XAL/USD "The Aluminium" Metal Market Heist Plan (Swing/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

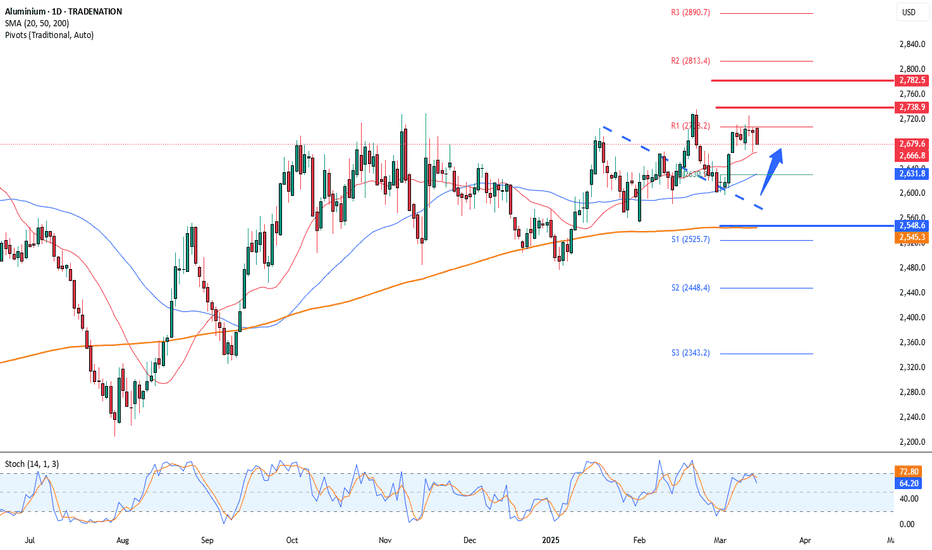

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAL/USD "The Aluminium" Metal Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

Stop Loss 🛑: Thief SL placed at 2630 (Swing/Day) Using the 4H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 2480 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

XAL/USD "The Aluminium" Metal Market Heist Plan (Swing/Day) is currently experiencing a bearishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Aluminium

Aluminium The Week Ahead 17th March ‘25Aluminium maintains a bullish sentiment, supported by a longer-term uptrend. However, recent price action shows sideways consolidation, indicating a potential breakout or corrective move in the near term.

Key Levels to Watch

Resistance Levels: 2708, 2740, 2780

Support Levels: 2660, 2544 (200 DMA), 2480, 2360

Bullish Scenario

A strong breakout above the 2660 resistance level could confirm bullish continuation, targeting 2708, followed by 2740 and 2780 in the longer term. If price sustains above 2660, it would signal renewed buying interest, reinforcing the prevailing uptrend.

Bearish Scenario

A confirmed breakdown below 2544 (200 DMA), with a daily close under this level, would weaken the bullish outlook. This could open the door for further declines toward 2480, with extended downside risk toward 2360 if selling pressure persists.

Conclusion

Aluminium remains bullish, but price action around 2660 will determine the next move. A breakout above this level could drive further gains, while a failure to hold above key support at 2544 may shift momentum toward a deeper correction. Traders should monitor these levels closely for confirmation of trend direction.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Aluminium The Week Ahead 10th March '25Aluminium maintains a bullish sentiment, supported by a longer-term uptrend. However, recent price action shows sideways consolidation, indicating a potential breakout or corrective move in the near term.

Key Levels to Watch

Resistance Levels: 2708, 2740, 2780

Support Levels: 2660, 2544 (200 DMA), 2480, 2360

Bullish Scenario

A strong breakout above the 2660 resistance level could confirm bullish continuation, targeting 2708, followed by 2740 and 2780 in the longer term. If price sustains above 2660, it would signal renewed buying interest, reinforcing the prevailing uptrend.

Bearish Scenario

A confirmed breakdown below 2544 (200 DMA), with a daily close under this level, would weaken the bullish outlook. This could open the door for further declines toward 2480, with extended downside risk toward 2360 if selling pressure persists.

Conclusion

Aluminium remains bullish, but price action around 2660 will determine the next move. A breakout above this level could drive further gains, while a failure to hold above key support at 2544 may shift momentum toward a deeper correction. Traders should monitor these levels closely for confirmation of trend direction.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

ALUMINIUM Bullish Flag breakout The Week Ahead 24 Feb ‘25The ALUMINIUM price action sentiment appears bullish, supported by the longer-term prevailing uptrend. The recent intraday price action appears to be a sideways consolidation bullish flag pattern.

The key trading level is at the 2593 level, the previous consolidation price range and also the 50 Day Moving Average zone. A corrective pullback from the current levels and a bullish bounce back from the 2593 level could target the upside resistance at 2670 followed by the 2708 and 2730 levels over the longer timeframe.

Alternatively, a confirmed loss of the 2593 support and a daily close below that level would negate the bullish outlook opening the way for a further retracement and a retest of the 2540 (200 Day Moving Average) support level followed by 2480.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Aluminium The Week Ahead 17th Feb 25The ALUMINIUM price action sentiment appears bullish, supported by the longer-term prevailing uptrend. The recent intraday price action appears to be a sideways consolidation bullish flag pattern.

The key trading level is at the 2593 level, the previous consolidation price range and also the 50 Day Moving Average zone. A corrective pullback from the current levels and a bullish bounce back from the 2593 level could target the upside resistance at 2670 followed by the 2708 and 2730 levels over the longer timeframe.

Alternatively, a confirmed loss of the 2593 support and a daily close below that level would negate the bullish outlook opening the way for a further retracement and a retest of 2540 (200 Day Moving Average) support level followed by 2480.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

XAL/USD "ALUMINIUM" Metal Market Heist Plan on Bullish🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAL/USD "ALUMINIUM" Metal market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. Be wealthy and safe trade.💪🏆🎉

Entry 📈 : Traders & Thieves with New Entry A bull trade can be initiated at any price level.

However I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Using the 2H period, the recent / nearest low or high level.

Goal 🎯: 2750.000 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Fundamental & Macro Outlook 📰🗞️

Based on the fundamental & macro analysis, I would expecting a bullish outlook for XAL/USD (Aluminum)

Demand and Supply: Aluminum demand has been rising due to its increasing use in the automotive, construction, and packaging industries. However, supply has also been growing, mainly driven by China's production.

Inventory Levels: Global aluminum inventories have been declining, which could support prices.

Production Costs: Aluminum production costs have been rising due to increasing energy costs, particularly in China.

Trade Tensions: Trade tensions between the US and China have been impacting aluminum prices, as China is a significant producer and consumer of aluminum.

Macro Analysis---

Global Economy: The global economy has been slowing down, which could negatively impact aluminum demand.

Interest Rates: Low interest rates in major economies could support aluminum prices by increasing demand for commodities.

Commodity Prices: Other commodity prices, such as copper and zinc, have been rising, which could support aluminum prices.

Currency: The US dollar has been appreciating, which could negatively impact aluminum prices.

Sentiment Metrics---

Sentiment Score: 0.15 (neutral)

Bullish Sentiment Index: 45 (out of 100)

Bearish Sentiment Index: 30 (out of 100)

Neutral Sentiment Index: 25 (out of 100)

Insights:

The overall sentiment is neutral, indicating that market participants are uncertain about the future direction of aluminum prices.

The bullish sentiment is slightly higher than the bearish sentiment, suggesting that some market participants are optimistic about aluminum prices.

The neutral sentiment is significant, indicating that many market participants are waiting for clearer market signals before making a decision.

Recommendation---

Based on the sentiment analysis, it's recommended to adopt a neutral stance on XAL/USD, with a slight bias towards a bullish trend. However, it's essential to continue monitoring market developments and adjust your strategy accordingly.

Disclaimer---Sentiment analysis is subjective and based on publicly available data. It should not be considered as investment advice. Trading commodities involves risk, and you could lose some or all of your investment. Always do your own research and consider multiple sources before making a trade.

Trading Alert⚠️ : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

XAL/USD "ALUMINIUM" Market Money Heist Plan on Bullish SideHii! My Dear Robbers / Money Makers & Losers, 🤑 💰

This is our master plan to Heist XAL/USD "ALUMINIUM" Market Market based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal / Trap at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Entry 📈 : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent / Nearest Low Point take entry in pullback.

Stop Loss 🛑 : Recent Swing Low using 2H timeframe

Attention for Scalpers : Focus to scalp only on Long side, If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss 🚫🚏. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

💖Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

Reynolds Consumer Products | REYN | Long at $27.00Reynolds Consumer Products NASDAQ:REYN is a "boring" company with excellent fundamentals. P/E of 15x, 3.35% dividend yield, low debt, and a 53M float. The Director just scooped up $196,000 in shares and earnings are expected to growth (while slowly) over the next few years. It recently tested the low of my historical simple move average (teal and white lines on the chart) and it looks primed for a move up to fill the price gaps. Thus, at $27.00, NASDAQ:REYN is in a personal buy zone.

Target #1 = $29.00

Target #2 = $31.00

Target #3 = $34.00

Aluminium Market Money Heist Plan on Bullish Side.This is our master plan to Heist Aluminium Market based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal / Trap at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Attention for Scalpers : If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Note: If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money.

Entry : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent / Nearest Swing Low

Stop Loss 🛑 : Recent Swing Low using 2H timeframe

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

Aluminium XAL/USD Bullish Robbery Plan To steal the moneyMy Dear Robbers / Traders,

This is our master plan to Heist XAL/USD Aluminium based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Note: If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money.

Entry : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent Swing Low

Stop Loss : Recent Swing Low using 2h timeframe

Warning : Fundamental Analysis comes against our robbery plan. our plan will be ruined smash the Stop Loss. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style

UPDATE Hulamin showing strong upside after it's break upto R3.91We were very close to the analysis being null and void.

But then, we had a change of wind and the market bounced off the lows heading back to the range.

It then broke up and is now on the way to the next target at R3.91

Looks good still.

Hulamin poised for great upside in 2024Cup and handle has formed on Hulamin since 10 May 2023.

With these Penny STocks and less liquid markets, they can take a long time to form patterns and formations.

But when they breakout, they can rocket in the direction of the breakout.

I like that it's restested the support and brim level, and is showing that the buying is accumulating.

And that that price is above the 200MA.

These are always risky markets to dabble into, but they're fun nevertheless.

Target R3.91

FUNDAMENTAL ANALYSIS:

Growth in the Can Market:

Hulamin has been focusing on expanding its presence in the lucrative can market. This strategic move likely increased investor confidence in the company's growth prospects and operational focus.

Aluminium Prices:

The price of aluminium has been testing a 13-year high, which positively impacts Hulamin's valuation and profitability, as it is an aluminium products group.

Stock Movement and Company Talks:

The company's stock has seen significant movement, with its value almost doubling in a week. This surge is partly due to Hulamin being in talks that may affect its stock, though details of these discussions were not disclosed.

ALUMINIUM PRICES MIGHT BE PULLED UP DUE TO CHINA DEMANDChina's aluminum market in 2023 stands out for its resilience, with prices on the Shanghai Futures Exchange (SHFE) bucking global trends by climbing over 1%, while the London Metal Exchange (LME) saw an 8% slump. This divergence is largely credited to the strength of China's green sector and decarbonization efforts. An open arbitrage window, created by SHFE outperforming LME, has led to a substantial increase in aluminum imports into China, mainly from Russia due to sanctions imposed by Western buyers after Russia's invasion of Ukraine. Despite the surge in imports, domestic aluminum production in China has reached new highs, partly due to an improved hydropower supply in Yunnan province. However, potential disruptions during the upcoming dry season could impact production and increase imports. Low domestic aluminum inventories underscore robust domestic demand, with SHFE stocks at their lowest levels since March 2019.

Beijing's decarbonization initiatives have driven aluminum demand, particularly in renewable energy-related manufacturing. Notably, the rapid growth of China's new energy vehicles (NEV) sector and the critical role of aluminum in battery electric vehicles highlight its significance in this industry. The solar sector, another major aluminum consumer, continues to expand, with China leading in solar photovoltaic (PV) capacity additions. This growth in green sectors is expected to counterbalance weaknesses in traditional sectors, sustaining demand for aluminum. China's aluminum market exemplifies a unique blend of domestic resilience, increasing imports, and a strong emphasis on green industries, all contributing to the sector's dynamics in 2023.

On a technical note, MACD and RSI are still in the neutral and sell zone, but are rising up and buy signals are starting to form.

If the trend continues, the price might reach levels of 2241, in the opposite scenario the price might revert to levels of 2178.

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.

#Aluminium - Could reach $2500 and $2700Hi guys! 👋🏻

🔔 There's no clean energy without Aliminium, which is widely used in electric vehicle and solar panels production

🔔 One of the largest consumers of Aluminium - China is expected to increase the demand for the metal in its e-vehicle, clean energy and airplane production.

🔔 Other fundamentals which support higher demand for metals are: global ecnomies raise their expenses on military, renewing their military equipment.

🔔 Aluminium daily chart

www.tradingview.com

✊🏻 Good luck with your trades! ✊🏻

If you like the idea hit the 👍🏻 button, follow me for more ideas.

Tailwinds build for Aluminium Paradoxically, aluminium was one of the worst performing base metals over the past month (22 May to 23 June 2023) despite the bauxite ore ban potentially tightening the market. In 2022, Indonesia produced some 21 million tonnes of bauxite, according to data from the US Geological Survey, making it the world’s fifth-largest producer. Almost 85 percent was exported overseas. According to data from the International Aluminium Institute, global production of primary aluminium registered a slight increase of 0.2% month-on-month in May 2023. The information portal Shanghai Metals Markets has reported that aluminium producers in the Yunnan region in China have been permitted since 17 June to ramp their operations up again after having been forced to scale them back since last autumn because electricity was rationed due to

drought. However, the ongoing heatwaves in many parts of China may drive production halts back again.

Aluminium futures inventory is 21% lower than 3 months ago, mainly as a result of Shanghai Futures Exchange inventory declining over that time window.

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Aluminium CURRENTLY SHORT Aluminium trend short

Aluminium prices have fallen over 10% since late January, which originally saw prices spike above HKEX:2 ,600 per tonne as the ending of Covid-19 restrictions in China saw demand for the metal rise.

Prior to this aluminium prices had dropped about 40% below record levels in late November 2022 due to weak demand outlook for the industrial metal.

Should I invest in aluminium?

Aluminium is a versatile, lightweight, corrosion-resistant and recyclable metal that has numerous use cases in construction, automobile, aerospace, packaging, electronics and many other industries.

It is the third most abundant element in the Earth’s crust, after oxygen and silicon.

According to Russian-based UC Rusal, one of the largest aluminium-producing companies in the world, construction and transportation make up over 50% of aluminium consumption by industry.

The shift towards electric vehicles has further increased demand for the metal. Aluminium is used in structural body frames and battery packs to keep electric cars light and improve battery efficiency.

Because the metal is easy to recycle, 75% of all aluminium ever produced being still in use, according to Norwegian aluminium company Norsk Hyrdo.

Environment-friendly initiatives by companies like Apple (AAPL) have prompted the increased use of recycled aluminium, alongside recycled tungsten, rare earths and cobalt.

Another factor is that producing aluminium from ore is an expensive, energy-intensive process. The cost of fuel, especially coal, which is still used extensively in major aluminium-producing countries such as China and India, influences the aluminium price forecast.

Aluminium companies such as Indian-based Hindalco have acquired coal mines to support aluminium production.

How is aluminium produced? Bauxite is the raw material used to produce the world’s second most-consumed metal. After bauxite is mined and ground, aluminium oxide (alumina) is extracted from the ore through refining.

The metal is then extracted from alumina via electrolytic reduction, which is highly power-intensive. Molten aluminium is then cast into extrusion ingots, sheet ingots and foundry alloys depending on its use.

Rise to record highs and recent fall

Aluminium prices rebounded with strength in 2021 amid the reopening of economies following Covid-19 lockdowns. Developments in China, which accounted for half of global aluminium production in 2020, dominated the price action for the industrial metal throughout the year.

By October 2021, aluminium had surged to 13-year highs as China’s policy to “aim to have CO2 emissions peak before 2030 and achieve carbon neutrality before 2060” brought greenhouse gas-emitting smelters to a grinding halt.

The aluminium supply chain was further disrupted by recurring power shortages in China as coal plants shut down to meet state-set energy consumption targets.

Aluminium prices eased after the October 2021 peak as weakened coal prices helped lower production costs. The falls were short-lived as prices surged in late December, eclipsing the highs hit in October.

Data from Capital.com showed that aluminium spot prices surged to an all-time high of over HKEX:4 ,000 per tonne on the back of supply concerns following the Russia-Ukraine war.

Commodity prices spiked as the West announced sanctions on Russian imports. Even though direct sanctions on aluminium were not introduced, several corporations and nations have refused to do business with Russia, cutting out supply from the world’s second largest primary aluminium producer.

According to the International Aluminium Institute, Russia accounted for 6% of global aluminium output in 2021.

In 2022, the focus shifted from supply to demand. A rise in Covid cases in China and the country’s subsequent nationwide lockdowns brought its industrial centres to a standstill. Meanwhile, aggressive interest rate hikes from the US Federal Reserve (Fed) pushed the US dollar index (DXY) to a near 20-year high, denting commodity demand due to higher foreign exchange costs.

Aluminium prices dropped nearly 50% from record highs to hit a 19-month low of HKEX:2 ,076 per tonne by 28 September 2022. However, it saw a rebound from its September lows as prices rose over 14% in the next two months and ended the year at HKEX:2 ,405.

The following the ending of China’s zero-Covid policy in December, Chinese output of aluminium hit record levels. In January 2023, aluminium prices rose steadily, reaching a seven-month high of HKEX:2 ,638 on 25 January.

However, the price later corrected and by late March it has shed mosts of its gains, reaching HKEX:2 ,266.50 on 21 March. This came as the US decided impose 200% tariffs on Russian metal starting on 10 March, effectively imposing a ban on Russian aluminium imports.

As of 24 April, the price of aluminium stood at HKEX:2 ,383.50.

Analyst view: Aluminium price forecast for 2023

London-based commodity investment firm Sucden Financial said in its first-quarter metals report:

“The rally we saw in Q4 2022 and the first weeks of 2023 has stalled, as China’s re-opening has not triggered a large increase in consumption and is a services play, as well as the Fed remaining hawkish on rates. The dollar has firmed, causing metals to weaken, highlighting the fragility of move higher. Spreads are in contango, Chinese prices are mostly in discount, and weaker premiums suggests a cautious market.”

For aluminium, the commodity investment house said:

“Aluminium benefitted by the year-end from the Chinese government announcing the removal of lockdown restrictions. The sentiment has continued into the start of this year, but a traditionally quiet Chinese New Year season has meant prices found support at HKEX:2 ,350/t levels. Growing domestic stockpiles in China and weaker overseas demand meant that consumers avoided committing to long-term contracts for now, with bulls waiting for another quarter before joining the trade.”

With regards to aluminium price predictions for 2023, Shanghai Metals Market (SMM) seemingly predicted more volatility in the metals future, stating that the price showed “no signs of stabilising”.

Meanwhile, Fitch Solutions has lowered its 2023 aluminium spot price forecast from HKEX:2 ,700 to HKEX:2 ,600 per tonne.

The research firm said “supply constraints will anchor prices at their current levels” as aluminium production suffers in Europe due to high energy prices, in Russia due to sanction-related concerns and in China due to a government-implemented hard cap on smelting capacity.

Looking forward: Aluminium price forecast for 2025 and 2030

Looking to the future, there are many tailwinds for aluminium demand due to the metal’s unique properties, which range from its light weight to recyclability.

US president Joe Biden’s $1.2trn infrastructure bill, passed late last year, has allocated $550bn to fund bridges, roads and energy systems over the next five years.

“We are excited to see significant investments in public transit, electric vehicles, and charging infrastructure included in the bill,” said Norsk Hydro’s VP of finance and strategy Michael Stier in an interview with Aluminium Insider.

“All of these pieces of infrastructure will rely heavily on aluminium as a means to reduce vehicle weight, improve efficiency, and enable clever design solutions. We are particularly excited to see new developments within electric vehicle chassis design and battery systems in combination with the phase-change developments needed to normalise charging technology and infrastructure in North America.”

According to Fitch Solution’s aluminium price forecast for 2025, the metal was expected to trade at HKEX:3 ,000 per tonne. Fitch’s aluminium price forecast for 2030 saw the metal trading at HKEX:3 ,300 per tonne.

“Going forward, we expect aluminium prices to remain elevated in the coming years, as aluminium demand is supported by the accelerating shift to a green economy,” Fitch Solutions said in its long-term aluminium price forecast.

The Westpac Market Outlook November 2022 report expected aluminium to trade at HKEX:2 ,200 per tonne in December 2022. The bank’s aluminum price forecast for 2023 saw the metal trading within a range of HKEX:2 ,150 per tonne and HKEX:2 ,500 per tonne during the year. It did not give any aluminium price forecast for 2025 and 2030.

Finally, Sucden Financial said in its quarterly metals report that any doveish remarks from the Federal Reserve regarding the monetary tigthening cycle “will cause a sell-off in the dollar, giving rise to metals prices.”

"If Chinese demand returns and the dollar weakens, this could present significant volatility and price rises, compounded inflationary pressures," added Sucden Financial.

Note that analysts’ predictions can be wrong. Aluminium price forecasts shouldn’t be used as substitutes for your own research. Always conduct your own diligence and remember that your decision to trade or invest should depend on your risk tolerance, expertise in the market, portfolio size and goals.

Keep in mind that past performance doesn’t guarantee future returns, and never invest or trade money you cannot afford to lose.

Hulamin downside update to R2.25M Formation formed on Hulamin and we saw bearish signs

The market then broke below and has stayed below the neckline but is creating a somewhat Rectangle.

They buyers and investors seem to be holding the level and supporting it as much as they can.

Once catalyst and the stock will drop dramatically

200 >21> 7 - Bearish

RSI <50 and bearish divergence

Target R2.25

ABOUT:

Hulamin is an aluminium semi-fabricator business located in South Africa supplying customers across Africa and the world with an extensive range of quality products.

Supported by a sales office in South Africa and a network of international agents, the company sells to leading manufacturers and distributors across many industries around the world.

Hulamin just got a sell signal to R2.25!M Formation has formed on Daily.

Things have been looking very bad for Hulmain for the last year now.

200 >21> 7 - Bearish

RSI <50 and bearish divergence

Target R2.25

General info:

Hulamin (est. 1935) is a South African aluminium rolled products manufacturer and distributor, listed on the Johannesburg Stock Exchange (JSE).

They produce a wide range of aluminium products, including plate, sheet, and foil products.

The company has a strong focus on innovation and has developed a number of unique and patented aluminium products.

There seems to be trouble in the Aluminium space. Either there is an overcapacity, lower demand, better alternatives and higher competition or there is a shift taking place where consumers are turning more and more to renewable sources. This is going to hamper the prices further with these companies.