ALTS

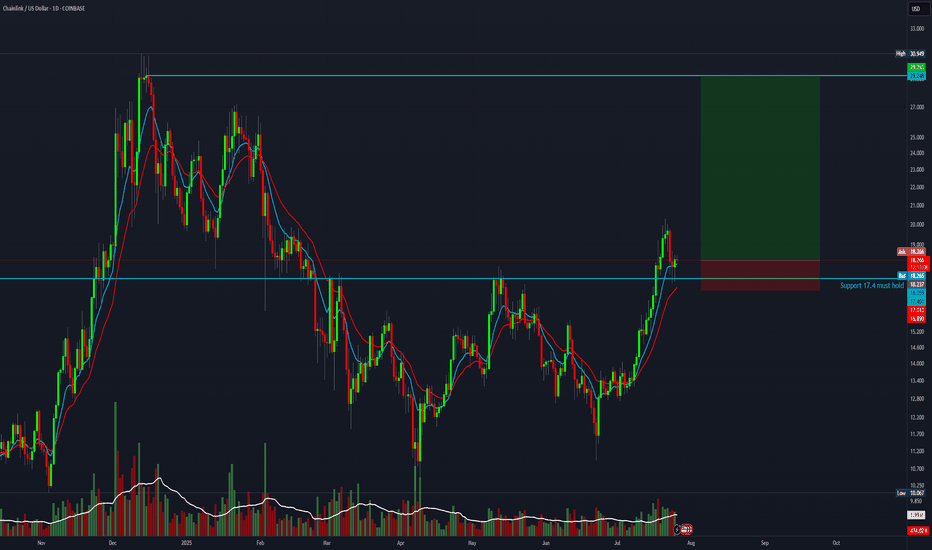

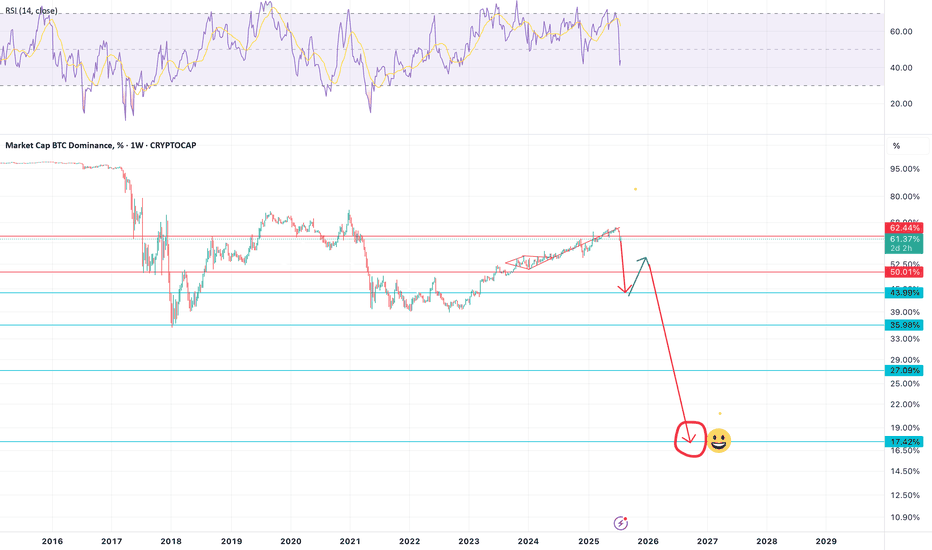

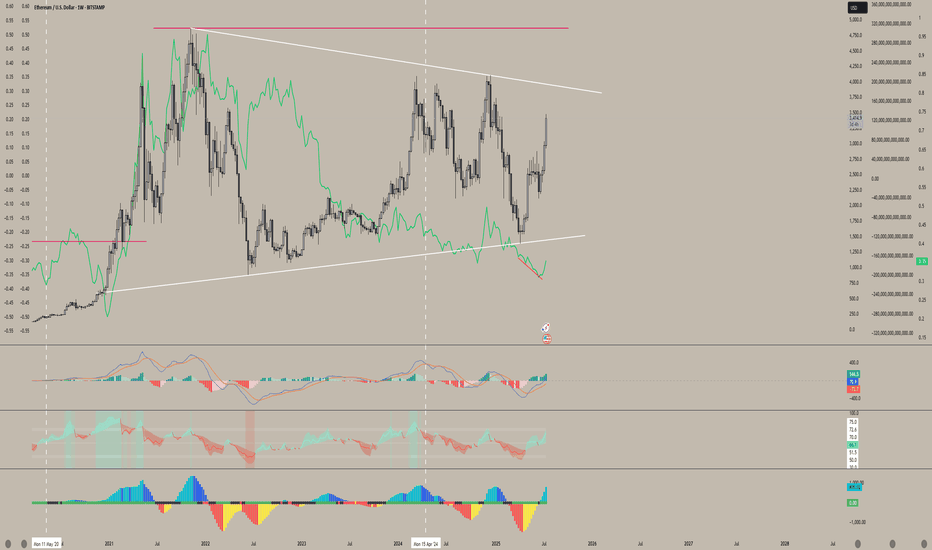

2025 BTC.D to %44 then retrace to %56 - 2026 real Altseasonthe drop in bitcoin dominance from now till end on August to %44 will send some Alts 5 to 10 X then all the market will dump till the end of the year and the dump will be brutal

Brutal means : bitcoin down %65 and altcoins %90 from the upcoming August mini Altseason run. which actually Alts prices will be cheaper than now ( today )

eventually BTC.D going down to %20

Not a financial advice

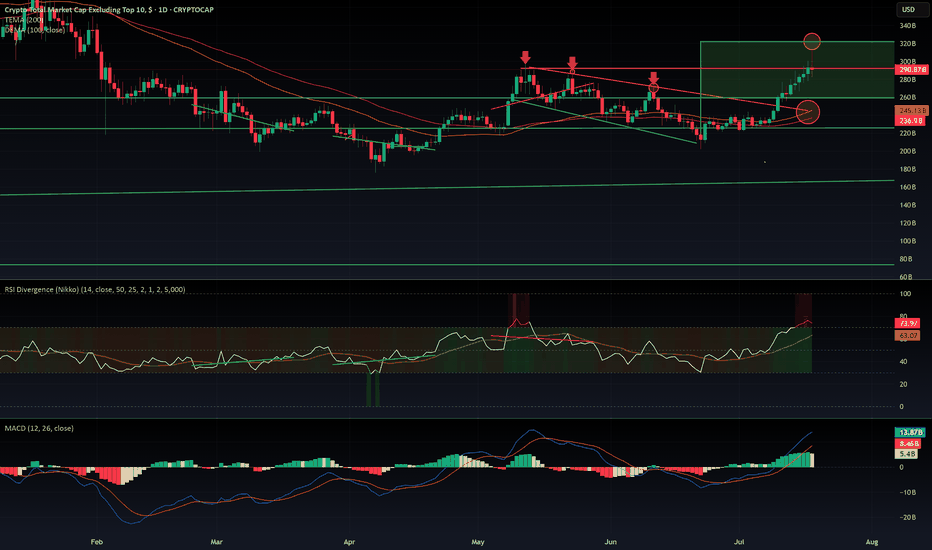

$OTHERS rejected from $320 B resistance. What is next?CRYPTOCAP:OTHERS Rejected at $320B: Is the Altseason on Pause?

CRYPTOCAP:OTHERS just got rejected at the $320B resistance after a decent pump — the kind that usually signals the start of an altseason. But if we dig into the indicators, warning signs are flashing:

- MACD is sitting in overbought territory.

- RSI is heavily extended, signaling potential exhaustion.

- EMA 100 & 200 are colliding with the top of a previous downtrend channel — a zone that historically acted as strong resistance.

The rejection was sharp. So what's next? Are we entering a range between $320B and $260B? It's quite possible. The aIf you wantltcoin market now sits at a decision point: either it keeps pushing higher or takes a breather — potentially pausing the rally until September.

Historically, August is a slow month in the West. People go on vacation, volumes drop, and markets tend to cool off. This seasonal pattern supports the idea of a consolidation phase before a stronger second leg of altseason kicks off in mid-September and carries into Q4.

I’m not posting too many ideas lately because the market landscape has changed. The new players aren’t just trading — they’re manipulating flows with massive capital to hunt retail liquidity.

They’re also using far more sophisticated tools than our classic MACD and RSI — including AI-powered indicators and multi-layered analytics that are beyond retail reach.

In this new environment, predictions are harder and risk is higher.

🧠 Do Your Own Research (DYOR), stay sharp, and don’t blindly trust social influencers.

Now We WaitTrading Fam,

In my last video, I mentioned how I had been learning to trade more patiently, giving myself those high-quality, high-probability winning trades. This is a perfect time to illustrate that strategy.

With our altcoin market overheated, I am expecting more rest, accumulation, and pullback in many of our alts. The selection of even decent entries is very slim. It's time for us to sit back, wait, and let the trades come to us again.

The TOTAL chart shows us more clearly what may occur. Let's discuss a few important indicators on this chart.

First of all, we see my indicator popped a BUY signal right around 3T. We had a safe bet at that point; we were going to see quite a bit of buying action in the altcoin space. Indeed, we did. The altcoin market increased by about 25 percent and went all the way to 4T, at which point the sellers came back in. Now, we are in the middle of a little bit of a pullback, and I think there could be more to come. I am expecting at least a touch of that rising 50-day SMA, currently at 3.4T.

Supporting my thesis here are the crossover of the RSI to the downside of its 14-day MA, the MACD cross, the Chalkin money flow decrease, and the HMV indicating high volume during these sell-offs. Leverage is being liquidated. This is healthy!

It is possible that the total market cap could drop even further, all the way down to that 3.24T PoC on the VRVP. That is where we see most of our volume in alts has occurred. Keep these two targets in mind. Once hit, I will begin looking for more trade entries once again.

✌️Stew

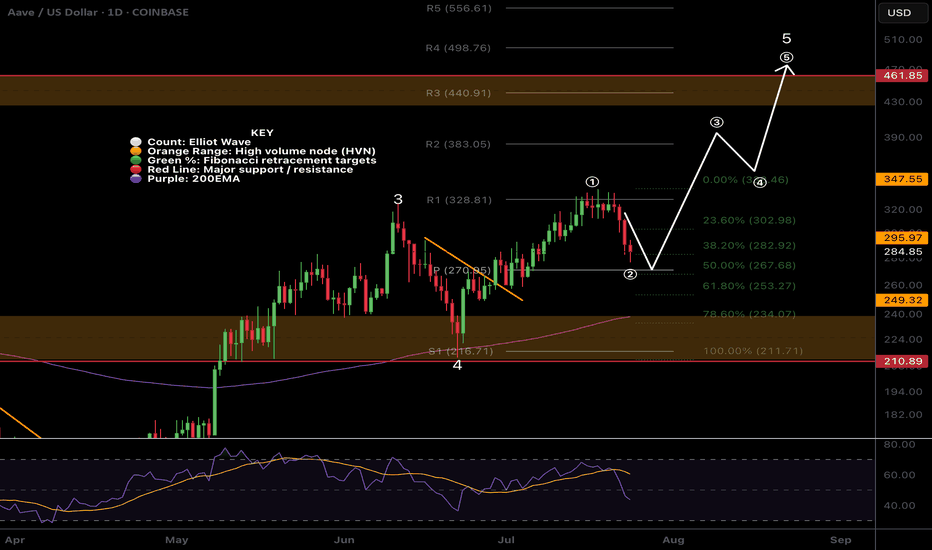

$AAVE Daily Hidden Bullish divergence?CRYPTOCAP:AAVE and alts begin their retracement Wednesday but is this a long term top or just local? Im betting we have a higher to go this summer..

Hidden daily bullish divergence is printing on RSI at the daily pivot and 0.5 Fibonacci retracement which should all act as strong support provided BTC doesn't dump.

The 'alt-coin golden pocket' Fibonacci retracement 0.786 sits at the descending daily 200EMA and High Volume Node support offering a secondary target for reversal and continued upside.

Losing this and closing below would flip me bearish until a new bullish signal emerges.

Safe trading.

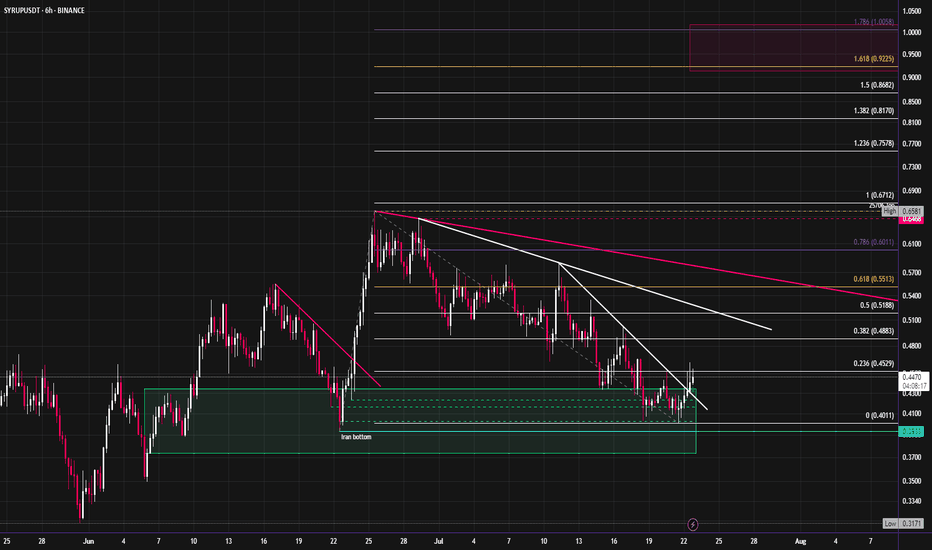

Syrup looks ready to start moving towards new ATH'sCRYPTOCAP:SYRUP has started to break out of its downtrend after revisiting the June lows. It has outperformed most of the market since April, with this month's pullback being an exception. I expect an aggressive move up into new highs. The fibs around $1 look like a good target for the short term, this would also be ~1b mc.

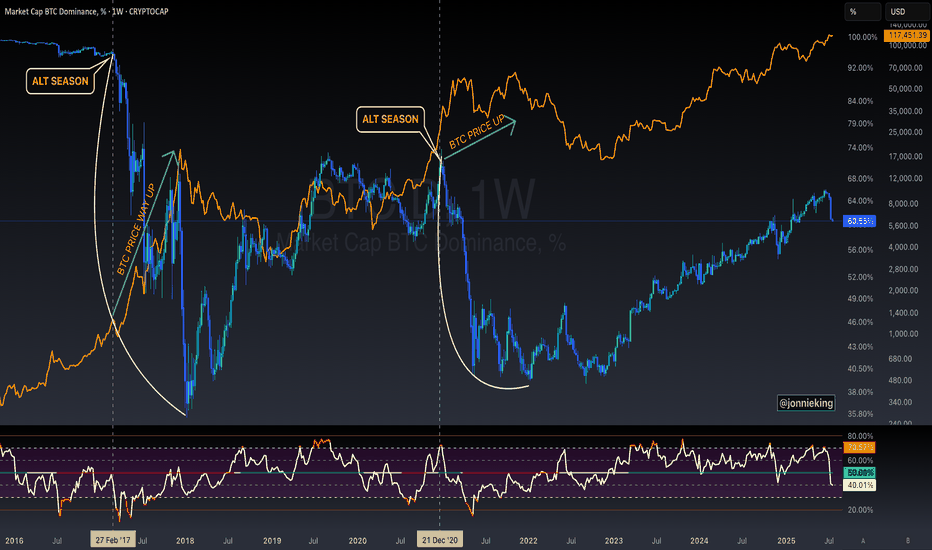

$BTC Will Go Up Alongside Alt SeasonSomeone posted on one of my tweets the following:

" Jonnie my bro, the only problem for me right now is that btc didnt top yet. You also talked how btc shoud top around 200k range. Alt season can only come when btc reach top"

MYTH DEBUNKED ✅

CRYPTOCAP:BTC does NOT need to top in order for Alt Season to commence.

Both can and will occur in tandem 🤝

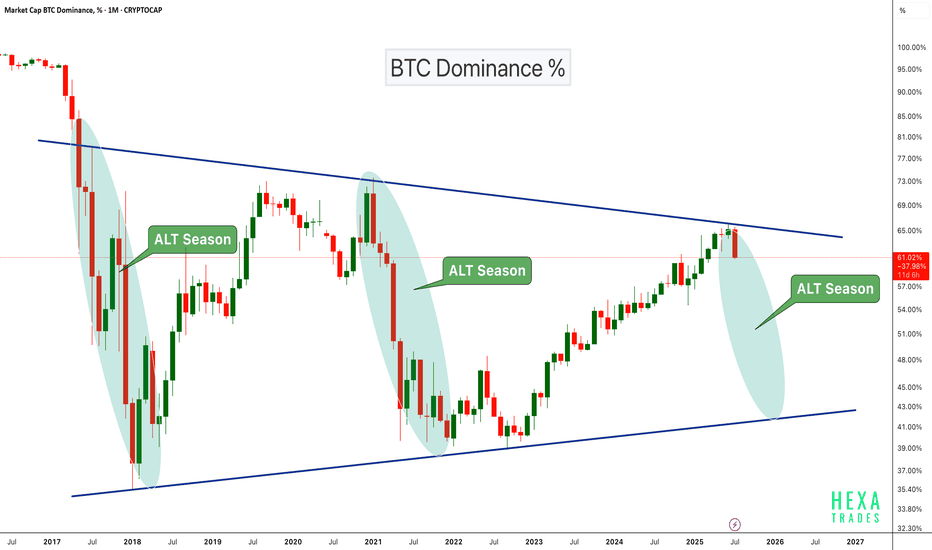

Altseason Loading?BTC Dominance chart has once again respected the long-term descending trendline resistance, showing a sharp monthly rejection. Historically, similar rejections have marked the beginning of ALT seasons, where capital flows out of Bitcoin into altcoins, boosting their performance significantly.

Chart Highlights:

-Major triangle pattern since 2017

-Clear rejections from the upper trendline coincide with previous ALT seasons (2018, 2021)

-Current rejection resembles those past cycles

-A move down in dominance could fuel strong altcoin rallies

If BTC dominance continues to decline, we could be entering another powerful altcoin season in the coming months.

Cheers

Hexa🧘♀️

CRYPTOCAP:BTC.D BINANCE:BTCUSDT

DOGE | Gearing up For a BIG MOVEDoge is looking mighty bullish after establishing a clear bottom.

Together with confirmation from BTC, we can safely say that altseason is yet ahead of us. BTC's recent increase show that the bullish impulse is still upon us. And after ETH increases, the rest of the altcoin market will follow suit as per usual.

DOGE is bullish because:

✅ Clear bottom

✅ Higher lows, daily looking to reclaim the moving averages:

✅ Altseason upon us after ETH increase

Ultimately, we need to wait for confirmation - if THIS major resistance zone is cleared (in other words if daily candles close ABOVE this zone) then we're full bull mode.

________________

BINANCE:DOGEUSDT

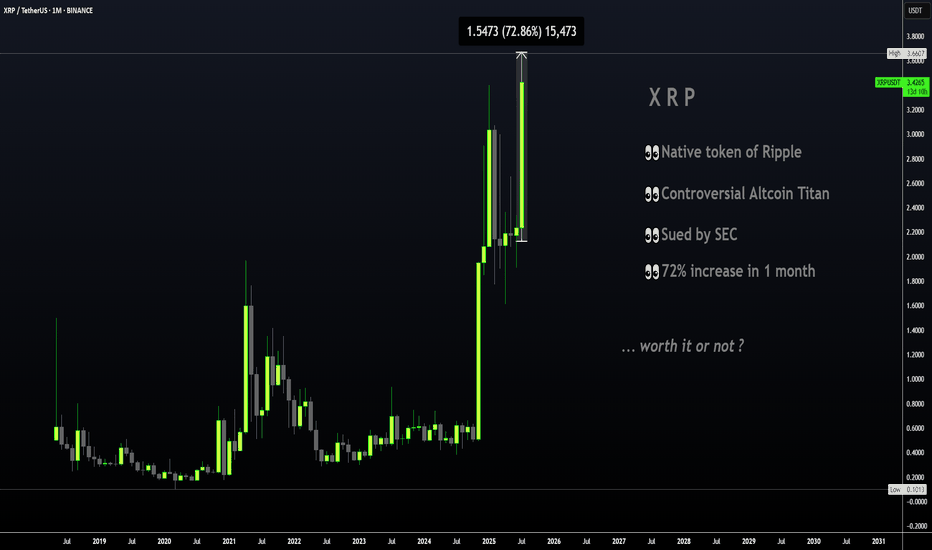

XRP | Great TP Zone is HERE for HODLERSXRP has seen a 62% increase since breaking out above the moving averages in the daily timeframe.

The previous time XRP broke out above the moving averages in the daily, the price increased around 440%:

However, with XRP being the ultimate pumper and dumper, I'll take my chances at 62%! Because this bull run has been anything but ordinary and it's best to avoid being too greedy. The price of XRP falls extremely quick, just as quick as it rises.. ( Maybe not overnight but you know, it has happened before ).

If you're one of few who bought around $1, or heck even later at $2, this is a solid increase and it should not be taken for granted. XRP has gone LONG periods without increases and often stayed behind making new ATH's when other cycles have come and gone (twice), as other alts make new ATH's. Over the years, I've made extensive posts on XRP; documented its use case, followed the SEC case closely and yet, XRP still remains one of the strangest and most unpredictable alts I have ever tried to analyze. Long term followers will remember that a I was bullish in 2018/2019 and then slowly became uninterested up until the point of negative towards XRP for probably the past 3-4 years.

This is not only because of the lagging price compared to other older alts that soared like ETH and even Litecoin. Sure we did not see the growth and the taco stand ( who remembers ) just kept dumping on the market... But the entire "scandal" of the actors marketing/pimping, the dumping behind the scenes by executives to fund Ripple in early days, the lawsuit etc. was just such a colossal mess that I even wonder how XRP is still alive and kicking today.

All I'm saying is that this is truly a spectacular moment - it's hard to even imagine cripple crossed $3 after years and years of waiting on XRP when other alts x1000% and beyond. Point being - Don't miss it! Trading only works when you take profits.

________________________

BINANCE:XRPUSDT

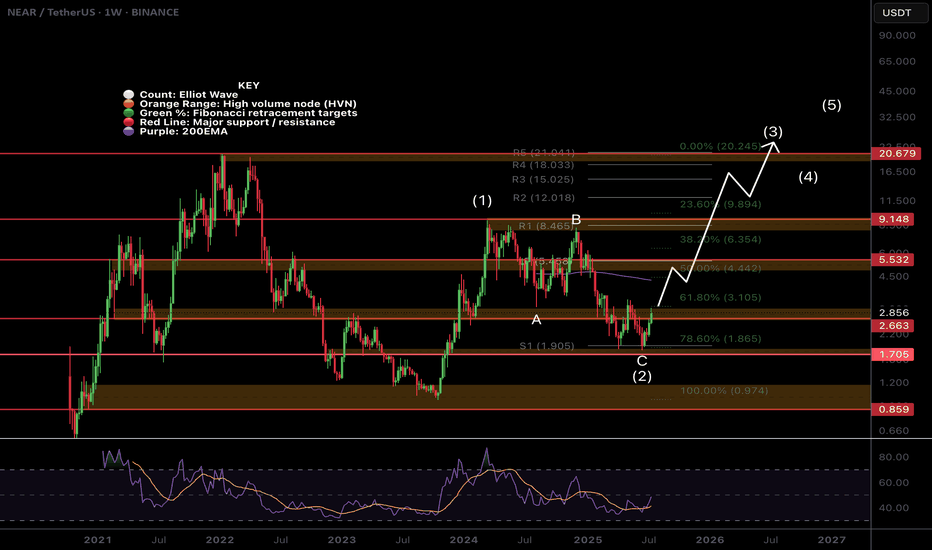

$NEAR Weekly TextBook Elliot Wave!CBOE:NEAR Weekly chart is a great demonstration of the text book motif wave followed by ABC corrective wave.

Bullish divergence has printed on the weekly RSI at the S1 weekly pivot support and the 'alt-coin golden pocket' 0.786 Fibonacci retracement. Price is closing in the major resistance High Volume Node.

The upside target is the newly printed weekly 200EMA followed by the weekly pivot and major resistance HVN just above $5.

A terminal target for this cycle may only see NEAR hitting all time highs around $21, the R5 weekly pivot point.

Safe trading

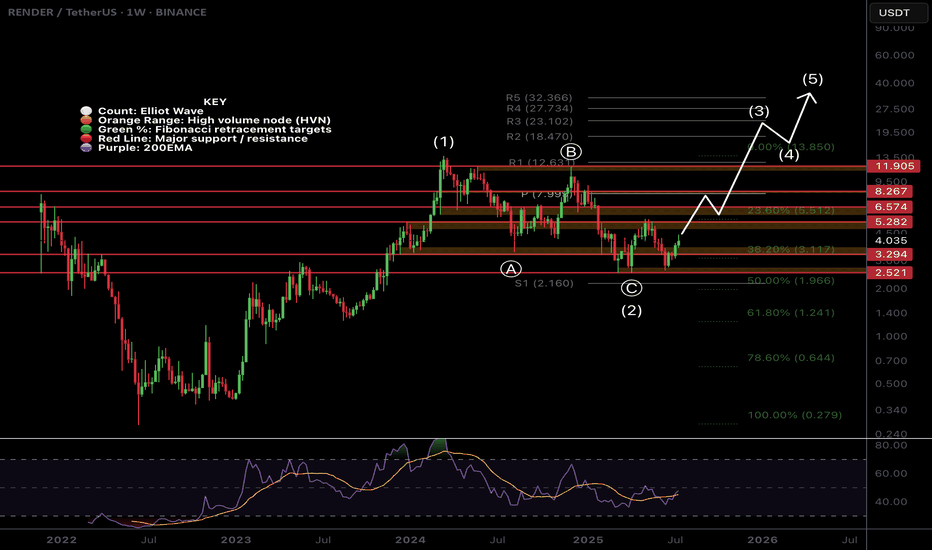

$RENDER Weekly Brings Clarity!CRYPTOCAP:RENDER weekly chart shows long term strength through the depth of the Fibonacci retracement not even reaching 0.5.

The depth of the recent swing low been so close wave (C) does concern me that the larger correction is not yet over and maybe price does want to visit the 'alt-coin' golden pocket of the 0.618-0.768 Fib retracement Where the would be a High Volume Node (not drawn).

For now the upside target is the weekly pivot but the local chart has a lot of work to do first with daily 200EMA!

Safe trading

$RENDER At Major Resistance!CRYPTOCAP:RENDER has been relatively weak. Looking at the local chart it appears we have finished a wave (3) at the daily 200EMA and descending resistance.

Price has overcome the High Volume Node (HVN) support flipped resistance but a strong at coin pull could see fresh lows for Render.

There is also daily bearish divergence on the RSI.

The Elliot Wave count could also be an ABC corrective wave up which has now terminated.

If its a new motif wave and a major bottom has formed , wave 2 should find support at the HVN, daily pivot and 'alt-coin' golden pocket between 0.168 and 0.782 Fibonacci retracement

Safe trading

Is Your Altcoin on the Chopping Block?-Update: Originally posted on July 8, 2025… but swiftly vanished into the void by a moderator (rookie mistake—I neglected the sacred posting rules). Turns out, publishing has rules… that I did not interpret accurately?

To my loyal circle of 5 followers: if this feels like déjà vu, my sincerest apologies for the rerun. But with the winds shifting and the drums beating for alts season, I figured it was worth a resurrection.

Let the thrills—and the calls—begin. 🎭📈

Whenever you see “-Update:” that’s the latest as of today — 07/18/25.

Is Your Altcoin on the Chopping Block? 🪓

Brace yourself—this might sting.

Odds are, your favorite altcoin is walking a tightrope. And while I’m not here to spread doom, I am here to give you a wake-up call. Don’t shoot the messenger.

TradingView recently dropped a chart that cuts through the noise: Total3ESBTC.

It’s a ratio of the Total Crypto Market Cap (minus BTC, ETH, and stablecoins) to Bitcoin.

Translation?

👉 A clear, undistorted look at how the altcoin market is actually doing—without ETH clouding the view or stablecoins muddying the waters.

Think of it like night-vision goggles for spotting altcoin strength—or weakness—in the shadows of BTC dominance.

Perfect tool to sniff out market rotation—that sweet spot where Bitcoin hands the baton to alts or rips it back.

So why should you care?

Because the writing's on the wall... and most altcoins might not survive what's coming.

Let’s break it down:

ZOOMED OUT – MONTHLY VIEW 🔭

Before every major altcoin run, there’s always a major low.

You’ll notice three big ones:

🔴 March 2017 (Pink Line)

🟣 Dec 2017 (Purple Line)

🟢 Jan 2021 (Green Line)

Yes, some individual alts have pumped. A few even went full parabolic.

But if altcoins as a whole were ready to fly? They would've taken off already.

-Update: Yes, they finally did it this week… but hold that excitement—there’s more to the story.

Instead, the altcoin ratio broke a critical support (White Line) back in May... and even closed below it. That’s not bullish—it’s a red flag flapping in the wind.

– Update: We just sliced through that white line, but for most alt’s to stay strong, we need a monthly close above it.

Strangely enough (or coincidental, if you believe in coincidences) ...

🗓️ All the major altcoin market highs happened in MAY.

Not once. Not twice. Every. Single. Time.

🔴 May 2017

🟣 May 2018

🟢 May 2021

Call it coincidence. Call it cycle magic.

Maybe it’s a message from the crypto gods—and they don’t whisper for no reason.

So if we just had another May, and the ratio is still sliding with no reversal in sight… ask yourself:

Was that the high?

Or are we still heading toward the low that resets the board?

Here’s the hard pill 💊

If altcoins are ever going to go up again, odds are they’ll need to hit one of these historical lows first.

That’s not a prediction. It’s just how the markets have moved before major alt run.

📉 That means more pain ahead.

We’re talking potential drops of:

🔻 -32% to revisit Dec '17 levels

🔻 -51% to retest Jan '21 lows

🔻 -85% if we go full wipeout to March '17

Harsh? Yeah.

But better you hear it now than wonder “what happened?” when the floor caves in.

The worst part?

Most won’t believe this until it’s already too late.

-Update: Those lows haven’t been tested yet—might be wise to hold off on loading your bags to the brim. Patience pays.

Now here’s the uncomfortable twist:

There’s a legit case to be made that we may never see another “real” alt season again.

Why?

🪙 Liquidity is being siphoned by stablecoins

📈 Speculation is migrating to AI stocks

⚠️ Risk appetite is narrowing

Altcoins used to be the Wild West. Now? They’re the illiquid backyard of a global casino.

BUT… Let’s put on our degen-tinted glasses for a second.

Suppose the Fed hits the panic button:

🛩️ Rates cut

💸 QE returns

🚁 Helicopter money rains from the sky (not that they’d ever do that… right?)

– Update: Crypto Week is announced and broadcasted to the herd.

What happens then?

That’s when this chart—this ugly, broken, bleeding chart—might finally spring back to life.

– Update: Clearing those lows would’ve made this week feel a lot more convincing. But if you’re looking for signs of life—ETH/BTC chart might just be lighting the way. 🚀

Stay Sharp! 🐋R hUNTING!

THIS IS NOT FINANCIAL ADVICE. FOR EDUTAINMENT PUPOSES ONLY.

ETH relative to AltcoinsI fee like at this current point as we see altcoin pairs bleed against ETH and BTC while putting in lower lows while Eth puts in higher highs we will not see the altseason we are hoping for until altcoin pairs hit here range lows which I can see happen end of Q3 into the start of Q4 but until then they can still rise as ETH.D continues its rally but I feel until altcoins reach its range lows being the .25 lvl on (TOTAL3-USDT)/BTC we will not see that face melting rally we are looking for.

MELANIA Main Trend. Memes with high hype and risk. July 17, 2025Main trend. Time frame 3 days (less is not necessary). Showed conditional levels (zones near them), and percentages of decrease from the maximum (note, I showed from the zone where the main retail of “affected investors” began to connect, that is, the maximum is much lower than on the chart).

Note that now a conditionally large volume “enters”, it is displayed on the price chart (this is important), a sideways squeeze has begun. Local impulse and rollback are now in the moment.

Also showed a large % (intentionally) for orientation, from minimum to maximum zones. On such hype assets, as a rule, medium-term - long-term holding (bought in the right zone) shows significant income.

All level zones are conditional, due to liquidity, but the price will most likely “play” after the breakdown of the downward trend in this range, another alt season (which many do not notice due to the slow breakdown of their opinions, news chaff, and inadequate goals). As for me, above these huge % (resistance zone, or up to 0.869, so as not to waste time), you should get rid of this meme, or its % from the previous position should already be minimal (5-10%).

There are hype zones, there are zones of potential gain (fading hype, interest, and a large % from the maximums). On such assets of "manual trading", where cryptocurrency has no value, it is always sold little by little (many do not understand this), but in order to sell, you sometimes need to make interest, and "instill hope" in previously deceived "investors" who want to get out at least at a loss (it is unlikely to happen). At the right time, 1-2 tweets - statements from the "powers that be" - are pumped up due to low liquidity by a huge percentage.

On such cryptocurrencies, you do not need to guess the “bottom” or maximums. Pricing is formed differently here, as there is no real supply/demand, utility, but only psychology and "hitting the jackpot" of gambling addicts. Be smarter. Diversify such assets, distribute the risk in advance. Make purchases/sales according to plan, without emotions.

When the price goes up, you think it will go much higher, but even if it does, you must sell a certain volume in certain planned zones, without any emotions or sense of lost profit.

Similarly, when the price goes down, people are driven by fear and refuse to buy, and these were probably the minimums of fear.

The average price of the set and reset is important. No minimums and maximums are needed. Be patient and consistent in your actions and plans.

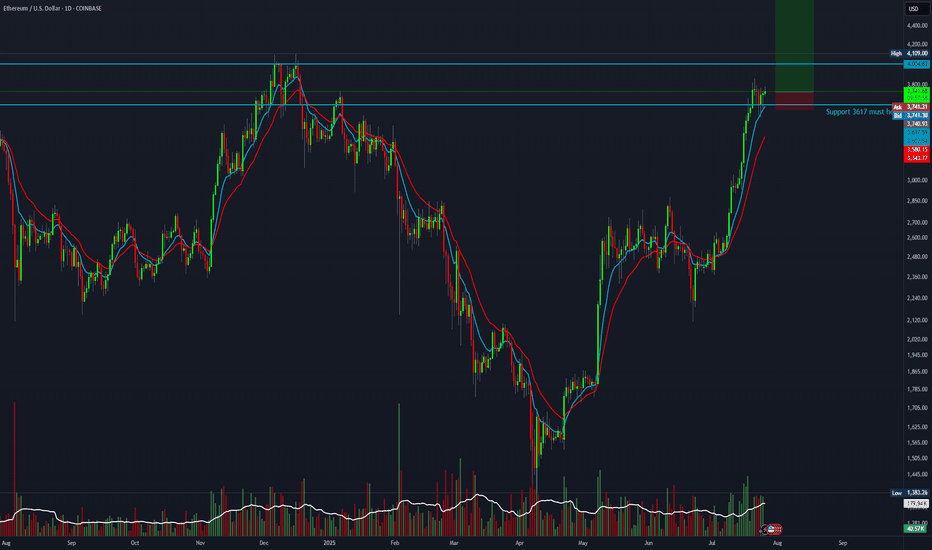

$ETH Pullback to $2630 Support?CRYPTOCAP:ETH has a great week pushing through resistance and making new local highs after testing the daily 200EMA and daily pivot as support.

Price is likely to retest the swing high and previous resistance as support around $2600-2700, also the .382 Fibonacci retracement.

RSI is printing daily bearish divergence in overbought from the wave (3) top to current as it did at the wave (5) top seeing large rejection. The retest of $2600 would reset RSI.

Price is ultimately set to test $3600 as the next resistance if the Elliot wave count is correct.

Analysis is invalidated below $2050

Safe trading

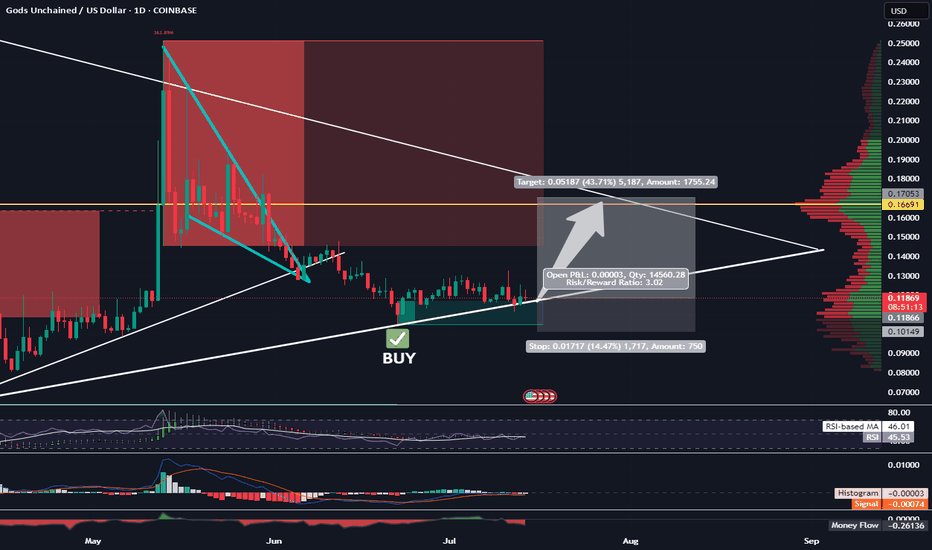

Long GODS - Target 17 Cents - 1:3 RRRTrading Fam,

As I continue to gain experience with my AI-created indicator, I am learning to remain patient and wait for the perfect setups. We have one here on GODS. You can see that we've returned to the bottom of a larger triangle and are using it as support. Additionally, we are within a favorable liquidity block where buyers tend to accelerate the volume. My indicator gave the BUY signal 2 weeks ago, and there has been plenty of sideways accumulation since the signal flashed. Probability suggest that GODS will pump soon.

I'll be targeting 17 cents with a SL at 10 for a 1:3 RRR.

Let's go!

Stew

Balla is still Bullish on BITCOIN. Cup & Handle pattern. The trend is still our friend.

I still see bullish developments in the price action.

We must have patience.

Dips still must be bought.

The plan hasn't changed.

We still aiming for that time period of 9 -15 months post #BTC Halving.

We are only one month down :)