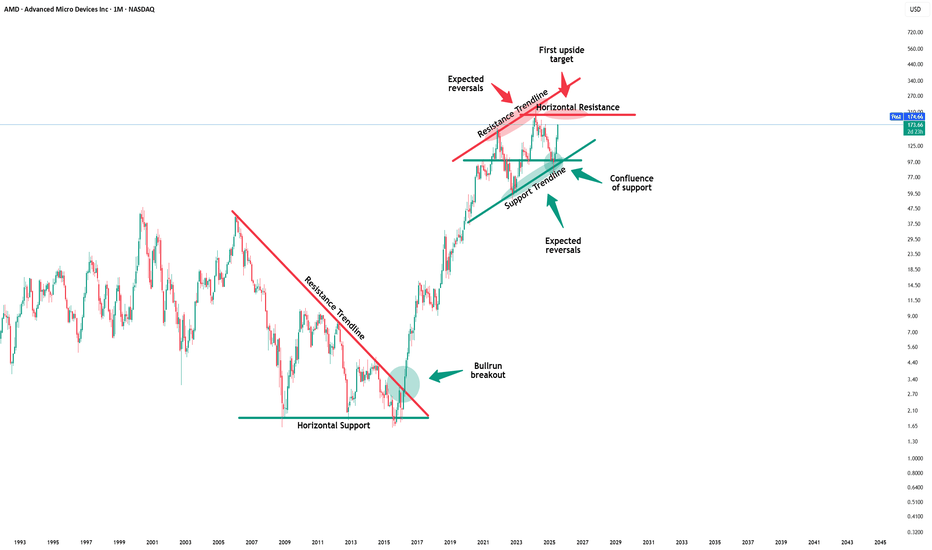

Amd - New all time highs will follow!🪠Amd ( NASDAQ:AMD ) rallies even much further:

🔎Analysis summary:

After Amd perfectly retested a major confluence of support a couple of months ago, we saw a textbook reversal. This retest was followed by a rally of more than +100% in a short period of time. But considering all the bullish momentum, Amd is far from creating a top formation.

📝Levels to watch:

$200

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

Amdbuy

AMD WEEKLY TRADE SIGNAL (7/31/25)

### 🚀 AMD WEEKLY TRADE SIGNAL (7/31/25)

📈 **MARKET SNAPSHOT**

🟢 Daily RSI: **86.0** 🔥

🟢 Weekly RSI: **80.4**

📊 Volume: 🔺 1.5x (Institutional surge)

💬 Call/Put Ratio: **1.90**

🌪 Gamma Risk: **HIGH (1DTE)**

🧠 Sentiment: **Extremely Bullish** across all models

---

💥 **TRADE IDEA**

📍 Ticker: **\ NASDAQ:AMD **

📈 Direction: **CALL (LONG)**

🎯 Strike: **\$190.00**

💵 Entry: **\$0.51**

🎯 Target: **\$0.90** (+75%)

🛑 Stop Loss: **\$0.30**

📆 Expiry: **Aug 1 (Friday)**

📊 Confidence: **85%**

⏰ Entry: Market Open (Time-sensitive!)

---

🧠 **STRATEGY CONTEXT**

✅ Bullish momentum from AI sector hype

✅ Institutional call buying volume spiking

⚠️ 1DTE = High Gamma Risk = TRADE FAST OR DON’T TRADE

⚠️ Manage decay & exit early if momentum stalls

---

📌 Signal Posted: 2025-07-31 @ 12:17 PM ET

\#AMD #OptionsAlert #AITrade #WeeklyOptions #TradingViewViral #1DTE #GammaSqueeze

AMD Weekly Trade Alert (2025-07-29)

**🔥 AMD Weekly Trade Alert (2025-07-29) 🔥**

💹 *Momentum Confirmed. Calls Loaded. Let’s Ride.*

📈 **Key Bullish Signals**

✔️ Daily RSI: **83.2** (Rising)

✔️ Weekly RSI: **79.9** (Rising)

✔️ Call/Put Ratio: **2.03** 🧨

✔️ Volatility: Low (VIX = 15.2)

⚠️ Volume Weak (0.9x) – But not a dealbreaker.

---

**🎯 TRADE SETUP**

🔹 **Ticker**: \ NASDAQ:AMD

🔹 **Strategy**: Weekly Naked Call

🔹 **Strike**: \$185C

🔹 **Entry**: \$0.66

🔹 **Profit Target**: \$1.32 (100%)

🔹 **Stop Loss**: \$0.33

🔹 **Expiry**: 2025-08-01

🔹 **Size**: 3 Contracts

🔹 **Confidence**: 75%

---

**🧠 WHY THIS WORKS**

🔋 Momentum → STRONG

💰 Institutions are loading up calls

🧘 VIX = calm

⚡ Short gamma risk = fast payoff or cut

---

📢 **Watchlist it. Trade it. Exit fast.**

💬 Comment “🔥AMD” if you’re in.

🔁 Repost if you see \$190 coming.

\#AMD #OptionsTrading #CallOptions #TradingView #WeeklySetup #MomentumPlay #BullishSignal #MarketMomentum

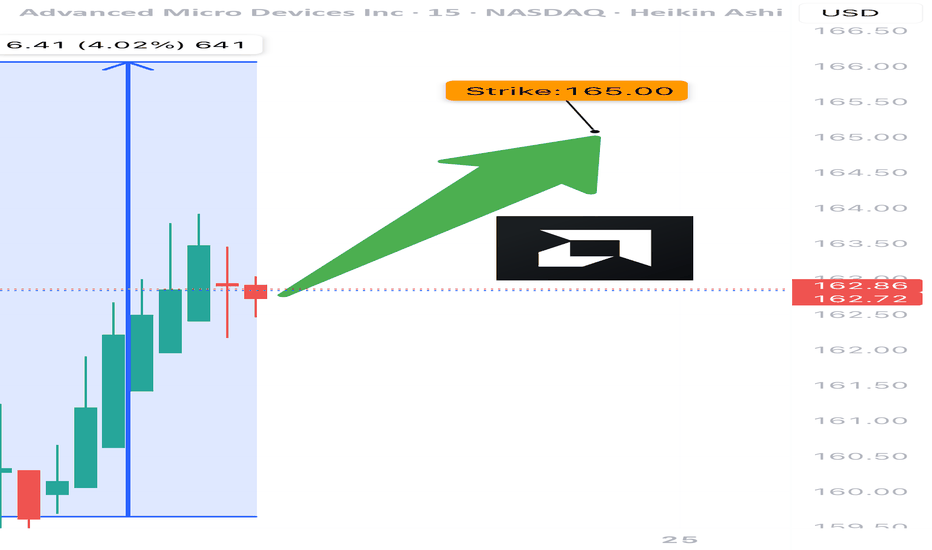

AMD TRADE ALERT (07/24)

🚨 AMD TRADE ALERT (07/24) 🚨

Options flow is screaming bullish 📈

🧠 Key Insights:

• Call/Put Ratio: 1.80 (🔥 heavy call bias)

• RSI: Daily 75.5 / Weekly 77.2 = strong momentum

• Volume = weak ⚠️ but sentiment remains bullish

• High gamma risk = explosive potential near expiry

💥 TRADE IDEA

🟢 Buy AMD $165 Call exp 7/25

💰 Entry: $0.80

🎯 Target: $1.60

🛑 Stop: $0.48

📊 Confidence: 75%

⚠️ Quick expiry = fast moves. Monitor closely.

#AMD #OptionsFlow #UnusualOptionsActivity #TradingView #OptionsTrading #BullishSetup #TechStocks #DayTrading #GammaSqueeze #OptionAlerts

The AMD Long Heist – Ready to Rob the Bulls?!🚨 AMD Stock Vault Heist: Bullish Breakout Plan with Thief Trading Style! 📈💰

🌟 Greetings, Wealth Raiders & Market Mavericks! 🌟

Hello, Ciao, Salaam, Bonjour, and Hola to all you savvy traders! Ready to crack the AMD Stock Vault (Advanced Micro Devices Inc.) with our 🔥 Thief Trading Style 🔥? This high-energy strategy blends technical precision with fundamental firepower to execute the ultimate market heist. Let’s dive into the plan, lock in profits, and escape the high-risk resistance zone like pros! 🏆💸

📝 The Heist Plan: AMD Bullish Breakout Strategy

Our chart lays out a long-entry blueprint designed to capitalize on AMD’s bullish momentum. The goal? Swipe the profits and exit before the bears take control at the resistance zone. This is a high-reward, high-risk setup, so stay sharp! ⚠️

📈 Entry: Crack the Vault!

Timing: Strike when the vault is open! Place buy limit orders on pullbacks within a 15 or 30-minute timeframe targeting the most recent swing low or high.

Tactic: Use a Dollar Cost Averaging (DCA) or layering strategy to stack multiple entries for optimal positioning.

Pro Tip: Look for bullish confirmation (e.g., candlestick patterns or volume spikes) to ensure you’re entering with momentum. 🚀

🛑 Stop Loss: Secure the Getaway!

Place your stop loss below the nearest swing low on the 3-hour timeframe (around $148.00 for day/swing trades).

Adjust based on your risk tolerance, lot size, and number of layered entries.

Why? This protects your capital from sudden reversals while giving the trade room to breathe. 🛡️

🎯 Target: Cash Out Big!

Aim for $179.00, a key resistance zone where bears may counterattack.

Watch for signs of overbought conditions or consolidation near this level—be ready to take profits and treat yourself! 💪🎉

💡 Why AMD? The Fundamental Fuel ⛽

AMD’s bullish surge is powered by:

Tech Sector Momentum: Strong demand for semiconductors and AI-driven chips.

COT Report Insights: Institutional buying pressure (check latest Friday COT data, UTC+1). 📅

Macro Tailwinds: Favorable economic conditions and positive sentiment in tech indices.

Geopolitical Stability: No major disruptions impacting tech supply chains.

Intermarket Edge: Monitor NASDAQ 100 and semiconductor ETFs for correlated moves. 📊

For a deeper dive, review:

Macroeconomic trends

Sentiment analysis

Index-specific correlations

Future price projections (overall outlook score: Bullish). 🌎

⚠️ Trading Alert: Navigate News & Volatility 📰

News releases can shake up the market like a rogue alarm system! To stay safe:

Avoid new trades during major news events (e.g., earnings or Fed announcements).

Use trailing stop-loss orders to lock in profits and protect open positions.

Stay agile—monitor real-time updates to adjust your strategy. 🚨

📌 Risk Disclaimer

This analysis is for educational purposes only and not personalized investment advice. Always conduct your own research, assess your risk tolerance, and align your trades with your financial goals. Markets move fast—stay informed and adaptable! 📚

💥 Boost the Heist! 💥

Love this Thief Trading Style? Smash the Boost Button to supercharge our robbery squad! 💪 Every like and share fuels our mission to conquer the markets with ease. Join the team, steal the profits, and let’s make money rain! 🌧️💰

Stay tuned for the next heist plan, you legendary traders! 🤑🐱👤🚀

Advanced Micro Devices | AMD | Long at $126.00Advanced Micro Devices NASDAQ:AMD may be the sleeping giant in the semiconductor / AI space. While all eyes on NVidia NASDAQ:NVDA , earnings for NASDAQ:AMD grew by 800% over the past year... and are now forecast to grow 40% per year. Any other company would be soaring right now (like NVidia), but that company is getting all the attention. And, to me, this means opportunity for the future. The cashflow is likely to grow tremendously for

NASDAQ:AMD into 2027 and beyond, which may inevitably reward investors with dividends.

From a technical analysis perspective, NASDAQ:AMD just entered my historical simple moving average zone. This area (currently $108-$126) is where I will be gathering shares. Something tremendous would have to change regarding the fundamentals of this company (like a scandal) for the overall thesis to change. There may be some near-term price pains as NVidia gets all the focus, but to meet demand in the semiconductor and AI space, NASDAQ:AMD is poised to fulfill that roll in the future.

Target #1 = $158.00

Target #2 = $175.00

Target #3 = $188.00

Target #4 = $205.00

Breakout Alert: AMD Head & Shoulders Points to $160+Overview

Name: Advanced Micro Devices, Inc.

Ticker Symbol: AMD

Exchange: NASDAQ

Founded: 1969

Headquarters: Santa Clara, California, USA

CEO: Lisa Su (as of 2025)Sector: Technology / Semiconductors

About

AMD is a leading semiconductor company known for its high-performance computing and graphics solutions. It competes with Intel and NVIDIA in the CPU, GPU, and data center markets. Its product line includes Ryzen (desktop/laptop CPUs), EPYC (server CPUs), and Radeon (GPUs), with strong expansion in AI and custom silicon for next-gen applications.

Fundamentals

Earnings: AMD reported strong Q1 2025 earnings with a beat on both revenue and EPS, supported by explosive demand in the AI and data center segments.Revenue: $6.52B, up 21% YoY

Outlook: The company raised guidance for the second half of 2025 as it expects to benefit from the AI chip boom and new product rollouts.

Technicals (4H Chart)

Inverted Head and Shoulders pattern confirmed with neckline breakout around ~$117

Breakout from Falling Channel aligning with bullish reversal structure

Price surged past resistance with strong volume, currently at $126.39 (+9.71%)

RSI at 65.88, approaching overbought but not signaling weakness

MACD bullish crossover, confirming momentum

Short-term target range: $145–$150, with extended projection up to $162.75

📌 Support Levels: $117, $111.50📈 Target Price (TP): $162.75 (based on pattern breakout height projection)

💡 My Take

AMD just pulled off a textbook bullish reversal — inverted head and shoulders breakout combined with a falling channel exit. With strong macro trends in AI hardware and data center expansion, this move feels well-supported fundamentally and technically.

The clean neckline breakout and explosive candle suggest continuation. I am expecting a potential consolidation around $130–$135ish before next leg to $150+. If momentum holds, $162+ is possible before August.

💼 Position

Type: AMD 145 Call

Expiry: July 03, 2025

Quantity: 15

Average Cost Basis: $.038

Date Purchased: June 12, 2025

Last Price: $0.47

Total % Gain/Loss: +23.4%

I entered after the neckline break and riding the wave. AMD’s setup is too clean to ignore — high conviction play.

AMD – The AI Underdog Setting Up for a Major MoveAMD is quietly building momentum as a major AI contender, rivaling NASDAQ:NVDA with its upcoming MI400 GPU series and strong Q2 guidance potential.

I'm watching this carefully for a medium-term swing with high reward potential based on both fundamental catalysts and technical structure.

🔍 Entry Points I'm Watching:

✅ $143 → Aggressive breakout entry if it clears $147.50 with strong volume

✅ $125 → Previous support + gap-fill zone from May

✅ $115 → Deep value zone near 200-day MA (if macro weakens)

🎯 Profit Targets:

• TP1: $160 – Key resistance & post-earnings reaction zone

• TP2: $176 – Melius Research target

• TP3: $200+ – ATH breakout potential if AI narrative extends into Q3

⚡ Catalysts to Watch:

• MI400 GPU launch in progress

• Q2 earnings (late July) – data center revenue in focus

• Sector momentum from NASDAQ:MU and NASDAQ:NVDA

⚠️ Disclaimer: This is not financial advice. I am sharing my personal trading plan and analysis for educational and discussion purposes only. Always do your own research and consult with a financial advisor before making investment decisions

Big move for AMD monday inverted H&S greatly confirmed 150USD!!!The pattern have been greatly confirmed for me and i will sell my amd this week at 150 USD and i will wait at july when a drop will occurs to rebuy and i will cumulate more stock or more profits in cash.

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations.

Thank you!

Subcribe TSXGanG! (For real chart)

Inverted H&S on AMD BULLISH FOR MONDAY !!!! 150$USD JUNE END!!!Analysis of the Inverted Head and Shoulders

- Left Shoulder: The price first dipped, formed a trough, and then rebounded.

- Head: The stock dropped further, creating a lower trough than the left shoulder, followed by a recovery.

- Right Shoulder: A higher low formed, aligning with the left shoulder before the price moved upward.

- Neckline Breakout: The confirmation of this pattern comes when the price decisively breaks above the neckline (resistance level), suggesting a continued uptrend.

Potential Outcomes

- Bullish Breakout: Once the neckline is breached, a surge in buying pressure could push prices higher.

- Volume Confirmation: Increased trading volume at the breakout strengthens the validity of the pattern.

- Price Target: Traders often project the price increase by measuring the distance between the head and the neckline, then adding this to the breakout point.

Given the current price action, this setup could indicate a strong bullish continuation. However, market conditions and external factors should always be considered before making trading decisions.

If you want to refine this analysis or explore other scenarios, I'm here to dive deeper into key points! 🚀 Subscribe! TSXGanG

I hold a CCVM and MNC (Certificate of Competence to become a securities broker anywhere in Canada) and have been working as a trader for five years.

It’s a pleasure for me to help people optimize their trading strategies and make informed financial market decisions.

AMD will be bullish if we go higher than 128$ USD (CCVM)AMD (Advanced Micro Devices)

Stock appears to show signs of an imminent bullish recovery, according to several technical and fundamental indicators.

Technical Analysis TSX:AMD

- Current Price: $118.87, up 1.33%.

- Bollinger Bands: Indicate moderate volatility, with a trend toward the upper band.

- Trend Lines: A rising purple curve suggests a possible bullish recovery.

- Buy and Sell Zones: Annotations indicate strategic entry and exit points in the market.

Fundamental Analysis

According to the latest market analyses:

- Revenue Growth: AMD recorded a 36% increase in revenue in Q1 2025.

- Strategic Acquisition: The purchase of ZT Systems strengthens its position in data centers and artificial intelligence.

- Stock Buyback Program: AMD announced a $6 billion buyback, boosting investor confidence.

- Analyst Consensus: The average target price is set at $154.45, indicating significant upside potential.

Conclusion

Technical and fundamental indicators suggest that AMD may soon enter a bullish phase.

If you want to refine this analysis or explore other scenarios, I'm here to dive deeper into key points! 🚀 Subscribe! TSXGanG

I hold a CCVM and MNC (Certificate of Competence to become a securities broker anywhere in Canada) and have been working as a trader for five years.

It’s a pleasure for me to help people optimize their trading strategies and make informed financial market decisions.

$AMD When, not IF! 105% UPSIDENASDAQ:AMD - It's not a matter of if, but when...🚀

Once this downtrend on the weekly is broken out of with a big fat engulfing candle we will launch off this volume shelf like a SpaceX rocket to mars!

All indictors are curling up and I think the time is coming for AMD to make their ascent higher and back to ATHs!

AMD - Advanced Money Destroyer...Not For Long!NASDAQ:AMD

Has been decimated but the DIP BUY BOX holds strong! $85-$100 could lead to an easy 2x!

- Key S/R Zone

- Massive Volume Shelf

- Bearish WCB Breakout will give Bullish Cue

- Lowest RSI since 2022 BOTTOM

A turnaround here could lead to outsized performance in portfolios.

Not financial advice

AMD - Medium Long Term Potential for circa 25% upside in 2025This one is nice and quiet, and well corrected

Short-Term Analysis (Days to Few Weeks)

Chart Patterns & Indicators:

• Price Action & Support/Resistance:

AMD appears to be trading in a consolidation phase. Recent price action has shown AMD testing a key support level which may be associated with a recently established trend line or the 20/50-day moving averages. A breakout above this consolidation zone could catalyse a short-term upward move.

• Momentum & Volume:

The RSI has hovered near the neutral-to-oversold territory, suggesting that any bounce may be brief if buying pressure fails to accelerate. Conversely, modest increases in volume during upward moves hint at a cautious optimism in the market. Traders might also observe MACD crossovers as indicators for a near-term reversal.

Price Target & Probabilities:

• Target:

Should AMD break out to the upside, a conservative target in the short term could be approximately 3–5% above current levels. Conversely, if support fails, a move 3–4% lower is plausible.

• Probability:

There is an estimated 55–60% chance of a modest recovery if support holds, balanced against roughly a 40–45% risk of further decline should the asset lose key support.

Medium-Term Analysis (Several Weeks to a Few Months)

Chart Patterns & Indicators:

• Trend Confirmation & Moving Averages:

On the daily chart, AMD has demonstrated some convergence between the 50-day and, in some cases, the 200-day moving averages. This could hint at an evolving medium-term trend, especially if a bullish crossover (often termed a “golden cross”) is confirmed. A consistent cluster of higher lows in the price action further reinforces medium-term recovery potential.

• Technical Indicator Convergence:

Both MACD and RSI are transitioning away from oversold levels, and support from recent trendlines suggests the build-up of medium-term momentum. Any significant divergence between these indicators and price action should, however, be monitored closely.

Price Target & Probabilities:

• Target:

If bullish momentum continues, AMD could target a rise of roughly 10–15% above current levels over the medium term. This projection assumes that key resistance zones act as temporary hurdles rather than insurmountable barriers.

• Probability:

There’s approximately a 50–55% likelihood of this upward move being realised, contingent on sustained trading volume and broad market sentiment supporting AMD’s recovery.

and finally..... the Long Game

Long-Term Analysis (Several Months to a Year and Beyond)

Chart Patterns & Indicators:

• Long-Term Trend & Accumulation:

On weekly and monthly charts, AMD has shown signs of a longer-term accumulation phase. This phase is typified by intermittent pullbacks that have set the stage for a gradual build-up in buying interest. Higher-timeframe moving averages and trend lines indicate that the market may be slowly re-calibrating to a more bullish perspective.

• Integration with Broader Market Trends:

Beyond the technicals, AMD’s performance is also intertwined with sector-specific and broader economic trends. An improvement in macroeconomic conditions, along with sustained institutional interest, could validate the longer-term bullish technical picture.

Price Target & Probabilities:

• Target:

In a scenario where the long-term uptrend gathers momentum, AMD might feasibly reach 20–30% above current levels over the coming year. This target assumes a clear breakout from consolidation and the eventual confirmation of a sustained bullish trend on monthly charts.

• Probability:

Given the current accumulation patterns and long-term trend indicators, there is an estimated 45–50% probability for this scenario. However, this likelihood is subject to change based on external market influences and AMD-specific corporate developments.

Market Close Update: AMD Continuation Long PlayAMD continued pushing higher today, alongside NVDA, after gaining $28+ per share over the past 2 trading sessions. The partnership with StradVision on providing chips to support their Perception Based Autonomous AI Systems with the goal of delivering high-performance perception solutions for automated driving systems. Looking for a potential entry around $128.90 with at least a $133.42 Short-Term Price Target, but retesting $144.36, it's most recent High that it tested at the beginning of December 2024. Will setting our Stop Loss around $127.40 moving forward if we're able to obtain a slight pullback to get that $128 entry.

Follow us for more to connect and stay tuned with more at MyMI Wallet. @MyMIWallet #MyMIWallet

Earning report Today! Can $AMD breakout the downtrend line?

Technically, AMD is closing to the downtrend line again. There was a FAKEOUT three weeks before.So will NASDAQ:AMD truly breakout the downtrend line this time?

It will depends on the earnings report today!

Here are 3 Things I'm Watching in NASDAQ:AMD 's Earnings on Tuesday

1. MI300 Series: Flagship AI GPU

• Their new Instinct MI300 series GPUs are built to compete directly with NASDAQ:NVDA H100 chips, supporting both training and inference for large-scale AI models. The MI300 offers high memory capacity and multi-chip module (MCM) architecture, making it suitable for AI workloads that require massive data processing. Early deployments include partnerships with key cloud providers like NASDAQ:MSFT Azure -- which is leveraging AMD’s GPUs for its AI infrastructure.

2. AI-Powered Accelerated Processing Units (APUs)

• Their APUs, which combine CPU and GPU capabilities on a single chip, are designed to handle AI tasks efficiently in edge computing and consumer applications. For instance, AMD’s latest Ryzen AI-powered APUs provide AI acceleration directly in laptops -- aiming to improve tasks like image processing and natural language interactions.

3. Capturing AI Market Share

• Their approach is centered around capturing a larger share of the rapidly growing AI semiconductor market, which is projected to surpass $400B by 2030. As AI models become more sophisticated, they require increased computational resources. AMD’s focus on energy efficiency and competitive pricing allows it to offer alternatives to Nvidia, making it more appealing to enterprises managing rising energy costs and budget constraints. Unlike Nvidia, which has historically focused on high-end GPUs, AMD’s diverse product mix, including CPUs, APUs, and data center GPUs, enables it to serve a broader range of AI use cases. This could lead to more consistent revenue growth as AI applications proliferate beyond just data centers -- spreading into edge devices and personal computing.

AMD (Advanced Micro Devices, Inc.) BUY TF D1 TP = 184.94On the D1 chart the trend started on Aug.8 (linear regression channel).

There is a high probability of profit taking. Possible take profit level is 184.94

This level, which I have outlined above, is certainly not a “finish” level. But it is the level that has the “highest percentage of hits on target.”

Using a trailing stop is also a good idea!

Please leave your feedback, your opinion. I am very interested in it. Thank you!

Good luck!

Regards, WeBelievelnTrading

AMD CALL Bought AMD Call

Strike $180

Expiry 14 Jun

Entry $2.50

Expecting AMD to reach

1st Target $184

2nd Target $193

Analysis as below:

Weekly TF:

1. Uptrend -- Above SMA200

Day TF:

1. Structure -- Inverse Head and shoulder (broke out of neckline, now retesting)

2. RSI -- bullish divergence

4hr TF:

1. MA -- Price closed above EMA 25 (blue)

2. Fib R -- Price closed above 0.618 Fib R aka $158 (uptrend in tact)

3. Confirmation candle -- printed green body candle after bouncing off EMA 25 and 0.618.

4. RSI -- not overbought yet/no bearish divergence (More room for upside)

Remarks:

Price is currently testing the resistance of SMA100(purple) for the 5th time.

The frequency of price testing to break SMA100 becoming shorter (Weaker selling pressure)

If price is able to close above SMA50(green) and SMA100(purple), expect AMD to rally in no time.