Amazon (AMZN) Shares Rise Ahead of Earnings ReportAmazon (AMZN) Shares Rise Ahead of Earnings Report

Today, 31 July, Amazon is set to release its quarterly earnings after the close of the regular trading session. Available data show that Amazon (AMZN) shares are exhibiting bullish momentum, reflecting positive market expectations:

→ In July, AMZN shares have outperformed the S&P 500 index (US SPX 500 mini on FXOpen);

→ Yesterday, following the end of the regular session, AMZN shares surged by approximately 3% in after-hours trading.

The rise in AMZN comes amid strong earnings reports from other tech giants, such as Microsoft (MSFT) and Meta Platforms (META). For example, MSFT shares rose by more than 8% in post-market trading. Their success has likely fuelled optimism that Amazon’s upcoming report will also impress.

All of this has brought noticeable changes to the technical outlook for the AMZN stock price.

Technical Analysis of the Amazon (AMZN) Chart

Following the release of the previous earnings report, price movements have formed an upward channel, as indicated by the Regression Trend tool. However, in recent days, a series of bearish signals emerged:

→ On Thursday, AMZN broke above the $230 level (marked by an upward arrow), but the session closed well below the highs – a sign of selling pressure;

→ Friday and Monday’s sessions produced candles with small bodies, indicating market indecision;

→ On Tuesday, bears took the lead (marked by a downward arrow), with a relatively long candle closing near the session low.

Thus, the chart gave reason to assume that optimistic sentiments were waning. However, today’s session is likely to open near the $237.30 level, effectively negating the bearish interpretation of the previous five candles and shifting momentum back in favour of the bulls.

In this context:

→ Support could be provided by the $230 level as well as the median of the Regression Trend channel;

→ Key resistance could be found at the previous high of $242.23 and the psychological level of $250.

Whether AMZN can surge to a new all-time high will largely depend on the company’s performance in AI – a theme that remains highly relevant in 2025.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Amazonstock

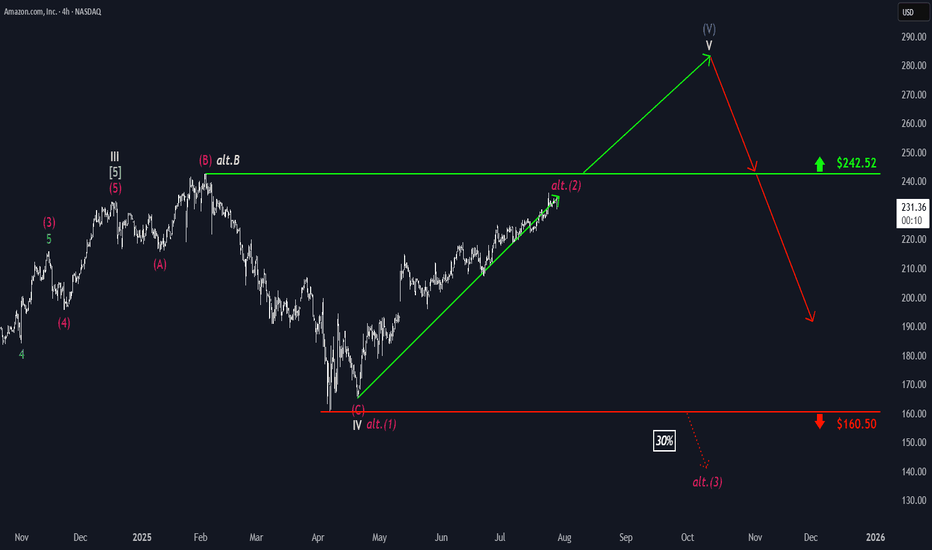

Amazon: Extending the Rally...Amazon maintaines its strong upward momentum. As this trend continues, the large blue wave (V) is expected to complete well above the resistance level at $242.52. However, an alternative scenario with a 30% probability remains on the table: in this case, the magenta corrective wave alt.(2) would peak below the $242.52 resistance, and a significant pullback below support at $160.50 would be anticipated afterward. In this scenario, the high of beige wave alt.B would have been set at $242.52, after which the stock would enter the broader downward movement of wave alt.C .

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do (for more: look to the right).

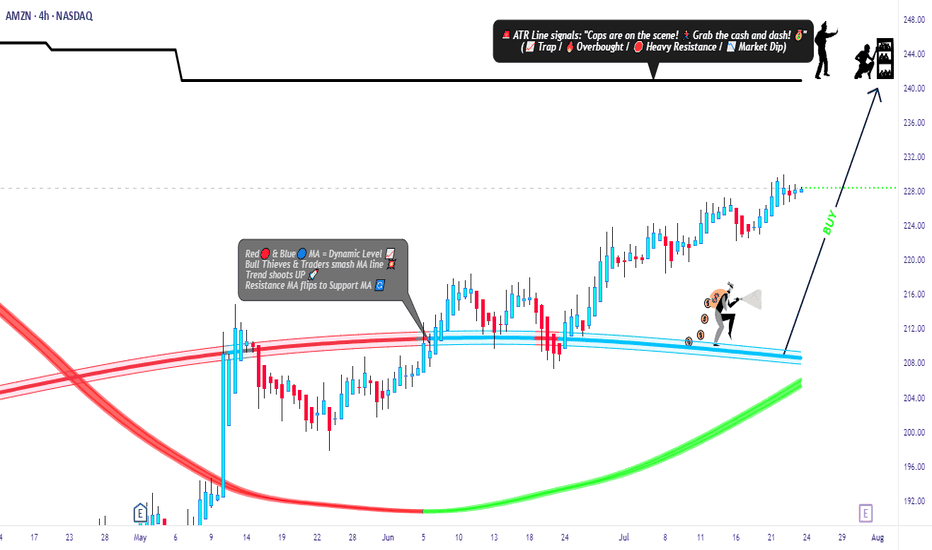

Amazon Market Robbery Blueprint – Swing/Scalp Long Setup🟨💣 “AMZN Market Heist Blueprint – Bullish Robbery in Progress 🚨💼💸” 💣🟨

By Thief Trader – Rob the Market with Precision

🌍 Hello World! Hi, Hola, Ola, Bonjour, Hallo, Marhaba!

🤑💰 Calling all Money Makers & Market Robbers – get ready to execute the next bullish heist on AMAZON.COM, INC (NASDAQ: AMZN), powered by our signature Thief Trading Style™ – where technical precision meets psychological warfare.

🔥 Plan Summary:

Based on our fundamental & technical intel, we’re eyeing a long entry into AMZN. The target? 💥The High-Risk ATR Police Barricade Zone – a zone flooded with liquidity, overbought conditions, fakeouts, and bear traps. It's where most traders get caught – but we walk in with a blueprint.

🟩 Entry Zone – “The Vault Is Wide Open!” 💼📈

🕰 Entry timeframe: 15min / 30min (preferably after confirmation or rejection wick)

💵 Buy Limit Orders: Place multiple layered entries (DCA-style) near recent swing lows/highs. Wait for breakout confirmation; no blind orders before breakout!

Thief Note: This isn’t spray-and-pray – this is sniper-mode. Scope, place, execute.🎯

🛑 Stop Loss – “SL is the Escape Route!”

📍 SL below recent 4H candle wick swing low (around 219.00 – adjust based on your risk/margin size).

Important: Only place SL after breakout; not before. Risk per order must match your lot strategy.

🎯 Target – “Grab the Bag or Escape Before the Alarms!”

💸 Target Zone: 240.00

🧠 Smart robbers know when to bail early – use a trailing SL to lock gains. Exit before reversal or heavy volume shift.

👀 Scalper Alert – “Only One Way – LONG!”

If you’re a quick thief with a fat bag, hit-and-run with a Long scalp. If you’re running lean, swing with the crew. Watch the PA and news timing. Trailing SL = insurance policy.

📊 Why Bullish? Here’s the Background:

🔍 Macro Drivers

💼 COT Report

🌍 Geo-political Influences

🧠 Sentiment Score

📈 Index Correlation

🔮 Intermarket Signals

💹 Institutional Positioning

All lights flashing green for short-to-midterm bullishness, but keep checking real-time updates.

⚠️ Risk Alert – News Triggers Can Blow Your Cover 🚨

🗞 Avoid trading near major news releases – they cause volatility spikes.

🧲 Always protect gains with trailing stops and don’t over-leverage your ammo.

💖 Support the Robbery – Hit BOOST 🔥

Smash that 💥BOOST💥 button if you ride with the Thief Trading Crew!

Let’s build this into the #1 robbery squad on TradingView.

Make money. Protect profits. Trade like a bandit – with a plan. 💼📈🏆

🔔 Stay Tuned for the Next Robbery Mission 🔔

Another heist plan dropping soon. Until then, rob smart, rob safe, and rob rich.

– Thief Trader™ | Rob The Market. Not Your Wallet.

Profit Raiders’ Guide to Conquering AMAZON Stock!Hello, Wealth Warriors! 🌟

Stock market adventurers, let’s embark on a thrilling quest to dominate AMAZON stock with our cunning Raider Trading Strategy! 🗡️📈 Fueled by razor-sharp technical analysis and robust fundamental insights, this plan targets high-reward zones while dodging market traps. Follow the long-entry map, aim for the golden profit zone, and stay vigilant for overbought signals, consolidation, or bearish ambushes that could shift the trend. 🐻🔍 Secure your gains and celebrate your victory! 🎉

Entry 📈

The treasure chest is wide open! 🏰 Seize the bullish momentum at the current price of $206.02—your adventure begins! For precision, set Buy Limit orders on a 15 or 30-minute chart for pullback entries, targeting a retest of recent highs ($206.69) or lows ($202.19).

Stop Loss 🛑

📍 Place your Raider Stop Loss at the recent swing low ($196.00) on a 4-hour chart for day trades. Adjust based on your risk tolerance, position size, and number of trades to stay in control. 🛡️

Target 🎯

Set your sights on $217.00 or exit early to lock in your profits! 💸 Refer to the finance card above for price trends.

Scalpers, Stay Sharp! 👀

Focus on quick long-side trades. Large accounts? Strike now! Smaller portfolios? Join swing traders for the raid. Use a trailing stop to safeguard your gains as the stock moves. 🧲💰

AMAZON Stock Market Insights 📊

AMAZON is charging bullish, driven by strong fundamentals. 📈 Dive into earnings reports, macroeconomic trends, geopolitical events, market sentiment, sector correlations, and future price projections for a complete view. As of May 28, 2025, at 12:04 AM EST (UTC-5), the stock’s momentum is supported by a market cap of $2.17 trillion and a year-to-date high of $242.52. Stay informed! 🔗

⚠️ Trading Alert: News & Risk Management 📰

Market-moving news can strike fast! Protect your gains:

Avoid opening trades during major news events.

Use trailing stops to secure profits and minimize losses. 🚫

Join the Raid! 💥

Support our battle plan—smash the Boost Button! 🚀 Let’s conquer the market with the Raider Trading Strategy and stack profits like true stock market legends. 💪🤝 Prepare for the next adventure, raiders! 🤑⚔️🎉

Amazon: Continuing to RiseWith Amazon’s recent climb, prices are edging closer to the top of wave (1) in magenta. However, there is still a bit of upside potential in the short term before wave (2) makes its corrective move. Our primary scenario does not anticipate a new low below $160.50. Instead, we expect wave (3) in magenta to eventually surpass resistance at $242.52. Under our alternative scenario, there is a 30% chance we could see new lows below $160.50. In this case, wave alt.B in beige would have peaked at $242.52, prompting us to focus on a magenta downward impulse.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

Amazon (AMZN) shares jump more than 7%Amazon (AMZN) shares jump more than 7%

As shown in the Amazon (AMZN) share chart, the price surged by over 7% yesterday, breaking above the key psychological level of $200 and closing at its highest point since early March.

The sharp rise in demand was driven by reports of a trade truce between the US and China following talks in Geneva. According to Reuters, the US has decided to lower the “de minimis” threshold on goods from China. This move could help de-escalate a potentially damaging trade war between the world’s two largest economies. For AMZN stock, this is a bullish signal, as Amazon sells a wide range of low-cost Chinese goods.

Technical analysis of Amazon (AMZN) shares

From a bearish perspective, the AMZN price has recovered to the 0.618 Fibonacci retracement level after falling from an all-time high to the early April low. In this context, selling pressure may re-emerge with the intention of resuming the downtrend—especially as most oscillators on the chart are signalling strong overbought conditions.

From a bullish perspective:

→ The pattern of higher highs and higher lows in late April and early May may have outlined the median of an ascending channel;

→ Yesterday’s price surge in AMZN shares may point to the channel’s upper boundary.

Given these conditions, it is reasonable to expect a minor pullback before the Amazon’s stock price resumes its upward trajectory within the blue channel.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Amazon I Detailed analysis and trading plan Welcome back! Let me know your thoughts in the comments!

** Amazon Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!Welcome back! Let me know your thoughts in the comments!

Amazon Stock Plummets After Earnings ReportDuring the last trading session, Amazon's stock dropped by more than 3.5% , bringing its price below $230 per share. This sharp decline followed the company's quarterly earnings release yesterday, where it reported earnings of $1.86 per share , surpassing the expected $1.49 , and revenue of $187.79 billion , slightly above the $187.30 billion projected.

However, investors were disappointed by the company’s sales growth forecast of only 5% for the first quarter of this year, along with a warning about a negative foreign exchange impact exceeding $2 billion. This has led to a decline in confidence, reinforcing a persistent bearish bias in Amazon’s stock price.

Bearish Trend Strengthens

Currently, a significant downward trendline has been in place since the last months of 2024. But the recent sell-off has raised doubts about the buying strength seen in previous sessions. If bearish pressure continues to increase, it could pose a considerable risk to the current market structure in the short term.

Neutrality Begins to Take Over

Both the RSI and CCI indicators have quickly dropped to their respective neutral levels— 50 for RSI and 0 for CCI. This suggests that recent price movements have turned neutral, making it unclear which force is currently dominating the market. If these indicators continue to hold within neutral territory, a potential sideways consolidation could emerge on the daily chart.

Key Levels to Watch:

$240 – The most important resistance level, representing the latest highs recorded by the stock. A breakout above this zone could reignite the long-term uptrend from last year and trigger sustained buying pressure.

$228 – A critical support zone that aligns with previous lows, as well as the uptrend line. If sellers push the price below this level, the bearish bias could strengthen, leading to a deeper downside correction in the short term.

$216 – Final support level, corresponding to the January lows and the Ichimoku cloud barrier in the short term. If selling pressure drags the price to this level, it could invalidate the current bullish structure on the chart.

By Julian Pineda, CFA – Market Analyst

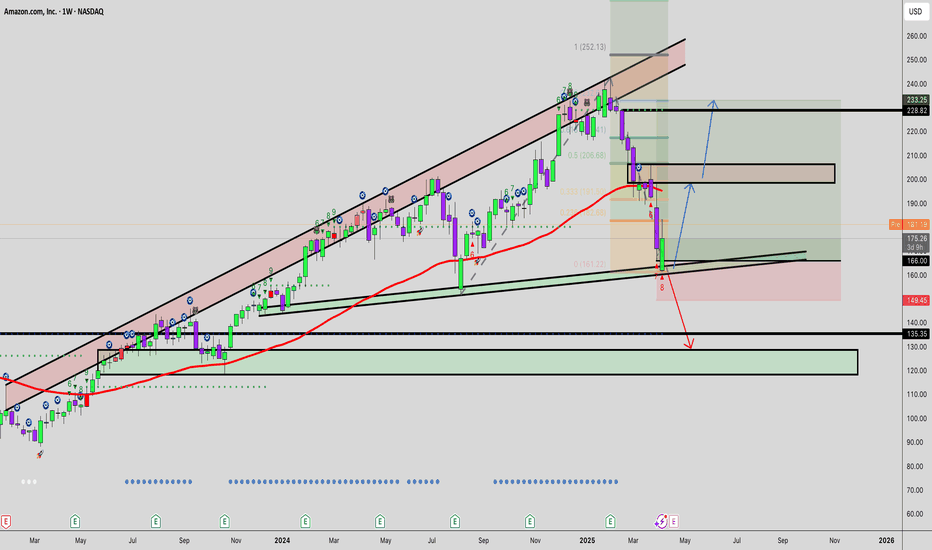

Amazon: Volatile!The Amazon stock has shown significant volatility recently but managed to recover its temporary losses of over 7% just as quickly. We still position the stock within the turquoise wave 3, which should have additional upside potential. Once this high is established—something that may have already occurred—we anticipate a wave 4 pullback before wave 5 completes the larger magenta wave (3) further to the upside. As you can see in the daily chart, this magenta wave (3) acts as a subwave of the green wave , which in turn should lead to the peak of the even larger beige wave III. Following this, we expect a more pronounced wave IV correction before another round of impulsive rallies drives the stock to new highs.

Amazon’s Stock Stuck in a Downhill Slope or Ready to Escape ?Amazon's stock price movement on a 4-hour timeframe, presenting a descending channel pattern. This pattern is often associated with bearish sentiment, as it reflects a market structure characterized by lower highs and lower lows, signaling a consistent effort by sellers to dominate price action.

Currently, the price is trading near the upper boundary of the channel, which acts as a dynamic resistance level. Historically, such resistance zones within descending channels tend to attract selling pressure, reinforcing the bearish outlook. If the price fails to break above this resistance and shows rejection signs (e.g., long wicks or bearish candlesticks), it could confirm a continuation of the downtrend, targeting the lower boundary of the channel as the next support level.

It is crucial to monitor this resistance area closely, as a breakout above the channel could shift the sentiment from bearish to bullish. For such a breakout to be credible, it must be accompanied by strong volume and decisive candlestick patterns, such as a bullish engulfing or a breakout gap. In that scenario, the price could invalidate the descending channel and initiate a reversal, targeting higher resistance levels.

Additionally, the broader market context and fundamental factors should be considered. If the stock is supported by positive catalysts or market sentiment, it could strengthen the likelihood of a breakout. Conversely, weak sentiment or negative news could intensify the bearish momentum, leading to further downside.

The chart currently reflects a bearish bias due to the descending channel structure. However, the key to determining the next move lies in the price action and volume near the upper resistance line, which will decide whether the pattern continues or reverses.

Amazon I Strong Growth Projections - Next Long Opportunity Welcome back! Let me know your thoughts in the comments!

** Amazon Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!Welcome back! Let me know your thoughts in the comments!

From Prime to Subprime: Why December Could See AMZN Fall

As always, we like to keep it clean and simple, with technicals and analysis that's easy to see and understand. Let's get into it:

AMZN could see a modest correction this December. It's at an all time high, and well into two Wave 5 sequences on the 4h. It's also overbought on an least two oscillators.

We see a 5%+ correction to the $215 price range in the coming 3-4 days .

SUPPORTING OBSERVATIONS:

Recent Rapid Stock Appreciation:

AMZN has seen a significant rise, gaining 14.1% since November 29, 2024. Such swift increases can lead to overvaluation, prompting investors to take profits, supporting the reversal to $215.

Seasonal Competitive Pressures:

Ho ho ho. The holiday season intensifies competition, often leading to increased discounting and promotional activities. This can compress profit margins, potentially impacting Amazon's financial performance and investor sentiment.

Investment in New Ventures:

Amazon's substantial investment in initiatives like Project Kuiper, its satellite internet project, involves significant capital expenditure. While promising long-term, these ventures may pressure short-term profitability, causing some investors to reassess their positions.

Be alert.

Trade green.

Amazon: Significant Breakout!The resistance at $189.76 has recently been a major hurdle for the AMZN stock. Since April, the price has essentially been moving sideways along this level, with each breakout attempt being sold off. As envisioned by our primary wave count, the stock has now managed a breakout above $189.76, developing a first impulsive move toward a new all-time high. We expect a more substantial correction only after the larger beige wave III has found its top at a higher level. An earlier sell-off remains possible as part of our 30% likely alternative scenario: this alternative count suggests that the recent peak was the top of the beige alt. b wave, which would lead to a pullback below $145.86 and a fresh low of the overarching blue wave alt. (IV).

$AMZN IS ABOUT TO EXPLODE! BUY NOW OR FOMO LATERNASDAQ:AMZN

💥 NASDAQ:AMZN IS ABOUT TO EXPLODE! 💥

I first called out NASDAQ:AMZN on October 21st as it was setting up for a huge move and CupnHandle breakout. Here's 3 reasons to not miss this investing or trading opportunity. Price targets at the end.

1.) HIGH FIVE SETUP (Check the numbers below and you will see. 1-Breaking out of cupnhandle & symmetrical triangle pattern. 2-Volume profile gap from a volume shelf. 3-Uptrending MACD. 4-Higher Highs on RSI. 5-Uptrending Stoch. (trend).

2.) #Amazon margins and FCF are growing rapidly and will continue this uptrend heading into the holiday season with a RESILIENT AMERICAN CONSUMER.

3.) It's a BUY according to the fundamentals especially when valuing this company according to it's Discounted Cash Flow (DCF).

Intrinsic Value: $250

🎯PT1: $231 (Symmetrical triangle measured move)

🎯PT2: $310 (Multi-year CupnHandle Measure Move)

Are you a shareholder? or Are you trading this name?

I'm done for the day! Going to be with my wife on her birthday and go trick or treating with my boys. Thanks for all the support, much love!

LIKE l FOLLOW l SHARE

HAPPY HALLOWEEN!

#Earnings

NFA

Amazon’s Next BIG Move: Can It Bounce to $207 from Key Support?If Amazon holds strong at $194.31, it could be setting up for a run to $207.30. This level is both a potential target and a great take-profit zone if the bounce holds. Let’s break down what to watch for as this setup unfolds!"

Trade Setup Details:

Support Level at $194.31

Right now, $194.31 is acting as a solid foundation. If Amazon finds buyer interest here, it could kick off a new upward move.

Target Zone: $207.30

If the support holds, $207.30 is the next target. This level is likely to see some selling pressure, making it an ideal area for profit-taking on a successful bounce.

Beginner Tip

Keep an eye on how Amazon reacts around $194.31. Look for strong buying signals (like a bullish candle) before entering, and consider setting your take-profit level around $207.30 to capture gains if the bounce holds.

Happy Trading

Kris/ Mindbloome Trading

Mindbloome Exchange

AMAZON LONG Trade Setup 15m TF - Sep 2, 2024AMAZON LONG Trade Setup

Amazon price crosses over the Risological dotted line at175.4 giving us a clear long trade entry.

Long entry: 175.4

Stoploss: 172.2

Targets for this short trade been marked on the chart for your reference and analysis.

Consider following me for more analysis and trade setups.

AMZN - Weekly Bearish SignsNASDAQ:AMZN ’s recent price action suggests that the stock may be poised for a further decline. After reaching the top of the long-term channel, Amazon’s price has pulled back and is now facing renewed selling pressure. This technical setup aligns with broader market concerns, particularly in light of recent economic data.

The rise in unemployment claims and disappointing PMI data signal growing economic uncertainty, which could weigh on consumer spending and, by extension, Amazon’s revenue. As the market digests this data, the technical weakness in Amazon’s chart could be a precursor to a more significant downturn, especially if economic conditions continue to deteriorate.