AMD TRADE ALERT (07/24)

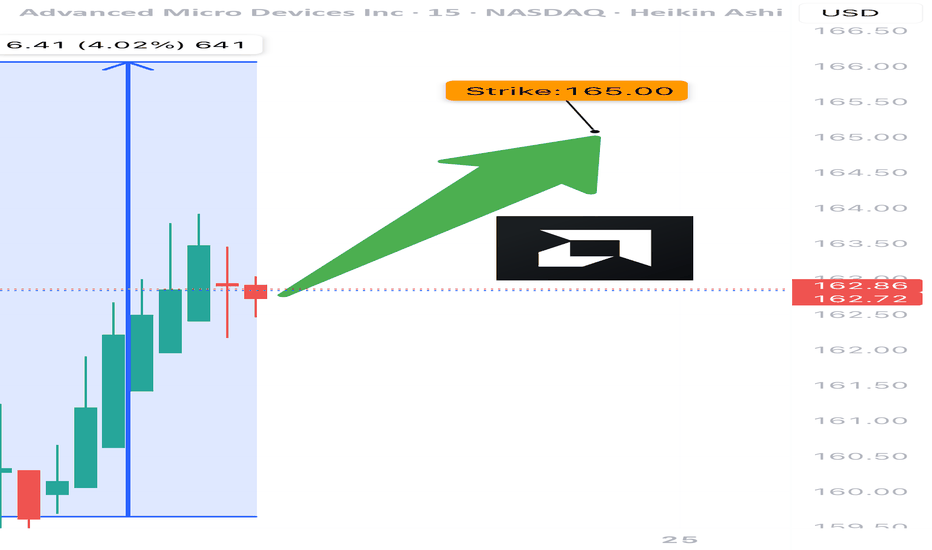

🚨 AMD TRADE ALERT (07/24) 🚨

Options flow is screaming bullish 📈

🧠 Key Insights:

• Call/Put Ratio: 1.80 (🔥 heavy call bias)

• RSI: Daily 75.5 / Weekly 77.2 = strong momentum

• Volume = weak ⚠️ but sentiment remains bullish

• High gamma risk = explosive potential near expiry

💥 TRADE IDEA

🟢 Buy AMD $165 Call exp 7/25

💰 Entry: $0.80

🎯 Target: $1.60

🛑 Stop: $0.48

📊 Confidence: 75%

⚠️ Quick expiry = fast moves. Monitor closely.

#AMD #OptionsFlow #UnusualOptionsActivity #TradingView #OptionsTrading #BullishSetup #TechStocks #DayTrading #GammaSqueeze #OptionAlerts

Amdlong

Advanced Micro Devices | AMD | Long at $126.00Advanced Micro Devices NASDAQ:AMD may be the sleeping giant in the semiconductor / AI space. While all eyes on NVidia NASDAQ:NVDA , earnings for NASDAQ:AMD grew by 800% over the past year... and are now forecast to grow 40% per year. Any other company would be soaring right now (like NVidia), but that company is getting all the attention. And, to me, this means opportunity for the future. The cashflow is likely to grow tremendously for

NASDAQ:AMD into 2027 and beyond, which may inevitably reward investors with dividends.

From a technical analysis perspective, NASDAQ:AMD just entered my historical simple moving average zone. This area (currently $108-$126) is where I will be gathering shares. Something tremendous would have to change regarding the fundamentals of this company (like a scandal) for the overall thesis to change. There may be some near-term price pains as NVidia gets all the focus, but to meet demand in the semiconductor and AI space, NASDAQ:AMD is poised to fulfill that roll in the future.

Target #1 = $158.00

Target #2 = $175.00

Target #3 = $188.00

Target #4 = $205.00

Breakout Alert: AMD Head & Shoulders Points to $160+Overview

Name: Advanced Micro Devices, Inc.

Ticker Symbol: AMD

Exchange: NASDAQ

Founded: 1969

Headquarters: Santa Clara, California, USA

CEO: Lisa Su (as of 2025)Sector: Technology / Semiconductors

About

AMD is a leading semiconductor company known for its high-performance computing and graphics solutions. It competes with Intel and NVIDIA in the CPU, GPU, and data center markets. Its product line includes Ryzen (desktop/laptop CPUs), EPYC (server CPUs), and Radeon (GPUs), with strong expansion in AI and custom silicon for next-gen applications.

Fundamentals

Earnings: AMD reported strong Q1 2025 earnings with a beat on both revenue and EPS, supported by explosive demand in the AI and data center segments.Revenue: $6.52B, up 21% YoY

Outlook: The company raised guidance for the second half of 2025 as it expects to benefit from the AI chip boom and new product rollouts.

Technicals (4H Chart)

Inverted Head and Shoulders pattern confirmed with neckline breakout around ~$117

Breakout from Falling Channel aligning with bullish reversal structure

Price surged past resistance with strong volume, currently at $126.39 (+9.71%)

RSI at 65.88, approaching overbought but not signaling weakness

MACD bullish crossover, confirming momentum

Short-term target range: $145–$150, with extended projection up to $162.75

📌 Support Levels: $117, $111.50📈 Target Price (TP): $162.75 (based on pattern breakout height projection)

💡 My Take

AMD just pulled off a textbook bullish reversal — inverted head and shoulders breakout combined with a falling channel exit. With strong macro trends in AI hardware and data center expansion, this move feels well-supported fundamentally and technically.

The clean neckline breakout and explosive candle suggest continuation. I am expecting a potential consolidation around $130–$135ish before next leg to $150+. If momentum holds, $162+ is possible before August.

💼 Position

Type: AMD 145 Call

Expiry: July 03, 2025

Quantity: 15

Average Cost Basis: $.038

Date Purchased: June 12, 2025

Last Price: $0.47

Total % Gain/Loss: +23.4%

I entered after the neckline break and riding the wave. AMD’s setup is too clean to ignore — high conviction play.

AMD – The AI Underdog Setting Up for a Major MoveAMD is quietly building momentum as a major AI contender, rivaling NASDAQ:NVDA with its upcoming MI400 GPU series and strong Q2 guidance potential.

I'm watching this carefully for a medium-term swing with high reward potential based on both fundamental catalysts and technical structure.

🔍 Entry Points I'm Watching:

✅ $143 → Aggressive breakout entry if it clears $147.50 with strong volume

✅ $125 → Previous support + gap-fill zone from May

✅ $115 → Deep value zone near 200-day MA (if macro weakens)

🎯 Profit Targets:

• TP1: $160 – Key resistance & post-earnings reaction zone

• TP2: $176 – Melius Research target

• TP3: $200+ – ATH breakout potential if AI narrative extends into Q3

⚡ Catalysts to Watch:

• MI400 GPU launch in progress

• Q2 earnings (late July) – data center revenue in focus

• Sector momentum from NASDAQ:MU and NASDAQ:NVDA

⚠️ Disclaimer: This is not financial advice. I am sharing my personal trading plan and analysis for educational and discussion purposes only. Always do your own research and consult with a financial advisor before making investment decisions

Big move for AMD monday inverted H&S greatly confirmed 150USD!!!The pattern have been greatly confirmed for me and i will sell my amd this week at 150 USD and i will wait at july when a drop will occurs to rebuy and i will cumulate more stock or more profits in cash.

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations.

Thank you!

Subcribe TSXGanG! (For real chart)

AMD IS READY FOR A STRONG BULLISH MOVENASDAQ:AMD Right now, am extremely bullish on AMD.

I expect AMD to give a good bullish run to trail NVIDIA.

Technically, AMD is supper bullish right now, having had a multiple bullish break of structure on the daily time frame.

I took a long entry on the bullish break of structure on daily time frame. Stop loss is below the recent structure swing low.

What do you see on your chart?

AMD - Inverted Head & Shoulders (Bullish Reversal)Let´s see if we can break the neckline (White trendline) and stay above with a close and possibly a retest on the neckline to confirm this pattern. If so, Im looking for the previous top on daily which is the all time high (So far).

This is not a financial advise. Always do your own research and decision before investing.

Inverted H&S on AMD BULLISH FOR MONDAY !!!! 150$USD JUNE END!!!Analysis of the Inverted Head and Shoulders

- Left Shoulder: The price first dipped, formed a trough, and then rebounded.

- Head: The stock dropped further, creating a lower trough than the left shoulder, followed by a recovery.

- Right Shoulder: A higher low formed, aligning with the left shoulder before the price moved upward.

- Neckline Breakout: The confirmation of this pattern comes when the price decisively breaks above the neckline (resistance level), suggesting a continued uptrend.

Potential Outcomes

- Bullish Breakout: Once the neckline is breached, a surge in buying pressure could push prices higher.

- Volume Confirmation: Increased trading volume at the breakout strengthens the validity of the pattern.

- Price Target: Traders often project the price increase by measuring the distance between the head and the neckline, then adding this to the breakout point.

Given the current price action, this setup could indicate a strong bullish continuation. However, market conditions and external factors should always be considered before making trading decisions.

If you want to refine this analysis or explore other scenarios, I'm here to dive deeper into key points! 🚀 Subscribe! TSXGanG

I hold a CCVM and MNC (Certificate of Competence to become a securities broker anywhere in Canada) and have been working as a trader for five years.

It’s a pleasure for me to help people optimize their trading strategies and make informed financial market decisions.

$AMD When, not IF! 105% UPSIDENASDAQ:AMD - It's not a matter of if, but when...🚀

Once this downtrend on the weekly is broken out of with a big fat engulfing candle we will launch off this volume shelf like a SpaceX rocket to mars!

All indictors are curling up and I think the time is coming for AMD to make their ascent higher and back to ATHs!

AMD LONG IDEA: AMD IS READY FOR A GOOD BULLISH RUNAMD is bouncing off the monthly time frame key level that is acting as support for price.

On weekly time frame and daily we had a shift in market structure from bearish trend to bullish.

I will be buying AMD on this retracement to the recent weekly gap created by price.

Once I see a good bullish price confirming that the retracement is over, i will enter for a buy trade.

My overall target is the 187 price level.

AMD LONG IDEAAMD stock has been in a downtrend for a while. This is also confirmed with the awesome oscillator being in oversold region. However, there's a breakout of the downtrend. This is also supported with price breaking and closing above a support level. An aggressive trader or investor can buy at the current market price. While a conservative trader or investor can wait for price to pull back to the support level before buying.

The entry will be 101.70 while the stop will be 76.05 and the final target will be 226.77.

Confluence for this signal are as follows:

1. Awesome oscillator in oversold region

2. Awesome oscillator divergence

3. Downtrend breakout

4. Weekly bullish candle closing above down trend line and support level.

5. Price respecting uptrend

Disclaimer: This is not a financial advice. The outcome maybe different from the projection. If you can't accept the risk, don't take the signal.

AMD analysis What I’m seeing here is that the price made a false breakout below the 200 EMA, just like it did in the previous move back in early 2023. It dipped below, tricked a lot of people, then snapped back up strong.

Now it’s kind of repeating that same behavior another fake break below the 200 EMA and a bounce If history repeats we might see a similar upside move from here.

Just my personal view — not financial advice. Markets are unpredictable, so always be cautious.

AMD Earnings About To PrintTechnical Analysis NASDAQ:AMD

RSI: 🟡 Near overbought but showing strength

MACD: 🟢 Bullish crossover in progress

Support: $96.84 → $93.64 → $90.00

Resistance: $100.75 → $101.72 → $103.96

Key Level to Watch: $100.75 (immediate resistance)

💰 Earnings Play

🎯 Trade Signal: BUY

✅ Justification

Recent uptrend confirmed by bullish MACD crossover with price action above key short-term MAs. Strong momentum heading into earnings with positive sentiment from analysts.

⚠️ Risk Management

Stop Loss: $93.64 (-5.2%)

Expected Range: $93.64 to $103.96

Best AI Generated Signals.

Stay Alpha

AMD Weekly Options Trade Plan 2025-05-06AMD Weekly Analysis Summary (2025-05-06)

Summary of Each Model’s Key Points

Grok/xAI Report

Technicals (5-min & daily): Bullish momentum (price above EMAs, positive MACD, RSI not yet overbought) Sentiment: VIX moderate, upcoming earnings adds uncertainty, max pain at $98 Directional Bias: Moderately bullish Trade: Buy $100 call expiring 2025-05-09 at $3.80 Profit Target: +25%; Stop-Loss: −50% Confidence: 65%

Claude/Anthropic Report

Technicals: Intraday slightly bearish, daily bullish Sentiment: Earnings risk, mixed signals, max pain at $98 Directional Bias: Neutral/unclear Trade: No trade (90% confidence)

DeepSeek Report

Technicals: Short-term bullish but near resistance, daily MACD bullish Sentiment: Elevated IV, earnings event risk, max pain at $98 Directional Bias: Neutral/unclear (55% confidence) Trade: No trade

Llama/Meta Report

Technicals: Moderately bullish across timeframes (price above key EMAs, positive MACD) Sentiment: Earnings caution, max pain at $98 may cap downside, premium high Directional Bias: Moderately bullish Trade: Buy $109 call expiring 2025-05-09 at $1.00 Confidence: 70%

Gemini/Google Report

Technicals: Strong daily bullish, 5-min approaching resistance Sentiment: Muted post-earnings move, max pain at $98, high IV Directional Bias: Neutral/unclear Trade: No trade (confidence <60%) Areas of Agreement and Disagreement

Agreement

Mixed signals between intraday and daily timeframes Elevated implied volatility around earnings Max pain at $98 may exert gravitational pull High open interest in both deep OTM puts ($90) and calls ($105–$110) Majority of models favor waiting until after earnings or see no clear edge

Disagreement

Grok and Llama see a moderately bullish setup and recommend buying calls ($100 and $109 strikes) Claude, DeepSeek, and Gemini advise no trade because of earnings event risk, mixed technicals, and expensive premiums Conclusion

Overall Market Direction Consensus: Neutral/Unclear Recommended Trade: None – conflicting signals, earnings overhang, and rich weekly premiums make a high-confidence single-leg trade unlikely before post-earnings clarity.

Entry Timing: N/A (no trade) Confidence Level: 90% in the decision to sit out this week’s expiration Key Risks and Considerations:

Earnings announcement can cause large gap moves Weekly options premiums remain elevated, requiring outsized moves to break even Max pain at $98 may pressure price if post-earnings reaction is muted or negative

TRADE_DETAILS (JSON Format)

{ "instrument": null, "direction": null, "strike": null, "expiry": null, "confidence": null, "profit_target": null, "stop_loss": null, "size": null, "entry_price": null, "entry_timing": null, "signal_publish_time": "2025-05-06 15:09:34 UTC-04:00" }

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions based on proprietary research which I am sharing publicly as my personal blog. Futures, stocks, and options trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of TradingView. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors' IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.

AMD - Advanced Money Destroyer...Not For Long!NASDAQ:AMD

Has been decimated but the DIP BUY BOX holds strong! $85-$100 could lead to an easy 2x!

- Key S/R Zone

- Massive Volume Shelf

- Bearish WCB Breakout will give Bullish Cue

- Lowest RSI since 2022 BOTTOM

A turnaround here could lead to outsized performance in portfolios.

Not financial advice

$AMD trying to breakout on the daily!NASDAQ:AMD being bought heavily by institutions for past 3 days straight. It’s looking like it wants to breakout on the daily. There could be added excitement for NASDAQ:NVDA earnings coming up in the semi-conductor space. I have been accumulating NASDAQ:AMD April 17 115Calls @ 7.00

*Not financial advice

$AMD Analysis: Profitable Structure! 2/13/2025

Another profitable structure is currently in progress, after completing the last leg of the correction at $106.50 (MY STOPLOSS!)

The targets of the uptrend swing (wave C) are displayed on the chart, and it has the potential to exceed the projected levels.

Start point of wave c= $106.50 (Stoploss)

Targets:

T1=$206

T2=$268

T3=$367

NASDAQ:AMD #AMD

Good Luck