now entering the major resistance zone between $3,725 and $4,081, which has repeatedly acted as a local top during previous cycles.

This red zone represents a high-supply area, and historically ETH has struggled to break and hold above it without a significant catalyst.

Rejection here could lead to a pullback toward the $2,300–$2,000 range.

A clean breakout and weekly close above $4,081 would flip this resistance into support and open the path toward the all-time high (ATH) at $4,868.

If ETH reclaims this red zone and flips it to support, it will act as a major trigger for a broad Altseason.

Historically, such ETH strength is a key confirmation that capital is rotating from BTC into the altcoin market.

Currently, momentum is favoring bulls unless this red supply zone causes a strong rejection.

4/ Altseason: Live -The Final game is in September. My plan Altszn Live #4: My <50% Win Rate, the Psychology of Missed Profits, and the Endgame in September. Start with 10k

Let's be brutally honest. Running a public trading experiment comes with immense psychological pressure. This isn't a game. It's real money, real nerves, and a real reputation on the line. The last 9 days have been tough; I hit a losing streak, and I want to show it to you, not hide it. Because trading isn't a non-stop party of green numbers. It's a marathon where your own psychology is both your greatest enemy and your greatest ally.

Section 1: Working on Myself. My System vs. Crowd Psychology

To be profitable in the long run, you have to be honest about your strengths and weaknesses. My weakness? My trade win rate is less than 50%. Yes, more than half of my positions do not close in profit.

My strength? I've developed one rule that allows me to stay profitable despite this win rate. This isn't some pretty quote; it's a hard-won system: "Hold your profitable positions for as long as possible, and close your losing positions as quickly as possible."

Now, look at the market. Most people do the exact opposite. They "marry" their losing positions for years, while a 20-30% profit is an irresistible temptation they must lock in immediately.

This leads to the pain of missed opportunities (FOMO). I went through this myself with $RSR. I was waiting to buy at 0.081. The price touched 0.083 and then flew to 10 cents without me. That feeling of the market leaving without you while you wait for the perfect correction is familiar to everyone. It's that burnout that causes you to make mistakes. But I've learned my lesson: there will be no deep corrections this season.

Section 2: Altseason in Full Swing. Where is the Money Flowing, and Where is the "Final Station"?

Altseason is already here. This isn't a guess; it's a fact. Billions of dollars in USDT and other stablecoins are pouring into the market right now. Bitcoin is at its highs. Ethereum is moving up aggressively, just as I've said in my previous posts. But the biggest potential isn't in them right now.

Money moves in waves in the market. You need to understand this to avoid getting on at the "final station":

1. First, Tier-1: Capital flows into BTC and ETH. (This phase is almost over).

2. Then, Tier-2: The flow shifts to large-cap projects (LINK, UNI, SOL, etc.). (Happening now).

3. Next, Tier-3 & Tier-4: Money moves into smaller, riskier altcoins. (Our main target).

4. The Finale - Memecoins: Euphoria, insane percentages, media headlines. When your grandmother asks you about Dogecoin — that's the "final station." It's time to get off the ship.

And we have a date. September 2025. For me, this is the deadline, after which I'm moving into stablecoins and waiting for major shifts in the global economy.

Section 3: My Hunt for "Green Flags" and the XETR:HEI Trade

How do you find that Tier-3 project in this chaos that could deliver massive returns? I look for "green flags." The main one is a rebranding. New tokenomics, a new chart, a new concept. It's a startup with a history.

It was precisely this principle that led me to XETR:HEI (formerly AMEX:LIT ). A small capitalization, a strong narrative, and a complete reset of old holders. The probability of such a project taking off is extremely high.

I'm managing this trade, from entry to exit, in real-time within my private channel. These aren't just signals; it's a demonstration of the system in action.

Conclusion & Call to Action

This public experiment is my personal challenge. I have one shot and only two months to show a result. I'm sharing everything: the wins and the losses. All proof of my trades is available on streaming platforms.

In the first post about Altseason, I invited you to join this journey, and the response was incredible. It brought many strong and mindful people into our community. Let's continue.

If you want to follow my trades in real-time, and ride this final wave of the altseason with me, write "Altseason " in the comments or in pm

And I have a question for you. Share your thoughts, your pain points, your projects. What's on your radar? And one more thing: would you want me to open a separate public account with $1000 and trade it in parallel for transparency? Let's discuss. I'm open to any suggestions.

Best regards EXCAVO

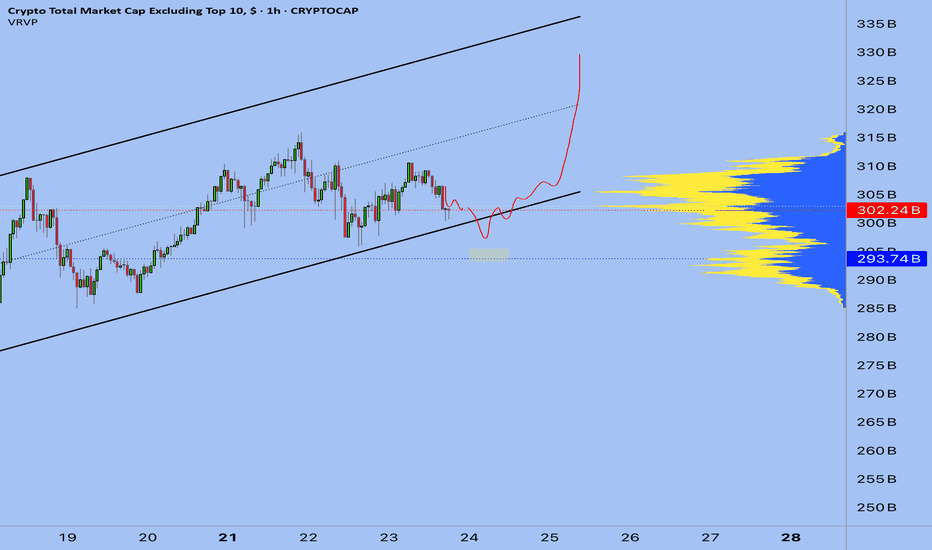

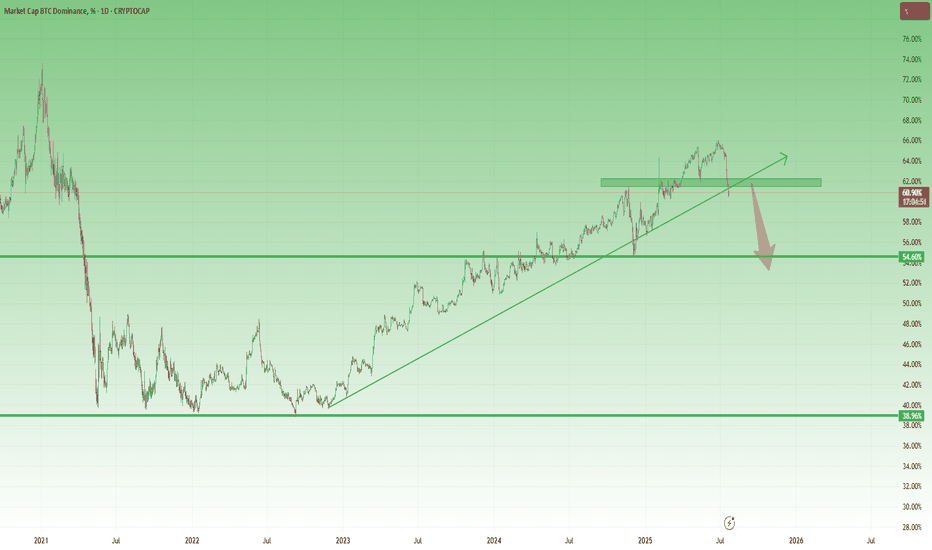

Altcoin Season May Be Real This TimeBitcoin Dominance Finally Breaks – Altcoin Season May Be Real This Time

Since late 2022, Bitcoin Dominance has been on a steady rise — and during this time, the vast majority of altcoins have bled heavily, losing value both in USD and BTC terms.

The long-awaited “altcoin season” became a meme more than a market event.

Every rally was short-lived, and rotation never truly materialized.

Until now...

________________________________________

📉 A Technical Break That Matters

Looking at the BTC.D chart, we finally see something meaningful:

➡️ A clear technical breakdown under confluence support given by the horizontal one and the rising trend line, which held for months and provided the structure for BTC outperformance.

At the same time, Bitcoin is stable around the 120k zone, and the price action suggests strength — not mania, not collapse — just solid consolidation at high levels, and most probably preparing for new ATHs.

This environment historically tends to be favorable for alts.

________________________________________

USDT Dominance (USDT.D) Also Pointing Lower

The USDT.D chart adds even more confluence to the idea:

• It's now pointing towards support

• The structure suggests there’s room for a further drop, which historically means more money flowing into risk assets — particularly altcoins

When stablecoins dominance drops, it usually reflects increased market participation and risk-on behavior — exactly what altcoins need to finally shine.

________________________________________

🔍 What Am I Doing?

I’ve already started buying selected altcoins and I'm looking to add more on dips.

This technical shift is meaningful. It’s not about catching hype, it’s about recognizing a real potential rotation.

In conclusion, I’ll be looking for strong altcoin setups to buy on pullbacks,

as I believe the next weeks and months could offer the kind of upside that can at least double my investment (yeah, yeah, I'm not "to the mooner, hoping for 100x ).

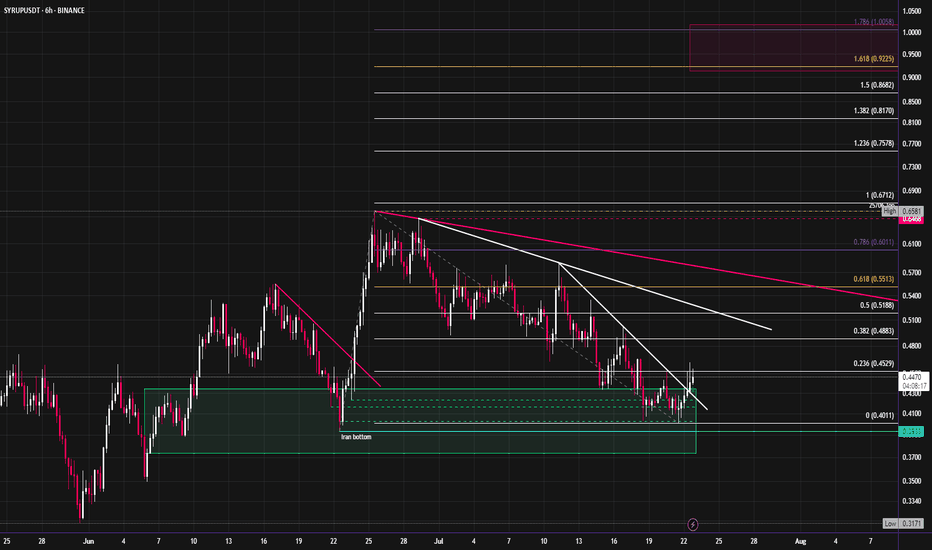

Syrup looks ready to start moving towards new ATH'sCRYPTOCAP:SYRUP has started to break out of its downtrend after revisiting the June lows. It has outperformed most of the market since April, with this month's pullback being an exception. I expect an aggressive move up into new highs. The fibs around $1 look like a good target for the short term, this would also be ~1b mc.

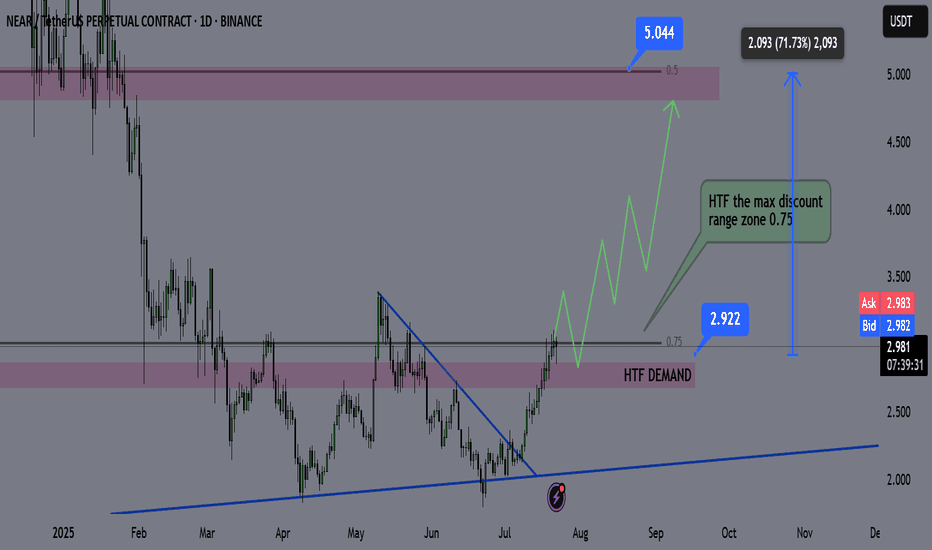

NEAR Swing Long Idea - Altseason 2025📌 Fundamental Sentiment:

The entire crypto market is rallying, alongside other risk assets. This is mainly driven by U.S. policy expectations — Trump is pressuring Powell to resign and aggressively pushing for rate cuts from the Federal Reserve.

📌 Technical Analysis:

NEAR has recently broken and closed above a significant HTF support/resistance level.

Additionally, we’re now trading inside the 0.75 Fibonacci retracement level of the HTF bullish trend — which I define as the maximum discounted zone.

For this setup, I’ll apply my Deep Range Theory (DRT):

If price dips below the 0.75 zone and accumulates there,

Then breaks above 0.75 after a period of consolidation,

→ It signals that price aims for the 0.5 level of the range and will likely run HTF liquidity for either reversal or re-accumulation before continuation.

📌 Gameplan:

✅ Break and close above HTF S/R

⏳ Waiting for break and daily close above 0.75

🔄 Retest to LTF demand (4H–1H)

📈 A bounce on LTF demand will trigger the long setup

📌 Trade Management:

This is a mid-term swing trade, as I’m following the HTF bullish trend.

🎯 Target: $5 — which is approximately a +70% move from current price.

❗Risk Management:

If price makes a daily close back below 0.75 after breaking and closing above, I will exit the trade to preserve capital.

I’ll also monitor macro sentiment closely. If there's a sharp bearish shift, I may consider an early exit before reaching the HTF target.

—

🔔 Follow the channel for daily trade ideas & weekly macro recaps.

💬 Drop a comment below if you have any questions or insights!

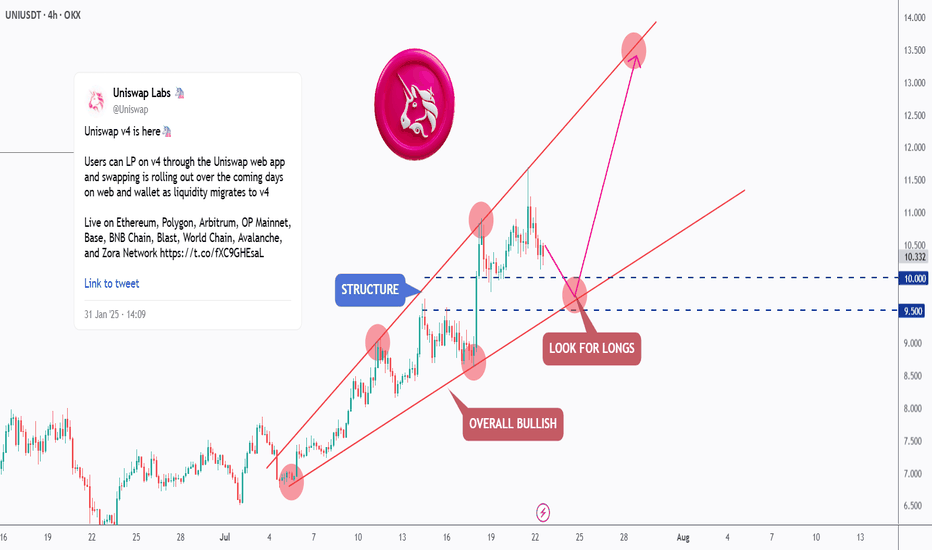

[Deep Dive] UNI – Edition 1: Retest. Reload. Rally?Uniswap (UNI) has been trading within a well-respected rising channel, showing consistent bullish structure across the 4H timeframe.

After a strong rally from the $7.50 region, price is now undergoing a healthy correction — retesting the lower boundary of the channel, which intersects with the $9.50–$10.00 demand zone.

📐 Technical Outlook

The market has printed a series of higher highs and higher lows, confirming the bullish momentum. The recent correction is testing a key support structure — previously a resistance zone — and this confluence aligns perfectly with the channel’s lower bound.

As long as this zone holds, UNI is well-positioned for a continuation toward the $13–$14 region, in line with the pink projected path.

🔥 Fundamental Boost

Uniswap has recently launched its V4 upgrade, introducing "hooks" — customizable smart contracts that allow developers to build more complex DeFi logic directly within liquidity pools. This upgrade not only enhances flexibility and capital efficiency, but also reduces gas costs — making Uniswap an even more dominant player in the DEX ecosystem.

Additionally, with Ethereum L2 adoption growing and Uniswap expanding across multiple chains (Arbitrum, Base, and Optimism), protocol usage and fees are on the rise again.

The UNI token may soon benefit from the proposed fee switch, which would redirect a portion of protocol fees to token holders — potentially adding new value accrual mechanics.

🟢 Conclusion

The technicals and fundamentals are aligning. UNI is in a bullish structure, trading at a key area of interest, and the latest upgrades may unlock new growth for the ecosystem.

Traders and investors alike should keep a close eye on this zone for long opportunities, as the next impulse could be just around the corner.

💬 What do you think — is UNI ready to break toward new highs, or will the demand zone fail? Let me know in the comments 👇

🔔 Disclaimer: This analysis is for educational and informational purposes only. It does not constitute financial advice or a recommendation to buy or sell any asset. Always do your own research and manage your risk accordingly.

📚 Always follow your trading plan => including entry, risk management, and trade execution.

Good luck!

All strategies are good, if managed properly.

~ Richard Nasr

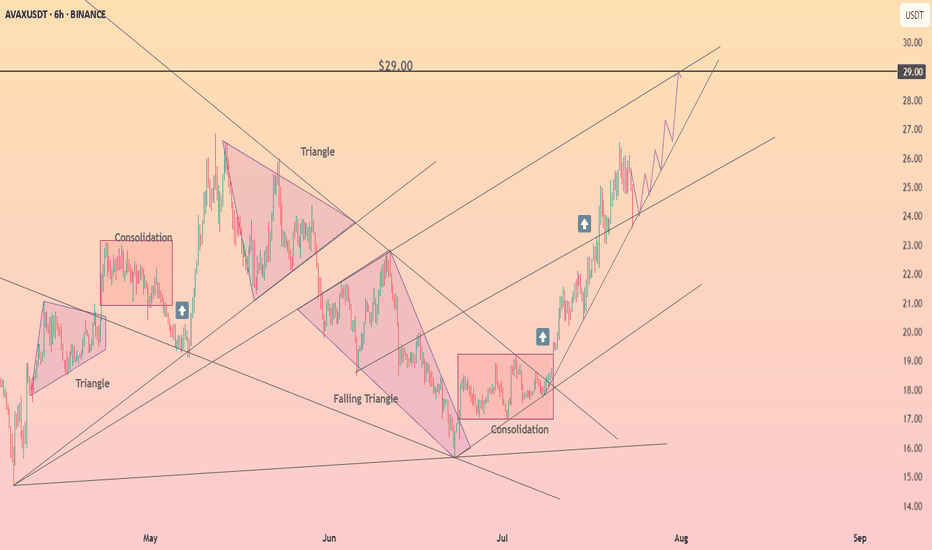

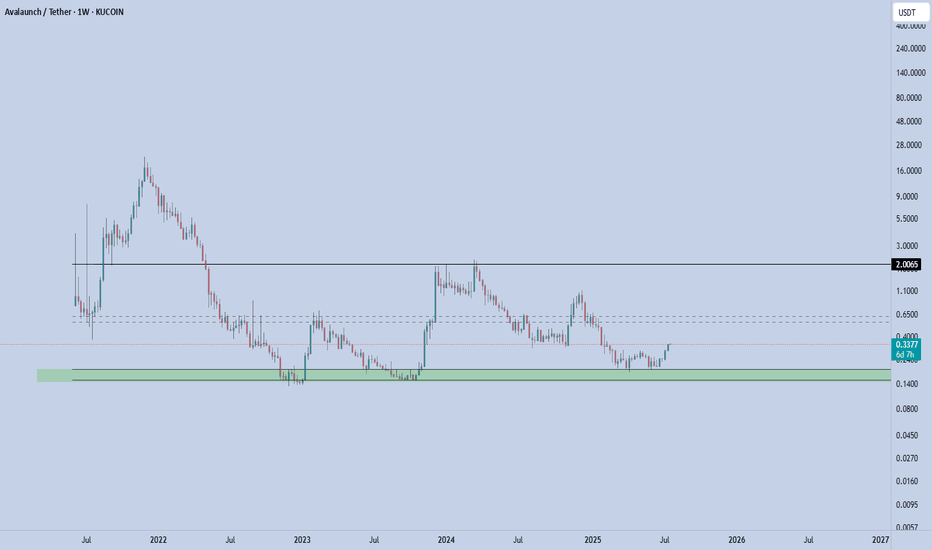

XAVA - Rebound in Play XAVA coin is currently stabilizing in a key support zone — the bottom of the defined channel, which has proven to be a strong and reliable support area. Price recently bounced from this level, confirming buyer interest.

From here, the next immediate target is the mid-range of the channel. If price manages to break above and hold the mid-channel, the next upside objective becomes the top of the channel.

Key Levels

Support (Channel Low): 0.15(invalidation below this level)

First Target (Mid-Channel): 0.56-0.62

Second Target (Channel High): 2

📌 Risk Management: A clean break below 0.15 invalidates this setup. As long as this level holds, the structure remains constructive and favors rotation toward higher levels within the channel.

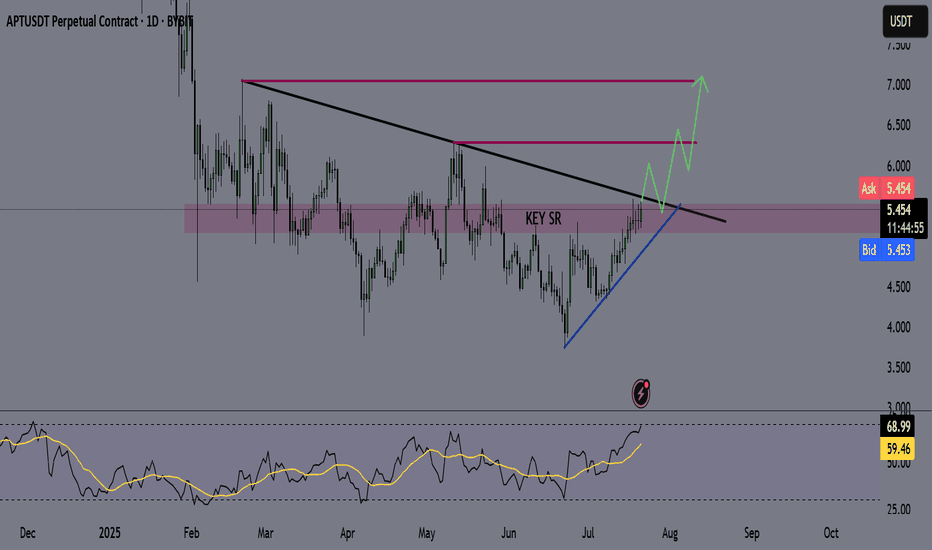

APT - APTOS Coin - Swing Long Idea📌 Fundamental Sentiment:

The entire crypto market is rallying, alongside other risk assets. This momentum is largely driven by U.S. policy expectations — specifically, Trump’s increasing pressure on Powell to resign and aggressively push for rate cuts from the Federal Reserve.

📌 Technical Analysis:

Price is currently testing the HTF supply zone with strong momentum. Additionally, it’s approaching a long-term bearish trendline that has dictated the downtrend since February 2025.

📌 Gameplan:

I want to see:

A clean breakout above the HTF supply zone with daily candle closure.

A confirmed break and close above the HTF bearish trendline on the daily timeframe.

If both confirmations align, I’ll start preparing for swing long setups, potentially riding into the early stages of a 2025 altseason.

—

🔔 Like & Follow for more daily updates. Feel free to drop your thoughts in the comments!

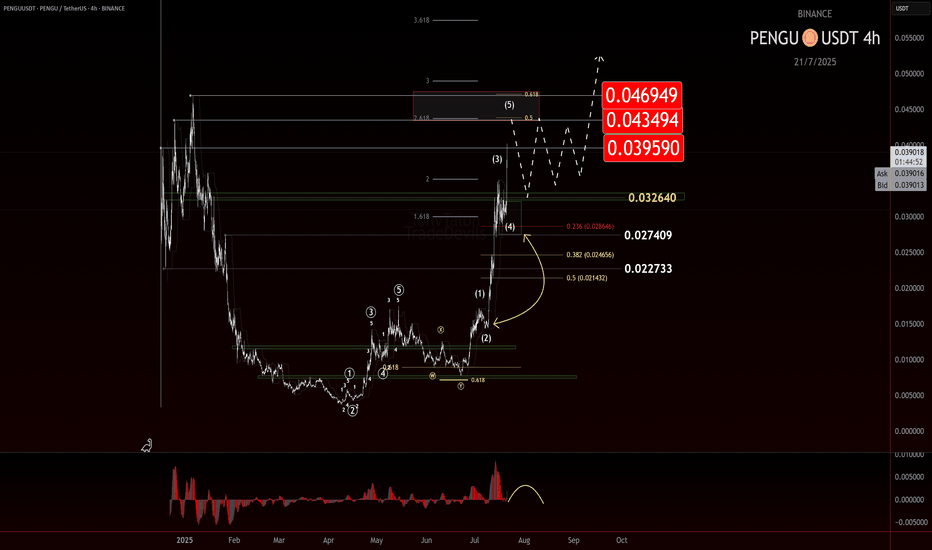

$PENGU: Taking Profit and Watching for a TurnIf you find this information inspiring/helpful, please consider a boost and follow! Any questions or comments, please leave a comment!

PENGU has made a strong move off the 0.007 level, now it just popped cleanly out of consolidation beneath the key LOI at 0.032. That break gave us the signal we needed for continuation, and so far, the price has followed through nicely.

But now, we’re approaching a zone where things could get a bit trickier.

This advance is starting to look like a classic wave 3 impulse, and while there’s no clear confirmation of a top yet, signs are beginning to flash caution. That means it’s time to start watching for potential topping behavior—especially if we move into a broader consolidation phase.

Here’s what’s on my radar:

• Wave 3 Exhaustion?

Still unconfirmed, but this could be the final leg of the wave 3 structure.

• AOI or Key Level Rejection

A stall or strong reaction near resistance could be a red flag. Channel parallel being reached.

• Bearish Divergence on the EWO

Momentum isn’t keeping pace with price. That’s often a precursor to a deeper pullback.

No need to force the next move here. This thing could just keep ripping up, but I am being extra cautious here. Not only to look for a potential top, but if a retrace is given, a potential long add to my current trade. Taking profit at these levels makes sense, especially given the early entry from 0.012 and my trade plan.

As always, trade what’s printed, not what’s hoped for. Stay nimble.

Trade Safe!

Trade Clarity!

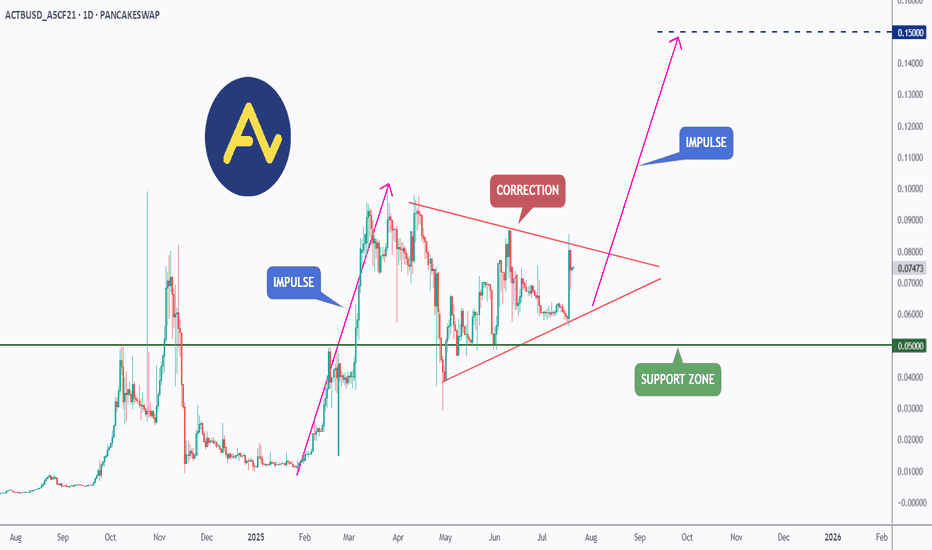

ACT (Acet) - Eyeing the Next Impulse Move?ACT has been forming a textbook bullish continuation pattern.↗️

After a strong impulse leg earlier this year, price has been consolidating within a symmetrical triangle, signaling a healthy correction phase.

🏹Today, ACT broke out of the triangle to the upside , indicating that bulls may be taking control once again.

📍If momentum continues, the next impulse move could push price toward the $0.15 resistance as a first target — a major psychological and technical level.

As long as the $0.050 support holds, ACT remains in bullish territory with upside potential in sight.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

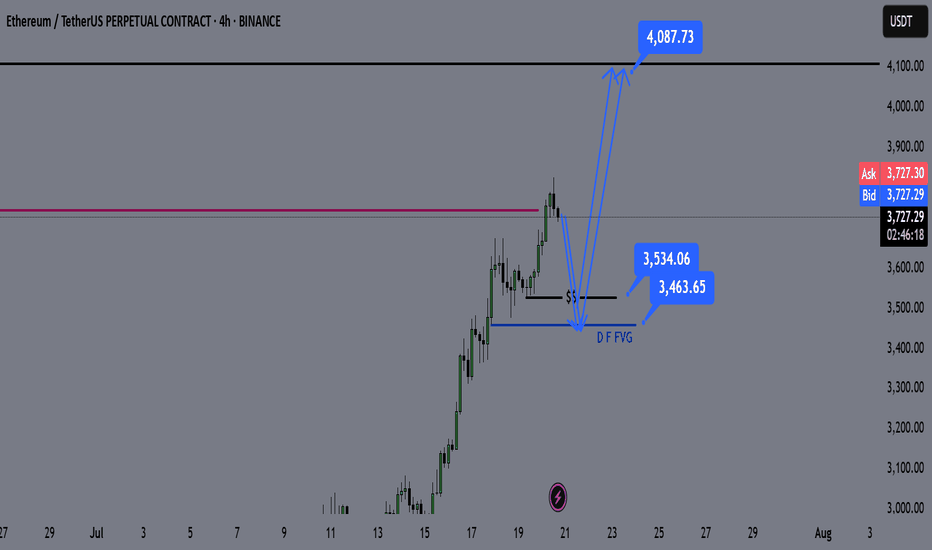

ETH Weekly Recap & Game Plan 20/07/2025📈 ETH Weekly Recap & Game Plan

🧠 Fundamentals & Sentiment

Market Context:

ETH continues its bullish momentum, driven by institutional demand and a supportive U.S. policy environment.

We captured strong profits by sticking to the plan (see chart below).

🔍 Technical Analysis

✅ Price has run into HTF liquidity at $3,750

📊 Daily RSI has entered the overbought zone, signaling potential short-term exhaustion.

We may see a brief retracement or LTF liquidity grabs, which could be enough to fuel a further push higher — potentially to $4,087.

🧭 Game Plan

I’m watching two key downside liquidity levels:

$3,534 (black line)

$3,464

A sweep of either could provide the liquidity needed for continuation toward $4,087.

⚠️ I’ll wait for LTF confirmation before entering a position.

📌 Follow for Weekly Recaps & Game Plans

If you find this analysis helpful, follow me for weekly ETH updates, smart money insights, and trade setups based on structure + liquidity.

BTC Weekly Recap & Outlook 20/07/2025📈 BTC Weekly Recap & Outlook

Market Context:

Price continued its bullish momentum, fueled by institutional demand and supportive U.S. policy outlook.

We captured solid profits by following the game plan I shared earlier (see linked chart below).

🔍 Technical Analysis

✅ BTC made a strong bullish move, breaking into new all-time highs.

📊 The daily RSI entered overbought territory, which signaled the potential for a short-term retracement or consolidation.

Currently, price is ranging, and RSI is cooling off. That tells me the market is likely building energy for the next leg up — but not before a significant liquidity run.

🎯 Game Plan

I'm watching for one of two potential setups:

1️⃣ Liquidity Sweep to the Downside

- A run of the daily swing low

- Into the most discounted range (0.75 Fib zone)

OR

2️⃣ Tap into the Weekly FVG Zone (marked with the purple line)

Either move would create the liquidity and energy needed to fuel a breakout above the equal highs (EQHs) marked by the black line.

🚀 Target

First Target: EQHs (Black Line)

Second Target: Price Discovery (new ATHs)

💬 Let me know your thoughts or drop your own chart ideas below!

📌 Follow for Weekly Recaps & Game Plans

If you found this useful, make sure to follow for weekly BTC updates, market outlooks, and detailed trade plans based on structure and liquidity.

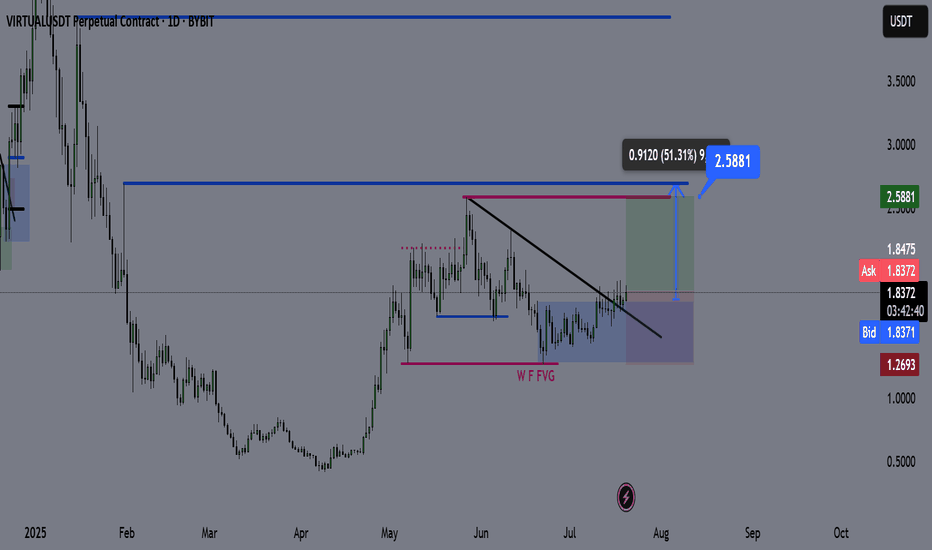

Virtual Coin – Technical Outlook & Trade Plan🔍 Technical Analysis

✅ Price has broken and closed above the bearish trendline, indicating a shift in market structure.

✅ It’s currently consolidating above the trendline, and each retest is showing strong bullish reactions.

✅ The bullish daily demand zone is holding aggressively, reinforcing upward momentum.

I do not expect a significant retracement from here until we reach the purple line (2.59). The current structure suggests price wants to seek higher liquidity.

📌 Trade Plan

Entry: Current market (above trendline + demand zone reaction)

Take Profit (TP): 2.59 (Purple Line)

Stop Loss (SL): 1.26 (Daily Close Below)

📊 Bias: Bullish

🕰️ Timeframe: Daily

📍 Invalidation: Daily close below the demand zone and trendline support

💬 Feel free to share your thoughts or ask questions below!

Time to Peel Some Gains — BananaUSDT Ripening at the Midline

📈 Technical Overview:

BananaUSDT is currently testing the midline of the descending channel. A confirmed breakout above this level could trigger a bullish move toward the top of the channel, which aligns with our secondary target. Until the breakout is validated, the price may continue to range within the current structure.

🔸 Watchlist Status:

Setup is not confirmed yet — keep this on your watchlist and wait for a clear breakout above the midline.

📍 Next resistance: Top of the channel

📍 Invalidation: Rejection at midline or breakdown below recent support

📉 Risk Management:

Enter only after confirmation, and risk no more than 1% of your capital. Always define your stop-loss.

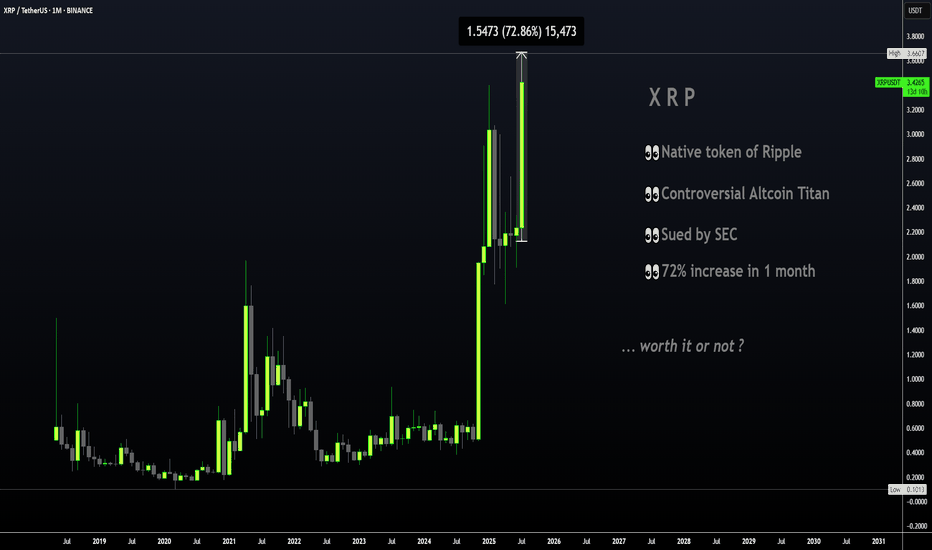

XRP | Great TP Zone is HERE for HODLERSXRP has seen a 62% increase since breaking out above the moving averages in the daily timeframe.

The previous time XRP broke out above the moving averages in the daily, the price increased around 440%:

However, with XRP being the ultimate pumper and dumper, I'll take my chances at 62%! Because this bull run has been anything but ordinary and it's best to avoid being too greedy. The price of XRP falls extremely quick, just as quick as it rises.. ( Maybe not overnight but you know, it has happened before ).

If you're one of few who bought around $1, or heck even later at $2, this is a solid increase and it should not be taken for granted. XRP has gone LONG periods without increases and often stayed behind making new ATH's when other cycles have come and gone (twice), as other alts make new ATH's. Over the years, I've made extensive posts on XRP; documented its use case, followed the SEC case closely and yet, XRP still remains one of the strangest and most unpredictable alts I have ever tried to analyze. Long term followers will remember that a I was bullish in 2018/2019 and then slowly became uninterested up until the point of negative towards XRP for probably the past 3-4 years.

This is not only because of the lagging price compared to other older alts that soared like ETH and even Litecoin. Sure we did not see the growth and the taco stand ( who remembers ) just kept dumping on the market... But the entire "scandal" of the actors marketing/pimping, the dumping behind the scenes by executives to fund Ripple in early days, the lawsuit etc. was just such a colossal mess that I even wonder how XRP is still alive and kicking today.

All I'm saying is that this is truly a spectacular moment - it's hard to even imagine cripple crossed $3 after years and years of waiting on XRP when other alts x1000% and beyond. Point being - Don't miss it! Trading only works when you take profits.

________________________

BINANCE:XRPUSDT

$DOGE Flipping to Bullish Structure!CRYPTOCAP:DOGE is coming to life after a second test of the weekly 200EMA as support and about to make a higher high, cementing in that higher low and flipping the macro structure bullish!

If the count is correct wave 3 of (III) should be powerful! The weekly pivot should put up a challenge as the first resistance before the High Volume Node at $0.45

Safe Trading

SUI: Calm Before the Wave 3 Surge?CRYPTOCAP:SUI is shaping up to be one of those charts that makes you lean in a little closer.

Right now, it appears to be sitting inside a potential wave 3, but something feels off. It hasn’t exploded yet. And when you’re looking for wave 3 behavior, that’s what you want: speed, commitment, follow-through. A clean surge, ideally in a straight line, that clears doubts and leaves the doubters behind.

We’re not seeing that yet. Right now the move is decipherable at many nested degrees making this move feel cautious.

And that opens the door to some possibilities:

It is a wave 3, just one that hasn’t lit the match yet.

We’re still nesting, multiple wave 1s and 2s stacking before the actual move hits.

Or it's a wave C of a Zig Zag.

As for levels, $4.20 stands out. Whether this turns into a rocket or a reset likely hinges on how price reacts there.

Stay nimble. If this is a true wave 3, it’ll leave no time for hesitation.

Be early, but not reckless.

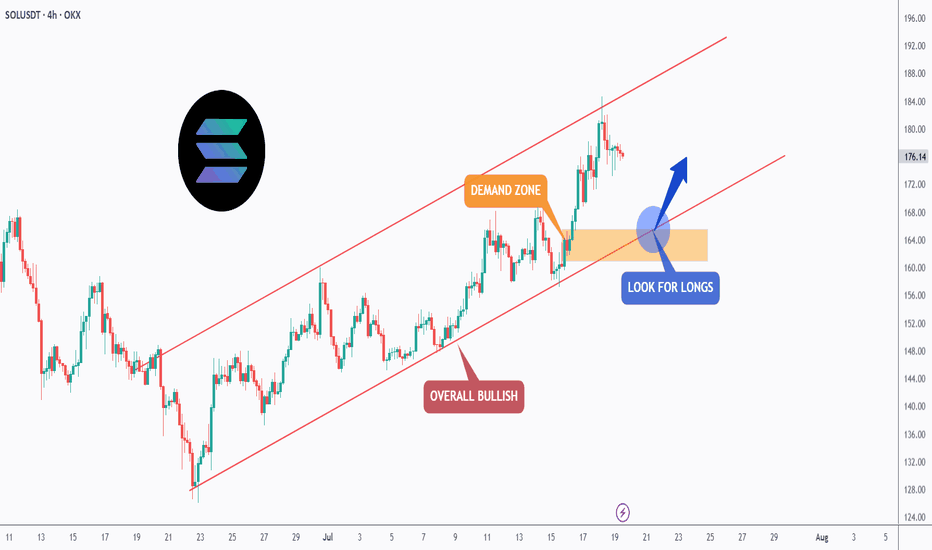

SOL - Trend-Following Longs in the making!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈SOL has been overall bullish trading within the rising channel in red.

Moreover, the orange zone is a strong demand.

🏹 The highlighted blue circle is a strong area to look for buy setups as it is the intersection of the orange demand zone and lower red trendline acting as a non-horizontal support.

📚 As per my trading style:

As #SOL retests the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

Drop Your Token – I’ll Do The AnalysisHey everyone! Hope you’re having an amazing weekend !

Want me to analyze your favorite token ? Just drop your request in the comments using this format:

Request Format

Project Name: Bitcoin

Token Symbol: BTC( BINANCE:BTCUSDT )

Important Notes:

I’ll pick and analyze only the first 10 tokens requested .

One request per person — so choose wisely!

I’ll reply directly under your comment with the analysis.

If you find this helpful, don’t forget to Like ❤️ and Share this post with your friends!

Here’s to your success — health, wealth, and great trades! 🚀

Notcoin and the Butterfly Effect

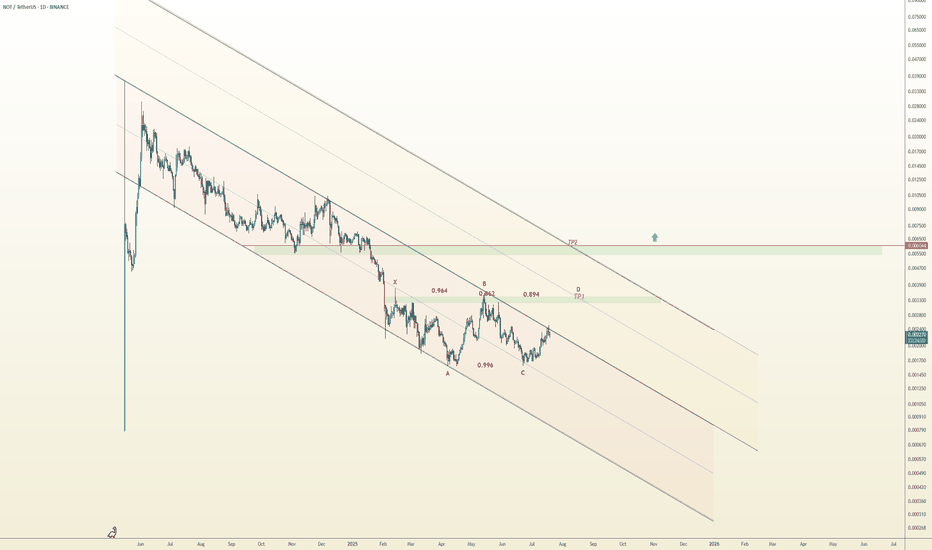

🦋 Bullish Butterfly Pattern Forming | NOTUSDT Analysis

A potential Bullish Butterfly is unfolding on NOTUSDT:

X to A: initial decline

A to B: ~94.3% retracement

B to C: higher low at ~99.6%

C to D: projected bullish leg toward 0.00327 (127.8% Fib), aligning with midline of the yellow descending channel

The price is currently testing the top of the red descending channel.

If bullish momentum holds and this upper boundary breaks, we anticipate a continuation toward point D, and potentially toward 0.006044, the upper yellow channel — a highly critical resistance. A breakout and close above this level may trigger the beginning of a major bullish trend.

🔸 Risk Management:

• Consider partial profit-taking near the midline of the yellow channel

• Trail stop-loss as the price nears point D

• Use only 1% of capital per position

⚠️ Key Note:

• If price breaks below point C, this bullish butterfly setup becomes invalid