Aluminum Futures ( ALUMINIL ), H4 Potential for Bullish continuaTitle: Aluminum Futures ( ALUMINIL ), H4 Potential for Bullish continuation

Type: Bullish continuation

Resistance: 218.00

Pivot: 211.00

Support: 201.40

Preferred case: Looking at the H4 chart, my overall bias for ALUMINIL is bullish due to the current price crossing above the Ichimoku cloud, indicating a bullish market. If this bullish momentum continues, expect price to continue heading towards the resistance at 218.00, where the previous swing high is.

Alternative scenario: Price may head back down to retest the pivot at 211.00, where the 38.2% Fibonacci line is.

Fundamentals: There are no major news.

Aluminum

#ALUMINIUM Weekly Major Support & Resistance Levels.Providing Weekly Support and Resistance levels for next coming week based on Central Pivot Range and its major support & resistance levels of week, where price can take support and face resistance. Three black lines indicating weekly Central Pivot Range. Previous week high & low also performs as a major support and resistance levels. Can take long & short positions according to how price perfoms at particular given support & resistance levels.

AA: Upside ReclaimAA upside reclaim with strength in the sector due to windfalls in the industry. Growth in the company is expected as a result of aluminum price hikes. Alcoa is breaching the 20MA once again after bouncing off support on key 50MA & 69.98 support. Re-seen auction puts AA back on track of an upside movement towards a channel from October 2021. MACD cross observed on technicals, RSI at 55, and healthy volume. Analysts reiterated to Buy with new PTs. Price target: 84-89 // ATR: 5.47, Beta: 2.25

Industrial metals are set to witness an upcoming rally

Industrial metals are set to witness an upcoming rally after Joe Biden's $6T budget proposal, The spending plans would fund investments roads, water pipes, broadband internet, electric vehicle charging stations and advanced manufacturing research.

CENX is an industrial metal stock that's being traded within a descending channel on the 4hr time frame since March 12.

Momentum and strength indicators are supporting that the stock would move upward to hit $14.65 and $16.25 levels consequitvely on the short term.

Century Aluminum shares CENX rose 7.62% in yesterday's trading in a strong session for metals.

MCX Aluminium Intraday Tips For TodayAccording to this chart, aluminium is moving flat under the rectangle pattern. The top of this rectangle is the resistance , and the bottom of this rectangle is the support . The trend is making frequent parallel channels between the support and resistance of this rectangle.

At present, aluminium is playing into support trendline (B) . There is a crucial support. Fakeout, volume spike, tail, massive buying pressure, and S-RSI crossover is made in that area.

So, break out of the crucial support means downfall for the levels of 143.6 - 142.6 .

...but aluminium will try to climb because of 50 & 10 MA crossover. Therefore we may see prices at 146.6 - 147.4 - 148+ soon.

AA: $8 Short Sell-off Target + Long PotentialFirst off, please don't take anything I say seriously or as financial advice. As always, this is on opinion basis. That being said, let me get into a few of my insights. Right now given the time period we are in, AA went down in the demand curve as a precious metals provider for aluminum mining. I expect an $8 target is imminent during this bearish period, and one price corrections happen, it can have long term hold potential.

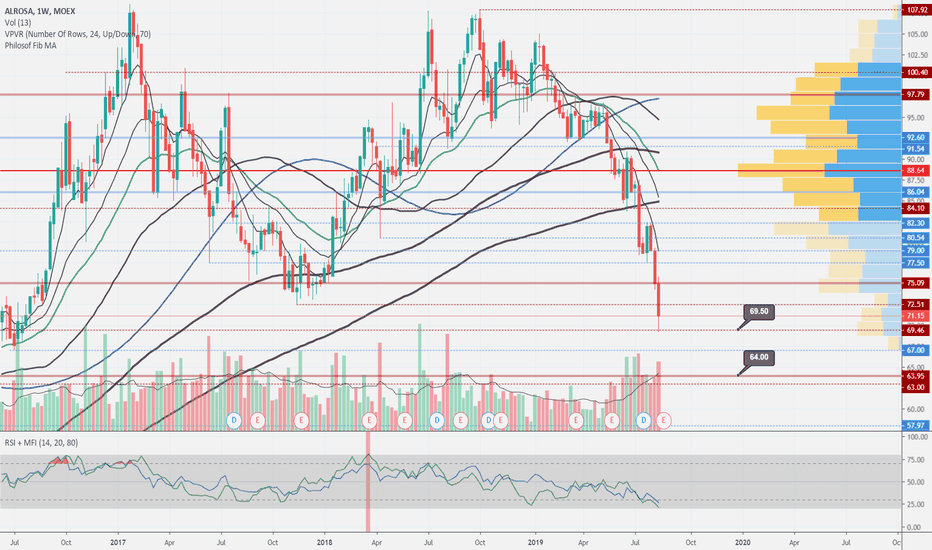

Alrosa near the bounceAlrosa been showing bad results for the whole 2019 year. Went below previous lows and now going deeper. Support at 69.5 bounced the price, and at day timeframe it looks nicely oversold and ready to bounce. But at week timeframe the situation is still dramatic. If current 70 SR won't stop the price, next support that has potential to stop the fall is at 64. In any case these stocks will have to recover for some time, before any kind of uptrend may appear.