Cross-breeding of systems. BTC D for example.Experimental review.

Hi.

There is a lot of debate going on on bitcoin dominance right now and I thought I wanted to get the most out of this picture.

I came up with the idea to take the weekly Renko chart for parsing and leave almost all my usual indicators except EMA (it is not needed here).

And VFI LF is also unnecessary.

So what do we observe, besides a clearly visible very strong support around 39.8%?

We have a fresh green cube with a pin bar.

1. Funny, the Renko cube went exactly where the clouds change was last time!

2. Next, Renko's cube climbs Kijun-Sen line for the third time. Believe me, not for it to serve as resistance anymore. Only as support. All tests passed. Chikou span (light green lag line) is looking up. Also a good sign.

3. What about the exact same exit upwards? On the edge of the clouds? Hypothesis! But let's note. That perhaps BTC D is flying upwards to a certain "cloud exchange" point. That's around April 1.

4. Devil, but that looks like a bull flag on a stochastic.

5. SQZMOM is heading steadily to the bullish side I'd say a minimum of three weeks, a month max we need before the first green bar.

As this is an experimental approach, there will be neither a "long" nor a "short" mark.

Let's see together if this kind of reasoning works?

Does reliability improve by combining Renko and Ichimoku?

We'll review this chart in second half of the spring 2023.

OK? Are you interested in this?

Thank you for your attention!

Altmarketcycles

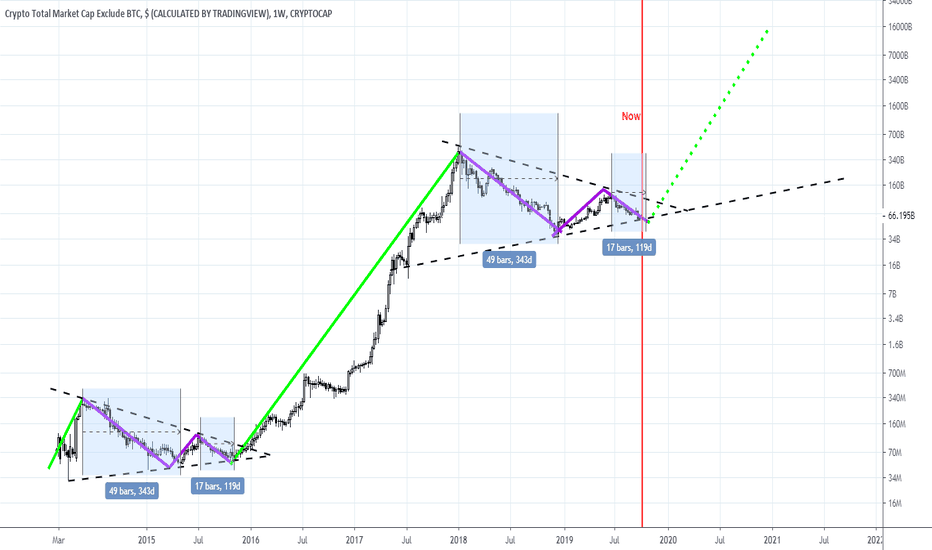

#ALT MARKETCAP Hitting a Major Resistance. What's Next ??ALT MARKEPCAP is hitting the resistance right now.

This is a threshold point for the alt market.

If the index breaks this resistance alts will pump along with BTC.

I will keep this chart updated follow me for more.

Hit the like button if you like it and share your views in the comment section.

Thank you

#PEACE

Alt Market Cap Analysis - upcoming opportunitiesHello buddies, how are you?

No need to explain about Alts for what happening over the past couple of days. We had seen huge red candles on the overall market. But most of us did not even imagine that the market will fall that much. So presenting you my thought on the current Alt market cap is what am seeing right now.

- In the chart, you can spot Pitchfork which I drew from the recent top. It was presenting index can be in short term or maybe long term downtrend.

- You can closely look into the pattern, every resistance and support line was working well, price action in this pattern was so much accurate.

For now....

- In the chart, you can see one dotted trendline which was the retest point of the index before moving upward and one red trendline named 'trigger line', yes the index broke this red trendline and the current price action is above this trendline. And what is that means is the price(index) has broken its downward momentum. Technically we may see an index at the green line soon which will be the C point of a pitchfork. If the index followed this pattern as it did in the past then there's a high possibility of relief in the alt market cap. As always we trade on possibilities so make sure you keep in mind every factor of the market and trade accordingly.

ALTCOIN MARKET CAP CHART. ALT SEASON COMING?Very similar pattern playing out right now to that of 2014 to 2016 on the Altcoin Marketcap!

Same wave patterns and very similar time duration's on the downtrend cycle of the bear markets.

Alt season should be starting within the next few weeks, around the 21st October.

Bull Flag in Bitcoin Market Cap Dominance Disclaimer: If you are primarily interested in copying other people’s trades then this is not for you. However, if you are willing to put in the work that it takes to learn how to trade for yourself then you have found the right place! Nevertheless please be advised that you can give 10 people a profitable trading strategy and only 1-2 of them will be able to succeed long term. If you fall into the majority that tries and fails then I assume no responsibility for your losses. What you do with your $ is your business, what I do with my $ is my business.

Click here for my Comprehensive Trading Strategy | Click here for my Comprehensive Trading Process | Click here to learn about the 2 BTC' to 20 BTC' Trading Challenge

Quick update, without the normal comprehensive TA. What I think is most important right now is the Bitcoin Market Cap Dominance (BTC.D). This is my main indicator to identify alt seasons vs salt seasons. The best alt seasons happen when: BTC is in a bull market and market cap dominance is > 70%. Conversely when market cap dominance is less than 60% it is usually a good indicator to sell alts.

The target from the bull flag is 77%.

Furthermore I think this is a very strong confirmation of a bottom in Bitcoin. Throughout this bear market any time BTC has pumped, alts have pumped more. Now we are seeing BTC pump and alts sell off vs BTC. This is exactly what we saw at the beginning of the 2016 bull market. This combined with the EMA's starting to signal a reversal has me sitting up in my seat.

That being said I am not viewing this as an opportunity to buy BTC. We are at resistance and well overdue for a correction. Instead what I've been doing is shorting ETH:BTC and longing ETH:USD as a hedge. If BTC continues going up then alts should continue selling off vs BTC but not necessarily USD. If BTC goes down then alts should selloff across the board and I will exit my ETH:USD long. If all works out then I can use the ETH:BTC short to hedge BTC spot purchase(s) when it eventually corrects.

Hopefully that all makes sense, if not feel free to ask questions!